BGC Bundle

How is BGC Company Revolutionizing Sales and Marketing?

BGC Group, Inc. is reshaping its sales and marketing strategy, fueled by innovative fintech solutions and strategic market positioning. This evolution is critical for navigating the competitive financial landscape and driving business growth. This document dives deep into BGC's transformation, offering insights into its marketing plan and sales process.

From traditional brokerage to tech-driven platforms like Fenics and the FMX Futures Exchange, BGC's approach is a case study in adapting to digital disruption. Understanding BGC's sales strategy, including its digital marketing strategy, is crucial for anyone interested in the future of financial markets. For a deeper dive into the company's strengths and weaknesses, consider exploring a BGC SWOT Analysis to see how they are implementing their marketing plan.

How Does BGC Reach Its Customers?

The company employs a multifaceted sales strategy, utilizing both traditional and electronic channels to reach its diverse clientele. This approach is designed to maximize market penetration and cater to the evolving needs of its institutional clients. The strategy emphasizes a hybrid model, blending voice brokerage with increasingly sophisticated electronic platforms.

The primary sales channels include direct sales teams, who maintain crucial relationships with institutional clients, and a suite of electronic trading platforms under the Fenics brand. These platforms, such as Fenics Markets and Fenics FX, provide clients with flexible options for price discovery, execution, and processing. This dual approach allows the company to serve a wide range of clients effectively.

The evolution of the company's sales channels reflects a strategic shift towards digitalization and omnichannel integration. This has been supported by significant investments in technology, totaling over $1.7 billion since 1998. This investment underscores the company's commitment to providing cutting-edge financial services and adapting to the changing demands of the market. The company's sales and marketing strategy is designed to drive business growth.

Direct sales teams are a cornerstone of the company's sales process, maintaining crucial relationships with institutional clients. These teams focus on providing personalized service and understanding the specific needs of each client. This approach is essential for building trust and ensuring customer satisfaction.

The Fenics brand encompasses a range of electronic trading platforms, including Fenics Markets, Fenics FX, and others. These platforms offer clients advanced tools for price discovery, execution, and processing. Fenics revenues increased by 8.6% to $142.1 million in Q4 2024, driven by higher electronic volumes.

Strategic partnerships and exclusive distribution deals have significantly contributed to the company's growth and market share. These collaborations enhance the company's reach and provide access to new markets. The investment by major investment banks into the FMX Futures Exchange is a prime example.

Acquisitions play a key role in expanding the company's market presence and service offerings. The acquisition of OTC Global Holdings in April 2025 for $325 million has significantly strengthened its position as the world's largest ECS brokerage firm. OTC generated over $400 million in revenue in 2024.

The company's sales strategy is continuously evolving to meet the demands of the market. This includes leveraging strategic partnerships and acquisitions to expand its reach and enhance its service offerings. A comprehensive market analysis is crucial for understanding the competitive landscape and identifying growth opportunities.

- Fenics revenues grew by 8.6% to a record $578.6 million in Q1 2024.

- Ten major investment banks invested $172 million in the FMX Futures Exchange.

- The acquisition of OTC Global Holdings for $325 million expanded the company's ECS brokerage capabilities.

- U.S. Treasury futures contracts are planned to launch on FMX in May 2025.

BGC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does BGC Use?

The sales and marketing strategy of BGC Group centers on digital marketing to boost brand awareness, generate leads, and drive sales within the financial technology and brokerage sectors. The company's marketing plan is designed to reach a specific institutional client base, utilizing content marketing and search engine optimization (SEO) to showcase expertise in fixed income, foreign exchange, equities, energy, and commodities. The strategy leverages a data-driven approach to communicate with stakeholders and provide tailored solutions.

BGC's marketing tactics include targeted digital advertising on financial news platforms and professional networks to reach its niche audience. Email marketing is a core component for direct communication with clients, providing market insights, product updates, and exclusive offers. Social media platforms, particularly LinkedIn, are used to engage with the financial community and share company news. The company's investor relations website serves as a central hub for financial results, presentations, and news.

The company's strong financial technology solutions and market data offerings enable it to capitalize on increased client activity and drive business growth. BGC's marketing mix has evolved significantly with strategic investments in technology, particularly through its Fenics brand, which supports electronic and hybrid transactions across asset classes. Innovations like the FMX Futures Exchange and its U.S. cash treasuries platform demonstrate BGC's commitment to experimental strategies and technological advancements.

Content marketing is a crucial part of the sales and marketing strategy for BGC Company, publishing thought leadership articles, market analyses, and whitepapers. This strategy helps to establish expertise in the financial technology and brokerage sectors. Content marketing is used to attract and engage the target audience and drive business growth.

SEO is vital for ensuring visibility in searches for financial technology solutions, market data, and brokerage services. A strong SEO strategy helps to improve search engine rankings and drive organic traffic to the company's website. This is a key component of the BGC Company's digital marketing strategy.

Paid advertising campaigns are likely utilized on financial news platforms and professional networks to reach the niche audience. Targeted advertising helps to increase brand awareness and generate leads. This is part of the overall marketing plan for BGC Company.

Email marketing is a core component for direct communication with clients, distributing market insights, product updates, and exclusive offers. This helps to nurture leads and maintain relationships with existing clients. Email marketing is a key element of the sales process.

Social media platforms, particularly LinkedIn, are used to engage with the financial community, share company news, and highlight technological advancements. This helps to build brand awareness and establish thought leadership. Social media is a crucial part of the marketing strategies to increase sales for BGC Company.

The investor relations website serves as a central hub for financial results, presentations, and news, underscoring a data-driven approach to communicating with stakeholders. This transparency helps to build trust and maintain a positive relationship with investors. This is a key part of the overall sales and marketing strategy.

BGC's approach to data-driven marketing, customer segmentation, and personalization is implicit in its focus on providing tailored solutions to its diverse client base. This includes banks, broker-dealers, investment banks, trading firms, hedge funds, governments, corporations, and investment firms. The company's strong financial technology solutions and market data offerings enable it to capitalize on increased client activity and drive growth.

- Customer Segmentation: BGC segments its clients to provide tailored solutions, which enhances customer satisfaction and loyalty.

- Personalization: The company personalizes its marketing efforts and product offerings to meet the specific needs of different client segments.

- Data Analysis: BGC uses data analytics to understand customer behavior and market trends, which informs its marketing decisions.

- Technology Investments: Strategic investments in technology, particularly through its Fenics brand, support electronic and hybrid transactions across asset classes.

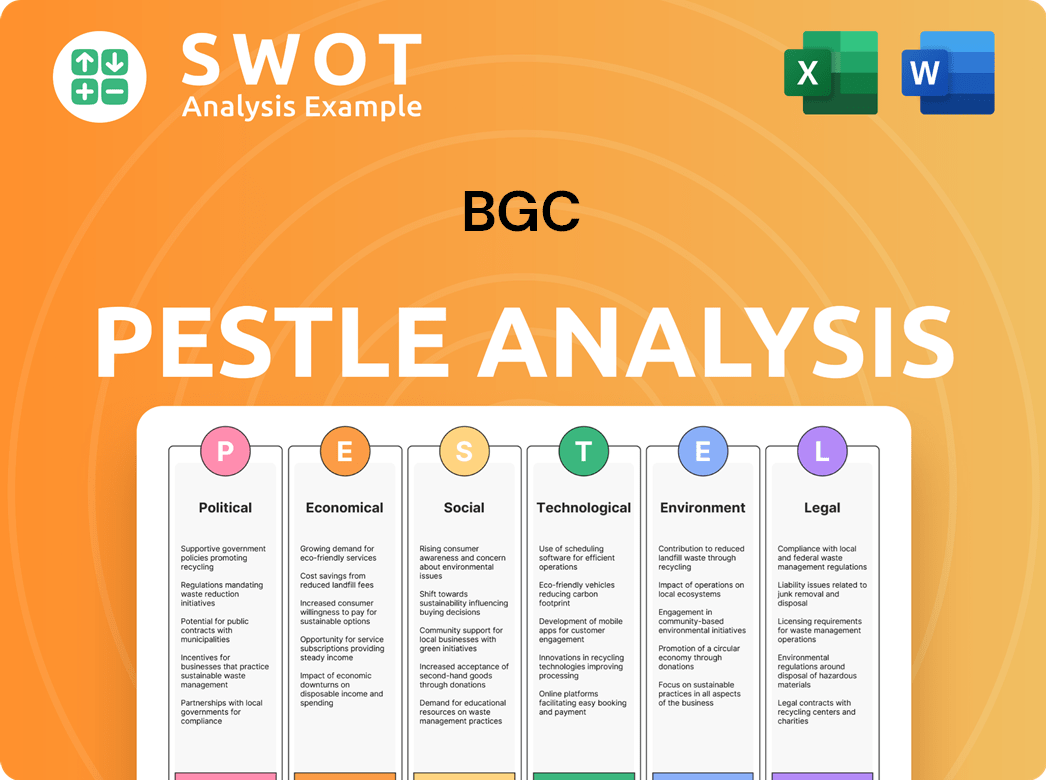

BGC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is BGC Positioned in the Market?

The brand positioning of the BGC Group is centered around its identity as a pioneering global brokerage and financial technology firm. This is achieved by emphasizing the synergy of 'Talent + Technology' to serve global financial markets effectively. Their core message focuses on delivering world-class products and services, supported by advanced technology and exceptional human talent. This approach allows the company to differentiate itself from competitors.

Their integrated platform is a key differentiator, offering clients flexibility and choice in price discovery, execution, and processing via voice, hybrid, or fully electronic brokerage options. The brand's visual identity and tone of voice are professional and authoritative, reflecting its role in the high-stakes financial industry. BGC appeals to its target audience by offering innovation, efficiency, and comprehensive solutions. The company's strategic focus on technology-driven businesses, particularly through Fenics, has significantly contributed to its revenue and overall business growth.

The company's strategic acquisitions, such as Stage Energy Partners and OTC Global Holdings, further bolster its market position and service variety, enabling it to respond to competitive threats and shifts in consumer sentiment. The company's commitment to innovation and technology, particularly through its Fenics platform, is a cornerstone of its sales and marketing strategy. For example, Fenics GO was recognized as the 'OTC Trading Venue of the Year' at the Global Derivatives Awards 2024, which indicates strong industry recognition for its electronic trading capabilities and brokerage services. To understand the BGC Company's overall strategy, consider reading about the Growth Strategy of BGC.

The integrated platform offers clients flexibility in price discovery and execution. They provide options via voice, hybrid, or fully electronic brokerage. This comprehensive approach sets them apart in the market.

BGC targets clients by offering innovation, efficiency, and comprehensive solutions. Their focus on technology-driven businesses, especially Fenics, is a key part of their appeal. They aim to provide value through advanced technology and expert talent.

Fenics GO was recognized as the 'OTC Trading Venue of the Year' at the Global Derivatives Awards 2024, demonstrating their strong electronic trading capabilities. BGC Group itself was named 'Interdealer Broker of the Year: Europe & Asia' at the same awards. This highlights their industry leadership.

Acquisitions like Stage Energy Partners and OTC Global Holdings strengthen their market position and service offerings. These moves help them respond to market changes and competitive pressures. This approach supports their sales process.

The Fenics platform is central to BGC's electronic trading operations, market data, and analytics. This technology-driven approach is a key differentiator. Their focus on technology is a core part of their marketing plan.

- Fenics powers electronic trading and provides market data.

- It offers clients flexibility in price discovery and execution.

- The platform supports both voice and electronic brokerage options.

- Technology is a key driver of revenue and market position.

BGC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are BGC’s Most Notable Campaigns?

The BGC Company's sales and marketing strategy in 2024 and 2025 has been heavily influenced by strategic acquisitions and expansions. Instead of traditional marketing campaigns, the company has focused on initiatives that enhance its market position and drive business growth. These moves are pivotal to understanding the BGC Company's approach to increasing sales and expanding its market presence.

A significant aspect of their strategy involves the growth of the FMX Futures Exchange. This initiative aims to solidify their presence in the fixed-income and financial technology sectors. By strategically investing in and expanding platforms, BGC Company is positioning itself to capture a larger share of the market. This approach highlights the importance of strategic partnerships and product expansion in their overall marketing plan.

The acquisition of OTC Global Holdings in April 2025 for $325 million is another key element of the BGC Company's sales strategy. This move is designed to establish the company as a leading player in the energy, commodities, and shipping (ECS) brokerage sector. OTC's revenue of over $400 million in 2024 underscores the potential for substantial growth through this acquisition, making ECS its largest asset class. These strategic decisions are critical components of their overall marketing plan.

In April 2024, ten major investment banks invested $172 million for a 25.75% ownership interest in FMX. This strategic partnership is expected to boost trading volumes and market share. FMX launched U.S. Treasury futures contracts in May 2025, demonstrating a focus on product expansion.

The acquisition of OTC Global Holdings for $325 million in April 2025 is a key move to become the premier ECS brokerage firm. OTC generated over $400 million in revenue in 2024. This acquisition is expected to boost BGC Company's future growth.

The BGC Company's sales process is heavily influenced by strategic moves. These moves are critical for business growth. The company's focus on acquisitions and partnerships, rather than traditional marketing, shows a unique approach to market analysis and expansion. For more details, refer to the Growth Strategy of BGC.

- Strategic investments and acquisitions are key drivers.

- Partnerships with major financial institutions boost credibility.

- Expansion of platforms like FMX enhances market position.

- The OTC acquisition strengthens the ECS sector.

BGC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BGC Company?

- What is Competitive Landscape of BGC Company?

- What is Growth Strategy and Future Prospects of BGC Company?

- How Does BGC Company Work?

- What is Brief History of BGC Company?

- Who Owns BGC Company?

- What is Customer Demographics and Target Market of BGC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.