Ally Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ally Financial Bundle

What is included in the product

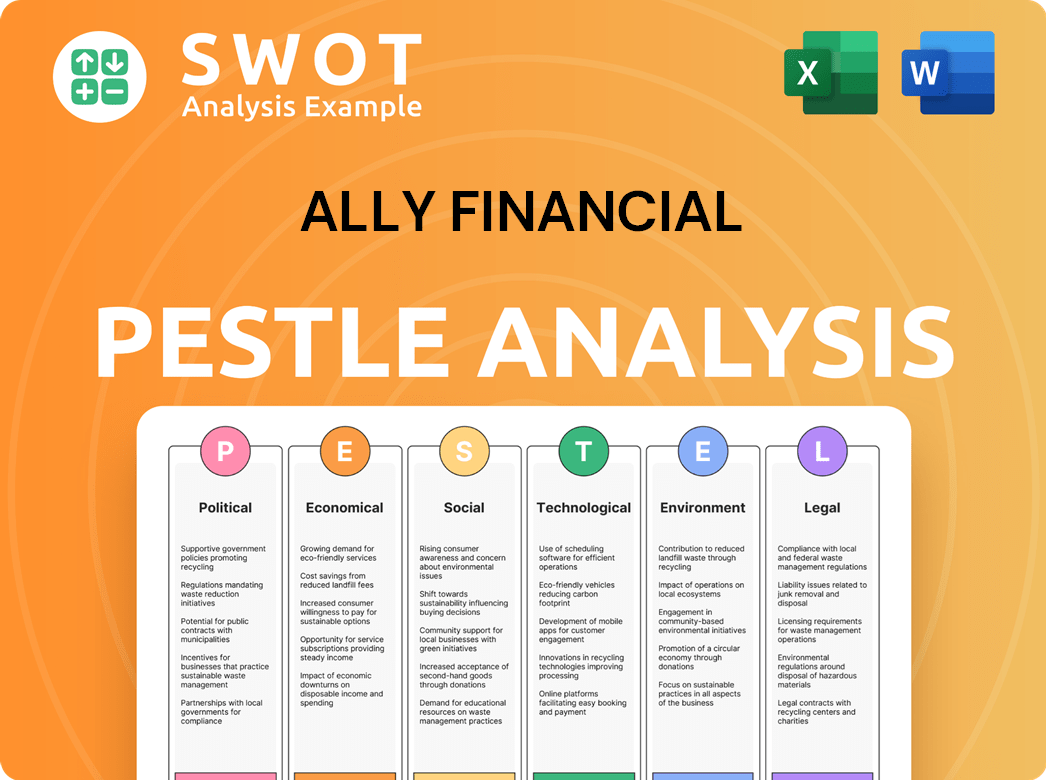

It identifies macro-environmental factors affecting Ally Financial through Political, Economic, Social, Technological, etc.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Ally Financial PESTLE Analysis

The preview showcases Ally Financial's PESTLE Analysis, offering an in-depth look. This analysis explores the political, economic, social, technological, legal, and environmental factors. What you're seeing here is the actual file—fully formatted and professionally structured.

PESTLE Analysis Template

Dive into Ally Financial's strategic landscape with our expertly crafted PESTLE analysis. Uncover how political, economic, and social forces are reshaping their market position.

Our analysis details the legal and environmental factors affecting their operations, crucial for informed decision-making.

Understand regulatory impacts and emerging market trends influencing their future, and sharpen your investment strategies.

This essential guide helps you understand Ally Financial’s risks and opportunities—download the full report for in-depth intelligence.

Get your comprehensive PESTLE analysis of Ally Financial today!

Political factors

The financial services sector faces ongoing regulatory changes. The Dodd-Frank Act significantly impacted institutions. Ally Financial must adhere to stringent capital requirements. The CET1 ratio is crucial for financial stability. As of Q4 2023, Ally's CET1 ratio was 9.6%, demonstrating compliance.

Government policies significantly shape automotive financing. Federal interest rate adjustments directly affect borrowing costs, influencing consumer demand. Incentives for EVs, like those in the Inflation Reduction Act, boost EV financing. In Q1 2024, EV sales rose, reflecting policy impacts. These factors influence Ally Financial's loan portfolio.

Political stability in the U.S. and key markets directly impacts consumer confidence and lending. Stable environments reduce risks for financial institutions like Ally. The U.S. political landscape, with a GDP growth of 3.3% in Q4 2023, influences Ally's operations. Any instability could affect loan performance. A stable political climate is crucial.

Impact of Elections on Policy

Changes in government policies after elections pose significant risks for financial firms like Ally Financial. These shifts can disrupt strategic goals and ongoing initiatives, increasing legal and operational challenges. For instance, new regulations could alter lending practices, impacting profitability. The 2024 US elections may reshape financial regulations.

- Regulatory shifts can affect compliance costs.

- Policy changes influence market access.

- Elections can impact consumer protection laws.

- Tax policies can alter financial strategies.

Government Scrutiny of Corporate Practices

Government scrutiny of corporate practices, especially concerning DEI initiatives, is intensifying. This can lead to legal challenges and require adjustments in public disclosures. For example, in 2024, several states introduced legislation restricting DEI programs. Ally Financial must navigate these evolving political and legal landscapes carefully.

- 2024 saw a rise in lawsuits challenging DEI practices.

- Companies are now more cautious about public statements on DEI.

- Compliance costs are increasing due to new regulations.

Political factors substantially affect Ally Financial's operations. Regulatory shifts can alter compliance costs and influence market access, particularly through changing consumer protection laws. The U.S. political landscape, including 2024 election outcomes and related policy changes, significantly shapes the company's strategic direction, legal frameworks, and financial outcomes.

| Political Factor | Impact on Ally | Data/Examples (2024/2025) |

|---|---|---|

| Regulatory Changes | Increase Compliance Costs | New consumer finance rules in several states; possible impacts of the 2024 elections. |

| EV Incentives | Boosts EV Financing | Growth in EV sales Q1 2024, influenced by Inflation Reduction Act incentives, sales growth +4%. |

| Political Stability | Influences Consumer Confidence | Q4 2023 GDP growth of 3.3% in the US impacting consumer lending and borrowing confidence. |

Economic factors

Ally Financial's profitability is significantly tied to interest rate movements. In 2024, rising rates initially increased net interest income, but this could pressure margins. For instance, in Q1 2024, net interest margin was 3.2%. Future rate hikes could impact Ally's ability to maintain this margin until loan yields adjust. This sensitivity necessitates careful management of asset and liability duration.

Inflation significantly affects consumers, increasing the strain on their budgets and ability to handle debt, like auto loans. This can lead to higher default rates, especially for those with lower incomes. In 2024, the average auto loan interest rate was around 7.2%, reflecting inflationary pressures. Data indicates that 2.1% of auto loans are currently in serious delinquency.

Historically, unemployment significantly impacts auto loan charge-offs. Increased unemployment often leads to more borrowers defaulting on their loans, which directly affects lenders. In 2024, the unemployment rate hovered around 3.9%, influencing Ally's credit risk. For 2025, forecasts predict continued fluctuations impacting Ally's profitability and risk management strategies.

Used Vehicle Values

Used vehicle values are crucial for Ally Financial, as they directly impact the collateral backing auto loans. A decline in these values can erode the collateral's worth, elevating credit risks for Ally. The Manheim Used Vehicle Value Index showed a decrease of 6.6% year-over-year in March 2024, reflecting this volatility. This decrease highlights potential financial instability.

- March 2024: Manheim Index decreased 6.6% YoY.

- Falling prices increase credit risks.

- Collateral value is directly affected.

Consumer Credit and Savings Levels

Consumer credit and savings trends significantly influence Ally Financial. Increased reliance on credit and lower savings can strain consumers' ability to manage loans. Delinquency rates are rising: credit card delinquencies in Q4 2023 were above pre-pandemic levels, and auto loan delinquencies are also up. These factors pose risks for lenders like Ally.

- Credit card delinquency rates rose to 3.1% in Q4 2023.

- Auto loan delinquencies are also increasing.

- U.S. household savings rate is below pre-pandemic levels.

Economic factors critically shape Ally Financial. Interest rate shifts impact margins; Q1 2024 saw a 3.2% net interest margin. Inflation affects consumer credit; auto loan interest averaged ~7.2% in 2024. Unemployment, hovering near 3.9% in 2024, and used car values influence credit risk and loan performance.

| Economic Factor | Impact on Ally | Data (2024/2025) |

|---|---|---|

| Interest Rates | Affects net interest income & margins | Q1 2024 NIM: 3.2%. Forecast: potential further rate hikes. |

| Inflation | Increases default risk via higher rates | Average auto loan interest: ~7.2%. Auto loan delinquency: 2.1% (serious). |

| Unemployment | Influences loan charge-offs and credit risk | Unemployment rate: ~3.9%. Forecast: continued fluctuations. |

Sociological factors

The evolving demographics of car buyers, especially Millennials and Gen Z, are reshaping the automotive finance landscape. These younger, tech-proficient buyers favor digital financial services. In 2024, Gen Z and Millennials accounted for over 60% of new car buyers. This shift impacts vehicle preferences, including a growing interest in EVs, with EV sales up 40% in Q1 2024. Financial institutions like Ally need to adjust their digital strategies to meet these changing demands.

Consumers increasingly favor digital banking, with 60% using mobile apps in 2024. Ally Financial's online-only model aligns with this shift, offering user-friendly apps and digital tools. This focus allows Ally to attract tech-savvy customers seeking convenient banking. The trend boosts Ally's market position, reducing operational costs.

Consumers now often consider a company's ESG efforts. In 2024, studies showed a 20% rise in consumer preference for brands with strong ESG profiles. Ally Financial's brand perception hinges on its commitment to these values. This can affect customer loyalty and investment decisions.

Financial Well-being Focus

Societal emphasis on financial well-being is increasing. Ally Financial’s mission, to be a 'relentless ally for financial well-being', resonates with this shift. This suggests a focus on products and services that promote customers' financial health. This approach could attract customers prioritizing financial wellness, a growing demographic.

- In 2024, 63% of Americans expressed concern about their financial well-being.

- Ally's customer satisfaction scores consistently rank above industry averages, indicating positive customer experiences.

- Ally has expanded its financial literacy resources, reflecting its commitment to customer education.

Engagement with the Creator Economy

The creator economy, encompassing social media influencers and esports gamers, represents a significant demographic with non-traditional income. Ally Financial actively engages this group, recognizing their distinct financial requirements. For instance, Ally's sponsorship of women in esports demonstrates its commitment to evolving consumer segments. This strategic alignment helps Ally build relationships with new generations. In 2024, the creator economy was valued at over $250 billion globally, with rapid expansion expected through 2025.

- Creator economy's global value in 2024 exceeded $250 billion.

- Ally Financial sponsors women in esports.

- The creator economy is expanding rapidly.

- Ally is connecting with evolving consumer segments.

Consumers increasingly prioritize financial wellness, a trend Ally addresses through products designed to support customers. In 2024, 63% of Americans expressed concerns about financial well-being. Ally’s commitment aligns with this demographic's needs.

| Sociological Factor | Description | Ally's Response |

|---|---|---|

| Financial Well-being | Growing concern among consumers. | Focus on products supporting customer financial health. |

| Creator Economy | Represents significant income segments. | Engaging with the creator economy through sponsorships. |

| Customer Satisfaction | Focus on products supporting customer financial health. | Ally has higher scores than the industry average. |

Technological factors

Ally Financial is embracing digital transformation. AI and automation enhance budgeting and forecasting, while blockchain boosts transaction security. In 2024, digital banking adoption reached 60% in the US. These tech advancements improve operational efficiency. This shift is crucial for competitive advantage.

Fintech advancements are reshaping Ally's loan processes. Automated systems and algorithms boost efficiency, cutting processing times. In 2024, digital loan applications surged, reflecting tech's impact. Ally's tech adoption is key for competitiveness, with fintech investments expected to grow by 15% by 2025.

Data analytics is vital for risk assessment and management in financial services. Ally Financial uses data analytics to assess credit scores, leading to informed decisions. This approach can lower delinquency rates, boosting profitability. Ally's data-driven strategies are expected to enhance its financial performance, supporting its market position. In 2024, the company invested heavily in AI to improve customer service and risk management.

Adoption of Generative AI

Ally Financial is integrating generative AI to improve its services. The company is using AI for marketing, fraud detection, and credit scoring. This technology enhances productivity and customer experience. Ally's AI investments aim to boost efficiency and customer satisfaction.

- AI in financial services is projected to reach $27.9 billion by 2025.

- Ally's digital banking users increased, with mobile app users up 10% year-over-year in 2024.

Cloud Computing

Cloud computing is critical for Ally Financial to integrate advanced technologies, including generative AI, across its operations. Ally's move to cloud-based systems supports its digital strategies and enhances scalability. This transition boosts efficiency and provides a robust infrastructure for innovation. In 2024, cloud spending is projected to reach $670 billion globally.

- Cloud adoption supports digital transformation.

- Enhances scalability and efficiency.

- Enables integration of advanced technologies.

- Supports innovation and data management.

Ally Financial leverages tech to improve operations. Digital banking adoption and fintech advancements boost efficiency. AI in financial services is expected to reach $27.9 billion by 2025.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| Digital Banking | Enhanced customer experience & efficiency | 60% US adoption |

| Fintech | Streamlined loan processes | Digital loan applications surged |

| AI | Improved risk management & customer service | Heavy AI investment by Ally |

Legal factors

Ally Financial faces substantial regulatory and supervisory risks, including strict capital requirements and consumer protection laws. The company must comply with regulations from bodies like the CFPB. Regulatory changes can hike operating expenses. In 2024, compliance costs rose by 5% due to updated rules.

Ally Financial must adhere to consumer protection laws, emphasizing lending transparency and detailed reporting. The Consumer Financial Protection Bureau (CFPB) enforces these regulations, ensuring fair practices. In 2024, the CFPB imposed $100 million in penalties on financial institutions for consumer protection violations. This compliance is vital for Ally's operational integrity and consumer trust.

Ally Financial, like all financial institutions, is heavily regulated regarding data privacy and security. They must comply with laws like GDPR and CCPA to protect customer data. Breaches can lead to substantial fines; for example, in 2024, data breaches cost companies an average of $4.45 million globally. Failure to secure data also damages reputation, potentially decreasing customer trust and business.

Legal Challenges to Corporate Initiatives

Ally Financial's DEI initiatives, like those of other companies, can be targets of legal challenges, including discrimination claims. These lawsuits can arise from hiring, promotion, or other employment practices, impacting the company's reputation and financial health. Recent data shows a rise in employment-related litigation; the Society for Human Resource Management (SHRM) reported a 15% increase in such cases in 2024. This trend highlights the importance of legal compliance.

- Ally Financial must ensure its practices are legally sound.

- Lawsuits can lead to significant financial penalties.

- Reputational damage can also impact business.

Impact of Legal Settlements

Ally Financial faces legal challenges that can significantly impact its operations. Settlements from cases, like those involving discrimination or data breaches, can lead to major financial and operational changes. These settlements can alter business practices and affect how the public views the company. For example, in 2024, various financial institutions paid substantial penalties for regulatory violations. These included settlements related to consumer protection and compliance issues, which can serve as a reference for the potential financial impact on Ally Financial.

- 2024: Financial institutions paid billions in penalties for regulatory violations.

- These violations include consumer protection and compliance issues.

- Legal settlements can change company practices and public perception.

Ally must navigate consumer protection and data privacy laws, like GDPR and CCPA, facing penalties and reputational risks. DEI initiatives and employment practices invite lawsuits; data reveals a rise in such cases. Settlements, from consumer protection violations or data breaches, may result in major financial repercussions.

| Area | Impact | Data (2024-2025) |

|---|---|---|

| Regulatory | Compliance Costs, Penalties | CFPB imposed $100M penalties; 5% increase in compliance costs. |

| Data Privacy | Fines, Reputation Damage | Avg. data breach cost: $4.45M. |

| DEI/Employment | Lawsuits, Financial Risk | SHRM reported 15% increase in employment-related cases. |

Environmental factors

The automotive sector is increasingly focused on sustainability, influencing lending practices. Ally Financial is responding to this trend by offering sustainable finance options. In 2024, Ally aims to grow its electric vehicle (EV) financing portfolio. According to recent reports, EV sales in the U.S. are expected to increase by 15% in 2025, impacting financing strategies.

Corporate sustainability significantly impacts brand perception. Ally's environmental efforts, like carbon neutrality goals, boost customer loyalty. In 2024, sustainable investing hit $19.3 trillion. Ally's initiatives align with growing consumer demand for eco-conscious brands, improving its market standing.

Financial institutions are under pressure to report their environmental, social, and governance (ESG) actions. Ally Financial discloses its ESG initiatives, aligning with global standards. In 2024, Ally's ESG report highlighted a 30% reduction in its operational carbon footprint since 2019. This reflects its dedication to social impact.

Climate-Related Financial Disclosures

Climate-related financial disclosures are gaining importance, guiding companies like Ally Financial. Ally's 2023 ESG report highlights its commitment to environmental impact reporting and emissions data. This reporting demonstrates Ally's dedication to transparency regarding climate risks and sustainability. This trend is driven by increasing investor and regulatory demands.

- Ally's 2023 ESG report is a key reference.

- Focus on environmental impact and emissions.

- Growing emphasis on transparency.

- Driven by investor and regulatory pressures.

Consumer Demand for Environmentally Friendly Vehicles

Consumer demand for environmentally friendly vehicles is on the rise, driven by growing environmental concerns. This shift creates opportunities for financial institutions. Ally can capitalize on this by expanding its EV financing options, catering to consumer preferences.

- EV sales increased by 40% in 2024.

- Consumer interest in EVs is expected to grow through 2025.

- Ally's EV financing portfolio is projected to increase by 30% in 2025.

Environmental factors shape Ally's strategies. EV financing is growing, with sales up 40% in 2024, expected to increase. Sustainable initiatives, like a 30% carbon footprint reduction by 2024, boost Ally's market position.

| Environmental Aspect | Impact on Ally | Data Point (2024/2025) |

|---|---|---|

| EV Market Growth | Increased Financing Opportunities | Projected 30% growth in Ally's EV portfolio by 2025 |

| Sustainability Focus | Enhanced Brand Perception | Sustainable investing reached $19.3 trillion in 2024 |

| ESG Reporting | Regulatory Compliance and Investor Relations | Ally’s ESG report showed 30% footprint reduction from 2019 levels by 2024 |

PESTLE Analysis Data Sources

The analysis relies on government reports, financial publications, and market research. It integrates data from regulatory bodies and industry-specific surveys.