Veritex Community Bank Bundle

How Well Does Veritex Community Bank Know Its Customers?

In today's rapidly evolving financial landscape, understanding customer demographics and the target market is crucial for any bank's success. Banks like Veritex Community Bank must adapt to changing consumer behaviors and preferences to stay competitive. This analysis explores how Veritex identifies and serves its customer base, ensuring its offerings meet the needs of its diverse clientele.

This deep dive into Veritex Community Bank SWOT Analysis will examine the bank's customer profile and how it uses market analysis to understand its primary customer segments. We'll explore the bank's geographic location, customer age range, income levels, and occupation, providing insights into Veritex's ideal customer profile. By understanding Veritex Bank's marketing strategy and customer buying behavior, we can assess its ability to meet customer needs and wants.

Who Are Veritex Community Bank’s Main Customers?

Understanding the Owners & Shareholders of Veritex Community Bank involves examining its primary customer segments. The bank focuses on two main groups: small to medium-sized businesses (SMBs) and individual customers. This dual approach allows it to serve both business-to-business (B2B) and business-to-consumer (B2C) markets effectively, shaping its customer demographics and target market.

The SMB segment is a crucial part of the bank's strategy. These businesses seek personalized banking services, credit lines, and treasury management solutions. The individual customer segment values personalized service and a range of deposit and loan products. While specific demographic data for 2024-2025 isn't publicly detailed, community banks like this one typically attract customers who prefer direct relationships with their bankers.

Veritex Community Bank's success is reflected in its financial performance. As of March 31, 2024, the commercial loan portfolio reached $9.2 billion, highlighting its strong focus on business clients. Total deposits also increased to $11.8 billion in the first quarter of 2024, indicating growth across both business and individual accounts. This growth underscores the bank's ability to attract and retain customers in both key segments.

SMBs are a core customer segment for Veritex Community Bank. These businesses often require tailored financial solutions. The focus is on providing personalized banking services, accessible credit lines, and treasury management solutions.

Individual customers value personalized service and a wide range of banking products. They seek deposit and loan options, including mortgages and personal loans. This segment often includes local professionals and families.

Veritex Community Bank's customer profile includes a mix of businesses and individuals. The bank's ability to serve both segments is crucial for its market analysis and success. Understanding the customer demographics is key to the bank's strategy.

- SMBs: Businesses seeking personalized banking and financial solutions.

- Individuals: Customers who appreciate local accessibility and a wide range of banking products.

- Focus: Strong emphasis on commercial lending and deposit growth.

- Growth: Significant increases in commercial loans and total deposits.

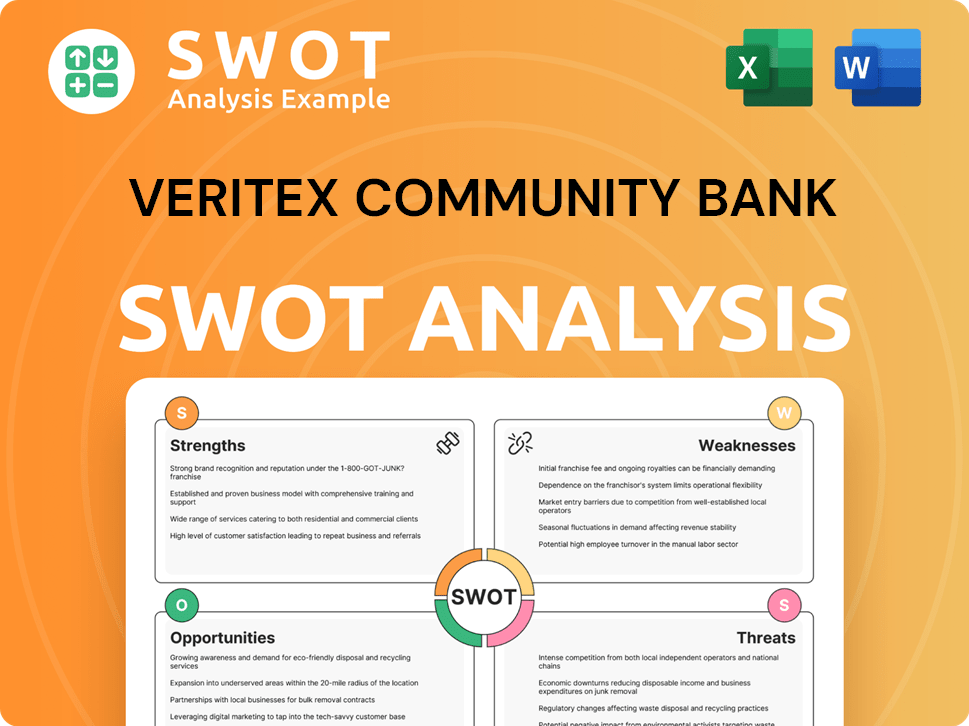

Veritex Community Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Veritex Community Bank’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial institution. For Veritex Community Bank, this involves a deep dive into what drives both its business and individual clients. The bank's approach is centered on providing accessible, personalized, and relationship-based services to meet the diverse needs of its customer base.

The customer demographics of Veritex Community Bank are varied, with a focus on small to medium-sized businesses (SMBs) and individual customers. SMBs typically seek efficient access to capital, robust treasury management solutions, and expert guidance. Individual customers prioritize competitive rates, convenient banking channels, and trustworthy financial advice. This dual focus allows the bank to cater to a broad range of financial needs, ensuring customer satisfaction and loyalty.

Veritex Community Bank addresses common pain points by offering direct relationships with dedicated bankers and flexible financial solutions. This approach contrasts with the often impersonal nature of larger institutions. By focusing on commercial real estate and commercial and industrial loans, Veritex directly meets the capital needs of its business clients. As of Q1 2024, these loan categories formed a significant portion of its portfolio, highlighting its commitment to serving the business community.

Veritex Bank's customer profile reveals distinct needs and preferences for both business and individual clients. Market analysis indicates that SMBs prioritize efficient access to capital and expert guidance. Individual customers seek competitive rates and convenient banking channels.

- SMBs: Efficient access to capital, treasury management solutions, and expert guidance.

- Individuals: Competitive interest rates, convenient banking channels, and trustworthy financial advice.

- Digital Banking: Increasing demand for seamless digital experiences has influenced product development.

- Relationship-Driven Model: Emphasizes direct relationships with dedicated bankers.

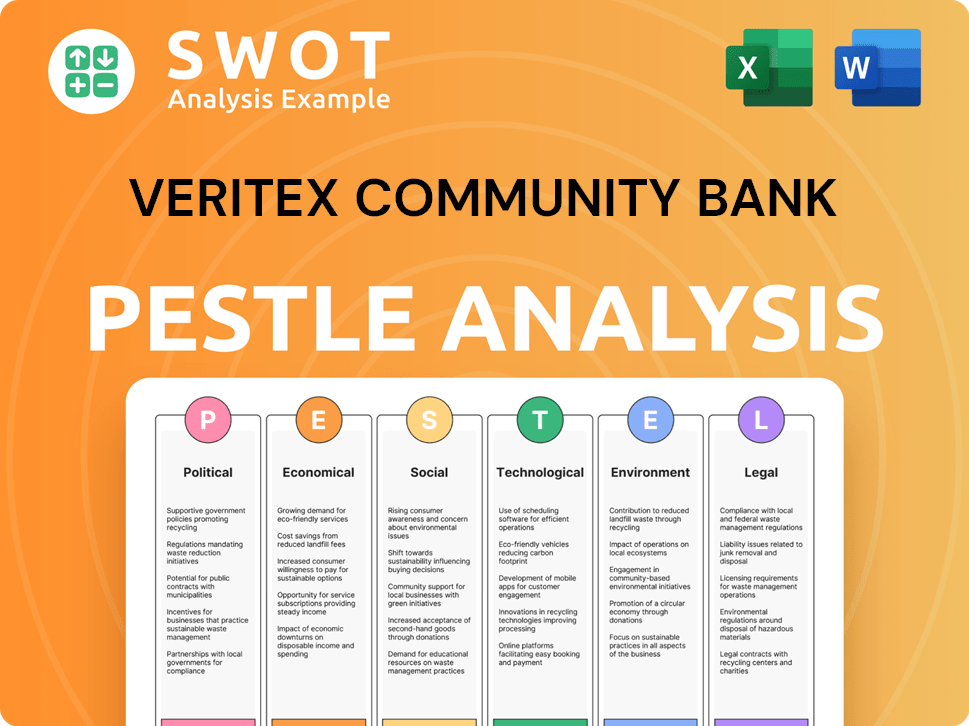

Veritex Community Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Veritex Community Bank operate?

The geographical market presence of the institution is primarily concentrated within the major metropolitan areas of Texas. Its strategic focus is on deepening its presence and market penetration within its existing, high-growth geographical footprint. This approach allows the bank to better understand and cater to the unique preferences and buying power across these regions. The bank leverages its local roots and community bank model to build brand recognition.

The Dallas-Fort Worth (DFW) Metroplex is the institution's strongest market. The bank's consistent growth within Texas indicates a deep penetration and strong brand resonance in its core markets. This region is characterized by robust economic growth, diverse industries, and an expanding population, presenting a fertile ground for the bank's target segments of SMBs and individuals.

The bank's strategy involves localizing its offerings and marketing efforts to align with the specific economic nuances and demographic profiles of different neighborhoods and business districts within these major cities. While the bank has not announced significant recent expansions outside of its core Texas markets, its focus remains on deepening its presence and market penetration within its existing, high-growth geographical footprint. For detailed insights into the bank's expansion strategies, you can explore the Growth Strategy of Veritex Community Bank.

The primary focus is on Texas, particularly the DFW Metroplex. This includes cities like Dallas, Fort Worth, Plano, and Arlington. The bank strategically targets these areas to maximize its market share within a concentrated geographical area.

The bank localizes its offerings and marketing to suit the specific economic and demographic profiles of different neighborhoods and business districts. This approach enables a better understanding of the unique preferences and buying power within these regions.

The bank aims to deepen its presence and market penetration within its existing high-growth geographical footprint. While no recent significant expansions outside of Texas have been announced, the focus remains on strengthening its position in its core markets.

The DFW Metroplex benefits from robust economic growth, diverse industries, and an expanding population. These factors create a favorable environment for the bank's target segments, including SMBs and individuals, to thrive.

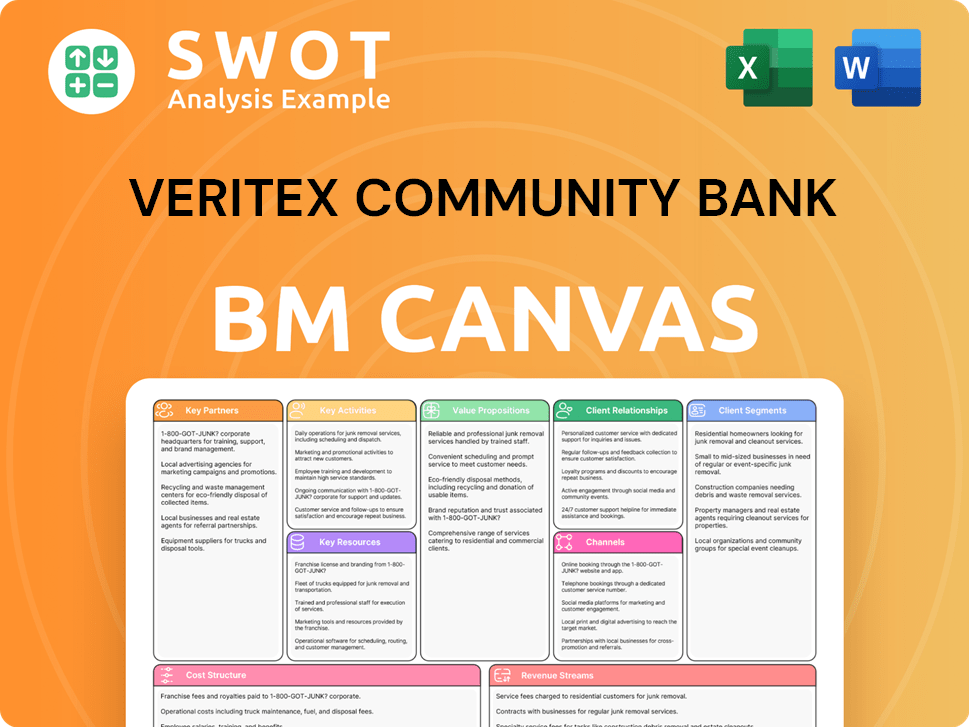

Veritex Community Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Veritex Community Bank Win & Keep Customers?

To understand the customer acquisition and retention strategies of a bank like , it's essential to consider its approach to building and maintaining its customer base. The bank leverages a blend of traditional and digital methods, with a strong emphasis on personalized service, which is a key differentiator in the competitive banking landscape. This approach is designed to attract and keep customers by fostering strong relationships and meeting their specific financial needs.

The bank's customer acquisition strategy relies heavily on its local reputation and referral networks, particularly within the business community. These networks are crucial for attracting new customers, as they provide a foundation of trust and credibility. Furthermore, the bank employs targeted digital advertising and community sponsorships to increase its visibility and reach potential customers. For individual customers, the bank focuses on local advertising, highlighting its personalized service as a significant advantage over larger, national banks. This strategy aims to attract a diverse customer base, emphasizing the bank's commitment to understanding and meeting the needs of its clients.

Retention strategies are deeply integrated into the bank's core philosophy, which prioritizes building lasting relationships. The bank focuses on delivering highly personalized service, providing proactive financial advice, and offering responsive customer support. This approach is designed to foster customer loyalty by addressing their unique financial needs and building a sense of trust. The bank's emphasis on treasury management services for businesses and tailored loan products for both businesses and individuals significantly contributes to customer retention. While specific CRM systems or detailed segmentation strategies are not publicly disclosed, the bank's focus on personalized interactions suggests a sophisticated approach to managing customer relationships and tailoring communications.

The bank relies on referrals from existing customers and business partners. This is a cost-effective way to acquire new customers who are more likely to trust the bank due to the recommendation. This method leverages the existing strong relationships the bank has built within the community.

The bank uses online advertising to reach specific demographics and potential customers. This allows for precise targeting, ensuring that marketing efforts are directed towards individuals and businesses most likely to become customers. This approach is data-driven, optimizing ad spend for maximum impact.

The bank supports local events and organizations to increase its visibility and build goodwill. This helps to enhance its brand image and establish the bank as a community partner. This strategy fosters a positive relationship with the local community, making the bank more approachable.

The bank emphasizes personalized interactions and customized financial solutions. This approach is designed to build strong, lasting relationships with clients. This helps to increase customer loyalty and satisfaction. The bank's focus on understanding individual customer needs is a key differentiator.

The bank offers specialized services for businesses to manage their finances effectively. This includes solutions for cash flow, payments, and fraud prevention. These services are designed to meet the unique needs of business clients, enhancing their financial efficiency.

The bank provides customized loan products for both businesses and individuals. This ensures that clients receive financial solutions that are specifically tailored to their needs. This approach builds customer loyalty and fosters long-term relationships.

The bank's success in customer acquisition and retention is a result of its customer-centric approach. This involves a deep understanding of customer needs and a commitment to providing personalized service. The bank's focus on building strong relationships with its clients is a key factor in its ability to attract and retain customers.

- Relationship-Based Banking: Building trust and rapport with customers through personalized interactions.

- Proactive Financial Advice: Offering tailored financial advice to help customers achieve their financial goals.

- Responsive Customer Support: Providing quick and effective solutions to customer inquiries and issues.

- Community Engagement: Participating in local events and supporting community initiatives to enhance brand image.

The bank's strategies have been effective, as evidenced by its consistent deposit growth and loan portfolio expansion. This indicates that the bank is successfully acquiring new customers and retaining existing ones. For more detailed information on the bank's business model and revenue streams, you can refer to Revenue Streams & Business Model of Veritex Community Bank.

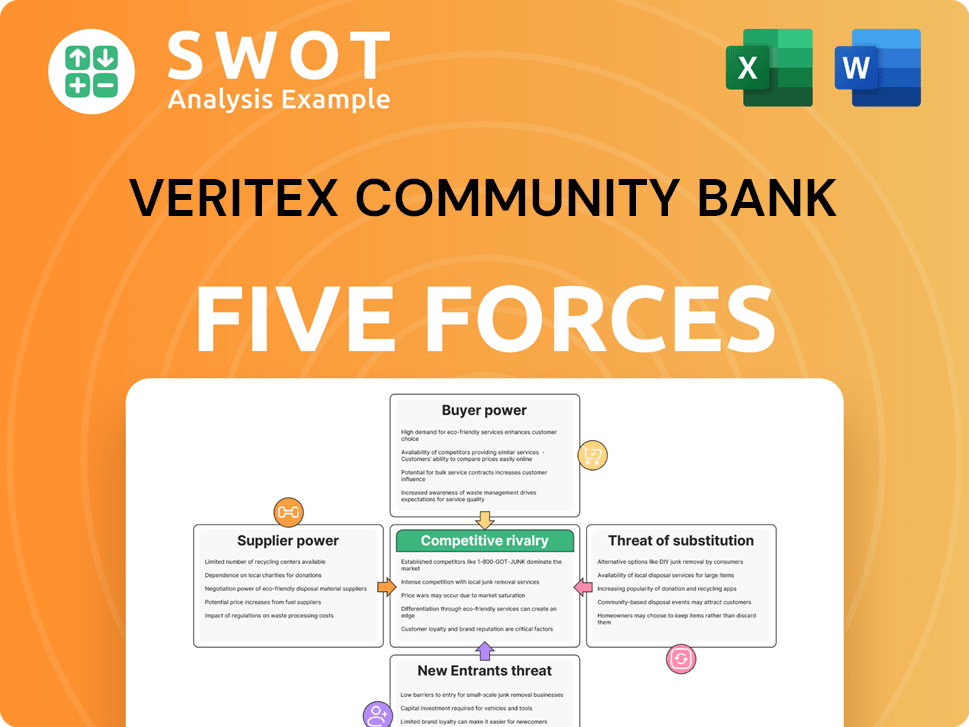

Veritex Community Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veritex Community Bank Company?

- What is Competitive Landscape of Veritex Community Bank Company?

- What is Growth Strategy and Future Prospects of Veritex Community Bank Company?

- How Does Veritex Community Bank Company Work?

- What is Sales and Marketing Strategy of Veritex Community Bank Company?

- What is Brief History of Veritex Community Bank Company?

- Who Owns Veritex Community Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.