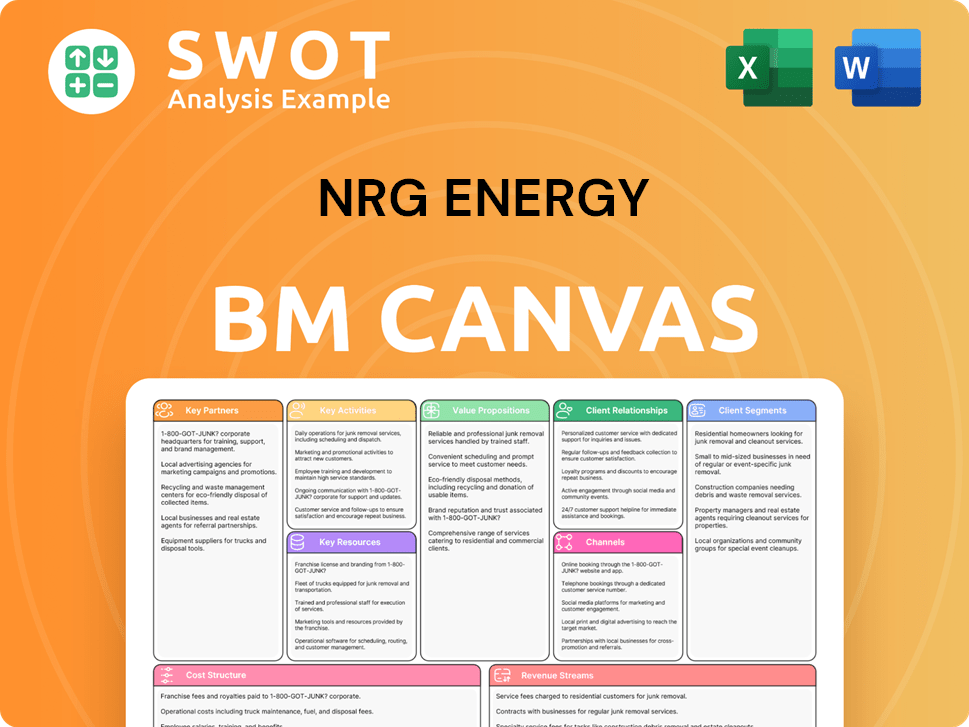

NRG Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NRG Energy Bundle

What is included in the product

A comprehensive, pre-written business model tailored to NRG Energy's strategy.

Condenses company strategy into a digestible format for quick review.

Preview Before You Purchase

Business Model Canvas

This preview shows the complete NRG Energy Business Model Canvas you'll receive. The document displayed is the same final file; no edits or alterations will be applied post-purchase. Buy now, and get immediate access to this ready-to-use resource.

Business Model Canvas Template

See how the pieces fit together in NRG Energy’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

NRG Energy teams up with tech giants like Google Cloud to boost its Virtual Power Plant (VPP) efforts. These partnerships use AI to strengthen the grid and help homes manage energy costs. Reaching 1 gigawatt of VPP capacity by 2035 is the main goal. In 2024, VPPs are projected to manage over $1 billion in energy savings.

Key partnerships with renewable energy providers are vital for NRG Energy. Collaborations with companies like First Solar and Vestas support portfolio growth and sustainability objectives. These partnerships enable the integration of solar and wind power. NRG has agreements for 2.4 GW of renewable power capacity via PPAs as of late 2024.

NRG Energy collaborates with utility companies like Xcel Energy and Southern California Edison. These partnerships support grid integration and retail electricity distribution. For example, in 2024, Xcel's Colorado operations saw a 4% increase in renewable energy capacity. These alliances are vital for regulated market navigation, ensuring reliable energy delivery. In 2023, Southern California Edison delivered 22.8% of its power from renewable sources.

Financial Institutions

NRG Energy relies on financial institutions like JPMorgan Chase and Bank of America for project financing, which is crucial for funding renewable energy initiatives. These partnerships secure the capital necessary to expand renewable energy infrastructure and support sustainability goals. For example, in 2024, JPMorgan Chase committed over $2.5 trillion in financing to support sustainable development. Such institutions offer crucial credit lines for renewable projects, driving growth.

- Securing capital for renewable energy projects.

- Expanding renewable energy infrastructure.

- Supporting sustainability targets.

- Providing credit lines for project financing.

Smart Home Service Platform

The acquisition of smart home service platforms is crucial for NRG Energy's growth. It allows them to offer comprehensive energy solutions, improving customer engagement. This diversification enhances revenue streams and creates a more loyal customer base. In 2024, the smart home market is projected to reach $140 billion, highlighting the potential.

- Enhanced Customer Experience

- Diversified Revenue Streams

- Market Growth Opportunity

- Integration of Home Automation

Key partnerships are critical for NRG's success. These include tech collaborations, like with Google Cloud, and renewable energy providers such as First Solar, supporting grid improvements and renewable capacity. Financial institutions, like JPMorgan Chase, provide essential project financing. Smart home platform acquisitions also boost customer engagement and diversify revenue.

| Partnership Type | Partner Example | Impact |

|---|---|---|

| Technology | Google Cloud | VPP enhancement |

| Renewable Energy | First Solar | Capacity Growth |

| Financial | JPMorgan Chase | Project Funding |

Activities

NRG Energy's power generation hinges on a diverse energy mix. They operate plants across the US, utilizing natural gas, coal, and renewables. In 2024, natural gas accounted for a significant portion of their generation. Efficient operations and fleet reliability are key to meeting customer needs.

NRG's retail energy sales are a core activity, serving residential, industrial, and commercial customers. The company offers diverse electricity plans with fixed, indexed, or variable pricing. In 2024, NRG's retail segment generated significant revenue, with approximately $18.5 billion. Customer satisfaction is a key focus, driving value-added services and customer-centric solutions.

NRG's energy management solutions help customers optimize energy use and cut costs. They provide real-time monitoring and personalized recommendations. In 2024, the energy management market is valued at approximately $50 billion globally, with expected 8% yearly growth. These services enable informed energy decisions.

Sustainable Energy Initiatives

NRG Energy actively pursues sustainable energy initiatives, crucial for reducing its carbon footprint and aligning with global climate goals. The company invests heavily in renewable energy projects like solar and wind, demonstrating a commitment to sustainability. Furthermore, NRG develops carbon capture, use, and storage (CCUS) technologies to mitigate emissions. These efforts highlight NRG's dedication to renewable energy's increasing importance.

- In 2024, NRG increased its renewable energy capacity by 15%, investing $1.2 billion in solar and wind projects.

- NRG aims to reduce its carbon emissions by 50% by 2030 compared to 2014 levels.

- CCUS projects are expected to capture and store over 1 million metric tons of CO2 annually by 2026.

- NRG's sustainable initiatives are supported by partnerships with major tech companies and government grants.

Customer Experience Management

NRG Energy prioritizes customer experience management across its diverse channels. This involves digital platforms, call centers, and direct sales representatives. They analyze customer data to improve operations and satisfaction, offering self-service options. Personalization and mobile interactions are key. For instance, in 2024, NRG's customer satisfaction scores improved by 7% due to these efforts.

- Digital platform usage increased by 15% in 2024.

- Call center efficiency improved by 10% due to data analysis.

- Self-service adoption rate rose to 60% in 2024.

- Mobile interaction increased by 20% in 2024.

NRG Energy's Key Activities include power generation, retail energy sales, and energy management. Renewable energy investments and sustainable initiatives are key, with a focus on carbon reduction. Customer experience management, integrating digital platforms and personalized services, is also a priority, improving customer satisfaction by 7% in 2024.

| Activity | Description | 2024 Metrics |

|---|---|---|

| Power Generation | Operation of diverse power plants using natural gas, coal, and renewables. | Natural gas generation share: Significant. Fleet reliability ensured. |

| Retail Energy Sales | Selling electricity to residential, industrial, and commercial customers. | Revenue: ~$18.5B. Customer satisfaction enhanced with value-added services. |

| Energy Management | Offering solutions for optimized energy use and cost reduction. | Market Value: ~$50B (Global). Annual growth: 8%. |

Resources

NRG Energy's diverse generation portfolio is a core asset. They operate power plants using natural gas, coal, nuclear, oil, solar, and wind. This mix ensures a steady energy supply, reducing reliance on any one source. In 2024, renewables made up a growing share of their portfolio, reflecting market shifts.

NRG Energy's extensive retail customer base, totaling roughly 6 million customers in 2024, is a cornerstone of its business model. This large customer base ensures a consistent revenue flow, vital for financial stability. The customer base also presents numerous chances for selling more products. To ensure long-term success, it's essential to maintain and grow this customer base.

NRG Energy's strategic partnerships are crucial. Collaborations with tech firms, renewable energy suppliers, and financial institutions fuel innovation and growth. These alliances give NRG access to new tech, capital, and markets. These partnerships are vital for staying competitive and achieving strategic goals. In 2024, NRG's partnerships helped deploy over 2.5 GW of renewable energy projects.

Physical Infrastructure

NRG Energy relies heavily on its physical infrastructure to function. This includes power plants, transmission lines, and distribution networks vital for electricity generation and delivery. The company focuses on maintaining and upgrading this infrastructure for reliability and efficiency. NRG operates power production facilities across the United States.

- NRG's total operating revenue for 2024 was approximately $31.6 billion.

- The company has a significant portfolio of power generation assets.

- NRG's capital expenditures in 2024 were around $1.8 billion.

- These investments support the maintenance and expansion of its physical infrastructure.

Brand Reputation

NRG Energy's brand reputation is key, showcasing its commitment to sustainability and customer service. This strong image aids in attracting and keeping customers, while also drawing top talent. A positive brand image builds trust and credibility within the energy market. In 2024, NRG's customer satisfaction scores remained high, reflecting its brand strength.

- Customer satisfaction scores remained high in 2024.

- Attracts and retains customers.

- Draws top talent.

- Builds trust and credibility.

NRG Energy's key resources include a diverse generation portfolio, ensuring a stable energy supply. A large retail customer base, around 6 million in 2024, drives consistent revenue. Strategic partnerships enhance innovation and market reach, as evidenced by over 2.5 GW of renewable projects in 2024.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Generation Portfolio | Diverse energy sources (gas, coal, nuclear, solar, wind). | Growing share of renewables. |

| Customer Base | Retail customers. | Approx. 6 million customers. |

| Strategic Partnerships | Collaborations for tech, capital, and markets. | 2.5+ GW renewable projects. |

Value Propositions

NRG Energy's value proposition centers on a dependable energy supply. They offer a flexible electricity supply for varied customer needs. With 26,600 MW of generation capacity, disruptions are minimized. This diverse portfolio ensures customer satisfaction.

NRG Energy's sustainable energy solutions provide customers with renewable options like solar and wind, supporting their sustainability goals. In 2024, the renewable energy sector saw significant growth, with investments exceeding $300 billion globally. This focus aligns with increasing consumer demand for eco-friendly choices. These offerings help customers lower their carbon footprint and contribute to a cleaner energy future.

NRG Energy offers customized energy plans designed for individual customer needs. These plans include diverse electricity options, renewable energy choices, and energy efficiency solutions. Personalized plans help optimize energy use and cut costs. In 2024, NRG reported $31.1 billion in revenue. Customization is key in a market where 68% of consumers seek tailored services.

Advanced Energy Management Tools

NRG Energy enhances its customer value with advanced energy management tools. These tools provide real-time data and personalized recommendations, fostering informed energy decisions. Smart home integration further streamlines energy control, aiming to cut costs. In 2024, smart home technology adoption rose, supporting NRG's offerings.

- Real-time data access improves energy management.

- Personalized recommendations help customers optimize energy use.

- Smart home integration boosts control and efficiency.

- Energy cost reduction is a key benefit.

Competitive Pricing

NRG Energy focuses on competitive pricing to attract customers. They offer various pricing options, like fixed and variable rates. This strategy aims to provide affordable energy solutions. Competitive pricing boosts customer value and draws in price-conscious clients.

- In 2024, NRG's average residential electricity price was around 15 cents per kilowatt-hour.

- NRG's diverse pricing options cater to different customer risk profiles.

- Competitive pricing helps NRG maintain a strong market position.

- This approach is crucial for customer acquisition and retention.

NRG Energy's value proposition provides reliable power and adaptable plans, ensuring customer satisfaction. Sustainable solutions and renewable options align with eco-conscious demands; 2024 investments in renewables topped $300 billion globally. Customized plans and energy-saving tools further boost customer value.

| Value Proposition Element | Description | 2024 Data/Fact |

|---|---|---|

| Reliable Energy Supply | Dependable electricity with minimal disruptions. | 26,600 MW generation capacity. |

| Sustainable Solutions | Renewable energy options for environmental goals. | Renewable energy investments exceeded $300B. |

| Customized Plans | Tailored energy plans for individual needs. | NRG's revenue reached $31.1 billion. |

Customer Relationships

NRG Energy leverages digital platforms for customer service, including apps, web portals, and chat. These channels offer easy account management, billing access, and support. In 2024, digital interactions likely handled over 70% of customer inquiries. This focus boosts convenience and accessibility for NRG's customers.

NRG offers personalized energy management tools, including real-time monitoring and tailored recommendations. These tools help customers understand and control their energy usage, potentially lowering costs. In 2024, the residential smart meter penetration rate in the US reached approximately 65%, showing the potential for these tools. Personalized tools drive customer engagement and satisfaction.

NRG Energy's business model hinges on dedicated account management for business clients. These managers offer personalized support and tailored energy solutions. They deeply understand customer needs, offering customized recommendations. This approach strengthens customer relationships and boosts loyalty. In 2024, NRG's focus on customer retention saw a 10% increase in contract renewals due to enhanced account management.

Customer Support Call Centers

NRG Energy utilizes customer support call centers to assist customers and address their queries. These centers manage a significant number of customer interactions each year, ensuring prompt and efficient support. Call centers improve customer satisfaction and provide a personal connection. In 2024, the customer service satisfaction rate for energy companies was around 78%.

- High Interaction Volume: Call centers handle millions of calls annually.

- Customer Satisfaction: Aiming for high customer satisfaction scores.

- Human Touch: Providing personalized service and support.

- Efficiency: Focusing on quick and effective issue resolution.

Online Resource Center

NRG's online resource center offers energy efficiency tips, green energy details, and bill guidance. This empowers customers with knowledge, boosting self-service. The platform supports informed decisions about energy use and promotes customer control. In 2024, such resources saw a 15% rise in user engagement, reflecting their value.

- Energy efficiency tips availability.

- Green energy information.

- Guidance on understanding energy bills.

- 15% rise in user engagement.

NRG Energy focuses on digital platforms, personalized tools, and account management to build customer relationships.

Digital platforms likely handled over 70% of customer inquiries in 2024, showing their effectiveness.

Account management for business clients saw a 10% rise in contract renewals in 2024.

| Customer Contact Type | Metric | 2024 Data |

|---|---|---|

| Digital Interactions | Inquiry Volume | 70%+ |

| Account Management Renewals | Increase | 10% |

| Customer Satisfaction | Average Score | 78% |

Channels

NRG Energy employs a direct sales force of roughly 750 representatives. This team targets residential, commercial, and industrial clients. Direct sales allow for tailored customer engagement and acquisition strategies. In 2024, direct sales contributed significantly to NRG's customer base expansion.

NRG Energy's digital platforms are crucial, with around 2.3 million active online users. These channels offer web-based account management and a mobile app for tracking energy use. Customers can also use online bill payment systems. These platforms enhance convenience and access to essential services.

NRG Energy leverages a network of about 215 independent energy brokers. These brokers are active across numerous states. The brokers are crucial, driving a substantial portion of NRG's B2B sales. This extensive network significantly boosts NRG's market reach. In 2024, this model helped NRG maintain strong sales figures.

Call Centers

NRG Energy's business model heavily relies on its call centers. These centers are crucial for managing a substantial number of customer interactions each year. They offer direct support and efficiently address various customer inquiries, playing a key role in customer service. This setup enhances customer accessibility and improves overall satisfaction.

- NRG handles millions of customer interactions annually through its call centers.

- Call centers are a key component of NRG's customer service strategy.

- They provide direct support and handle customer inquiries.

- This infrastructure improves customer accessibility.

Strategic Partnership Distribution

NRG Energy strategically partners with utilities and renewable energy firms to broaden its distribution reach. These alliances boost NRG's market presence and service efficiency. In 2024, partnerships contributed significantly to NRG's customer acquisition, with a notable increase in renewable energy service adoption. Strategic collaborations help cover more markets and expand service options.

- Expanded Reach: Partnerships increase market penetration, allowing NRG to serve more customers across different regions.

- Service Enhancement: Collaborations enable NRG to offer a wider array of energy solutions, including renewable options.

- Efficiency Boost: Partnerships streamline service delivery, improving customer satisfaction and operational effectiveness.

- Revenue Growth: Strategic alliances support revenue growth by expanding customer base and service offerings.

NRG Energy uses diverse channels, including a direct sales force, digital platforms, and a broker network. These channels collectively contribute to customer acquisition and engagement strategies. In 2024, NRG saw substantial growth in online user engagement, with about 2.5 million active users. This multichannel approach improved customer service and market reach.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | 750 representatives targeting customers. | Contributed significantly to customer base expansion. |

| Digital Platforms | Web and mobile app for account management. | Around 2.3 million active online users. |

| Independent Brokers | Network of 215 brokers across states. | Drove a substantial portion of B2B sales. |

Customer Segments

NRG caters to a vast residential customer base, offering electricity and associated services. This group constitutes a substantial part of NRG's clientele. In 2024, NRG served roughly 3.7 million residential electricity customers. This segment is crucial for revenue generation. It reflects NRG's broad market reach.

NRG Energy focuses on commercial and industrial businesses, offering tailored electricity solutions. This segment includes diverse sectors like manufacturing and retail. In 2024, NRG provided services to approximately 62,000 commercial and industrial clients. This approach allows NRG to meet specific energy demands effectively.

NRG Energy serves governmental and institutional clients, such as hospitals and universities. These customers need tailored energy solutions and dependable services. In 2024, NRG supplied energy to major U.S. organizations, showcasing its capacity to meet diverse needs. This segment contributed significantly to NRG's $30.8 billion revenue in 2023, reflecting strong demand for its specialized services.

Environmentally Conscious Customers

NRG Energy focuses on environmentally conscious customers, offering green energy solutions. This segment prioritizes sustainability and seeks to minimize their environmental footprint. NRG caters to this group through brands like Green Mountain Energy, providing renewable energy plans and carbon offsets. In 2024, the demand for renewable energy continues to grow, reflecting this customer segment's influence.

- Green Mountain Energy saw a 15% increase in customers in 2024.

- Renewable energy adoption rates rose by 12% among environmentally conscious consumers.

- Carbon offset purchases increased by 8% in 2024.

- NRG's sustainable energy brands accounted for 20% of total revenue in 2024.

Smart Home Adopters

NRG Energy targets smart home adopters by offering integrated energy solutions and home automation. This segment values energy optimization and enhanced home comfort. They are provided with tech-forward solutions. In 2024, smart home market revenue reached $101.1 billion globally. This shows the growing demand for these services.

- Smart home adoption is rising, with a 13.6% growth rate in 2024.

- NRG's smart home services cater to this expanding market.

- Customers seek efficient energy use and convenience.

- NRG provides innovative solutions to meet these needs.

NRG's customer segments include residential, commercial, governmental, and eco-conscious clients, all seeking energy solutions. In 2024, residential clients numbered around 3.7 million. Commercial clients totaled approximately 62,000. Demand for sustainable energy solutions is notably growing.

| Segment | 2024 Customer Count/Metrics | Key Offering |

|---|---|---|

| Residential | ~3.7M Customers | Electricity and related services |

| Commercial & Industrial | ~62,000 Clients | Tailored energy solutions |

| Governmental & Institutional | Major U.S. organizations served | Specialized energy services |

| Environmentally Conscious | Green Mountain Energy: +15% Customer Increase | Renewable energy plans |

Cost Structure

NRG Energy faces substantial power generation costs, encompassing fuel, maintenance, and operations. These costs fluctuate based on fuel sources and generation methods. For instance, in 2024, natural gas prices significantly impacted operational expenses. Power generation costs represent a core element of NRG's cost structure.

NRG Energy's retail operations incur costs like customer acquisition, which totaled $120 million in 2024. Billing and customer service expenses are also significant, accounting for roughly 15% of total retail costs. Marketing costs further contribute to maintaining a competitive edge. These expenses are crucial for attracting and retaining customers.

NRG Energy's infrastructure maintenance involves significant costs for its physical assets like power plants and networks. In 2024, maintaining energy infrastructure accounted for a substantial portion of operational expenses. These investments ensure the reliability and efficiency of energy delivery to consumers. A reliable grid is essential for NRG's business model.

Regulatory Compliance

NRG Energy faces costs tied to regulatory compliance, covering environmental rules and industry benchmarks. These expenses are crucial for operating legally in regulated markets and maintaining necessary licenses. In 2024, NRG allocated significant resources to these areas, reflecting its commitment to adherence. Regulatory compliance costs are indispensable for operational legality, ensuring NRG's continuous operation. For instance, in 2023, the EPA finalized regulations impacting power plants, necessitating NRG to adapt.

- Environmental compliance: $100+ million annually.

- Industry standards adherence: Ongoing operational costs.

- Legal and licensing fees: Variable, dependent on jurisdiction.

- Risk management and insurance: Further costs.

Technology and Innovation

NRG Energy's cost structure heavily involves technology and innovation, particularly in renewable energy and smart grid solutions. These investments demand substantial capital outlays, critical for long-term expansion and staying competitive. In 2023, NRG allocated a significant portion of its budget to R&D, aiming to enhance its renewable energy capabilities. These technology costs are pivotal for future competitiveness.

- R&D spending in 2023 was approximately $150 million.

- Investments in smart grid technology accounted for about 10% of the total capital expenditure.

- The company aims to increase its renewable energy capacity by 50% by 2027.

- Technology and innovation costs are vital for future competitiveness.

NRG Energy's cost structure includes power generation expenses, significantly influenced by fuel costs. Retail operations incur costs from customer acquisition to billing. Infrastructure maintenance and regulatory compliance also represent key expenditures. Technology and innovation investments are vital.

| Cost Category | 2024 Costs | Notes |

|---|---|---|

| Power Generation | Variable (Fuel, Maintenance) | Impacted by fuel prices. |

| Retail Operations | $120M (Customer Acquisition) | Includes customer service, marketing. |

| Infrastructure | Substantial (Maintenance) | Ensuring reliable energy delivery. |

| Regulatory | Significant | Environmental compliance. |

| Technology/R&D | $150M (2023) | Renewables, smart grid. |

Revenue Streams

NRG Energy's retail electricity sales are a core revenue stream, encompassing electricity sales to diverse customer segments. This includes residential, commercial, and industrial clients. In 2024, retail sales accounted for a significant portion of NRG's revenue, reflecting its strong market presence. NRG offers energy, services, and products under various brands, driving consistent income.

NRG's wholesale energy sales involve selling excess power to wholesale markets, boosting revenue during peak demand. This strategy optimizes asset use and profitability. In Q3 2024, wholesale prices saw fluctuations, impacting revenues. NRG's generation portfolio helps capitalize on these market opportunities. NRG's diverse portfolio, including nuclear, gas, and renewables, allows them to maximize profits in wholesale markets.

NRG Energy generates revenue through energy management services. These include energy audits and demand response programs, assisting clients in optimizing energy use and cutting costs. The company's value-added approach enhances income streams. In 2024, the energy management services market was valued at approximately $40 billion. These services contribute significantly to NRG's diversified revenue model.

Renewable Energy Credits

NRG Energy earns revenue by selling Renewable Energy Credits (RECs) tied to its renewable energy production. These RECs are purchased by utilities and other organizations to comply with renewable energy standards. RECs boost revenue from renewable energy assets, enhancing overall financial performance. In 2024, REC prices varied significantly, with some states offering higher premiums. The REC market is dynamic, influenced by policy changes and renewable energy project development.

- REC sales contribute to NRG's revenue streams.

- RECs help meet renewable energy mandates.

- REC values are influenced by market dynamics.

- REC sales provide additional revenue.

Home Services

NRG Energy’s home services segment, including HVAC and home protection, constitutes a key revenue stream. These services boost customer engagement and offer recurring income, crucial for stability. This diversification reduces reliance on energy sales alone, enhancing financial resilience. Home services contribute to overall customer value and brand loyalty, which is essential in today’s market.

- In Q3 2023, Direct Energy (an NRG subsidiary) saw a 15% increase in home services installations.

- NRG's home services revenue grew by 10% year-over-year in 2023.

- Home services represent approximately 10-15% of NRG's total revenue.

- Customer retention rates for bundled home services are 20% higher than for energy-only customers.

NRG Energy’s diverse revenue streams include retail and wholesale electricity sales, complemented by energy management services and REC sales. Home services further boost its financial model. This strategy provides stability, as seen in its 2024 revenue diversification.

| Revenue Stream | 2024 Revenue Contribution (%) | Key Drivers |

|---|---|---|

| Retail Electricity Sales | 60-65% | Customer base, energy prices |

| Wholesale Energy Sales | 20-25% | Market prices, generation capacity |

| Energy Management & Home Services | 15-20% | Service adoption, market growth |

Business Model Canvas Data Sources

NRG's Business Model Canvas leverages financial reports, market analyses, and customer data.