BGC Bundle

Who Really Owns BGC Group?

Understanding the ownership structure of a company is crucial for investors and strategists alike. BGC Group, Inc., born from a spin-off, presents a fascinating case study in corporate ownership dynamics. From its roots with Cantor Fitzgerald to its current status as a global brokerage and financial technology leader, the question of who owns BGC Company is central to understanding its future.

Delving into BGC Group's ownership reveals a complex interplay of public shareholders, institutional investors, and influential executives. The evolution of BGC ownership, from its founding in 2004, showcases how key decisions and strategic shifts have reshaped its landscape. This analysis will explore the roles of BGC shareholders, the impact of major investors, and the influence of the BGC SWOT Analysis on its strategic direction, offering a detailed look at who truly controls this financial powerhouse.

Who Founded BGC?

The roots of BGC Group, Inc. are deeply connected to Cantor Fitzgerald, a well-established financial services firm. The spin-off in 2004 marked the formal beginning of BGC Partners, which later became BGC Group, Inc. Howard W. Lutnick, the Chairman and CEO of Cantor Fitzgerald since 1996, played a key role in the formation and initial ownership of BGC.

While not a traditional startup, the early ownership structure was heavily influenced by Cantor Fitzgerald's existing partners and its strategic decision to create a separate, publicly traded brokerage business. This move allowed for a distinct focus on brokerage services while still maintaining a close relationship with its parent company.

At its inception, the equity split reflected the distribution to Cantor Fitzgerald's partners and the public offering. Cantor Fitzgerald retained significant ownership in BGC through its control of BGC Holdings, L.P. This structure ensured that a substantial portion of the economic and voting control initially remained with Cantor Fitzgerald and its key executives, including Howard Lutnick.

Howard W. Lutnick, Chairman and CEO of Cantor Fitzgerald, was instrumental in the formation of BGC Partners. His leadership shaped the early direction and strategy of the company. The spin-off from Cantor Fitzgerald was a key event in BGC's history.

The initial ownership involved Cantor Fitzgerald retaining a significant stake through BGC Holdings, L.P. This structure provided a blend of public and private ownership, with Cantor Fitzgerald partners holding limited partnership interests. This setup allowed for a smooth transition while maintaining control.

Early agreements likely included detailed partnership agreements governing profit distributions and voting rights. These agreements mirrored the long-standing partnership culture of Cantor Fitzgerald. This ensured that key executives and Cantor Fitzgerald maintained substantial influence.

The initial public offering (IPO) played a crucial role in establishing BGC Partners as a separate entity. The IPO provided capital for growth and expansion. This move also allowed Cantor Fitzgerald to unlock value from its brokerage business.

The formation of BGC was part of a strategic vision to create a complementary but independent brokerage business. This allowed BGC to focus on its specific market while leveraging the resources of Cantor Fitzgerald. This strategic move helped drive BGC's growth.

Key executives from Cantor Fitzgerald, including Howard Lutnick, played pivotal roles in shaping BGC's early direction. Their experience and leadership were crucial for the company's initial success. These leaders ensured a smooth transition.

The early BGC ownership structure was a blend of public shareholders and private interests held by Cantor Fitzgerald and its partners. The BGC Group ownership structure has evolved over time, influenced by market performance and strategic decisions. As of the latest filings, Cantor Fitzgerald still holds a significant stake, reflecting its continued influence. For further insights into BGC's marketing strategies, you can explore the Marketing Strategy of BGC.

- BGC Group ownership structure includes both public and private components.

- Cantor Fitzgerald's influence remains significant through its holdings in BGC Holdings, L.P.

- Early agreements and partnership structures ensured key executives maintained control.

- The IPO and subsequent market performance have shaped the company's ownership.

BGC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has BGC’s Ownership Changed Over Time?

The ownership structure of BGC Group, Inc. has been shaped by key events since its 2004 spin-off and initial public offering (IPO). Initially, Cantor Fitzgerald maintained considerable control through BGC Holdings, L.P. The IPO allowed public shareholders to acquire stakes, but the dual-class share structure and limited partnership units ensured significant voting power remained with Howard Lutnick and Cantor Fitzgerald. Strategic acquisitions, such as the 2011 acquisition of Newmark Knight Frank, further diversified the business, impacting its capital structure and ownership. In 2018, BGC Partners spun off its commercial real estate services business, Newmark Group, Inc., as a separate publicly traded company, refining BGC Group's focus on brokerage and financial technology. This spin-off also altered BGC shareholders' proportional ownership in the remaining entity.

These changes have allowed BGC Group's history to focus more on its core brokerage and financial technology businesses. Ownership shifts reflect this strategic refinement, with major stakeholders including institutional investors, mutual funds, and individual insiders. The company's multi-class share structure and Howard W. Lutnick's holdings, including through Cantor Fitzgerald, grant him and Cantor Fitzgerald disproportionate voting rights compared to their economic interest, allowing them to exert significant influence over company strategy and governance.

| Event | Date | Impact on Ownership |

|---|---|---|

| Spin-off from Cantor Fitzgerald | 2004 | Initial IPO, public shareholders acquire stakes, dual-class shares. |

| Acquisition of Newmark Knight Frank | 2011 | Business diversification, impact on capital structure. |

| Spin-off of Newmark Group, Inc. | 2018 | Refined focus on brokerage and financial technology, altered shareholder ownership. |

As of early 2025, institutional ownership accounts for a significant portion of BGC Group's outstanding shares. Large asset managers and mutual funds collectively hold a substantial percentage of the company's Class A common stock. The ownership structure continues to evolve, reflecting the company's strategic direction and market dynamics. Howard W. Lutnick, through his direct and indirect holdings, remains a pivotal figure with substantial voting control.

BGC Group's ownership structure has evolved significantly since its IPO, with Cantor Fitzgerald and Howard Lutnick maintaining considerable influence.

- Institutional investors hold a significant portion of the company's shares.

- The dual-class share structure gives disproportionate voting rights to certain stakeholders.

- Strategic acquisitions and spin-offs have reshaped the company's focus and ownership.

- Understanding BGC ownership is crucial for investors and stakeholders.

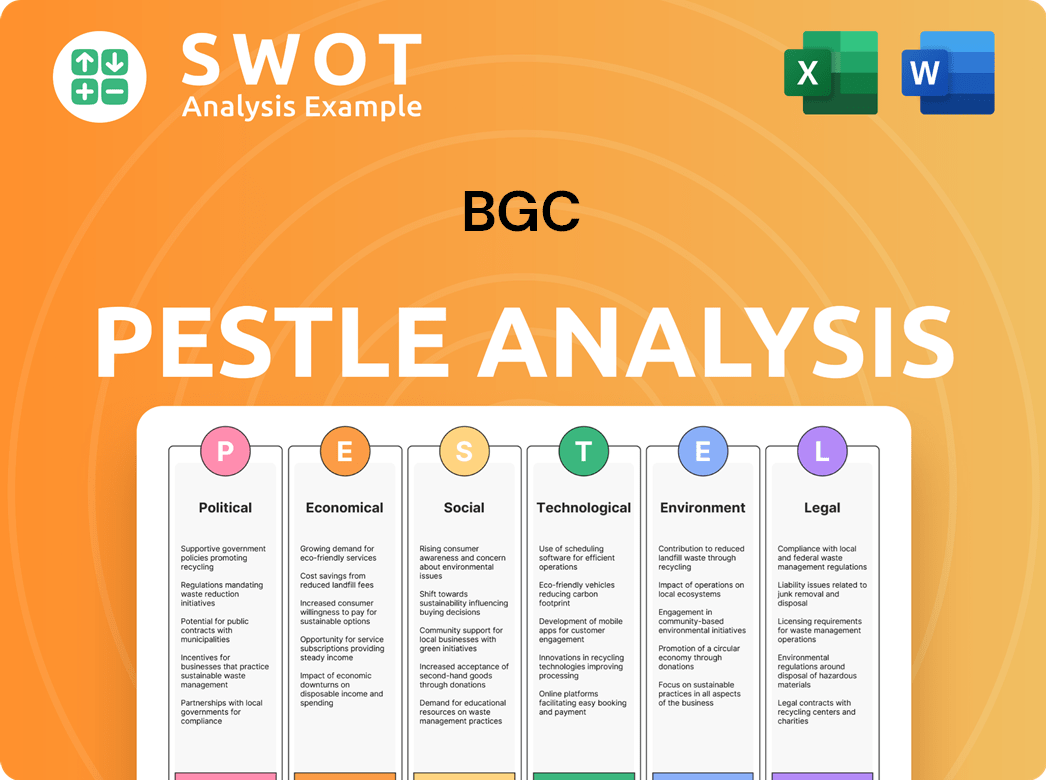

BGC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on BGC’s Board?

As of early 2025, the Board of Directors of BGC Group, often includes a mix of executive directors and independent directors. Howard W. Lutnick serves as the Chairman and Chief Executive Officer, holding a prominent position on the board. Other board members may include senior executives from BGC Group, representatives from Cantor Fitzgerald, and independent directors.

The composition of the board reflects the company's ownership structure and strategic direction. The board's responsibilities include overseeing the company's financial performance, setting strategic goals, and ensuring compliance with regulations. The specific individuals on the board and their roles can be found in the company's annual reports and proxy statements, which provide detailed information on the company's governance practices and board member profiles.

| Board Member | Title | Affiliation |

|---|---|---|

| Howard W. Lutnick | Chairman and CEO | BGC Group |

| Sean Windeatt | Chief Financial Officer | BGC Group |

| Steven Bisgay | Director | Cantor Fitzgerald |

The voting structure of BGC Group is characterized by a multi-class share system. Class B common stock, primarily held by Cantor Fitzgerald and its partners, typically carry disproportionate voting rights compared to the Class A shares. This arrangement ensures that Cantor Fitzgerald and Howard Lutnick maintain outsized control over the company's strategic decisions. This structure means that while public shareholders own a significant portion of the company's economic interest, the ultimate voting power and control over major corporate actions largely reside with the holders of Class B shares. To understand the growth trajectory of the firm, consider reading about the Growth Strategy of BGC.

The board of directors at BGC Group plays a vital role in overseeing the company's operations and strategic direction.

- Howard W. Lutnick is the Chairman and CEO, wielding significant influence.

- The voting structure favors Class B shareholders, primarily Cantor Fitzgerald.

- This structure ensures stability in strategic decision-making.

- The board's composition includes executive and independent directors.

BGC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped BGC’s Ownership Landscape?

Over the past few years, the ownership profile of BGC Group has seen significant shifts. A key development was the complete separation of Newmark Group, Inc. in 2018, which refocused BGC Group on its core brokerage and financial technology businesses. This strategic move, involving the distribution of Newmark shares to BGC Group shareholders, directly impacted the composition of BGC ownership. More recently, BGC Group has continued to pursue strategic acquisitions within its brokerage and technology segments, which influences ownership through share issuances or integrating acquired company shareholders. For example, in 2024, the company enhanced its technology offerings, potentially involving acquisitions or partnerships that could indirectly affect ownership or capital structure. This dynamic landscape reflects the company's evolving strategic direction and its adaptation to market trends.

Industry trends in financial services ownership, such as increasing institutional ownership, also play a role. Large asset managers and index funds are accumulating significant stakes in publicly traded companies. While founder dilution is a common trend, BGC Group's multi-class share structure and the continued involvement of Cantor Fitzgerald have somewhat mitigated this typical dilution. Environmental, social, and governance (ESG) factors are gaining importance among institutional investors, influencing their investment decisions and potentially leading to ownership shifts as companies align with these criteria. Ongoing share repurchase programs also affect ownership by reducing the number of outstanding shares, which increases the proportionate ownership of remaining shareholders. For more information about the target market of the company, check out this article: Target Market of BGC.

BGC Group's focus on technology and data suggests potential strategic investments or partnerships that could further evolve its ownership landscape. The company's share repurchase programs also impact ownership by reducing the number of outstanding shares, thereby increasing the proportionate ownership of remaining shareholders. These factors, combined with the company's strategic initiatives, create a dynamic environment for BGC Group's ownership structure. As of the latest financial reports, the company's major investors and their respective holdings are subject to change, reflecting the ongoing evolution of BGC ownership.

BGC Group has strategically acquired companies to enhance its brokerage and technology offerings. These acquisitions often lead to changes in BGC shareholders through share issuances or the integration of acquired company shareholders. This approach supports the company's growth strategy and expands its market presence.

Institutional investors, including asset managers and index funds, hold significant stakes in BGC Company. This trend reflects broader shifts in financial markets. Their investment decisions can influence BGC Group's ownership structure, based on factors such as ESG criteria.

BGC Group's share repurchase programs reduce the number of outstanding shares. This action increases the proportionate ownership of existing BGC shareholders. It is a strategy used to return value to shareholders and potentially boost the stock price.

The company's emphasis on technology and data could lead to future strategic investments or partnerships. These initiatives may further evolve BGC ownership and its capital structure. This focus aligns with industry trends and the company's growth objectives.

BGC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BGC Company?

- What is Competitive Landscape of BGC Company?

- What is Growth Strategy and Future Prospects of BGC Company?

- How Does BGC Company Work?

- What is Sales and Marketing Strategy of BGC Company?

- What is Brief History of BGC Company?

- What is Customer Demographics and Target Market of BGC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.