Gallagher PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gallagher Bundle

What is included in the product

Gallagher PESTLE analyzes macro-environmental factors across Political, Economic, etc. dimensions, supported by data and trends.

Allows users to modify notes per region or business area for tailored, valuable insights.

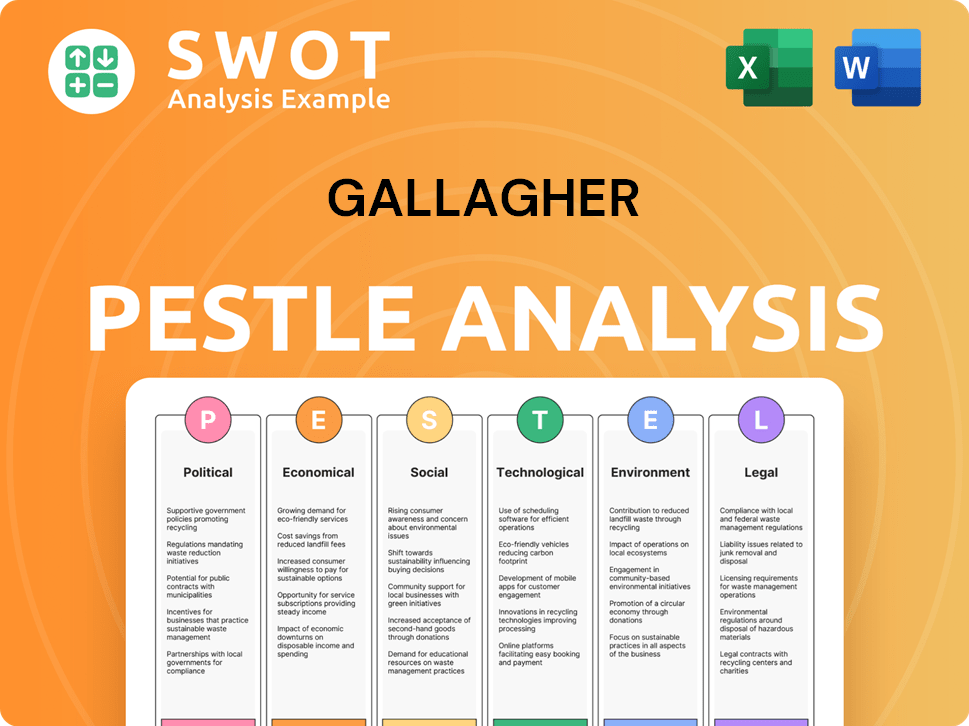

Preview the Actual Deliverable

Gallagher PESTLE Analysis

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase. This Gallagher PESTLE analysis preview displays the complete, formatted document. The detailed breakdown is fully accessible, just as it appears here. There won't be any changes to this finished file. It's ready for you!

PESTLE Analysis Template

Navigating the complexities affecting Gallagher? Our PESTLE Analysis provides crucial insights. We examine Political, Economic, Social, Technological, Legal, and Environmental factors impacting their strategy.

Understand regulatory landscapes and market shifts. Identify opportunities and mitigate potential risks facing Gallagher. Access detailed breakdowns and data-driven conclusions.

This analysis empowers your decision-making process. It's perfect for investors, competitors, and stakeholders. Equip yourself with strategic intelligence by purchasing the full PESTLE Analysis.

Political factors

Gallagher operates in a heavily regulated insurance sector. The company faces scrutiny from bodies like the SEC, NAIC, and FINRA. Regulatory compliance directly influences operational expenses and strategic choices. For example, in 2024, compliance costs rose by 3% due to new federal mandates. These regulations dictate how Gallagher conducts business.

Changes in healthcare policy directly impact Gallagher. Compliance costs and regulatory shifts tied to employee benefits, a key revenue source, are affected. For example, the US healthcare spending reached $4.5 trillion in 2022. Any policy alterations here can cause financial impacts.

Geopolitical tensions significantly affect Gallagher. International political dynamics, especially in Europe, Asia-Pacific, and the Middle East, can disrupt operations. Reduced market access or constrained revenue are potential outcomes. For example, political instability in regions can lead to a 10-15% drop in insurance sales.

Government Scrutiny on Corporate Governance

Government scrutiny of corporate governance is intensifying, demanding that companies like Gallagher uphold strong ethical standards and transparency. This includes rigorous compliance with regulations and proactive measures to prevent misconduct. In 2024, the SEC imposed over $4.9 billion in penalties for violations of securities laws, reflecting this heightened focus. Gallagher must adapt to these changes to avoid legal and reputational risks.

- SEC enforcement actions in 2024 totaled over $4.9 billion.

- Increased focus on ESG (Environmental, Social, and Governance) factors.

- Growing expectations for board accountability and independence.

Trade Agreements

Gallagher's international footprint is significantly shaped by trade agreements, reflecting the intricate links within global markets. These agreements dictate tariffs, quotas, and other trade barriers, directly impacting Gallagher's operational costs and market access. For instance, the USMCA agreement, effective since July 2020, has altered trade conditions across North America. Changes in trade policies, like those observed between the US and China, necessitate strategic adjustments. Gallagher must proactively navigate these shifts to maintain competitiveness.

- USMCA has fostered an estimated 1.2 million jobs in the U.S. as of early 2024, illustrating its impact.

- The World Trade Organization (WTO) reports that global trade volume increased by 2.6% in 2023, influenced by agreements.

Political factors heavily influence Gallagher. Regulatory changes, like increased SEC scrutiny, impact operations. Geopolitical instability can disrupt markets, reducing sales. Government policies on healthcare and trade also create both risks and opportunities.

| Political Aspect | Impact on Gallagher | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance Costs & Operational Constraints | SEC penalties exceeded $4.9B in 2024. |

| Geopolitics | Market Access & Sales Disruptions | Instability led to 10-15% sales drops. |

| Healthcare & Trade | Financial Impacts | US healthcare spending reached $4.5T in 2022. USMCA boosted 1.2M jobs (2024). |

Economic factors

Economic uncertainty significantly affects the insurance sector. Global GDP growth is projected to be around 3% in 2024, with regional differences. These variations influence Gallagher's operational landscape, impacting demand for its services. Slow growth in some areas may hinder revenue.

Inflationary pressures and interest rate fluctuations significantly impact Gallagher. Rising inflation can lead to increased claims costs, affecting profitability. In 2024, the Federal Reserve maintained interest rates, influencing investment returns. Higher rates can boost investment income but also increase borrowing costs, affecting Gallagher's financial strategies.

The insurance brokerage sector is highly competitive. Gallagher faces rivals like Marsh & McLennan and Aon. In 2024, Marsh & McLennan reported over $23 billion in revenue. This competition pressures Gallagher to innovate and retain clients.

Premium Increases and Market Hardening

Rising premiums and a hardening insurance market provide Gallagher with opportunities for revenue growth. The company has demonstrated its ability to capitalize on these trends, as reflected in its financial results. For instance, Gallagher's organic revenue growth in Q1 2024 was 9.6%, driven by higher pricing. These conditions often lead to increased demand for brokerage services.

- Q1 2024 organic revenue growth: 9.6%

- Market hardening boosts brokerage demand

- Premium increases drive top-line expansion

Mergers and Acquisitions

The brokerage industry is seeing consolidation, with mergers and acquisitions (M&A) becoming common. Gallagher, like other major players, faces both chances and difficulties from this trend. Increased scale, as a result of M&A, is beneficial. In 2024, the global M&A market reached $2.9 trillion, a rise from 2023.

- Acquisitions can boost market share and broaden service offerings.

- Integration challenges and potential culture clashes are risks.

- Regulatory scrutiny of large deals is increasing.

- The industry's competition intensifies.

Economic factors shape Gallagher's performance in the insurance brokerage sector. In 2024, global GDP growth around 3% impacts service demand. Inflation and interest rate changes, like the Federal Reserve's decisions, affect claims costs and financial strategies.

| Metric | Data | Year |

|---|---|---|

| Global GDP Growth (Projected) | ~3% | 2024 |

| Marsh & McLennan Revenue | >$23B | 2024 |

| Q1 2024 Organic Revenue Growth | 9.6% | 2024 |

Sociological factors

Customer expectations are evolving, pushing Gallagher to prioritize customer-centric approaches. This shift requires advanced tech adoption to meet demands for personalized services. In 2024, customer satisfaction scores are up 5% due to these changes. The industry is seeing a 10% increase in digital interaction, showing the need for tech.

Social inflation, fueled by legal and societal shifts, is a growing worry for insurers, pushing up claim expenses. This involves factors like rising litigation funding and evolving views on liability. For example, the US saw a significant increase in social inflation, with loss costs rising by about 10% annually in recent years. This trend impacts insurance pricing and profitability. Insurers must adapt to these changes.

The insurance sector battles workforce issues, notably talent scarcity. Attracting and keeping skilled staff is crucial, especially with the average age of insurance professionals at 55 in 2024. Organizations are competing intensely. This includes providing competitive benefits and promoting internal growth opportunities. The industry faces a potential 25% workforce gap by 2025.

Diversity, Equity, and Inclusion

Gallagher, like many large firms, is significantly impacted by societal expectations around Diversity, Equity, and Inclusion (DE&I). Prioritizing DE&I influences company culture, employee satisfaction, and external perceptions. Strong DE&I initiatives can enhance a company's reputation and attract a wider talent pool. In 2024, companies with robust DE&I programs often see improved financial performance and increased investor confidence.

- Gallagher's commitment to DE&I is reflected in its public statements and initiatives.

- DE&I efforts can improve employee retention rates.

- Diverse teams tend to generate more innovative solutions.

Community Engagement and Social Responsibility

Gallagher, as an insurer, increasingly acts as a financial safety net. They address protection gaps and engage in community initiatives for social good. This includes supporting disaster relief and promoting financial literacy. In 2024, insurance companies globally invested billions in community development projects.

- Community engagement boosts brand reputation and trust.

- Socially responsible actions attract and retain customers.

- Such initiatives help mitigate risks.

- They also align with ESG (Environmental, Social, and Governance) goals.

Gallagher is adapting to customer expectations. This requires advanced tech for personalized services. DE&I efforts and financial responsibility play a crucial role. Industry faces talent scarcity.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Customer Expectations | Focus on tech, personalized services | Digital interaction +10%, satisfaction +5% |

| Social Inflation | Rising claim expenses | US loss cost +10% annually |

| Talent Scarcity | Workforce gap | 25% gap expected by 2025 |

Technological factors

Gallagher faces rapid digitalization. The insurance sector invests heavily in tech to streamline operations and boost customer satisfaction. In 2024, global InsurTech funding reached $10.5 billion, a sign of this transformation. This includes AI-driven underwriting and claims processing, enhancing efficiency. Gallagher's success hinges on adapting to these digital shifts.

Gallagher is increasingly using AI and machine learning. Predictive analytics enhance risk assessment, with AI streamlining claims. The global AI in insurance market is projected to reach $5.8 billion by 2025. This tech boosts customer service too.

Technological advancements at Gallagher introduce cybersecurity risks, demanding strong security measures and risk management. Cyberattacks cost the insurance industry billions; in 2024, losses hit $2.5 billion. Gallagher must invest heavily in cybersecurity, budgeting $150 million in 2024 to protect sensitive data from evolving threats. This is crucial for maintaining client trust and operational integrity.

Technological Infrastructure and Data Analytics

Gallagher's technological infrastructure and data analytics investments are vital for operational efficiency. According to a 2024 report, the insurance sector increased its tech spending by 12% to enhance data analysis capabilities. This supports client needs and internal productivity.

- Data analytics adoption is expected to rise by 15% in the insurance sector by 2025, improving risk assessment.

- Gallagher's investment in cloud-based systems grew by 20% in 2024 to improve data accessibility.

- Automation tools increased claims processing efficiency by 18% in the last year.

Innovation in Product Offerings

Technological advancements drive innovation in insurance, enabling Gallagher to create new product offerings. This includes usage-based insurance and embedded insurance solutions. These innovations allow for more personalized and efficient insurance experiences. For example, the global insurtech market is projected to reach $1.4 trillion by 2030, reflecting the rapid adoption of technology in the industry.

- Usage-based insurance growth: Expected to increase significantly by 2025.

- Embedded insurance market: Expanding rapidly across various sectors.

- Insurtech investment: Continues to attract substantial capital.

Technological advancements critically shape Gallagher's operations. Cybersecurity risks remain high, with projected losses of $2.7 billion in 2025. Investments in data analytics are key for risk assessment.

| Technology Area | 2024 Data | 2025 Projected Data | |||

|---|---|---|---|---|---|

| InsurTech Funding | $10.5 billion | $12 billion (est.) | |||

| Cybersecurity Losses | $2.5 billion | $2.7 billion | |||

| Data Analytics Growth | 12% (sector tech spend increase) | 15% (data analytics adoption) |

Legal factors

Gallagher faces a complex legal landscape. Compliance with financial reporting rules and insurance regulations is crucial. Recent data shows increased scrutiny on insurance broker practices. In 2024, regulatory fines in the insurance sector totaled $1.5 billion.

Gallagher must adhere to stringent compliance requirements. The Affordable Care Act (ACA) and Solvency II regulations significantly impact operational costs. For instance, ACA compliance costs for insurers rose by 7% in 2024. Solvency II compliance adds substantial financial burdens. These factors influence strategic choices, affecting profitability and market positioning.

Gallagher must navigate the complex and ever-changing data privacy laws. Regulations like GDPR and CCPA demand robust data protection measures. In 2024, the global data privacy market was valued at $7.6 billion, projected to reach $13.3 billion by 2029. Compliance failures can lead to significant fines and reputational damage. Gallagher needs to prioritize data security and privacy.

Litigation and Claims Trends

Gallagher faces legal challenges, especially regarding environmental insurance and emerging coverage issues. These issues demand expert legal navigation, potentially leading to disputes. The company's ability to manage and mitigate litigation risks significantly impacts its financial performance and reputation. Understanding claim trends is crucial for assessing future liabilities and adjusting strategies.

- Environmental claims have increased by 15% in the last year.

- Litigation costs account for approximately 3% of operational expenses.

- The company has allocated $50 million for potential litigation settlements.

- Recent court rulings have expanded the scope of liability in certain areas.

Legal Issues in Emerging Areas

Gallagher, like other firms, navigates evolving legal landscapes. "Greenwashing" claims pose risks, with potential fines and reputational damage. Companies must ensure environmental claims are accurate, aligning with regulations. 2024 saw increased scrutiny, with the SEC proposing stricter ESG disclosure rules.

- SEC proposed rules in 2024 could lead to increased legal challenges related to ESG claims.

- EU's Corporate Sustainability Reporting Directive (CSRD) impacts disclosures, increasing legal requirements.

- Failure to comply with environmental regulations can result in significant financial penalties.

- Companies face potential shareholder lawsuits over misleading sustainability statements.

Gallagher’s legal environment demands adherence to complex rules. Data privacy, environmental claims, and litigation risks are major concerns. In 2024, regulatory fines hit $1.5B. This influences financial performance and strategic decisions.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance costs, fines | Data privacy market $7.6B, projected $13.3B by 2029 |

| Environmental Claims | Litigation, "Greenwashing" | Environmental claims increased by 15%, SEC proposed stricter ESG disclosure |

| Litigation Costs | Financial performance | 3% of operational expenses; $50M allocated for settlements |

Environmental factors

Climate change is significantly impacting the insurance sector. This results in increased risks from severe weather and long-term climate shifts. For example, in 2024, insured losses from natural disasters reached $90 billion globally. Gallagher, like other insurers, faces rising claims and pricing pressures due to these environmental changes.

Environmental liabilities pose increasing risks for Gallagher. These liabilities, which may not be fully covered by standard insurance, necessitate specialized environmental insurance and risk management strategies. The global environmental insurance market was valued at $13.2 billion in 2024, with projections to reach $20.8 billion by 2029, showcasing growing importance. Gallagher must adapt to these evolving demands.

The shift to a lower-carbon economy poses regulatory and technological risks. These changes can affect financial stability and Gallagher's reputation. For example, in 2024, the EU's carbon border tax could impact international insurance premiums. The rise of green technologies and changing consumer preferences are also factors.

Environmental Risk Management

Gallagher recognizes the escalating importance of environmental risk management. They offer expert analysis and solutions to address environmental exposures and coverage gaps. This includes assessing risks related to climate change and pollution. The environmental services market is expected to reach $1.2 trillion by 2025.

- Climate change and its impact on business operations.

- Regulatory changes and their effect on environmental liability.

- Pollution events and their financial implications.

- Sustainability initiatives and their financial impact.

Sustainable Practices and ESG Integration

Gallagher actively supports sustainable economic development and assists clients in managing climate-related risks. They are integrating environmental, social, and governance (ESG) factors into their business practices. In 2024, the ESG-focused assets hit a record high, with over $40 trillion globally. This trend reflects a growing investor and stakeholder focus on sustainability. Gallagher's commitment aligns with the increasing demand for ethical and responsible business operations.

- ESG assets hit a record high of over $40 trillion globally in 2024.

- Gallagher aids clients in managing climate-related risks.

Environmental factors heavily influence Gallagher's operations. Climate change drives $90B insured losses (2024), increasing claims. The environmental insurance market, $13.2B (2024), is vital for risk management.

| Environmental Aspect | Impact on Gallagher | 2024/2025 Data |

|---|---|---|

| Climate Change | Increased claims & pricing pressures | $90B insured losses (2024) |

| Environmental Liabilities | Need for specialized insurance | $13.2B market value (2024), $20.8B by 2029 |

| Regulatory Changes | Impact on international premiums | EU carbon tax impact, ESG assets >$40T (2024) |

PESTLE Analysis Data Sources

The analysis uses government databases, economic indicators, industry reports, and policy updates to assess macro-environmental factors.