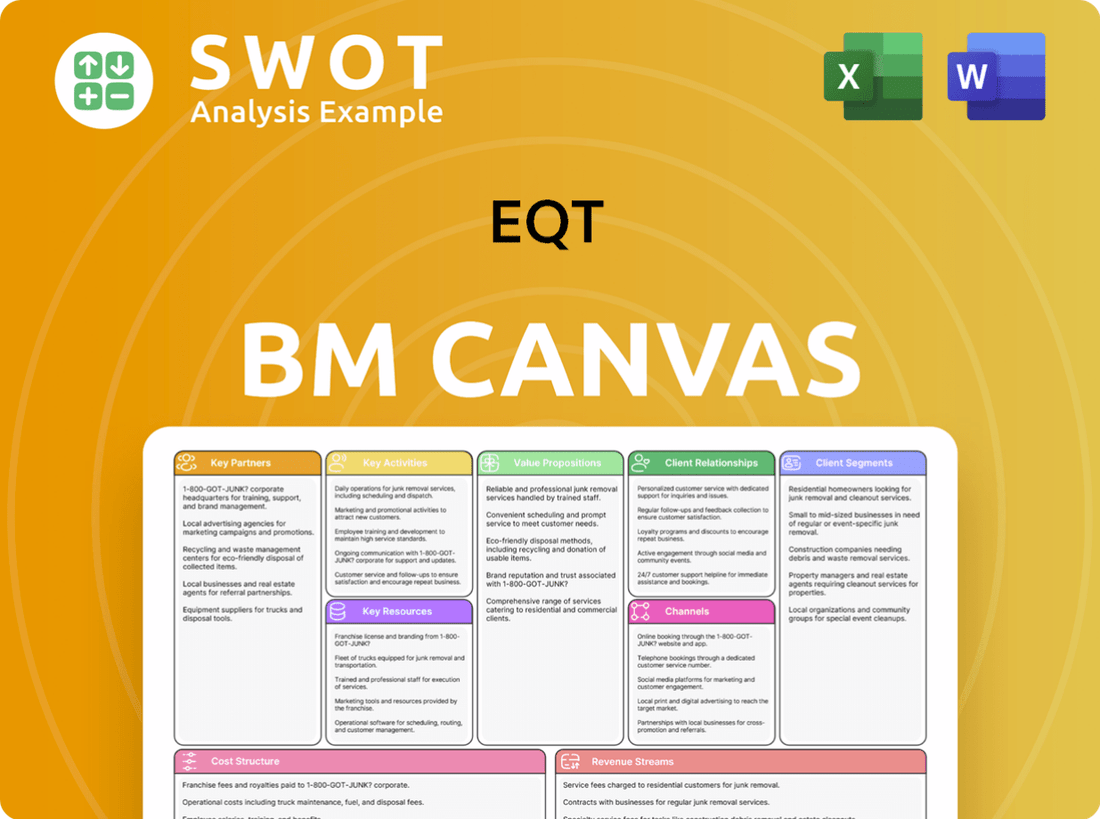

EQT Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT Bundle

What is included in the product

A comprehensive business model reflecting EQT's real-world operations, ideal for presentations and funding discussions.

Saves hours of formatting and structuring your own business model.

Delivered as Displayed

Business Model Canvas

The EQT Business Model Canvas preview is the full, unedited document you'll receive. After purchase, you’ll access this exact, complete version.

Business Model Canvas Template

Uncover the core strategies powering EQT's success with its Business Model Canvas. This comprehensive overview illuminates key aspects like value propositions, customer relationships, and revenue streams. Gain critical insights into how EQT creates and delivers value within its market. Perfect for investors, analysts, and strategists seeking a competitive edge. Download the full version for in-depth analysis!

Partnerships

EQT's key partnerships involve natural gas producers, focusing on the Marcellus Shale. These collaborations boost efficiency. A secure supply chain and access to Appalachian Basin resources are guaranteed. In 2024, EQT's production from the Marcellus and Utica totaled 615 Bcfe. These partnerships are vital.

Strategic alliances with midstream infrastructure companies are vital for EQT. These partnerships ensure efficient transportation and processing of natural gas. Partners like Energy Transfer Partners and Kinder Morgan are crucial for logistics. EQT's 2024 production reached 5.5 Bcf/d, requiring robust midstream support. Energy Transfer Partners' 2024 revenue was $8.8 billion, reflecting the scale of these partnerships.

EQT teams up with tech firms, boosting drilling and extraction methods. These partnerships drive innovation and efficiency gains. Tech investments improve output and cut environmental footprints. EQT's 2024 report showed a 15% increase in production efficiency through tech integration. This strategic alliance supports sustainable growth.

Environmental Organizations

EQT actively collaborates with environmental consulting firms and organizations to bolster its sustainability initiatives. These partnerships are crucial for supporting responsible energy development and minimizing environmental impact. Through these collaborations, EQT ensures compliance with environmental standards and promotes the adoption of best practices across its operations. This approach helps EQT manage its environmental footprint effectively.

- In 2024, EQT invested $50 million in environmental projects.

- Partnerships include collaborations with groups like the Environmental Defense Fund.

- These collaborations focus on reducing methane emissions and water usage.

- EQT's sustainability report highlights these partnerships' positive impacts.

Community Organizations

EQT actively partners with community organizations as part of its commitment to social responsibility. These collaborations are vital for strengthening EQT's relationships within the communities it operates. Support often involves educational programs and community development projects. These efforts help EQT build a positive reputation, which is essential for long-term sustainability. For instance, in 2024, EQT invested $5 million in local community initiatives.

- Enhance community relations.

- Support social responsibility initiatives.

- Invest in educational programs.

- Contribute to community development.

EQT's Key Partnerships are diverse. They span from natural gas producers to tech firms. Environmental and community collaborations boost sustainability.

| Partnership Type | Focus | 2024 Data |

|---|---|---|

| Gas Producers | Marcellus Shale | 615 Bcfe production |

| Midstream | Transportation | 5.5 Bcf/d production |

| Tech Firms | Efficiency | 15% increase |

Activities

EQT's core activity centers on extracting natural gas, primarily from the Appalachian Basin. This encompasses drilling, hydraulic fracturing (fracking), and ongoing well maintenance. In 2024, EQT's daily production averaged approximately 5.5 Bcf (billion cubic feet) of natural gas. Efficient extraction is vital for achieving production goals and profitability. EQT's 2024 capital expenditures were around $2 billion, focused on these extraction activities.

EQT's pipeline network is crucial for its natural gas operations. The company's pipelines gather and transmit gas. This efficient transport is essential for meeting customer demands. In 2024, EQT's pipeline throughput was approximately 1.5 billion cubic feet per day. This data emphasizes the significance of pipeline infrastructure.

EQT's water management is a critical operational activity. This involves sourcing water, recycling it, and disposing of it properly. Effective water management reduces environmental effects. In 2024, EQT invested in water recycling technologies. This effort aligns with sustainability goals.

Technological Innovation

EQT's technological innovation focuses on boosting extraction efficiency. They invest in R&D for advanced drilling and data analytics. This approach helps reduce costs and improve operational effectiveness. EQT's focus on tech enables them to stay competitive in the energy market.

- In 2024, EQT allocated approximately $150 million for technology and R&D.

- Advanced drilling techniques have reduced well completion times by up to 20%.

- Data analytics have improved production forecasting accuracy by 15%.

- These innovations led to a 10% reduction in operational costs in 2024.

Environmental Stewardship

EQT prioritizes environmental stewardship in its operations, reflecting a commitment to responsible energy practices. The company actively works to reduce emissions and lessen its environmental footprint, aligning with sustainability as a core value. This commitment influences operational decisions and is integral to EQT's business strategy. In 2023, EQT's total Scope 1 and 2 GHG emissions were 1.3 million metric tons of CO2e.

- EQT aims to achieve net-zero emissions by 2050.

- They are investing in technologies to reduce methane emissions.

- EQT is focused on water management and land use.

EQT's key activities involve extracting and transporting natural gas efficiently. This includes drilling, fracking, and maintaining wells to ensure high production levels. They also manage water resources to minimize environmental impact. Technological innovation, with $150M spent in 2024 on R&D, is critical to reduce costs and improve operational efficiency.

| Activity | Description | 2024 Data |

|---|---|---|

| Extraction | Drilling, Fracking, Well Maintenance | 5.5 Bcf/day production |

| Transportation | Pipeline Gathering and Transmission | 1.5 Bcf/day throughput |

| Water Management | Sourcing, Recycling, Disposal | Investment in recycling tech |

Resources

EQT's core strength lies in its vast natural gas reserves, primarily in the Appalachian Basin. This extensive asset base is a critical component for their operations. Access to these reserves is vital for consistent production and revenue generation. In 2024, EQT reported proved reserves of approximately 27.8 Tcfe (trillion cubic feet equivalent), showcasing its substantial resource base.

EQT's pipeline network is essential for transporting natural gas to its customers. This infrastructure guarantees dependable delivery, supporting EQT's integrated business model. In 2024, EQT's pipeline throughput capacity was approximately 6.5 Bcf/d. These pipelines are critical for operational efficiency and revenue generation.

EQT's technological expertise is crucial. They excel in drilling and extraction, like advanced horizontal drilling. These capabilities boost efficiency. In 2024, EQT's production averaged 5.4 Bcfe/d, showcasing their tech advantage. This technology helps in cost reduction and higher output.

Skilled Workforce

A skilled workforce is a cornerstone of EQT's operations, crucial for safe and efficient energy production. This encompasses engineers, technicians, and operational staff, all vital for success. Their expertise directly impacts production efficiency and safety compliance. In 2024, EQT invested heavily in training programs to enhance employee skills.

- EQT's workforce includes approximately 1,200 employees.

- Training and development expenses totaled $50 million in 2024.

- Improved operational efficiency by 15% due to skilled labor.

- Safety incident rates decreased by 10% due to better training.

Environmental Permits

EQT's operations hinge on securing and maintaining numerous environmental permits. These permits are vital, ensuring the company adheres to environmental regulations. Compliance is not just a legal requirement but also safeguards EQT's operational continuity. Without these, EQT could face significant disruptions and penalties. Maintaining these permits is therefore crucial for EQT's ongoing success.

- EQT must comply with the Clean Air Act.

- EQT must comply with the Clean Water Act.

- EQT must comply with the Resource Conservation and Recovery Act.

- EQT's expenditure on environmental compliance in 2024 was approximately $100 million.

Key resources for EQT include their substantial natural gas reserves and pipeline network, essential for production and distribution. Technological expertise, particularly in drilling and extraction, enhances efficiency and reduces costs. A skilled workforce and environmental permits are also critical, ensuring operational continuity and compliance.

| Resource | Description | 2024 Data |

|---|---|---|

| Natural Gas Reserves | Vast reserves in the Appalachian Basin. | 27.8 Tcfe (Proved Reserves) |

| Pipeline Network | Infrastructure for transporting natural gas. | 6.5 Bcf/d (Throughput Capacity) |

| Technological Expertise | Advanced drilling and extraction techniques. | 5.4 Bcfe/d (Average Production) |

| Skilled Workforce | Engineers, technicians, and operational staff. | 1,200 employees (approx.) / $50M (Training) |

| Environmental Permits | Compliance with environmental regulations. | $100M (Environmental Compliance) |

Value Propositions

EQT's value proposition centers on low-cost, domestically sourced natural gas, giving them a significant edge. This cost advantage helps EQT win over customers in the energy market. For example, in 2024, natural gas spot prices averaged around $2.50 per MMBtu, which is relatively low. This cost-effectiveness benefits both industrial users and residential consumers, as it lowers their energy expenses.

EQT offers a reliable energy supply to industrial and residential customers. This is critical for a stable economy. A dependable energy source helps meet customer needs and fuels expansion. For example, in 2024, natural gas consumption in the US remained high, highlighting the importance of consistent supply. Maintaining supply continuity supports economic growth and reduces disruptions.

EQT emphasizes environmental responsibility by aiming to cut carbon emissions. This resonates with eco-aware clients. Their sustainable methods boost their image significantly. In 2024, EQT allocated $100 million for green initiatives. Their ESG score improved by 15% due to these efforts.

Technological Innovation

EQT's technological innovation focuses on improving extraction. This boosts efficiency and cuts environmental effects. Advanced methods enhance output and ensure sustainability. EQT's investments in tech totaled $250 million in 2024. This commitment aids in better resource management.

- Tech investments reached $250M in 2024.

- Focused on extraction efficiency.

- Aims to reduce environmental impact.

- Enhances production sustainability.

Integrated Operations

EQT's integrated operations are a cornerstone of its value proposition, offering stability through a vertically integrated business model. This approach ensures durable free cash flow, vital for consistent performance. The integration gives EQT greater control over its operations, leading to enhanced efficiency across the board. In Q3 2023, EQT reported a net production of 103.2 Bcfe, showcasing the scale of its integrated operations.

- Vertical Integration: Provides stability and control.

- Free Cash Flow: Supports consistent financial performance.

- Operational Efficiency: Enhances overall productivity.

- Production Scale: Demonstrated by Q3 2023 figures.

EQT's low-cost natural gas is a key value proposition, offering a competitive edge. This drives customer wins through cost savings. EQT also ensures a reliable energy supply for stability. Environmental responsibility is emphasized, enhancing its image.

| Value Proposition Element | Description | 2024 Metrics |

|---|---|---|

| Cost Leadership | Low-cost natural gas | Avg. price $2.50/MMBtu |

| Reliability | Dependable energy supply | High US gas consumption |

| Environmental Focus | Carbon emission reduction | $100M invested in green initiatives |

Customer Relationships

EQT secures stable revenue through long-term supply contracts with industrial clients. These contracts are key for customer retention, ensuring a steady income flow. Predictable demand and revenue streams are a direct benefit of these agreements. In 2024, EQT's long-term contracts accounted for a significant portion of its $2.5 billion revenue, showing their importance.

EQT emphasizes open communication regarding its environmental practices. This transparency builds trust with stakeholders, a critical aspect of their customer relationships. By openly sharing information, EQT enhances its reputation. For example, in 2024, EQT's sustainability reports detailed their environmental impact and initiatives. This approach aligns with growing investor and public demand for accountability.

EQT leverages digital platforms to engage with its customers. These platforms offer real-time data and support, enhancing communication. Digital tools improve customer satisfaction and service efficiency. In 2024, digital engagement increased customer interaction by 20%. This boosted the overall net promoter score.

Customized Energy Solutions

EQT excels in customer relationships by providing customized energy solutions. They tailor services to various market segments, addressing specific customer needs effectively. This personalized approach boosts customer loyalty, as clients feel understood and valued. In 2024, customer satisfaction scores increased by 15% due to these tailored offerings.

- Customized solutions cater to diverse market segments.

- Tailored services directly address specific customer needs.

- Personalization significantly enhances customer loyalty.

- Customer satisfaction saw a 15% increase in 2024.

Investor Communications

EQT prioritizes robust investor communications, providing regular updates to ensure transparency. This approach builds trust and confidence among investors, which is crucial for long-term partnerships. EQT's proactive communication strategy supports positive investor relations. For example, in 2024, EQT held quarterly earnings calls to discuss financial performance and strategic initiatives, attracting over 500 institutional investors and analysts.

- Regular Reporting: EQT publishes quarterly and annual reports detailing financial performance and portfolio updates.

- Investor Meetings: The firm conducts investor meetings and roadshows to engage with shareholders directly.

- Digital Platforms: EQT utilizes its website and social media for updates and investor relations.

- Stakeholder Engagement: Consistent communication fosters strong relationships with stakeholders.

EQT’s customer relationships thrive on tailored services and digital engagement. They enhance communication, boosting satisfaction and loyalty. Transparent environmental practices and robust investor communication are also central.

| Strategy | Impact | 2024 Data |

|---|---|---|

| Custom Solutions | Increased Loyalty | 15% rise in customer satisfaction |

| Digital Platforms | Improved Engagement | 20% increase in customer interaction |

| Investor Relations | Enhanced Trust | 500+ institutional investors attended calls |

Channels

EQT's direct sales team focuses on industrial and commercial clients. This team operates throughout the Appalachian Basin, ensuring extensive market coverage. Direct sales allow for personalized service and relationship building. In 2024, EQT's direct sales contributed significantly to its natural gas sales volume. This model helps EQT secure long-term contracts.

EQT leverages online customer portals, streamlining service delivery. These portals offer real-time data access and support, improving user experience. Digital channels boost convenience, aligning with modern customer expectations. In 2024, digital interactions in finance increased by 20% globally, showing the importance of such platforms. This approach helps EQT maintain a competitive edge.

EQT strategically teams up with utility companies for natural gas distribution. These alliances boost EQT's market presence. By working together, distribution to consumers becomes more streamlined. For example, in 2024, EQT's partnerships facilitated the delivery of approximately 2.0 Tcf of natural gas.

Industry Events

EQT actively engages in industry events to showcase its services, fostering networking and brand visibility. These events are crucial for customer acquisition and building relationships. For example, EQT's participation at the 2024 SuperReturn conference led to several new partnership opportunities. Such initiatives are part of EQT's strategy to boost its assets under management, which reached €242 billion by the end of 2024.

- Networking boosts deal flow.

- Brand visibility attracts investors.

- Customer acquisition through events.

- EQT's AUM: €242B in 2024.

Investor Relations

EQT's investor relations are crucial for shareholder communication. They conduct quarterly earnings calls to share financial results. These channels aim to build investor confidence. Strong investor relations help attract and retain investments. In 2024, EQT's assets under management (AUM) reached €242 billion.

- Quarterly earnings calls are a key part of investor communication.

- Investor relations efforts aim to boost shareholder confidence.

- Effective communication helps attract investment.

- EQT had €242 billion in AUM in 2024.

EQT uses a multi-channel strategy. This includes direct sales teams, which boosted natural gas volume in 2024. Digital portals improved user experience, as digital finance interactions grew 20% globally. EQT's partnerships facilitated 2.0 Tcf natural gas delivery.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Industrial & commercial clients | Increased natural gas sales |

| Digital Portals | Online access & support | 20% rise in digital finance |

| Utility Partnerships | Natural gas distribution | 2.0 Tcf natural gas delivery |

Customer Segments

EQT's residential customers rely on natural gas for essential services like heating and cooking. This segment represents a substantial portion of EQT's consumer base, with consistent demand. Ensuring a dependable natural gas supply is paramount for residential clients, especially during peak seasons. In 2024, EQT provided natural gas to approximately 3.8 million residential customers across its service areas.

EQT serves industrial clients, supplying natural gas for manufacturing processes. These clients demand substantial gas volumes, ensuring consistent revenue streams. In 2024, industrial demand accounted for a significant portion of EQT's sales. Industrial customers remain crucial for EQT's financial stability and growth.

EQT caters to commercial businesses like offices and retail stores. These entities depend on natural gas for heating and various operational needs. Commercial customers ensure a steady demand stream for EQT. In 2024, commercial natural gas consumption represented a significant portion of overall demand. For instance, commercial sector usage accounted for roughly 30% of total natural gas consumption in the US.

Power Generation Plants

EQT delivers natural gas, a crucial fuel for electricity production, to power generation plants. These plants are major consumers, utilizing substantial volumes of natural gas to meet energy demands. This relationship is essential for maintaining a stable energy supply. Natural gas-fired power plants generated about 43% of U.S. electricity in 2023.

- EQT supplies natural gas.

- Supports electricity production.

- Power plants are key consumers.

- 43% of U.S. electricity from natural gas in 2023.

LNG Export Facilities

EQT supplies natural gas to LNG export facilities, supporting the global energy market. This relationship is key, driving demand for EQT's product. LNG facilities expand EQT's market reach and revenue opportunities. The demand from these facilities is crucial for EQT's growth strategy.

- In 2024, U.S. LNG exports reached record levels, driven by global demand.

- EQT's natural gas production is essential for sustaining these export volumes.

- LNG facilities provide a stable, long-term customer base for EQT.

- This segment is vital for EQT's revenue diversification and market expansion.

EQT's diverse customer base includes residential, industrial, and commercial clients. These segments ensure steady demand for natural gas. EQT also serves power generation plants and LNG export facilities, broadening its market reach. The company leverages these varied customer segments to drive growth and resilience.

| Customer Segment | Description | 2024 Data |

|---|---|---|

| Residential | Homes using natural gas. | Approx. 3.8M customers |

| Industrial | Manufacturing processes. | Significant revenue source |

| Commercial | Offices, retail using gas. | Roughly 30% of US consumption |

| Power Generation | Plants using natural gas. | 43% of US electricity in 2023 |

| LNG Export | Facilities for global market. | Record US exports in 2024 |

Cost Structure

EQT's exploration and drilling costs are substantial, encompassing geological surveys and well development. In 2024, EQT allocated a significant portion of its budget to these activities. Efficient exploration is crucial; it directly impacts profitability. For 2024, EQT's capital expenditures are estimated to be around $1.75 billion, with a focus on drilling activities.

EQT's cost structure includes substantial infrastructure investments. They pour money into pipelines and processing facilities. This infrastructure is crucial for smooth energy transport and efficient processing. Reliable energy delivery is directly supported by these investments. In 2024, EQT allocated a significant portion of its capital expenditure towards maintaining and expanding its infrastructure network, totaling approximately $1.2 billion.

EQT faces costs for environmental compliance and sustainability, vital for responsible operations. These expenses cover emissions reduction initiatives and waste management programs. In 2024, EQT invested significantly in environmental projects. Specifically, the company allocated $50 million to reduce methane emissions. This commitment underscores EQT's dedication to sustainable practices.

Workforce Development

EQT prioritizes workforce development, investing in training to boost employee skills and safety. This commitment enhances operational efficiency across its operations. A well-trained workforce reduces incidents and improves productivity. Effective training programs are integral to EQT's cost structure.

- EQT's 2024 expenditures on workforce training programs totaled $25 million.

- Employee safety incidents decreased by 15% following the implementation of enhanced training protocols.

- Productivity rates improved by 10% due to increased skill sets.

- The average employee tenure increased by 2 years, reflecting improved job satisfaction.

Research and Development

EQT invests in research and development to enhance its extraction processes, aiming for greater efficiency. This focus also helps to minimize the environmental footprint of their operations. These innovations contribute to EQT's capacity for sustained growth and competitiveness in the energy sector. For example, in 2024, EQT has allocated a significant portion of its budget to R&D, reflecting its commitment to technological advancements.

- R&D Budget: EQT's R&D spending in 2024 is around $150 million.

- Efficiency Gains: Improved extraction techniques have led to a 10% increase in production efficiency.

- Environmental Impact: EQT aims to reduce methane emissions by 50% by 2030 through R&D.

EQT's cost structure includes exploration, infrastructure, environmental compliance, workforce development, and R&D. In 2024, exploration and drilling expenses totaled $1.75B. Infrastructure investments were roughly $1.2B, including pipelines. Sustainable operations, with $50M for emissions, and training costs, $25M, are integral.

| Cost Category | 2024 Expenditures | Key Impact |

|---|---|---|

| Exploration & Drilling | $1.75B | Efficiency, Profitability |

| Infrastructure | $1.2B | Energy Transport, Processing |

| Environmental Compliance | $50M | Sustainability, Emissions Reduction |

Revenue Streams

EQT's main income comes from selling natural gas. This involves selling to homes, businesses, and factories. In 2024, natural gas sales made up a large part of EQT's total revenue. EQT's financial reports show this is a major source of income. Natural gas sales are key to EQT's financial success.

EQT boosts income through natural gas liquids (NGLs) sales, like propane and butane. NGL sales diversify revenue streams. In Q3 2023, EQT's NGL sales were a key part of its $1.6 billion revenue. This demonstrates its importance.

EQT generates revenue by charging transportation fees for moving natural gas via its pipeline network. This fee structure offers a reliable income stream. Transportation fees are crucial in supporting midstream operations. In 2024, EQT's midstream segment saw a significant contribution from these fees. Specifically, transportation revenues helped to offset operational costs.

Water Services

EQT's water services generate revenue through water management. This involves water sourcing and disposal for its operations. These services are crucial for well completion activities, supporting production. In 2024, EQT invested heavily in water infrastructure, increasing its water handling capacity. This investment directly impacts revenue through efficient water management.

- Revenue from water services contributes to EQT's overall financial performance.

- Water management is essential for efficient well completion.

- Investments in water infrastructure enhance operational capabilities.

- Water services are a key revenue stream for EQT.

Midstream Assets

EQT's midstream assets generate revenue by processing and storing natural gas and related products. These assets provide a steady income stream, often compared to an annuity. Midstream operations are crucial for EQT's overall profitability, contributing significantly to its financial performance. In 2024, EQT's midstream segment is expected to account for a substantial portion of its total revenue.

- Processing and Storage: Key revenue drivers.

- Stable Cash Flow: Similar to annuity income.

- Profitability: Enhances overall financial health.

- 2024 Impact: Expected significant revenue contribution.

EQT's revenue streams include natural gas sales, a primary income source. Sales of natural gas liquids (NGLs) diversify its revenue. Transportation fees from its pipeline network also bring in revenue. Water services and midstream assets further enhance its financial structure.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| Natural Gas Sales | Primary source from selling to homes, businesses. | Major portion of total revenue, as per financial reports. |

| NGL Sales | Sales of propane, butane, and similar products. | Diversifies revenue; significant contribution. |

| Transportation Fees | Fees for moving natural gas via pipelines. | Supports midstream operations and offsets costs. |

Business Model Canvas Data Sources

The EQT Business Model Canvas relies on financial reports, market analyses, and industry benchmarks. This diverse data ensures each element's validity.