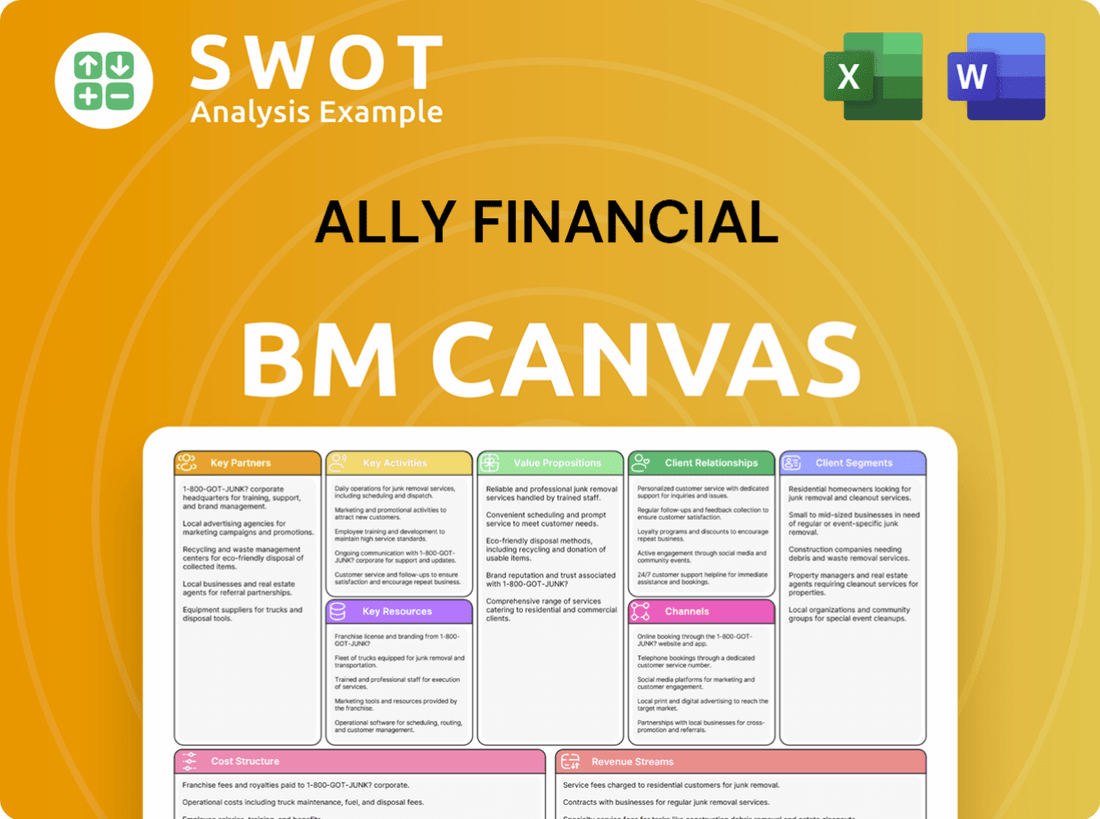

Ally Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ally Financial Bundle

What is included in the product

Ally Financial's BMC details customer segments, channels, and value propositions.

Condenses Ally's strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

The Ally Financial Business Model Canvas you see is the final document. It's a complete, ready-to-use file. Purchasing provides the exact same content in an editable format. No changes or omissions—this is the full, unlocked version.

Business Model Canvas Template

Understand Ally Financial's strategy with its Business Model Canvas. It breaks down key activities, partnerships, and customer segments. Discover its value proposition and revenue streams through this concise framework. Ideal for investors, analysts, and business strategists. Get the full canvas for in-depth analysis and strategic insights. Download the complete Business Model Canvas now!

Partnerships

Ally Financial's key partnerships include a broad network of automotive dealerships. This collaborative approach allows Ally to offer auto loan products directly at the point of sale, boosting convenience. The network included about 18,000 dealerships across the U.S. by the end of Q4 2023. This strategy is crucial for Ally's market reach and loan origination.

Ally Financial teams up with insurance firms to offer diverse insurance products. This collaboration lets Ally provide extensive coverage, including car insurance and extended warranties, benefiting customers. In 2024, P&C premiums grew by $40 million YoY, boosted by new OEM deals and rising inventory. These partnerships enhance Ally's customer value proposition.

Ally Financial collaborates with online banking tech providers. They enhance digital banking and user experience. This includes mobile banking and bill pay. Ally’s advanced tech infrastructure is a key resource. In Q4 2023, Ally reported 2.8 million active mobile users.

WNBA

Ally Financial's strategic alliance with the WNBA, announced recently, solidifies its position as the league's official banking partner and a key Changemaker. This collaboration involves Ally as the presenting partner for the inaugural 'Rivals Week' in August 2025, enhancing brand visibility. The partnership showcases Ally's commitment to women's sports and financial empowerment, aligning with its brand values.

- Official Banking Partner: Ally Financial has secured a significant role within the WNBA ecosystem.

- Presenting Partner of 'Rivals Week': This positions Ally at the forefront of a major league event.

- All-Star Game Integration: Ally will be the logo patch partner for All-Star Game jerseys.

- Fan Engagement: Ally will host a fan activation at WNBA Live.

Financial Wellness Platforms

Ally Financial strategically teams up with financial wellness platforms, enhancing customer support. These partnerships provide tools and resources to boost financial literacy, aligning with Ally's commitment to customer well-being. In 2024, Ally expanded its financial wellness offerings, including collaborations with Calm and Money Roots, reflecting its dedication to comprehensive financial support. These initiatives show Ally's focus on value beyond banking.

- Partnerships with Calm and Money Roots.

- Focus on customer financial literacy.

- Commitment to value beyond banking.

- Expansion of financial wellness offerings in 2024.

Ally Financial strategically forges diverse partnerships to enhance its business model. Key alliances include auto dealerships, insurance providers, and tech firms. These collaborations boost market reach, offer diverse services, and improve user experience. Ally also teams up with financial wellness platforms, expanding its commitment to customer well-being and financial literacy.

| Partnership Type | Partners | Benefits |

|---|---|---|

| Automotive | ~18,000 U.S. Dealerships | Direct loan origination & market reach |

| Insurance | Various Insurance Firms | Extensive coverage & customer value |

| Tech | Online Banking Providers | Enhanced digital experience |

| WNBA | WNBA | Brand visibility & empowerment |

| Financial Wellness | Calm, Money Roots | Financial literacy & support |

Activities

A primary activity for Ally Financial is automotive financing. They offer loans and leases for new and used vehicles. Ally also finances dealer inventory and operations. In 2023, Ally originated $53.2 billion in auto loans. Their market share in automotive financing was 11.4%.

Ally Financial's key activities include offering a full range of digital banking services. This encompasses deposit accounts, credit cards, and personal loans, all provided online. The focus is on a user-friendly digital experience through Ally Bank. Ally invested $387 million in technology by the end of Q4 2023. This investment supports and enhances its digital banking platform.

Ally Financial’s insurance services are a key activity, providing auto insurance, GAP insurance, and extended warranties. These services enhance Ally's auto financing, adding value. In 2023, insurance earned premiums hit $1.3 billion, the highest since Ally's 2014 IPO. This demonstrates the significant contribution of insurance to the company's revenue streams.

Corporate Finance

Ally Financial's Corporate Finance division is a key activity, delivering financial solutions to equity sponsors and middle-market businesses. They offer capital for various corporate transactions, including acquisitions and leveraged buyouts. The division's pre-tax income reached $120 million in a recent quarter. This highlights its consistent financial performance and contribution to Ally's overall strategy.

- Offers financial solutions to equity sponsors and middle-market companies.

- Provides capital for acquisitions and leveraged buyouts.

- Achieved $120 million in pre-tax income in a recent quarter.

- Supports Ally's overall business strategy.

Risk Management

Ally Financial places a strong emphasis on risk management. The company's balance sheet is moderately asset-sensitive in the short term, shifting to liability-sensitive over the medium term. They actively manage credit risk and aim to maintain a robust capital position. This includes investing in technology and diversifying funding.

- In 2024, Ally's Tier 1 capital ratio was approximately 10.5%.

- Ally's provision for credit losses in Q4 2024 was $255 million.

- The company's total assets were around $187 billion as of December 31, 2024.

- Ally's net charge-offs for Q4 2024 were 0.90%.

Ally Financial's Corporate Finance offers financial solutions, including capital for acquisitions. In a recent quarter, this division saw $120 million in pre-tax income. This supports Ally's broader business objectives.

| Key Activity | Description | Data |

|---|---|---|

| Financial Solutions | Provides capital to equity sponsors and middle-market businesses. | Pre-tax income: $120M |

| Capital Provision | Offers capital for acquisitions and leveraged buyouts. | Supports Ally's growth initiatives. |

| Strategic Support | Enhances Ally's overall financial strategy and performance. | Consistent contribution to revenue. |

Resources

Ally's digital banking platform is a cornerstone of its operations, enabling nationwide service accessibility. This sophisticated technology infrastructure is a vital resource. In Q4 2023, Ally invested $387 million in tech. This investment underscores its commitment to digital banking.

Ally Financial's deep expertise in auto financing, cultivated over a century, stands as a crucial resource. This includes a strong understanding of the automotive market, dealership relationships, and credit risk management capabilities. In 2023, Ally originated $53.2 billion in auto loans. The company held an 11.4% market share in the automotive financing sector.

Ally Financial's strong deposit base is a key resource, offering a low-cost funding source. In 2024, retail deposits grew significantly, reaching $146 billion, with 92% FDIC insured. This stable base supports Ally's lending operations. Retail deposit funding makes up 89% of its total liability-based funding.

Brand Reputation

Ally Financial's brand reputation is pivotal, reflecting its customer-centric approach. This asset is strengthened by superior customer service, transparency, and competitive pricing strategies. Ally's strong brand contributed to a high customer retention rate. The company's focus on innovation also boosts its brand value.

- Focus on customer satisfaction.

- Transparency in all dealings.

- Offer competitive pricing.

- Emphasize innovation.

Dealer Network

Ally Financial's dealer network is essential. It gives Ally access to many auto loan customers, boosting its auto financing. This network is a key resource for Ally's business model. As of Q4 2023, Ally partnered with roughly 18,000 U.S. dealerships.

- Dealer relationships are vital for auto loan origination.

- Supports Ally's auto financing business.

- Provides access to a broad customer base.

- Approximately 18,000 dealership partnerships as of Q4 2023.

Ally’s Key Resources include its digital banking platform, essential for nationwide service and efficiency. A strong deposit base provides low-cost funding, with $146 billion in retail deposits in 2024. The company's brand and its dealer network support its auto financing operations.

| Resource | Description | 2024 Data/Facts |

|---|---|---|

| Digital Banking Platform | Enables nationwide service accessibility. | Q4 2023 tech investment: $387M. |

| Auto Financing Expertise | Over a century of experience in auto financing. | Originated $53.2B in auto loans in 2023; 11.4% market share. |

| Deposit Base | Low-cost funding source. | Retail deposits: $146B, 92% FDIC insured. |

Value Propositions

Ally Financial's digital banking offers a seamless experience. Customers manage finances via online and mobile platforms. This includes easy access to various financial products. In 2024, Ally's mobile app saw a 15% increase in user engagement. This aligns with the growing trend of digital financial management.

Ally Financial's competitive interest rates are a key value proposition. They attract customers with appealing returns and affordable financing. Ally Bank's Savings Account APY was 3.75% in January 2024. This strategy helps Ally gain and retain customers.

Ally Financial emphasizes transparent pricing, ensuring no hidden fees to foster customer trust. The company focuses on clear product and service information, enhancing customer understanding. Ally's customer-centric approach delivers exceptional experiences, solidifying its value proposition. In 2024, Ally's commitment to transparency has helped it maintain a high customer satisfaction score. This transparency has been a key factor in Ally's ability to attract and retain customers, with a reported 15% increase in new accounts in Q3 2024.

Exceptional Customer Service

Ally Financial emphasizes outstanding customer service across digital and traditional platforms, aiming to be a steadfast ally for its customers. They offer personalized support to swiftly resolve customer issues, enhancing satisfaction. This commitment has helped Ally retain a high customer retention rate. In 2024, Ally's customer retention rate remained strong.

- Online, mobile, and phone support are the main customer service channels.

- Ally focuses on personalized assistance and efficient issue resolution.

- Ally maintained a customer retention rate of 96% in 2024.

Integrated Financial Services

Ally Financial's value proposition centers on Integrated Financial Services, providing a comprehensive suite of financial products. This includes auto finance, mortgages, insurance, and commercial banking all under one roof. This approach streamlines customer financial management. In 2024, Ally's auto finance segment saw strong performance.

- Offers a broad range of financial products.

- Simplifies financial management.

- Enhances customer experience.

- Drives cross-selling opportunities.

Ally Financial's Value Propositions include seamless digital banking, offering easy online and mobile financial management. Competitive interest rates attract customers with attractive returns. Transparent pricing and outstanding customer service build trust and satisfaction. Integrated financial services, including auto finance and insurance, provide a comprehensive suite.

| Value Proposition | Details | 2024 Data |

|---|---|---|

| Digital Banking | Seamless online and mobile access to financial products | 15% increase in mobile app user engagement |

| Competitive Rates | Attractive returns and financing options | Savings Account APY: 3.75% in January |

| Transparency | Clear pricing and information; no hidden fees | High customer satisfaction score |

| Customer Service | Personalized support across digital platforms | 96% customer retention rate |

| Integrated Services | Comprehensive financial products (auto, etc.) | Strong performance in auto finance segment |

Customer Relationships

Ally Financial prioritizes personalized service, focusing on individual customer needs and goals. They offer tailored financial solutions and advice. This approach supports Ally's value proposition of Personalized Financial Solutions for Diverse Customer Needs. In 2024, Ally's customer satisfaction scores consistently reflected this commitment, exceeding industry benchmarks. This customer-centric strategy fuels retention and growth.

Ally Financial heavily relies on digital channels like social media and email for customer interaction. In 2024, digital banking interactions grew by 15% year-over-year. The company uses these platforms to offer support and collect customer insights. Ally continues to invest in its digital direct bank, enhancing personalization through advanced analytics. These efforts aim to boost efficiency and fortify security measures.

Ally Financial provides customer support via phone, email, and online chat. Their goal is to promptly assist customers with inquiries or issues. Ally focuses on high service levels across multiple platforms. In 2024, Ally's customer satisfaction scores remained consistently high, reflecting their commitment.

Community Involvement

Ally Financial strengthens customer relationships by actively engaging in community involvement, which includes charitable donations and volunteer programs. They focus on initiatives that boost financial literacy, affordable housing, and economic growth. Ally's commitment to its 'Do It Right' mission benefits customers, communities, and employees through innovative financial solutions.

- In 2023, Ally invested over $4 million in community initiatives.

- Ally's volunteer efforts totaled over 10,000 hours in 2023.

- Ally focuses on programs in underserved communities.

- These efforts align with Ally's values.

Proactive Communication

Ally Financial actively communicates with its customers through various channels. They provide regular account statements, newsletters, and educational resources to keep customers informed. This proactive approach aims to deepen customer relationships and boost brand loyalty, crucial for growth. In 2024, Ally reported over 3 million active deposit accounts. Their customer-centric strategy supports future loan and deposit growth.

- Regular Account Statements: Ally sends out detailed statements.

- Newsletters: Informative content is delivered to customers.

- Educational Materials: Resources to help customers make informed financial decisions are provided.

- Customer-Centric Approach: Enhances brand loyalty and growth.

Ally Financial fosters strong customer relationships through personalized service and tailored financial solutions. Digital channels, including online banking and social media, are primary platforms for communication and support, with digital interactions growing. Customer support is available via phone, email, and chat. Ally's customer satisfaction scores in 2024 remained high, reflecting their dedication.

| Customer Relationship Aspect | Description | 2024 Metrics |

|---|---|---|

| Personalized Service | Tailored financial solutions and advice. | Customer satisfaction scores exceed industry benchmarks. |

| Digital Channels | Online banking, social media, email. | Digital banking interactions grew by 15% year-over-year. |

| Customer Support | Phone, email, online chat. | High service levels maintained across platforms. |

Channels

Ally Financial's primary channel is its online banking platform. Customers use it to manage accounts and apply for loans. The company invests heavily in its platform to improve user experience. In Q1 2024, Ally's digital banking users reached 3.2 million.

Ally's mobile app is a key channel, offering convenient account access. Customers can use features like mobile check deposit and bill pay. In 2024, Ally deployed an updated mobile app. It received an excellent rating from Corporate Insights.

Ally Financial's call centers are a crucial touchpoint for customer service, offering support for banking needs. These centers aim for quick, effective solutions, enhancing customer satisfaction. In 2024, Ally handled a significant volume of calls, focusing on a positive customer experience. This approach helps solidify Ally's reputation for service, complementing their financial offerings.

Automotive Dealerships

Ally Financial's automotive dealership channel is crucial for distributing auto loans and financing. This direct-to-customer approach at the point of sale is highly effective. In 2024, Ally partnered with roughly 18,000 dealerships nationwide, boosting its market reach. This channel strategy significantly contributes to Ally's loan origination volume and customer acquisition.

- Partnerships: Ally's network of dealerships is a key distribution channel.

- Reach: This allows direct access to customers during vehicle purchases.

- Scale: Approximately 18,000 dealerships were partnered with Ally in 2024.

- Impact: Dealerships drive loan origination and customer growth.

Partnerships and Sponsorships

Ally Financial strategically forms partnerships and sponsorships to broaden its customer base and enhance brand visibility. These alliances often involve sports teams, events, and organizations that resonate with Ally's core values and target demographic. A prime example is Ally's role as the official banking partner of the WNBA, highlighting its commitment. These collaborations help Ally connect with diverse audiences and reinforce its brand image.

- Partnerships: Ally Financial partners with various organizations to expand its reach.

- Sponsorships: Ally sponsors events to boost brand visibility.

- WNBA: Ally is the official banking partner of the WNBA.

- Strategic Alignment: These partnerships align with Ally's values.

Ally Financial utilizes several channels to engage with customers. Their online platform and mobile app offer digital banking solutions. Call centers provide customer service and automotive dealerships facilitate loan distribution. Partnerships and sponsorships expand brand visibility and reach.

| Channel | Description | 2024 Data |

|---|---|---|

| Online Banking | Primary platform for account management. | 3.2M digital banking users (Q1 2024) |

| Mobile App | Convenient account access with features. | Updated app deployed in 2024. |

| Call Centers | Customer service and support. | Significant call volume handled in 2024. |

| Automotive Dealerships | Distribution for auto loans. | Partnership with ~18,000 dealerships in 2024. |

| Partnerships/Sponsorships | Brand visibility and reach. | Official banking partner of the WNBA. |

Customer Segments

Ally Financial's auto loan customers are primarily individuals and families needing vehicle financing. These customers present diverse creditworthiness and financial requirements. In 2023, Ally originated $53.2 billion in auto loans. This resulted in an 11.4% market share in the automotive financing sector.

Ally Financial focuses on digital banking customers, who prioritize online convenience. These customers seek competitive rates and low fees. In 2024, Ally's online deposit base grew significantly. Offering higher rates than traditional banks is key.

Ally Financial caters to insurance customers by offering vehicle and asset protection solutions. This includes auto insurance, gap insurance, and extended warranties, meeting diverse customer needs. In 2023, insurance earned premiums hit $1.3 billion, the highest since Ally's IPO in 2014. This demonstrates strong customer demand and growth in their insurance offerings.

Corporate Clients

Ally Financial's corporate clients encompass equity sponsors and middle-market businesses, offering tailored corporate finance solutions. These clients seek capital for acquisitions and leveraged buyouts. Corporate Finance operations significantly contributed to Ally's revenue, with $113.1 billion in assets. In 2024, it generated $5.8 billion in total net revenue, underscoring its importance.

- Focus on providing capital for acquisitions and leveraged buyouts.

- Corporate Finance operations manage substantial assets.

- Generated $5.8 billion in total net revenue in 2024.

- Serves equity sponsors and middle-market companies.

WNBA Fans

Ally Financial is expanding its customer base to include WNBA fans through a new partnership. This strategic move aligns with Ally's objective to achieve parity in its paid media spending. The company aims to reach a 50/50 split by 2026, accelerating its diversity and inclusion goals. This positions Ally to connect with a broader audience and enhance its brand visibility within the sports community.

- The WNBA's viewership in 2023 increased by 21% across all platforms.

- Ally Financial's marketing spend in 2023 was approximately $800 million.

- The goal of 50/50 spending parity targets both men and women in marketing.

- Ally aims to leverage this partnership for brand growth and customer acquisition.

Ally Financial's customer segments include auto loan borrowers, digital banking users, and insurance clients. Corporate clients, such as equity sponsors and middle-market businesses, are also key. A recent WNBA partnership broadens Ally's reach.

| Customer Segment | Description | 2024 Data/Facts |

|---|---|---|

| Auto Loan Customers | Individuals/families needing vehicle financing. | Originated $53.2B in auto loans (2023), 11.4% market share. |

| Digital Banking Customers | Prioritize online convenience. | Significant growth in online deposit base in 2024. |

| Insurance Customers | Seeking vehicle/asset protection. | Insurance premiums reached $1.3B (2023). |

| Corporate Clients | Equity sponsors and middle-market businesses. | $5.8B total net revenue in 2024. |

| WNBA Fans | Expanded customer base via partnership. | WNBA viewership increased 21% in 2023. |

Cost Structure

Ally Financial's cost structure heavily involves technology and infrastructure. They spend a lot to keep their digital banking platform and tech up-to-date. This includes software development, data security, and system maintenance costs. In Q4 2023, Ally invested $387 million in technology. These investments are crucial for their digital-first approach.

Interest expense is a major cost for Ally Financial, specifically on deposit accounts and borrowings. Ally needs to offer competitive rates to attract and keep deposits. In Q1 2024, Ally's net income from continuing operations dropped by 30% to $669 million. This decrease was primarily from higher interest expenses and credit loss provisions.

Ally Financial's cost structure includes substantial expenses for salaries, benefits, and employee training. The company's large workforce across different business segments drives these costs. In 2023, compensation and benefits expenses declined by 3% to $1.842 billion, due to the sale of Ally Lending. This reflects efforts to manage operating expenses efficiently.

Loan Losses

Ally Financial's cost structure includes expenses tied to loan losses. This occurs when borrowers fail to repay their loans, impacting Ally's profitability. To manage this, Ally establishes reserves to offset potential losses. In 2024, the provision for credit losses grew by 10% to $2,166 million due to increased net charge-offs in the consumer automotive sector.

- Loan losses are a significant cost component.

- Reserves are used to cover potential defaults.

- Provision for credit losses increased in 2024.

- The rise was driven by consumer auto loan issues.

Marketing and Advertising

Ally Financial's marketing and advertising costs are crucial for brand visibility and customer acquisition. They invest in digital ads, sponsorships, and public relations efforts. A significant new aspect includes integrating with the WNBA through media partnerships. This strategy aims to boost brand recognition and attract new clients.

- In 2023, Ally spent $234 million on advertising and marketing.

- The WNBA partnership involves investments in media coverage.

- These efforts support Ally's growth and market presence.

- Marketing spend is a key component of Ally's cost structure.

Ally Financial's cost structure is significantly influenced by technology and infrastructure investments, with $387 million allocated in Q4 2023. Interest expenses, particularly on deposits, are a considerable factor, contributing to a 30% decrease in Q1 2024 net income to $669 million. Loan losses and marketing also add to costs, as seen in increased credit loss provisions and $234 million spent on advertising in 2023.

| Cost Category | Description | 2023 Data |

|---|---|---|

| Technology | Digital platform maintenance & upgrades | $387M (Q4 investments) |

| Interest Expense | Deposit interest & borrowings | Impacts net income |

| Loan Losses | Provision for defaults | $2,166M (2024 increase) |

Revenue Streams

Ally Financial's interest income is a key revenue stream, primarily from auto loans. The company profits from the interest on its loan portfolio's outstanding balances. In Q4 2023, Ally reported $1.37 billion in auto loan interest income. This demonstrates the importance of loan interest to their financial health.

Ally Financial generates service fees from deposit accounts, credit cards, and investment advisory services. The company focuses on offering value-added services to boost fee income. In Q4 2023, other revenue, including insurance and SmartAuction, positively impacted fee revenue. For 2024, these sources are expected to continue as tailwinds.

Ally Financial's revenue model includes insurance premiums derived from products like auto and gap insurance. The company collects premiums from customers who buy these insurance coverages. In 2024, insurance premiums and service revenue rose by 11% to $1,413 million. This growth was fueled by the vehicle inventory insurance program and new partnerships.

Corporate Finance Income

Ally Financial generates revenue through its corporate finance segment, focusing on fees and interest from corporate loans. They provide capital for acquisitions and leveraged buyouts. In 2024, Automotive Finance, a key part of this, had $113.1 billion in assets. This segment also contributed significantly to the total net revenue.

- Corporate finance activities generate revenue through fees and interest on loans.

- Capital is provided for acquisitions and leveraged buyouts.

- Automotive Finance held $113.1 billion in assets in 2024.

- Automotive Finance generated $5.8 billion in total net revenue in 2024.

Gains on Sales of Loans

Ally Financial's revenue streams include gains from selling loans, especially in auto finance. This involves selling loans to investors and other institutions. This strategy supports Ally's focus on core strengths. Ally is strategically shifting to its most competitive franchises.

- Auto finance is a key area for loan sales.

- Selling loans generates immediate revenue.

- This supports the company's strategic focus.

- It helps manage risk and capital.

Ally Financial’s revenue streams are multifaceted. They include interest income from auto loans, with $1.37 billion in Q4 2023. Service fees from deposits and credit cards also contribute, as do insurance premiums.

Corporate finance, including Automotive Finance, generated substantial revenue, with $5.8 billion in 2024. Gains from loan sales, particularly in auto finance, further boost revenue.

| Revenue Source | 2024 Revenue (Approx.) |

|---|---|

| Auto Loan Interest | $1.37B (Q4 2023) |

| Insurance & Service | $1.413B (2024, +11%) |

| Corporate Finance | $5.8B (2024) |

Business Model Canvas Data Sources

Ally Financial's BMC relies on financial reports, market analysis, and customer behavior insights for accurate strategic planning.