EQT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT Bundle

What is included in the product

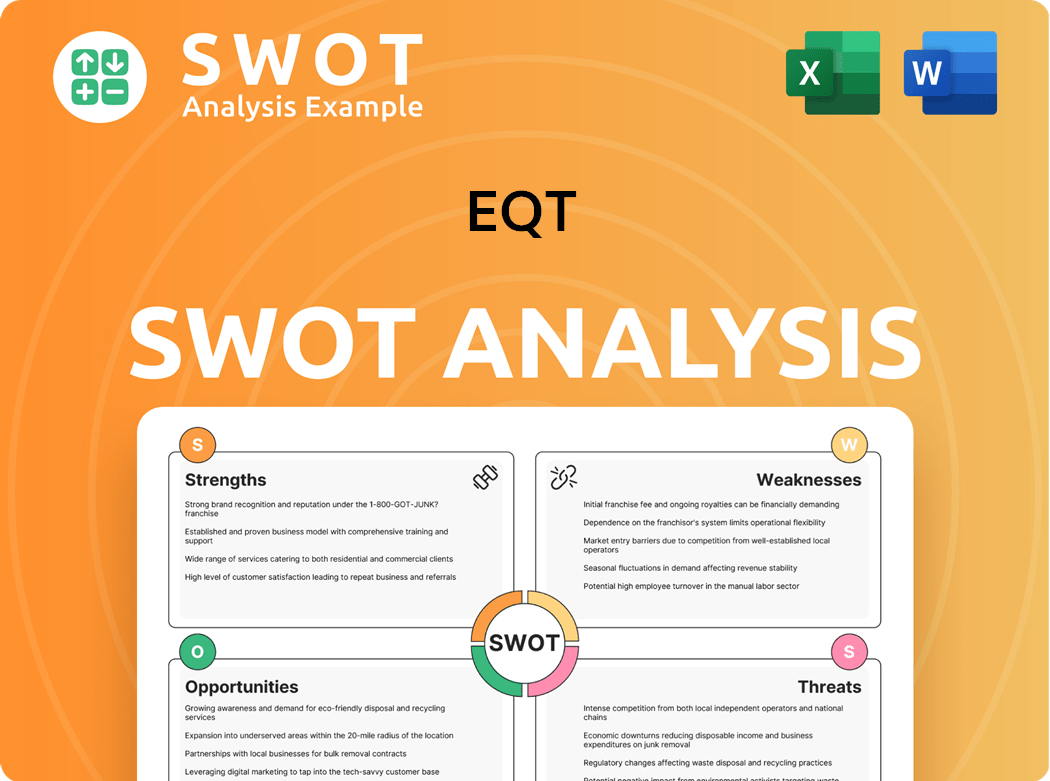

Analyzes EQT’s competitive position through key internal and external factors.

Provides clear visualization of EQT's strategic situation, boosting swift decision-making.

Same Document Delivered

EQT SWOT Analysis

The analysis below is a preview of the complete EQT SWOT document you'll receive. See the professional breakdown of Strengths, Weaknesses, Opportunities, and Threats. After purchase, you'll get this detailed report immediately. It's the same document, fully accessible!

SWOT Analysis Template

EQT's SWOT analysis reveals its strong position in global infrastructure development, but highlights risks from regulatory changes. Key strengths include robust project management and established market presence. Weaknesses point to potential vulnerabilities to commodity price fluctuations and financing complexities. Opportunities lie in sustainable energy projects and infrastructure investments, and threats involve intense competition and political instability.

Unlock the full SWOT report to get detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

EQT Corporation's status as the largest U.S. natural gas producer is a major strength. This leadership grants EQT economies of scale, which helps to reduce per-unit production costs. In 2024, EQT produced approximately 6.6 Bcf/d of natural gas. This scale boosts negotiating power with suppliers and customers.

Post-merger, EQT's integrated model merges upstream and midstream assets. This synergy enhances value chain control, potentially cutting costs. Streamlined operations also enable quicker responses to market shifts. In Q3 2024, EQT reported $1.4 billion in adjusted EBITDA, reflecting operational efficiencies.

EQT's low break-even point is a significant strength. This advantage stems from efficient operations and cost management. In 2024, EQT's break-even price per Mcf was notably competitive. This resilience allows EQT to maintain profitability during market downturns. This also gives EQT a competitive edge.

Operational Efficiency

EQT Corporation's status as the largest natural gas producer in the U.S. is a major strength. This scale provides operational efficiency through economies of scale, cutting per-unit costs. Its large production volume strengthens its negotiation position with suppliers and customers. In Q3 2023, EQT produced 570 Bcfe, demonstrating its substantial operational capacity.

- Largest Natural Gas Producer: 570 Bcfe produced in Q3 2023.

- Economies of Scale: Potential for reduced per-unit costs.

- Negotiating Power: Stronger position with suppliers and customers.

Commitment to Environmental Stewardship

EQT's commitment to environmental stewardship is a strength. The company is focused on reducing its environmental footprint. This includes lowering methane emissions and investing in renewable energy. EQT's efforts can enhance its reputation.

- EQT aims to achieve net-zero Scope 1 and 2 emissions by 2025.

- In 2023, EQT reduced its methane emissions intensity by 30%.

- EQT invested $20 million in carbon capture projects in 2024.

EQT, the largest U.S. natural gas producer, leverages substantial scale for efficiency. It benefits from an integrated model, cutting costs and improving value chain control. With a low break-even point, EQT shows resilience, even in downturns.

| Strength | Details | 2024 Data |

|---|---|---|

| Production Capacity | Largest U.S. producer, benefits from scale. | Approx. 6.6 Bcf/d production |

| Operational Efficiency | Integrated model reduces costs and boosts value chain control. | Adjusted EBITDA: $1.4B in Q3 2024. |

| Financial Resilience | Low break-even price provides profitability. | Competitive break-even cost/Mcf. |

Weaknesses

EQT's financial health is vulnerable to natural gas price swings, a key weakness. Price volatility can trigger production cuts and lower cash flow. In 2024, natural gas prices saw significant fluctuations, impacting EQT's earnings. This dependency on market unpredictability poses a substantial risk.

EQT's environmental impact, especially emissions and water quality, draws scrutiny. Stricter regulations could boost expenses and curb growth. Negative publicity from incidents can damage its image. For example, in 2024, EQT faced increased pressure to reduce methane emissions.

EQT faces a substantial debt burden, which could restrict its financial agility. High debt levels may hinder investments in expansion and shareholder returns. In Q3 2024, EQT's total debt was approximately $5.8 billion, a significant financial commitment. Managing this debt is a key operational challenge.

Dependence on the Appalachian Basin

EQT's financial health is closely tied to natural gas prices, which are notoriously unpredictable. The company's dependence on the Appalachian Basin means any price downturn can significantly affect its production and cash flow. This vulnerability stems from the volatile nature of the natural gas market, potentially leading to profit margin squeezes. In 2024, natural gas prices experienced fluctuations, highlighting this risk.

- 2024 natural gas price volatility impacted EQT's profitability.

- Production curtailments can result from price drops.

- EQT's cash flow is sensitive to market changes.

Operational Risks

EQT faces operational risks, especially regarding environmental impact. Scrutiny of well-site emissions and water quality is growing. Stricter regulations could increase costs and limit growth. Negative publicity from incidents can also damage EQT’s reputation. The EPA's methane rule could impact EQT.

- Environmental fines and compliance costs are increasing.

- Reputational damage from environmental incidents is a concern.

- Regulatory changes pose financial risks.

EQT struggles with fluctuating natural gas prices, affecting profits and production. Environmental concerns and related regulations escalate costs and potential reputational damage. High debt levels restrict financial flexibility, potentially impacting investments.

| Weakness | Impact | 2024 Data Point |

|---|---|---|

| Price Volatility | Production cuts; Lower Cash flow | ~10% price drop Q2 |

| Environmental Risks | Increased costs; Negative publicity | Methane rule impacts; Increased EPA scrutiny |

| High Debt | Limits expansion, shareholder returns | $5.8B debt in Q3 |

Opportunities

The global demand for liquefied natural gas (LNG) is rising, offering EQT a chance to broaden its market presence. Increased LNG exports could boost natural gas prices, positively impacting EQT's revenue. In 2024, global LNG demand is projected to increase by 5.8%, presenting EQT with a substantial opportunity. Strategic investment in export capabilities is crucial to capitalize on this trend.

The surge in AI is boosting energy needs, particularly favoring natural gas. AI infrastructure, including data centers, demands substantial electricity, often sourced from natural gas. EQT, as a natural gas supplier, is poised to capitalize on this trend. In 2024, natural gas consumption in the U.S. reached approximately 31 trillion cubic feet, driven partly by data center growth. This positions EQT for long-term expansion as AI adoption accelerates.

Technological advancements present significant opportunities for EQT. Innovations in drilling and completion technologies can boost operational efficiency and cut costs. These technologies also help minimize environmental impact, supporting sustainability. In 2024, EQT invested $150 million in technology upgrades. Embracing these advancements is key to maintaining a competitive edge.

Strategic Acquisitions

EQT can seize opportunities through strategic acquisitions, particularly in the growing LNG market. Global LNG demand is projected to increase, offering EQT a chance to broaden its market presence. Higher LNG exports can boost natural gas prices, enhancing EQT's financial performance. To capitalize, EQT needs strategic investments in infrastructure and export capabilities.

- In 2024, global LNG trade reached approximately 404 million metric tons.

- The US LNG exports hit a record high of 91.2 million metric tons in 2023.

- EQT's total revenue for 2023 was $6.18 billion.

Infrastructure Development

EQT is poised to capitalize on infrastructure development opportunities, particularly with the surge in AI. The increasing need for energy to support AI applications, like data centers, boosts natural gas demand, a sector EQT is heavily involved in. This positions EQT for sustained growth by meeting the energy needs of AI-driven infrastructure. In 2024, natural gas consumption in the US increased, reflecting this trend.

- Energy consumption for AI is projected to rise significantly.

- EQT's natural gas supply can meet this growing demand.

- This contributes to EQT's long-term growth prospects.

EQT can benefit from rising LNG demand and U.S. LNG exports, which hit a record high in 2023 of 91.2 million metric tons. This boosts natural gas prices and improves financial performance. Strategic acquisitions, particularly in LNG, support market expansion.

The increasing need for energy to support AI applications, such as data centers, boosts natural gas demand, which EQT can supply. Technological advancements can boost efficiency and reduce costs, supporting long-term growth prospects.

| Opportunity | Details | 2024 Data |

|---|---|---|

| LNG Market Growth | Increased global LNG demand; boosts revenue. | Global LNG trade approx. 404M metric tons |

| AI-Driven Demand | AI infrastructure, including data centers. | US natural gas consumption ~31T cubic feet |

| Technological Advancements | Efficiency gains in drilling and operations | EQT invested $150M in tech upgrades |

Threats

EQT faces potential threats from regulatory changes, especially those concerning fracking and emissions. Stricter rules could raise compliance expenses and restrict well development. For example, in 2024, the EPA finalized regulations on methane emissions. Adapting to these changes is crucial to avoid operational disruptions. Failure to comply could lead to penalties and operational limitations.

EQT faces intense competition in the natural gas market. Many companies compete for market share, potentially lowering prices and profits. In Q1 2024, EQT's average realized price was $2.33 per Mcf, reflecting competitive pricing. Cost efficiency and innovation are crucial for EQT to stay ahead.

Shifting energy policies, particularly the push for renewables, threaten natural gas demand. Government incentives favor solar and wind, potentially impacting EQT's competitiveness. Decarbonization mandates and reduced carbon emissions further challenge natural gas's role. EQT must adapt to these changes to ensure its long-term viability. Natural gas consumption in the U.S. decreased by approximately 2% in 2024 due to renewable energy growth.

Environmental Protests and Litigation

EQT faces threats from environmental protests and litigation, especially concerning fracking and methane emissions. Changes in environmental regulations, such as those proposed by the EPA, could increase compliance costs. Stricter rules might limit new well development, impacting production. Adapting to these regulatory shifts is crucial for risk mitigation.

- The EPA finalized rules in 2023 to reduce methane emissions from the oil and gas industry.

- Compliance costs could rise due to stricter environmental standards.

- Litigation related to environmental concerns could lead to financial penalties.

- EQT's ability to develop new wells might be restricted.

Economic Downturns

Economic downturns pose a significant threat to EQT. During economic slumps, demand for natural gas can decrease as industrial activity slows, impacting EQT's revenue. Price volatility, exacerbated by economic uncertainty, can further squeeze profit margins. EQT's financial performance is closely tied to broader economic trends, making it vulnerable. In 2023, natural gas prices experienced fluctuations, reflecting economic concerns.

- Demand sensitivity: Economic downturns can reduce natural gas demand.

- Price volatility: Economic uncertainty can lead to price fluctuations.

- Profitability: Economic downturns can squeeze profit margins.

- Market impact: EQT's performance is linked to economic trends.

Regulatory changes and environmental concerns pose risks. The EPA's 2023 methane rules and compliance costs affect operations. Economic downturns impact demand and pricing volatility, affecting profits.

| Threat | Impact | Example |

|---|---|---|

| Regulatory Changes | Increased Compliance Costs | EPA methane rules finalized in 2023. |

| Market Competition | Reduced Profit Margins | EQT's average realized price Q1 2024: $2.33/Mcf. |

| Economic Downturn | Decreased Demand | 2023-2024: natural gas price fluctuations. |

SWOT Analysis Data Sources

The EQT SWOT is fueled by trusted financial reports, market data, industry insights, and expert evaluations for reliable analysis.