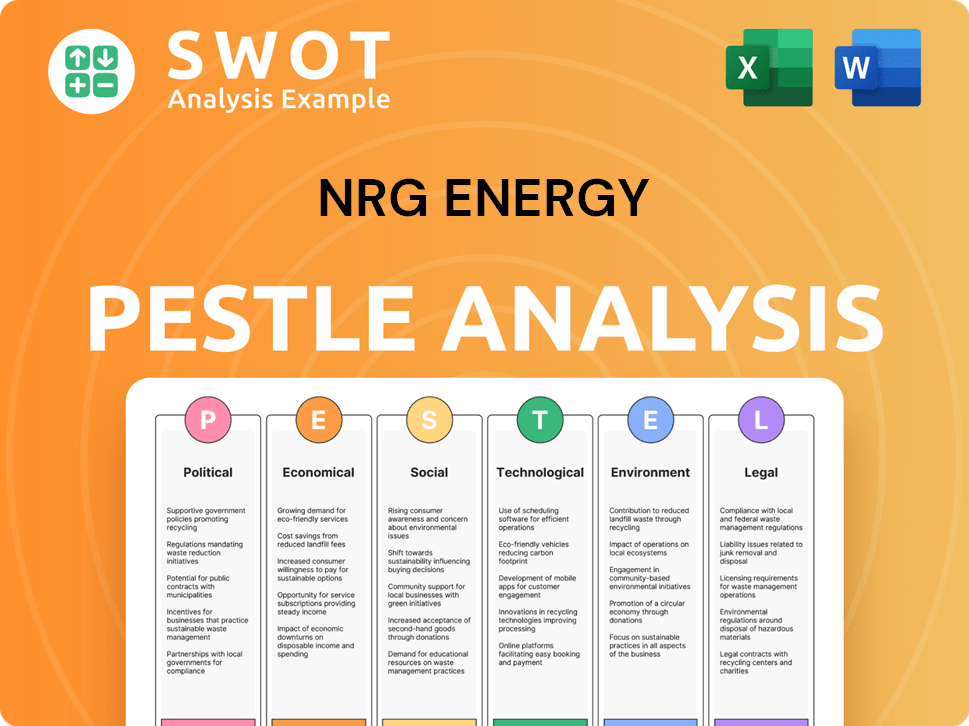

NRG Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NRG Energy Bundle

What is included in the product

Identifies how macro-environmental factors affect NRG across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

NRG Energy PESTLE Analysis

This is the NRG Energy PESTLE Analysis preview. The content displayed mirrors the final document you’ll receive. It is ready for instant download after your purchase. All analysis, details, and structure remain identical. Access the fully formatted file after buying.

PESTLE Analysis Template

Explore the forces shaping NRG Energy’s future with our PESTLE Analysis. Uncover political shifts, economic impacts, social trends, technological advancements, legal frameworks, and environmental concerns influencing NRG Energy’s operations. This analysis provides strategic insights essential for informed decision-making. Grasp how external factors can be a strength and a weakness. Access the complete, in-depth analysis instantly.

Political factors

NRG Energy faces significant impacts from government regulations across federal, state, and local levels. Stricter environmental standards, like those targeting emissions, can require major capital spending. For instance, compliance with carbon regulations could affect the financial health of fossil fuel plants. In 2024, the US government continued implementing measures to boost renewable energy, impacting NRG’s strategies.

Government actions and how energy markets are set up have a big impact on NRG's finances. Policies influence power prices, fuel expenses, and electricity demand, which are key to NRG's earnings. For instance, in 2024, the U.S. Energy Information Administration reported shifts in energy consumption. Market changes can present NRG with new possibilities or hurdles.

Geopolitical instability impacts NRG's operations. For example, the Russia-Ukraine conflict has altered energy supply chains globally. Shifts in political landscapes can lead to modified regulations. Public support for renewable energy sources is increasing. In 2024, NRG's stock price saw fluctuations influenced by political decisions.

Trade Policies and International Agreements

NRG Energy, though mainly North American, faces political risks from shifting trade policies. Changes in energy-related international agreements, like those affecting renewable energy, could influence its operations. For example, the Inflation Reduction Act in 2022 offered significant tax credits, impacting renewable energy investments. The US-Mexico-Canada Agreement (USMCA) also shapes energy trade dynamics. These policies affect fuel costs and equipment expenses.

- The Inflation Reduction Act (IRA) of 2022 provides substantial tax credits for renewable energy projects.

- USMCA influences energy trade dynamics among the US, Mexico, and Canada.

- Changes to environmental standards globally can also indirectly impact NRG's cost structure.

Government Incentives and Support for Renewables

Government incentives significantly influence NRG's renewable energy investments. Subsidies, tax credits, and grants boost project viability. The Inflation Reduction Act of 2022 offers substantial tax credits, potentially increasing renewable energy deployment. These incentives support NRG's decarbonization goals and expansion of sustainable resources. Such policies create market opportunities.

- The Inflation Reduction Act provides up to 30% investment tax credits for renewable energy projects.

- In 2024, the U.S. government allocated $369 billion to climate and energy programs.

- State-level renewable portfolio standards (RPS) mandate renewable energy adoption.

Political factors significantly shape NRG Energy's operations. The Inflation Reduction Act (IRA) of 2022 offers substantial tax credits for renewable projects. In 2024, U.S. climate and energy programs received $369 billion in funding, impacting NRG's investment strategies. Fluctuations in trade policies and energy regulations influence fuel costs and investments.

| Policy Impact | Specifics | 2024 Data |

|---|---|---|

| IRA Tax Credits | Up to 30% investment tax credits | $369B allocated to climate/energy programs |

| Trade Agreements | USMCA shaping energy trade | Influences fuel costs |

| Renewable Portfolio Standards (RPS) | State-level mandates | Drive renewable energy adoption |

Economic factors

NRG Energy is highly sensitive to wholesale power and fuel price volatility, especially natural gas, a key fuel source. In 2024, natural gas spot prices at the Henry Hub averaged around $2.50-$3.00 per MMBtu, impacting generation costs. These fluctuations directly affect NRG's profitability and revenue streams in the competitive energy market.

Overall economic conditions significantly impact NRG Energy's performance, as economic growth or contraction directly affects energy demand. For example, in 2024, the U.S. GDP grew by around 3%, influencing energy consumption across sectors. During economic downturns, energy demand typically decreases. Conversely, a robust economy boosts energy consumption, benefiting NRG Energy.

Changes in interest rates significantly influence NRG's financial strategy. In 2024, rising rates increased borrowing costs, impacting project financing. Lower rates could decrease debt servicing costs. Access to capital is vital; NRG's ability to secure funding at favorable terms drives its operational and strategic moves.

Inflation and Operating Costs

Inflation significantly impacts NRG Energy's operational expenses. Rising costs for fuel, labor, and equipment directly affect profitability. NRG needs effective cost management strategies to mitigate these inflationary pressures. In 2024, the U.S. inflation rate was around 3.1%, increasing operational challenges.

- Fuel costs, a major expense, are heavily influenced by inflation.

- Labor costs rise due to inflation, affecting operational efficiency.

- Equipment expenses increase with inflation, impacting capital expenditure.

- Effective cost management is crucial for maintaining profit margins.

Market Competition

NRG Energy faces intense competition in the power market, influencing pricing and market share dynamics. The retail power sector is especially fragmented and competitive, with numerous providers vying for customers. Competition can lead to narrower margins and the need for innovative offerings to stay ahead. In 2024, the U.S. energy market saw significant price volatility due to various factors.

- Retail electric competition is intensifying with more customer choice.

- NRG's market share fluctuates depending on regional market conditions.

- Competitive pressures drive innovation in energy products and services.

Economic factors significantly influence NRG's profitability. Fluctuations in GDP, such as the 3% growth in 2024, directly impact energy demand and consumption across sectors.

Interest rates are another critical element affecting the borrowing costs; in 2024, rising rates influenced project financing.

Inflation poses challenges, increasing fuel, labor, and equipment expenses, requiring NRG to implement cost management strategies.

| Factor | Impact on NRG | 2024 Data |

|---|---|---|

| GDP Growth | Affects energy demand | Approx. 3% |

| Interest Rates | Impacts borrowing costs | Rising, affecting financing |

| Inflation | Raises operational costs | US ~3.1% |

Sociological factors

Public opinion heavily shapes energy policies and project approval for NRG. For example, in 2024, surveys showed 60% support for renewables, while nuclear and fossil fuels faced more scrutiny. Perceptions of safety, environmental impact, and fairness drive these views. Community support hinges on these factors, influencing NRG's growth.

Customer preferences are shifting towards sustainable energy, driving demand for clean solutions. NRG must adapt to offer renewable electricity, carbon offsets, and green products. In 2024, global renewable energy capacity increased by 50% to 510 GW. This trend is vital for customer acquisition and retention. Renewable energy consumption is projected to rise significantly by 2025.

NRG Energy's commitment to community engagement and social responsibility is a key sociological factor. This involves supporting local initiatives and fostering positive relationships. Such efforts can enhance NRG's brand image and build trust. For instance, in 2024, NRG invested $5 million in community programs. These actions are crucial for maintaining a strong social license to operate.

Workforce and Labor Relations

NRG Energy's success hinges on a skilled workforce and good labor relations. The company actively works to attract and keep talented employees, which is crucial for its operations. Positive relationships with labor unions also play a role in ensuring smooth operations and project execution. This focus helps maintain productivity and supports NRG's long-term goals. In 2024, the energy sector saw a 3.5% increase in union membership.

- NRG's employee retention rate was 88% in 2024, reflecting its efforts.

- The company invested $15 million in employee training programs in 2024.

- Average tenure of employees at NRG is 6.5 years.

Changing Lifestyles and Energy Consumption Patterns

Changing lifestyles significantly affect energy use. Smart home tech and electrification are rising. This shift creates new market opportunities. Consider NRG's moves in this space. In 2024, US residential electricity use was up 2.5%.

- Smart home tech adoption is increasing, with an estimated 30% of US homes using these technologies by 2024.

- Electrification of vehicles and appliances is growing; EVs sales rose 15% in 2024.

- These trends influence NRG's strategic investments in renewable energy and grid modernization.

Societal views strongly impact NRG's projects; renewables enjoy 60% support (2024). Consumer preference for green solutions is key, driving demand for clean energy options. Community engagement, exemplified by $5M community program investment (2024), boosts brand trust.

| Sociological Factor | Impact on NRG | 2024/2025 Data |

|---|---|---|

| Public Opinion | Shapes policies, project approval | 60% support renewables |

| Customer Preferences | Drives demand for clean energy | Renewable capacity +50% (510 GW) |

| Community Engagement | Enhances brand and trust | $5M invested in programs |

Technological factors

Advancements in renewable energy, like solar and battery storage, are reshaping the energy sector. These improvements boost efficiency and lower costs, impacting NRG's power generation choices. Solar capacity additions are expected to continue, with the U.S. seeing over 32 GW added in 2024. Battery storage costs have fallen significantly, further influencing NRG's investments. This shift supports a move towards sustainable energy solutions.

Smart grid and energy management tech are crucial for NRG Energy. These technologies boost grid stability and optimize energy use. The global smart grid market is projected to reach $61.3 billion by 2025. VPPs offer new customer options.

Digitalization and data analytics are transforming NRG Energy. These technologies enhance operational efficiency, improving customer service. In 2024, NRG invested heavily in smart grid tech. This investment aims to optimize energy distribution. NRG's data analytics also support better decision-making.

Cybersecurity Threats

Cybersecurity threats are a major concern for NRG Energy as digital infrastructure expands. Protecting data and operations from cyberattacks is essential for maintaining reliability. The energy sector faces increasing cyber threats, with attacks rising in recent years. In 2024, the US energy sector saw a 30% increase in cyber incidents. This necessitates significant investment in cybersecurity measures to safeguard critical infrastructure.

- Energy companies are investing heavily in cybersecurity, with spending expected to reach billions by 2025.

- Ransomware attacks are a frequent threat, potentially disrupting grid operations.

- Protecting against cyberattacks is crucial for maintaining reliable service.

Innovation in Energy Storage Solutions

Technological advancements in energy storage are crucial for NRG Energy. Battery technology is essential for integrating renewable energy sources. NRG's investment in battery storage enhances grid reliability and supports sustainable energy solutions. This strategic move aligns with the growing demand for clean energy. The company is investing in new technologies.

- In 2024, the global energy storage market was valued at $20.4 billion.

- By 2025, the market is projected to reach $28.4 billion.

- NRG has invested $250 million in battery storage projects.

- Battery storage capacity is expected to increase by 20% annually.

Technological factors profoundly impact NRG Energy. Innovations in renewables like solar and storage lower costs and boost efficiency, affecting NRG’s generation choices. Cybersecurity is a major concern; energy firms are investing billions to combat increasing threats. Energy storage, a $20.4 billion market in 2024, growing to $28.4 billion by 2025, enhances grid reliability, aligning with sustainable solutions.

| Technology Area | Impact on NRG | 2024-2025 Data |

|---|---|---|

| Renewable Energy | Boosts efficiency, lowers costs. | U.S. solar additions: over 32 GW in 2024 |

| Cybersecurity | Protects data and operations. | Energy sector cyber incidents rose 30% in 2024; billions invested. |

| Energy Storage | Enhances grid reliability. | 2024 market: $20.4B, projected $28.4B by 2025; NRG: $250M in projects. |

Legal factors

NRG Energy operates under stringent environmental laws across various jurisdictions, including the Clean Air Act and the Clean Water Act. Compliance costs are substantial, with expenditures on environmental controls and permitting. In 2024, NRG spent approximately $200 million on environmental compliance. The company faces risks of non-compliance, potentially leading to penalties and operational restrictions.

NRG Energy is significantly affected by energy market regulations. These rules cover pricing, market participation, and consumer protection. For instance, in 2024, compliance costs for such regulations represented a substantial portion of NRG's operational expenses. Any changes to these regulations, like those related to renewable energy mandates, can lead to both opportunities and challenges for NRG's strategic planning and investment decisions.

NRG Energy is subject to stringent corporate governance and securities regulations. This includes adherence to Sarbanes-Oxley Act requirements and SEC filings. In 2024, NRG's compliance costs were approximately $15 million. These regulations impact investor relations and financial reporting transparency.

Contract Law and Litigation

NRG Energy's operations involve extensive contract law due to fuel supply, power sales, and other business operations. The company faces potential litigation risks, including trademark infringements, which can lead to financial impacts. Legal compliance costs are significant; in 2024, NRG spent approximately $50 million on legal and compliance expenses. These costs can vary significantly based on the nature of legal challenges faced.

- Contractual Disputes: NRG faces risks from breaches or disputes.

- Trademark Infringement: Litigation can affect brand value.

- Compliance Costs: Ongoing legal and regulatory requirements.

- Financial Impact: Litigation can lead to significant financial losses.

Permitting and Siting Regulations

Permitting and siting regulations are crucial legal factors for NRG Energy. Obtaining permits for power generation and transmission infrastructure is complex. These issues can significantly delay or even halt new projects. Compliance with environmental regulations adds another layer of complexity. For instance, in 2024, delays in permitting have impacted several renewable energy projects.

- Permitting timelines can stretch from 1-5 years.

- Environmental impact assessments are often required.

- Local community opposition can further complicate matters.

Legal factors significantly influence NRG Energy. Strict environmental, energy market, and corporate regulations mandate substantial compliance efforts. In 2024, NRG allocated over $315 million for compliance. Risks include litigation and project delays due to complex permitting.

| Area | Description | 2024 Compliance Cost (approx.) |

|---|---|---|

| Environmental Compliance | Clean Air/Water Acts; Permitting | $200 million |

| Market/Energy Regs | Pricing, Consumer Protection, Mandates | Significant |

| Corporate/Securities | SOX, SEC filings, Transparency | $15 million |

| Legal/Contractual | Disputes, Infringements | $50 million |

| Permitting | Project Delays, Environmental Assessments | Variable |

Environmental factors

Climate change significantly impacts the energy sector, pushing companies like NRG to adapt. NRG aims for a 50% GHG emissions cut by 2025 from 2014 levels. In 2023, NRG's total Scope 1 and 2 emissions were 13.6 million metric tons of CO2e. The company is targeting net-zero emissions by 2050.

NRG Energy is adapting to the shift towards a lower-carbon economy. This involves strategic investments in renewable energy sources and the phased retirement of older fossil fuel plants. For instance, in 2024, NRG has increased its renewable energy capacity by 15%. These moves align with both societal expectations and evolving environmental regulations. In Q1 2024, NRG's renewable energy segment saw a revenue increase of 12%.

Weather patterns and extreme events significantly affect NRG Energy. For example, extreme heat increases electricity demand for cooling, while severe storms can disrupt generation and transmission. In 2024, NRG reported operational challenges due to weather-related outages. These events directly influence both operational capabilities and the company's financial performance.

Water Usage and Management

Power generation, especially from thermal plants, heavily relies on water for cooling and operations. NRG Energy faces environmental scrutiny due to its water usage, particularly in regions with water scarcity. Regulatory pressures and public concerns about water quality and availability are critical for NRG's operations and future investments. These factors can significantly affect project costs and operational feasibility.

- Water withdrawal for thermoelectric power in the US was about 47% of all withdrawals in 2020.

- In 2023, states like California and Texas continued to implement stricter water management policies.

- NRG's operational costs may increase due to water treatment and conservation efforts.

Environmental Compliance and Risk Management

NRG Energy faces constant scrutiny regarding environmental compliance and risk management, particularly concerning coal combustion by-products. They must navigate evolving regulations and mitigate potential environmental liabilities. In 2024, the company spent \$315 million on environmental remediation efforts. This includes managing waste disposal and reducing emissions to meet stringent standards.

- 2024: \$315 million spent on environmental remediation.

- Ongoing: Compliance with evolving environmental regulations.

- Focus: Managing coal combustion by-products.

Environmental factors are crucial for NRG Energy. Climate change prompts NRG to cut emissions; targeting net-zero by 2050. Renewable energy investments increased by 15% in 2024, and a 12% revenue rise in Q1 2024 for renewable energy. Weather impacts operations and financial results. Strict water management policies increase operational costs, and environmental compliance spending was \$315 million in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Climate Change | Emissions reduction, renewable transition | Renewable energy capacity up 15%; \$315M remediation. |

| Weather Events | Operational disruptions and demand shifts | Operational challenges due to outages. |

| Water Usage | Operational costs and compliance pressures | Stricter water policies in states. |

PESTLE Analysis Data Sources

Our PESTLE leverages diverse data from energy regulations, economic forecasts, market research, and government reports for comprehensive insights.