AutoZone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoZone Bundle

What is included in the product

Tailored analysis for AutoZone's product portfolio, revealing strategic moves for each quadrant.

Printable summary optimized for A4 and mobile PDFs, enabling effective communication.

Full Transparency, Always

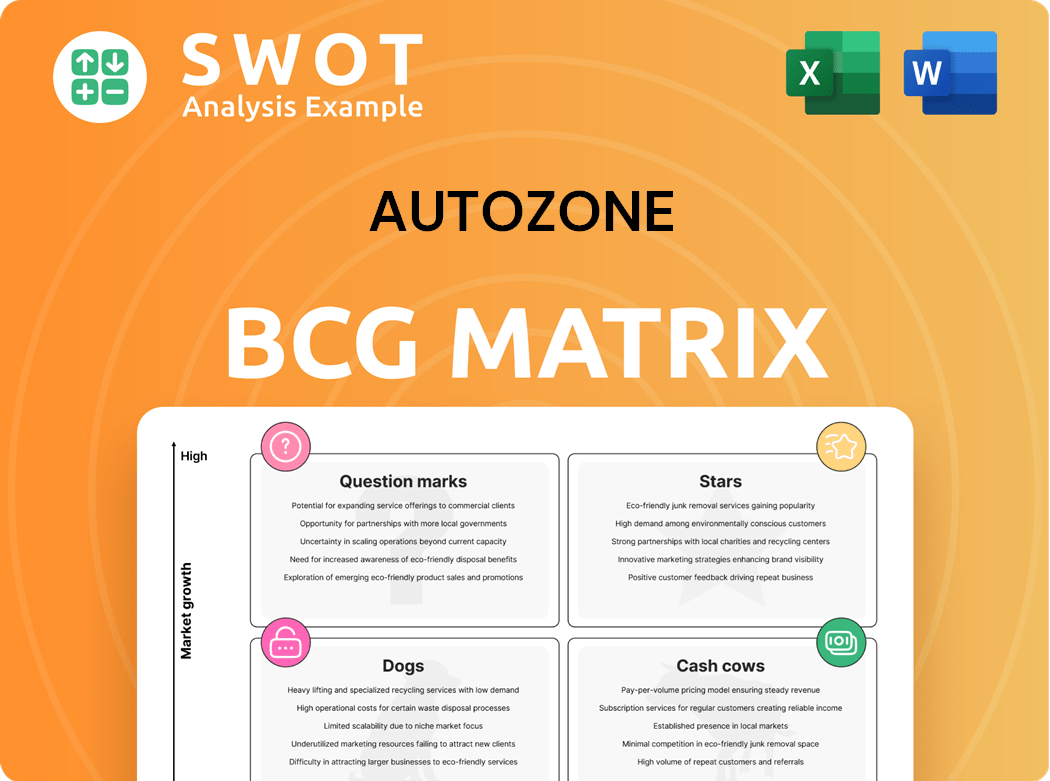

AutoZone BCG Matrix

This preview is the exact AutoZone BCG Matrix you receive post-purchase. It's a complete, editable report for strategic insights.

BCG Matrix Template

AutoZone's BCG Matrix paints a picture of its diverse product portfolio. Stars are shining bright with high market share, while Cash Cows generate steady profits. Dogs might be dragging down resources, and Question Marks need careful assessment. This snapshot only scratches the surface. Purchase the full BCG Matrix report for detailed quadrant analysis and strategic recommendations to optimize AutoZone's performance.

Stars

AutoZone's 'Do-It-For-Me' (DIFM) commercial business is a rising star, with a strong growth focus. Investments in part availability and delivery are key strategies. This segment's expansion boosts domestic sales. In 2024, commercial sales represented over 30% of total revenue, a substantial increase.

AutoZone's mega-hub expansion is a growth driver. These hubs act as mini-distribution centers, boosting parts availability. The retailer plans to accelerate mega-hub openings in fiscal year 2025. In Q1 2024, AutoZone's net sales were $4.2 billion, reflecting strong demand. This expansion strategy supports the company's ability to meet customer needs.

AutoZone's expansion in Mexico and Brazil positions it as a "Star" in its BCG matrix. They're actively opening new stores and tailoring products. In Q1 2024, international same-store sales grew 10.4% on a constant currency basis. This growth reflects the success of their international strategy.

E-commerce and Digital Sales

AutoZone's e-commerce and digital sales are boosting growth. Online platforms and the mobile app offer convenient access, driving sales. Integration with in-store retail enhances customer engagement through advanced diagnostic and repair solutions. Digital sales growth is a key area of focus for the company's expansion strategy.

- In 2024, AutoZone's digital sales increased, contributing significantly to overall revenue.

- The company's mobile app saw increased usage, improving customer interaction and sales.

- AutoZone continued to invest in its online platform to enhance user experience.

- The expansion of digital diagnostic and repair solutions aimed to boost sales.

Financial Performance & Share Repurchases

AutoZone shines as a star due to its robust financial health. The company's revenue and earnings per share have consistently grown. AutoZone's financial strategy includes share repurchases, which boost shareholder value. The company's strong cash flow and manageable debt levels support its stability.

- Revenue Growth: In fiscal year 2024, AutoZone reported a 6.2% increase in total sales.

- Earnings Per Share: The diluted EPS for fiscal year 2024 was $138.95, a 12.3% increase.

- Share Repurchases: During fiscal year 2024, AutoZone repurchased $2.6 billion of its common stock.

- Financial Stability: AutoZone's debt-to-capital ratio is maintained at a healthy level.

AutoZone's "Stars" are high-growth, high-market-share businesses. The DIFM commercial business, mega-hub expansion, and international growth in Mexico and Brazil are key. Digital sales and robust financials further solidify its "Star" status.

| Metric | 2024 Performance | Details |

|---|---|---|

| Total Sales Growth | 6.2% | Reflects strong demand across all segments. |

| Diluted EPS | $138.95 | Up 12.3%, demonstrating profitability. |

| Share Repurchases | $2.6B | Enhances shareholder value. |

Cash Cows

AutoZone's DIY segment is a cash cow, driving significant revenue. In 2024, this segment represented a major portion of the company's $17.7 billion in sales. AutoZone's strong customer service and extensive network, with over 6,300 stores, solidify its market leadership. This focus on DIY customers and parts availability sets it apart.

Duralast, AutoZone's private-label, is a cash cow. These products offer quality and competitive prices. They generate higher margins. In 2024, private-label sales boosted revenue.

AutoZone's Loan-A-Tool program remains a cash cow, attracting customers and boosting loyalty. This free tool rental service sets AutoZone apart, addressing customer needs directly. It tackles the high cost of specialty tools for occasional repairs. In 2024, this program contributed significantly to AutoZone's revenue, with a reported increase in same-store sales.

Extensive Store Network in the U.S.

AutoZone's vast U.S. store network is a significant strength, offering unparalleled convenience. This extensive presence allows for broad market capture and strong sales. AutoZone operates approximately 6,400 stores across all 50 states, ensuring accessibility. This widespread reach solidifies its position as a cash cow.

- 6,400 stores in the U.S.

- Presence in all 50 states

- Convenient customer access

- Strong market capture

Strong Brand Recognition

AutoZone's strong brand recognition is a key factor in its success, making it a cash cow. The brand is highly trusted by consumers, driving consistent customer traffic and sales. This recognition supports robust financial performance, as seen in its leading position. AutoZone holds the top spot in automotive aftermarket parts retail.

- AutoZone's revenue in fiscal year 2024 was $17.7 billion.

- The company operates over 7,000 stores.

- AutoZone's market capitalization exceeds $60 billion.

- Customer satisfaction scores consistently rank high.

AutoZone's DIY segment, a cash cow, fuels revenue with over $17.7B in 2024 sales. Duralast private-label products also act as cash cows, boosting margins. Loan-A-Tool and a vast store network drive traffic.

| Feature | Details | Impact |

|---|---|---|

| Revenue (2024) | $17.7 Billion | Strong financial foundation |

| Store Count | Approx. 7,000 stores | Wide market reach |

| Market Cap | >$60 Billion | High investor confidence |

Dogs

Non-automotive products at AutoZone might be dogs in the BCG matrix. They likely have low growth and market share compared to auto parts. These items may not significantly boost profits. In 2024, AutoZone's net sales were over $17.7 billion, primarily from automotive parts, suggesting non-automotive sales are less impactful.

Some auto accessories with slow growth and low market share fit the "dog" category. Demand is often lower for non-essential items. Discretionary merchandise sales faced challenges. AutoZone's Q1 2024 sales rose, but certain categories might still struggle. Accessories' performance can vary.

Certain areas where AutoZone's presence is small or competition is fierce are considered dogs. Sales and profits may be lower in these regions versus core markets. AutoZone's revenue heavily relies on auto repair, creating potential risk. For example, in 2024, AutoZone's expansion in new regions showed varied success.

Outdated or Obsolete Inventory

Outdated or obsolete inventory at AutoZone, like slow-moving parts, lands in the "Dogs" category of the BCG matrix. These items drain resources and capital, offering minimal returns. Effective inventory management becomes vital to lessen the negative effects of these obsolete items. In 2024, AutoZone's inventory turnover rate was approximately 2.5 times, highlighting the need for careful inventory control.

- AutoZone's inventory turnover was roughly 2.5 times in 2024.

- Obsolete items tie up capital.

- Inefficient inventory management can hurt profits.

- "Dogs" generate minimal returns.

Products Heavily Impacted by EV Transition

As the automotive industry transitions to EVs, some AutoZone products face potential decline. Items like spark plugs and exhaust systems could become "dogs." AutoZone is adjusting its inventory to include EV parts. The company aims to offset the risk of decreased demand in traditional areas.

- EV sales are projected to reach 30% of new car sales by 2025.

- AutoZone's revenue in 2024 was $17.7 billion.

- The company is investing in EV-related parts to adapt.

- Internal combustion engine parts sales may decrease.

Products with low market share and growth at AutoZone fit the "Dogs" category. These items drain resources and offer poor returns. In 2024, AutoZone's inventory turnover was around 2.5, showing the need for efficiency.

| Category | Description | Impact |

|---|---|---|

| Inventory | Slow-moving parts | Minimal Returns |

| Market Share | Low compared to core auto parts | Negative |

| Financials | Inventory turnover 2.5 times in 2024 | Inefficiency |

Question Marks

Electric vehicle (EV) parts and services represent a question mark for AutoZone within its BCG Matrix. Demand for EV-specific parts is growing, but market share remains uncertain. AutoZone stocks EV replacement parts, tools, and charging accessories. The EV parts market could reach $35 billion by 2030.

Expanding advanced diagnostic services places AutoZone in the question mark quadrant of the BCG matrix. Demand is rising due to vehicle complexity, but investments in training and equipment are necessary. AutoZone's revenue in 2024 was around $17.5 billion, reflecting a market need. Capturing this market share requires strategic resource allocation.

Expanding into new international markets represents a question mark for AutoZone, particularly beyond its existing presence in Mexico and Brazil. The company faces uncertainties in new markets. Despite the U.S. dominance, international growth offers significant potential. In 2023, AutoZone's international sales were a fraction of its $17.5 billion total revenue, indicating room for expansion.

Partnerships with Technology Companies

Partnerships with tech companies represent a question mark for AutoZone. These collaborations aim to innovate vehicle maintenance solutions, but success hinges on technology integration and customer adoption. AutoZone's recent ventures highlight the increasing importance of tech partnerships. The company's investment in e-commerce and digital tools shows this commitment.

- AutoZone's digital sales grew significantly in 2024, reflecting the importance of tech.

- Partnerships could enhance diagnostics and repair services.

- Investments in tech totaled $200 million in 2024.

- Customer acceptance of new tech is key to success.

Subscription-Based Services

Introducing subscription-based services at AutoZone represents a "Question Mark" in the BCG Matrix. The demand for these services, such as vehicle maintenance or diagnostics, is currently uncertain. AutoZone needs to craft a strong value proposition to draw in subscribers, potentially enhancing customer loyalty and sales. This approach aligns with AutoZone's customer-focused strategy for growth.

- Uncertainty in demand for subscription services.

- Need for a compelling value proposition to attract subscribers.

- Potential to boost customer loyalty and sales.

- Alignment with AutoZone's customer-centric growth strategy.

AutoZone faces uncertainties in subscription services, classified as a "Question Mark" in its BCG Matrix. These services, targeting vehicle maintenance or diagnostics, require a strong value proposition to attract subscribers. Success could boost customer loyalty and sales, aligning with AutoZone's customer-centric growth plan.

| Aspect | Details | Implication |

|---|---|---|

| Demand Uncertainty | Subscription service demand fluctuates. | Requires market validation. |

| Value Proposition | Needs a strong, clear offer. | Attracts and retains subscribers. |

| Strategic Alignment | Fits customer-focused strategy. | Potential for growth. |

BCG Matrix Data Sources

The AutoZone BCG Matrix utilizes financial statements, sales data, market reports, and industry analysis for its foundation. This provides robust positioning within each strategic quadrant.