Fortum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortum Bundle

What is included in the product

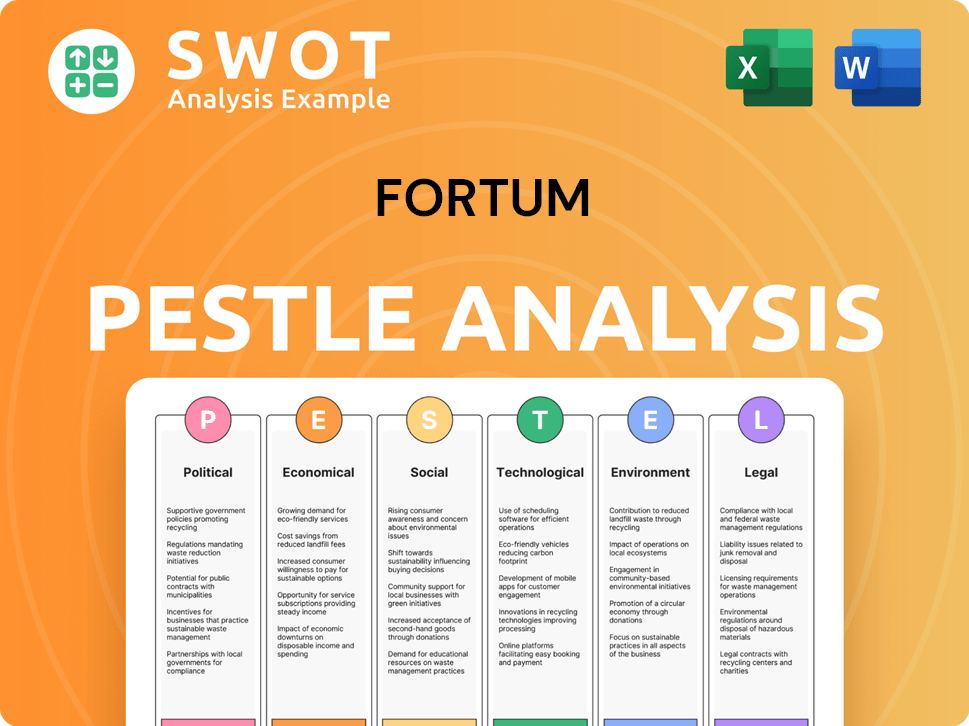

Analyzes Fortum's environment using Political, Economic, Social, Tech, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Fortum PESTLE Analysis

This is the genuine Fortum PESTLE analysis document. The content and layout presented in the preview are identical. After purchase, you'll instantly download the same, finished analysis.

PESTLE Analysis Template

Uncover the external forces shaping Fortum's strategy. Our PESTLE Analysis reveals critical insights into political, economic, social, technological, legal, and environmental factors impacting its business. Understand market risks and opportunities like never before.

Navigate Fortum's future with confidence. Get the full PESTLE Analysis now!

Political factors

Government policies in Nordic countries, crucial for Fortum, heavily favor renewable energy. Finland, a key market, has aggressive renewable energy targets, supporting Fortum's clean energy focus. These policies drive demand, creating a supportive environment for Fortum's investments. In 2024, Finland aimed for 51% renewable energy in electricity, boosting Fortum's growth.

Geopolitical instability, fueled by conflicts like the war in Ukraine and shifts in US trade policies, significantly affects Fortum. These factors disrupt supply chains and commodity markets, potentially leading to financial losses. The company is navigating these challenges, including legal actions against Russia. In 2024, Fortum's financial results were impacted by these geopolitical risks.

Fortum faces regulations from the EU and national energy bodies. The EU Green Deal and emissions targets push decarbonization. Regulatory shifts and market interventions can significantly affect Fortum. In 2024, Fortum invested €1.6 billion in renewable energy. Compliance costs are considerable.

Energy policy and security of supply

Energy policy is crucial for Fortum, especially with government decisions on nuclear power and the need for reliable energy sources. Fortum actively engages with the Swedish and Finnish governments regarding financing and market mechanisms for new nuclear projects. This highlights the political importance of ensuring energy supply security, which is vital for supporting renewable energy sources. The company is focused on securing its position in the evolving energy landscape.

- Finland's electricity consumption in 2023 was approximately 87 TWh.

- Fortum's operating profit decreased to EUR 658 million in 2023.

- The Finnish government aims to increase nuclear power's share in the energy mix.

Lobbying and political engagement

Fortum actively lobbies and engages with political entities to foster a supportive regulatory landscape for its strategic goals. The firm participates in initiatives that advocate for lobbying transparency, offering its expertise on energy and climate policies. Fortum has introduced an internal transparency register in its primary operational regions. In 2024, Fortum's political engagement efforts included meetings with policymakers and contributions to industry forums.

- Fortum's lobbying expenses in 2024 were approximately €2 million.

- The company held over 100 meetings with EU policymakers in 2024.

- Fortum actively participates in industry associations influencing energy policy.

- The internal transparency register is updated quarterly.

Political factors profoundly influence Fortum's strategy. Government support for renewables in Finland is strong. Geopolitical instability, like the Ukraine war, creates financial challenges. Regulatory compliance with EU targets impacts costs.

| Area | Impact | Data (2024/2025) |

|---|---|---|

| Policy | Renewable Targets | Finland: 51% renewable electricity goal achieved in 2024 |

| Geopolitics | Supply Chain | Fortum's operating profit in 2023 was EUR 658 million |

| Regulation | Compliance Costs | 2024: €1.6 billion invested in renewables |

Economic factors

Fluctuations in wholesale electricity prices are a key economic factor for Fortum. In 2024, the Nordic market saw lower power prices compared to 2023. Fortum uses hedging strategies to manage price volatility. For example, Fortum's hedging ratio for 2024 was around 75%.

Fortum's capital expenditure plans for 2025-2027 are set at around EUR 1.4 billion, targeting clean energy projects. These investments are crucial for Fortum's decarbonization strategy. The company's investment decisions are closely tied to economic forecasts. In 2024, Fortum's investments were impacted by energy market fluctuations.

Fortum is actively running efficiency programs to cut annual fixed costs. The goal is to achieve substantial cost reductions by the close of 2025. These initiatives should be fully operational by early 2026, according to company statements. These programs are crucial for future growth and strong financial results.

Market demand for electricity and decarbonisation solutions

Market demand for electricity is projected to rise due to economic growth and electrification efforts. Fortum anticipates growth opportunities, supported by increasing demand for clean energy solutions. The European Union aims for a 55% reduction in emissions by 2030, boosting demand. Fortum's focus on decarbonization aligns with this trend, driving investment in renewables.

- Electricity demand is expected to increase in the long term.

- Decarbonization through electrification drives demand.

- Fortum sees growth opportunities in this trend.

- EU aims for a 55% emissions cut by 2030.

Property taxes and other operating costs

Property taxes and operating costs are critical economic factors for Fortum. Increases in property taxes, like the planned rise in Sweden from 2025, directly affect operational expenses. These tax adjustments are integrated into Fortum's financial planning and efficiency goals. The company strategically manages these costs to maintain profitability.

- Sweden's annual property tax increase from 2025 will likely impact Fortum's operational costs.

- Fortum's financial outlook and efficiency targets consider these cost changes.

Fortum navigates economic volatility, hedging about 75% of its 2024 price exposure. It plans approximately EUR 1.4 billion in capital expenditure from 2025-2027 for clean energy, affected by market changes.

Efficiency programs seek major cost reductions by late 2025. Rising electricity demand, fueled by decarbonization goals, presents significant growth chances, mirroring EU’s emission targets.

Property tax increases, like Sweden’s 2025 changes, directly affect operational costs, incorporated into financial planning.

| Economic Aspect | Impact | Data |

|---|---|---|

| Wholesale Electricity Prices | Volatility Management | Nordic market, lower prices in 2024, hedging ~75% |

| Capital Expenditure (2025-2027) | Clean Energy Investments | EUR 1.4 billion |

| Cost Reduction Programs | Operational Efficiency | Targeted for 2025, fully operational by early 2026 |

Sociological factors

Public opinion significantly shapes energy policies and investments. For instance, a 2024 survey showed 60% support for renewables in Finland, where Fortum operates. Fortum's nuclear feasibility studies directly address public acceptance as a key factor. Societal views on nuclear power, though improving, vary widely. Public acceptance is crucial for project success.

Customer behavior significantly impacts clean energy demand. Rising climate change awareness fuels demand for sustainable solutions. Fortum's focus on clean energy aligns with this shift. In 2024, global renewable energy capacity grew by 50%, showing customer preference. Fortum's decarbonisation efforts cater to evolving consumer needs.

Fortum prioritizes employee well-being, focusing on occupational safety across its operations. In 2024, Fortum's lost workday injury frequency rate was 1.8, a key performance indicator. Safety targets are integrated into operational considerations and incentive programs, aiming for continuous improvement. This commitment reflects in reduced injury rates year-over-year, enhancing employee relations.

Community engagement and social responsibility

Fortum's activities significantly influence local communities. They actively engage with communities, especially through renewable energy initiatives and by assessing the social effects of their projects. Corporate Social Responsibility (CSR) is central to their operations, with focus areas such as biodiversity and education. Fortum invested €1.1 million in social responsibility projects in 2023, supporting community well-being.

- €1.1 million invested in CSR in 2023.

- Focus on biodiversity, water, equality, and education.

- Community engagement through renewable projects.

Demographic trends and energy consumption patterns

Macroeconomic and demographic shifts significantly shape energy use. Population growth, urbanization, and evolving lifestyles directly affect electricity and heating needs, crucial for Fortum's operations. For example, the EU's population is around 448 million as of late 2024, influencing energy demand. These demographic shifts require Fortum to adapt its strategies.

- EU electricity consumption was approximately 2,800 TWh in 2023.

- Urbanization rates are rising, increasing energy needs in cities.

- Changing consumer behavior drives demand for specific energy solutions.

Public opinion directly influences energy policy, as seen in the 60% renewable support in Finland. Shifting consumer behavior drives demand for sustainable solutions, mirroring the 50% growth in 2024 renewable capacity globally. Fortum prioritizes employee safety with a 1.8 lost workday injury rate.

| Factor | Details | Data |

|---|---|---|

| Public Opinion | Support for Renewables | 60% support (Finland, 2024) |

| Customer Behavior | Renewable Energy Growth | 50% increase in global capacity (2024) |

| Employee Safety | Lost Workday Injury Rate | 1.8 (Fortum, 2024) |

Technological factors

Ongoing developments in renewable energy, like wind and solar, boost efficiency and competitiveness. Fortum invests in these technologies, aligning with its clean energy strategy. For example, Fortum's solar capacity reached 500 MW by late 2024. This strategic move reduces reliance on fossil fuels.

The push for decarbonization technologies accelerates, opening doors for Fortum. This includes hydrogen production and carbon capture. Fortum's investments in green hydrogen projects totaled €130 million in 2024. By 2025, the company aims to expand its CCS capabilities to serve industrial clients, with estimated investments reaching €80 million.

Fortum is actively embracing digitalization, focusing on IoT, AI, and data analytics to boost operational efficiency. This strategic move helps to optimize performance and cut costs across its operations. In 2024, Fortum allocated €100 million towards digital initiatives. These technologies are critical for managing energy sites and streamlining business processes.

Modernization of existing power plants

Technological factors significantly influence Fortum's operations, particularly regarding the modernization of existing power plants. Advancements allow for extending the operational life of assets like nuclear and hydropower plants. Fortum invests in upgrades to maintain reliable operations. For example, in 2024, Fortum allocated approximately €200 million for upgrades to its existing power generation infrastructure. These upgrades aim to increase efficiency and reduce emissions.

- €200 million allocated for upgrades in 2024.

- Focus on nuclear and hydropower plants.

- Goal: increase efficiency and reduce emissions.

Energy storage solutions

Energy storage solutions are crucial for integrating renewable energy and stabilizing the grid. Fortum's investments in this area are vital. The global energy storage market is projected to reach $23.7 billion in 2024. It is expected to grow to $39.1 billion by 2029.

- Lithium-ion batteries dominate, but other technologies are emerging.

- Fortum might invest in battery storage projects.

- Grid-scale storage is essential for renewable energy adoption.

- Advancements in storage drive grid efficiency.

Technological factors drive Fortum’s strategy through renewable investments like solar, aiming for cleaner energy. Digitalization, with €100M invested in 2024, enhances operations using IoT and AI. Upgrades to existing power plants received about €200M, improving efficiency.

| Investment Area | 2024 Investment | Focus |

|---|---|---|

| Digital Initiatives | €100M | Operational Efficiency |

| Power Plant Upgrades | €200M | Efficiency & Emission Reduction |

| Green Hydrogen Projects | €130M | Decarbonization |

Legal factors

Fortum faces stringent EU directives, especially on environmental protection and emissions. The EU Green Deal shapes Fortum's strategies. Compliance costs are significant. In 2024, the EU's emission trading system (ETS) allowances hit approximately €80-€90 per ton of CO2.

Fortum navigates diverse national energy laws across its operational countries. These laws, differing by nation, dictate market structures, licensing, and environmental standards. For example, Finland's energy market is governed by the Energy Authority, ensuring fair competition. In 2024, Fortum's compliance costs were approximately €150 million due to regulatory changes.

Fortum, operating internationally, faces legal risks tied to investment treaties. These agreements safeguard foreign investments, a crucial aspect for a company like Fortum. Fortum has engaged in legal actions against Russia. This highlights the importance of legal frameworks in protecting investments. As of late 2024, the outcome of these proceedings is still pending.

Corporate governance and reporting standards

Fortum is bound by Finnish law and corporate governance codes, ensuring responsible operations. The company's financial reporting adheres to International Financial Reporting Standards (IFRS), fostering reliability. Sustainability reports are prepared in line with the Corporate Sustainability Reporting Directive (CSRD). These measures promote transparency and accountability, crucial for investor trust.

- Fortum's 2023 financial statements were prepared in accordance with IFRS.

- CSRD implementation began in 2024, affecting sustainability reporting.

Permitting and licensing for energy projects

Fortum, like other energy companies, must navigate complex permitting and licensing procedures. These legal hurdles are crucial for developing and operating energy projects. The time needed to secure these can significantly affect project timelines, particularly for renewable energy initiatives and nuclear plant expansions. Delays can lead to increased costs and potential project cancellations.

- Permitting processes can take several years.

- Compliance with environmental regulations is essential.

- Legal challenges from stakeholders can further delay projects.

- In 2024, regulatory changes impacted several Fortum projects.

Fortum must comply with the EU's environmental directives. These rules, alongside varying national energy laws, heavily influence its operations. The firm faces risks related to international investment treaties. Corporate governance, financial reporting, and complex permitting procedures also impact the company.

| Legal Factor | Description | Impact |

|---|---|---|

| EU Directives | Stringent environmental rules, like the EU Green Deal. | Increased compliance costs; ETS allowances around €80-€90/ton CO2 (2024). |

| National Energy Laws | Different rules across countries where Fortum operates. | Influences market structures, licensing, and standards. Costs around €150M (2024). |

| International Treaties | Investment protection agreements. | Legal risks and safeguarding foreign investments. Legal actions ongoing. |

Environmental factors

Climate change is central to Fortum's strategy. The company targets net-zero emissions by 2040. Fortum has 2030 goals, following the Science Based Targets initiative. In 2023, Fortum's Scope 1 and 2 emissions were 0.8 million tonnes of CO2e. Fortum plans to reduce its emissions intensity by 65% by 2030.

Fortum is committed to eliminating coal from its energy production by the end of 2027, a move aimed at lowering its carbon footprint. This includes earlier deadlines for certain sites. In 2024, Fortum's focus is on accelerating its transition to cleaner energy sources. The company has already reduced its coal usage significantly, with further reductions planned. This strategy aligns with global efforts to combat climate change.

Fortum acknowledges its operational footprint on biodiversity, implementing strategies for no net loss across current and future ventures. The company is focused on lessening adverse effects within its upstream value chain, specifically terrestrial impacts. In 2024, Fortum invested €1.5 million in biodiversity projects, demonstrating a commitment to environmental stewardship. This includes measures to preserve and restore natural habitats.

Water usage and management

Water usage is a key environmental aspect for Fortum, particularly concerning cooling in power generation. Fortum actively monitors its water withdrawal to mitigate any adverse effects on water resources. In 2024, Fortum's water consumption figures highlighted the need for sustainable practices. The company is investing in technologies to minimize water use.

- Fortum's water use is crucial for cooling power plants, impacting water resources.

- The company's 2024 data showed its commitment to reducing water consumption.

- Fortum is implementing water-saving technologies across its operations.

Circular economy and resource efficiency

Fortum actively champions circular economy principles and resource efficiency within its operations. This includes recycling and reusing waste materials to minimize environmental impact. The company provides waste management solutions, supporting the transition to a more sustainable model. Fortum also focuses on enhancing energy and resource efficiency across all its projects.

- In 2024, Fortum processed approximately 1.3 million tonnes of waste.

- The company aims to increase the use of recycled materials in its infrastructure projects by 15% by 2025.

- Fortum's recycling rate for operational waste reached 80% in 2024.

Fortum targets net-zero emissions by 2040 and aims to eliminate coal by 2027. In 2023, Scope 1 and 2 emissions were 0.8 million tonnes of CO2e. €1.5 million was invested in biodiversity projects in 2024.

| Environmental Aspect | 2023 Performance | 2024 Target/Results |

|---|---|---|

| CO2e Emissions | 0.8 million tonnes | 65% reduction in emissions intensity by 2030 |

| Coal Phase-out | Ongoing reductions | Complete phase-out by the end of 2027 |

| Waste Processed | Not Available | Approx. 1.3 million tonnes |

PESTLE Analysis Data Sources

Fortum's PESTLE leverages governmental reports, industry data, and market analysis.