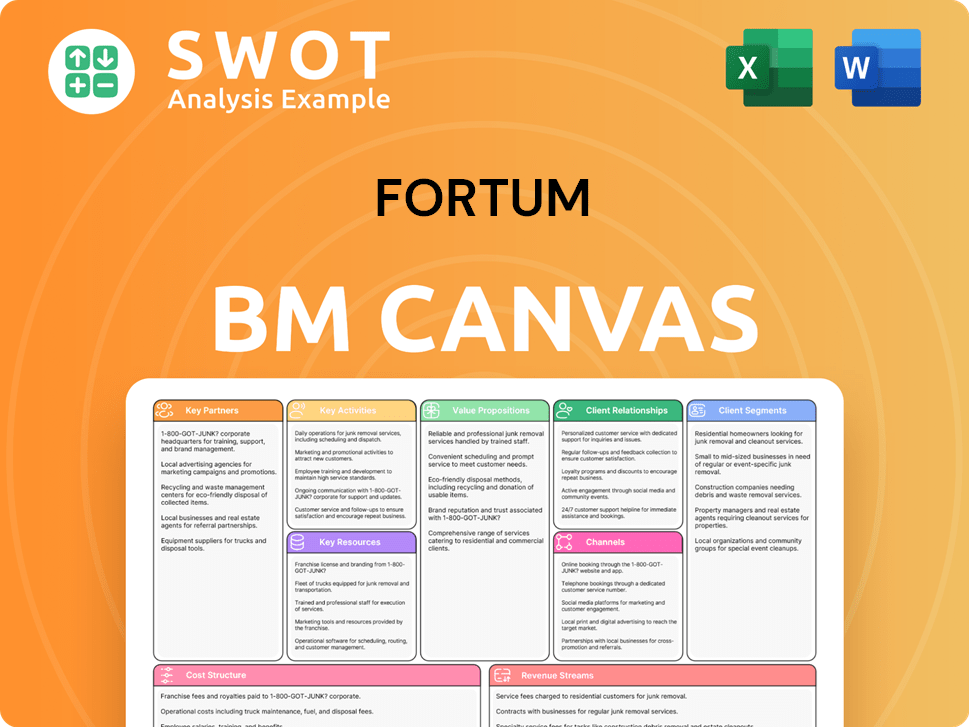

Fortum Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortum Bundle

What is included in the product

Fortum's BMC covers customer segments, channels, and value propositions with detailed real-world operations. Ideal for presentations.

Quickly identify core components with a one-page business snapshot.

Delivered as Displayed

Business Model Canvas

This Business Model Canvas preview is the full document you'll receive. It's not a sample; it's the same file you get post-purchase. Instantly download the complete, ready-to-use Canvas in its entirety.

Business Model Canvas Template

Fortum's Business Model Canvas reveals its strategic focus on clean energy. It highlights key partnerships and cost structures tied to renewable sources. Customer segments include utilities and industrial clients. The canvas details Fortum's value proposition of sustainable energy solutions. Revenue streams come from electricity sales and related services. This framework offers insights for investors and business strategists. It's a useful tool for understanding Fortum's operations.

Partnerships

Fortum's collaborations with technology providers like EDF, Westinghouse-Hyundai, and GE-Hitachi are pivotal. These partnerships are essential for assessing new nuclear build opportunities, giving access to cutting-edge reactor technologies. In 2024, Fortum allocated €1.5 billion for nuclear projects. Deepening these vendor ties lets Fortum evaluate various reactor designs, vital for future energy strategies.

Fortum's success hinges on robust relationships with the Swedish and Finnish governments. Securing financing and favorable electricity market conditions for new nuclear projects is essential. Regulatory alignment and political stability are paramount for mitigating investment risks. Fortum actively engages with these governments to achieve these goals. In 2024, Fortum's revenue was approximately €2.05 billion.

Fortum's industrial partnerships are key for decarbonization. They collaborate on projects like the low-carbon aluminium study in Finland. Such partnerships boost clean energy demand and industrial shifts. The potential aluminium facility could use roughly 7 TWh of electricity yearly.

Energy Companies

Fortum's strategic alliances with energy firms, like the 60:40 partnership with Helen Limited in the Pjelax wind project, highlight its collaborative approach. These partnerships facilitate the sharing of resources and risks, which is crucial in the volatile energy sector. This collaboration model improves the efficiency of renewable energy projects, such as the Pjelax wind farm with a capacity of 380 MW.

- Pjelax wind project capacity: 380 MW.

- Partnership with Helen Limited: 60:40.

- Focus: Renewable energy projects.

- Objective: Share resources and risks.

Research Institutions

Fortum's collaborations with research institutions, such as MIT, are crucial for innovation. These partnerships drive technological advancements in areas like Small Modular Reactor (SMR) modelling. A notable project between Fortum and MIT focuses on SMR modelling, enhancing Fortum’s future nuclear capabilities. Such collaborations are vital for staying at the forefront of energy solutions.

- In 2024, the global SMR market was valued at $7.3 billion.

- Fortum's R&D spending in 2023 was approximately €50 million.

- MIT's nuclear research budget for 2024 is estimated at $40 million.

- The SMR market is projected to reach $18.5 billion by 2030.

Fortum relies on diverse partnerships to enhance its business model. Key collaborations include tech providers, governments, and industrial partners. These alliances support nuclear projects, regulatory alignment, and decarbonization initiatives. The Pjelax wind project, a Helen Limited partnership, has a capacity of 380 MW, highlighting collaborative efficiency.

| Partnership Type | Examples | Key Benefit |

|---|---|---|

| Technology Providers | EDF, Westinghouse | Access to advanced reactor tech |

| Government | Swedish, Finnish | Financing, Regulatory alignment |

| Industrial | Aluminium study | Decarbonization |

Activities

Power generation is a key activity for Fortum, focusing on diverse sources such as nuclear, hydro, and wind. Optimizing this mix is essential for reliability and efficiency. In 2024, Fortum produced 46 TWh of electricity. Nuclear accounted for 24 TWh, and hydropower contributed 20 TWh.

Fortum actively manages its financial risks through hedging and trading activities. Hedging is crucial for stabilizing revenue by mitigating price fluctuations in power sales. Trading on power markets and employing bilateral agreements are integral parts of their risk management strategy. By the end of 2024, about 75% of the Generation segment's anticipated Nordic power sales volume was hedged for 2025. This approach ensures financial stability.

Fortum actively invests in decarbonization, exemplified by its €100 million investment in the Czestochowa CHP plant in Poland. A key initiative is phasing out coal by 2027. The company aims for net-zero GHG emissions across its value chain by 2040. This aligns with the EU's climate goals.

Project Development

Project development is vital for Fortum's renewable energy expansion. This includes creating onshore wind and solar projects. Fortum focuses on pumped hydro and extending existing nuclear plants. By the end of 2024, Fortum had a 5 GW pipeline of onshore wind and solar projects in the Nordic countries.

- 5 GW pipeline of onshore wind and solar projects in the permit process across the Nordic countries (2024).

- Focus on pumped hydro projects.

- Extending the lifespan of existing nuclear plants.

- Developing renewable energy projects for future growth.

Customer Solutions

Customer solutions form a crucial part of Fortum's operations, focusing on providing energy solutions to residential, commercial, and industrial customers. This involves delivering electricity, heating, and cooling services. Fortum is a major player in the Nordics. The company also offers digital solutions to enhance customer experiences.

- Fortum had 2.1 million customers in the Nordics, as of 2024.

- The company's customer solutions include digital services.

- Fortum's focus is on energy provisions.

Fortum's key activities include power generation from nuclear, hydro, and wind sources, producing 46 TWh of electricity in 2024. Risk management is crucial, with 75% of Nordic power sales hedged for 2025 to ensure financial stability. They invest in decarbonization, like the €100M Czestochowa plant, and develop renewable projects.

| Activity | Description | 2024 Data |

|---|---|---|

| Power Generation | Diverse sources, efficiency focus | 46 TWh total, 24 TWh nuclear |

| Risk Management | Hedging, trading, agreements | 75% hedged for 2025 |

| Decarbonization | Phasing out coal, net-zero by 2040 | €100M investment |

Resources

The Loviisa nuclear power plant is a cornerstone, generating over 10% of Finland's electricity. Fortum's focus includes extending the plant's operational life to 2050 through modernization efforts. The plant, operated by Fortum, features two VVER-440 reactors. In 2024, Loviisa produced 8.2 TWh of electricity.

Hydropower assets form a crucial key resource for Fortum, offering a steady, carbon-neutral energy source. Enhancing the flexibility of hydropower and ancillary services is vital for maintaining grid stability. Fortum utilizes hourly, daily, weekly, and seasonal optimization strategies for its hydropower operations. In 2024, Fortum's hydropower production reached 24 TWh, showcasing its significance.

Wind and solar farms are crucial for diversifying energy sources and boosting renewable energy output. Fortum is actively developing a 5 GW pipeline of onshore wind and solar projects across the Nordic region. In 2024, the company launched commercial operations at the 380 MW Pjelax wind project, expanding its clean energy portfolio.

Skilled Workforce

A skilled workforce is a cornerstone for Fortum's operations, ensuring the smooth running of power plants, driving new projects, and delivering top-notch customer service. With a team of around 5,000 employees, Fortum prioritizes a safe and motivating work environment. They invest in their employees' development to maintain high operational standards and foster innovation. This focus is essential for their long-term success in the energy sector.

- Fortum employed roughly 5,000 people.

- The company aims for a safe and inspiring workplace.

- Skilled workforce is vital for power plant operations.

- Employee development supports operational excellence.

Financial Resources

Financial resources are vital for Fortum to invest in new ventures, upkeep assets, and handle risks effectively. Solid financial strategies and a robust balance sheet are critical for long-term sustainability. In 2024, Fortum's credit rating, at least BBB, supports its financial strength. This rating allows Fortum to secure funding at favorable rates.

- Credit rating supports financial flexibility.

- Prudent policies are key for stability.

- Strong balance sheet enables investment.

- Financial resources manage potential risks.

Fortum's Key Resources include nuclear power from Loviisa, generating 8.2 TWh in 2024. Hydropower production reached 24 TWh in 2024. Wind and solar projects are also vital, including the Pjelax wind farm, which started commercial operations in 2024.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Loviisa Nuclear Plant | Generates electricity and extends operational life | 8.2 TWh electricity production |

| Hydropower | Provides carbon-neutral energy and grid stability | 24 TWh electricity production |

| Wind & Solar Farms | Diversify energy sources; includes new projects | Pjelax wind project operational |

Value Propositions

Fortum's value proposition centers on a reliable energy supply. This commitment involves maintaining high availability of power generation. Fortum's nuclear fleet targets over 90% availability, while hydro aims for over 95%.

Fortum's value proposition centers on providing clean energy solutions, setting it apart in the market. This approach aids customers in reducing their carbon footprint, fostering a sustainable future. Fortum is committed to achieving net-zero GHG emissions across its value chain by 2040. In 2024, Fortum's investments in renewable energy projects reached €1.2 billion.

Fortum offers competitively priced energy to draw in and keep customers. They use hedging and efficient operations to manage costs effectively. In 2024, Fortum's power price performance benefited from successful hedging and physical optimization strategies. For example, the company's achieved power price showed improvement compared to previous periods, reflecting their focus on cost-effectiveness.

Decarbonization Partnerships

Fortum's decarbonization partnerships deliver significant value by collaborating with industrial clients to cut emissions. They provide customized energy solutions and expertise, essential for the clean transition. This positions Fortum as a trusted partner in sustainable energy practices. This approach aligns with the growing demand for eco-friendly operations.

- Fortum aims to reduce its Scope 1 and 2 emissions by 60% by 2030 from a 2019 baseline.

- In 2024, Fortum signed several deals to support industrial decarbonization.

- By Q3 2024, Fortum's renewable energy capacity reached 6.1 GW.

- The European Union's Emission Trading System (ETS) price averaged around €80 per ton of CO2 in 2024.

Innovation and Development

Fortum's commitment to innovation and development is a cornerstone of its long-term strategy. Investments in new technologies, like hydrogen production, are crucial. This positions Fortum at the forefront of the energy transition, ensuring future relevance. In 2024, Fortum started building a 2 MW hydrogen pilot plant in Loviisa.

- Hydrogen production is a key area for innovation.

- Fortum aims to be a leader in the energy transition.

- The Loviisa pilot plant is a concrete step in this direction.

Fortum provides reliable and competitively priced energy, supported by efficient operations. Its focus on clean energy and sustainability, including achieving net-zero emissions by 2040, is a core value. Through innovation in areas like hydrogen, Fortum drives the energy transition.

| Value Proposition | Description | 2024 Data Highlight |

|---|---|---|

| Reliable Energy Supply | Ensuring high availability of power generation. | Nuclear fleet availability targeted over 90%. |

| Clean Energy Solutions | Providing clean energy to reduce carbon footprint. | €1.2 billion invested in renewables. |

| Competitive Pricing | Offering competitively priced energy. | Improved power price performance due to hedging. |

Customer Relationships

Long-term contracts with industrial clients are crucial for Fortum's revenue stability and decarbonization goals. Power purchase agreements (PPAs) are a central element. In 2024, Fortum aimed to increase its PPA portfolio. They planned to build a ready-to-go pipeline to meet growing customer demand through these long-term agreements.

Fortum's digital services boost customer engagement by offering online portals and energy tools. In 2024, the digital segment saw increased customer interaction. This approach integrates customers, improving service delivery. Digital solutions also allow personalized customer support, improving satisfaction.

Fortum's dedicated account management provides personalized service to large industrial clients, strengthening relationships. This approach supports long-term partnerships, crucial for driving decarbonization initiatives. In 2024, Fortum's customer satisfaction scores for key accounts are expected to be above 80%. Fortum serves as a key customer interface for industrial and municipal clients focused on emission reductions.

Customer Service Channels

Fortum prioritizes customer relationships by offering various customer service channels. This approach ensures accessibility and responsiveness, critical for maintaining customer satisfaction and loyalty. Fortum's commitment to customer service is evident in its operations. Fortum has around 2.1 million customers in the Nordics, underlining the importance of effective service channels.

- Online support provides instant access to information and assistance.

- Phone support offers direct communication for complex issues.

- In-person support provides personalized assistance where available.

- These channels collectively enhance customer experience and trust.

Community Engagement

Fortum's community engagement focuses on building strong relationships with local communities and stakeholders, fostering trust for project success. This involves proactive communication, addressing concerns, and supporting local initiatives. For example, Fortum invested approximately €2 million in local community projects in 2023. Fortum's societal engagement is crucial for its new nuclear projects.

- Local Community Support: Fortum invests in local projects.

- Stakeholder Communication: Proactive dialogue to address concerns.

- Trust Building: Essential for project acceptance and success.

- Financial Commitment: Significant investments in community initiatives.

Fortum's customer strategy focuses on long-term contracts, digital services, and dedicated account management. Digital tools and account managers enhance customer engagement and personalized support. In 2024, they aimed for high customer satisfaction through multiple service channels.

| Customer Aspect | Description | 2024 Goal/Result |

|---|---|---|

| PPAs | Long-term agreements | Increase PPA portfolio |

| Digital Interaction | Online portals, tools | Increase customer engagement |

| Key Accounts | Personalized service | 80%+ satisfaction |

Channels

Fortum's direct sales force focuses on major clients, offering tailored energy solutions and building lasting relationships. This approach is crucial for decarbonization partnerships, a key area of growth. In 2024, Fortum's customer solutions segment saw significant activity. The commercial organization is pivotal for customer engagement.

Fortum's online platforms streamline customer interactions. These platforms offer self-service tools for residential and small business clients. Customers can pay bills and monitor energy usage. This approach improves efficiency and customer satisfaction. In 2024, Fortum reported a substantial increase in online platform usage, with 75% of customers regularly utilizing these digital services.

Fortum strategically partners with retail chains and other businesses to broaden its access to residential customers. This collaborative approach involves distributing energy products and services through established partner channels. For instance, Fortum's distribution agreement with Orange Polska S.A. grants access to Poland's extensive retail network until 2028. This partnership helps Fortum serve its customers more efficiently. In 2024, Fortum's retail partnerships contributed significantly to its customer acquisition strategy.

Brokers and Agents

Fortum leverages brokers and agents to broaden its market reach. This strategy is crucial in competitive retail markets, helping to connect with diverse customer groups. Fortum's hedging uses dual channels, including futures exchanges and bilateral deals. In 2024, Fortum's customer base expanded by 5%, showing the effectiveness of these channels.

- Brokers and agents expand market reach.

- Effective in competitive retail markets.

- Dual hedging channels are utilized.

- Customer base grew by 5% in 2024.

Digital Marketing

Fortum's digital marketing efforts boost product and service awareness, drawing in new customers through online ads, social media, and content. This strategy is crucial for customer acquisition and interaction. In 2024, Fortum allocated a significant portion of its marketing budget to digital channels, reflecting a shift towards online engagement. Digital channels offer extensive reach and targeted advertising capabilities, making them vital for Fortum's growth.

- Digital marketing campaigns are critical for brand visibility and customer acquisition.

- Fortum utilizes digital channels to connect with consumers effectively.

- Online advertising, social media, and content marketing are key components.

- Investment in digital marketing has increased to improve customer engagement.

Fortum uses brokers and agents to broaden its market reach, especially in competitive retail environments. This strategy includes utilizing dual hedging channels for risk management, which proved effective in 2024. The customer base saw a 5% increase, demonstrating the impact of these channels.

| Channel | Description | 2024 Impact |

|---|---|---|

| Brokers & Agents | Expand market reach, especially in competitive retail environments. | Customer base growth. |

| Hedging Channels | Dual channels like futures exchanges and bilateral deals. | Risk management and market stability. |

| Customer Growth | Overall customer base expansion. | 5% increase, demonstrating channel effectiveness. |

Customer Segments

Residential customers form a significant segment for Fortum, depending on dependable and cost-effective energy solutions for their homes. This group places a high value on ease of use, quality customer support, and attractive pricing options. Fortum leads as the largest electricity retailer in the Nordics, serving approximately 2.1 million customers.

Commercial customers, encompassing SMEs, require dependable energy for their business activities. They prioritize energy efficiency and budget-friendly options. Fortum's acquisition of Orange Energia in Poland aims to serve 130,000 customer contracts. This expansion enhances Fortum's presence in the commercial sector. Fortum's focus helps businesses manage energy costs effectively.

Industrial customers, a key segment for Fortum, demand substantial energy for their operations. They prioritize reliability and seek clean energy options. Fortum acts as a crucial interface, aiding industrial clients in decarbonizing their processes. In 2024, Fortum's industrial sales reached €4.3B, reflecting this focus.

Municipalities

Municipalities represent a key customer segment for Fortum, demanding energy for essential services like street lighting, public transit, and heating. This segment prioritizes sustainability and seeks cost-effective energy solutions to manage public budgets. Fortum collaborates with municipalities, offering clean energy options and tailored services to meet their specific needs. For example, in 2024, Fortum signed several agreements with cities across the Nordics to supply renewable energy.

- Focus on sustainable energy solutions.

- Aim for cost-effective energy supply.

- Provide tailored services.

- Collaborate with cities.

Energy-Intensive Industries

Energy-intensive industries are key customers for Fortum, especially those needing reliable, clean energy. These industries, including aluminum manufacturing, have substantial energy demands. Fortum actively investigates low-carbon aluminum manufacturing opportunities in Finland, supporting feasibility studies. In 2024, the aluminum sector's energy consumption was approximately 1.5% of global energy use.

- Feasibility studies focus on reducing the carbon footprint of aluminum production.

- This supports Fortum's strategy to provide sustainable energy solutions.

- The goal is to help these industries lower their emissions.

- It aligns with the growing demand for green industrial processes.

Fortum's Customer Segments include residential, commercial, industrial, and municipal clients, each with specific energy needs. Industrial customers, for example, consumed about 1.5% of global energy in 2024. Municipalities seek sustainable and cost-effective energy solutions.

| Customer Segment | Key Needs | Fortum's Offering |

|---|---|---|

| Residential | Cost-effective energy, ease of use | Reliable electricity supply, customer support |

| Commercial | Energy efficiency, budget-friendly options | Energy solutions, focus on energy management |

| Industrial | Reliability, clean energy | Clean energy options, decarbonization support |

| Municipalities | Sustainability, cost-effectiveness | Renewable energy, tailored services |

Cost Structure

Fuel costs, encompassing nuclear fuel, natural gas, and biomass, represent a substantial portion of Fortum's expenses. Effective fuel procurement and optimization of the fuel mix are critical for cost management. In 2024, Fortum highlighted its commitment to CO2-free power generation. Fortum's operational expenditure was approximately EUR 4.8 billion in 2023.

Operating and maintenance costs are substantial for Fortum's diverse power generation assets. Maintaining nuclear, hydro, and wind facilities involves significant expenditures. Fortum aims for high availability, with targets of >90% for nuclear and >95% for hydro. In 2024, Fortum's operating expenses were influenced by these maintenance needs.

Capital expenditures are significant for Fortum, especially for new ventures like wind farms and nuclear facility enhancements. These investments demand careful allocation and efficient project oversight. Fortum's capital expenditure forecast for 2025–2027 is roughly EUR 1.4 billion. This spending is vital for sustaining and growing its energy infrastructure.

Personnel Costs

Personnel costs are a major part of Fortum's cost structure, covering salaries and benefits for around 5,000 employees. Effective workforce management and training are crucial to managing these costs. Fortum focuses on providing a safe and motivating work environment for its employees. In 2023, personnel expenses were a substantial portion of the operational costs, reflecting the company's commitment to its workforce.

- In 2023, personnel expenses were a significant part of total operating costs.

- Fortum employs approximately 5,000 people.

- Employee training is essential for operational efficiency.

- The company aims for a safe and inspiring workplace.

Regulatory and Compliance Costs

Regulatory and compliance expenses, encompassing environmental permits and safety regulations, are vital for Fortum's energy operations. Adhering to stringent compliance standards is essential for maintaining its operational licenses. The Loviisa plant, featuring two VVER-440 reactors, necessitates significant investment in this area. These costs are inherent in the energy sector, impacting profitability. In 2024, Fortum's compliance costs were approximately 15% of operational expenses.

- Environmental permits and safety regulations are crucial.

- Compliance is key for operational licenses.

- The Loviisa plant incurs significant costs.

- Compliance costs are a substantial part of Fortum's budget.

Fortum's cost structure includes substantial fuel costs, with operational expenses of EUR 4.8 billion in 2023. Operating and maintenance costs, including those for nuclear, hydro, and wind facilities, are a significant portion of expenses. Capital expenditures are significant, with a forecast of EUR 1.4 billion for 2025–2027, and personnel costs, covering roughly 5,000 employees, are also substantial.

| Cost Category | Description | 2023 Data |

|---|---|---|

| Fuel Costs | Nuclear, gas, biomass | Significant |

| OpEx | Operating Expenses | EUR 4.8B |

| CapEx | 2025-2027 Forecast | EUR 1.4B |

Revenue Streams

Electricity sales are a core revenue stream for Fortum, generated through selling power to residential, commercial, and industrial clients. Success hinges on competitive pricing and a dependable supply of electricity. In 2024, power sales in the Nordic region decreased by 6% to 58.9 TWh. This highlights the importance of effective sales strategies.

Heat sales are a key revenue stream for Fortum, especially in district heating. They stem from combined heat and power (CHP) plants. In 2024, heat sales volumes decreased by 5% to 5.2 TWh. Efficient production and distribution are crucial for profitability.

Fortum earns revenue by offering ancillary services, including frequency regulation and voltage support, to grid operators. Hydropower's flexibility is a key asset, enabling hourly, daily, weekly, and seasonal optimization. In 2024, such services contributed significantly to Fortum's overall revenue. Fortum's ability to quickly adjust power output is crucial. These services generated approximately €100 million in revenue in 2024.

Capacity Payments

Fortum's capacity payments stem from grid operators, ensuring dependable power generation. These payments are crucial, supporting investments in new power plants, particularly essential for long-term energy security. New nuclear projects, if conditions align, could start contributing to the Nordics' power supply in the late 2030s. This strategic approach helps stabilize revenue, supporting infrastructure development.

- Capacity payments guarantee revenue, offering financial stability for power generation projects.

- Investments in new power plants are supported, vital for meeting future energy demands.

- New nuclear projects could start contributing to the Nordics' power supply in the late 2030s.

- This strategy enhances Fortum's financial resilience and operational planning.

Environmental Value Products

Fortum's Environmental Value Products revenue stream focuses on selling environmental attributes tied to renewable energy production. This primarily includes Guarantees of Origin (GOs) and Elcertificates. Fortum's sales of GOs in Europe allow customers to demonstrate their commitment to renewable energy. This revenue stream supports Fortum's sustainability goals and provides a market-based mechanism for promoting green energy.

- GOs are crucial for tracking and validating renewable energy consumption.

- Fortum sells GOs as part of its power sales.

- This stream aligns with increasing corporate sustainability demands.

- Revenue helps fund further renewable energy projects.

Fortum's revenue streams encompass electricity and heat sales, both central to its business model. Ancillary services like frequency regulation add to its diverse income. Environmental Value Products, such as Guarantees of Origin, also boost revenue.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Electricity Sales | Sales to residential, commercial, and industrial clients. | Nordic power sales decreased 6% to 58.9 TWh |

| Heat Sales | Generated from district heating, CHP plants. | Heat sales decreased 5% to 5.2 TWh. |

| Ancillary Services | Services to grid operators, like frequency regulation. | Generated €100 million. |

Business Model Canvas Data Sources

The Fortum Business Model Canvas relies on financial statements, market research, and competitor analysis for its data. This helps make informed strategic decisions.