BGC Bundle

Who Does BGC Company Really Serve?

In the fast-paced world of finance, knowing your customer is key to survival. Understanding the customer demographics and target market of a company like BGC Group, Inc. offers crucial insights into its strategic direction and potential for growth. This analysis is essential for anyone looking to understand the company's position in the market and its ability to adapt to changing trends.

This exploration delves into the BGC SWOT Analysis, examining how BGC company has evolved its customer segmentation strategies to meet the demands of a dynamic financial landscape. We'll uncover the intricacies of BGC company's target market, providing a detailed business profile that includes customer age range, income levels, location data, and buying behavior, offering a comprehensive market analysis. This deep dive will help you identify the target audience of BGC company and understand the best strategies for targeting them.

Who Are BGC’s Main Customers?

Understanding the customer demographics and target market of the BGC company is crucial for grasping its business model. BGC primarily operates in the business-to-business (B2B) sector, focusing on financial institutions and corporations. This focus shapes its approach to customer segmentation and market analysis.

The business profile of BGC centers on serving a sophisticated clientele within the financial industry. The company's success hinges on its ability to meet the complex needs of these institutions, offering advanced brokerage and technology solutions. This approach allows BGC to maintain a strong position in the financial markets.

For a deeper dive into how BGC operates, you can explore Revenue Streams & Business Model of BGC.

BGC's primary customers are financial institutions and corporations. These include investment banks, hedge funds, and asset managers. They also serve commercial banks, central banks, and other entities involved in financial market activities.

Segmentation is based on the type of institution, trading volume, and global reach. It also considers the specific needs related to asset classes like fixed income and foreign exchange. The adoption of financial technology is also a key factor.

The company sees increasing demand from firms using advanced financial technology. They are also expanding to include smaller, specialized financial entities. This expansion is driven by new products, market research insights, and digitalization.

Increased regulatory scrutiny and the digitalization of financial markets influence BGC's target segments. The demand for data and analytics services has expanded their client base. This includes firms seeking market intelligence and post-trade processing capabilities.

In 2024, the global fintech market is valued at approximately $150 billion, with projections indicating significant growth, potentially reaching over $300 billion by 2025. This growth is driven by increasing demand for advanced financial technology solutions, directly impacting BGC's target market. The expansion of services to include data analytics and post-trade processing capabilities aligns with the industry's shift towards digitalization and regulatory compliance. The rise in demand for these services is also reflected in the growth of fintech investments, which reached over $100 billion globally in 2024.

- Investment banks and hedge funds remain key clients, contributing significantly to revenue.

- The trend towards adopting advanced financial technology is accelerating, driving growth in specific segments.

- Smaller, specialized financial entities are becoming increasingly important for market access and diversification.

- Data and analytics services are crucial for firms seeking market intelligence and post-trade processing.

BGC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do BGC’s Customers Want?

Understanding the customer needs and preferences is crucial for BGC Company. Their customers, primarily institutional investors and financial institutions, are driven by the need for efficiency, transparency, and robust risk management in their trading activities. This focus shapes their expectations and influences their choices within the financial markets.

The target market analysis for BGC Company reveals that customers prioritize platforms that offer reliable trade execution, accurate pricing, and comprehensive market data. The decision-making process often hinges on the speed and reliability of trading platforms, the breadth of asset classes covered, and the quality of brokerage services. These factors are essential for navigating the complexities of global financial markets.

The psychological drivers behind choosing BGC's offerings include the desire to mitigate operational risk and gain a competitive edge through superior market insights. Unmet needs often involve customized solutions for niche markets. BGC addresses these by leveraging its hybrid brokerage model and continually investing in its Fenics ecosystem.

Customers seek reliable trade execution and accurate pricing. They require comprehensive market data to inform their trading decisions. These needs are fundamental for effective market participation.

Mitigating operational risk and achieving best execution are primary motivations. Gaining a competitive edge through superior market insights is also a key driver. These motivations shape customer behavior.

Customers prefer platforms with competitive pricing, robust security, and regulatory compliance. They value seamless integration with existing infrastructure. These preferences guide their platform choices.

Demand for highly customized solutions for niche markets and complex derivatives persists. Integration of diverse data sources for holistic market views is also important. Addressing these needs can enhance customer satisfaction.

BGC addresses these needs through its hybrid brokerage model and continuous investment in the Fenics ecosystem. Customer feedback and market trends, like the demand for ESG data, drive product development. This responsiveness helps maintain a competitive edge.

BGC tailors data offerings for specific asset classes and regions. Technology platforms are updated for faster execution and sophisticated order types. This focus on data and technology supports evolving customer needs.

Customer segmentation for BGC Company involves identifying groups based on their trading strategies, asset class preferences, and risk profiles. Understanding the customer base of BGC Company allows for tailored services. Buying behavior is significantly influenced by the need for speed, accuracy, and access to liquidity.

- Institutional Investors: These clients, including hedge funds and asset managers, often require high-frequency trading capabilities and access to a wide range of financial instruments. Their buying behavior is driven by the need for efficiency and sophisticated trading tools.

- Financial Institutions: Banks and other financial institutions prioritize platforms that offer robust security, regulatory compliance, and comprehensive market data. They seek reliable execution and transparent pricing.

- High-Frequency Trading Firms: These firms demand ultra-fast execution speeds and low latency. Their buying decisions are heavily influenced by the performance and reliability of trading platforms.

- Broker-Dealers: Broker-dealers require platforms that offer a broad range of products and services to meet their clients' needs. They value competitive pricing and strong customer support.

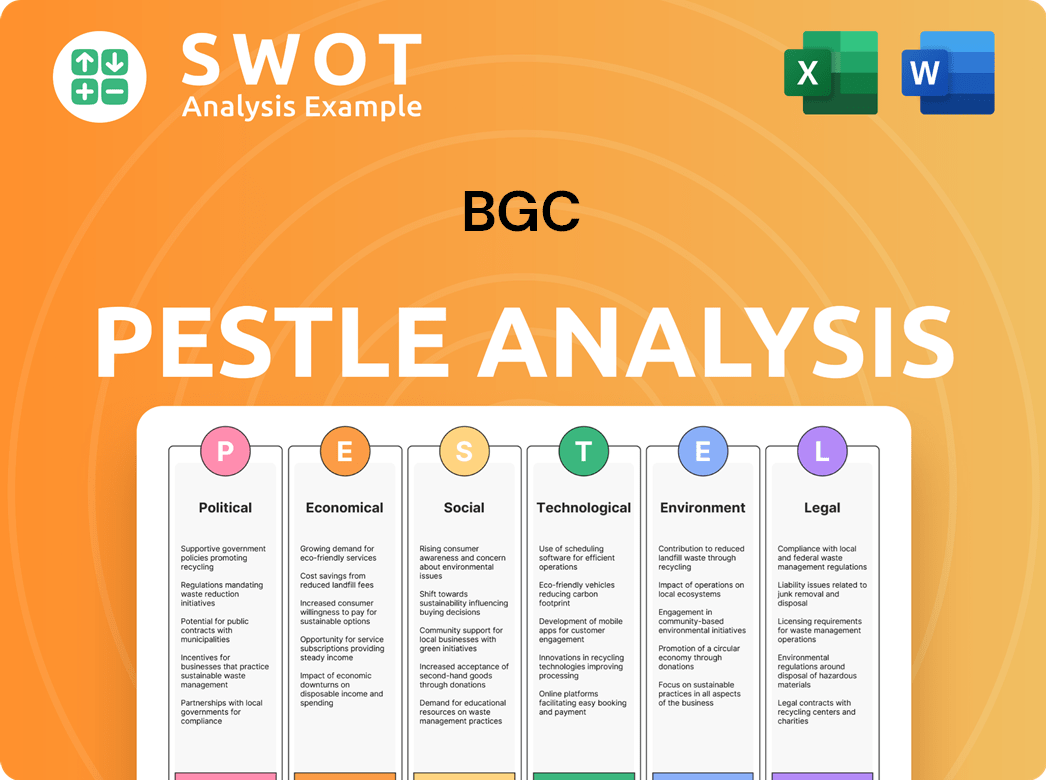

BGC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does BGC operate?

The geographical market presence of the BGC Group is extensive, focusing on key financial hubs across North America, Europe, and Asia. Its primary markets include major cities like New York, London, and Singapore, where the company has a strong market share. This global footprint is essential due to the interconnected nature of the financial markets that BGC serves, making it a key player in the industry.

Understanding the nuances of customer demographics and preferences across different regions is critical for BGC. For instance, the European market may have different regulatory requirements compared to those in Asia. BGC tailors its offerings to meet these regional needs by maintaining local sales teams and customizing its technology platforms. This localized approach helps BGC maintain its competitive edge and serve its diverse customer base effectively.

BGC's strategic focus includes strengthening its presence in emerging markets, reflecting its commitment to long-term growth. The company's revenue distribution is heavily influenced by its established operations in North America and Europe, with increasing contributions from its Asia-Pacific operations. This geographical diversification supports BGC's resilience and ability to capitalize on global financial activities. For more information, you can read about the Owners & Shareholders of BGC.

A significant portion of BGC's revenue is generated from its operations in North America and Europe. These regions represent mature financial markets with established customer bases and infrastructure. The company's strategic focus is on maintaining and growing its presence in these key areas.

The Asia-Pacific region is a crucial area for growth, with increasing contributions to BGC's overall revenue. The company is expanding its presence in emerging markets within this region. This expansion is driven by the growing financial infrastructure and increasing demand for financial services.

BGC localizes its offerings to meet regional demands, maintaining sales teams with deep market knowledge. The company tailors its technology platforms to comply with local regulations. Strategic partnerships with local financial institutions are also key to success.

Navigating diverse regulatory frameworks is essential for BGC's global operations. The company ensures compliance with local regulations in each market. This approach minimizes risks and supports sustainable growth.

BGC's customer base includes institutional investors, financial institutions, and corporations. These customers are located across North America, Europe, and Asia. Customer segmentation helps tailor services to meet specific needs.

Market analysis is crucial for understanding customer preferences and behaviors. BGC uses data to refine its strategies and offerings. This approach helps BGC stay competitive and meet the evolving needs of its target market.

BGC segments its customers based on their location, industry, and financial needs. This segmentation enables the company to provide customized services. Customer segmentation is essential for effective market targeting.

Understanding customer buying behavior is key to BGC's success. The company analyzes customer preferences and buying patterns. This analysis helps BGC optimize its sales and marketing efforts.

BGC's ideal customer profile includes institutional investors and financial institutions. These customers have significant trading volumes and complex financial needs. The company focuses on building strong relationships with these clients.

Customer location data is essential for BGC's market analysis. The company uses this data to identify areas of high demand and growth potential. This data helps BGC make informed decisions about resource allocation.

BGC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does BGC Win & Keep Customers?

Customer acquisition and retention strategies at the BGC Group are multifaceted, blending traditional relationship-building with cutting-edge digital tools. The company focuses on direct sales, leveraging experienced brokers and account managers to foster long-term relationships with institutional clients. Marketing efforts include targeted digital advertising and participation in industry conferences, alongside thought leadership content like white papers and webinars. Understanding the Marketing Strategy of BGC provides further insights into their approach.

Given its business-to-business (B2B) model, the company prioritizes professional networking platforms, such as LinkedIn, for talent acquisition and enhancing brand visibility. Sales strategies highlight the comprehensive services offered, including the advanced Fenics technology platform, deep liquidity pools, and extensive market data. Retention strategies are centered on exceptional after-sales service, personalized client support, and continuous product innovation.

BGC Group utilizes customer data and sophisticated CRM systems for detailed customer segmentation, enabling highly targeted campaigns and customized service delivery. Successful acquisition campaigns often emphasize the efficiency and cost-effectiveness of its electronic trading solutions. Retention initiatives include bespoke data analytics packages and exclusive market insights access. The strategic shift towards integrating brokerage and technology divisions has enhanced customer loyalty and lifetime value.

Experienced brokers and account managers cultivate long-term relationships with institutional clients. This relationship-based approach is a cornerstone of BGC’s acquisition strategy, focusing on personalized service and understanding client needs.

BGC employs targeted digital advertising to reach its desired customer demographics. This includes online ads and content marketing designed to attract and engage potential clients within the financial sector.

Participation in industry conferences and the use of webinars as a platform to showcase expertise and connect with potential clients. These events provide opportunities for networking and demonstrating thought leadership.

BGC leverages strategic partnerships to expand its market reach. Collaborations with other financial institutions and technology providers enhance its service offerings and customer base.

The company reported a 2024 revenue of $2.27 billion, demonstrating the effectiveness of its client engagement and service diversification strategies. This figure reflects the success of its acquisition and retention efforts within the target market.

BGC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.