Gallagher SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

What is included in the product

Analyzes Gallagher’s competitive position through key internal and external factors.

Streamlines SWOT communication with visual, clean formatting.

Full Version Awaits

Gallagher SWOT Analysis

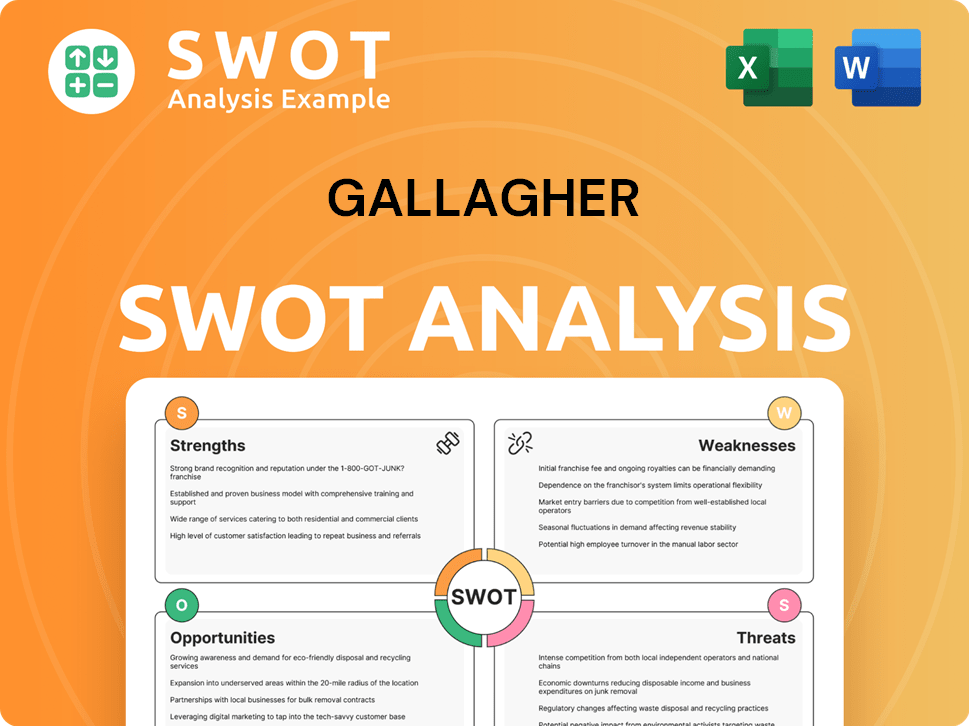

Take a peek at the Gallagher SWOT analysis preview! This is exactly the same comprehensive document you’ll receive upon successful purchase.

SWOT Analysis Template

The Gallagher SWOT analysis spotlights key strengths, like its strong market presence and diverse service offerings. It also unveils vulnerabilities, such as reliance on specific industries. We briefly touch on opportunities for growth and highlight potential threats to consider. This snapshot offers valuable insights, but it’s just the start.

Want to elevate your understanding of Gallagher's strategic landscape? Purchase the full SWOT analysis to gain detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

Arthur J. Gallagher & Co. boasts a robust market presence, operating in roughly 130 countries. This widespread global reach is a major strength, providing access to diverse insurance markets. The company's distribution capabilities are extensive, enhancing its ability to serve clients. Gallagher's focus on the SME market and global expansion sets it apart in the industry. In 2024, Gallagher's international revenue reached $3.5 billion, reflecting its global strength.

Gallagher's strengths include consistent organic growth in brokerage and risk management. The company reported total revenues of $10.1 billion in 2024, a significant increase. Net earnings also saw a rise, reflecting strong operational performance. Effective cost management further boosted financial outcomes.

Gallagher's strength lies in its acquisition prowess. They consistently acquire and integrate firms, boosting growth and offerings. In 2024, 48 mergers added to their revenue stream. This strategy has a proven track record of generating value.

Diverse Portfolio of Services

Arthur J. Gallagher & Co. boasts a diverse portfolio of services, spanning insurance brokerage, risk management, and consulting. This wide range allows for tailored solutions, boosting client retention and market reach. In 2024, Gallagher's brokerage segment generated $8.4 billion in revenues, showcasing the strength of its offerings. They provide specialized services, catering to various industries and client needs. This diversification minimizes risk and supports consistent financial performance.

- Revenue growth in 2024 was approximately 15%

- Brokerage segment accounted for the majority of the revenue

- Offers specialized services for diverse industries

- Enhanced client retention through tailored solutions

Effective Cost Management and Margin Improvement

Gallagher's commitment to effective cost management has significantly boosted its margin performance. The company's adjusted EBITDAC margins saw an increase in 2024, signaling enhanced operational efficiency and stringent cost controls. This focus allows Gallagher to improve profitability and maintain a strong financial position. These efforts are pivotal for driving sustainable growth and enhancing shareholder value.

- Adjusted EBITDAC margins increased in 2024.

- Operational efficiency and cost controls improved.

Gallagher's strengths include vast global presence with access to many markets. They have strong, consistent revenue growth. In 2024, revenue grew approximately 15%, driven by a robust brokerage segment and effective cost management. They have a knack for acquisitions.

| Strength | Details | 2024 Data |

|---|---|---|

| Global Reach | Operates in ~130 countries, enhancing access to various markets. | International revenue of $3.5B. |

| Financial Performance | Consistent organic growth with effective cost management | Total revenues: $10.1B; Revenue growth: ~15%. |

| Acquisition Prowess | Regularly acquires & integrates firms, boosting growth. | 48 mergers added to revenue stream |

Weaknesses

Gallagher faces margin pressure if short-term interest rates decrease. This financial risk could squeeze profitability, a key concern. The Federal Reserve's decisions significantly impact interest rates. In 2024, any rate cuts might challenge Gallagher's financial performance. Understanding this risk is crucial for investors.

Gallagher's pending AssuredPartners deal highlights integration risks. Integrating large acquisitions can disrupt operations and lead to financial setbacks. Historically, successful integrations are complex, demanding significant resources and time. Failure to integrate smoothly can negatively affect profitability and market position. The AssuredPartners deal, valued at billions, increases these integration challenges.

Gallagher's reliance on reinsurance revenue poses a weakness, especially with potential pricing pressures. A decrease in property catastrophe reinsurance pricing could slow down organic growth in reinsurance brokerage. For instance, in 2024, Gallagher's reinsurance segment contributed significantly to overall revenue. This dependence makes the company sensitive to market fluctuations. The company needs to diversify to mitigate this risk.

Regulatory and Legal Risks

Gallagher's global operations expose it to significant regulatory and legal risks. Changes in data privacy laws, such as those related to AI, could lead to compliance costs and penalties. Any legal proceedings or shifts in tax regulations can also negatively impact Gallagher's finances and reputation. These risks are particularly relevant given the company's international presence and diverse service offerings.

- Data breaches in 2024 cost companies an average of $4.45 million.

- Gallagher's revenue in Q1 2024 was $2.2 billion.

- Global insurance market is projected to reach $7.4 trillion by 2025.

Cybersecurity Risks

Gallagher faces cybersecurity risks, including regulatory scrutiny and reputational damage from data breaches. A remote workforce amplifies these risks, making the company more vulnerable. In 2024, the global cost of cybercrime is projected to reach $9.5 trillion. This includes potential losses from operational disruptions and legal expenses. Effective cybersecurity is crucial for Gallagher's financial health and market standing.

- Cybersecurity incidents can lead to significant financial losses.

- Remote work environments increase attack surfaces.

- Regulatory compliance adds to the complexity.

- Reputational damage impacts client trust.

Margin pressure from falling rates is a key weakness. The Fed's 2024 rate decisions directly impact profitability. Integration risks exist with the AssuredPartners deal, potentially affecting financial outcomes. Reinsurance revenue dependence creates vulnerability to market changes.

| Area of Weakness | Impact | Financial Data |

|---|---|---|

| Interest Rate Sensitivity | Margin pressure, decreased profitability | 2024 Q1 revenue of $2.2B |

| Acquisition Integration | Disruption, financial setbacks | AssuredPartners deal value: billions |

| Reinsurance Dependence | Slowed growth | Projected market size: $7.4T by 2025 |

Opportunities

Gallagher's strategic acquisitions, such as the AssuredPartners deal, are key to boosting its market share. This approach strengthens its global presence. The AssuredPartners deal is expected to boost client capabilities. These moves significantly improve Gallagher's competitive position. For example, in 2024, Gallagher's revenue increased to $10.1 billion, with acquisitions contributing significantly to growth.

Gallagher's acquisitions and broad services boost cross-selling. This strategy leverages expertise across segments, creating new business opportunities. A 2024 report showed a 10% rise in revenue from integrated services. Such synergies could further boost Gallagher's financial performance. This approach is a key driver of revenue growth.

Gallagher can expand globally, acquiring businesses and growing organically. This diversification strengthens its position. In 2024, international revenues rose, showing growth potential. Expanding services and reach boosts resilience. The company's global presence is key to future success.

Growth in Niche/Practice Groups and Middle-Market Accounts

Gallagher sees substantial growth potential in niche/practice groups and middle-market clients. Targeting these segments enables customized solutions, fostering stronger client bonds. This strategic focus is expected to drive revenue, as seen in recent financial reports.

- In 2024, Gallagher's revenue grew, with significant contributions from specialized practices.

- Middle-market accounts showed strong retention rates and increased service demand.

- The company plans to expand these areas, aiming for sustained growth in 2025.

Leveraging Technology and Data Analytics

Gallagher can capitalize on technology and data analytics to boost operational efficiency and service offerings. Investing in AI and automation, particularly in claims processing, can streamline operations. A recent report indicates that AI-driven automation can reduce claims processing time by up to 40%. This strategic move aligns with the company's goal of improving client service and market competitiveness.

- AI-driven automation reduces claims processing time by up to 40%.

- Improved operational efficiency.

- Enhanced service offerings.

- Innovation in AI and claims process automation.

Gallagher's strategic acquisitions fuel market share growth and global reach, evident in revenue increases in 2024. Cross-selling initiatives leveraging expertise boost revenue, highlighted by a 10% rise in integrated services revenue. Expanding globally and targeting niche markets, like middle-market clients, drives revenue growth, aiming for continued success in 2025.

| Opportunity | Details | Impact |

|---|---|---|

| Strategic Acquisitions | AssuredPartners deal. | Boosts market share, improves client capabilities. |

| Cross-Selling | Leverages expertise across segments. | 10% revenue rise from integrated services in 2024. |

| Global Expansion & Niche Markets | Targeting middle-market clients, specialized practices. | Drives revenue growth and client retention. |

Threats

Regulatory scrutiny poses a threat, potentially delaying acquisitions. Extended review processes can hinder strategic benefits. The AssuredPartners deal saw timeline adjustments. Such delays can impact financial projections and market positioning. These factors can affect Gallagher's growth plans.

Economic headwinds pose a threat to Gallagher. Global events like interest rate hikes and inflation can hurt operations. Economic uncertainty may cause clients to cut spending, impacting revenue. Rising claims costs could further squeeze profitability. In 2024, inflation rates and geopolitical tensions continue to fluctuate, impacting financial markets.

The insurance brokerage market is intensely competitive. Gallagher contends with large firms like Marsh & McLennan and Aon. Smaller, regional brokers also pose a threat. Competition can squeeze margins. In 2024, the industry saw significant M&A activity, intensifying rivalry.

Potential for Integration Difficulties with Large Acquisitions

Gallagher's growth strategy, heavily reliant on acquisitions, faces integration risks. Large acquisitions, while boosting scale, can strain resources and management focus. This can lead to operational inefficiencies and missed financial targets. Successfully integrating acquired entities is crucial for realizing projected returns and synergies.

- In 2023, Gallagher spent over $1 billion on acquisitions.

- Integration challenges can delay synergy realization, potentially impacting profitability.

- Cultural clashes between acquired firms and Gallagher can lead to employee turnover.

Impact of Climate Change and Natural Events

Climate change and extreme weather events are significant threats to Gallagher. The insurance industry faces rising insured losses due to more frequent and severe disasters. Underwriting models and coverage availability may need adjustments. For instance, the U.S. experienced over $100 billion in losses from weather events in 2023.

- Increased frequency of extreme weather events.

- Potential for higher insured losses.

- Need for adjustments in underwriting models.

- Possible changes in coverage availability.

Regulatory hurdles and delays in acquisitions present risks for Gallagher, impacting timelines and financial targets. Economic volatility, including inflation and interest rate fluctuations, could hurt operations. The insurance market's competitive landscape, with firms like Marsh & McLennan, intensifies margin pressures.

| Threat | Impact | Data |

|---|---|---|

| Economic Headwinds | Client spending cuts | Q1 2024: Inflation remains above target in major economies. |

| Acquisition Integration | Operational Inefficiencies | 2023: Gallagher spent $1B+ on acquisitions. |

| Climate Change | Rising insured losses | 2023 US weather events: >$100B in losses. |

SWOT Analysis Data Sources

This analysis integrates financial data, market reports, and expert opinions, leveraging reliable and validated sources for accurate assessment.