PUMA Bundle

Who Really Owns PUMA?

Ever wondered who pulls the strings at one of the world's leading sportswear brands? Understanding PUMA's SWOT analysis starts with knowing its ownership. From its origins to its current status, the story of PUMA's ownership is a fascinating journey of corporate evolution and strategic shifts. Let's explore the key players and how they've shaped the PUMA brand.

The question of "Who owns PUMA?" is more complex than it seems, involving a rich PUMA history and a dynamic ownership structure. Knowing the PUMA parent company and its major shareholders provides critical insights into the brand's direction and financial performance. This exploration into PUMA's company owner details reveals the influences shaping its future, from its headquarters in Germany to its global presence.

Who Founded PUMA?

The story of PUMA begins with a family feud. The company's origins trace back to a split within the Dassler family, setting the stage for a rivalry that would shape the sports apparel industry. This division led to the creation of two iconic brands, each vying for dominance in the global market.

Rudolf Dassler founded PUMA in 1948, marking a pivotal moment in sports history. This occurred after a falling out with his brother, Adolf Dassler, with whom he had previously co-founded the 'Gebrüder Dassler Schuhfabrik'. This separation resulted in the formation of two distinct companies, each with its own identity and vision.

Initially, Rudolf registered his new venture as 'Ruda,' a combination of his first name and surname. However, he soon rebranded it as PUMA, officially registering the brand on October 1, 1948. The early logo, featuring a leaping puma, symbolized the brand's core values of speed, strength, and agility, reflecting Rudolf's ambition to create high-performance athletic wear.

Rudolf Dassler founded PUMA in 1948, after a split from his brother, Adolf Dassler.

The company started in Herzogenaurach, Germany, and was initially named 'Ruda'.

The PUMA brand was officially registered on October 1, 1948, with a logo that embodied speed and strength.

The separation from Adolf Dassler led to the formation of Adidas, creating a long-standing rivalry.

Rudolf Dassler took approximately 14 employees with him when he founded PUMA.

The split between the Dassler brothers established a competitive dynamic that continues to influence the sports industry.

The early ownership of PUMA was primarily held by Rudolf Dassler, with no public details available about angel investors or initial equity splits. The company's formation was a direct result of the rift between the Dassler brothers, which intensified during World War II. This division led to the creation of two distinct companies, PUMA and Adidas, which have since become global leaders in the sports apparel market. The intense rivalry between the two brands has significantly shaped the industry's landscape, driving innovation and competition. For a deeper dive into how PUMA has strategically positioned itself in the market, consider exploring the Marketing Strategy of PUMA.

- Rudolf Dassler's vision was to create products that reflected the attributes of a puma.

- The brand's early focus was on athletic shoes, expanding into apparel and accessories over time.

- The rivalry with Adidas has been a central theme in the history of both companies.

- The company's headquarters is located in Herzogenaurach, Germany.

PUMA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has PUMA’s Ownership Changed Over Time?

The evolution of PUMA's ownership structure reflects significant shifts over the years. Initially, the company went public in 1986, listing its shares on the Börse München and Frankfurt Stock Exchange. A pivotal change occurred in 1989 when Rudolf Dassler's sons sold their 72% stake to Cosa Liebermann SA. This marked the beginning of a series of ownership transitions that shaped the company's current landscape. Later, in 2003, Monarchy/Regency sold its majority shareholdings to various institutional investors, broadening the shareholder base.

A major transformation happened in 2018, when Kering SA, a significant shareholder since 2007, distributed approximately 70% of its PUMA shares to its own shareholders. This strategic move reduced Kering's direct stake to about 16%. As a result, Artémis S.A., the investment holding company owned by Kering's CEO, François-Henri Pinault, became a direct and long-term shareholder, acquiring roughly 29% of PUMA's share capital, along with an indirect stake. This repositioned Artémis as the largest single shareholder.

| Event | Date | Impact |

|---|---|---|

| Initial Public Offering | 1986 | Shares listed on Börse München and Frankfurt Stock Exchange |

| Sale by Rudolf Dassler's Sons | May 1989 | Cosa Liebermann SA acquired a 72% stake |

| Monarchy/Regency Shareholding Sale | 2003 | Shareholdings sold to institutional investors |

| Kering's Share Distribution | 2018 | Artémis S.A. became the largest shareholder |

As of early 2025, the major institutional shareholders include BlackRock, Inc. (5.26%), T. Rowe Price Group, Inc. (5.09%), Schroder Investment Management Limited (3.09%), Fidelity International Ltd (3.04%), and The Vanguard Group, Inc. (2.95%). The increased free float, rising to approximately 55% after Kering's distribution, aimed to attract a broader investor base and boost trading volumes. These changes in PUMA ownership have significantly influenced its strategic direction and corporate governance, reflecting its evolution as a global brand. Understanding the PUMA parent company and its stakeholders is crucial for anyone interested in the PUMA brand. For further insights into the company's strategic initiatives, you can explore the Growth Strategy of PUMA.

The ownership structure of PUMA has evolved significantly since its IPO in 1986.

- Artémis S.A. is currently the largest shareholder, holding approximately 29.20% of the shares as of December 30, 2024.

- Institutional investors like BlackRock and T. Rowe Price hold substantial stakes, influencing the company's direction.

- The shift towards a higher free float has made PUMA shares more accessible to a wider range of investors.

- Understanding the PUMA ownership structure is essential for assessing its strategic trajectory and financial performance.

PUMA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on PUMA’s Board?

As of early 2025, the Supervisory Board of PUMA SE is chaired by Héloïse Temple-Boyer. The Management Board, which handles the day-to-day running of the company, has recently seen some changes. Effective July 1, 2025, Arthur Hoeld takes over as Chairman of the Management Board and CEO of PUMA SE, succeeding Arne Freundt, who stepped down on April 11, 2025.

The Management Board, from July 1, 2025, will include Arthur Hoeld (CEO), Markus Neubrand (Chief Financial Officer), Maria Valdes (Chief Product Officer), and Matthias Bäumer (Chief Commercial Officer). Matthias Bäumer became Chief Commercial Officer on April 1, 2025. During the period from April 12 to July 1, 2025, Maria Valdes, Markus Neubrand, and Matthias Bäumer led the Management Board. The Growth Strategy of PUMA reflects these leadership transitions and the company's strategic direction.

| Board Position | Name | Effective Date |

|---|---|---|

| Chairman of the Supervisory Board | Héloïse Temple-Boyer | Early 2025 |

| Chairman of the Management Board & CEO | Arthur Hoeld | July 1, 2025 |

| Chief Financial Officer | Markus Neubrand | July 1, 2025 |

| Chief Product Officer | Maria Valdes | July 1, 2025 |

| Chief Commercial Officer | Matthias Bäumer | April 1, 2025 |

While specific details about voting structures aren't provided, PUMA, as a publicly traded company on the Frankfurt Stock Exchange, generally follows standard corporate governance practices. Major shareholders, such as Artémis S.A. with a 29.20% stake, have significant influence over the PUMA brand's operations and strategy. The Board of Directors often includes members representing major shareholders, a common practice to ensure alignment with shareholder interests. No recent proxy battles or governance controversies have been reported for PUMA SE.

The current owner of PUMA is influenced by its major shareholders and board structure. Artémis S.A. plays a significant role in PUMA's strategic direction.

- Héloïse Temple-Boyer chairs the Supervisory Board.

- Arthur Hoeld is the current CEO.

- Major shareholders have representation on the board.

- PUMA's corporate structure follows standard governance practices.

PUMA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped PUMA’s Ownership Landscape?

Over the past few years, the ownership structure of PUMA has seen some notable shifts. In early 2024, the company initiated a share buyback program, reflecting a strategy to return value to shareholders. The program, which concluded on March 31, 2025, involved repurchasing approximately 1.88% of the company's shares. This move is part of a broader effort to allocate a portion of the Group's net income to shareholders through dividends and buybacks, as outlined for the 2024 financial year.

Leadership changes have also played a role in shaping PUMA's current trajectory. Arne Freundt stepped down as CEO on April 11, 2025, with Arthur Hoeld taking over the role on July 1, 2025. Additionally, Matthias Bäumer joined the Management Board as Chief Commercial Officer in April 2025. These changes are part of a strategic turnaround, including cost-cutting measures like the reduction of around 500 jobs globally. Understanding the Target Market of PUMA is essential for grasping the company's strategic direction.

Financially, PUMA's performance in 2024 showed a mixed picture. Currency-adjusted sales increased by 4.4% to €8.817 billion. However, operating income remained flat at €622 million, and net income decreased by 7.6% to €282 million. For 2025, PUMA anticipates continued economic challenges and expects sales growth in the low- to mid-single-digit range. The company is also planning further cost control measures and a significant increase in marketing investments as part of its 'Go Wild' brand repositioning campaign, launched in March 2025. As of December 2024, PUMA's market capitalization was €6.6 billion, and as of June 13, 2025, it was $3.59 billion.

The program, which started in March 2024 and ended on March 31, 2025, repurchased 2,816,714 shares. This represents approximately 1.88% of the company's nominal share capital. The average price per share during the buyback was €35.50.

Arne Freundt stepped down as CEO on April 11, 2025, with Arthur Hoeld taking over on July 1, 2025. Matthias Bäumer became Chief Commercial Officer on April 1, 2025. These changes are part of a strategic turnaround for the company.

Currency-adjusted sales increased by 4.4% to €8.817 billion. Operating income remained at €622 million, and net income decreased by 7.6% to €282 million. The company is anticipating ongoing geopolitical and economic challenges in 2025.

PUMA's market capitalization as of December 2024 was €6.6 billion. As of June 13, 2025, the market cap was $3.59 billion. This data reflects the company's valuation in the market.

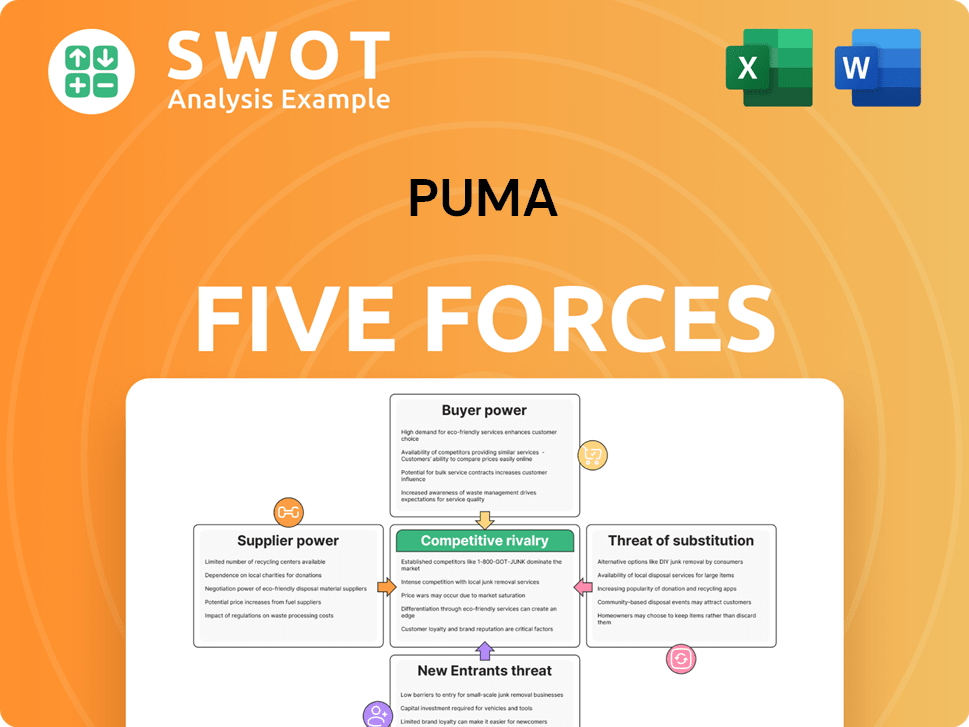

PUMA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PUMA Company?

- What is Competitive Landscape of PUMA Company?

- What is Growth Strategy and Future Prospects of PUMA Company?

- How Does PUMA Company Work?

- What is Sales and Marketing Strategy of PUMA Company?

- What is Brief History of PUMA Company?

- What is Customer Demographics and Target Market of PUMA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.