Fortum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortum Bundle

What is included in the product

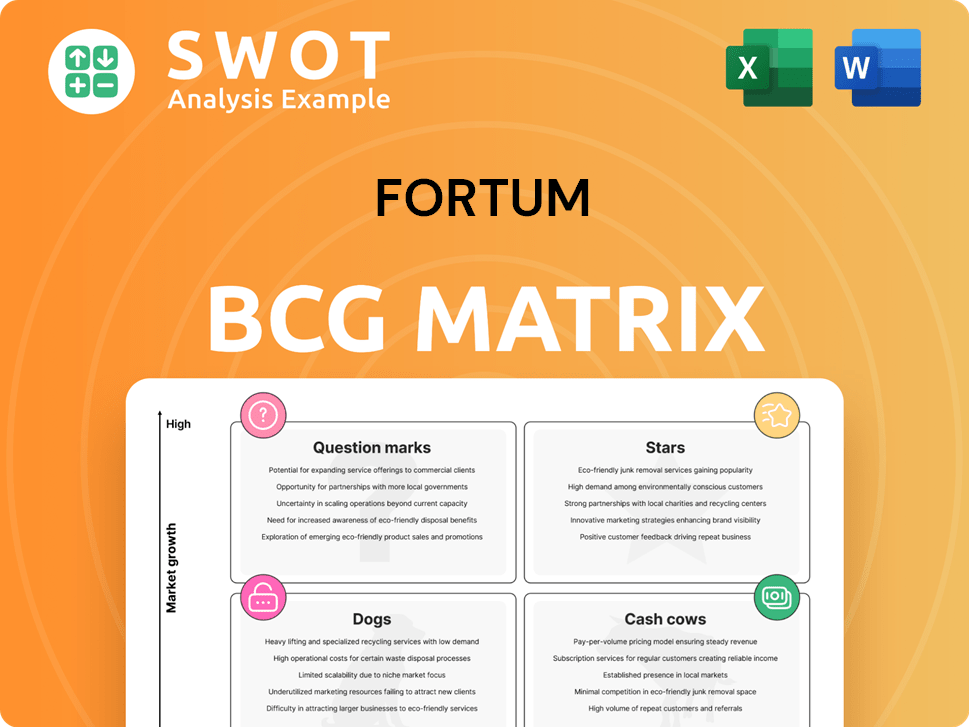

Fortum's portfolio analyzed by the BCG Matrix, highlighting investment, hold, or divest strategies.

Export-ready design for quick drag-and-drop into PowerPoint, allowing for painless presentations.

Delivered as Shown

Fortum BCG Matrix

The BCG Matrix previewed here is the complete document you'll receive post-purchase. Enjoy immediate access to a fully customizable and insightful strategic tool, designed for impactful decision-making.

BCG Matrix Template

Fortum's portfolio is complex, and understanding its strategic position is key. The BCG Matrix helps visualize product market share and growth. This snapshot hints at their Stars, Cash Cows, Dogs, and Question Marks. Knowing this helps with investment and resource allocation.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Fortum's Nordic hydropower assets are a "Star" in its BCG matrix, capitalizing on stable water resources. In 2024, hydropower represented a significant portion of Fortum's generation mix. This aligns with Europe's push for renewables. Hydropower offers a reliable baseload, crucial for grid stability.

The Loviisa Nuclear Power Plant is a key CO2-free energy source for Finland, crucial for energy security. Fortum aims to extend its operation until 2050 through upgrades. In 2024, Loviisa generated 8.2 TWh of electricity. This represented approximately 12% of Finland's total electricity consumption.

Fortum actively boosts its wind power in the Nordics. The Pjelax wind farm is a key project. This growth addresses rising renewable energy needs. In 2024, Fortum's wind capacity increased. This aligns with climate goals.

Customer Solutions in the Nordics

Fortum's Nordic customer solutions are a "Star" due to its strong position. It offers electricity and services to many customers, ensuring stable income. This sector gains from brand recognition and customer loyalty. In 2024, Fortum's Nordic retail sales totaled €1.5 billion.

- Stable Revenue: €1.5 billion in 2024 from Nordic retail sales.

- Customer Base: Serves a large number of customers in the region.

- Brand Recognition: Benefits from strong brand presence and customer trust.

- Cross-selling: Opportunities for selling energy-efficient solutions.

Green Hydrogen Initiatives

Fortum is actively involved in green hydrogen initiatives, marking it as a "Star" in its BCG Matrix. The company has launched pilot projects and forged partnerships to explore green hydrogen's potential. A key example is supplying renewable energy to P2X Solutions' green hydrogen plant. These efforts place Fortum at the forefront of clean energy innovation, supporting industrial decarbonization. In 2024, the green hydrogen market is projected to grow significantly.

- Fortum's green hydrogen projects include supplying renewable energy.

- These initiatives support the decarbonization of industrial processes.

- The green hydrogen market is expected to grow in 2024.

Fortum's green hydrogen projects are key. They support industrial decarbonization and leverage renewable energy. The green hydrogen market is forecasted to expand in 2024. This positions Fortum at the forefront of energy innovation.

| Initiative | Focus | Impact |

|---|---|---|

| Green Hydrogen Projects | Renewable energy supply | Decarbonization of industrial processes |

| Market Growth (2024) | Green hydrogen market | Significant expansion |

| P2X Solutions Partnership | Renewable energy for plant | Clean energy innovation |

Cash Cows

Fortum's Loviisa nuclear plant is a cash cow due to its reliable output. In 2024, Loviisa produced 8.2 TWh of electricity. The focus is on extending its lifespan. These plants have low operational costs.

Fortum's district heating in Nordic and Polish cities generates consistent revenue. These networks, like those in Espoo, benefit from long-term contracts and stable demand. They focus on efficiency and integrating renewables. In 2024, district heating accounted for a significant portion of Fortum's earnings.

Fortum utilizes advanced hedging to stabilize power prices, mitigating market risks. This strategy ensures dependable cash flow, vital for financial stability. In 2024, hedging helped manage price fluctuations, supporting profitability. Hedging is key for navigating energy market volatility. Fortum's Q3 2024 report showed stable earnings due to effective hedging.

Energy Optimization Services

Fortum's energy optimization services, encompassing trading and portfolio management, are a reliable source of income. These services utilize Fortum's deep understanding of energy markets to their advantage. They enable the company to get the most out of its generation assets and seize market opportunities. In 2024, Fortum's trading and optimization segment saw a solid performance, contributing significantly to the company's overall profitability.

- Trading and optimization services consistently generate strong cash flow.

- Fortum's market expertise is a key driver of these services.

- Maximizing asset value and capitalizing on market opportunities are primary goals.

- The segment's performance in 2024 was robust.

Long-Term Power Purchase Agreements (PPAs)

Securing long-term Power Purchase Agreements (PPAs) with industrial customers creates a predictable revenue stream. This strategy reduces the risk associated with fluctuating spot market prices. PPAs are especially crucial for renewable energy projects, ensuring financial stability. They support further investment in clean energy. In 2024, Fortum signed several PPAs, including a 10-year agreement for solar power in Finland.

- Predictable revenue streams are key.

- Reduces reliance on spot market prices.

- Supports renewable energy projects.

- Financial stability is improved.

Cash cows are strong, stable businesses. They generate significant cash with low investment needs. Fortum's nuclear plants and district heating exemplify this. Strategic hedging and long-term contracts boost these cash flows.

| Cash Cow | Description | 2024 Data |

|---|---|---|

| Loviisa Nuclear Plant | Reliable electricity generation. | 8.2 TWh electricity produced. |

| District Heating | Consistent revenue from Nordic and Polish cities. | Significant earnings contribution in 2024. |

| Hedging and Optimization | Stabilizing power prices & market expertise. | Stable earnings in Q3 2024. |

Dogs

Fortum's Russian assets, seized in 2023, are now "Dogs" in its BCG Matrix. These assets, including power plants, no longer generate revenue for Fortum. The company's Q3 2023 report showed a loss of €1.7 billion due to these discontinued operations. Fortum is actively seeking compensation through legal channels.

The recycling and waste business, divested in 2024, is a discontinued operation, according to Fortum's reports. The business, which did not fit the company's clean energy focus, was sold. The divestment resulted in a one-time gain of EUR 150 million, but the business no longer generates revenue.

Fortum's exit from the Indian solar market, finalized in 2023, involved selling its remaining stake. This strategic move aligns with a focus on its core Nordic operations. The divested Indian solar assets are classified as "Dogs" within Fortum's BCG matrix. In 2023, Fortum's total revenue was approximately EUR 5.25 billion, reflecting this strategic shift.

Poland Electricity Price Cap Impact

The electricity price cap in Poland, effective in 2024, has notably suppressed Orange Energia's EBITDA. This regulatory measure directly curtailed the profitability of this segment. Consequently, the short-term attractiveness of this business unit has diminished. These interventions are expected to continue affecting earnings until market dynamics normalize.

- Polish government implemented electricity price caps in 2024 to protect consumers.

- Orange Energia's EBITDA was negatively impacted due to lower revenue.

- The price cap reduced the company's profitability in the short term.

- Market stabilization is crucial for improved financial performance.

Baltic District Heating (Prior to Divestment)

Before its divestment, Fortum's Baltic district heating business, a part of its BCG Matrix, struggled with growth due to market saturation and regulatory hurdles. The business needed considerable capital for upgrades, making it less appealing within Fortum's holdings. Fortum sold its Baltic district heating operations to EQT Infrastructure in 2024. This strategic move allowed Fortum to focus on core areas.

- Market saturation limited growth prospects.

- Regulatory constraints presented challenges.

- Significant capital investments were needed.

- Divestment occurred in 2024 to EQT Infrastructure.

Fortum's "Dogs" represent assets with low market share and growth potential. These include divested units like the Baltic district heating business and Russian assets, impacting revenue. The electricity price cap in Poland, effective in 2024, also negatively affected Orange Energia's EBITDA. Strategic shifts and regulatory impacts classify these units as Dogs.

| Asset Type | Status | Impact |

|---|---|---|

| Russian Assets | Seized | Loss of €1.7B (Q3 2023) |

| Recycling/Waste | Divested (2024) | One-time gain of EUR 150M |

| Indian Solar | Divested (2023) | Strategic Shift |

Question Marks

Fortum eyes new nuclear projects in Finland and Sweden. These are high-investment, high-risk ventures. Uncertain timelines and regulations add to the challenges. The demand for carbon-free power could make them "Stars." In 2024, nuclear accounted for ~30% of Finland's electricity.

Fortum is developing an eSAF plant in Rauma, tapping into the growing sustainable aviation fuel market. This initiative targets a sector with high growth prospects, as global demand for eSAF is projected to increase substantially. The financial success hinges on technological breakthroughs and supportive government regulations, like those promoting renewable fuels. In 2024, the eSAF market showed promise, with investments rising, though specific plant data from Fortum is still emerging.

Fortum is building a 2-MW hydrogen pilot plant in Loviisa, a strategic move to test future investments. This pilot project is a crucial step, especially as the European hydrogen market is projected to reach €130 billion by 2030. It positions Fortum to capitalize on the burgeoning hydrogen economy.

Carbon Capture and Storage (CCS) Initiatives

Fortum is investigating carbon capture and storage (CCS) solutions to cut emissions from its current power facilities. This strategy is expensive but could yield significant returns, especially as decarbonization goals become more stringent. The viability of CCS hinges on technological advances and favorable government policies. In 2024, the International Energy Agency (IEA) estimated that CCS projects would require substantial investments.

- Fortum's CCS projects are still in the early stages of development.

- Government support, such as subsidies and tax incentives, is crucial.

- Technological advancements could significantly reduce CCS costs.

- CCS could become a key part of Fortum's long-term strategy.

Pumped Hydro Storage Projects

Fortum is evaluating pumped hydro storage projects to boost grid flexibility. This technology stores extra renewable energy. It releases energy during peak demand, helping integrate intermittent sources. These projects are capital-intensive.

- Pumped hydro projects help balance energy supply and demand.

- They offer a way to store excess energy from renewables.

- Capital costs are high, but the benefits are significant.

- These projects are crucial for grid stability.

Fortum faces Question Marks with its CCS and pumped hydro ventures. These projects demand substantial investment but have uncertain returns. Success hinges on technological advancements and supportive policies. In 2024, the IEA highlighted substantial investment needs for CCS projects.

| Project | Status | Key Challenges |

|---|---|---|

| CCS | Early development | High costs, policy support |

| Pumped Hydro | Evaluation phase | Capital intensive, grid integration |

| eSAF Plant | Development | Tech, regulation |

BCG Matrix Data Sources

Fortum's BCG Matrix leverages financial reports, market research, and analyst estimates for accurate segment assessment.