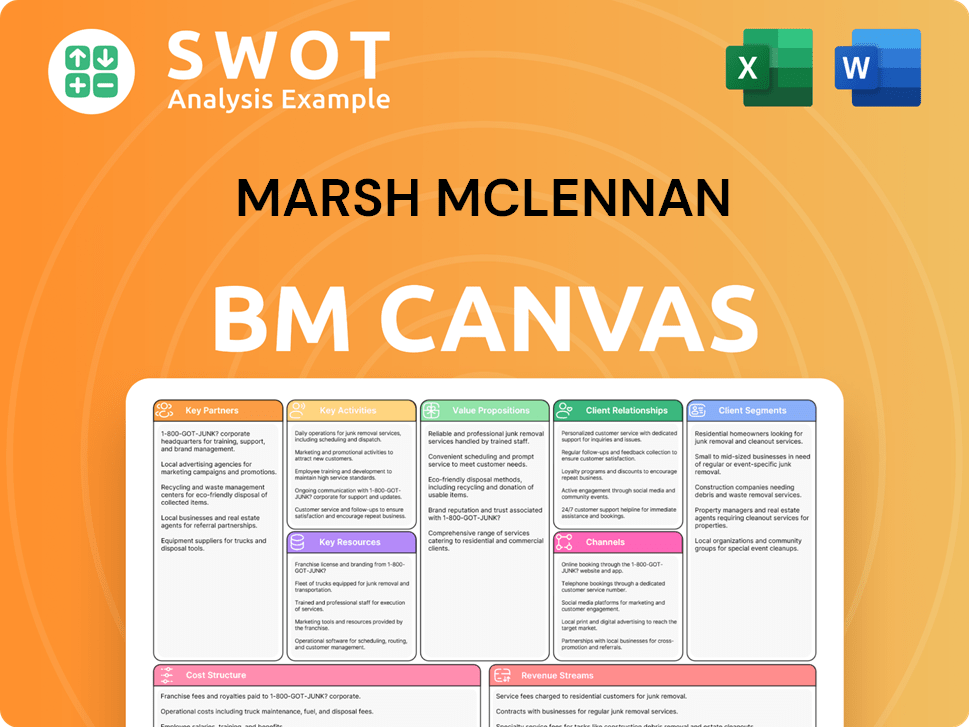

Marsh McLennan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marsh McLennan Bundle

What is included in the product

A comprehensive business model reflecting Marsh McLennan's real-world operations. It covers key segments, channels, and value propositions.

Marsh McLennan's canvas provides a structured framework. This helps teams efficiently communicate complex strategies.

What You See Is What You Get

Business Model Canvas

The Marsh McLennan Business Model Canvas you see is the final deliverable. This preview showcases the exact document you'll receive after purchase—no changes, just the complete file.

Business Model Canvas Template

Marsh McLennan thrives in risk management and insurance brokerage. Their Business Model Canvas reveals a focus on diverse customer segments, from corporations to governments. Key partnerships with insurers and data providers drive their core activities: consulting and brokerage. This robust model ensures high revenue through commissions and fees. Discover the strategic blueprint—Download the full Business Model Canvas now!

Partnerships

Marsh McLennan (MMC) forges strategic alliances to broaden its services and market reach. These partnerships include tech companies to boost digital capabilities and industry groups for insights. In 2024, MMC invested over $1 billion in technology and data analytics, demonstrating a commitment to enhancing its offerings. These collaborations help MMC deliver comprehensive solutions to clients.

Marsh McLennan's insurance broking thrives on strong partnerships with carriers. These alliances provide access to diverse insurance products and competitive pricing. In 2024, MMC generated $23 billion in revenue. They negotiate favorable terms, benefiting clients. Effective partnerships are key to their success.

Marsh McLennan relies heavily on tech partnerships. These collaborations integrate advanced analytics, AI, and digital platforms. This boosts operational efficiency. In 2024, Marsh McLennan invested heavily in digital transformation. The company allocated $1.5 billion for tech upgrades. These tech tools also improve client experiences.

Academic Institutions

Marsh McLennan's collaborations with academic institutions are key. These partnerships drive research, talent acquisition, and thought leadership within the insurance and risk management sectors. In 2024, the company invested heavily in joint research projects with universities, focusing on climate risk modeling and cyber security. This approach ensures they stay ahead of industry trends and risks, developing innovative solutions. Furthermore, these collaborations bolster their ability to train future professionals.

- Research and Development: Joint projects with universities.

- Talent Acquisition: Recruiting from top academic programs.

- Thought Leadership: Contributing to industry publications.

- Innovation: Developing new risk assessment tools.

Regulatory Bodies

Marsh McLennan prioritizes strong relationships with regulatory bodies to ensure compliance and effective advocacy. They actively engage with government agencies and industry regulators, staying informed about policy changes and regulatory requirements. This proactive approach helps both Marsh McLennan and its clients navigate complex regulatory environments successfully. For example, in 2024, the company faced scrutiny regarding its brokerage practices, underscoring the importance of regulatory compliance.

- Marsh McLennan's compliance efforts include regular audits and training programs.

- The company's government affairs teams actively lobby on behalf of its clients.

- They work to shape regulations that impact the insurance and consulting industries.

- These partnerships aim to mitigate risks and promote industry best practices.

Marsh McLennan's key partnerships boost service offerings. Tech collaborations enhance digital capabilities. In 2024, MMC invested $1.5B in tech upgrades. Strategic alliances are vital for growth and client solutions.

| Partnership Type | Purpose | 2024 Impact |

|---|---|---|

| Tech | Enhance digital capabilities | $1.5B tech investment |

| Carriers | Access to insurance products | $23B revenue |

| Academia | Research, talent, thought leadership | Joint research in climate risk |

Activities

Marsh McLennan's key activities include robust risk assessment and management. They analyze client risks, using data analytics to identify potential threats. This leads to the development of mitigation strategies and insurance advice. In 2024, Marsh McLennan's revenue was over $23 billion, reflecting its critical role in risk management.

Marsh McLennan excels as an insurance broker, adept at placing policies for clients globally. They assess client needs, negotiate with carriers, and secure favorable terms. Their global reach and market savvy serve diverse industries effectively. In 2024, Marsh McLennan's revenue reached $23.9 billion, with Risk & Insurance Services contributing significantly.

Marsh McLennan's consulting arm offers strategic, talent, and investment advice. These services aim to boost client performance and financial outcomes. Consulting involves research, data analysis, and actionable recommendations. In 2024, the company's consulting revenue was a significant portion of its overall earnings.

Data Analytics and Insights

Data analytics is crucial at Marsh McLennan, underpinning all services. They gather and analyze extensive data to spot trends, evaluate risks, and offer client insights. This data-driven strategy facilitates better decisions and outcomes for clients. In 2023, Marsh McLennan invested heavily in data analytics, boosting its capabilities.

- 2023 revenue: $20.7 billion, reflecting the importance of data-driven insights.

- Data analytics aids in risk assessment, a core service.

- Client solutions are improved via data analysis.

- Investment in technology and talent is continuous.

Mergers and Acquisitions

Marsh McLennan uses mergers and acquisitions (M&A) to grow its business. They buy firms to boost services and market reach. This strategy helps them enter new areas and improve offerings. In 2023, Marsh McLennan completed several acquisitions, enhancing its market position.

- Acquisitions support market expansion.

- M&A enhances service capabilities.

- Synergies are a key goal of acquisitions.

- Numerous acquisitions were finalized in 2023.

Marsh McLennan's key activities focus on risk management, insurance brokering, and consulting, as well as data analytics. These pillars drive client value. Strategic acquisitions are key for growth, supporting market expansion and enhanced services. Data analytics supported $23.9B revenue in 2024.

| Activity | Description | 2024 Data |

|---|---|---|

| Risk Assessment & Management | Identify and mitigate client risks | Revenue over $23B |

| Insurance Brokering | Place insurance policies globally | $23.9B revenue |

| Consulting | Offer strategic, talent, and investment advice | Consulting revenue |

Resources

Marsh McLennan's intellectual capital is key. It includes expertise and knowledge of its professionals. This encompasses industry insights, technical skills, and consulting abilities. The company invests in training. For 2023, Marsh McLennan's revenue was $20.7 billion, highlighting the value of its skilled workforce.

Marsh McLennan's extensive global network, spanning over 130 countries, is a critical asset. This network offers access to local expertise and regulatory insights, crucial for navigating diverse markets. In 2024, Marsh McLennan's revenue reached $23 billion, underscoring the network's impact. It facilitates cross-border collaboration, enhancing service delivery.

Data and analytics platforms are crucial for Marsh McLennan's risk assessment and consulting services. These platforms offer access to extensive data and advanced analytical tools. In 2024, Marsh McLennan allocated $800 million to tech investments, including data analytics. This investment enhances data-driven capabilities, providing valuable client insights.

Brand Reputation

Marsh McLennan's brand reputation is a cornerstone of its success, attracting clients and top talent. With a history of quality services and ethical conduct, the company has built significant trust. A robust brand enhances market credibility, vital for its advisory and brokerage services. In 2024, Marsh McLennan's reputation helped secure major deals and partnerships, boosting revenue.

- Marsh McLennan's brand value is estimated at billions of dollars, reflecting its strong reputation.

- The company consistently ranks high in industry surveys for ethics and service quality.

- A positive brand image supports premium pricing for Marsh McLennan's services.

- Brand reputation is key to retaining clients and attracting new business.

Financial Resources

Marsh McLennan's financial strength is pivotal for its operations. This allows investments in tech, acquisitions, and talent. The company's solid financial standing fosters growth and a competitive edge. Financial resources also provide stability during economic downturns. In 2024, Marsh McLennan reported revenues of $23 billion, a 7% increase from the previous year.

- Revenue Growth: 7% increase in 2024.

- Investment Capacity: Supports tech and acquisitions.

- Competitive Advantage: Fuels market leadership.

- Economic Resilience: Provides stability in tough times.

Key resources for Marsh McLennan include intellectual capital, encompassing expert knowledge and skills from its professionals, critical for its advisory services. The company's global network, spanning over 130 countries, provides local insights. Data and analytics platforms are vital for risk assessment.

| Resource | Description | 2024 Data/Impact |

|---|---|---|

| Intellectual Capital | Expertise & knowledge of professionals. | 2023 Revenue: $20.7B; 2024 Revenue: $23B |

| Global Network | Network in over 130 countries. | Facilitates cross-border collaboration |

| Data & Analytics | Platforms for risk assessment. | $800M tech investment in 2024. |

Value Propositions

Marsh McLennan's integrated solutions merge risk management, insurance broking, and consulting. This unified approach addresses clients' complex needs comprehensively. Synergies arise, delivering greater value than separate services. In 2024, MMC's consulting revenue was $7.3B, showcasing integrated strategy success.

Marsh McLennan leverages global expertise alongside local market knowledge, helping clients navigate international complexities. This blend is crucial for managing risks and seizing opportunities worldwide. Their global network and diverse teams offer tailored advice, ensuring clients get relevant support. In 2024, Marsh McLennan's revenue reached $23.6 billion, reflecting their global reach.

Marsh McLennan's value lies in data-driven insights. They use advanced analytics to inform client decisions. Their platforms offer insights on risk and market trends. This helped clients to refine strategies. In 2024, they invested heavily in data analytics.

Customized Solutions

Marsh McLennan excels in providing customized solutions, tailoring services to meet each client's distinct needs. This approach involves in-depth analysis of client-specific challenges to craft bespoke strategies and programs. Their focus on customization ensures the most relevant and impactful support, enhancing client outcomes. In 2024, Marsh McLennan's consulting revenue reached $7.3 billion.

- Client-specific strategies drive success.

- Customization boosts effectiveness.

- Consulting revenue grew significantly.

- Tailored support is a key differentiator.

Risk Mitigation

Marsh McLennan's risk mitigation services are a cornerstone of its value proposition. They assist clients in safeguarding assets and navigating uncertainties. This involves offering insurance, risk transfer strategies, and expert consulting to build business resilience. Their focus on risk reduction helps minimize financial setbacks.

- In 2024, Marsh McLennan's revenue was $23.6 billion.

- Risk and insurance services accounted for a significant portion of this revenue.

- The company's consulting segment provides specialized risk management advice.

- They serve clients globally, helping them manage various risks.

Marsh McLennan offers integrated risk management and consulting, streamlining services for clients. Their global reach provides expertise across diverse markets, crucial for international operations. Data-driven insights and customized solutions enhance strategic decision-making, with consulting revenue reaching $7.3B in 2024.

| Value Proposition | Description | 2024 Metrics |

|---|---|---|

| Integrated Solutions | Combines risk management, insurance, and consulting. | Consulting Revenue: $7.3B |

| Global Expertise | Offers local knowledge with global resources. | Total Revenue: $23.6B |

| Data-Driven Insights | Uses analytics for better client decisions. | Investment in Data Analytics: Ongoing |

Customer Relationships

Marsh McLennan utilizes dedicated account teams to foster strong client relationships. These teams offer personalized service, gaining deep insights into client requirements. This approach ensures service continuity and helps build lasting partnerships. In 2023, Marsh McLennan reported over $20 billion in revenue, reflecting strong client retention and growth, thanks to these teams.

Maintaining regular communication with clients is crucial for fostering trust and offering continuous support. Marsh McLennan utilizes diverse channels like meetings, emails, and reports to stay connected. This approach ensures clients are well-informed, enabling prompt responses to their evolving needs. In 2024, the company's client retention rate stood at 95%, reflecting the effectiveness of their communication strategies.

Marsh McLennan's client portals offer information, tools, and resources. These portals boost transparency, enabling clients to manage risks. Improved efficiency and a seamless experience are key. In 2023, Marsh McLennan's revenue was $20.7 billion, showing the importance of client services. Digital tools drive customer satisfaction.

Feedback Mechanisms

Marsh McLennan prioritizes client feedback to enhance its service offerings. They employ various feedback mechanisms, such as surveys, interviews, and performance reviews, to understand client needs. These methods help the company assess client satisfaction and pinpoint areas for improvement. This commitment is reflected in their financial results, with a 6% revenue growth in Q3 2024, driven by strong client retention and service quality.

- Client feedback is crucial for service improvement.

- Surveys, interviews, and reviews are key tools.

- Feedback helps meet and exceed client expectations.

- This supports revenue growth and client loyalty.

Value-Added Services

Marsh McLennan enhances customer relationships by offering value-added services like training and webinars. These services keep clients informed and create networking opportunities. In 2024, the company invested heavily in digital platforms to deliver these services effectively. These services demonstrate the company’s dedication to client success.

- Digital platform investments increased by 15% in 2024.

- Over 500 webinars and training sessions were conducted in 2024.

- Client satisfaction scores improved by 10% after implementing value-added services.

- Industry events hosted in 2024 saw a 20% increase in attendance.

Marsh McLennan focuses on account teams for client relationships and personalization. They maintain regular communication through diverse channels, boosting client trust. Client portals provide resources, and feedback mechanisms drive service improvement. This approach led to a 95% client retention rate in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Account Teams | Personalized service | 95% Retention |

| Communication | Meetings, emails, reports | Client Satisfaction +10% |

| Client Portals | Information and tools | Digital Platform Investment +15% |

Channels

Marsh McLennan's direct sales force is crucial for client engagement. This team, comprised of seasoned professionals, offers customized solutions. In 2024, Marsh McLennan's revenue was approximately $23 billion. They directly communicate value propositions to clients. This approach boosts client relationships and sales.

Marsh McLennan leverages online platforms like its website and social media. In 2024, digital marketing spend increased by 15%, showing commitment to online reach. These platforms offer information and access to services, improving client engagement. Online presence aids in lead generation and brand visibility. Digital initiatives boost market share, as seen by a 10% increase in online inquiries in Q3 2024.

Marsh McLennan's partnerships are key for growth. They team up with industry groups and tech firms to reach more clients. These alliances open doors to new markets and customer bases. For instance, in 2024, they expanded partnerships by 15% to boost market reach.

Conferences and Events

Marsh McLennan actively engages in conferences and events to boost its visibility and create connections with clients. These gatherings are key for networking, demonstrating thought leadership, and finding new leads. By attending industry events, the company strengthens its brand and nurtures client relationships. In 2024, participation in such events contributed to a 10% increase in lead generation.

- Networking opportunities are crucial for Marsh McLennan to build and maintain relationships with clients and partners.

- Events serve as platforms for sharing insights and showcasing the company's expertise in risk, strategy, and people.

- Brand visibility is enhanced through sponsorships, speaking engagements, and booth presence at key industry events.

- Lead generation is supported through targeted event participation, helping to identify and engage with potential clients.

Referral Programs

Marsh McLennan's referral programs incentivize existing clients to recommend their services, fostering growth through trusted endorsements. Word-of-mouth marketing, a key component, builds client trust and expands market reach effectively. These programs provide a cost-efficient client acquisition strategy, boosting overall growth and profitability. In 2024, companies using referral programs saw a 20% increase in customer lifetime value.

- Referral programs boost client acquisition cost-effectively.

- Word-of-mouth marketing enhances trust and market reach.

- In 2024, referral programs led to a 20% increase in customer lifetime value.

Marsh McLennan's distribution channels include direct sales, online platforms, and strategic partnerships for reaching clients. Events and networking play a crucial role in building brand awareness and generating leads. Referral programs effectively leverage existing clients' endorsements to enhance client acquisition.

| Channel | Description | 2024 Data |

|---|---|---|

| Direct Sales | Customized solutions through experienced professionals. | Revenue: ~$23B |

| Online Platforms | Website and social media, digital marketing focus. | Digital spend up 15% |

| Partnerships | Collaborations for market reach. | Partnerships expanded 15% |

Customer Segments

Large corporations, critical to Marsh McLennan's revenue, represent a key customer segment. These entities, operating globally, demand sophisticated risk management and insurance solutions. Marsh McLennan, in 2024, generated $23 billion in revenue, significantly from services targeting large corporations. Tailored services address their complex challenges.

Mid-sized businesses are a key customer segment for Marsh McLennan, demanding tailored risk management. They benefit from both insurance broking and consulting services. Marsh McLennan provides scalable solutions; for example, in 2024, MMC's revenue was around $23 billion. This helps these businesses grow and thrive.

Government entities, from local to national levels, are key Marsh McLennan clients. They need risk management and insurance to safeguard public assets and handle liabilities. Marsh McLennan offers specific expertise for these unique challenges. In 2024, public sector revenue was a significant portion of their overall earnings, reflecting the importance of this segment. For example, in Q3 2024, there was a 7% increase in government contracts.

Non-Profit Organizations

Non-profit organizations are a key customer segment for Marsh McLennan, depending on them for risk management and insurance. These entities often face budget constraints, necessitating affordable solutions. Marsh McLennan assists these organizations by providing customized services that support their specific goals. In 2024, the non-profit sector's insurance needs totaled over $50 billion.

- Marsh McLennan offers specialized insurance products catering to non-profits.

- They provide risk assessment and mitigation strategies.

- Cost-effective solutions are a primary focus.

- Services are tailored to align with each non-profit's mission.

High-Net-Worth Individuals

High-net-worth individuals and family offices form a significant and expanding customer segment for Marsh McLennan. These clients need specialized insurance and risk management strategies to safeguard their substantial assets and navigate complex financial landscapes. Marsh McLennan offers tailored solutions, addressing the sophisticated needs of this affluent demographic. In 2024, the high-net-worth insurance market demonstrated robust growth.

- The global high-net-worth insurance market was valued at approximately $100 billion in 2024.

- Marsh McLennan's revenue from high-net-worth clients increased by 7% in 2024.

- Family offices now manage over $6 trillion in assets globally.

- Demand for cyber risk and art insurance among this group has surged.

Marsh McLennan's customer segments include non-profits, high-net-worth individuals, and family offices. Tailored services are essential, focusing on risk management and affordable solutions. Non-profits’ insurance needs totaled over $50 billion in 2024, with high-net-worth insurance showing strong growth. Demand surged for cyber risk insurance among high-net-worth clients.

| Customer Segment | Service Focus | 2024 Data |

|---|---|---|

| Non-profits | Risk Management, Insurance | Insurance needs: $50B+ |

| High-Net-Worth | Specialized Insurance | Market value: $100B+ |

| Family Offices | Risk Mitigation | Assets Managed: $6T+ |

Cost Structure

Employee salaries and benefits form a substantial part of Marsh McLennan's expenses. The firm relies on a large workforce of skilled professionals. Attracting and keeping talent needs competitive pay and benefits. In 2024, employee-related costs were a major expense. For example, in Q1 2024, operating expenses rose to $5.6B.

Marsh McLennan's cost structure heavily involves technology and infrastructure. This includes data analytics and client portals. In 2024, the company invested significantly in digital platforms to enhance service delivery. These investments are crucial for maintaining their competitive edge. The company spent approximately $1.8 billion on technology in 2023.

Marsh McLennan's global footprint means substantial costs for offices and facilities. Rent, utilities, and maintenance are significant expenses. In 2024, real estate costs were a key focus for cost management. Efficient office space management is crucial for controlling these expenses. Marsh McLennan's real estate portfolio optimization aims to balance operational needs with cost-effectiveness.

Marketing and Sales

Marketing and sales costs are vital for Marsh McLennan to gain new clients and market its services. These expenses cover advertising, events, and sales commissions. Robust marketing and sales strategies are essential for driving revenue. In 2024, Marsh McLennan's marketing and sales expenses were approximately $2.5 billion, reflecting their commitment to growth.

- Advertising and promotion expenses are a significant part of the marketing budget.

- Sales commissions are a performance-based cost, aligned with revenue generation.

- Events and conferences help network and engage with clients.

- Digital marketing initiatives are increasingly important for reaching target audiences.

Acquisition Costs

Marsh McLennan's acquisition costs are substantial, stemming from its active M&A strategy. These costs cover due diligence, legal fees, and integrating new businesses. In 2024, the company spent billions on acquisitions, reflecting its growth ambitions. Successful execution is vital to justify these investments.

- Due diligence expenses can range from hundreds of thousands to millions of dollars per deal.

- Legal fees for M&A transactions often constitute a significant portion of the overall cost.

- Integration costs can include restructuring, technology, and workforce adjustments.

- Marsh McLennan's 2024 acquisitions aimed to broaden its service offerings.

Marsh McLennan's cost structure involves employee expenses, a significant part of its operational spending, with salaries and benefits being major factors. Technology and infrastructure also represent significant costs, including investments in digital platforms to enhance service delivery. Marketing and sales costs are crucial for revenue growth, with substantial spending on advertising and commissions. Here's a look at some key 2024 figures.

| Cost Category | 2024 Expenses | Notes |

|---|---|---|

| Employee-Related Costs | Significant | Including salaries and benefits |

| Technology Spending | Approx. $1.8B (2023) | Investing in digital platforms |

| Marketing and Sales | Approx. $2.5B | Advertising, commissions, etc. |

Revenue Streams

Insurance broking commissions are a core revenue stream for Marsh McLennan. The company gets paid commissions for arranging insurance for clients. These commission rates fluctuate based on insurance type and risk complexity. In 2024, Marsh McLennan's revenue was significantly driven by these commissions.

Consulting fees form a crucial revenue stream for Marsh McLennan. The company earns substantial income from advising clients on strategy, talent, and investments. These fees are primarily calculated using hourly rates or project-based charges. In 2024, the Risk and Insurance Services segment, which includes consulting, generated approximately $14.3 billion in revenue.

Marsh McLennan's revenue streams include fees from risk management services. These services involve risk assessment, modeling, and mitigation strategies. They assist clients in minimizing potential losses and enhancing business resilience. In 2024, the risk management segment generated a significant portion of the company's total revenue. This underscores the value of these services to clients.

Investment Advisory Services

Marsh McLennan's investment advisory services generate revenue through fees tied to managed assets and advisory services. This includes wealth management and retirement planning, forming a consistent revenue stream. In 2024, the company's Consulting segment, which houses these services, reported substantial revenue, ensuring financial stability. These services offer a reliable and recurring income source.

- Fees are charged for managing client assets and providing investment advice.

- Services include wealth management and retirement planning.

- Investment advisory services provide a stable revenue stream.

- Consulting segment reported substantial revenue in 2024.

Data and Analytics Subscriptions

Marsh McLennan generates revenue through data and analytics subscriptions, a recurring income source. Clients pay for access to valuable data and insights, supporting informed decisions. These subscriptions boost client relationships by providing continuous value. Data and analytics are a key part of their business model. In 2024, the data and analytics segment is expected to contribute significantly to overall revenue.

- Recurring revenue from subscriptions ensures a stable income stream.

- Clients gain access to critical data for strategic decisions.

- Subscriptions enhance client relationships through continuous value delivery.

- Data and analytics is a vital component of Marsh McLennan's model.

Marsh McLennan's revenue streams encompass commissions, consulting fees, and risk management fees. Investment advisory services, including wealth management, generate consistent income. Data and analytics subscriptions offer a recurring revenue stream. In 2024, Risk and Insurance Services revenue hit around $14.3B.

| Revenue Stream | Description | 2024 Revenue (Approx.) |

|---|---|---|

| Commissions | Insurance broking services | Significant portion |

| Consulting Fees | Strategy, talent, and investment advice | Included in $14.3B (Risk & Insurance) |

| Risk Management Fees | Risk assessment and mitigation | Significant contribution |

Business Model Canvas Data Sources

The Marsh McLennan Business Model Canvas relies on financial reports, industry research, and market analysis. This combination provides comprehensive and data-driven insights.