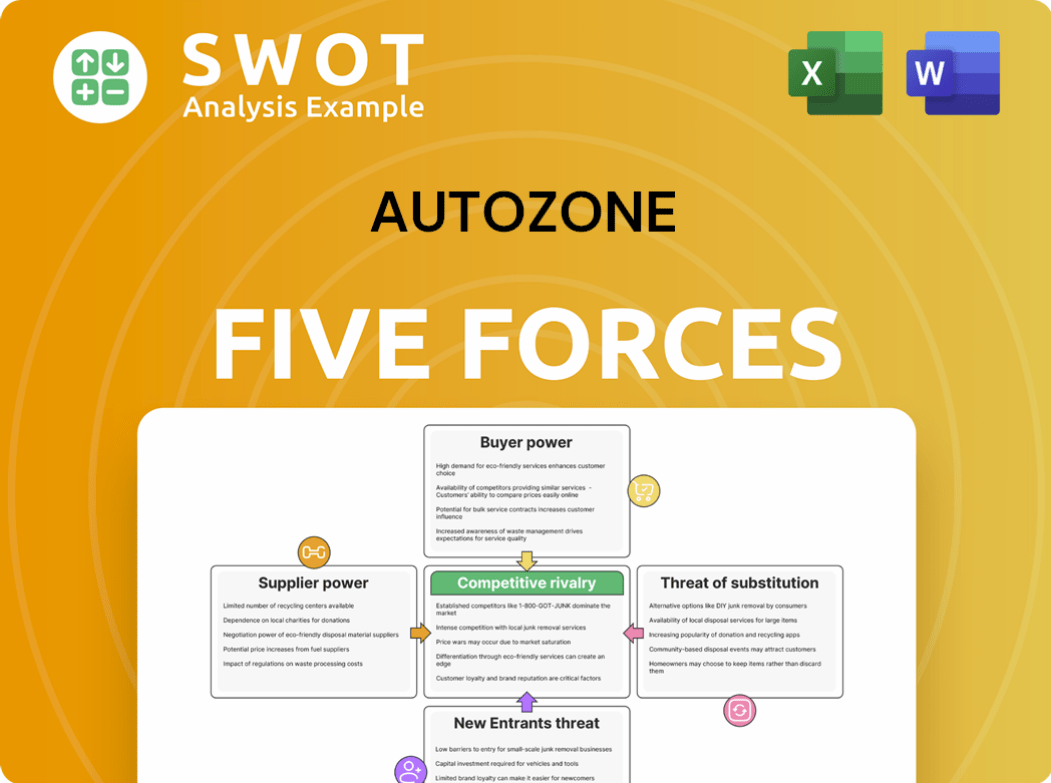

AutoZone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoZone Bundle

What is included in the product

Tailored exclusively for AutoZone, analyzing its position within its competitive landscape.

Instantly visualize competitive dynamics, offering a quick overview of potential threats and opportunities.

Preview Before You Purchase

AutoZone Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for AutoZone. The document covers all forces impacting the business, detailing competitive rivalry, supplier power, buyer power, threat of substitutes, and the threat of new entrants. The analysis is professionally written, offering actionable insights. You're previewing the final version—precisely the same document that will be available to you instantly after buying.

Porter's Five Forces Analysis Template

AutoZone operates in a competitive automotive parts market. The threat of new entrants is moderate due to established brands and capital requirements. Bargaining power of suppliers is significant, with consolidation impacting pricing. Buyer power is considerable, driven by consumer choice and online options. Substitute products, like used parts, pose a limited threat. Rivalry among existing competitors, including major chains, is intense.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AutoZone’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The automotive parts sector sees supplier concentration, with a few specialized manufacturers holding significant power. The top five manufacturers control roughly 40% of the market. This concentration enables suppliers to potentially increase prices, impacting AutoZone's profitability. Such dependency on key suppliers presents a risk in the competitive landscape.

Switching suppliers is challenging for AutoZone due to the need for consistent quality and part compatibility. Stable relationships with key manufacturers are crucial to mitigate supplier power. AutoZone's strong ties lead to better pricing and terms, reducing supplier influence. In 2024, AutoZone's cost of revenue was approximately $12.7 billion, underscoring the importance of managing supplier costs effectively.

Supplier bargaining power is shaped by raw material costs, which can vary due to economic and geopolitical events. AutoZone is unlikely to face significant tariff risks. The company will likely pass on cost increases to customers, as it has done historically. In 2024, AutoZone's gross profit margin was around 53%, demonstrating its ability to manage costs.

Aftermarket Parts Availability

Suppliers of aftermarket parts significantly influence the automotive industry, offering alternatives often priced lower than Original Equipment Manufacturer (OEM) components. This dynamic affects businesses, such as AutoZone, by providing consumers and repair shops with cost-effective choices. The aftermarket parts market's substantial size and growth trajectory highlight this influence.

- The global aftermarket parts market was valued at $222 billion in 2020.

- It's projected to grow at a CAGR of 4.7% through 2028.

- This growth amplifies the threat to businesses focused on OEM parts.

E-commerce Impact

E-commerce platforms pressure suppliers to lower prices to stay competitive, squeezing margins. Automotive parts retail had roughly 20% profit margins in 2022, showcasing the impact of price wars. E-commerce platforms can switch suppliers for better deals, increasing their leverage.

- Suppliers face margin pressure to serve e-commerce.

- 20% profit margins in 2022 highlight price competition.

- E-commerce platforms can switch suppliers.

AutoZone faces supplier power from concentrated manufacturers. Switching suppliers is hard due to quality needs, affecting costs. Raw material costs and e-commerce competition impact margins. In 2024, AutoZone's gross profit margin was about 53%.

| Aspect | Impact on AutoZone | Data/Facts (2024) |

|---|---|---|

| Supplier Concentration | Higher prices, reduced profitability | Top 5 manufacturers control ~40% of the market. |

| Switching Costs | Requires stable relationships | Cost of revenue: $12.7 billion. |

| Raw Material Costs | Affects pricing | Gross profit margin ~53% |

| E-commerce | Margin pressure | Aftermarket parts market CAGR 4.7% through 2028. |

Customers Bargaining Power

AutoZone caters to DIY and DIFM customers, each with different bargaining power. DIY customers are price-sensitive, increasing their bargaining power due to choices. DIFM clients, like repair shops, prioritize reliability and speed, lessening their bargaining power. In 2024, AutoZone's sales were approximately $17.7 billion. This financial data indicates the significance of understanding customer segments.

Customers' price sensitivity significantly impacts AutoZone, particularly in the DIY market, where switching costs are low. Consumers can readily opt for competitors or substitutes if prices are unfavorable. AutoZone faces tough price competition from online retailers like Amazon and Carparts.com. In 2024, AutoZone's gross profit margin was around 53%, while online competitors may have more flexibility. Due to its extensive store network, AutoZone's prices often exceed online rivals.

Customers wield considerable power due to the wide availability of alternatives. Auto parts shoppers can choose from numerous brick-and-mortar stores and online retailers. Walmart's expansion into auto parts significantly heightens competition. In 2024, Walmart's auto parts sales reached $8 billion, challenging AutoZone's market share. This makes it easier for customers to switch.

Customer Loyalty Programs

AutoZone's customer loyalty programs significantly diminish buyer power by boosting switching costs and cultivating brand loyalty. The company's value proposition emphasizes convenience, knowledgeable staff, and superior service. This focus on service, alongside a wide product selection, gives AutoZone a competitive edge in the market. These elements make it harder for customers to switch to competitors.

- AutoZone reported a customer loyalty program participation of over 25 million members in 2024.

- The company's same-store sales growth in 2024 was approximately 5%, showing the effectiveness of customer retention strategies.

- AutoZone's customer satisfaction scores, as measured by Net Promoter Score (NPS), consistently rank above industry averages, indicating strong customer loyalty.

- AutoZone's high inventory turnover rate, compared to competitors, shows efficiency in meeting customer needs and reducing buyer power.

Impact of Economic Conditions

Economic conditions significantly influence customer bargaining power in the automotive parts market. Downturns heighten price sensitivity, causing consumers to delay maintenance. AutoZone faces this challenge, as economic uncertainty affects sales. In 2024, the automotive aftermarket saw fluctuations due to economic pressures.

- Consumers become more price-conscious during economic downturns, impacting demand.

- Rising prices and cautious spending affect AutoZone's sales, as reported in recent financial statements.

- Economic uncertainty leads to reduced spending on non-essential automotive parts.

- In 2024, the automotive aftermarket's performance varied due to economic factors.

Customer bargaining power varies between DIY and DIFM segments for AutoZone. DIY customers' price sensitivity and readily available alternatives enhance their power. However, AutoZone's loyalty programs and focus on service counter this. Economic conditions also impact buyer power.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High in DIY segment | Gross profit margin ~53% |

| Alternatives | Numerous brick-and-mortar, online | Walmart's auto parts sales ~$8B |

| Loyalty | Reduces buyer power | Loyalty program participation: 25M+ |

Rivalry Among Competitors

The automotive aftermarket is incredibly fragmented, increasing competition. AutoZone competes with numerous rivals for market share. The commercial auto parts sector is even more spread out, with AutoZone only controlling about 5% of the $90-$100 billion market. The top four companies together hold approximately 30% of the market.

AutoZone contends with rivals like O'Reilly, Advance Auto Parts, and NAPA. These competitors battle fiercely for market share. The automotive industry faces significant shifts. Electric vehicles and evolving technologies challenge traditional auto part retailers. In 2024, O'Reilly's revenue reached $16.2 billion, showing the scale of competition.

Online competition has intensified due to e-commerce, with Amazon and RockAuto offering competitive pricing and convenience. Online retailers attract customers through competitive pricing, broader product choices, and user-friendly shopping experiences. The trend includes virtual try-ons and AI-driven customization. In 2024, online auto parts sales grew, with Amazon's automotive revenue reaching over $10 billion.

Growth Strategies

Auto parts retailers are enhancing product quality and delivery to stay competitive, potentially impacting AutoZone. O’Reilly Automotive expects a slight decrease in operating margins, and Genuine Parts Company anticipates modest gross margin expansion. These trends point to a competitive market that could pressure AutoZone's performance. The industry's volatility presents challenges, particularly with rivals actively pursuing strategic initiatives.

- O’Reilly Automotive's operating margins are under pressure, signaling increased competition.

- Genuine Parts Company aims for gross margin expansion, suggesting strategic moves to gain market share.

- The auto parts market is volatile, creating uncertainty for AutoZone's future.

Market Consolidation

Market consolidation presents both prospects and obstacles for AutoZone. The exit of Advance Auto Parts from specific markets, like the five West Coast markets, opens doors for AutoZone to expand its market share. This strategic shift can strengthen AutoZone's competitive position. However, the company must contend with increased competition from Walmart.

- Advance Auto Parts exited five West Coast markets.

- Walmart is a major competitor in the DIY auto space.

Competition in the auto parts market is high, with many players vying for market share. AutoZone competes with rivals like O'Reilly, Advance Auto Parts, and NAPA, alongside online retailers such as Amazon.

The automotive aftermarket is also affected by market consolidation. The exit of Advance Auto Parts from some markets offers opportunities for AutoZone to expand. Walmart has a major competitive edge in the DIY auto space.

In 2024, O'Reilly's revenue was $16.2 billion, highlighting the scale of the competition. This industry volatility could pressure AutoZone's performance.

| Company | 2024 Revenue (Billions) |

|---|---|

| O'Reilly | $16.2 |

| Amazon (Auto) | $10+ |

| Market Share (Top 4) | ~30% |

SSubstitutes Threaten

The rise of public transportation presents a threat to AutoZone. Increased public transit use means fewer personal vehicle repairs. Ride-sharing services also grow the market, but aftermarket fraud challenges growth. In 2024, public transit ridership increased. However, the market growth is challenged by both factors.

The rise of do-it-yourself (DIY) options poses a threat to AutoZone. Online resources like repair guides and videos enable consumers to fix their vehicles themselves, potentially decreasing AutoZone's parts sales. AutoZone itself offers repair guides and videos, but the availability of free online content is a competitive factor. In 2024, the DIY auto repair market is estimated to reach $45 billion. AutoZone's e-commerce platform helps it compete, but DIY remains a consideration.

Used or refurbished automotive parts pose a threat to AutoZone. This is because they offer a cheaper alternative to new parts, attracting budget-conscious customers. The global automotive aftermarket, including used parts, was valued at $404 billion in 2022. It's projected to hit $700 billion by 2028. This growth indicates a rising acceptance of substitutes.

Electric Vehicles

The surge in electric vehicles (EVs) presents a substitution threat to AutoZone. EVs need less maintenance than gasoline cars, potentially decreasing demand for traditional auto parts. This shift could impact AutoZone's long-term revenue. EVs are mechanically simpler, affecting the aftermarket parts business. The future impact is still unfolding, but the trend is clear.

- EV sales in the US reached over 1.18 million units in 2023, up from about 807,000 in 2022.

- The global EV market is projected to reach $823.75 billion by 2030.

- The average maintenance cost for an EV is lower than for a gasoline car.

- AutoZone's revenue in 2023 was approximately $17.5 billion.

Longer-Lasting Parts

Advancements in automotive technology are producing more durable, longer-lasting parts, which directly affects the demand for aftermarket components. This trend potentially reduces the frequency with which consumers need to replace parts, thus affecting AutoZone's sales. Companies that offer faster maintenance services can extend the life of vehicles, which could also impact the market dynamics. This could help the company financially.

- The global automotive aftermarket is projected to reach $499.8 billion by 2024.

- The average age of light vehicles in operation in the U.S. is around 12.5 years in 2024.

- Electric vehicles (EVs) have fewer moving parts, potentially decreasing the need for aftermarket parts.

- AutoZone's revenue for fiscal year 2023 was $17.5 billion.

Several factors threaten AutoZone through substitution. Public transportation and ride-sharing reduce the need for personal vehicle maintenance. DIY auto repair and used parts offer cheaper alternatives, and EVs require less servicing than gasoline cars. This shift could impact the company's future revenues.

| Threat | Description | Impact on AutoZone |

|---|---|---|

| Public Transportation/Ride-sharing | Increased use of public transit and ride-sharing services. | Reduced need for vehicle repairs, lower demand for parts. |

| DIY Repair | Consumers fix vehicles themselves using online resources. | Decreased sales of parts. |

| Used/Refurbished Parts | Cheaper alternatives to new parts. | Attract budget-conscious customers, lowering the sales. |

| Electric Vehicles (EVs) | EVs require less maintenance compared to gas vehicles. | Potential decrease in demand for traditional auto parts. |

Entrants Threaten

High capital requirements are a significant threat to new entrants in the automotive parts retail sector. AutoZone's extensive inventory, including a $4.3 billion investment in 2023, presents a considerable financial hurdle. Building a robust distribution network and establishing physical store locations also demand substantial capital. These costs make it challenging for new businesses to compete.

AutoZone's strong brand loyalty, built through effective marketing, presents a significant barrier. The company's marketing strategies have successfully highlighted its brand, creating a competitive advantage. With marketing evolving rapidly, AutoZone must adapt to maintain its lead, especially with competitors like Advance Auto Parts and O'Reilly Automotive. In 2024, AutoZone's net sales reached approximately $17.5 billion, showcasing its market strength.

AutoZone's established position benefits from economies of scale, especially in purchasing, distribution, and marketing, creating a barrier for new entrants. The top four auto parts retailers control roughly 45% of the market. AutoZone and O'Reilly have been able to increase their market share due to their economies of scale and improved service. The increasing average age of vehicles in the U.S., which was 12.5 years in 2023, fuels the demand for AutoZone's offerings.

Supply Chain Complexity

New entrants face supply chain hurdles in the automotive parts retail industry, a significant barrier. AutoZone combats these challenges, intensified by rising inflation and fuel costs, by enhancing distribution and inventory management. The company's initiatives include expanding distribution centers to boost product availability. These efforts aim to ensure a steady supply of parts.

- AutoZone's same-store sales grew by 4.5% in fiscal year 2024.

- AutoZone invested significantly in its supply chain, including distribution center expansions.

- Inflation and fuel costs continue to impact supply chain efficiency.

- Improved inventory deployment is a key focus for enhancing product availability.

Regulatory and Compliance Costs

The automotive industry's regulatory landscape presents significant hurdles for new entrants, increasing costs and complexity. Compliance with environmental standards, safety regulations, and consumer protection laws demands substantial investment. Regulatory changes, such as those impacting emissions or vehicle safety, can further raise the bar for newcomers. The rise of electric vehicles (EVs) and associated infrastructure creates additional challenges and opportunities.

- Compliance costs include emissions testing, safety certifications, and adherence to data privacy regulations.

- New entrants must navigate complex processes, including obtaining necessary permits and licenses.

- The shift towards EVs requires investment in charging infrastructure and battery technology.

- Failure to comply with regulations can result in significant fines and legal repercussions.

The threat of new entrants for AutoZone is moderate due to substantial barriers. High capital needs, like AutoZone's $4.3 billion inventory in 2023, make entry difficult. Brand loyalty and economies of scale, with the top four retailers controlling about 45% of the market, further deter new competitors.

| Barrier | Impact | Data |

|---|---|---|

| Capital | High investment required | AutoZone inventory: $4.3B (2023) |

| Brand | Customer loyalty | 2024 Net sales: ~$17.5B |

| Scale | Competitive advantage | Top 4 control ~45% market |

Porter's Five Forces Analysis Data Sources

AutoZone's Porter's Five Forces analysis utilizes company reports, financial databases, and industry research for a detailed assessment.