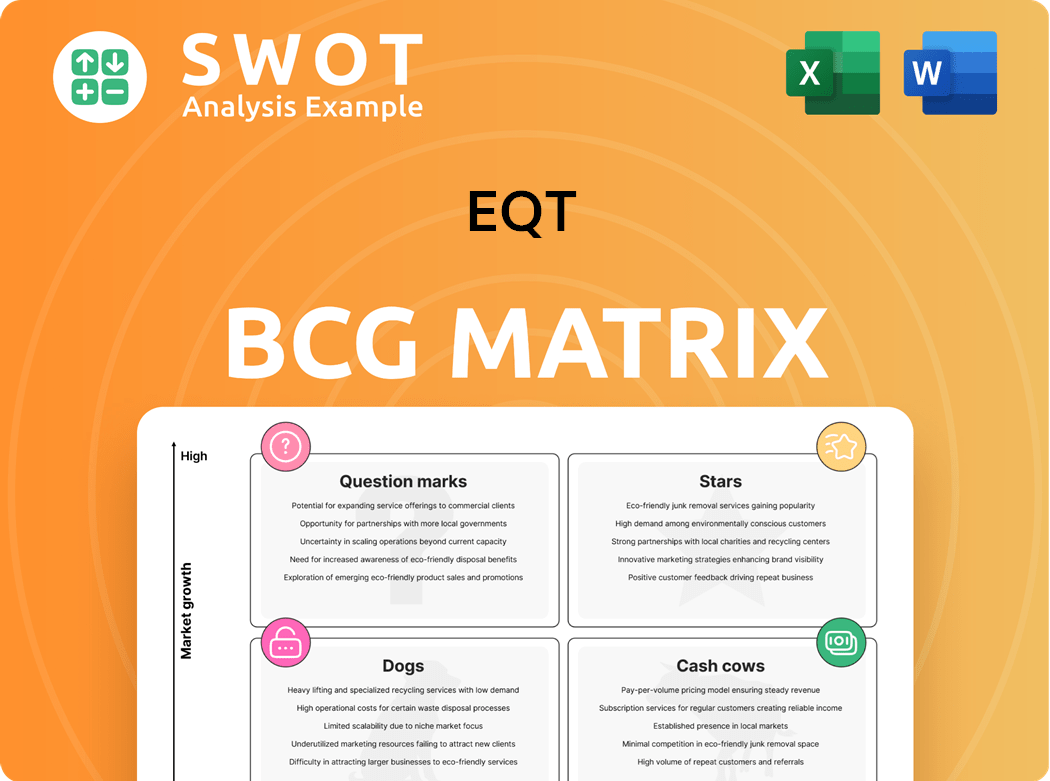

EQT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Export-ready design for effortless integration into any presentation.

What You’re Viewing Is Included

EQT BCG Matrix

The EQT BCG Matrix preview is identical to the purchased document. Download the complete, ready-to-use file directly; no hidden content, just a refined strategic tool.

BCG Matrix Template

Uncover EQT's portfolio strengths with a glimpse into its BCG Matrix, revealing product placements across quadrants. See which products are stars, cash cows, or question marks. This preview barely scratches the surface. Dive into the complete BCG Matrix for detailed analyses and strategic recommendations.

Stars

EQT's strategic focus on the Appalachian Basin, especially the Marcellus and Utica Shales, is central to its operations. The company holds a substantial natural gas inventory, with over 30 years of de-risked drilling locations. This large footprint makes EQT the largest U.S. natural gas producer. In 2024, EQT produced around 5.3 Bcf/d of natural gas.

EQT's vertical integration across well development, production, and midstream operations boosts efficiency. The Equitrans Midstream integration strengthens infrastructure, ensuring gas transport. This reduces reliance on third parties, increasing profitability. In Q3 2024, EQT reported a net income of $282 million, reflecting operational strengths.

EQT prioritizes operational efficiency, technology, and sustainability to enhance its production. The company anticipates a 5-10% yearly decrease in reserve development capital intensity in 2025, a 15% drop from 2023 levels. In 2025, well costs are projected to fall by $70 per foot compared to 2024. Completion efficiencies are at record highs, with a 35% rise in completed lateral footage per day in the second half of 2024.

Strong Free Cash Flow Generation

EQT's solid free cash flow (FCF) demonstrates financial strength, especially in challenging price scenarios. In Q4 2024, it produced $588 million in FCF, even with Henry Hub prices at $2.81/MMBtu. EQT anticipates substantial FCF in the coming years. This financial health supports debt reduction and shareholder returns.

- Q4 2024 FCF: $588 million

- 2025 FCF projection: $2.6 billion

- 2026 FCF projection: $3.3 billion

- Five-year FCF forecast: $15 billion

Net Zero Scope 1 and 2 GHG Emissions Achievement

EQT's early achievement of net-zero Scope 1 and 2 GHG emissions across its legacy operations by 2024, ahead of its 2025 target, showcases dedication to environmental responsibility. This covers all upstream operations, including recent acquisitions. This enhances EQT's appeal to sustainability-focused investors, creating a competitive advantage.

- EQT's Scope 1 and 2 emissions reduction contributes to broader industry goals.

- The company's focus on sustainability aligns with growing investor demands.

- This achievement potentially boosts EQT's valuation and market position.

- It reflects positively on EQT's risk management and long-term strategy.

EQT, as a Star, boasts high market share in the growing natural gas market. It is supported by strong financials, with substantial free cash flow (FCF) projected. The company's commitment to operational efficiency and sustainability further boosts its appeal.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Position | Leading US natural gas producer | 5.3 Bcf/d natural gas production |

| Financial Health | Strong FCF generation | Q4 FCF: $588M, Henry Hub: $2.81/MMBtu |

| Sustainability | Net-zero emissions achievement | Scope 1 & 2 emissions reduction |

Cash Cows

EQT's Appalachian Basin base offers reliable revenue. 2024 proved reserves held at 26 Tcfe. SEC pricing fell from $2.64 to $2.13/MMBtu. This stability fuels consistent cash flow. It supports EQT's expansion plans.

EQT's midstream assets, like the Mountain Valley Pipeline, offer steady cash flow. A Blackstone joint venture highlights their value, providing EQT with capital. These assets transport natural gas, ensuring consistent revenue. In Q1 2024, EQT reported $1.16 billion in adjusted EBITDA from its midstream assets. This segment's stability is crucial.

EQT's focus on continuous operational efficiency boosts profitability. In Q4 2024, capital expenditures were 7% under guidance due to efficiency gains. This lowers production costs, improving profit margins and cash flow. These gains stem from better well performance and reduced spending.

Long-Term Contracts and Agreements

EQT's long-term contracts with utilities in Appalachia are a cornerstone of its stable financial performance. These agreements secure a steady demand for natural gas, mitigating the impact of fluctuating spot prices. This predictability is vital for consistent cash flow, supporting EQT's strategic initiatives. In 2024, EQT's long-term contracts accounted for a significant portion of its revenue, reinforcing its cash cow status.

- Revenue Stability: Long-term contracts help buffer against market volatility.

- Predictable Cash Flow: Ensures consistent financial resources for investments.

- Strategic Advantage: Supports EQT's ability to plan and execute long-term projects.

- 2024 Performance: Long-term contracts contributed significantly to EQT's revenue.

Focus on Cost Reduction

EQT's strategy emphasizes cost reduction to boost cash flow generation. This includes lowering well costs and reducing capital intensity, which directly impacts its financial performance. EQT anticipates a 5-10% year-over-year decline in reserve development capital intensity for 2025, building on a 15% reduction from 2023 levels.

- Cost reduction is a key focus for EQT.

- Capital intensity is expected to decrease.

- This enhances profitability and competitiveness.

- 2025 targets are set to improve financial results.

EQT's "Cash Cow" status is bolstered by its stable revenue streams and efficient cost management, as seen in 2024. This stability allows EQT to generate consistent cash flow, enabling strategic investments. Long-term contracts and operational efficiency contribute significantly to its financial strength.

| Feature | Details |

|---|---|

| Revenue Stability | Long-term contracts with utilities |

| Cash Flow | Consistent, supporting investments |

| Operational Efficiency | Cost reduction efforts |

Dogs

EQT's heavy reliance on dry natural gas, accounting for approximately 90% of its production mix, exposes it to natural gas price volatility. This volatility directly influences EQT's revenue and profitability. In 2024, natural gas spot prices have seen fluctuations, impacting EQT's financial performance. Unexpected weather events and geopolitical shifts further exacerbate this volatility, creating uncertainty in predicting future cash flows.

EQT faces growing environmental scrutiny, especially regarding fracking. Investigations into emissions and water quality are ongoing. Stricter regulations could increase EQT's costs. In 2024, there were multiple environmental violation notices issued.

EQT's debt situation is a key consideration. Despite efforts to lower it, the debt burden is still substantial. As of December 31, 2024, EQT reported $9.3 billion in total debt. High debt levels may restrict EQT's ability to grow.

Dependence on Appalachian Basin

EQT's reliance on the Appalachian Basin makes it a "Dog" in the BCG Matrix due to concentrated risk. This geographical concentration exposes EQT to regional issues. Adverse events like infrastructure problems or regulatory shifts could severely affect EQT. Diversifying production is key to reducing this risk.

- 2024: Appalachian Basin accounted for nearly all of EQT's production.

- 2024: Any pipeline disruptions in the region directly impact EQT's ability to transport gas.

- 2023: EQT's stock price may fluctuate more than competitors with diversified assets.

Hedge Book Limitations

EQT's hedge book strategy, which balances risk with potential gains, has limitations. The hedge coverage is expected to drop to 40% by Q4 2025, fully exposing it to the market in 2026. This exposes EQT to price swings, potentially affecting finances if gas prices fall. In 2024, natural gas spot prices averaged around $2.75 per MMBtu.

- Hedge coverage decreasing exposes EQT to market volatility.

- Full market exposure begins in 2026, increasing financial risk.

- Natural gas price fluctuations can negatively affect results.

- 2024's average natural gas spot price was approximately $2.75/MMBtu.

EQT is a "Dog" in the BCG Matrix due to high risks. The Appalachian Basin is its primary production area in 2024. Pipeline disruptions and regulatory shifts in this region can greatly impact the company's performance. EQT stock price volatility is also a concern due to its concentrated assets.

| Risk Factor | Impact | 2024 Data |

|---|---|---|

| Geographic Concentration | High regional risk | Appalachian Basin: ~100% production. |

| Pipeline Disruptions | Impaired transport | Regional disruptions directly hit EQT. |

| Price Volatility | Financial Risk | Gas averaged ~$2.75/MMBtu. |

Question Marks

The Mountain Valley Pipeline (MVP) expansion and Southgate project are growth opportunities for EQT, potentially increasing market access. Regulatory and environmental challenges pose risks, with delays negatively impacting growth. Successfully completing these projects could boost EQT's transportation capacity significantly. As of late 2024, EQT's stock faced volatility amid pipeline project uncertainties. The projects' outcomes will be crucial for EQT's long-term financial performance.

The surge in natural gas demand, fueled by new LNG export facilities like Plaquemines LNG Phase 1 and Corpus Christi LNG Stage 3, positions EQT in a growth area. These facilities aim to boost U.S. LNG exports, creating more demand for natural gas. EQT can gain by ramping up production and securing long-term supply deals with exporters. In 2024, U.S. LNG exports are projected to reach 12 billion cubic feet per day.

EQT could boost revenue and its green image by investing in carbon capture and storage (CCS). CCS traps CO2 from natural gas and power plants, stopping it from polluting. In 2024, the global CCS market was valued at $3.8 billion. EQT might partner on CCS projects to cut emissions and gain carbon credits. The CCS market is projected to reach $10.6 billion by 2029.

Low-Emission Gas Development

EQT sees potential in low-emission gases like hydrogen and RNG, offering growth. These gases, made from renewable sources, present cleaner alternatives. EQT could invest in R&D, diversifying and meeting sustainable energy demand. The global hydrogen market is projected to reach $600 billion by 2030.

- Hydrogen production from electrolysis could grow by 30% annually.

- RNG use in transportation has increased by 25% in 2024.

- EQT has allocated $50 million for low-emission projects.

- Investment in carbon capture tech is up 15% in the sector.

Strategic Acquisitions

Strategic acquisitions remain a key growth avenue for EQT. Future moves, much like the Equitrans Midstream merger, could broaden its asset portfolio, potentially creating substantial synergies. These acquisitions might unlock access to new resources, infrastructure, and markets, enhancing EQT's competitive edge. However, successful integration and the realization of anticipated synergies are crucial for these acquisitions to deliver value.

- EQT's 2024 capital expenditures are estimated at $1.65 billion.

- The Equitrans Midstream merger is a recent example of a strategic acquisition.

- Successful integration is critical to capture the full benefits of any acquisition.

- Acquisitions can provide access to new markets and resources.

EQT's "Question Marks" involve high-growth potential but uncertain outcomes. Mountain Valley Pipeline and Southgate expansion face regulatory and environmental hurdles. These projects require significant investment, affecting EQT's financial stability.

| Project | Status | Impact on EQT |

|---|---|---|

| MVP Expansion | Under Development | Increased Transportation Capacity |

| Southgate Project | Planning Phase | Enhanced Market Access |

| Capital Expenditure (2024) | $1.65 Billion | Project Funding |

BCG Matrix Data Sources

The EQT BCG Matrix uses company filings, market reports, industry analysis, and financial databases for reliable insights.