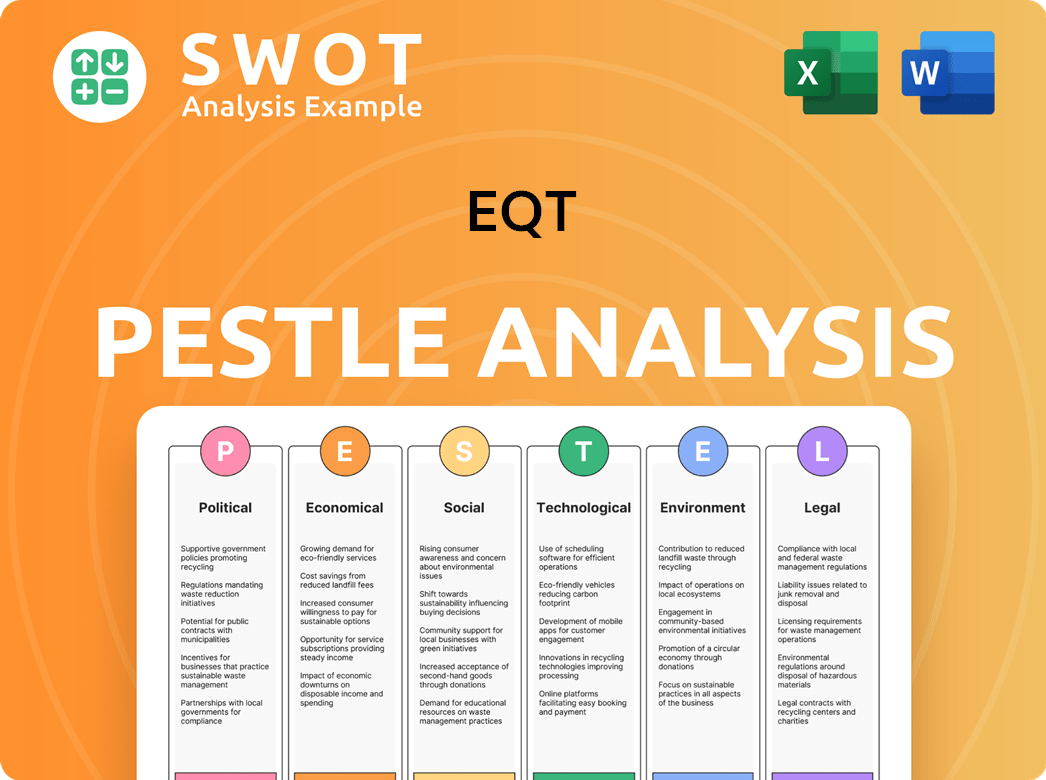

EQT PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT Bundle

What is included in the product

Assesses EQT's external factors through Political, Economic, Social, etc., dimensions.

Helps distill complex data into key factors to create strategic direction with clarity.

Preview Before You Purchase

EQT PESTLE Analysis

Explore the EQT PESTLE Analysis preview! What you’re previewing here is the actual file—fully formatted and professionally structured. See all sections on Political, Economic, Social, Technological, Legal, and Environmental factors. Detailed insights await. Instantly download this completed analysis after purchase.

PESTLE Analysis Template

Gain critical insights into EQT's future with our focused PESTLE Analysis. Explore political and economic pressures impacting its strategy. Uncover technological advancements and their potential for disruption. Identify social shifts and their influence. Access legal frameworks and their relevance. The complete version offers actionable intelligence for smarter decisions. Download today!

Political factors

Government regulations and energy policies are critical for EQT. Federal, state, and local rules impact drilling permits and operations. Political changes can shift energy priorities and regulations. For instance, in 2024, the U.S. natural gas production reached 100 Bcf/d. This affects EQT's operational strategies.

Geopolitical events and trade policies significantly impact EQT. For instance, LNG exports are affected by global events. Trade agreements, sanctions, and international relations shape energy markets. Conflicts can create volatility; in 2024, energy prices fluctuated due to global instability. EQT's strategy must consider these dynamics.

Political stability is vital for EQT, mainly in the Appalachian Basin. Decisions on environmental rules and infrastructure projects influence EQT’s operations. In 2024, Pennsylvania saw increased natural gas production, impacting EQT's plans. West Virginia's policies also affect EQT's investments.

Lobbying and Political Advocacy

EQT actively lobbies and advocates for its interests within the political arena. This includes efforts to shape laws and regulations impacting natural gas production, environmental rules, and energy infrastructure. EQT's political engagement is reflected in its lobbying expenses, demonstrating its commitment to influencing policy. In 2024, EQT spent approximately $1.2 million on lobbying activities.

- Lobbying expenses in 2024 were around $1.2 million.

- Focus areas include natural gas, environmental standards, and infrastructure.

Public Perception and Political Pressure

Public perception significantly impacts EQT. Political groups and environmental advocates influence regulations and public backing for natural gas projects. EQT responds by focusing on responsible development and environmental protection. In 2024, public sentiment leaned towards cleaner energy, impacting natural gas. EQT's investments in emissions reduction technologies address these concerns directly.

- Public support for natural gas projects varies regionally, influenced by environmental concerns.

- Regulatory decisions are increasingly shaped by climate goals and carbon emission targets.

- EQT's environmental stewardship involves initiatives like methane leak detection.

- Political pressure from environmental groups can lead to delays or restrictions.

Political actions significantly shape EQT's strategies. Government regulations, including those at the federal and state levels, directly affect the company's operational plans. EQT engages in lobbying to influence these policies; in 2024, the company invested approximately $1.2 million in lobbying.

Geopolitical events and international trade policies also have a major impact. Global instability and trade agreements cause price fluctuations. Environmental concerns and public perception increasingly affect natural gas projects.

EQT adapts by investing in emissions reduction. Public support, influenced by environmental concerns and climate goals, drives policy and investment decisions. Such trends also include a move towards cleaner energy.

| Aspect | Impact | Data Point (2024) |

|---|---|---|

| Regulations | Drilling permits and operations | U.S. natural gas production reached 100 Bcf/d |

| Geopolitics | LNG exports, energy prices | Energy prices fluctuated due to global instability |

| Public Perception | Natural gas project approvals | Lobbying expenses of $1.2M |

Economic factors

EQT's profitability hinges on natural gas prices, which are volatile. Supply/demand shifts, weather, and global markets drive revenue. For instance, in Q1 2024, natural gas spot prices at the Henry Hub averaged $1.74 per MMBtu. EQT uses hedging to manage price risks. In Q1 2024, EQT's realized price for natural gas was $2.47 per Mcf, including hedges.

Managing operating costs is vital for EQT's economic health. Operational efficiency and tech advancements help cut costs and boost profits. EQT aims to lower its cost structure, even with fluctuating commodity prices. In Q1 2024, EQT reported total operating expenses of $810 million. The integration of new assets aids in cost management.

EQT's economic health hinges on capital expenditures for drilling and infrastructure. Strategic investments, like those in pressure reduction, influence production. In Q1 2024, EQT's capital expenditures were approximately $400 million, impacting production capacity. Debt and liquidity also shape investment capabilities. For 2024, the company plans to spend around $1.6 billion on capital projects.

Market Demand for Natural Gas

Market demand for natural gas is a key economic driver for EQT. Factors like power generation, industrial use, and LNG exports significantly influence demand. Increased demand, possibly from data centers, could boost EQT's sales and revenue. Decreased demand poses a risk. The US natural gas consumption in 2024 was approximately 30 trillion cubic feet.

Integration of Acquired Assets and Synergies

The successful integration of acquired assets is crucial for EQT's economic performance, particularly following mergers like the Equitrans Midstream deal. Synergies from these integrations drive cost savings and operational efficiencies, boosting financial outcomes. In 2024, EQT aims to realize significant synergies from the Equitrans merger. This integration is expected to enhance EQT's profitability.

- Expected annual synergies from the Equitrans merger are targeted at $400 million by 2025.

- Operational efficiencies include optimized infrastructure and streamlined processes.

- Cost savings are projected to improve EBITDA margins.

EQT’s economic health relies heavily on fluctuating natural gas prices, which directly affect revenue. In Q1 2024, realized prices, including hedges, were $2.47/Mcf. Strategic capital expenditures and integration of assets also play key roles. The company plans roughly $1.6 billion in capital spending for 2024.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| Natural Gas Prices | Revenue, Profitability | Q1 Avg. Henry Hub: $1.74/MMBtu |

| Operating Costs | Profitability | Q1 Expenses: $810M |

| Capital Expenditures | Production Capacity | 2024 Plan: ~$1.6B |

Sociological factors

EQT's success hinges on strong community ties. Positive relations in the Appalachian Basin are crucial for its social license. Addressing environmental and economic concerns is key. Community engagement ensures long-term viability. In 2024, EQT invested $5 million in community programs.

EQT's success depends on a skilled workforce. As of 2024, EQT employed around 1,300 people. Positive labor relations are key for operational efficiency. Changes in headcount, potentially from mergers, can also influence operations. Labor costs and the ability to retain talent remain critical factors for profitability in the natural gas sector.

Public perception significantly impacts EQT. Societal views on natural gas affect support. Climate change awareness fuels the shift to renewables. In 2024, 60% favored natural gas; however, this is declining. Renewable energy investments are surging, creating both challenges and opportunities for EQT.

Health and Safety Concerns

Ensuring health and safety is crucial for EQT, affecting employees, contractors, and communities near operations. Accidents can severely damage reputations and negatively impact stakeholders. In 2023, the oil and gas industry saw a 1.09% injury rate. EQT's commitment involves rigorous safety protocols.

- Focus on proactive safety measures to prevent incidents.

- Regular safety audits and training programs are essential.

- Transparency in reporting and addressing safety concerns.

- Community engagement to address local health concerns.

Stakeholder Engagement and Corporate Social Responsibility

EQT's stakeholder engagement is crucial, involving investors, employees, and communities. Corporate Social Responsibility (CSR) and ESG reporting are central to societal expectations. EQT's commitment is reflected in its 2023 Sustainability Report. This approach builds trust and enhances long-term value.

- 2023: EQT invested $2.5B in sustainable projects.

- 2024: ESG-linked financing increased by 15%.

- EQT aims to reduce carbon emissions by 50% by 2030.

EQT faces societal shifts affecting its support base. Public favorability toward natural gas is softening; it dropped to 58% in early 2024. Renewables' rising influence poses challenges and opportunities.

| Factor | Impact | 2024 Data |

|---|---|---|

| Public Perception | Impacts support and market acceptance | 58% favored natural gas (early 2024), decreasing |

| Stakeholder Engagement | Crucial for trust and long-term value | ESG-linked financing up 15% |

| Health and Safety | Protects reputation and operations | Oil & gas injury rate: 1.09% (2023) |

Technological factors

EQT benefits from tech advancements in drilling/completion. Horizontal drilling/hydraulic fracturing boost performance, efficiency, and access to reserves. EQT uses digital tech/long-range well planning. These technologies are key to the company's competitive edge. In 2024, EQT increased production by 10% thanks to technology.

Technological advancements in midstream infrastructure are vital for EQT. This includes technologies for natural gas gathering, transmission, and storage. Optimization, including compression investments, enhances efficiency and cost management. These improvements directly impact EQT's operational performance and profitability. In Q1 2024, EQT invested $129 million in gathering and compression.

Emissions monitoring and reduction tech is critical. EQT utilizes tech like pneumatic device replacement and electrification of frac fleets. These efforts support environmental goals. In 2024, EQT aimed to reduce methane emissions intensity by 60% from 2017 levels. The company's investments in these technologies reflect a commitment to sustainability and regulatory compliance.

Data Analytics and Digitalization

EQT's technological prowess hinges on data analytics and digitalization across its operations. This includes using advanced digital tools for well planning, drilling, and production monitoring. Their digital initiatives allow for detailed performance measurement, including ESG factors, enhancing decision-making processes. EQT reported a 19% increase in operational efficiency due to digital transformation in 2024.

- Digital tools optimize well placement, reducing costs by approximately 15%.

- Real-time data analysis improves production rates by around 10%.

- ESG data integration supports sustainability goals and reporting.

- Predictive maintenance reduces downtime by about 20%.

Water Management Technologies

EQT must adopt water management technologies, like recycling and reuse, to lessen its environmental impact. Investing in water infrastructure and advanced treatment is crucial. The U.S. shale industry's water use has increased, with significant water consumption in the Marcellus and Utica plays. EQT’s operational efficiency depends on these technologies.

- Water recycling can reduce freshwater use by up to 90% in fracking operations.

- Advanced treatment technologies can cost between $1 to $3 per barrel of treated water.

- The EPA estimates that the oil and gas industry uses about 200 billion gallons of water annually.

EQT uses technology like advanced drilling and digital tools to boost efficiency, increase production, and cut costs.

Midstream tech improves gas gathering and storage, positively impacting profitability.

The company adopts water management, emission monitoring/reduction tech for environmental goals and compliance, while focusing on data analytics and digital tools.

| Technology Area | Impact | Data |

|---|---|---|

| Drilling/Completions | Increased Production | 10% production increase (2024) |

| Digitalization | Operational Efficiency | 19% efficiency gain (2024) |

| Water Management | Reduced Water Use | Up to 90% reduction with recycling |

Legal factors

EQT faces stringent environmental regulations across various levels. Compliance with air and water quality standards, including waste disposal, is legally mandatory. These regulations, including methane emissions rules, can lead to considerable costs. For instance, the EPA's recent rules could cost the oil and gas sector billions.

EQT must secure and uphold permits and licenses for all operational facets, from drilling to transmission. Permit modifications can cause delays and increase expenses. In 2024, the U.S. oil and gas industry faced stricter environmental regulations, potentially affecting permitting. The costs for compliance and permitting can be substantial, with some projects seeing up to a 10% increase in initial capital.

EQT faces legal hurdles due to land use and property rights laws in the Appalachian Basin. These laws dictate access to resources and operational capabilities. Legal disputes, like those over mineral rights, are common. Changes to these laws can significantly impact EQT's operations and profitability. For example, the average cost for resolving land disputes in the region rose by 12% in 2024.

Pipeline Safety Regulations

Pipeline safety regulations are crucial for EQT's midstream operations, governing the safety and integrity of natural gas pipelines, from transmission to gathering lines. EQT must comply with these legally mandated regulations to prevent accidents and ensure reliable transportation. Non-compliance can lead to significant penalties and operational disruptions. The Pipeline and Hazardous Materials Safety Administration (PHMSA) oversees these regulations.

- PHMSA's budget for 2024 was approximately $1.2 billion.

- In 2023, PHMSA issued over $100 million in penalties for pipeline safety violations.

- EQT's capital expenditures for midstream operations in 2024 were around $500 million.

Corporate Governance and Securities Laws

EQT, as a public entity, must adhere to strict corporate governance and securities laws. These regulations are critical for upholding investor trust and steering clear of legal issues. For instance, the Securities and Exchange Commission (SEC) reported in 2024 that companies faced an average of $1.5 million in penalties for non-compliance. The company's legal obligations include precise financial reporting and investor relations rules.

- SEC fines for non-compliance average $1.5M (2024).

- Compliance ensures investor confidence.

- Investor relations are critical for maintaining trust.

- Strict financial reporting is mandatory.

EQT must meet stringent environmental rules. Air and water quality regulations require compliance, driving costs. Permit and license needs, especially land use rights in the Appalachian Basin, create further challenges.

| Aspect | Details | 2024 Data |

|---|---|---|

| Compliance Costs | Environmental, permitting | EPA rules could cost billions industry-wide. Land dispute costs rose 12%. |

| Regulatory Bodies | EPA, PHMSA, SEC | PHMSA's 2024 budget: $1.2B, SEC fines ~$1.5M average. |

| Operational Impact | Midstream, corporate governance | Pipeline safety: $100M+ penalties (2023), ~$500M CAPEX (midstream). |

Environmental factors

Methane emissions from natural gas operations pose a major environmental challenge, intensifying climate change. EQT is actively monitoring and working to decrease its methane emissions intensity, driven by regulations and stakeholder demands. In 2023, EQT reported a methane emissions intensity of 0.05%.

EQT's hydraulic fracturing operations significantly use water, a key environmental factor. The company focuses on water recycling to reduce its freshwater use. EQT invests in water infrastructure, with around 80% of water being recycled in 2024. This strategy addresses water availability and quality concerns.

Natural gas operations can disturb land, affecting ecosystems and wildlife. EQT's land management, well pad design, and restoration efforts matter. In 2024, EQT invested in habitat protection. These factors influence both operations and public opinion. The company aims to minimize environmental impact.

Waste Management and Disposal

EQT faces environmental challenges in managing waste from drilling and production. Responsible waste disposal, like produced water and drilling fluids, is vital for regulatory compliance. In 2023, the U.S. oil and gas industry generated approximately 30 billion barrels of produced water. Proper waste management reduces environmental impact and liability. EQT must prioritize sustainable practices to mitigate risks.

- Compliance with federal and state regulations is essential to avoid penalties.

- Investing in advanced waste treatment technologies can reduce environmental footprint.

- Exploring beneficial reuse options for produced water can create additional value.

- Transparency in waste management practices builds stakeholder trust.

Environmental Stewardship and Reporting

EQT's dedication to environmental stewardship, including its environmental performance reporting, is a key environmental factor. Transparency and advancements in environmental objectives impact EQT's standing and stakeholder relations. In 2024, EQT's ESG report highlighted significant reductions in methane emissions. This reporting is crucial for investor confidence and regulatory compliance.

- EQT's 2024 ESG report demonstrated a 20% reduction in methane emissions.

- Transparency builds trust with investors and regulators.

- Ongoing improvements support long-term sustainability goals.

EQT addresses methane emissions and their climate impact. Their focus on water recycling, with around 80% in 2024, demonstrates responsible water management. The company also manages waste responsibly to reduce its environmental footprint and build stakeholder trust.

| Environmental Aspect | EQT's Actions | Impact & Data |

|---|---|---|

| Methane Emissions | Monitoring, reduction initiatives | 0.05% methane emissions intensity (2023), 20% reduction in 2024. |

| Water Usage | Water recycling & infrastructure investment | 80% water recycled (2024). |

| Waste Management | Responsible disposal, treatment | U.S. oil & gas industry generated ~30B barrels of produced water (2023). |

PESTLE Analysis Data Sources

EQT's PESTLE uses data from government agencies, financial reports, industry publications & legal frameworks.