AutoZone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoZone Bundle

What is included in the product

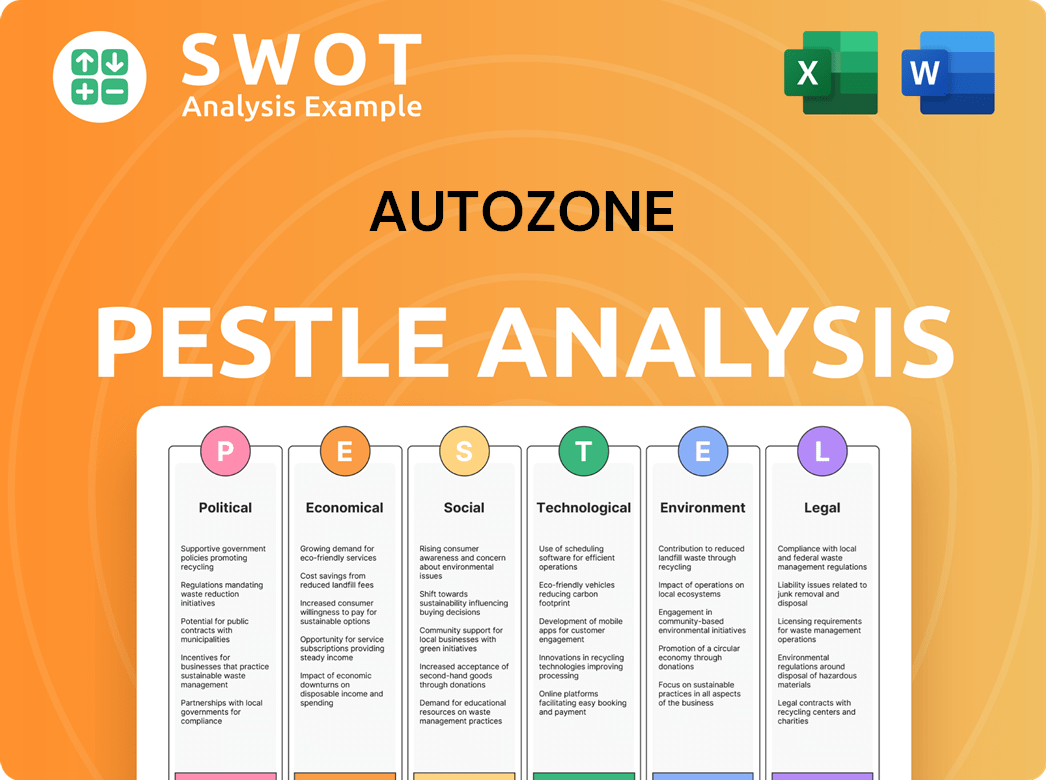

Examines how external factors impact AutoZone across six areas: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

AutoZone PESTLE Analysis

This is the actual AutoZone PESTLE Analysis you'll receive! What you see is what you get, ready to download and utilize instantly.

PESTLE Analysis Template

Navigate AutoZone's complex market with our PESTLE Analysis. Uncover political, economic, social, technological, legal, and environmental influences on their business. This analysis provides vital insights for strategic planning and decision-making. Understand potential risks and opportunities affecting AutoZone's performance. Don't miss crucial market intelligence. Get the complete analysis now!

Political factors

Government regulations significantly shape AutoZone's operations. Changes in vehicle safety standards and emissions rules, like the EPA's stricter 2027 standards, affect the parts they must stock. Import/export policies, crucial for supply chains, are impacted by political shifts. Political stability in regions like Mexico, where AutoZone has a strong presence, influences business strategies. For example, in 2024, AutoZone's sales in Mexico reached $1.2 billion, highlighting the importance of stable political environments.

AutoZone's profitability is significantly impacted by trade policies. Tariffs and trade agreements, particularly with Mexico and Brazil, affect the cost of imported auto parts. For example, in 2024, the US-Mexico-Canada Agreement (USMCA) continues to shape trade dynamics, potentially influencing AutoZone's supply chain costs. Changes in these policies could lead to higher expenses and impact pricing, making it essential for AutoZone to adapt its strategies.

Political stability in the U.S., Mexico, and Brazil is crucial for AutoZone. Changes in government or civil unrest can disrupt supply chains and affect consumer behavior. For example, political uncertainty in Brazil in 2024 led to economic fluctuations. AutoZone needs to actively manage these geopolitical risks to maintain operations. In 2024, AutoZone's international sales were about 17% of total sales, underscoring the importance of monitoring these markets.

Vehicle Standards and Inspections

Government regulations on vehicle standards and inspections significantly influence AutoZone's business. These mandates, covering maintenance, inspections, and specific parts like catalytic converters, drive demand for AutoZone's products and services. For instance, the U.S. Environmental Protection Agency (EPA) sets standards for vehicle emissions, impacting the types of parts needed. Compliance with evolving vehicle regulations is crucial for AutoZone to adapt and thrive.

- EPA regulations directly affect the sale of emissions-related parts.

- State-level inspection requirements vary, creating diverse market needs.

- Changes in vehicle technology necessitate adjustments in parts inventory.

Lobbying and Industry Advocacy

Political lobbying significantly impacts AutoZone. Automotive industry groups, including retailers, influence legislation on vehicle maintenance and consumer rights. AutoZone likely engages in advocacy to support the aftermarket parts industry. This helps navigate potential regulatory challenges. In 2024, the automotive aftermarket is projected to reach $499.6 billion.

- AutoZone's lobbying spending in 2023: approximately $1 million.

- The Motor Equipment & Manufacturers Association (MEMA) is a key lobbying group.

- Focus areas include vehicle data access and emissions standards.

- These efforts aim to protect the aftermarket parts business.

Political factors significantly influence AutoZone's operations and profitability. Government regulations impact the products AutoZone stocks and its supply chain. In 2024, AutoZone’s sales in Mexico were $1.2B. Lobbying efforts by the company also play a key role.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Regulations | Shape product offerings, e.g., emissions parts. | EPA standards influence part sales. |

| Trade | Affects cost of imported auto parts. | USMCA affects supply chain costs. |

| Stability | Impacts supply chains and consumer behavior. | Brazil's political uncertainty in 2024 caused economic fluctuations. |

Economic factors

Consumer spending on car maintenance hinges on disposable income and economic confidence. In economic downturns, people may delay repairs, affecting AutoZone's sales. A robust economy usually boosts spending on vehicle upkeep. In Q1 2024, U.S. real disposable income rose by 2.2%, potentially increasing AutoZone's sales.

Fluctuating fuel costs significantly influence consumer driving behaviors, directly impacting vehicle maintenance patterns. In 2024, rising fuel prices may lead to decreased mileage, reducing demand for routine maintenance like oil changes. Conversely, elevated fuel prices can extend the lifespan of existing vehicles, boosting demand for repair parts. According to the U.S. Energy Information Administration, gasoline prices in early 2024 showed volatility, affecting consumer spending habits.

Interest rates significantly influence AutoZone. Higher rates increase consumer financing costs for repairs, potentially reducing demand. AutoZone's borrowing costs for inventory and expansion also rise. For example, the Federal Reserve's rate hikes in 2023-2024 directly impacted financing terms. Credit availability is crucial for managing working capital and future growth, too.

Inflation and Cost of Goods

Inflation significantly influences AutoZone's cost of goods sold, affecting parts, labor, and shipping. Increased costs can squeeze profit margins if not offset by higher prices for consumers. To combat this, AutoZone must carefully manage inventory and pricing. In 2024, the U.S. inflation rate was around 3.1%, impacting operational expenses.

- Impact on inventory costs.

- Pressure on profit margins.

- Necessity of strategic pricing.

- Importance of supply chain management.

Unemployment Rates and Economic Growth

Unemployment rates significantly influence AutoZone's performance. High unemployment often curtails consumer spending, reducing demand for auto parts. Conversely, robust economic growth and low unemployment boost vehicle usage and maintenance spending. The economic climate directly impacts AutoZone's sales and profitability.

- In March 2024, the U.S. unemployment rate was 3.8%.

- Strong economic growth typically correlates with increased miles driven.

- Consumer confidence is a key indicator tied to spending.

Economic conditions profoundly shape AutoZone’s performance, including consumer spending habits and business expenses. Key factors include disposable income, inflation, unemployment, and interest rates. These variables influence demand for auto parts and the company’s operating costs. Managing these economic shifts is crucial for AutoZone's profitability and market positioning.

| Economic Factor | Impact on AutoZone | 2024-2025 Data/Forecast |

|---|---|---|

| Real Disposable Income | Influences consumer spending | Q1 2024: +2.2% increase in U.S. |

| Inflation Rate | Affects COGS and pricing | 2024 U.S. rate: approx. 3.1% |

| Unemployment Rate | Impacts demand and spending | March 2024 U.S.: 3.8% |

| Interest Rates | Influences financing costs | Federal Reserve rate hikes impacted terms. |

Sociological factors

Vehicle ownership rates are shifting, influenced by economic conditions and lifestyle changes. The average age of vehicles on the road continues to increase, with the average vehicle age in the U.S. estimated to be 12.5 years in 2024, up from 12.2 years in 2022. Remote work and evolving driving patterns are also changing demand. AutoZone must adapt its inventory to meet these evolving consumer needs effectively.

The DIY versus DIFM dynamic significantly shapes AutoZone's business. In 2024, around 60% of vehicle maintenance was still handled by professionals. AutoZone's Loan-A-Tool program supports DIYers. Marketing and product mix must adapt to changing consumer preferences. Data from 2025 will highlight how these trends evolve.

Consumer preferences are always changing, affecting what AutoZone sells. There's more interest in customizing cars, boosting performance, and adding accessories. Trends like outdoor activities drive demand for vehicle modifications. AutoZone needs to adapt to these shifts. In 2024, the auto parts market is valued at around $450 billion, with customization and performance upgrades seeing significant growth.

Awareness of Vehicle Maintenance

Public awareness of vehicle maintenance significantly impacts AutoZone's preventative repair business. Educational campaigns can boost consumer interest in regular upkeep. AutoZone's offerings cater to diverse maintenance knowledge levels. In 2024, the average vehicle age in the U.S. was over 12 years, indicating a need for maintenance.

- Preventative maintenance awareness drives sales of parts and services.

- Marketing efforts can increase customer visits for check-ups.

- AutoZone provides resources for all maintenance skill levels.

Demographic Shifts

Demographic shifts significantly influence AutoZone's market. An aging population often means more older cars, boosting repair part demand. Younger generations may prefer different vehicle types or maintenance. AutoZone must adapt its strategies.

- The U.S. population aged 65+ is projected to reach 82.1 million by 2050.

- Millennials and Gen Z are increasingly focused on vehicle customization and tech.

- Income levels affect spending on vehicle maintenance and upgrades.

Changes in vehicle ownership rates impact AutoZone's business model. DIY versus professional repair choices, influenced by skill and cost, shift demand. Customer preferences for customization and performance enhancements drive sales.

| Aspect | Details | Impact |

|---|---|---|

| Vehicle Age | U.S. average age: 12.5 years (2024). | Increased demand for repair parts. |

| DIY vs. DIFM | 60% of maintenance done by pros in 2024. | Guides inventory and marketing strategies. |

| Market Size | Auto parts market valued ~$450B in 2024. | Indicates growth opportunities in modifications. |

Technological factors

AutoZone faces challenges from vehicle technology evolution. Modern vehicles' complexity, with advanced electronics, sensors, and electric powertrains, necessitates inventory and training adaptations. In 2024, electric vehicle (EV) sales are projected to reach 10% of the market, driving demand for specialized parts and diagnostic tools. AutoZone must stock these parts and train employees. Rapid advancements require continuous adaptation, impacting operational costs.

E-commerce is essential for AutoZone's growth. Online sales are growing, with 15% of retail sales online in 2024. A strong digital presence, including apps, boosts customer engagement. AutoZone's online sales increased by 10% in 2024. Integrating online and in-store experiences is crucial for success.

Technological advancements in diagnostic tools are key for AutoZone to support customers and mechanics. Offering advanced diagnostic testers boosts AutoZone's value. Investing in current tech ensures accurate problem identification. AutoZone's tech investments totaled $100.8 million in Q1 2024. This includes diagnostic equipment and information systems.

Supply Chain Technology

Supply chain technology is vital for AutoZone, ensuring parts are available efficiently. Advanced systems like inventory tracking and logistics optimization minimize costs. Warehouse automation further enhances efficiency, a key competitive advantage. AutoZone's supply chain investments support its same-store sales growth. In Q1 2024, AutoZone reported a 4.7% increase in same-store sales.

- Inventory management systems reduce stockouts, improving customer satisfaction.

- Logistics optimization speeds up delivery times, supporting quick service.

- Warehouse automation increases order fulfillment speed and accuracy.

- Efficient supply chains lower operational costs.

Data Analytics and AI

AutoZone can utilize data analytics and AI to gain insights into customer behavior and market trends. In 2024, the global AI in retail market was valued at $5.6 billion and is expected to reach $22.8 billion by 2029. This technology helps optimize inventory, personalize marketing, and improve operational efficiency. AI can enhance demand forecasting and customer service.

- AI-driven demand forecasting can reduce inventory costs by up to 15%.

- Personalized marketing can boost sales by 10-20%.

- Data analytics can identify new market opportunities.

- AI-powered chatbots can improve customer satisfaction scores.

Technological factors significantly impact AutoZone's operations, driving the need for adaptation. E-commerce is vital, with online sales up 10% in 2024. Investment in diagnostics and supply chain tech is crucial. AutoZone's tech investments in Q1 2024 were $100.8M. Data analytics, fueled by the AI in retail market ($5.6B in 2024) offer valuable insights.

| Factor | Impact | 2024 Data |

|---|---|---|

| EV Adoption | Demand for specialized parts & tools | EV sales: 10% of market (projected) |

| E-commerce | Customer Engagement and Sales | Online sales increased 10% |

| Diagnostic Tools | Accurate Problem Identification | Tech investment: $100.8M (Q1 2024) |

Legal factors

Consumer protection laws are vital for AutoZone, governing product safety, warranties, and customer rights. AutoZone must comply with regulations on product quality and disclosure. The company's customer service is crucial, with 2024 data showing a 90% customer satisfaction rate. Adhering to these standards is critical across all operating regions.

AutoZone must adhere to employment laws, including minimum wage and working hours. Workplace safety regulations are crucial for employee well-being. Employee benefits also influence labor costs and HR. In 2024, the U.S. minimum wage averaged $7.25, impacting operational costs.

Environmental regulations significantly influence AutoZone's operations. Laws governing hazardous material handling, like used oil and batteries, are crucial. AutoZone must comply with waste management and pollution control regulations. Compliance ensures responsible practices. In 2024, the EPA increased enforcement actions by 15% for environmental violations.

Import and Export Regulations

Import and export regulations significantly impact AutoZone's global operations, especially in the U.S., Mexico, and Brazil. These legal frameworks dictate how automotive parts are sourced and distributed internationally. Compliance with customs procedures, tariffs, and trade restrictions is crucial for smooth operations. For example, in 2024, U.S. imports of auto parts from Mexico totaled over $28 billion. Navigating these regulations is essential for AutoZone's international success.

- U.S. auto parts imports from Mexico in 2024 exceeded $28 billion.

- Brazil's import tariffs can significantly affect the cost of imported auto parts.

- AutoZone must comply with NAFTA/USMCA trade agreements.

Business Licensing and Zoning Laws

AutoZone's operations hinge on strict adherence to business licensing and zoning laws across various jurisdictions. These regulations govern where AutoZone can establish its stores and distribution centers, ensuring compliance with local land use policies. The company must secure the necessary permits and approvals to operate legally, which is an ongoing process. Non-compliance could lead to hefty fines or even store closures, impacting AutoZone's financial performance. For example, in 2024, AutoZone spent approximately $1.2 billion on capital expenditures, a portion of which was allocated to ensure regulatory compliance.

- Compliance with zoning laws is critical for site selection and expansion.

- AutoZone must navigate diverse regulations across states and municipalities.

- Permitting processes can be time-consuming and costly.

- Failure to comply can result in significant financial penalties.

Legal factors like consumer protection are vital for AutoZone's customer satisfaction and product safety. Employment laws, including minimum wage regulations, influence AutoZone's operational costs; the average US minimum wage in 2024 was $7.25. Environmental regulations, covering hazardous material handling, and waste management are also critical for compliance.

International trade compliance significantly affects sourcing and distribution; for example, in 2024, US auto parts imports from Mexico totaled over $28 billion. Business licensing and zoning laws across jurisdictions affect where AutoZone can operate; the company spent approximately $1.2 billion on capital expenditures in 2024 for compliance. Strict adherence is essential to avoid financial penalties.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Consumer Protection | Product safety, customer rights | 90% Customer Satisfaction Rate |

| Employment Laws | Minimum wage, working hours | US Avg. Min Wage: $7.25 |

| Environmental Regulations | Hazardous materials, waste management | EPA enforcement actions up 15% |

| Import/Export | Trade restrictions, tariffs | US auto parts imports from Mexico: >$28B |

| Business Licensing/Zoning | Store locations, permits | Capital Expenditures $1.2B |

Environmental factors

The automotive aftermarket industry, including AutoZone, faces environmental scrutiny due to waste generation from used parts and fluids. AutoZone must comply with regulations for waste disposal, recycling (e.g., batteries), and hazardous materials handling. In 2024, the global waste management market was valued at $2.2 trillion. Effective waste management, including recycling, is critical for sustainability and cost management.

AutoZone's energy use across stores, distribution, and transport impacts its footprint. Upgrades to lighting, HVAC, and fuel-efficient vehicles boost efficiency. In 2024, AutoZone invested $100 million in energy-saving initiatives. Reducing energy use remains a key focus for the company.

Climate change, with extreme weather events, poses risks. Supply chains, store ops, and driving patterns are affected. AutoZone needs climate-resilient infrastructure and logistics. Regional climate vulnerabilities are key. In 2023, extreme weather caused $92.9 billion in damages in the US.

Packaging and Material Usage

AutoZone must address the environmental footprint of its packaging and the materials used in its products. Consumers are pushing for sustainable packaging, and regulators are tightening environmental standards. In 2024, the global market for green packaging is valued at over $260 billion, reflecting this trend. AutoZone can reduce waste and offer eco-friendly alternatives.

- The global green packaging market was estimated at $260 billion in 2024.

- Consumers increasingly prefer sustainable products.

- Regulatory pressure is growing for eco-friendly materials.

- AutoZone can explore reducing packaging.

Vehicle Emissions and Environmental Standards

AutoZone must consider vehicle emission standards, as they affect the parts customers need. Stricter standards increase demand for emission-related components like catalytic converters. The global catalytic converter market was valued at $28.2 billion in 2023. AutoZone supports vehicle maintenance to meet these regulations. In 2024, there's a growing emphasis on environmental sustainability in the automotive sector.

- Catalytic converter sales are expected to rise by 5-7% annually through 2025.

- The US EPA sets emission standards, which vary by state and vehicle type.

- Electric vehicle (EV) adoption influences the demand for internal combustion engine (ICE) parts.

AutoZone confronts environmental issues like waste from parts, requiring compliance and recycling efforts. Energy efficiency via upgrades is a key focus, reflected in a $100 million investment in 2024. Climate change presents risks through extreme weather impacting supply chains. In 2023, extreme weather damage totaled $92.9B in the US. Packaging, emissions standards, and consumer preference for sustainable products create new opportunities and pressures.

| Environmental Factor | Impact on AutoZone | Data Point (2024/2025) |

|---|---|---|

| Waste Management | Compliance & Cost | $2.2T global waste management market (2024) |

| Energy Use | Operational Efficiency | $100M invested in energy-saving in 2024 |

| Climate Change | Supply Chain Risks | $92.9B in US weather damage (2023) |

PESTLE Analysis Data Sources

This PESTLE Analysis utilizes financial reports, regulatory databases, consumer behavior studies, and industry-specific publications.