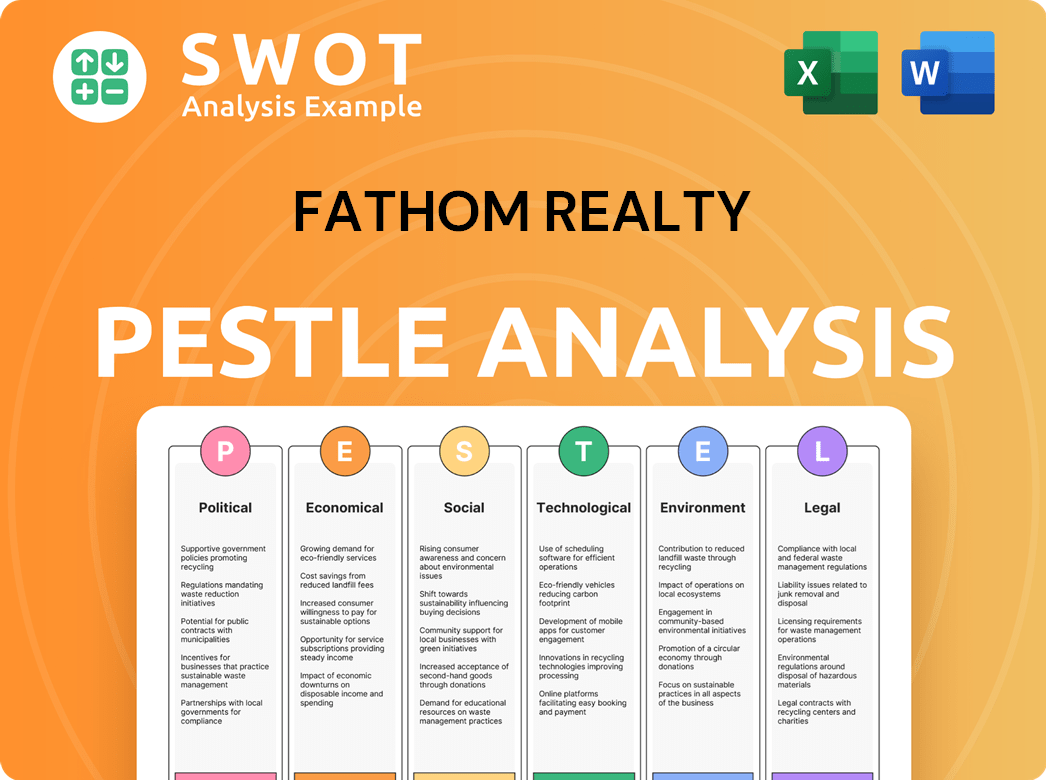

Fathom Realty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fathom Realty Bundle

What is included in the product

The analysis assesses how external factors impact Fathom Realty across Political, Economic, etc. dimensions.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Fathom Realty PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment.

This is a thorough Fathom Realty PESTLE Analysis. It covers the Political, Economic, Social, Technological, Legal, and Environmental factors. Gain a comprehensive view to make informed decisions. This complete document is yours to use right after purchase.

PESTLE Analysis Template

Navigate Fathom Realty's external landscape with precision.

Our PESTLE Analysis unveils critical political, economic, social, technological, legal, and environmental factors shaping its trajectory.

Understand how these forces influence operations, market positioning, and future opportunities.

From regulatory shifts to technological disruptions, we break down the external world.

Gain a strategic edge: download the full analysis for actionable insights to guide your business strategy!

Political factors

Government housing policies at federal and state levels heavily influence the real estate market. For instance, initiatives like the First-Time Homebuyer Tax Credit, which provided up to $8,000, can boost demand. Changes in zoning regulations impact land availability and development costs. In 2024, the National Association of Realtors reported a 5.7% increase in existing home sales due to government support.

Political stability and upcoming elections significantly shape the real estate market. Policy shifts from new administrations, like changes to housing regulations or tax incentives, directly impact investor confidence. For example, in 2024, shifts in interest rate policies influenced housing affordability. Consumer behavior and investment decisions are also influenced by economic stimulus measures.

Changes in property taxes, such as those seen in California with Proposition 13, can significantly affect property values and investment decisions. Capital gains taxes, which in 2024 can reach up to 20% for higher earners, also influence the profitability of real estate sales. Tax incentives, like the federal tax credit for first-time homebuyers (though not currently active), can stimulate market activity. Fathom Realty must adapt to these tax policy shifts to maintain agent competitiveness and profitability.

Regulation of the Real Estate Industry

Government bodies oversee real estate licensing, agent behavior, and brokerage activities. Changes in regulations concerning agent qualifications, consumer protection, or business practices would necessitate adjustments to Fathom Realty's operations and compliance. For example, the National Association of Realtors reported in 2024 that 1.56 million members were under regulatory bodies. Any shifts in these regulatory frameworks could influence Fathom Realty's operational costs and market access.

- Compliance costs are expected to increase by 5-7% annually due to stricter regulatory requirements.

- Changes in fair housing laws could impact property valuation and sales strategies.

- Increased scrutiny of agent conduct might lead to more disciplinary actions and legal challenges.

- New data privacy regulations could affect how Fathom Realty collects and uses customer information.

International Relations and Trade Policies

International relations and trade policies indirectly affect Fathom Realty by influencing foreign investment, economic growth, and migration. For instance, in 2024, foreign direct investment in US real estate totaled $38.3 billion, a 15% increase. Trade agreements can spur economic activity, boosting demand in specific markets. Shifts in migration patterns, influenced by global events and policies, affect property demand.

- Foreign investment in US real estate reached $38.3 billion in 2024.

- Trade agreements can increase economic activity.

- Migration patterns affect property demand.

Political factors significantly shape Fathom Realty's performance through policy, regulation, and international relations.

Government initiatives, like tax credits, can stimulate demand, while changes to interest rate policies can impact affordability.

Regulatory compliance costs are expected to increase, potentially affecting operational costs.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Housing Policies | Influences demand & affordability | Existing home sales up 5.7% |

| Tax Changes | Affects property values & investments | Capital gains tax up to 20% |

| Regulations | Affects operations and compliance | 1.56M NAR members regulated |

Economic factors

Interest rate changes, especially mortgage rates, directly affect housing affordability and demand. Higher rates may cool the market, while lower rates can boost it. In 2024, the Federal Reserve's actions significantly impacted mortgage rates. Fathom Realty's agent commissions and transaction volumes are sensitive to these shifts. For example, a 1% change in rates can affect buying power substantially.

Overall economic growth and stability significantly impact the real estate market. Strong GDP growth and low unemployment, like the 3.9% rate in April 2024, boost housing demand. Conversely, economic downturns, such as the potential slowdown predicted in late 2024, could reduce activity. Consumer confidence levels, which influence purchasing decisions, are crucial; data from early 2024 showed fluctuating confidence, reflecting market uncertainty. The Federal Reserve's monetary policy, including interest rate adjustments, plays a pivotal role in shaping economic conditions and the housing market's performance.

Inflation significantly influences housing costs, diminishing purchasing power and home affordability. In early 2024, housing prices continued to rise, with the national median home price around $380,000. This trend, combined with inflation, poses challenges for prospective homebuyers, potentially decreasing transaction volumes for real estate brokerages. The Federal Reserve's monetary policies, including interest rate adjustments, continue to affect the housing market's dynamics into 2025.

Housing Supply and Demand

The housing market is significantly influenced by the relationship between supply and demand. A scarcity of homes for sale or shifts in buyer demand due to demographic shifts or economic changes directly affect property pricing and market competition. For example, in early 2024, the U.S. housing inventory was still below pre-pandemic levels, leading to higher prices in many areas. This imbalance is crucial for Fathom Realty's strategic planning.

- U.S. housing inventory in Q1 2024 was approximately 10% below the levels seen in Q1 2020, before the pandemic.

- The median home price in the U.S. in March 2024 was around $393,500, reflecting ongoing supply constraints.

- Interest rate fluctuations in 2024 continue to affect buyer demand and housing affordability.

Income Levels and Wage Growth

Household income and wage growth are crucial for housing affordability, directly affecting Fathom Realty's market. Rising incomes can boost demand, as more potential buyers enter the market. Stagnant wages can restrict growth, impacting sales and property values. Recent data shows that average hourly earnings rose 4.1% year-over-year in March 2024, indicating some wage growth.

- March 2024: Average hourly earnings increased by 4.1%.

- Higher incomes generally lead to increased housing demand.

- Wage stagnation can limit market expansion for Fathom Realty.

Economic conditions, particularly interest rates, shape Fathom Realty's performance, affecting housing affordability. Inflation and its impact on home prices are key challenges for potential buyers, with median home prices fluctuating throughout 2024. Income and wage growth play crucial roles, directly impacting demand and Fathom Realty's market dynamics.

| Factor | Impact on Fathom Realty | Data (2024) |

|---|---|---|

| Interest Rates | Affects buying power and demand | Mortgage rates influence transaction volumes. |

| Inflation | Impacts affordability; affects home prices | Median home price around $393,500 in March 2024. |

| Income/Wage Growth | Drives demand, influences sales. | Average hourly earnings increased by 4.1% in March. |

Sociological factors

Shifts in population size, age, and household formation directly impact housing demand. For instance, the U.S. population grew by 0.5% in 2023, with significant regional variations. Areas seeing growth, like the Sun Belt, may boost Fathom Realty's business. Conversely, declining birth rates and an aging population could influence the demand for specific housing types, such as single-family homes versus senior living.

Lifestyle changes significantly impact housing preferences, particularly with the rise of remote work. This shift is evident in the increasing demand for properties outside of major urban centers. According to a 2024 study, 30% of the workforce now works remotely at least part-time. This trend influences the types of properties Fathom Realty agents handle, with a growing focus on suburban and rural listings.

Cultural emphasis on homeownership strongly impacts market dynamics, influencing demand and participation rates. In 2024, approximately 65.9% of Americans own their homes. Societal values and shifting perceptions, such as the rising popularity of renting among millennials, can significantly alter buyer behavior. Economic barriers, including high housing costs and interest rates, also affect homeownership aspirations, potentially decreasing demand in the near future.

Consumer Behavior and Expectations

Modern consumers, especially younger individuals, are reshaping the real estate landscape with their preferences for digital tools and personalized experiences. Fathom Realty's tech-focused approach aligns with these shifts, providing online platforms and tailored services. The National Association of Realtors (NAR) indicates that over 90% of homebuyers now use online resources during their search. This statistic emphasizes the importance of digital integration in real estate.

- Digital Tools: Over 90% of homebuyers use online resources.

- Personalization: Consumers seek tailored experiences.

- Fathom's Strategy: Tech-driven model meets evolving demands.

Community Development and Urbanization Trends

Community development and urbanization trends significantly influence real estate markets. Urbanization, suburban expansion, and neighborhood revitalization directly affect property values and market activities. Agents must understand these sociological shifts to advise clients effectively. For example, in 2024, urban population growth in the U.S. continues to rise, with a projected increase of 0.7% annually.

- Urbanization drives demand, especially in tech hubs and cultural centers.

- Suburban growth shows shifts due to remote work and affordability.

- Revitalization projects can boost property values but also cause displacement.

- Agents should monitor local government plans for future growth.

Sociological factors critically shape housing market dynamics for Fathom Realty.

Population shifts like the 0.5% U.S. growth in 2023 and remote work trends significantly impact demand.

Consumer preferences, from digital tool use to homeownership rates (65.9% in 2024), require strategic adaptation.

| Factor | Impact on Fathom Realty | 2024 Data |

|---|---|---|

| Demographics | Demand in specific areas/types | U.S. pop growth 0.5% |

| Lifestyle | Focus on suburban/rural listings | 30% work remotely part-time |

| Cultural | Buyer behavior/market participation | 65.9% homeownership rate |

Technological factors

Fathom Realty's cloud platform is key. It supports agents and data management. A robust platform boosts productivity. In 2024, cloud spending hit $670B globally. Platform reliability is crucial for client services.

Fathom Realty leverages technology for digital marketing. This includes online listings and virtual tours. Social media promotion is also key. In 2024, digital ad spending in real estate was about $19 billion. Fathom's tech helps agents connect with clients.

Data analytics and AI are crucial for Fathom Realty's market analysis, lead generation, and client experiences. Their tech platform can use these to offer agents valuable insights. The global AI in real estate market is projected to reach $1.9 billion by 2024, showing significant growth. This will help Fathom enhance agent effectiveness.

Communication and Collaboration Tools

Communication and collaboration tools are pivotal for Fathom Realty. Technology streamlines interactions between agents, clients, and stakeholders. Efficient tools ensure smooth transaction management and document sharing. In 2024, the average real estate transaction used at least 3 digital communication platforms. The use of collaborative platforms increased by 20% in the real estate sector in Q1 2024.

- Digital communication is now standard.

- Transaction management software adoption is up.

- Document sharing is cloud-based.

- Client portals are essential.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical for Fathom Realty, a tech-focused company. This involves protecting client data and complying with regulations. In 2024, the global cybersecurity market was valued at $200 billion, with an expected rise to $300 billion by 2025. Breaches can cost millions.

- Global cybersecurity market forecast to reach $300 billion by 2025.

- Data breaches cost companies an average of $4.45 million in 2023.

- Investment in cybersecurity is crucial for maintaining client trust.

Fathom Realty’s tech-driven operations rely on several key factors. Digital communication, crucial for client interaction, has seen transaction software adoption increase. Cybersecurity is vital, given the escalating cost of data breaches. Cloud computing and AI, set to reach $3.45 billion in real estate by the end of 2024, greatly support operations.

| Technological Factor | Impact on Fathom Realty | 2024 Data Point |

|---|---|---|

| Cloud Platform | Supports agents and data management, boosts productivity. | $670B global cloud spending. |

| Digital Marketing | Helps agents connect with clients via online listings. | $19B digital ad spending in real estate. |

| Data Analytics and AI | Enhances market analysis, lead generation. | $1.9B global AI in real estate market. |

Legal factors

Recent legal actions challenge traditional real estate commission structures. Fathom Realty, operating a flat-fee model, must adapt to these changes. The company settled one lawsuit, reflecting the evolving legal landscape. 2024-2025 data shows increased scrutiny of commission practices, impacting brokerage models. Compliance with new rules is crucial for Fathom's operations.

Fathom Realty must comply with fair housing laws. These laws, like the Fair Housing Act, prohibit discrimination in housing based on protected characteristics. Increased enforcement, as seen with recent HUD actions, demands ongoing agent training. For example, in 2024, HUD settled over 4,000 housing discrimination cases, highlighting the importance of compliance.

Fathom Realty must comply with state and local licensing laws, which vary by location. Agents need to meet specific education and exam requirements before obtaining licenses. The National Association of REALTORS® reported over 1.5 million members in 2024. Agent conduct is strictly regulated to protect consumers and maintain industry integrity.

Contract Law and Real Estate Transactions

Real estate transactions are heavily reliant on contract law, and any shifts in these laws can significantly affect how agents and agencies operate. For example, updates in disclosure regulations or inspection requirements can lead to compliance challenges. In 2024, the National Association of Realtors reported a 15% increase in legal disputes related to non-disclosure issues. Agents must stay informed about these legal changes to mitigate risks.

- 2024: 15% increase in legal disputes related to non-disclosure.

- Compliance with evolving disclosure regulations is crucial.

- Agents must be updated on inspection rules to avoid legal issues.

Property Laws and Zoning Regulations

Property laws and zoning regulations are critical legal factors for Fathom Realty. These laws dictate property ownership, land use, and what can be built where. Agents must understand these rules to guide clients effectively. For example, in 2024, zoning changes in major US cities led to shifts in property values.

- Land use regulations influence development possibilities.

- Zoning laws impact property types and values.

- Agents need current knowledge for client advice.

- Compliance is essential to avoid legal issues.

Fathom Realty faces legal challenges from evolving commission structures and requires compliance with anti-discrimination laws, exemplified by over 4,000 HUD cases settled in 2024. Contract and property law changes impact agent practices, with non-disclosure disputes up 15% in 2024. Understanding zoning is key.

| Legal Aspect | Impact on Fathom | 2024/2025 Data |

|---|---|---|

| Commission Structures | Adapt flat-fee models to comply with new rules. | Ongoing litigation and settlements; industry shifts. |

| Fair Housing Laws | Agent training essential to avoid discrimination. | Over 4,000 HUD cases settled in 2024, and high fines. |

| Licensing Laws | Comply with varying state and local rules. | 1.5M+ NAR members in 2024; rigorous enforcement. |

Environmental factors

Climate change is significantly impacting property. The rise in extreme weather events, like hurricanes and floods, is increasing property damage and insurance costs. For example, in 2024, the National Oceanic and Atmospheric Administration (NOAA) reported over 20 billion-dollar weather disasters. This leads to shifts in buyer preferences, with demand dropping in high-risk areas.

Growing environmental awareness boosts demand for energy-efficient homes. Regulations and incentives affect construction and renovation. In 2024, green building projects grew, with LEED certifications up 15%. Tax credits for energy-efficient upgrades are rising. This shapes buyer preferences and investment in sustainable features.

Environmental regulations influence real estate, particularly hazardous materials, land contamination, and protected areas. Agents must adhere to disclosure rules concerning environmental issues. The U.S. EPA reported over 1,300 Superfund sites in 2024, impacting property values. Compliance costs can reach millions, affecting development feasibility. Proper disclosures protect all parties involved.

Sustainability in Real Estate Development

The real estate sector is increasingly prioritizing sustainability. This shift impacts new property types, driven by the rising demand for eco-friendly homes. Sustainable materials and practices are becoming standard. For instance, in 2024, green building projects saw a 15% increase in investment.

- Green building market expected to reach $814 billion by 2025.

- Demand for sustainable homes increased by 20% in 2024.

- LEED-certified projects grew by 12% in 2024.

Natural Disaster Risks and Insurance Costs

Fathom Realty must consider natural disaster risks as they directly impact property values and insurance costs. Properties in high-risk zones, such as those prone to hurricanes or wildfires, often see decreased buyer interest and higher insurance premiums. For instance, in 2024, the average homeowner's insurance premium rose by 20% due to increased disaster frequency. Agents need to be well-versed in regional environmental risks to advise clients effectively.

- US homeowners' insurance premiums rose 20% in 2024.

- Properties in disaster-prone areas may face lower valuations.

- Agents must disclose environmental risks to buyers.

Environmental factors significantly influence Fathom Realty. Climate change and extreme weather raise property risks and insurance costs; the US homeowners' insurance premiums rose by 20% in 2024. Growing environmental awareness boosts demand for green homes and sustainable features.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Climate Change | Increased property damage | Over 20 billion-dollar weather disasters (NOAA) |

| Sustainability | Demand for energy-efficient homes rises | Green building projects up 15% |

| Regulations | Influence development and disclosure rules | 1,300+ EPA Superfund sites |

PESTLE Analysis Data Sources

Our Fathom Realty PESTLE draws from official governmental reports, industry analyses, and economic forecasts for accurate insights.