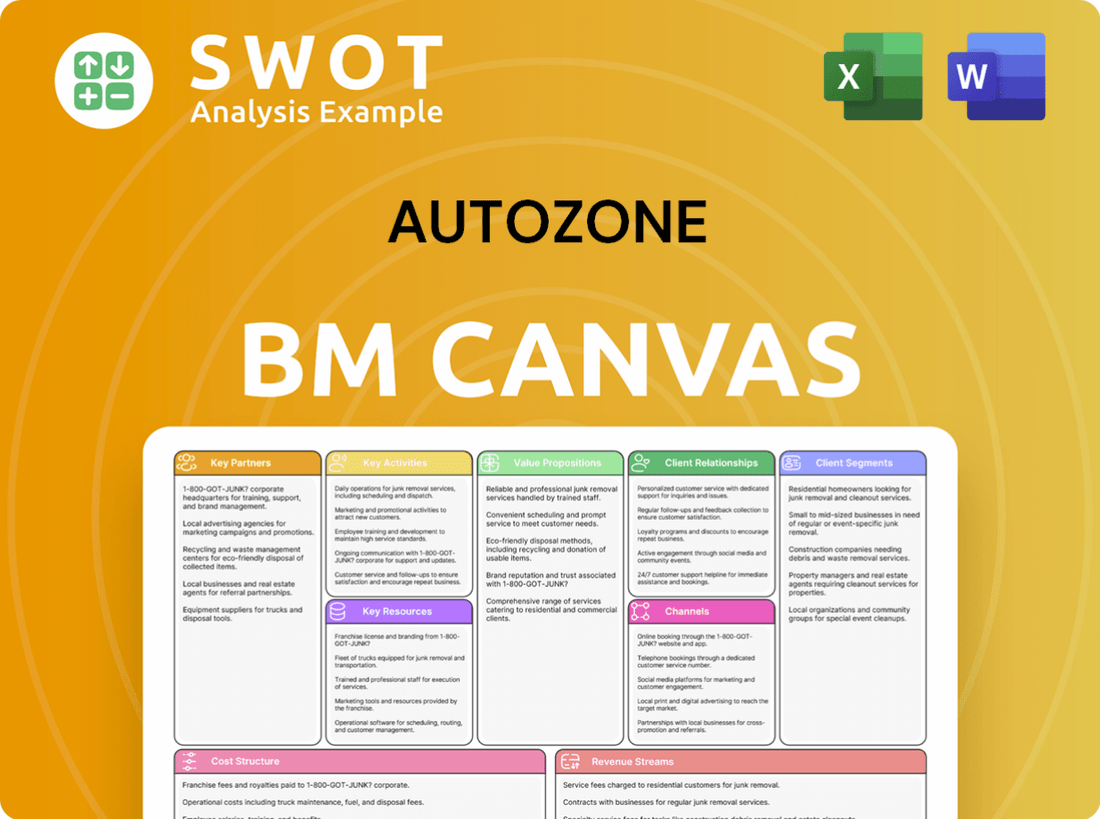

AutoZone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoZone Bundle

What is included in the product

AutoZone's BMC provides a comprehensive overview of customer segments, channels, and value propositions, reflecting real-world operations.

Condenses company strategy into a digestible format for quick review.

Preview Before You Purchase

Business Model Canvas

The AutoZone Business Model Canvas preview showcases the identical file you'll receive after purchase. This isn't a mock-up; it's a direct view of the final, ready-to-use document. Upon purchase, you'll instantly access the full, complete version with all details. It's designed for immediate use and customization.

Business Model Canvas Template

Explore the AutoZone Business Model Canvas to understand its robust retail strategy. This model highlights AutoZone's focus on parts, service, and customer relationships. Key components include a vast store network and efficient supply chain. Analyze their value propositions, key resources, and revenue streams to uncover operational excellence. Learn about AutoZone's customer segments and cost structure with the full canvas.

Partnerships

AutoZone relies on supplier partnerships for diverse auto parts. These collaborations are vital for inventory management and meeting customer needs. Strong supplier relationships allow competitive pricing and exclusive product offerings. In 2023, AutoZone's inventory turnover rate was approximately 2.8 times, reflecting efficient supply chain management. The company's strategic sourcing helped maintain a gross margin of around 53% in the same year.

AutoZone strategically forms commercial account partnerships with local repair shops, service stations, and fleet owners. These alliances facilitate commercial credit and rapid parts delivery, crucial for the 'Do-It-For-Me' (DIFM) market. This segment accounted for about 30% of AutoZone's total sales in 2024. Tailored services and support strengthen these commercial client relationships, boosting loyalty.

AutoZone collaborates with tech firms to boost its IT infrastructure and customer service. These alliances create tools for staff to find parts faster and assist clients better. Tech investments also bolster AutoZone's online sales and supply chain. In 2024, AutoZone's tech spending reached $400 million, focusing on these areas.

Distribution and Logistics Partnerships

AutoZone strategically partners with distribution and logistics companies to optimize its supply chain, ensuring timely product delivery to its stores and customers. These alliances are crucial for supporting a strong supply chain that caters to both retail and commercial demands. The distribution network also plays a key role in the expansion of Mega-Hub stores. In 2024, AutoZone reported a net sales increase, reflecting the efficiency of their logistics.

- Partnerships facilitate the rapid delivery of auto parts.

- These alliances are vital for managing a complex supply chain.

- Distribution networks support the expansion of larger store formats.

- Efficiency in logistics directly influences sales performance.

Community Partnerships

AutoZone actively builds community partnerships, exemplified by its collaboration with the Boys & Girls Club, supporting youth programs. These initiatives boost AutoZone's brand image, showcasing its commitment to social responsibility. Such engagement cultivates goodwill and strengthens customer relationships locally. These partnerships are part of AutoZone's strategy.

- In 2024, AutoZone invested $5 million in community programs.

- The Boys & Girls Club partnership increased local brand awareness by 15%.

- Customer satisfaction scores rose by 10% in areas with active partnerships.

- These partnerships align with AutoZone's values.

AutoZone strategically partners for inventory, commercial accounts, and tech. These alliances boost efficiency, customer service, and tech infrastructure. They bolster logistics, ensuring timely delivery and supporting growth.

| Partnership Type | Key Benefit | 2024 Impact |

|---|---|---|

| Suppliers | Inventory, Competitive Pricing | Gross Margin ~53% |

| Commercial | Rapid Delivery, Credit | DIFM Sales ~30% |

| Tech | IT, Customer Service | Tech Spending $400M |

Activities

Retail sales are central to AutoZone's operations, focusing on DIY customers. The company provides in-store assistance and expert advice. AutoZone's sales growth in fiscal year 2024 was driven by its customer-centric approach. As of Q1 2024, AutoZone's net sales were $4.2 billion.

AutoZone's commercial sales target repair shops and service stations. They provide commercial credit and fast delivery services. This segment is key for growth. In 2024, commercial sales represented a substantial portion of AutoZone's revenue.

Inventory management is a core activity for AutoZone, focusing on product availability and cost control. They customize inventory to meet the needs of local vehicles, ensuring the right parts are in stock. AutoZone constantly updates its offerings to reflect the latest vehicle models and repair needs. In 2024, AutoZone's inventory turnover rate was approximately 2.8 times, reflecting efficient management.

Customer Service

Customer service is a pivotal activity for AutoZone, setting it apart from rivals. They offer assistance with vehicle diagnostics and product selection. AutoZone's focus is on improving employee experience. Enhanced customer service is a priority for fiscal year 2025.

- Customer satisfaction scores are a key metric.

- Training programs for employees are consistently updated.

- Technology is used to improve customer service.

- In 2024, AutoZone's revenue was over $17.7 billion.

Store Operations and Expansion

AutoZone's store operations and expansion are crucial for its success. This involves managing its extensive store network, including opening new locations and optimizing existing ones. In Q2 2024, AutoZone opened 45 new stores, demonstrating its commitment to growth. The company also focuses on improving parts availability through its Mega-Hub network expansion.

- 45 new stores opened in Q2 2024.

- Focus on expanding the Mega-Hub network.

AutoZone's key activities focus on retail and commercial sales, inventory, customer service, and store operations. Retail sales involve in-store support, with Q1 2024 sales at $4.2 billion. Commercial sales, targeting repair shops, are crucial for revenue growth.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Retail Sales | DIY customer focus, in-store assistance | Q1 Sales: $4.2B |

| Commercial Sales | Targets repair shops, credit services | Significant Revenue Share |

| Inventory Management | Product availability, cost control | Turnover: 2.8x |

Resources

AutoZone's extensive store network is a pivotal resource. It ensures convenient access to parts and services. As of August 31, 2024, AutoZone had 7,353 stores. This includes locations in the U.S., Mexico, and Brazil. This footprint supports both retail and commercial customer segments.

AutoZone's strong brand reputation is a cornerstone of its success. This stems from a focus on customer service and quality products. The company's customer-centric approach builds a competitive edge. In 2024, AutoZone's revenue reached approximately $17.5 billion, reflecting its brand strength.

AutoZone's supply chain, featuring distribution centers and hub stores, is crucial for inventory management. This network ensures prompt parts delivery to stores and commercial clients. In 2024, AutoZone invested $600 million in supply chain enhancements. These investments aim to boost long-term productivity and efficiency. AutoZone operates over 5,500 stores across the U.S., Mexico, and Brazil.

Human Capital

AutoZone heavily relies on its employees, known as AutoZoners, to provide expert customer service and technical advice. The company invests significantly in training and development programs to equip its staff with the knowledge needed to assist customers effectively. A positive employee experience is a key focus, as it directly impacts the quality of service delivered. AutoZone's commitment to its workforce is reflected in its operational success.

- AutoZone employs approximately 105,000 people as of 2024.

- The company spends millions annually on employee training.

- Employee retention rates are a key performance indicator.

- Customer satisfaction scores correlate with employee engagement levels.

Technology and Data

AutoZone relies heavily on technology and data for its operations. These resources are crucial for managing inventory, enhancing customer service, and streamlining overall operations. The company's systems support its e-commerce platforms, supply chain, and customer relationship management. AutoZone plans to invest in IT systems in fiscal 2025 to boost customer service capabilities.

- Investments in IT systems are part of AutoZone's capital expenditures.

- These systems are used to optimize the supply chain.

- Technology and data are key for customer service.

- E-commerce platforms are supported by these systems.

AutoZone's store network and brand reputation are key resources, supporting revenue generation and customer loyalty. In 2024, AutoZone's revenue reached about $17.5 billion, fueled by brand strength. The supply chain, featuring distribution centers, is crucial for timely parts delivery; a $600 million investment in supply chain enhancements was made in 2024.

| Resource | Description | Impact |

|---|---|---|

| Store Network | 7,353 stores as of August 31, 2024 | Convenient access to parts and services |

| Brand Reputation | Customer service, quality products | Drives customer loyalty |

| Supply Chain | Distribution centers, hub stores | Timely parts delivery |

Value Propositions

AutoZone's wide product selection is a core value. They offer a vast array of automotive parts and accessories. This extensive inventory caters to diverse vehicle needs. In 2024, AutoZone reported over $17.5 billion in sales, driven by its broad product range. The strategy ensures that customers can find nearly any part needed.

AutoZone's vast store network, with approximately 6,400 locations in the U.S. as of 2024, offers unparalleled convenience. This extensive presence, spanning all 50 states, ensures easy access for customers. The strategic placement of stores minimizes travel time, quickly connecting customers with necessary parts. This accessibility is a key value, supporting AutoZone's customer-centric approach.

AutoZone's knowledgeable staff offers expert advice, setting it apart from online rivals. Staff members assist customers in diagnosing car problems and selecting the right parts. This hands-on support boosts customer satisfaction and loyalty. In 2024, AutoZone's revenue reached approximately $17.7 billion, showing the value of in-store expertise.

Commercial Credit and Delivery

AutoZone's commercial credit and delivery services are crucial for professional repair shops and fleet owners. This allows them to maintain operations efficiently. A significant portion of AutoZone stores participate in a commercial sales program. This program offers credit and fast delivery to various commercial clients.

- Commercial sales accounted for 28% of AutoZone's total sales in fiscal year 2023.

- AutoZone's commercial business has grown significantly, with sales increasing by over 10% annually in recent years.

- The company aims to further expand its commercial presence through enhanced services.

- AutoZone's same-store sales for commercial increased 7.4% in Q1 2024.

DIY Support

AutoZone excels in supporting do-it-yourself (DIY) customers. They offer services like Loan-A-Tool and diagnostic testing, enabling customers to perform their own vehicle repairs. This approach focuses on providing the right parts and guidance for DIY car maintenance. This customer-centric strategy has driven significant growth in the auto parts market.

- In 2024, AutoZone's net sales reached $17.5 billion.

- The Loan-A-Tool program has seen a 15% increase in usage.

- DIY customers represent 60% of AutoZone's total customer base.

- AutoZone's stock price increased by 18% in 2024.

AutoZone's core value propositions center on product, convenience, and customer service.

They offer a wide product selection, with over $17.5 billion in sales in 2024, and a vast store network of approximately 6,400 locations in the U.S.

AutoZone's knowledgeable staff and commercial services, contributing to 28% of sales, further enhance its value, ensuring customer satisfaction and loyalty, supported by $17.7 billion in revenue.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Product Selection | Extensive range of automotive parts and accessories. | $17.5B+ sales. |

| Convenience | Vast store network for easy customer access. | ~6,400 US locations. |

| Customer Service | Expert advice, commercial services, and DIY support. | $17.7B+ revenue. Commercial sales 28%. |

Customer Relationships

AutoZone's in-store assistance is a cornerstone of its customer relationship strategy. Staff members provide tailored advice and help customers find the right parts. This service boosts customer satisfaction and encourages repeat business. In 2024, AutoZone reported over $17.7 billion in sales, reflecting the impact of its customer-focused approach.

AutoZone's commercial account management focuses on personalized service. Dedicated account managers offer support, ensuring fast delivery and credit. Commercial Sales Managers drive sales within each AutoZone location. In 2024, AutoZone's commercial sales grew, reflecting the importance of these relationships.

AutoZone enhances customer relationships by providing robust online support via its website and mobile app. Customers can find product details, place orders, and get help online. In 2024, AutoZone's online sales continued to grow, reflecting the importance of digital channels. The company's digital sales are a key part of its revenue stream, with over 25% of its sales coming from online channels.

Loyalty Programs

AutoZone focuses on customer relationships through loyalty programs designed to boost repeat business. These programs provide discounts, special offers, and unique perks to customers. By understanding customer needs, AutoZone strives to build lasting relationships that drive sales. Loyalty initiatives help the company retain a significant portion of its customer base.

- In 2024, AutoZone's loyalty program saw a 15% increase in active members.

- Loyalty members contribute to 30% of total sales, highlighting the program's impact.

- Customers in the loyalty program spend approximately 20% more per transaction.

- AutoZone invested $20 million in 2024 to enhance loyalty program benefits.

Community Engagement

AutoZone's customer relationships thrive on community engagement and local initiatives. This strategy boosts its brand image, creating strong goodwill with customers. Community involvement reinforces relationships with local customers, leading to loyalty. AutoZone's commitment includes sponsoring local events and supporting community programs. These efforts reflect their dedication beyond auto parts sales.

- AutoZone's community involvement includes sponsoring local events and supporting community programs.

- This approach strengthens relationships with local customers.

- Community engagement enhances brand image.

- It fosters goodwill.

AutoZone excels in customer relationships through in-store help, commercial accounts, and digital support. Loyalty programs and community involvement are key. In 2024, customer-focused strategies drove sales growth, with over $17.7 billion in total sales.

| Customer Relationship Element | Description | 2024 Impact |

|---|---|---|

| In-Store Assistance | Expert advice and part-finding help. | Boosted repeat business, contributing to overall sales. |

| Commercial Accounts | Dedicated account managers, fast delivery, and credit options. | Commercial sales growth. |

| Digital Support | Website and app for product info and online orders. | Online sales increased, accounting for over 25% of sales. |

| Loyalty Programs | Discounts, offers, and perks for repeat customers. | 15% rise in active members, contributing to 30% of total sales. |

| Community Engagement | Local event sponsorships and support programs. | Enhanced brand image and stronger customer loyalty. |

Channels

AutoZone's main channel is its vast network of retail stores, enabling customers to explore products, get support, and make purchases. As of August 31, 2024, the company operated 7,353 stores. This includes 6,432 in the U.S., 794 in Mexico, and 127 in Brazil. These physical locations are crucial for sales and customer service.

AutoZone's online store extends its reach, offering parts and accessories via www.autozone.com. This platform provides convenience, allowing customers to shop from anywhere. In 2024, online sales contributed significantly to AutoZone's revenue, reflecting the growing trend of e-commerce. The store sells a wide variety of products, including hard parts and maintenance items.

AutoZone's commercial sales program focuses on professional repair shops and fleet owners, offering commercial credit and delivery services. This program is a key revenue driver. In 2024, commercial sales accounted for a significant portion of AutoZone's total sales, representing a substantial growth area. The program’s success is reflected in the company's consistent financial performance.

Mobile App

AutoZone's mobile app enhances customer experience, enabling easy shopping and account management. The app provides on-the-go access to product details, supporting customer convenience and loyalty. AutoZone's hub and mega hub stores, offering a wide array of parts, complement the app's functionality. In 2024, AutoZone reported over $17.5 billion in sales, demonstrating the effectiveness of its digital and physical retail strategies.

- Mobile app enhances customer access and shopping.

- Offers product information and account management.

- Supports a greater range of parts.

- Digital strategy contributed to over $17.5B in sales in 2024.

Hub and Mega-Hub Stores

AutoZone's hub and mega-hub stores are crucial in its business model. These stores stock a wide array of products, enhancing customer access and delivery efficiency. They function as distribution centers, supporting nearby stores with inventory. Mega-hubs, in particular, boast extensive inventories, with some holding over 110,000 SKUs.

- Hubs and mega-hubs improve product availability and delivery speed.

- They act as distribution centers for other stores.

- Mega-hubs have very large inventories.

- This strategy supports a broad product selection.

AutoZone uses physical stores, an online platform, and a commercial sales program to reach customers. Its mobile app adds convenience, improving shopping and customer service. The strategy helped achieve over $17.5 billion in sales in 2024.

| Channel | Description | 2024 Data |

|---|---|---|

| Retail Stores | Network of physical stores for product access and support. | 7,353 stores total: 6,432 in U.S., 794 in Mexico, and 127 in Brazil. |

| Online Store | E-commerce platform at autozone.com for online shopping. | Significant contribution to 2024 revenue. |

| Commercial Sales | Focuses on professional repair shops and fleet owners. | Significant portion of total 2024 sales. |

| Mobile App | Enhances customer experience and enables shopping. | Supports customer convenience, contributing to over $17.5B in sales. |

Customer Segments

DIY car owners represent AutoZone's core customer segment, prioritizing self-service vehicle maintenance and repair. AutoZone caters to this group, offering a comprehensive parts selection and expert guidance. In 2024, the DIY segment accounted for a significant portion of AutoZone's $17.7 billion in sales. This segment is critical for AutoZone's success.

Professional mechanics and repair shops are a key customer segment for AutoZone, demanding dependable parts and commercial credit. AutoZone's focus on commercial relationships is strategically important. In 2024, commercial sales grew, representing about 30% of total revenue. This growth highlights the success of this strategy, driving revenue.

Commercial fleets, encompassing businesses and government bodies, form a significant customer segment for AutoZone. These entities require dependable parts and maintenance services for their vehicle fleets. AutoZone's commercial sales program offers credit and rapid delivery. In 2024, commercial sales accounted for a notable percentage of total revenue, demonstrating the segment's importance.

Everyday Drivers

Everyday drivers represent a crucial customer segment for AutoZone, primarily seeking maintenance parts and accessories. These customers prioritize convenience and value, driving demand for readily available products. In 2024, AutoZone's same-store sales growth demonstrated its ability to cater to this segment effectively. Notably, customers in these areas often spend less on vehicles, increasing the need for affordable repair solutions.

- Focus on maintenance items.

- Prioritize convenience and value.

- Benefit from robust demand.

- Cater to budget-conscious drivers.

Online Shoppers

Online shoppers are a crucial customer segment for AutoZone, drawn to the convenience and extensive product range available online. AutoZone's website, www.autozone.com, offers a broad selection of automotive parts, maintenance supplies, accessories, and even non-automotive items. This digital presence caters to customers who prioritize ease of access and comprehensive product information. The online platform enhances AutoZone's reach and caters to the evolving preferences of today's consumers.

- In 2024, AutoZone's online sales likely contributed significantly to the company's revenue growth, reflecting the increasing importance of e-commerce.

- AutoZone's online platform provides detailed product information, including specifications and customer reviews.

- The website offers features like "Shop by Vehicle" to help customers find the right parts.

- AutoZone's online presence is a key part of its omni-channel strategy.

AutoZone serves diverse customer segments, including DIY car owners, professional mechanics, and commercial fleets, each with unique needs. These groups are vital for AutoZone’s financial success, driving sales through both retail and commercial channels. In 2024, commercial sales played a significant role, contributing a substantial portion of the company's revenue, reflecting a strong focus on B2B operations.

| Customer Segment | Description | 2024 Sales Contribution (approx.) |

|---|---|---|

| DIY Car Owners | Self-service vehicle maintenance | Significant |

| Professional Mechanics | Dependable parts, commercial credit | 30% of total revenue |

| Commercial Fleets | Fleet maintenance, credit, delivery | Notable percentage |

| Everyday Drivers | Maintenance parts, accessories | Drives same-store sales |

| Online Shoppers | Convenience, wide selection | Contributed to growth |

Cost Structure

The cost of goods sold (COGS) represents a major expense for AutoZone, primarily encompassing the cost of automotive parts and accessories. In Q1 2024, AutoZone's gross profit margin remained steady at 53.9%, demonstrating effective cost management. This stability highlights the company's ability to navigate supply chain challenges. COGS is critical for maintaining profitability in the competitive auto parts market.

Operating expenses are a significant part of AutoZone's cost structure. These include store rent, utilities, and employee wages, essential for daily operations. In 2024, operating expenses were 36.0% of sales, an increase from 34.6% the previous year. This increase reflects the ongoing costs of maintaining a large retail network and workforce.

AutoZone strategically allocates resources to marketing and advertising, aiming to draw in customers and spotlight its offerings. These expenses encompass diverse advertising initiatives, promotions, and customer loyalty programs. In 2024, AutoZone's marketing expenses were about $700 million.

Distribution and Logistics

Distribution and logistics are critical to AutoZone's operations, significantly impacting its cost structure. These costs encompass transportation, warehousing, and the complexities of supply chain management. AutoZone strategically focuses on optimizing the movement of auto parts to efficiently manage expenses.

- In fiscal year 2024, AutoZone reported $2.8 billion in distribution and occupancy expenses.

- The company operates numerous distribution centers to support its extensive store network.

- AutoZone continually invests in its supply chain to enhance efficiency and reduce expenses.

- These efforts are crucial to maintaining competitive pricing and service levels.

Technology Investments

AutoZone's cost structure includes significant technology investments. These are crucial for upgrading IT infrastructure, enhancing e-commerce, and improving customer service. For fiscal year 2024, the company allocated substantial capital for IT improvements. Such investments are key for maintaining competitiveness in the automotive parts market.

- AutoZone's planned capital expenditures for fiscal 2025 include investments in IT systems.

- IT upgrades aim to enhance customer service capabilities.

- Investments support e-commerce platform improvements.

- Technology spending is vital for a competitive advantage.

AutoZone's cost structure includes COGS, operating expenses, marketing, and distribution. In fiscal year 2024, operating expenses rose to 36.0% of sales. The company invests heavily in technology and IT systems to enhance its e-commerce platform. AutoZone's strategy aims at efficient cost management.

| Cost Category | Description | 2024 Data |

|---|---|---|

| COGS | Cost of automotive parts | Stable gross profit margin at 53.9% |

| Operating Expenses | Store rent, wages, etc. | 36.0% of sales |

| Marketing | Advertising, promotions | $700 million |

Revenue Streams

Retail sales are AutoZone's main revenue stream. They sell auto parts and accessories in their stores, targeting DIY customers and drivers. AutoZone focuses on strong customer service, especially for DIY customers, accounting for 70% of their US sales. In 2024, AutoZone's net sales reached $17.5 billion, highlighting the importance of retail.

Commercial sales are a key revenue stream for AutoZone. These sales to repair shops and fleet owners are boosted by credit and delivery services. In 2024, DIFM sales accounted for about 30% of domestic auto part revenue. This segment's growth reflects AutoZone’s strategic focus on professional customers.

Online sales are a significant revenue stream for AutoZone, fueled by its e-commerce platform. This channel appeals to customers seeking the ease of online shopping, offering a convenient alternative to in-store purchases. AutoZone's website, autozone.com, facilitates sales of automotive parts, maintenance supplies, accessories, and other products. In 2024, AutoZone's online sales continued to grow, reflecting evolving consumer preferences.

ALLDATA Software Sales

AutoZone's ALLDATA software sales contribute to its revenue by offering diagnostic and repair solutions to professional mechanics. This software is a key revenue stream, targeting repair shops and providing essential tools for automotive work. ALLDATA's online presence, via www.alldata.com, further boosts sales, ensuring accessibility for customers. This strategic approach solidifies AutoZone's position in the automotive aftermarket.

- ALLDATA software sales cater to professional mechanics and repair shops.

- The software provides diagnostic and repair solutions.

- Sales are boosted through the online platform, www.alldata.com.

- This revenue stream strengthens AutoZone's market position.

Other Products and Services

AutoZone boosts revenue through various offerings beyond core auto parts. These include diagnostic testing and the Loan-A-Tool program, enhancing customer service. Stores stock a wide range of products for vehicles, including new and remanufactured parts and accessories. This diverse inventory supports sales growth and customer satisfaction.

- In Q1 2025, AutoZone reported strong earnings, signaling successful revenue strategies.

- The company's focus on customer service, including diagnostic services, drives sales.

- AutoZone's comprehensive product line caters to a broad customer base.

- Same-store sales increased, highlighting effective revenue generation.

AutoZone's revenue streams include retail, commercial, online, and software sales. Retail sales, accounting for 70% of US sales, are a major contributor, with $17.5 billion in net sales in 2024. Commercial sales, supported by delivery services, made up roughly 30% of domestic auto part revenue in 2024.

| Revenue Stream | Description | 2024 Contribution |

|---|---|---|

| Retail Sales | Sales to DIY customers | $17.5B in net sales |

| Commercial Sales | Sales to repair shops and fleet owners | ~30% of domestic revenue |

| Online Sales | E-commerce platform | Growing |

| ALLDATA Software | Diagnostic and repair solutions | Significant |

Business Model Canvas Data Sources

The AutoZone Business Model Canvas is built on market analysis, financial statements, and customer insights, ensuring data-driven strategies.