Bank Mandiri Bundle

Who Does Bank Mandiri Serve?

Bank Mandiri's journey, from its 1998 inception to its current status, reflects a significant evolution in serving the Indonesian market. Understanding the bank's Bank Mandiri SWOT Analysis will give you a better understanding of its customer base. This transformation is crucial for any financial institution aiming for sustained success. This analysis delves into the specifics of Bank Mandiri's customer demographics and target market.

Initially focused on corporate and commercial banking, Bank Mandiri now caters to a diverse range of customers, including individuals, SMEs, and institutions. This shift highlights the importance of effective market segmentation and understanding the evolving needs of its customer profile. The bank's strategic adaptation to digital banking, particularly with the launch of Livin' by Mandiri, showcases its commitment to meeting the demands of a digitally-savvy target market. Analyzing the customer demographics, including Bank Mandiri customer age range, income levels, and education levels, is key to understanding its success in providing financial services.

Who Are Bank Mandiri’s Main Customers?

Understanding the customer demographics and target market of Bank Mandiri is crucial for assessing its strategic positioning and growth potential. Bank Mandiri's customer base is broad, encompassing both individual consumers (B2C) and businesses (B2B). This diverse approach allows the bank to cater to a wide range of financial needs, from basic savings to complex corporate finance solutions.

Bank Mandiri employs a comprehensive market segmentation strategy to effectively reach its varied customer groups. This involves tailoring products and services to meet the specific needs of each segment, ensuring customer satisfaction and driving business growth. The bank's focus on both retail and business customers reflects its commitment to a balanced and diversified portfolio.

The bank's approach to customer profile development involves analyzing various factors such as age, income, education, and occupation. This detailed understanding enables Bank Mandiri to offer targeted financial services, enhancing customer engagement and loyalty. Recent data indicates a strong emphasis on digital banking solutions to cater to evolving customer preferences.

For B2C customers, Bank Mandiri targets a wide spectrum of ages, including young professionals and millennials who prefer digital banking. Older generations are also served through traditional branch services. Income levels vary, with services tailored for mass affluent individuals and those in lower to middle-income brackets.

In the B2B segment, Bank Mandiri focuses on micro, small, and medium-sized enterprises (MSMEs), large corporations, and institutional clients. MSMEs receive working capital and investment loans, alongside digital banking solutions. Large corporations benefit from corporate banking services, while institutional clients use payment systems and fund management.

Bank Mandiri's digital transformation is crucial, with the Livin' by Mandiri app amassing over 24 million users by the first quarter of 2024. This highlights a strong penetration into the retail customer base and the bank's commitment to digital innovation. The bank continuously enhances its digital offerings to meet evolving customer needs.

The MSME segment is a significant growth driver for Bank Mandiri, supported by government initiatives and the bank's extensive network. This focus allows Bank Mandiri to diversify its portfolio and reduce reliance on corporate lending. The bank's strategy aligns with broader economic goals.

Bank Mandiri's target market includes a wide range of demographics, including young professionals, families, and entrepreneurs. The bank caters to various customer income levels, from those seeking basic savings accounts to high-net-worth individuals requiring wealth management. The bank also focuses on customer education levels, offering tailored products for different educational backgrounds.

- Age Range: Spans from young adults (millennials and Gen Z) to older generations, with digital banking solutions like Livin' by Mandiri catering to younger demographics.

- Income Levels: Services range from basic savings and loans for lower to middle-income groups to wealth management for the mass affluent.

- Education and Occupation: Tailored products for civil servants, private sector employees, and entrepreneurs.

- Family Status: Home and auto loans are popular among families.

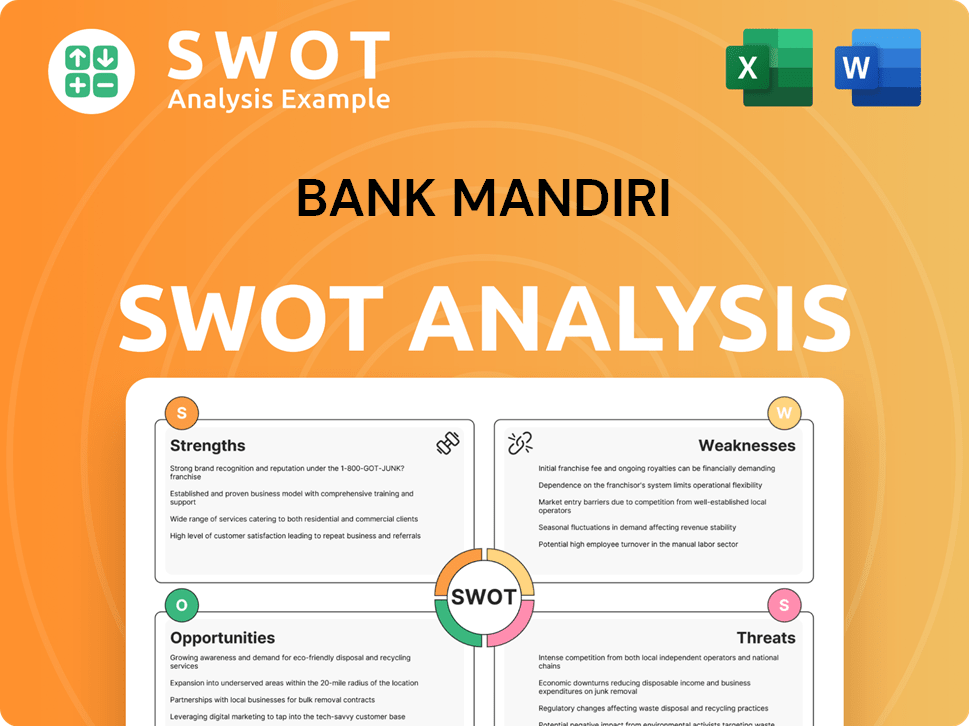

Bank Mandiri SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bank Mandiri’s Customers Want?

Understanding the customer needs and preferences is crucial for Bank Mandiri to tailor its financial services effectively. This involves analyzing the diverse requirements and motivations of its customer base, from retail clients to business entities. By identifying these needs, the bank can enhance its products and services, fostering customer loyalty and driving growth.

For retail customers, the focus is on convenience, speed, and security, especially with the increasing adoption of digital channels. Business clients, on the other hand, prioritize efficient cash management, access to capital, and robust digital platforms. Addressing these varied needs allows Bank Mandiri to maintain its competitive edge in the financial services sector.

The bank continuously adapts to evolving customer expectations, leveraging data and feedback to refine its offerings. This proactive approach ensures that Bank Mandiri remains relevant and responsive to the dynamic needs of its target market.

Retail customers of Bank Mandiri prioritize convenience, speed, and security in their banking experiences. They seek seamless transactions, instant payments, and easy access to services through digital channels. Their needs are met through the bank's mobile application, Livin' by Mandiri.

Psychological drivers for retail customers include a desire for financial stability and security for their savings. They also aspire to achieve financial goals such as homeownership or education. Bank Mandiri's services are designed to support these aspirations.

Practical drivers involve efficient bill payments, accessible credit for daily needs, and simplified investment options. Bank Mandiri provides these services to meet the day-to-day financial requirements of its retail customers. This includes offering credit for various needs.

Business customers require efficient cash management, access to capital for growth, and robust digital platforms. They seek tailored financial solutions that support operational efficiency and strategic expansion. Bank Mandiri addresses these needs with specific services.

Bank Mandiri addresses pain points such as complex loan application processes and limited access to credit for MSMEs. The bank simplifies loan applications and expands digital lending capabilities. It also enhances its platforms to offer comprehensive solutions.

Livin' by Mandiri processed 845 million transactions in Q1 2024, marking a 23.3% year-on-year increase. This highlights the success of meeting the digital banking needs of its customers. The app's features are continuously enhanced.

Bank Mandiri employs various strategies to meet and exceed customer expectations. These include simplifying loan application processes, expanding digital lending capabilities, and enhancing digital platforms like Livin' by Mandiri and Kopra by Mandiri. Continuous improvement is a key focus.

- Customer Feedback: Actively collects and analyzes customer feedback to understand needs and preferences.

- Market Trends: Monitors market trends, particularly the shift to digital banking, to inform product development.

- Product Enhancements: Continuously enhances user experience and introduces new features, such as investment options and lifestyle services within the Livin' by Mandiri app.

- Digital Transformation: Focuses on digital transformation to meet the evolving needs of its target market for digital banking.

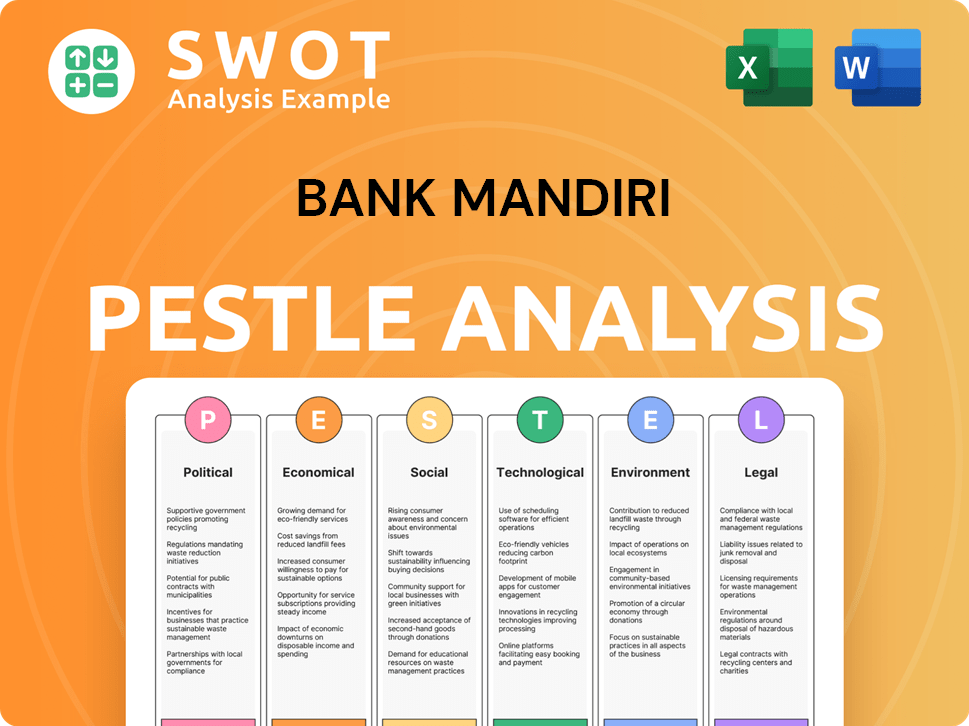

Bank Mandiri PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bank Mandiri operate?

Bank Mandiri's geographical market presence is primarily centered in Indonesia, where it maintains an extensive network of branches and ATMs. This widespread presence allows it to serve a diverse range of customers across the archipelago. The bank's strong market share and brand recognition are particularly notable in major urban centers, which serve as key economic hubs.

In these key areas, Bank Mandiri caters to a diverse customer base, including affluent individuals, large corporations, and a growing number of SMEs. The bank's customer base varies across different regions, with more digitally-savvy customers in urban areas and those in rural areas who may rely more on traditional branch services. This highlights the importance of understanding local market dynamics.

Beyond Indonesia, Bank Mandiri has a limited international presence with offices in financial centers such as Singapore, Hong Kong, and London. These international branches primarily support Indonesian businesses operating abroad and facilitate international trade finance. This strategic positioning supports cross-border transactions and serves the global needs of its corporate clients. For more insights, you can explore Revenue Streams & Business Model of Bank Mandiri.

Bank Mandiri segments its market in Indonesia based on factors such as income levels, age, and location. This market segmentation allows the bank to tailor its financial services to meet the specific needs of different customer groups. Understanding customer demographics is crucial for effective service delivery.

In urban areas, the target market includes tech-savvy individuals and businesses that readily adopt digital banking solutions. In contrast, rural areas may have a greater reliance on traditional banking services offered through physical branches. This dual approach helps Bank Mandiri to cater to a broader audience.

Bank Mandiri's international branches focus on supporting Indonesian businesses and facilitating trade finance. These branches are strategically located in key financial centers to serve the global needs of corporate clients. The international presence supports cross-border transactions.

The bank is actively promoting digital banking solutions, particularly in urban areas, to enhance customer convenience and reduce operational costs. The focus on digital services is a key aspect of Bank Mandiri's strategy. This includes mobile banking and online platforms.

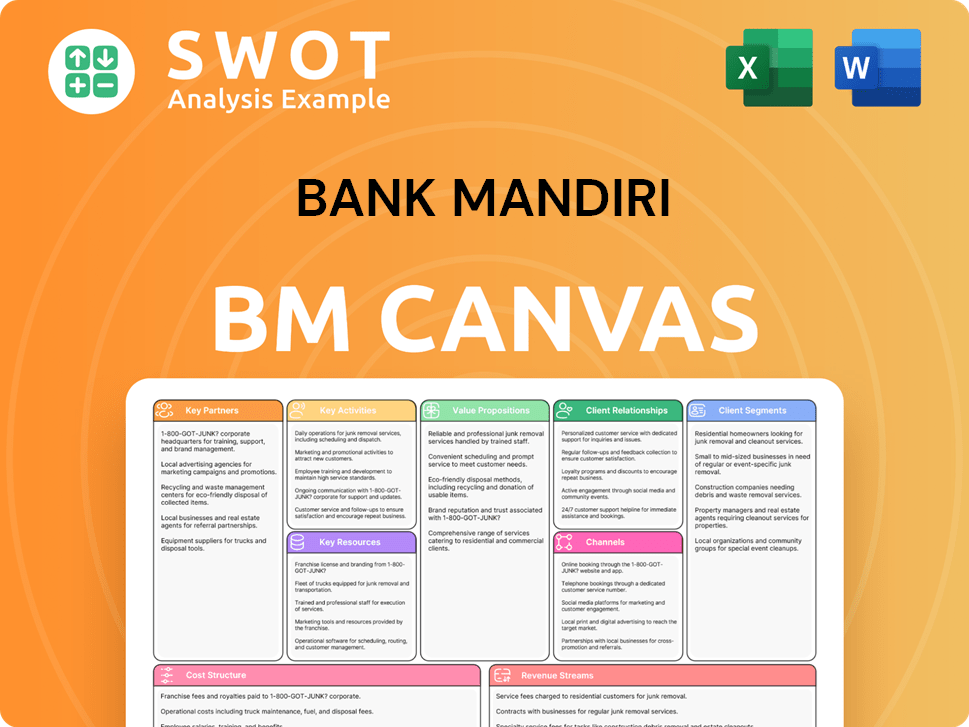

Bank Mandiri Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bank Mandiri Win & Keep Customers?

Bank Mandiri's approach to acquiring and retaining customers is multifaceted, blending digital and traditional strategies. The bank focuses on expanding its customer base through digital marketing, including social media campaigns and online advertising, while also utilizing traditional channels such as television and print media. Sales teams and promotional offers further drive customer acquisition, with the extensive branch network playing a key role in direct customer engagement.

Customer retention is a priority, with loyalty programs and personalized experiences at the forefront. The Livin' by Mandiri app offers personalized insights, financial planning tools, and lifestyle features to boost customer engagement. The bank employs customer data and CRM systems to segment its customer base and tailor marketing campaigns and product offerings, improving the relevance of its outreach.

Successful acquisition campaigns often highlight the convenience and features of digital platforms. The Livin' by Mandiri app's continuous upgrades have significantly increased user growth. Retention initiatives include partnerships with e-commerce platforms and lifestyle merchants. Over time, the bank has shifted towards digital acquisition and retention, recognizing the growing importance of digital channels.

Digital marketing is a key strategy to reach the target market. This includes social media campaigns, search engine optimization (SEO), and online advertising. The bank uses its digital platforms to promote its products and services.

Traditional marketing channels are still utilized to reach a broader audience. These include television commercials, print media, and billboards. These channels help in reaching segments less exposed to digital platforms.

Direct sales teams target corporate and SME clients. Promotional offers such as cashback incentives and preferential interest rates attract new retail customers. These tactics are designed to boost customer acquisition.

The extensive branch network is used for direct customer engagement and onboarding. This provides a physical presence for customer interactions. Branches are essential for providing personalized services.

Loyalty programs and personalized experiences are central to the retention strategy. The Livin' by Mandiri app offers personalized insights and financial planning tools. The bank also offers various loyalty programs to retain customers. For more insights, consider the Marketing Strategy of Bank Mandiri.

- Reward points for credit card usage.

- Exclusive benefits for priority banking customers.

- Partnerships with e-commerce platforms and lifestyle merchants.

- Data-driven marketing campaigns and personalized communication.

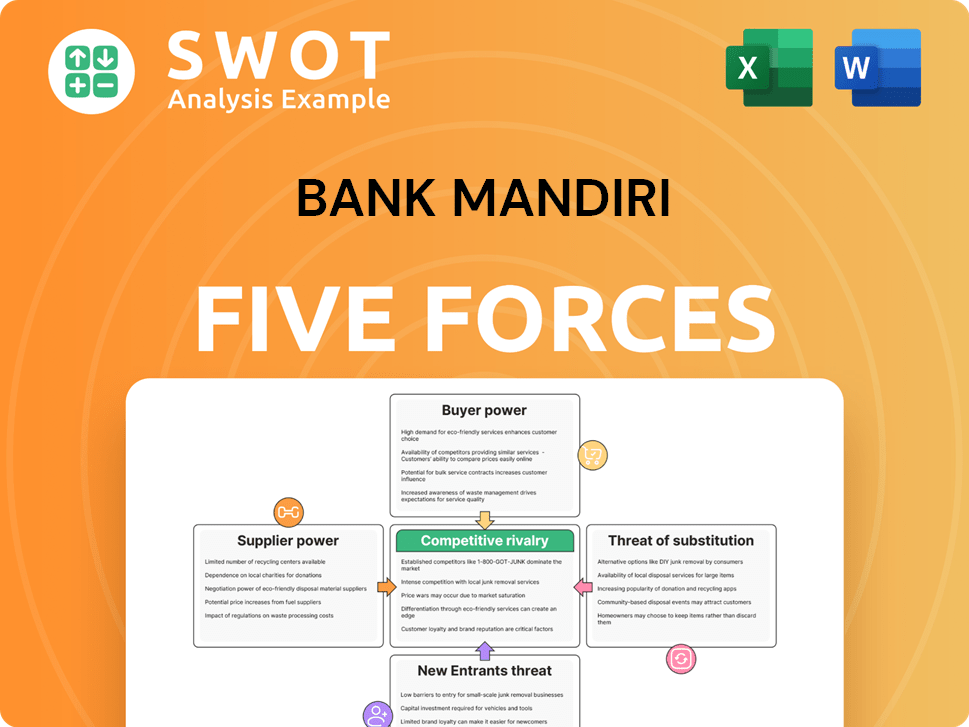

Bank Mandiri Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank Mandiri Company?

- What is Competitive Landscape of Bank Mandiri Company?

- What is Growth Strategy and Future Prospects of Bank Mandiri Company?

- How Does Bank Mandiri Company Work?

- What is Sales and Marketing Strategy of Bank Mandiri Company?

- What is Brief History of Bank Mandiri Company?

- Who Owns Bank Mandiri Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.