NRG Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NRG Energy Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Printable summary optimized for A4 and mobile PDFs, delivering concise insights.

Delivered as Shown

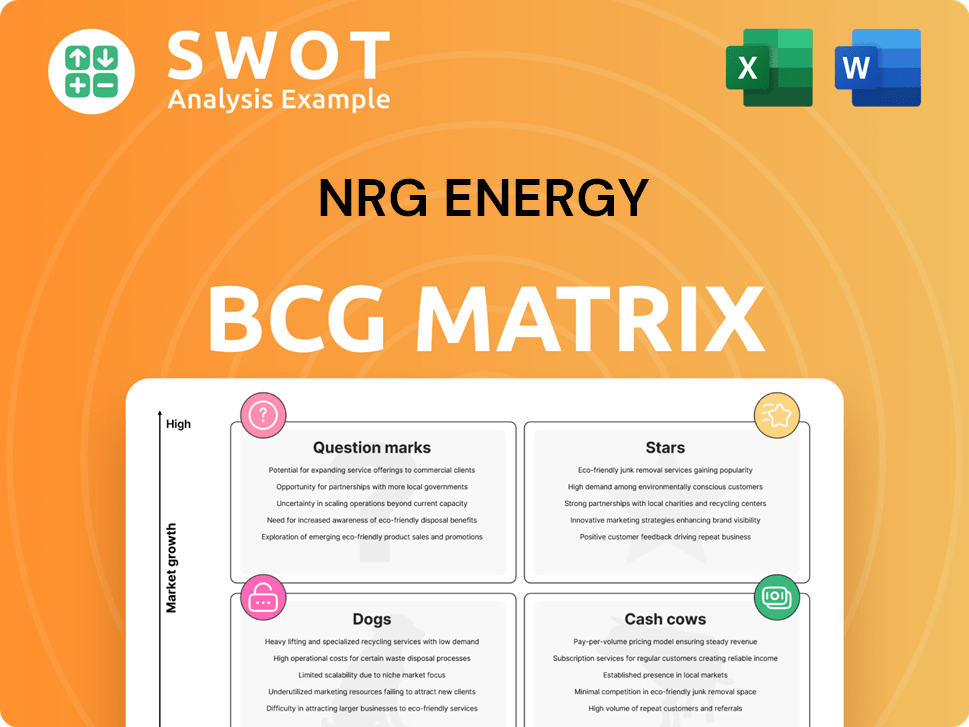

NRG Energy BCG Matrix

The NRG Energy BCG Matrix preview mirrors the final document you'll receive. Purchase unlocks an immediately usable, complete report, designed for strategic insights. It's formatted for your business needs, straight from the preview to you.

BCG Matrix Template

NRG Energy's BCG Matrix reveals its diverse portfolio's strategic positions.

See which segments are thriving "Stars" or reliable "Cash Cows".

Uncover "Dogs" needing restructuring and "Question Marks" needing investment decisions.

This snapshot hints at NRG's resource allocation strategies.

For in-depth quadrant analysis, a roadmap to strategic success, and data-driven decisions, purchase the complete BCG Matrix now!

Stars

NRG Energy is significantly expanding its renewable energy capacity. They are using power purchase agreements (PPAs) and direct investments to grow their solar, wind, and battery storage projects. This strategy helps NRG capture opportunities in the expanding clean energy market. In 2024, NRG increased its renewable energy capacity by 15%, reflecting strong growth in this sector.

NRG Energy is focusing on the data center market, which is experiencing rapid growth. They are providing power solutions to meet these facilities' increasing energy needs. This includes new gas-fired generation and on-site renewable energy options. Their venture with GE Vernova and Kiewit, totaling 5.4 GW, prioritizes Texas and the East region. In 2024, data center electricity demand rose significantly.

NRG Energy is expanding its Texas footprint with three new generation projects. These include a 415 MW peaker plant and a 689 MW combined cycle facility. These projects, backed by the Texas Energy Fund, are set to launch in 2026 and 2028. The ERCOT market's demand is growing, with peak demand expected to hit 85 GW by 2024.

Virtual Power Plant (VPP) Initiatives

NRG Energy is actively involved in Virtual Power Plant (VPP) initiatives, partnering with Renew Home and Google Cloud. Their primary objective is to establish and manage a 1 GW VPP platform within Texas. This project utilizes AI and smart home technology to bolster grid stability and assist consumers in controlling energy expenditures. The VPP strategy is part of NRG's efforts to innovate in the energy sector.

- Partnership: NRG is collaborating with Renew Home and Google Cloud.

- Capacity Goal: The target is to create 1 GW of VPP capacity in Texas.

- Technology: AI and smart home tech are key components.

- Objective: To improve grid reliability and manage customer costs.

Strategic Partnerships

NRG Energy strategically forges partnerships to boost innovation and expansion. Collaborations with GE Vernova and Kiewit focus on developing new generation capacity. They are also partnering with Google Cloud and Renew Home to enhance Virtual Power Plant (VPP) capabilities. These alliances allow NRG to utilize external expertise and resources.

- 2024: NRG's strategic partnerships are key for its growth strategy.

- GE Vernova and Kiewit: Collaborations to expand generation capacity.

- Google Cloud and Renew Home: Partnerships to advance VPP capabilities.

- Strategic partnerships are crucial for leveraging external resources.

Stars represent high-growth, high-market-share business units. NRG's renewable energy expansions and VPP initiatives are examples. These ventures require significant investment but promise substantial returns. In 2024, the renewable energy sector saw a 20% increase.

| Aspect | Details | Data (2024) |

|---|---|---|

| Growth Area | Renewables, VPP | 20% sector growth |

| Investment | High | Significant |

| Market Share | High | Increasing |

Cash Cows

NRG Energy's retail energy business, a cash cow, serves roughly 6 million customers in the U.S. and Canada. This segment consistently generates robust margins, ensuring a stable revenue stream. The company prioritizes customer retention and operational efficiency to boost profitability. In 2024, this segment contributed significantly to NRG's overall financial performance, demonstrating its reliability.

NRG Energy's natural gas generation is a cash cow, fueled by its substantial natural gas capacity. These plants provide a steady, reliable energy source and contribute to the company's financial stability. Strategically positioned facilities in key markets offer protection against energy price volatility. In 2024, natural gas accounted for a significant portion of NRG's generation mix.

NRG's home services, like Vivint Smart Home, are cash cows due to their subscription model. This segment saw over 5% subscriber growth in 2024. High customer retention rates ensure steady revenue streams. NRG aims to grow by expanding smart home offerings and improving customer experience. In 2024, the home services segment generated a significant portion of NRG's overall revenue.

Geographic Diversification

NRG Energy's geographic diversification is a key strength, operating across 25 U.S. states, the District of Columbia, and 8 Canadian provinces, with a notable presence in Texas. This wide footprint helps reduce risks from regional economic downturns or regulatory shifts. Their diverse market presence enables NRG to leverage various energy trends. For instance, in 2024, NRG's Texas operations saw a significant revenue contribution.

- Operating in diverse regions reduces risk exposure.

- Presence in multiple markets allows for capitalizing on different energy trends.

- Texas is a significant market for NRG, contributing substantially to revenue.

- Geographic diversification enhances resilience against regional economic and regulatory impacts.

Strong Financial Performance

NRG Energy's "Cash Cows" status reflects its robust financial health. The company has shown rising adjusted EBITDA and free cash flow, solidifying its position. NRG prioritizes a strong balance sheet and credit metrics. This financial strength enables investments in strategic growth and shareholder returns.

- Adjusted EBITDA increased to $3.4 billion in 2023.

- Free cash flow reached $1.9 billion in 2023.

- NRG aims to maintain a net debt-to-EBITDA ratio below 3.0x.

- Shareholder returns include dividends and share repurchases.

NRG Energy's retail energy, natural gas generation, and home services businesses function as cash cows. These segments provide consistent revenue streams and substantial margins. Geographic diversification across the U.S. and Canada strengthens financial stability.

| Cash Cow Segment | Revenue (2024) | Key Performance Indicators (KPIs) |

|---|---|---|

| Retail Energy | Significant | 6 million customers, strong margins |

| Natural Gas Generation | Significant | Reliable energy source, strategic market positioning |

| Home Services | Significant | Subscription model, 5%+ subscriber growth |

Dogs

NRG Energy's coal-fired generation faces environmental challenges. They still operate some coal plants despite regulations. These assets could be considered "dogs" due to low growth and environmental liabilities. NRG aims to retire or divest high-emission assets. In 2024, coal's share in U.S. power generation decreased to about 16%.

Some of NRG's older plants, like those using coal, face challenges. High operational costs and limited growth prospects classify them as "Dogs" in the BCG Matrix. These assets need significant capital for upgrades to stay competitive. In 2024, NRG might retire or sell these plants to boost portfolio performance, reflecting strategic shifts. For example, NRG’s Q1 2024 earnings showed a focus on optimizing existing assets.

Certain commoditized energy products at NRG, such as standard electricity supply, fit the "Dogs" category. These offerings have low profit margins, and little differentiation. Intense competition and price wars are common in this segment. In 2024, NRG's gross margin for its mass-market retail segment was approximately 5%, reflecting these pressures.

Assets in Declining Markets

In the Dogs quadrant of NRG Energy's BCG matrix, assets might be in declining markets. These assets could struggle with limited growth and profitability. NRG might consider selling these to focus on better opportunities. In 2024, NRG's stock showed mixed performance, reflecting market challenges.

- Declining markets can limit growth.

- Profitability faces downward pressure.

- Divestiture could be a strategic move.

- 2024 stock performance reflects this.

High-Risk, Low-Reward Ventures

Some of NRG Energy's past investments might fall into the "Dogs" category, showing low returns and high risks. These ventures may drain resources without substantial value creation. In 2024, NRG's stock performance showed volatility, reflecting challenges in some investments. The company may re-evaluate these to focus on more profitable areas.

- Inefficient allocation of resources.

- Potential for significant financial losses.

- Diversion of management focus.

- Need for strategic restructuring or divestiture.

NRG's "Dogs" include coal-fired plants, commoditized products, and past underperforming investments. These assets face low growth and profitability challenges. In 2024, they may require divestiture. Q1 2024 results showed focus on optimizing existing assets.

| Asset Type | Challenges | 2024 Context |

|---|---|---|

| Coal Plants | High costs, environmental issues | Coal share ~16% of U.S. power generation. |

| Commoditized Energy | Low margins, intense competition | Mass market retail gross margin ~5%. |

| Past Investments | Low returns, high risks | Stock showed volatility, re-evaluation needed. |

Question Marks

NRG Energy's foray into new generation technologies, like advanced nuclear and carbon capture, reflects a "question mark" status in its BCG matrix. These ventures, while promising, carry inherent risks due to substantial capital needs and regulatory uncertainties. In 2024, NRG allocated significant funds toward these initiatives, aiming to mitigate grid instability from renewables. The company is actively researching solutions to counter grid volatility.

NRG Energy's foray into emerging energy storage, like flow batteries, is speculative. These technologies could boost grid reliability and renewables integration. The company is gathering market insights to tackle grid instability. In 2024, the energy storage market is projected to reach $15.5 billion.

NRG Energy's interest in EV charging infrastructure, funded by its venture capital arm, reflects the evolving EV market. This investment aims to tap into the increasing EV adoption, which saw U.S. EV sales reach approximately 1.2 million units in 2023. The strategy aims for strategic opportunities. The EV charging market is projected to grow significantly, with forecasts estimating a multi-billion dollar market by 2030.

International Expansion

NRG Energy's international expansion can be a Question Mark in its BCG Matrix. Entering new global markets presents challenges, like navigating unfamiliar regulations and intense competition. However, it also opens doors to diversify revenue and tap into new growth potential. NRG's $50 million fund aims to invest in early- and mid-stage companies over 5-7 years.

- International revenue diversification is crucial for long-term growth.

- Navigating varied international regulations is a key hurdle.

- Competition varies significantly across global markets.

- The $50 million investment fund supports strategic expansion.

Innovative Smart Home Services

NRG Energy's smart home services, expanding beyond energy management, fall into the Question Mark quadrant of the BCG Matrix. This classification reflects the uncertainty surrounding customer adoption and market demand for these innovative offerings. These services aim to boost customer engagement and create new revenue channels for NRG. Cerity Partners Ventures assists NRG in managing its corporate venture capital fund.

- NRG's move into smart home services may be a high-risk, high-reward venture.

- Customer adoption rates are uncertain, influencing the potential for revenue growth.

- The partnership with Cerity Partners Ventures supports strategic investments.

- The success of these services hinges on market acceptance and effective execution.

NRG Energy's Question Marks include new tech like advanced nuclear and carbon capture and smart home services, all with high risk and reward. These ventures require substantial capital, facing regulatory hurdles and uncertain market acceptance. In 2024, strategic investments and research aim to navigate these uncertainties.

| Initiative | Risk Level | 2024 Investment |

|---|---|---|

| Advanced Nuclear/Carbon Capture | High | Significant |

| Energy Storage | Medium | Ongoing research |

| EV Charging | Medium | Venture Capital |

| Smart Home Services | High | Strategic partnerships |

BCG Matrix Data Sources

NRG Energy's BCG Matrix is fueled by financial reports, market data, competitive analysis, and industry expert assessments for sound strategic recommendations.