Bank Mandiri Bundle

How is Bank Mandiri Dominating the Indonesian Market?

Bank Mandiri, a titan in Indonesia's financial landscape, has masterfully navigated the digital revolution to reshape its sales and marketing strategies. This transformation has not only solidified its industry leadership but also fueled impressive growth. Discover how this state-owned bank leverages cutting-edge digital platforms to attract and retain millions of customers.

Bank Mandiri's success story is a testament to its innovative approach to Bank Mandiri SWOT Analysis, with a keen focus on digital solutions and ecosystem synergy. The bank's Bank Mandiri sales strategy and Bank Mandiri marketing strategy are now deeply intertwined with its digital platforms, Livin' by Mandiri and Kopra by Mandiri, driving significant transaction volumes and user growth. This in-depth analysis will explore the core elements of Mandiri sales and marketing initiatives, its impressive Mandiri financial services and how it maintains a strong Bank Mandiri market share through effective Mandiri customer acquisition techniques.

How Does Bank Mandiri Reach Its Customers?

The sales and marketing strategy of Bank Mandiri, a prominent player in the Indonesian financial sector, is a dynamic blend of traditional and digital channels. This approach allows the bank to cater to a diverse customer base, from individual retail clients to large corporate entities. The bank's strategy focuses on leveraging its extensive network while embracing digital transformation to enhance customer experience and drive growth.

Bank Mandiri's sales strategy is designed to maximize market share and customer engagement through various channels. This includes a strong emphasis on digital platforms, strategic partnerships, and targeted marketing campaigns. The bank continuously refines its approach to stay competitive and meet the evolving needs of its customers. This comprehensive strategy supports its position as a leading financial institution in Indonesia.

The bank's sales channels have evolved significantly, reflecting a strategic shift towards digital adoption and omnichannel integration. The primary focus is on digital platforms like Livin' by Mandiri for retail customers and Kopra by Mandiri for wholesale clients. These platforms serve as key sales channels, offering a wide range of banking and beyond-banking services, including customer acquisition and product cross-selling. This digital-first approach is complemented by strategic partnerships and exclusive distribution deals.

Bank Mandiri maintains a robust network of physical branches and ATMs across Indonesia and internationally. These traditional channels remain crucial for specific customer segments and complex transactions. While digital channels are growing, the physical presence ensures accessibility and supports customer service.

Livin' by Mandiri is the bank's flagship digital platform for retail customers. It serves as a super app, offering a wide array of banking and non-banking services, including online customer acquisition and cross-selling. In 2024, Livin' by Mandiri had over 29.3 million users, with transaction frequency increasing by 38% annually to 3.9 billion transactions.

Kopra by Mandiri is designed for corporate and business clients. It facilitates wholesale transactions and provides specialized services to meet the needs of these segments. In 2024, Kopra by Mandiri processed transactions worth Rp 22,700 trillion, reflecting a 17% year-over-year growth in transaction volume.

Bank Mandiri leverages strategic partnerships to expand its reach and enhance customer offerings. These collaborations, such as the 'Leveraging Digital Ecosystem' strategy, involve partners like Telkomsel, Traveloka, and PT Garuda Indonesia. This approach allows customers to fulfill various transactions without switching applications, contributing to customer acquisition and market share.

Bank Mandiri's sales and marketing strategies are multifaceted, focusing on digital innovation, customer-centric services, and strategic partnerships. These strategies aim to enhance customer experience, drive growth, and maintain a competitive edge in the financial market. The emphasis on digital platforms and strategic collaborations is a testament to the bank's commitment to adapting to evolving customer needs and market dynamics. For more insight, check out the Growth Strategy of Bank Mandiri.

- Digital Transformation: Prioritizing digital platforms like Livin' by Mandiri and Kopra by Mandiri to streamline banking services and enhance customer experience.

- Strategic Partnerships: Collaborating with various industries to expand reach and offer integrated services within the Livin' by Mandiri app.

- MSME Support: Providing digital transaction services like Livin' Merchant to support and facilitate small and medium-sized enterprises.

- Customer Segmentation: Tailoring services and marketing efforts to different customer segments, including retail, corporate, and MSMEs.

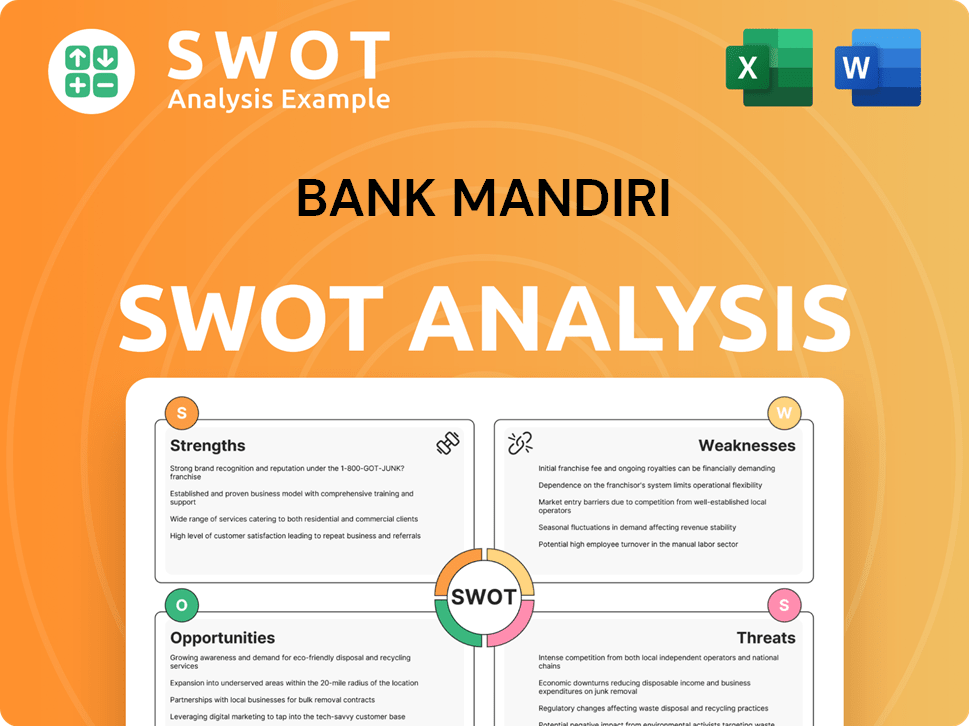

Bank Mandiri SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Bank Mandiri Use?

The sales and marketing strategy of Bank Mandiri is a multifaceted approach, combining digital and traditional tactics. This strategy aims to enhance brand awareness, generate leads, and boost sales. The bank's digital transformation initiatives are central to improving its services and operational efficiency.

Bank Mandiri's marketing efforts are guided by data-driven insights, customer segmentation, and personalization. The bank's strategic focus in 2024 was on 'Growth through Digital and Ecosystem Synergy,' prioritizing ecosystem-based lending and product bundling through sector-specific initiatives. This approach allows for targeted campaigns and promo programs.

The bank's marketing mix has evolved to prioritize digital solutions for faster and more reliable customer banking activities. The bank's digital transformation initiatives are geared towards enhancing its digital banking services and improving business efficiency.

Bank Mandiri heavily utilizes digital marketing, including content marketing, SEO, paid advertising, email marketing, and social media engagement. The Bank Mandiri digital marketing strategy focuses on enhancing customer engagement and driving sales through its digital platforms.

The Livin' by Mandiri super app is a key marketing tool, continuously introducing new features like Livin' Auto, Livin' Investasi, and Livin' Loyalty. This drives customer engagement and product cross-selling. The app's high transaction volume, with 3.9 billion transactions in 2024, highlights its effectiveness.

For wholesale clients, Kopra by Mandiri offers broader and more integrated services, serving as a marketing tactic by providing comprehensive digital financial solutions. This platform is continually developed to meet the evolving needs of wholesale customers.

Bank Mandiri emphasizes data-driven marketing, customer segmentation, and personalization to tailor its campaigns. This approach allows for more effective targeting and personalized customer experiences. This strategy is crucial for Mandiri customer acquisition.

The bank's strategic focus in 2024 was 'Growth through Digital and Ecosystem Synergy,' prioritizing ecosystem-based lending and product bundling. This approach allows for targeted campaigns and promo programs, enhancing the Bank Mandiri sales strategy.

While digital tactics are paramount, Bank Mandiri still uses traditional media, albeit with a shift towards integrated campaigns. The bank's presence in mass events, such as supporting the Makassar Festival 8 2024, indicates continued use of events for brand visibility.

The Bank Mandiri marketing strategy is designed to drive growth and enhance customer engagement. The bank's approach includes a mix of digital and traditional marketing techniques, supported by data-driven insights and customer segmentation.

- Digital Transformation: Focus on improving digital banking services and efficiency.

- Content Marketing and SEO: Utilizing content and search engine optimization to increase online visibility.

- Paid Advertising and Email Marketing: Implementing targeted advertising and email campaigns.

- Social Media Engagement: Actively engaging with customers on social media platforms.

- Livin' by Mandiri: Leveraging the super app to introduce new features and drive cross-selling.

- Kopra by Mandiri: Offering comprehensive digital financial solutions for wholesale clients.

- Data-Driven Marketing: Utilizing customer segmentation and personalization for targeted campaigns.

- Ecosystem Synergy: Prioritizing ecosystem-based lending and product bundling.

- Traditional Media: Using events and integrated campaigns for brand visibility.

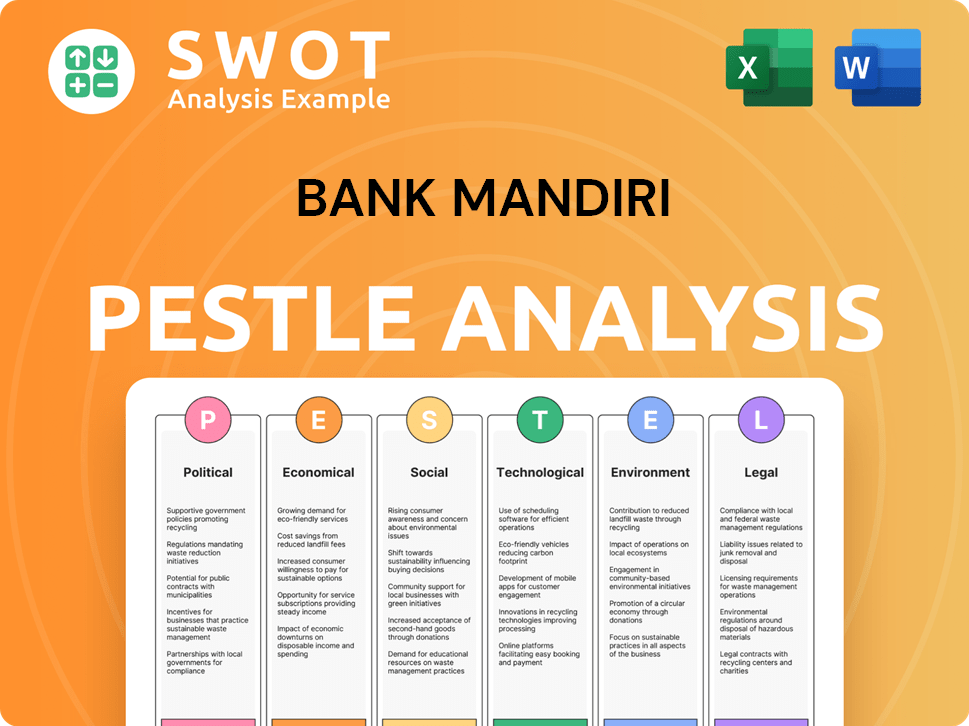

Bank Mandiri PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Bank Mandiri Positioned in the Market?

Bank Mandiri's brand positioning centers on being 'Your preferred financial partner,' a message that emphasizes reliability, simplicity, and integrated digital banking solutions. This positions the institution as a seamless part of customers' lives, fostering long-term, trust-based relationships with both individual and business clients. The focus on digital innovation and an ecosystem-based strategy differentiates the bank, aiming to be a one-stop solution provider across all segments, which is key to its Bank Mandiri sales strategy.

The bank's visual identity, tone of voice, and customer experience are designed to reflect its modern and accessible digital offerings while maintaining a professional and trustworthy image. This approach is critical for attracting and retaining customers in the competitive Mandiri financial services market. Bank Mandiri's commitment to supporting economic growth through innovation is evident in its numerous awards and recognitions, solidifying its position as a leader in the financial sector.

Brand consistency is crucial across all channels, from physical branches to digital platforms like Livin' by Mandiri and Kopra by Mandiri. The bank actively responds to shifts in consumer sentiment and competitive threats by continuously innovating and adapting. For example, the 'Livin' Planet' feature within the Livin' by Mandiri super app demonstrates a commitment to sustainability, appealing to environmentally conscious customers. This strategic move aligns with its broader ESG initiatives, enhancing its brand image and appeal.

Bank Mandiri emphasizes digital innovation to enhance customer experience and streamline services. This includes continuous updates to its digital platforms, such as Livin' by Mandiri, to meet evolving customer needs. The bank's investment in digital tools is a core element of its Bank Mandiri marketing strategy, aiming to improve customer acquisition and retention.

The bank employs an ecosystem-based strategy, offering a wide range of integrated financial solutions. This approach aims to provide a one-stop solution for customers across all segments, from personal banking to business services. This strategy is a key driver for increasing Bank Mandiri market share.

Bank Mandiri integrates sustainability into its brand through initiatives like 'Livin' Planet,' appealing to environmentally conscious customers. This aligns with broader ESG initiatives, enhancing its brand image and attracting a wider audience. These efforts are part of a comprehensive Mandiri sales and marketing plan.

The bank prioritizes building long-term relationships based on trust with both business and individual customers. This customer-centric approach is fundamental to its brand positioning, focusing on reliability and simplicity. Understanding Bank Mandiri's target market analysis is key to this strategy.

Bank Mandiri's brand positioning is reinforced by its strong financial performance and industry recognition. The bank was named the Best Digital Banking Platform in Indonesia in 2024 and the Best International Banking Network 2024 by Alpha SouthEast Asia, highlighting its digital prowess and global reach. Additionally, it ranked 105th among the top 500 companies in the Asia Pacific region in TIME's World's Best Companies 2025 list, being the leading bank in Indonesia within its category. This demonstrates its commitment to excellence and innovation, which are crucial for its Mandiri customer acquisition efforts. For more insights into the financial aspects of the company, you can read about Owners & Shareholders of Bank Mandiri.

Bank Mandiri's key strengths include its focus on digital innovation, ecosystem-based strategy, and commitment to sustainability. These elements enhance its brand image and customer appeal. These are the core elements of What are the key strengths of Bank Mandiri's sales strategy.

The bank's digital platforms, particularly Livin' by Mandiri, are central to its brand positioning. Continuous updates and new features, such as 'Livin' Planet,' showcase its commitment to innovation and customer convenience. This is a key component of its Bank Mandiri digital marketing strategy.

Bank Mandiri's ESG initiatives, including the 'Livin' Planet' feature, align with the growing importance of sustainability. This approach attracts environmentally conscious customers and enhances its brand reputation. This is a key element of its Bank Mandiri branding and marketing strategy.

The bank focuses on creating a seamless and user-friendly customer experience across all its touchpoints. This includes both physical branches and digital platforms, ensuring consistency and ease of use. This is crucial for How Bank Mandiri increases customer loyalty.

Bank Mandiri's strong financial performance and industry recognition support its brand positioning. Awards such as Best Digital Banking Platform in Indonesia 2024 and its ranking in TIME's World's Best Companies 2025 list validate its leadership. This is a result of its Bank Mandiri sales performance analysis.

The bank actively responds to shifts in consumer sentiment and competitive threats by continuously innovating and adapting. This includes introducing new features and services that meet evolving customer needs. This is part of the Bank Mandiri marketing plan 2024.

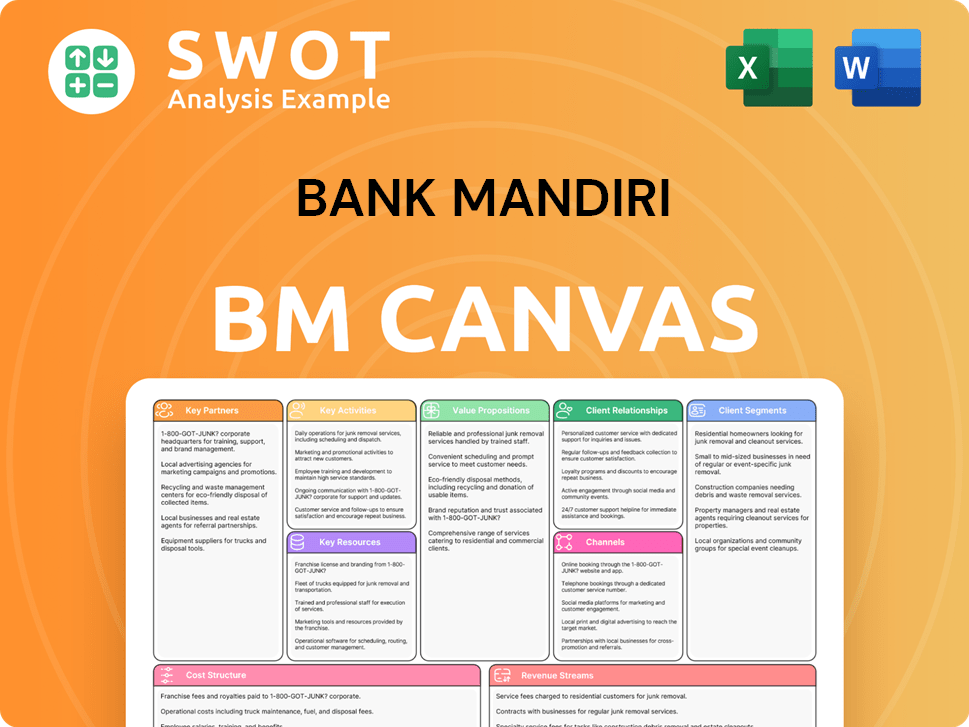

Bank Mandiri Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Bank Mandiri’s Most Notable Campaigns?

The sales and marketing strategy of Bank Mandiri is characterized by impactful campaigns designed to boost customer engagement and drive growth. These initiatives leverage digital platforms and targeted programs to enhance market share and customer acquisition. The focus is on innovation, customer-centric solutions, and sustainable practices, reflecting a commitment to both financial performance and social responsibility.

Key campaigns include the continuous development of digital platforms, international expansion, and initiatives promoting environmental awareness. These efforts are supported by targeted promotions that cater to specific customer segments. Through these strategies, Bank Mandiri aims to strengthen its position in the financial services sector.

A deep dive into Growth Strategy of Bank Mandiri reveals that the company has been focusing on digital transformation and customer-centric approaches to boost its sales performance.

Bank Mandiri's digital platforms, Livin' by Mandiri and Kopra by Mandiri, are central to its sales and marketing strategy. Livin' by Mandiri, recognized as the Best Mobile Banking Service in Indonesia for 2024, processed nearly four billion transactions, a 38% year-on-year increase. Kopra by Mandiri, the wholesale banking platform, processed over 1.3 billion transactions amounting to Rp 22,700 trillion in 2024.

The 'Kopra Beyond Borders' initiative, launched in 2022, expanded Kopra by Mandiri's reach internationally. By 2024, this platform supported over 63,000 transactions for overseas customers, exceeding US$1.5 billion. This demonstrates successful international expansion and digital innovation, reinforcing Mandiri's global presence.

The 'Livin' Planet' feature within Livin' by Mandiri promotes environmental awareness and sustainable living. In 2024, this initiative tracked a reduction of 8,538.68 kg CO2e. Recognized as the Best Green Financial Lifestyle Initiative in Indonesia, it highlights Bank Mandiri's commitment to ESG principles and appeals to environmentally conscious customers.

The 'Mandiri JCB Japan Festival Program Campaign,' running from April to December 2024, targets the mass premium segment. This campaign offers incentives like lucky draws for round-trip air tickets to Japan and double points for specific transactions. The campaign aims to incentivize card usage and cater to niche customer interests, driving customer acquisition.

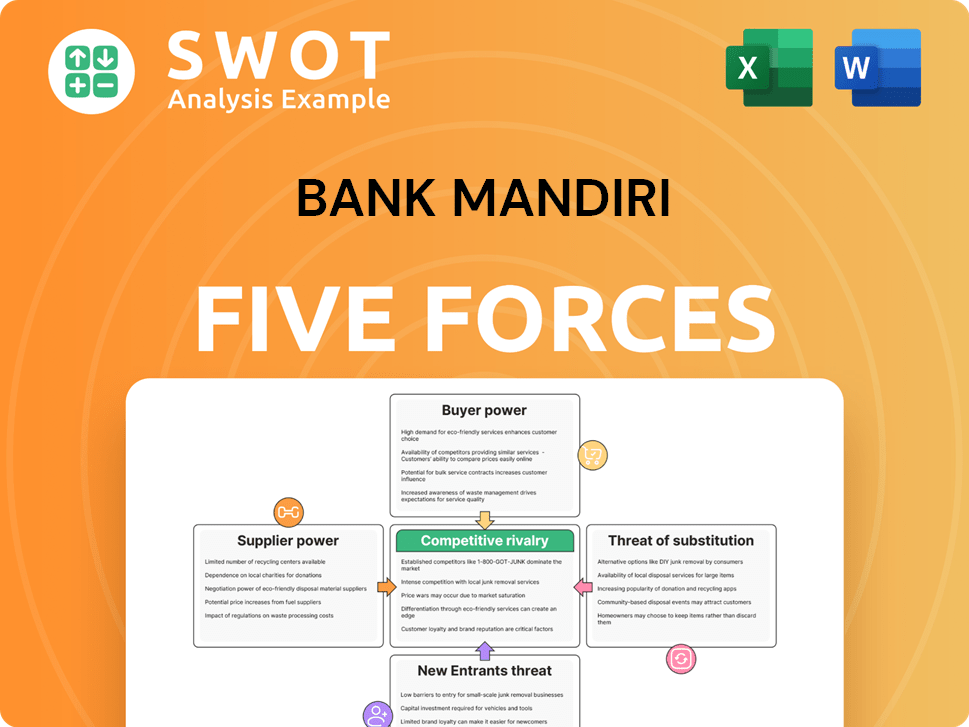

Bank Mandiri Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank Mandiri Company?

- What is Competitive Landscape of Bank Mandiri Company?

- What is Growth Strategy and Future Prospects of Bank Mandiri Company?

- How Does Bank Mandiri Company Work?

- What is Brief History of Bank Mandiri Company?

- Who Owns Bank Mandiri Company?

- What is Customer Demographics and Target Market of Bank Mandiri Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.