Gallagher Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs, easily sharing and reviewing business strategies.

Preview = Final Product

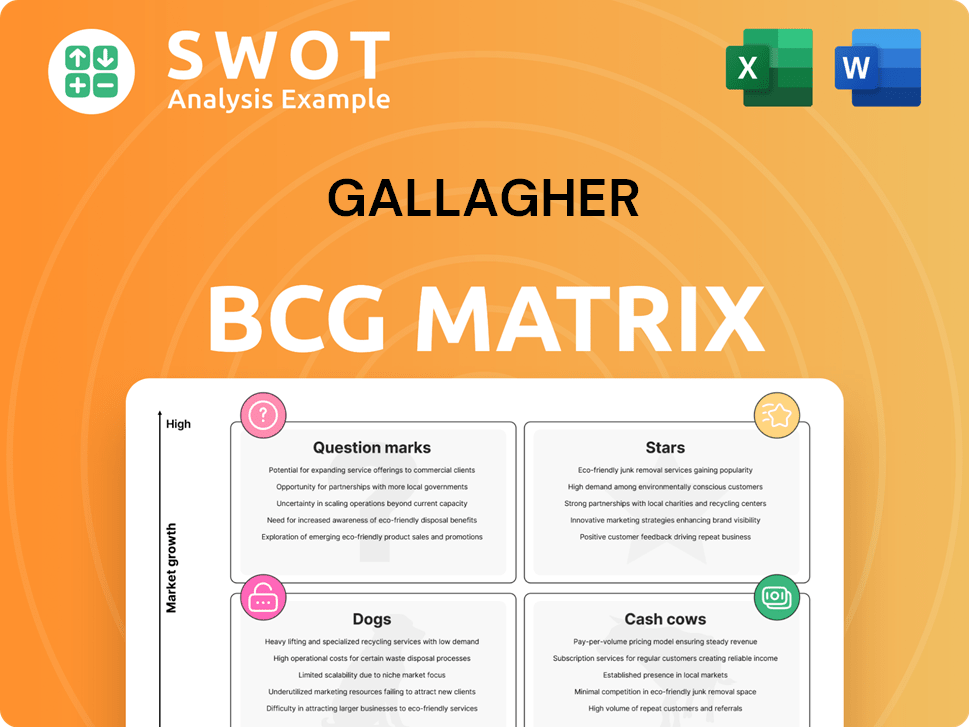

Gallagher BCG Matrix

This preview showcases the same Gallagher BCG Matrix report you'll receive after checkout. Featuring in-depth strategic analysis and designed for easy application, the full document is yours to download and use immediately.

BCG Matrix Template

See a glimpse of Gallagher's market positioning through a simplified BCG Matrix. We've categorized its key products—but there's so much more to uncover. This initial look scratches the surface of strategic opportunities and challenges. Purchase the full BCG Matrix for a detailed breakdown and actionable insights.

Stars

The Brokerage segment shines as a Star in Gallagher's BCG Matrix. It's a major revenue engine, contributing 86% of revenues in 2024. This segment demonstrated robust growth, with a 15% revenue increase from 2023. This growth, fueled by acquisitions and organic expansion, solidifies its Star status.

Gallagher's Risk Management segment is a Star, showcasing robust growth. Revenues in 2024 surged by 13% compared to 2023. This growth is driven by new clients and claims services. The segment's performance and growth rate are very impressive.

The acquisition of Woodruff Sawyer by Gallagher, finalized in 2023, significantly boosted Gallagher's market standing. Woodruff Sawyer's specialization in areas like management liability strengthens Gallagher's service offerings. This strategic acquisition is anticipated to generate substantial revenue growth, with Gallagher's 2024 revenue reaching approximately $10.4 billion.

Strategic Acquisitions

Gallagher's strategic acquisitions are a key driver of its growth. For example, the acquisition of My Plan Manager expanded its service offerings. Cadence Insurance, Eastern Insurance, and Buck, further broadened its reach. These moves solidify Gallagher's position as a market leader.

- In 2024, Gallagher's revenue increased, partly due to these acquisitions.

- The company's ability to integrate new businesses is crucial.

- Acquisitions like Buck have added specialized expertise.

- These strategic moves support long-term value creation.

International Expansion

Gallagher's international expansion is a key driver, with 36% of its revenue from abroad. This growth, especially in Australia, Canada, New Zealand, and the U.K., marks it as a Star. Their strategy includes acquisitions and organic growth, enhancing their global presence. This international focus strengthens Gallagher's position in the market.

- Revenue: 36% from international operations.

- Key Markets: Australia, Canada, New Zealand, UK.

- Strategy: Acquisitions and organic growth.

- Impact: Enhances global reach.

Gallagher's Stars, like the Brokerage and Risk Management segments, are key revenue drivers. These segments showed strong revenue growth in 2024, with the Brokerage segment contributing 86% of total revenue. Strategic acquisitions and international expansion, with 36% of revenue from abroad, further fueled growth.

| Segment | 2024 Revenue Growth | Contribution to Revenue |

|---|---|---|

| Brokerage | 15% | 86% |

| Risk Management | 13% | N/A |

| International | N/A | 36% |

Cash Cows

Gallagher's U.S. retail property/casualty segment is a cash cow, ensuring steady revenue. This success stems from Gallagher's expertise, data analytics, and diverse offerings. In 2024, the segment is expected to contribute significantly to overall revenue. Its established market position and consistent performance solidify its cash cow status.

Employee benefits consulting is a Cash Cow for Gallagher. This sector provides a stable revenue stream as companies consistently require benefits program management. Gallagher's expertise leads to high client retention rates. In 2024, the benefits consulting segment contributed significantly to Gallagher's overall revenue, showcasing its stable profitability and market position. The steady income and limited growth prospects define this segment.

Gallagher Bassett Services Inc. offers consistent revenue via claims management. This service meets the ongoing demand for efficient claims handling. Its stable market position and low growth rate classify it as a Cash Cow. In 2023, Arthur J. Gallagher & Co. reported over $8 billion in revenue from its brokerage and risk management services, including claims management. This indicates a solid, reliable income stream.

Middle-Market Accounts

Gallagher's middle-market accounts are a stable source of revenue. These accounts consistently need insurance and risk management. This ongoing demand and established relationships make them a reliable Cash Cow. This segment contributed significantly to Gallagher's revenue in 2024.

- Stable Revenue: Provides consistent income.

- Service Demand: Requires ongoing insurance and risk management.

- Established Relationships: Benefits from long-term client partnerships.

- Financial Contribution: Contributed significantly to Gallagher's 2024 revenue.

Reinsurance Brokerage

Gallagher's reinsurance brokerage is a key part of its business, contributing substantially to its revenue. Although there may be some pricing slowdowns in 2025, it is still a significant income source. Gallagher’s strong client relationships and expertise ensure a stable revenue flow, classifying it as a Cash Cow. This segment continues to perform well, supported by its market position and steady financial contributions.

- Reinsurance brokerage accounts for a notable portion of Gallagher's brokerage revenue.

- Pricing deceleration may present challenges in 2025.

- Strong client relationships and expertise support revenue stability.

- The segment's market share and consistent revenue generation support its Cash Cow status.

Gallagher's cash cows, including employee benefits and retail, generate consistent revenue. These segments benefit from strong market positions and client retention. In 2024, these businesses provided stable, predictable income. Reinsurance brokerage is a cash cow, ensuring revenue flow.

| Segment | Characteristics | 2024 Revenue Contribution |

|---|---|---|

| U.S. Retail Property/Casualty | Expertise, data analytics | Significant |

| Employee Benefits Consulting | Stable revenue stream, high retention | Significant |

| Reinsurance Brokerage | Strong client relationships | Notable |

Dogs

Divested operations within Gallagher's BCG Matrix represent businesses the company has sold off. These no longer boost revenue or growth. Often, they are cash traps. In 2024, Gallagher's divestitures may include underperforming units. For example, a business with a low market share and a growth rate under 5% could be divested.

In the Gallagher BCG Matrix, "Dogs" represent niche markets with low market share and poor growth prospects. These underperforming areas, like certain specialized insurance lines, may need significant restructuring. For example, in 2024, a specific segment of property insurance experienced a 10% drop in market share. Turnaround strategies are often costly and may not yield positive outcomes, potentially leading to divestiture.

Legacy clean energy investments can face tax, environmental, and compliance risks, classifying them as "Dogs" in the Gallagher BCG Matrix. These investments may hinder resource allocation, potentially yielding low returns. For example, older solar projects might struggle to compete with newer, more efficient technologies. In 2024, outdated renewable energy projects saw a 5-10% decrease in profitability due to these factors.

Unsuccessful New Products/Services

In the Gallagher BCG Matrix, "Dogs" represent offerings with low market share in a slow-growing market. These are unsuccessful new products or services. They often drain resources without bringing in much revenue. For example, in 2024, many tech startups failed, resulting in financial losses.

- Low market share.

- Slow growth.

- Resource drain.

- Financial losses.

Stagnant Geographic Regions

If Gallagher has operations in regions with slow growth and low market share, they are considered "Dogs." These areas might drain resources without generating substantial profits. In 2024, specific geographic markets could be struggling, potentially affecting Gallagher's performance. These situations often require careful evaluation and strategic decisions, such as divestiture or restructuring.

- Areas with low growth rates and low market share are "Dogs."

- Dogs may need significant investment without good returns.

- Gallagher must make strategic decisions in these regions.

- In 2024, some geographic markets may struggle.

Dogs in the Gallagher BCG Matrix are low market share, slow-growth areas. These often drain resources without profit. In 2024, segments like underperforming property insurance and outdated renewable energy projects were examples. Strategic decisions, including divestiture, are critical for Dogs.

| Characteristic | Impact | 2024 Example |

|---|---|---|

| Low Market Share | Resource Drain | Property insurance segment dropped 10% |

| Slow Growth | Financial Losses | Outdated renewables saw 5-10% profit decrease |

| Strategic Need | Divestment or Restructure | Tech startups faced financial struggles |

Question Marks

Gallagher's cybersecurity services are positioned as Question Marks in the BCG Matrix, indicating high growth potential in a market increasingly threatened by cyberattacks. Despite the high growth, Gallagher's market share in this segment may be lower than that of established cybersecurity firms. To transform into a Star, significant investment is crucial. The global cybersecurity market is projected to reach $345.7 billion in 2024.

Gallagher's sustainability services, including consulting and risk management, address a rising market. Despite the growing demand, their market share may be relatively small currently. To compete, significant investment is needed to boost visibility and transition these services towards a "Star" status. For example, the global sustainability market was valued at $1.3 trillion in 2023.

Gallagher is leveraging data analytics and AI, a high-growth area in insurance. However, market share is limited due to the novelty and complexity of these services. The global AI in insurance market was valued at $3.9 billion in 2023. To increase adoption, Gallagher must invest in tech and expertise.

New Insurance Products for Emerging Risks

Insurance products for emerging risks, like those tied to new tech or climate change, show high growth potential. These products often start with low market share due to limited awareness. Successful strategies require robust marketing and education to boost adoption. For example, the global parametric insurance market was valued at $12.9 billion in 2024.

- Parametric insurance market expected to reach $29.7 billion by 2032.

- Climate risk insurance premiums are increasing.

- Cyber insurance premiums rose significantly in 2023.

- Insurtech investments continue to grow.

Expansion in Developing Markets

Gallagher's foray into developing markets signifies a "Question Mark" in the BCG matrix, highlighting high growth potential but also considerable uncertainty. These markets, while offering significant opportunities, often present challenges in capturing market share due to fierce competition and complex regulatory environments. Strategic investments and partnerships are crucial for navigating these hurdles and achieving success. To illustrate, in 2024, emerging markets accounted for approximately 40% of global economic growth, underscoring their importance.

- High growth potential in developing markets.

- Challenges include competition and regulations.

- Strategic investments and partnerships are key.

- Emerging markets contributed ~40% to global growth in 2024.

Gallagher's Question Marks face high growth with low market share.

Cybersecurity, sustainability, data analytics, and emerging risk insurance represent these areas.

Strategic investment and marketing are critical to transforming these into Stars.

| Service | Market Size (2024) | Growth Drivers |

|---|---|---|

| Cybersecurity | $345.7B | Increasing cyber threats |

| Sustainability | $1.3T (2023) | Rising environmental concerns |

| Data Analytics/AI in Insurance | $3.9B (2023) | Tech advancements, efficiency |

| Emerging Risk Insurance | $12.9B | New technologies, climate change |

BCG Matrix Data Sources

The Gallagher BCG Matrix leverages financial statements, industry reports, and market growth data to offer dependable insights.