Public Service Enterprise Group Bundle

Who Really Controls Public Service Enterprise Group?

Uncover the ownership secrets of Public Service Enterprise Group (PSEG), a key player in the energy sector. Understanding PSEG ownership is crucial for investors and anyone interested in the future of energy. From its historical roots to its current structure, the ownership landscape shapes PSEG's strategic decisions and its impact on the market.

Delving into the Public Service Enterprise Group SWOT Analysis, we uncover the dynamics behind PSEG ownership, exploring how its shareholder composition influences its operations and strategic direction. This analysis will explore the evolution of PSEG ownership, from its early days to the present, examining the influence of major shareholders and the roles of its board of directors. Understanding the PSEG company profile and its stock is essential for anyone looking to make informed decisions about this critical utility.

Who Founded Public Service Enterprise Group?

Public Service Enterprise Group (PSEG) began in 1903 as Public Service Corporation. Thomas N. McCarter, a lawyer and businessman, spearheaded the consolidation and served as its first president. This marked the beginning of a unified utility system in New Jersey.

The initial ownership structure was a complex merger of various gas, electric, and transportation companies. The focus was on centralizing control and achieving economies of scale, reflecting a collective ownership model rather than a few dominant initial stakeholders.

Early agreements would have focused on the terms of the merger, including share exchanges and the establishment of a unified corporate governance structure under the new Public Service Corporation. This structure laid the foundation for a publicly-oriented utility, with a focus on providing essential services.

Founded in 1903 as Public Service Corporation.

Thomas N. McCarter, the first president, played a pivotal role in the consolidation.

Ownership was distributed among shareholders of the merged companies.

The consolidation aimed to create a unified and efficient utility system.

Early agreements focused on share exchanges and corporate governance.

The structure was designed for a publicly-oriented utility.

The early ownership of Public Service Enterprise Group (PSEG) was a result of merging various gas, electric, and transportation companies. The shareholders of these constituent companies became the initial PSEG shareholders. The focus was on building a unified utility system rather than individual founder equity. The structure set the stage for PSEG to become a publicly traded company. For more details on the company's history, see the article about Public Service Enterprise Group.

- Initial ownership was distributed among the shareholders of the merged companies.

- The consolidation aimed to create a unified utility system.

- Early agreements focused on share exchanges and corporate governance.

- The structure was designed for a publicly-oriented utility.

Public Service Enterprise Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Public Service Enterprise Group’s Ownership Changed Over Time?

Public Service Enterprise Group (PSEG), a publicly traded company with the stock symbol 'PEG' on the New York Stock Exchange (NYSE), has seen its ownership evolve significantly since its inception. The company's structure reflects its history as a consolidated public utility, with its modern form emerging from an initial public offering (IPO). This evolution has been shaped by market dynamics and strategic decisions, influencing the composition of its shareholder base over time.

The ownership structure of PSEG is primarily defined by its status as a publicly traded entity. As of the first quarter of 2025, institutional investors hold a substantial majority of PSEG's outstanding shares. This contrasts with individual insider ownership, which, while present, constitutes a smaller portion of the total shares. The influence of these major shareholders is critical, affecting company strategy and governance, especially concerning environmental, social, and governance (ESG) factors and financial performance. The company's strategic shift towards cleaner energy, including regulated utility operations and clean energy generation, reflects, in part, the influence of these institutional investors.

| Ownership Aspect | Details | Impact |

|---|---|---|

| Publicly Traded Status | Listed on NYSE under 'PEG' | Broad investor base, subject to market forces |

| Institutional Ownership | Significant majority of shares held by institutions | Influences company strategy, especially ESG and financial performance |

| Insider Ownership | Smaller portion of total shares | Limited direct impact compared to institutional holdings |

Major institutional shareholders of PSEG often include large asset management firms, mutual funds, and index funds. For instance, as of March 31, 2025, prominent institutional holders such as Vanguard Group Inc., BlackRock Inc., and State Street Corp. collectively hold substantial percentages of PSEG's stock. These holdings fluctuate based on quarterly filings, reflecting their passive investment strategies and broad market exposure. The influence of these shareholders is evident in PSEG's strategic direction, as discussed in Growth Strategy of Public Service Enterprise Group.

PSEG's ownership is primarily institutional, with significant holdings by major asset management firms.

- Institutional investors drive strategic direction, particularly in ESG and financial performance.

- The company's stock is traded on the NYSE under the symbol 'PEG.'

- Changes in institutional holdings can influence company strategy and governance.

- PSEG's shift towards cleaner energy aligns with investor priorities.

Public Service Enterprise Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Public Service Enterprise Group’s Board?

The Board of Directors of Public Service Enterprise Group (PSEG) currently comprises a mix of independent directors and executives, ensuring a balance of perspectives. As of early 2025, the board typically includes individuals with expertise in areas such as energy, finance, regulation, and technology. This composition reflects a commitment to strong corporate governance practices. The structure generally emphasizes independent oversight, with the majority of board members being independent.

For example, Ralph Izzo, who recently transitioned from CEO to Executive Chair, provides key executive presence, while the independent directors fulfill governance best practices. The board's role includes overseeing the company's strategic direction, risk management, and executive performance. The specific composition may change, but the emphasis on independent oversight remains consistent.

| Board Member | Title | Key Expertise |

|---|---|---|

| Ralph Izzo | Executive Chair | Energy, Executive Leadership |

| Jane E. Kenny | Lead Director | Finance, Governance |

| Other Independent Directors | Various | Energy, Finance, Technology, Regulation |

PSEG operates under a one-share-one-vote voting structure for its common stock. This means that each share held by an investor grants one vote on corporate matters. There are no dual-class shares or other mechanisms that would grant disproportionate voting rights. This straightforward approach ensures that voting power is directly proportional to the economic interest in the company. Institutional investors, as major PSEG shareholders, routinely engage with the company on governance issues, executive compensation, and strategic direction. They influence decisions through their voting power and direct dialogue. For more information, you can read a brief history of Public Service Enterprise Group.

The PSEG board is structured to provide strong oversight with a mix of independent and executive directors.

- PSEG's voting structure is one-share-one-vote, ensuring fair representation.

- Institutional investors play a significant role in influencing company decisions.

- The board's composition reflects a commitment to expertise in the energy sector and related fields.

- The company's governance structure is designed to align with best practices.

Public Service Enterprise Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Public Service Enterprise Group’s Ownership Landscape?

In recent years, Public Service Enterprise Group (PSEG) has undergone strategic shifts impacting its ownership. A significant move was the sale of PSEG Power's non-nuclear generation assets, including its fossil fuel portfolio, to a subsidiary of ArcLight Capital Partners. This shift, occurring in late 2021 and early 2022, saw PSEG refocusing on its regulated utility, Public Service Electric & Gas Co. (PSE&G), and its remaining nuclear assets. This strategic pivot aimed to reduce risk and strengthen its regulated earnings profile, often favored by institutional investors.

Industry trends, particularly the emphasis on environmental, social, and governance (ESG) factors, have also influenced PSEG's ownership. Institutional investors increasingly scrutinize companies' sustainability practices. PSEG's commitment to clean energy and grid modernization aligns with these investor priorities. This has likely reinforced ownership by large institutional funds that prioritize ESG considerations. Leadership transitions, such as CEO successions, are closely watched by shareholders. PSEG's strategy to invest in transmission and distribution infrastructure and clean energy is expected to continue attracting long-term institutional capital.

| Metric | Value | Year |

|---|---|---|

| Market Capitalization (approx.) | $22 billion | Early 2024 |

| PSE&G's Regulated Assets | Approximately $30 billion | 2023 |

| Percentage of Institutional Ownership (approx.) | Over 70% | 2023 |

PSEG's focus on its regulated utility business and investments in clean energy infrastructure suggests a continued emphasis on attracting long-term institutional investors. No immediate plans for privatization or major public listing changes have been announced.

PSEG is a publicly traded company, with a significant portion of its stock held by institutional investors. The ownership structure is primarily institutional, with a smaller percentage held by retail investors and company insiders. The company's focus on regulated utilities and clean energy projects aligns with the investment strategies of many institutional shareholders.

Major institutional shareholders of PSEG include large investment firms and mutual funds. These shareholders often have a long-term investment horizon and are focused on the company's financial performance and strategic initiatives. The concentration of institutional ownership reflects the stability and regulated nature of PSEG's core business.

ESG factors play a crucial role in influencing PSEG's ownership profile. The company's commitment to clean energy and grid modernization attracts investors prioritizing sustainability. Institutional investors increasingly assess companies based on their environmental and social impact, and PSEG's initiatives align with these priorities, potentially attracting more ESG-focused investment.

PSEG's future ownership trends are likely to be shaped by its continued focus on regulated utility operations and investments in clean energy. The company's strategy to enhance its infrastructure and reduce carbon emissions is expected to attract long-term institutional investors. The company's financial performance and strategic decisions will be key factors influencing its ownership profile.

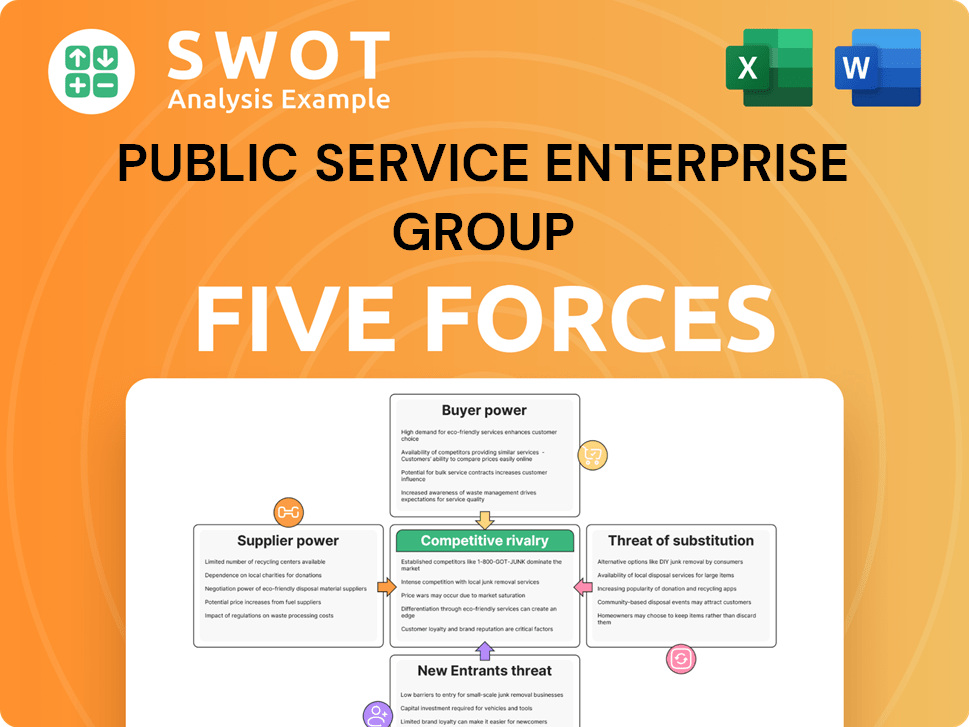

Public Service Enterprise Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Public Service Enterprise Group Company?

- What is Competitive Landscape of Public Service Enterprise Group Company?

- What is Growth Strategy and Future Prospects of Public Service Enterprise Group Company?

- How Does Public Service Enterprise Group Company Work?

- What is Sales and Marketing Strategy of Public Service Enterprise Group Company?

- What is Brief History of Public Service Enterprise Group Company?

- What is Customer Demographics and Target Market of Public Service Enterprise Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.