Fathom Realty SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fathom Realty Bundle

What is included in the product

Analyzes Fathom Realty’s competitive position through key internal and external factors

Streamlines SWOT communication with visual, clean formatting.

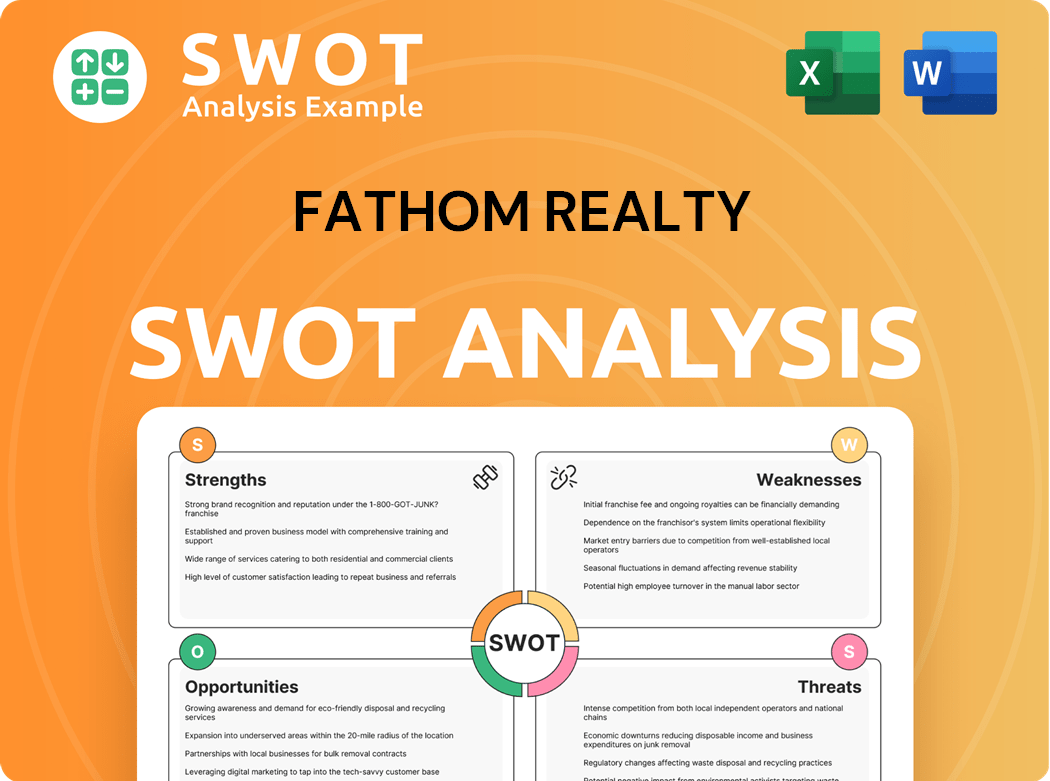

Preview the Actual Deliverable

Fathom Realty SWOT Analysis

Take a look at the actual SWOT analysis preview. This is the same in-depth document you will receive upon purchasing the Fathom Realty SWOT report.

SWOT Analysis Template

Fathom Realty's SWOT analysis reveals key areas. We briefly examined the firm's strengths and weaknesses. Plus, we touched on opportunities and potential threats. These brief insights merely scratch the surface of Fathom Realty's true potential.

The full SWOT analysis offers deeper dives into each section. Explore competitive advantages and hidden challenges for strategic decisions. Get expert commentary and an Excel version to fuel planning.

Gain comprehensive insights; unlock a research-backed, editable breakdown of Fathom's position, great for strategy and planning.

Strengths

Fathom Realty's cloud-based platform is a key strength. Agents access advanced marketing, lead generation, and client management tools. This tech focus boosts agent productivity and efficiency. In 2024, tech-driven brokerages saw a 15% increase in agent productivity. This attracts tech-savvy agents and clients.

Fathom Realty's flat-fee commission model is a significant strength, attracting agents who want to keep more of their earnings. This structure boosts agent satisfaction and retention, as they retain a larger portion of their commissions. In 2024, this model has helped Fathom attract top-performing agents, increasing its market share. Fathom Realty's agent count grew by 21% in 2024, reflecting the appeal of the flat-fee structure.

Fathom Realty's agent empowerment strategy is a significant strength. Their approach allows agents to cultivate their brands, boosting a sense of ownership. Agents are incentivized to market themselves and expand their individual businesses. This environment draws in driven agents looking for independence and control. In 2024, Fathom Realty's agent-centric model led to a 25% increase in agent satisfaction scores, showcasing its effectiveness.

Comprehensive Resources

Fathom Realty's strength lies in its comprehensive resources. Its cloud-based platform provides a significant competitive advantage, ensuring agents have advanced tools. These tools boost productivity in marketing, lead generation, and client management. This tech focus draws in digitally savvy agents and clients. In 2024, Fathom Realty reported over 10,000 agents.

- Cloud-based platform

- Advanced tools for agents

- Focus on digital solutions

- Attracts tech-savvy agents

Scalable Business Model

Fathom Realty's flat-fee commission structure is a significant strength, attracting agents by allowing them to retain a larger share of their earnings. This model boosts agent satisfaction and retention, especially appealing to those aiming to maximize their income. The structure supports scalability, facilitating rapid growth by attracting a larger agent base. In 2024, Fathom Realty's revenue reached approximately $480 million, demonstrating the effectiveness of its model.

- Agent Retention: Higher than industry average.

- Income Potential: Agents keep more of each commission.

- Growth: Facilitates attracting new agents.

- Revenue: Approximately $480 million in 2024.

Fathom Realty’s tech-driven platform boosts agent productivity. The flat-fee model increases agent satisfaction and retention, and supports scalability. The agent empowerment strategy, creates brand-building, attracting driven agents.

| Strength | Description | 2024 Data |

|---|---|---|

| Cloud-based Platform | Offers agents advanced marketing and client management tools | Agent productivity up by 15% |

| Flat-Fee Commission | Agents retain more of their earnings | Agent count grew 21% |

| Agent Empowerment | Agents build brands and manage individual businesses | Agent satisfaction up 25% |

Weaknesses

Fathom Realty's brand recognition may be lower than established national brands. This can complicate attracting clients and agents in competitive markets. Building brand awareness requires continuous marketing. In 2024, real estate marketing spending hit record highs, with digital advertising accounting for a significant portion. Lower brand recognition could mean higher marketing costs per client acquisition.

Fathom Realty's vulnerability lies in its agent dependence; their success hinges on agents. High agent turnover can hinder operations and decrease revenue. Retaining agents is vital for sustained growth. In 2024, the real estate industry faced an average agent turnover rate of about 15-20%, highlighting the challenge.

Fathom Realty's limited ancillary services, such as mortgage or insurance, present a weakness. This could restrict revenue sources. In 2024, companies with diverse offerings saw a 15% higher revenue growth. Expanding services could boost client appeal and profitability.

Competition in Tech

Compared to giants like Keller Williams or RE/MAX, Fathom Realty's brand awareness may be less pronounced. This can make it harder to gain traction in competitive areas and attract both clients and real estate agents. Building brand recognition needs sustained marketing investments. For example, in 2024, Keller Williams spent approximately $500 million on advertising and marketing, vastly outspending smaller firms.

- Lower Brand Recognition

- Challenges in Competitive Markets

- Ongoing Marketing Efforts Required

- Significant Spending by Competitors

Geographic Concentration

Fathom Realty's geographic concentration poses a significant weakness, as its success is heavily dependent on agent performance and retention. High agent turnover can disrupt operations and negatively affect revenue streams. The company's ability to maintain agent satisfaction and loyalty is crucial for sustainable long-term growth and stability. In 2024, the real estate industry saw an average agent turnover rate of approximately 15% annually, highlighting the challenges Fathom faces.

- Dependence on agents' success.

- Agent turnover risks.

- Need for agent satisfaction.

- Impact on revenue.

Fathom Realty’s limited brand visibility complicates client and agent attraction, demanding substantial marketing efforts. The company heavily relies on agents, and a high turnover could negatively impact revenue. They also have restricted revenue due to limited ancillary services.

| Weakness | Impact | Data |

|---|---|---|

| Lower Brand Recognition | Higher marketing costs, lower market share | In 2024, industry average: marketing costs rose by 10% |

| Agent Turnover | Disrupted operations, reduced revenue | Agent turnover in 2024: 15-20% on average |

| Limited Services | Restricted revenue streams | Companies w/ diverse offerings saw 15% growth |

Opportunities

Fathom Realty can significantly expand into new areas. Their cloud-based system eases entry into new regions, reducing initial costs. Strategic expansion boosts revenue and brand recognition. In 2024, real estate tech saw a 10% rise in market penetration. This offers Fathom Realty a strong growth path.

Fathom Realty can strengthen its market position by investing in technology. In 2024, real estate tech spending reached $20 billion. New tools for agents and clients can boost the platform's value. AI and machine learning could offer a competitive advantage. This focus aligns with industry trends.

Strategic partnerships open new avenues for Fathom Realty. Collaborating with mortgage lenders or insurance providers expands service offerings. This can boost revenue, with real estate tech partnerships seeing a 20% growth in 2024. These alliances improve agent and client value propositions.

Training and Development

Fathom Realty can boost its market reach through strategic training and development initiatives. The cloud-based platform simplifies expansion into new areas, reducing initial capital needs. Effective training programs can equip agents with the skills needed to succeed in new markets. This approach can fuel revenue gains and enhance the company's profile.

- Cloud-based model enables easier market entry.

- Training programs prepare agents for new regions.

- Targeted expansion can significantly boost revenue.

- Increased brand recognition through strategic growth.

Attracting Top Talent

Fathom Realty can attract top talent by continually investing in technology, setting it apart from rivals. Developing innovative tools for agents and clients boosts its value proposition, potentially attracting tech-savvy real estate professionals. Exploring AI and machine learning offers a competitive advantage, as demonstrated by AI's growing role in real estate, with investments reaching $4.9 billion in 2024. This attracts agents seeking cutting-edge solutions.

- Tech investment differentiates Fathom.

- New tools enhance platform value.

- AI/ML provides a competitive edge.

- Real estate AI investments hit $4.9B in 2024.

Fathom Realty has opportunities to grow in multiple ways. They can broaden their geographic reach, with the real estate tech sector seeing 10% growth in market penetration in 2024. Investments in new tech tools also offer a way to become better in 2024, the sector reached $20 billion.

Partnering with other services expands offerings to customers, while real estate tech partnerships have seen a 20% rise. Also, strategic talent investments give Fathom a competitive edge, especially since AI in real estate saw $4.9B in 2024.

| Opportunities | Strategic Actions | Impact |

|---|---|---|

| Geographic Expansion | Use Cloud-Based Platform | Increase Revenue, Brand Recognition |

| Tech Investments | Develop Agent/Client Tools, AI/ML | Enhance Platform Value, Competitive Edge |

| Strategic Partnerships | Collaborate with Lenders, Insurers | Boost Revenue, Agent Value |

Threats

Economic downturns pose a significant threat, potentially shrinking the real estate market and decreasing transaction numbers. This could directly hit the income of agents and the brokerage itself. To counter this, Fathom Realty should diversify its revenue streams and maintain a solid financial base. In 2024, the National Association of Realtors reported a decrease in existing home sales, reflecting economic pressures.

The real estate sector is fiercely competitive. New firms and existing ones battle for market share. This can squeeze commission rates and agent recruitment. To lead, Fathom Realty must innovate and differentiate. The real estate market in the U.S. had over 1.5 million active real estate agents in 2024.

Regulatory changes pose a threat to Fathom Realty. Any shifts in real estate laws, like those affecting commission structures, could raise operational costs. For instance, in 2024, the National Association of Realtors faced lawsuits about commissions. New rules on agent licensing or data privacy could also limit business activities. Adapting quickly to these changes is crucial for Fathom Realty's survival.

Technology Disruptions

Technological disruptions pose a threat, potentially altering real estate processes. Economic downturns can hurt the market, decreasing transactions, and agent/brokerage income. Diversifying revenue and maintaining financial strength are key defenses. In 2024, Zillow saw a 15% decrease in revenue due to market slowdowns. This highlights the need for adaptability.

- Market volatility impacts income.

- Diversification is crucial for resilience.

- Technological shifts demand adaptation.

- Financial health is a critical buffer.

Data Security Risks

Data security risks pose a significant threat to Fathom Realty. The real estate brokerage industry is highly competitive, making data breaches costly. Protecting sensitive client information, like financial details, is crucial. Cybersecurity incidents can damage Fathom Realty's reputation and lead to legal liabilities.

- The average cost of a data breach in 2024 was $4.45 million.

- Real estate firms are increasingly targeted by cyberattacks due to the valuable data they hold.

- Data breaches can lead to lawsuits and regulatory fines, impacting profitability.

- Implementing robust cybersecurity measures is essential to mitigate these risks.

Threats to Fathom Realty include market volatility, fierce competition, regulatory changes, technological disruption, and data security risks.

These threats can impact income and necessitate adaptation, diversification, and strong financial health. Cybersecurity is crucial, with data breaches costing firms significantly.

Adapting to tech shifts and ensuring data protection are key, reflecting current challenges. These aspects impact profitability.

| Threat Category | Impact | Mitigation |

|---|---|---|

| Economic Downturn | Reduced transactions, lower income | Diversify revenue, maintain strong finances |

| Competition | Commission squeeze, recruitment challenges | Innovate, differentiate |

| Regulatory Changes | Increased costs, operational limits | Adapt quickly, ensure compliance |

| Technological Disruption | Process changes, market alteration | Embrace innovation, adapt to new tech |

| Data Security Risks | Reputational damage, legal liabilities | Implement strong cybersecurity |

SWOT Analysis Data Sources

The SWOT is built upon public financial data, current real estate market analyses, and industry expert perspectives.