Ally Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ally Financial Bundle

What is included in the product

Analysis of Ally Financial's portfolio, identifying investment, hold, and divest strategies per quadrant.

Clean and optimized layout for sharing or printing; a pain point reliever, ensuring easy distribution of insights.

Full Transparency, Always

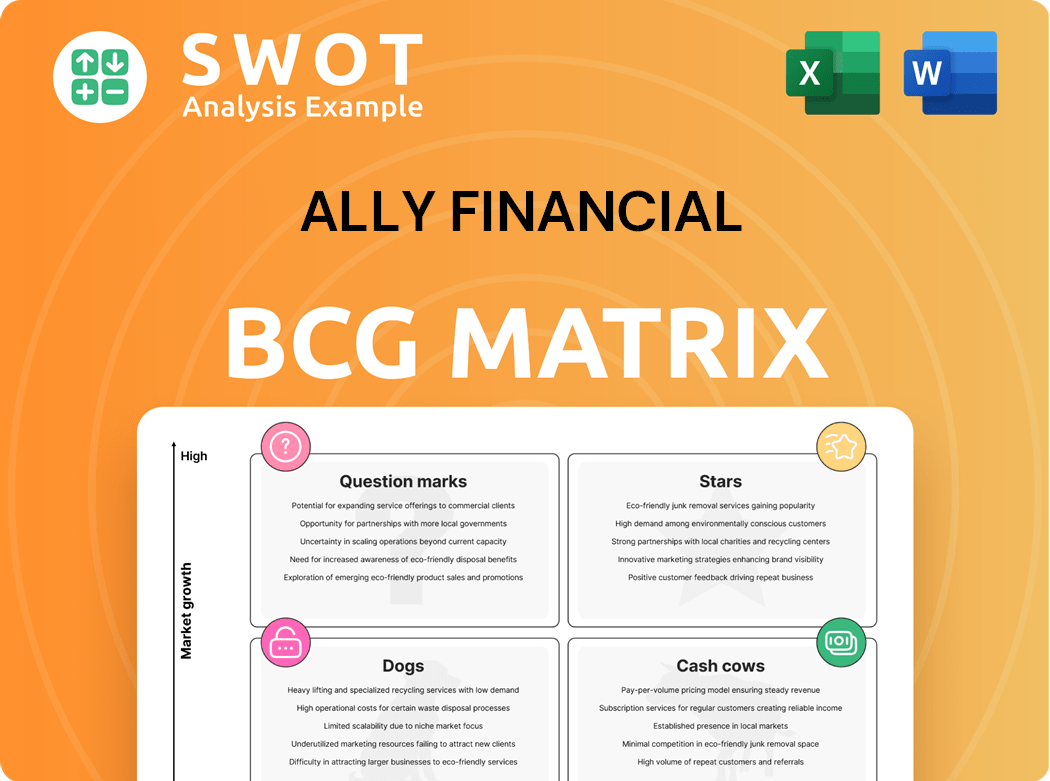

Ally Financial BCG Matrix

The Ally Financial BCG Matrix you see here is the same document you'll receive. It's a complete, ready-to-use analysis, with no hidden content or modifications after purchase.

BCG Matrix Template

Ally Financial navigates a complex financial landscape, and the BCG Matrix helps decipher its product portfolio's true potential. This matrix unveils which offerings shine as Stars, generating high growth. It also identifies Cash Cows, the stable revenue generators fueling the company. Question Marks and Dogs highlight areas requiring strategic decisions. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Ally Financial's auto finance is a star, leading the market through strong dealer relationships. In 2024, Ally originated $39.2 billion in auto loans, showcasing its market dominance. Q1 2025's 9.8% retail auto yield and 3.8M applications highlight its continued success. This segment's growth is a key driver for Ally.

Ally Bank's digital banking platform shines as a star within its portfolio. It draws in tech-savvy customers with competitive rates and easy-to-use online services. Retail deposit balances hit $146 billion in Q1 2025, with 92% FDIC insured. The bank gained 58,000 new deposit customers in Q1 2025, reaching a total of 3.3 million.

Ally's insurance business is a rising star, thriving through auto finance synergies and new partnerships. In 2024, written premiums hit $1.5 billion, the highest since its IPO, showing robust growth. This segment boosts Ally's diversified revenue and profitability.

Corporate Finance

The corporate finance segment shines as a star within Ally Financial's BCG Matrix, consistently delivering robust returns. In Q1 2025, this segment held $10.9 billion in held-for-investment loans, underscoring its financial muscle. It achieved an impressive 23% average ROE between 2014 and 2024, and recorded zero net charge-offs in 2024, signaling its profitability and solid asset quality.

- Strong Performance: High returns and quality loan book.

- Q1 2025 Portfolio: $10.9 billion in held-for-investment loans.

- ROE: 23% average from 2014-2024.

- 2024 Charge-Offs: Zero net charge-offs.

Strategic Focus on Core Businesses

Ally Financial's strategic pivot towards its core businesses—auto finance, insurance, and digital banking—is a key move. This allows for resource concentration in areas with the greatest growth potential. The company's decision to divest from non-core areas boosts its ability to leverage competitive advantages. This focused approach should enhance shareholder value.

- In Q3 2023, Ally's auto originations reached $10.7 billion, demonstrating its strong position in auto finance.

- Ally's efficiency ratio improved to 43.9% in Q3 2023, indicating better operational management.

- The company's digital banking segment continues to grow, with a focus on attracting deposits.

Ally's corporate finance segment is a star performer in its portfolio. It shows robust financial muscle. The segment recorded zero net charge-offs in 2024, highlighting its profitability and strength.

| Metric | Value |

|---|---|

| Q1 2025 Held-for-Investment Loans | $10.9 billion |

| Average ROE (2014-2024) | 23% |

| 2024 Net Charge-Offs | Zero |

Cash Cows

Ally's auto loan portfolio is a cash cow, producing steady income. In 2022, retail auto finance originations hit roughly $12.3 billion. The company holds a strong market share, around 12.3%, solidifying its position. This segment ensures dependable cash flow due to its established presence.

Ally Financial's digital banking deposits are a cash cow, providing a steady funding source. Deposits grew to $106.8 billion by Q3 2023, up from $91 billion in 2021, showcasing strong growth. Competitive interest rates fuel deposit growth; Ally's deposit growth rate was about 17% annually over two years. This deposit base supports Ally's lending operations efficiently.

Ally Financial's financial services, like auto loans and insurance, are cash cows. These services have healthy margins, contributing significantly to Ally's profits. The Q3 2023 net interest margin (NIM) was roughly 3.48%, showing efficient loan portfolio management. Adjusted earnings for 2022 from this segment were about $1.5 billion, demonstrating strong financial performance.

Dealer Financial Services

Ally's Dealer Financial Services segment, a cash cow in the BCG matrix, is a major revenue generator. In 2024, this segment, including Automotive Finance and Insurance, had $113.1 billion in assets. It brought in $5.8 billion in total net revenue, highlighting its financial strength. Approximately 1.2 million automotive loans and leases were originated, totaling $39.2 billion.

- Assets in 2024: $113.1 billion

- 2024 Net Revenue: $5.8 billion

- 2024 Loan/Lease Originations: 1.2 million

- 2024 Origination Value: $39.2 billion

SmartAuction Platform

SmartAuction is a cash cow for Ally Financial, generating stable revenue through vehicle sales to dealers. In 2024, the platform handled around 556,000 vehicle sales, highlighting its significant role. This supports Ally's auto finance business and strengthens dealer relationships.

- Revenue Stability: Provides consistent income.

- Market Presence: Enhances Ally's footprint in the auto industry.

- Dealer Relations: Strengthens ties with dealerships.

- Operational Efficiency: Streamlines vehicle sales processes.

Ally Financial's cash cows, including auto loans and digital banking, ensure stable income. Dealer Financial Services generated $5.8B in revenue in 2024. SmartAuction facilitated 556,000 vehicle sales in 2024, supporting Ally's auto finance operations.

| Segment | 2024 Revenue/Sales | Key Benefit |

|---|---|---|

| Dealer Financial Services | $5.8B (Net Revenue) | Financial Strength |

| SmartAuction | 556,000 vehicles sold | Supports Auto Finance |

| Digital Banking | $106.8B (Deposits, Q3 2023) | Steady Funding |

Dogs

Ally Financial has discontinued new mortgage loan originations, signaling a shift in strategic focus. This move, driven by underperformance, redirects capital to more lucrative avenues. The exit aims to streamline operations, concentrating on higher-yield segments.

Ally Financial divested its credit card business, indicating it wasn't a top performer. This move streamlined Ally's focus on key areas. A $118 million goodwill impairment at Ally Credit Card backed the decision. The sale helps Ally concentrate on its most profitable sectors, like auto lending.

Non-prime auto loans might be a 'dog' for Ally, given higher credit risks and potential losses. Despite Ally's focus on better borrowers, this segment needs careful monitoring. Ally's tightening of standards aims to reduce risks. In Q4 2023, Ally's auto originations were $10.1 billion, with a focus on prime. The net charge-off rate for auto loans was 1.57% in Q4 2023.

Legacy Debt

Ally Financial's "legacy debt," a high-cost obligation, aligns with the "dog" quadrant of the BCG matrix because it negatively impacts profitability. The company has been actively working to eliminate this debt through strategic activities and restructuring efforts. Addressing this issue is crucial for Ally to improve its financial performance and reduce its cost of capital. In 2024, Ally's focus remains on extinguishing this legacy debt.

- Legacy debt negatively affects profitability.

- Extinguishment is a key repositioning effort.

- Strategic activities and restructuring are involved.

- Ally aims to improve financial performance.

Businesses Lacking Scale

Ally Financial's "Dogs" represent moderately sized, non-core businesses without the scale for good returns. Ally is streamlining its focus. In 2024, Ally sold Ally Lending and its credit card business. Residential mortgage originations also ceased.

- Divestitures aim to improve profitability.

- Focus is on core financial services.

- Strategic shift to maximize shareholder value.

Ally's "Dogs" include underperforming or non-core units. Ally sold Ally Lending, credit card, and stopped mortgage originations in 2024. These moves boost profitability. Divestitures align with a strategic shift.

| Dog Category | Strategic Action | Impact |

|---|---|---|

| Legacy Debt | Restructuring & Extinguishment | Reduce Cost, Improve Profitability |

| Credit Card Business | Sale | Streamline Focus, Reduce Risk |

| Mortgage Originations | Discontinuation | Redirect Capital, Enhance Performance |

Question Marks

Ally Financial's EV leasing is a "question mark" in its BCG matrix. It offers below-market rates but gets tax credits, impacting its net interest margin. In Q4 2023, Ally's auto originations were $10.4B. This strategy creates pressure on net interest income. The firm's net income isn't declining due to tax credits.

Ally Financial's small business lending is a question mark in its BCG matrix. This segment, though smaller, shows promise for growth. In 2023, Ally's small business lending grew by 6.2%. The company's small business loan portfolio is valued at $1.4 billion. Growth is projected at 8-10% for 2024.

International digital banking is a question mark for Ally Financial. This market presents a $42.6 billion opportunity in 2024. Expansion demands substantial investment and adapting to various regulations and consumer behaviors. It involves high growth potential, but also comes with uncertainties.

AI and Technology Initiatives

Ally Financial's AI and technology initiatives are classified as question marks within its BCG matrix, reflecting uncertainty about their future impact. The company is investing in generative AI and exploring autonomous agents to enhance its services. Ally.ai, a vendor-agnostic platform, will provide access to various large language models (LLMs). These investments aim to improve customer experience and operational efficiency, but their long-term financial benefits remain to be seen. In 2024, Ally Financial allocated a significant portion of its technology budget to AI and digital transformation, signaling a strong commitment to these areas.

- 2024: Ally Financial increased its tech budget by 15%, with a focus on AI.

- Ally.ai platform is designed to integrate multiple LLMs.

- The company is exploring autonomous agents to automate tasks.

- Impact on Ally's financial performance is yet to be fully realized.

New Insurance Programs

Ally Financial's new insurance program relationships are classified as a question mark in its BCG matrix. Their contribution to revenue is still developing, making their future uncertain. In 2024, insurance written premiums reached $1.5 billion, the highest since Ally's IPO, boosted by these new programs. These programs could fuel further growth within the insurance segment, but their long-term performance requires close monitoring.

- Question mark status reflects the uncertainty of new insurance programs.

- Insurance written premiums reached $1.5 billion in 2024, the highest since the IPO.

- New programs have the potential for growth but need monitoring.

The insurance program is a question mark for Ally Financial in its BCG matrix. In 2024, written premiums were at $1.5B, the highest post-IPO. The long-term impact on revenue is uncertain.

| Aspect | Details |

|---|---|

| Status | Question Mark |

| 2024 Premiums | $1.5B |

| Future | Uncertain |

BCG Matrix Data Sources

Ally's BCG Matrix uses financial reports, market data, and industry analysis for trustworthy positions. Competitor benchmarks and growth trends also shape our strategy.