Bank Mandiri Bundle

What Drives Bank Mandiri's Success?

Uncover the guiding principles behind Indonesia's largest bank. Explore how Bank Mandiri's mission, vision, and core values shape its strategic direction and impact its stakeholders. Discover the essence of Mandiri Company's commitment to the Indonesian economy and its customers.

Understanding the Bank Mandiri SWOT Analysis is crucial for grasping its strategic positioning, but its mission, vision, and core values provide the foundation. These elements are not merely statements; they are the driving force behind Bank Mandiri's operations, influencing its strategic goals and long-term vision. Delving into Bank Mandiri's mission and vision statement reveals its commitment to serving its customers and contributing to national prosperity, while its core values exemplify its corporate culture and business practices.

Key Takeaways

- Bank Mandiri's mission, vision, and core values provide a strategic framework for success.

- Digital banking solutions and customer-centricity are central to Bank Mandiri's mission.

- AKHLAK values build a strong ethical and cultural foundation for the company.

- Recent performance shows alignment between principles and operational achievements.

- Adherence to guiding principles is crucial for maintaining market leadership.

Mission: What is Bank Mandiri Mission Statement?

Bank Mandiri's mission is to provide reliable and simple digital banking solutions that become a part of customer life – “Seamlessly integrate our financial products and services into our costumers' lives by delivering simple, fast digital banking solutions.”

Delving into the heart of Bank Mandiri, understanding its mission is crucial for grasping its strategic direction and commitment to its customers. The Bank Mandiri Mission statement is not just a set of words; it's a guiding principle that shapes the bank's operations, product development, and overall customer experience. This mission statement reflects a clear focus on digital innovation and customer-centricity.

The mission emphasizes digital banking. This means developing and enhancing digital platforms to provide financial services. The bank is investing heavily in its digital infrastructure to meet the evolving needs of its customers.

Bank Mandiri aims to offer banking solutions that are easy to use and fast. This focus on simplicity and speed is designed to improve the overall customer experience. This is a key aspect of the Mandiri Strategy.

The bank's mission is to seamlessly integrate its services into customers' lives. This involves making financial products and services an integral part of daily routines. This is a core part of the Bank Mandiri Goals.

The mission statement is customer-focused, prioritizing their needs and experiences. This ensures that all initiatives are designed with the customer in mind. This customer-centric approach is fundamental to the Bank Mandiri Mission.

Bank Mandiri's digital platforms, such as Livin' by Mandiri for retail customers and Kopra by Mandiri for wholesale customers, are prime examples of this mission in action. These platforms offer a comprehensive suite of financial services, enhancing convenience and accessibility. These digital platforms are key to the bank's future plans.

The bank's strategy includes ecosystem-based lending and product bundling, leveraging its digital capabilities to offer integrated financial services. This approach aims to provide holistic financial solutions across various segments. This approach is crucial for the Bank Mandiri Vision.

The implementation of this mission is evident in Bank Mandiri's strategic initiatives. For instance, the continuous upgrades to its digital platforms, Livin' by Mandiri and Kopra by Mandiri, are designed to provide a seamless and user-friendly banking experience. These platforms are constantly evolving to meet the changing needs of customers. Furthermore, the bank's focus on ecosystem-based lending and product bundling demonstrates its commitment to integrating financial services into various aspects of customers' lives. These initiatives are supported by significant investments in technology and infrastructure, with digital transactions accounting for a substantial portion of the bank's overall transactions. For a deeper understanding of how Bank Mandiri generates revenue and operates, you can explore the Revenue Streams & Business Model of Bank Mandiri.

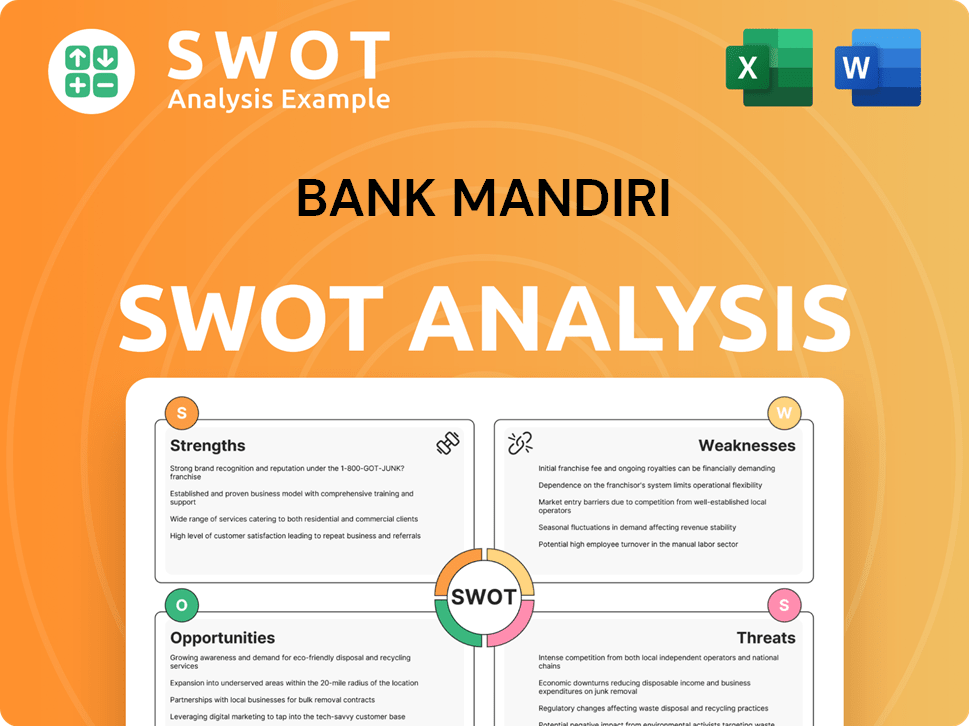

Bank Mandiri SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Bank Mandiri Vision Statement?

Bank Mandiri's vision is 'To be your preferred financial partner'.

Bank Mandiri's vision statement, "To be your preferred financial partner," encapsulates the institution's ambition to be the top choice for customers seeking a financial partner. This vision, which guided the company from 2020 to 2024, is a forward-looking statement that reflects Bank Mandiri's strategic goals. It is designed to position the bank as the leading financial institution in Indonesia, offering comprehensive services and solutions.

The vision is future-oriented, focusing on establishing Bank Mandiri as the preferred choice for both individual and business clients. This customer-centric approach emphasizes the bank's commitment to understanding and meeting the diverse financial needs of its customers. This focus is crucial in a rapidly evolving financial landscape.

The scope of the vision is broad, aiming to provide international service standards and innovative financial solutions. This includes a commitment to leveraging technology and digital platforms to enhance customer experience and streamline operations. This is a key element of Bank Mandiri's strategy.

Bank Mandiri's vision also includes an ambition to play an active role in driving Indonesia's long-term growth. This involves supporting various sectors of the economy, from small and medium-sized enterprises (SMEs) to large corporations. This commitment is a core part of the Bank Mandiri Mission.

The vision includes the goal of consistently delivering high returns for shareholders. This financial performance is crucial for sustaining the bank's growth and investment in future initiatives. This focus on shareholder value is a key component of Bank Mandiri's strategic goals.

The vision is both realistic and aspirational, building on Bank Mandiri's position as the largest financial institution in Indonesia. The bank's focus on digital transformation and ecosystem synergy supports its ambition to be a preferred partner in the digital age. The bank's long-term vision is a key aspect of its overall strategy.

While the vision doesn't explicitly mention global impact, its focus on international service standards and being a prominent player in ASEAN suggests a regional aspiration beyond its domestic market. This regional focus is part of Bank Mandiri's long-term vision.

The vision statement reflects Bank Mandiri's commitment to excellence and its ambition to be a leader in the financial industry. The bank's strategic goals are designed to support this vision, ensuring that Bank Mandiri remains a trusted and preferred partner for its customers. The Brief History of Bank Mandiri provides further context on the bank's evolution and strategic direction.

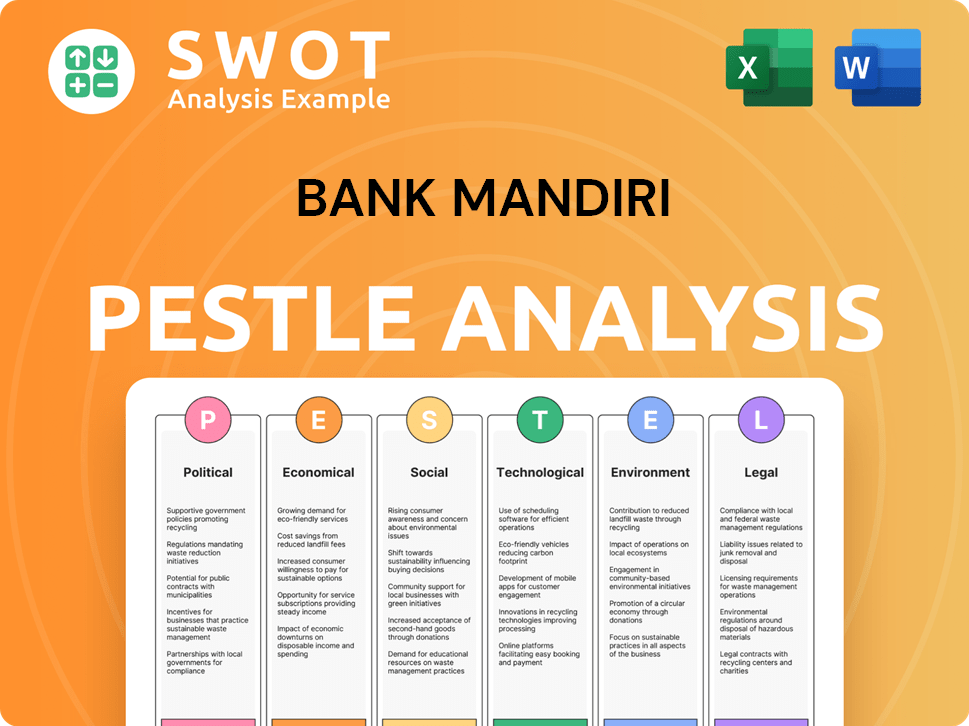

Bank Mandiri PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Bank Mandiri Core Values Statement?

Bank Mandiri's core values are the bedrock of its operations, guiding its interactions with customers, employees, and stakeholders. These values, deeply ingrained in the company's culture, shape its strategic direction and commitment to national development.

Amanah, or trustworthiness, is fundamental to Bank Mandiri's operations, emphasizing ethical conduct and transparent management. This value ensures the security and reliability of its financial services, fostering long-term relationships with customers. This commitment to trust is reflected in the bank's robust corporate governance practices, which are crucial for maintaining stakeholder confidence and achieving its growth strategy.

Kompeten, or competence, drives Bank Mandiri's investment in human capital, fostering a culture of continuous learning and development. This value is evident in the bank's training programs and talent management initiatives, ensuring its workforce is equipped with the skills to provide innovative financial solutions. Bank Mandiri's commitment to competence is reflected in its financial performance, with net profits reaching Rp33.8 trillion in 2023, a 33.7% increase year-on-year, driven by improved operational efficiency and asset quality.

Harmonis, or harmonious, promotes a collaborative and inclusive environment within Bank Mandiri, fostering mutual respect and understanding. This value influences customer relations by encouraging professional and friendly service that caters to diverse needs. This contributes to a positive work environment and is reflected in the bank's high employee satisfaction scores and its ability to attract and retain top talent.

Loyal, or loyalty, underscores Bank Mandiri's dedication to the nation and state, aligning its strategies with national development goals. This commitment is reflected in its support for economic growth and social welfare initiatives. As a state-owned enterprise, Bank Mandiri plays a crucial role in Indonesia's financial ecosystem, contributing significantly to the country's GDP and supporting various government programs.

Understanding these core values provides a foundation for appreciating how Bank Mandiri pursues its mission and vision. The next chapter will explore how these guiding principles influence the company's strategic decisions and shape its future plans.

How Mission & Vision Influence Bank Mandiri Business?

Bank Mandiri's mission and vision are not merely aspirational statements; they are the cornerstones upon which the company builds its strategic decisions and operational frameworks. These statements directly influence the bank's approach to innovation, customer service, and overall market positioning.

The Bank Mandiri Mission to provide simple, fast digital banking solutions fuels the development of platforms like Livin' and Kopra. The Bank Mandiri Vision of being the preferred financial partner drives the bank to enhance service quality and expand digital offerings.

- Significant investment in digital infrastructure and AI implementation for improved processes.

- Focus on ecosystem-based lending and product bundling to integrate financial services.

- Commitment to sustainable finance and ESG principles in lending decisions.

- Strategic partnerships to broaden service offerings and customer reach.

The growth in Livin' users, surpassing 23 million with a 39% year-on-year increase, showcases the success of the digital banking mission. This growth demonstrates the effectiveness of the Mandiri Strategy to provide accessible and user-friendly digital banking solutions.

Bank Mandiri's robust financial performance in 2024, with a consolidated net profit of USD 3.35 billion, a 10.7% increase from the previous year, highlights the success of strategies guided by its mission and vision. This financial success underscores the importance of the Bank Mandiri Goals of sustainable growth and customer satisfaction.

Bank Mandiri continues to make substantial investments in technology and infrastructure to support its digital transformation initiatives. These investments are directly aligned with the Bank Mandiri Vision of becoming a leading digital financial institution. This includes significant spending on AI and data analytics to improve operational efficiency.

The bank's commitment to customer satisfaction is a direct reflection of its mission and vision. This customer-centric approach is evident in the continuous improvements to the Livin' platform and the expansion of services to meet evolving customer needs. This focus helps to define Bank Mandiri's core values.

Bank Mandiri's integration of ESG principles into its lending decisions and operations reflects its commitment to sustainability, aligning with its broader purpose of contributing to the nation's prosperity. This commitment is a key aspect of its long-term Bank Mandiri's vision for sustainability.

Bank Mandiri actively forms strategic partnerships to broaden its service offerings and customer reach. These partnerships are a crucial part of the Mandiri Company's strategy to become a preferred financial partner within various economic ecosystems. This approach enhances its ability to serve diverse customer segments.

The influence of the Bank Mandiri Mission, Bank Mandiri Vision, and Bank Mandiri Core Values is evident in every facet of the company's operations, from technological advancements to customer service initiatives and sustainable practices. Understanding the company's structure also helps to understand the direction of the company, to know more about the owners of the company, you can read the article about Owners & Shareholders of Bank Mandiri. This alignment ensures that Bank Mandiri remains competitive and relevant in the dynamic financial landscape. Let's explore the core improvements to the company's mission and vision in the next chapter.

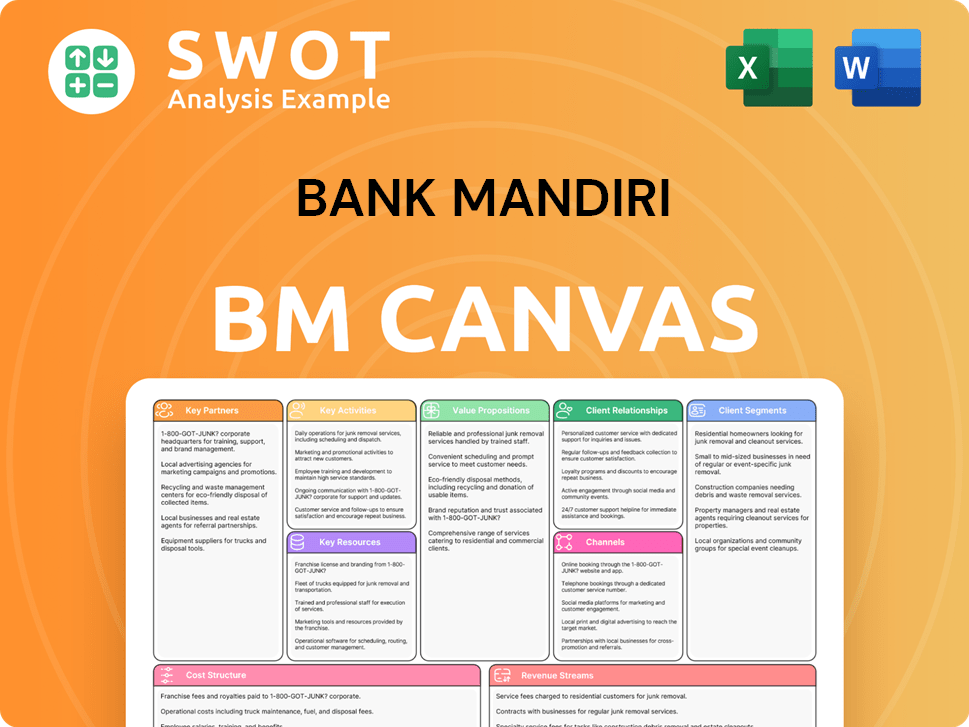

Bank Mandiri Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Bank Mandiri has a strong foundation, continuous improvement is essential in the dynamic financial landscape. This section outlines four key areas where refining the Bank Mandiri Mission, Vision, and Core Values can further enhance its strategic positioning and impact.

To better align with industry trends, Bank Mandiri could explicitly integrate data-driven insights and artificial intelligence into its mission and vision statements. This would signal a stronger commitment to leveraging technology for personalized financial services and predictive capabilities, a key area for competitive advantage. For example, global banks are investing heavily in AI, with projected spending reaching $20 billion by 2026, highlighting the importance of this strategic direction.

Bank Mandiri can reinforce its commitment to financial inclusion by explicitly mentioning serving the unbanked population through digital channels in its mission and vision. This would not only align with national development goals but also differentiate the bank in a market where digital financial inclusion is a priority. Indonesia's financial inclusion rate has been steadily increasing, reaching 85% in 2023, indicating a significant opportunity for further growth in this area, according to the World Bank.

Integrating a more explicit commitment to environmental and social impact within Bank Mandiri’s core mission or vision would elevate its position as a leader in sustainable finance. This is increasingly important as investors and consumers prioritize sustainability; the ESG (Environmental, Social, and Governance) investment market is projected to reach $50 trillion by 2025. Bank Mandiri's commitment to sustainability is also crucial in understanding the Target Market of Bank Mandiri.

While Bank Mandiri emphasizes customer focus, refining its mission and vision to highlight hyper-personalization of services could strengthen its customer-centric approach. This involves leveraging data to offer tailored financial products and proactive financial wellness guidance, a trend seen in leading global banks. Banks that successfully implement hyper-personalization often see a 20-30% increase in customer engagement and retention rates.

How Does Bank Mandiri Implement Corporate Strategy?

The successful execution of a company's mission, vision, and core values is crucial for achieving its strategic objectives and fostering a strong organizational culture. This implementation phase translates the aspirational goals into tangible actions, ensuring that the entire organization works towards a unified purpose.

Bank Mandiri actively demonstrates its commitment to its Bank Mandiri mission and vision through significant investments in digital platforms and innovative technologies. This commitment is evident in the continuous development and enhancement of its digital banking platforms, Livin' by Mandiri for retail customers and Kopra by Mandiri for wholesale clients. These platforms are designed to provide seamless, reliable, and user-friendly digital banking experiences, directly aligning with the bank's mission to offer accessible and convenient financial solutions.

- Livin' by Mandiri: As of Q1 2024, Livin' had over 25 million users, processing over 800 million transactions with a total transaction value exceeding Rp 1,000 trillion. The platform's continuous updates and feature additions, such as enhanced security protocols and personalized financial management tools, reflect the bank's dedication to customer-centric innovation.

- Kopra by Mandiri: Kopra, designed for wholesale customers, facilitates various financial transactions, including supply chain financing and cash management. The platform's growth in user base and transaction volume underscores Bank Mandiri's strategic focus on serving the needs of its corporate clients and supporting the growth of the Indonesian economy.

- AI and Technology Integration: Bank Mandiri's investment in artificial intelligence (AI) for credit scoring, fraud detection, and operational efficiencies further demonstrates its commitment to leveraging technology to improve its services and streamline its operations. This aligns with its vision to be a leading digital bank.

Bank Mandiri's leadership plays a critical role in reinforcing its mission, vision, and core values throughout the organization. While specific direct quotes may vary over time, the bank's strategic reports and public announcements consistently highlight key themes that reflect the company's core tenets. These themes include a strong emphasis on digital transformation, a customer-centric approach, and a commitment to contributing to national economic growth.

Effective communication of the Bank Mandiri mission, vision, and core values to all stakeholders is essential for fostering a cohesive and purpose-driven organization. The bank utilizes multiple channels to disseminate this information, including its official website, annual reports, and internal communication programs designed for its employees.

The implementation of the AKHLAK values (Amanah, Kompeten, Harmonis, Loyal, Adaptif, and Kolaboratif) as core to the corporate culture further embeds the principles of the mission and vision within the organization. These values guide employee behavior and decision-making, ensuring alignment with the bank's overall strategic goals.

Bank Mandiri demonstrates a strong alignment between its stated core values and its actual business practices. This is evident in several key areas, including the integration of Environmental, Social, and Governance (ESG) principles into its lending decisions. This reflects the bank's commitment to sustainability and its value of caring for society and the environment.

The bank's commitment to employee development and training programs directly supports the 'Kompeten' value, ensuring that its employees have the skills and knowledge necessary to meet the evolving needs of its customers and the market. Bank Mandiri also utilizes formal programs and systems, such as its Corporate Plan and business planning processes, to ensure strategic alignment with its mission and vision, with regular reviews to track progress and make necessary adjustments.

To ensure the effective implementation of its mission, vision, and core values, Bank Mandiri employs robust strategic planning and performance monitoring mechanisms. The Corporate Plan serves as a roadmap, outlining the bank's strategic goals, initiatives, and key performance indicators (KPIs). Regular reviews and performance evaluations are conducted to assess progress against these goals and make necessary adjustments to the strategy.

Financial Performance: In 2023, Bank Mandiri reported a net profit of Rp 51.4 trillion, a 33.8% increase year-on-year, demonstrating strong financial performance. The bank's focus on digital transformation, customer service, and operational efficiency has contributed to this positive financial outcome, aligning with its strategic goals. The bank's loan portfolio grew, and its non-performing loan (NPL) ratio remained well-managed, reflecting prudent risk management practices.

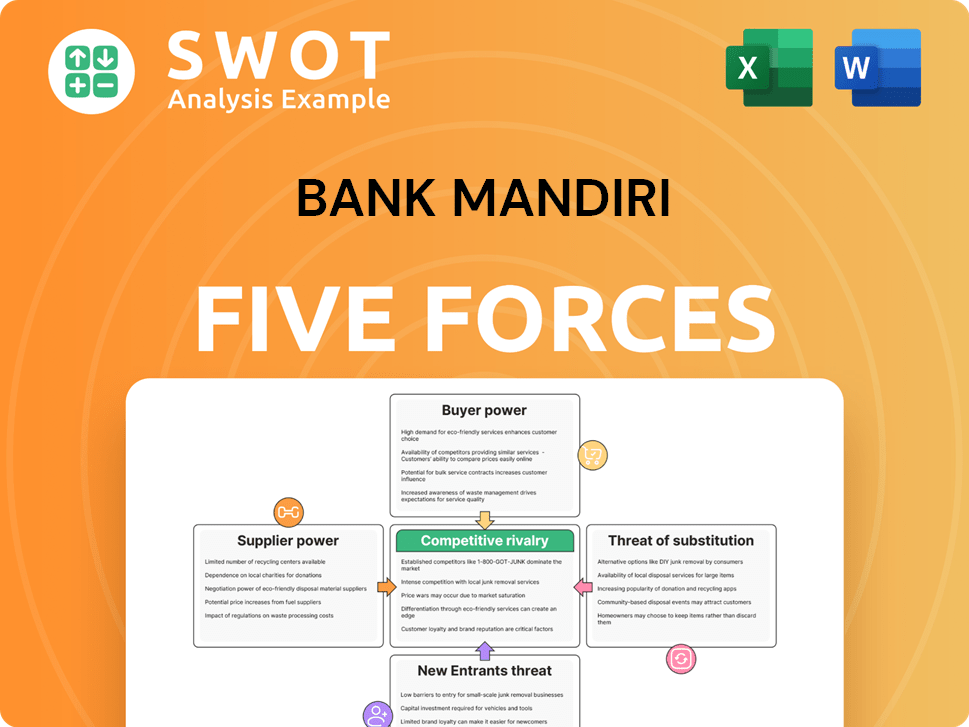

Bank Mandiri Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank Mandiri Company?

- What is Competitive Landscape of Bank Mandiri Company?

- What is Growth Strategy and Future Prospects of Bank Mandiri Company?

- How Does Bank Mandiri Company Work?

- What is Sales and Marketing Strategy of Bank Mandiri Company?

- Who Owns Bank Mandiri Company?

- What is Customer Demographics and Target Market of Bank Mandiri Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.