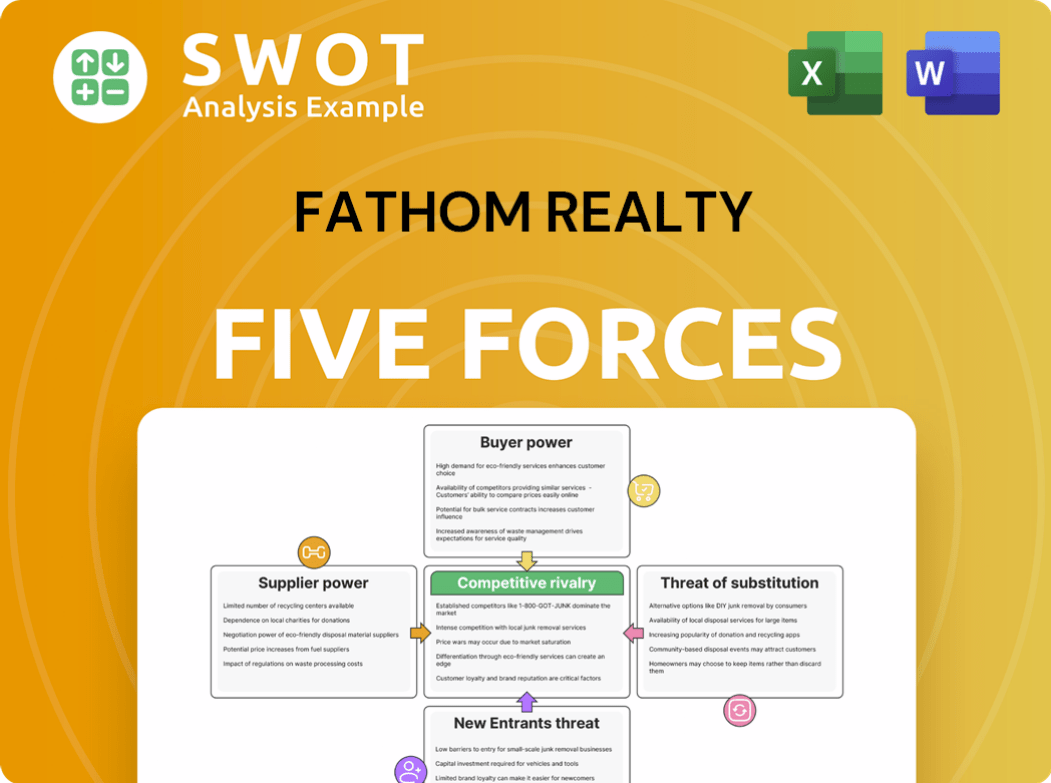

Fathom Realty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fathom Realty Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview the Actual Deliverable

Fathom Realty Porter's Five Forces Analysis

This preview provides the complete Fathom Realty Porter's Five Forces analysis. The document showcases the assessment of industry competition, potential threats, and market dynamics. It examines the bargaining power of suppliers and buyers, plus the threat of new entrants and substitutes. You'll get this exact document after purchase.

Porter's Five Forces Analysis Template

Fathom Realty operates within a dynamic real estate landscape, shaped by several competitive forces. Buyer power, driven by informed consumers, presents a significant challenge. The threat of new entrants, particularly tech-savvy disruptors, is also a key consideration. Strong supplier influence from MLS and other services adds pressure. The presence of substitute services, like FSBO, demands careful evaluation. Finally, competition among existing rivals is intense.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Fathom Realty.

Suppliers Bargaining Power

Fathom Realty depends on technology platform providers for its cloud-based services. These providers hold significant bargaining power due to their essential role. In 2024, the cloud computing market grew substantially. Companies like Amazon Web Services and Microsoft Azure dominate, influencing pricing and service terms. This concentration gives them leverage over Fathom Realty.

Fathom Realty's suppliers of marketing and training resources possess moderate bargaining power. They provide essential tools for agents, impacting operational efficiency. In 2024, companies spent an average of 5-10% of revenue on marketing and training. This spending level gives suppliers some leverage. However, Fathom's size and network somewhat offset this power.

Fathom Realty's model, offering agents benefits, could give insurance providers some bargaining power. This is because Fathom needs these providers to secure essential coverage. In 2024, the insurance industry saw a 7% increase in premiums, showing their ability to adjust costs. Therefore, providers might leverage their position to influence terms or pricing.

Lenders

Fathom Realty's ownership of Encompass Lending impacts supplier power. This internal lending arm gives Fathom more control over mortgage services. However, external lenders still exist, potentially offering competitive terms. The balance of power depends on Fathom's ability to leverage its internal services and negotiate with outside lenders.

- Encompass Lending provides in-house mortgage options, potentially reducing reliance on external lenders.

- External lenders can still exert power through competitive rates and services.

- Fathom's negotiation skills are key to managing supplier power in this area.

- Market conditions, such as interest rate fluctuations, can influence lender leverage.

Title Companies

Fathom Realty's ownership of Verus Title impacts supplier bargaining power. Title companies might have reduced leverage due to this vertical integration. This setup could potentially lower costs and increase control over the closing process. However, external title companies still exist, influencing the overall power dynamics. In 2024, the real estate market saw shifts, with title insurance premiums fluctuating based on market conditions and competition.

- Verus Title integration could limit title company power over Fathom.

- External title companies maintain some influence in the market.

- Title insurance premiums vary with market dynamics.

- Fathom aims to streamline processes and control costs.

Fathom Realty faces varied supplier bargaining power across different areas. Technology providers, like cloud service companies, hold significant sway, impacting pricing and service terms. Marketing and training suppliers have moderate power, influencing operational costs, with companies spending 5-10% of revenue on these services in 2024. The company's vertical integration, like ownership of Encompass Lending and Verus Title, aims to reduce external supplier power.

| Supplier Type | Bargaining Power | Factors Influencing Power |

|---|---|---|

| Cloud Providers | High | Market Concentration, Essential Services |

| Marketing/Training | Moderate | Spending Levels (5-10% of revenue in 2024), Network Size |

| Insurance Providers | Moderate | Essential coverage, Premium increases (7% in 2024) |

| Lenders/Title Cos. | Variable | Internal vs. External Services, Market Dynamics |

Customers Bargaining Power

Agents wield significant power as they select their brokerage, impacting Fathom Realty's market position. In 2024, approximately 10% of real estate agents switched brokerages annually, highlighting agent mobility. Fathom must offer competitive commission splits and support to attract and retain agents. The agent's ability to choose affects Fathom's profitability and market share.

Agents have the power to negotiate commission splits, directly impacting Fathom's revenue. In 2024, the average commission split at Fathom was around 80/20 in favor of the agent, showcasing agent leverage. This influences Fathom's profitability, as lower splits reduce income. The ability of agents to seek better terms with competitors further intensifies this pressure.

Agents expect Fathom to provide robust support, including marketing, technology, and training. High service demands increase costs, potentially squeezing profit margins. In 2024, Fathom's technology investments totaled $5 million, aiming to improve agent service. Satisfying these expectations is crucial for agent retention, directly impacting Fathom's revenue.

Mobility

The bargaining power of Fathom Realty's customers, including agents, is significantly high due to their mobility. Agents can readily move to other brokerages if they are unhappy with Fathom's terms, commissions, or support. This ease of switching puts pressure on Fathom to offer competitive packages. The real estate industry's low barriers to entry further amplify this power dynamic.

- Agent turnover rates in 2024 averaged around 15-20% annually, reflecting high mobility.

- National Association of Realtors (NAR) data indicates a highly fragmented market with numerous brokerage options.

- Fathom Realty's commission split structures are constantly benchmarked against competitors.

Negotiation Power

Fathom Realty's customers, primarily home buyers and sellers, wield significant bargaining power. Top-producing agents often have more leverage in negotiations, potentially influencing commission splits or service terms. This dynamic impacts profitability and service offerings, especially in competitive markets. The real estate market saw a 5.9% increase in existing home sales in 2024, indicating a robust environment where customer choices are critical.

- Agent experience significantly influences negotiation outcomes.

- Market conditions directly affect customer bargaining power.

- Commission structures are often subject to negotiation.

- Customer reviews and referrals impact agent selection.

Customer power, encompassing agents and clients, is high due to market dynamics. Agents influence terms, with turnovers around 15-20% in 2024. This pressures Fathom to offer competitive deals. The home sales increase of 5.9% in 2024 amplified client choices.

| Customer Segment | Bargaining Power | Impact on Fathom |

|---|---|---|

| Agents | High; mobility and competition | Influences commission splits & service demands |

| Home Buyers/Sellers | Moderate to High; market conditions and agent choice | Affects sales volume & service expectations |

| Market Condition 2024 | Robust: 5.9% Sales Growth | Increased customer choices |

Rivalry Among Competitors

The real estate brokerage market is fiercely competitive, with numerous players vying for market share. Fathom Realty faces rivals like RE/MAX and Keller Williams. In 2024, the top 10 real estate brokerages generated billions in revenue, highlighting the intense competition.

The real estate market faces low barriers to entry. New brokerages can start with relatively low capital, increasing competition. In 2024, over 86,000 real estate brokerages operated in the U.S. This intensifies rivalry among existing firms and the influx of new competitors. This dynamic puts pressure on pricing and service differentiation.

Fathom Realty faces competition from firms with diverse commission models. Traditional brokerages often charge 5-6% per sale. Discount brokerages may offer lower rates, like 1-3%. In 2024, the average real estate commission was about 5.1%, showing the competitive landscape.

Technology Adoption

Technology adoption is a key battleground in the real estate sector. Firms are heavily investing in tech to boost efficiency and customer experience. This includes AI-powered tools for property valuation and virtual tours. The competition to offer the best tech-driven services is fierce, impacting market share.

- Zillow’s revenue in 2023 was $4.7 billion, showing the impact of tech on the real estate market.

- Companies like Redfin continue to invest heavily in technology to differentiate themselves.

- The adoption of AI in real estate is projected to reach $1.5 billion by 2024.

Market Share

Fathom Realty faces intense competition for market share and agent recruitment. The real estate market is highly fragmented, with numerous brokerages vying for agents and clients. In 2024, the top 10 brokerages controlled approximately 30% of the market share, indicating significant rivalry.

- Brokerage size and resources impact agent attraction.

- Agent retention strategies are critical for market share.

- Technological advancements create competitive advantages.

- Local market dynamics intensify competition.

Fathom Realty competes in a cutthroat real estate market, battling against established and emerging brokerages. Low barriers to entry and commission structure variations increase rivalry. Tech adoption, with AI expected to hit $1.5B by 2024, is a key competitive area.

| Aspect | Details | Impact |

|---|---|---|

| Market Share Concentration | Top 10 brokerages held ~30% of the market in 2024 | Intense competition, agent recruitment battles |

| Technology Investment | AI in real estate projected at $1.5B by 2024 | Tech-driven services impact market share |

| Commission Rates | Average real estate commission ~5.1% in 2024 | Price and service differentiation |

SSubstitutes Threaten

Traditional, discount, and virtual brokerages all present viable alternatives. For example, in 2024, discount brokerages like Redfin and Compass captured a significant share of the market. Their lower fees and tech-driven approaches directly compete with traditional models. Virtual brokerages, such as eXp Realty, leverage technology to reduce overhead, offering another cost-effective option for both agents and clients. This diversification challenges the dominance of traditional firms.

DIY options pose a threat to Fathom Realty. Agents might bypass brokerages, increasing competition. In 2024, around 10% of agents considered independent operations. Reduced brokerage fees are a major draw. This shift impacts Fathom's revenue and market share.

The threat of substitute technology solutions looms over Fathom Realty. Agents could opt for independent tech platforms, potentially reducing their reliance on Fathom's integrated services. In 2024, the real estate tech market saw significant growth, with investments reaching billions. This shift increases the risk of agents switching to competitors.

Referral Networks

The threat of substitutes in Fathom Realty's referral networks is moderate. Agents might bypass the brokerage by leveraging their personal networks. This could reduce Fathom's transaction volume. Consider that, in 2024, approximately 15% of real estate transactions involved referrals.

- Personal networks can offer similar services.

- Referrals may bypass brokerage fees.

- Network strength varies among agents.

- Fathom must foster agent loyalty.

Flat-Fee MLS Services

The threat of substitutes in Fathom Realty's market includes flat-fee MLS services. These services allow agents to list properties on the MLS for a fixed fee, potentially undercutting Fathom's commission-based model. This shift can pressure Fathom to lower its fees or offer more value to retain agents. In 2024, the flat-fee MLS market is estimated to be around $500 million, reflecting its growing popularity.

- Market size: The flat-fee MLS market reached approximately $500 million in 2024.

- Agent behavior: Agents are increasingly considering flat-fee options to save on costs.

- Competitive pressure: Fathom Realty faces pressure to remain competitive on pricing.

- Value proposition: Fathom must provide superior services to justify its fees.

Various substitutes challenge Fathom Realty. Discount and virtual brokerages, like Redfin and eXp Realty, offer lower-cost alternatives. DIY options and tech platforms also pose threats. Additionally, personal networks and flat-fee MLS services create competition, affecting market share.

| Substitute | Description | Impact on Fathom |

|---|---|---|

| Discount Brokers | Lower fees, tech-driven | Reduced revenue |

| DIY Options | Agents operate independently | Loss of agents |

| Tech Platforms | Agent-owned tech solutions | Decreased reliance |

Entrants Threaten

The real estate brokerage industry generally has low barriers to entry, making it easier for new firms to emerge. Start-up costs are relatively modest, primarily involving office space, licensing, and marketing. According to the National Association of Realtors, the number of real estate agents in the U.S. has fluctuated, with approximately 1.6 million members as of 2024.

New entrants in the real estate market can utilize technology to gain a competitive edge. For example, in 2024, companies like Zillow and Redfin continue to innovate, offering virtual tours and AI-driven property valuation tools. These advancements lower the barriers to entry, allowing new players to quickly establish themselves. This technological disruption intensifies competition, potentially squeezing profit margins for traditional real estate firms.

New entrants in the real estate market encounter significant scalability hurdles. Recruiting and training a large network of agents is time-consuming and costly. Fathom Realty, for instance, had approximately 9,000 agents by late 2024, demonstrating the scale needed.

Brand Recognition

Brand recognition poses a significant barrier for new entrants in the real estate market. Established brands like Fathom Realty benefit from existing customer loyalty and trust, making it harder for newcomers to gain traction. Competing with a well-known brand requires substantial investment in marketing and building brand awareness. According to a 2024 study, brand recognition significantly influences consumer choice in real estate, with recognized brands capturing a larger market share.

- Customer loyalty is crucial for established brands.

- New entrants face high marketing costs.

- Brand recognition is a key competitive advantage.

- Established brands have a clear edge.

Regulatory Compliance

Regulatory compliance poses a significant barrier for new entrants into the real estate market. New companies must navigate complex real estate regulations, which vary by location. These regulations often involve licensing, property disclosures, and adherence to fair housing laws. The costs associated with compliance, including legal fees and training, can be substantial.

- Real estate regulations vary significantly by state and locality, adding complexity for new entrants.

- Compliance costs, including legal fees and training, can be substantial.

- Failure to comply can result in significant penalties.

- Staying current with changing regulations requires ongoing investment.

The real estate market sees fluctuating barriers to entry, influenced by technology and brand recognition. Low initial costs and tech-driven tools can ease entry, yet scalability and brand building pose significant challenges. Regulatory compliance adds to the complexity and costs for new firms.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Technology | Lowers Entry Barriers | Zillow, Redfin continue innovation |

| Scalability | High Hurdles | Fathom Realty ~9,000 agents |

| Brand Recognition | Key Competitive Advantage | Influences market share |

Porter's Five Forces Analysis Data Sources

This Porter's analysis leverages company reports, market research, and competitor analyses.