RTL Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RTL Group Bundle

What is included in the product

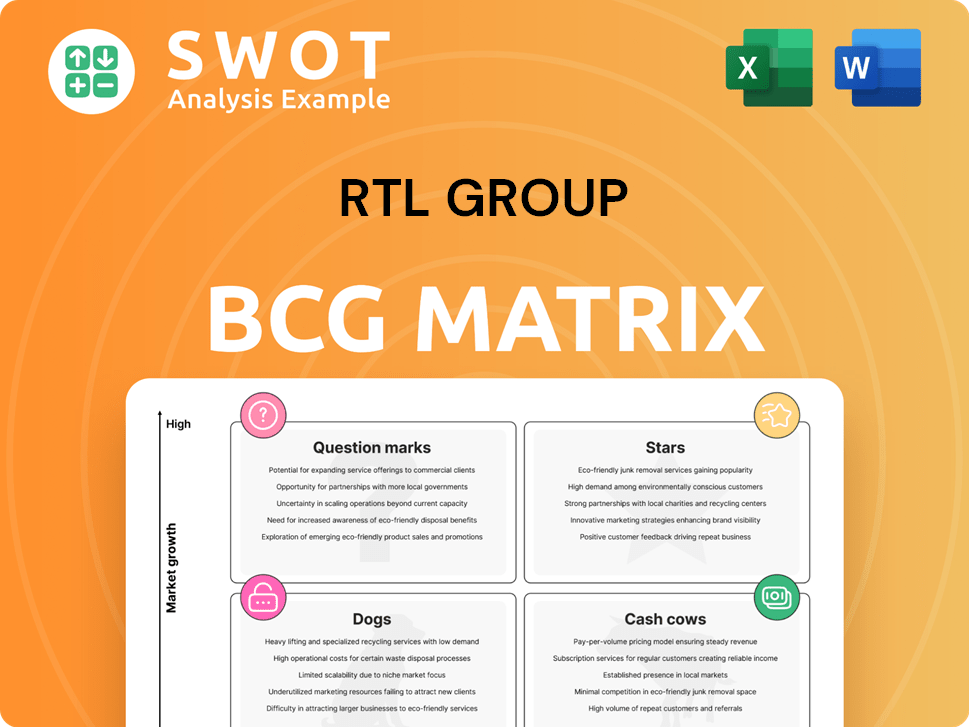

RTL Group's BCG Matrix analysis examines its business units across quadrants, offering strategic insights.

Printable summary optimized for A4 and mobile PDFs, enabling easy distribution and concise insights.

Full Transparency, Always

RTL Group BCG Matrix

The BCG Matrix report you're viewing is the identical file you’ll download upon purchase. This comprehensive strategic tool, complete with analysis, is ready for instant integration into your business strategy. The full document provides a clear framework for portfolio analysis.

BCG Matrix Template

RTL Group's BCG Matrix offers a snapshot of its diverse portfolio. Discover how its assets fare in the market, from shining "Stars" to lagging "Dogs." Understand how RTL is strategically allocating resources across its various business units. The preview reveals only a glimpse. Get the full BCG Matrix report for detailed quadrant placements and data-driven recommendations.

Stars

RTL+ shines as a star due to its robust growth. By late 2024, RTL+ had over six million paying subscribers in Germany. This streaming service saw major improvements in paying subscribers, viewing hours, and revenue from subscriptions and ads. Projections suggest RTL+ could reach nine million subscribers by 2026.

Fremantle, a star in RTL Group's portfolio, is a major content producer globally. In 2024, Fremantle is on track to produce over 11,000 hours of programming. The company is targeting €3 billion in revenue and a 9% Adjusted EBITA margin by 2026. Fremantle continues to grow through both organic expansion and acquisitions across various content categories.

RTL Deutschland shines as a star in the RTL Group's portfolio, holding a leading position in the German TV market. In 2024, RTL Deutschland's combined audience share and advertising market share solidified its status. RTL, its flagship channel, saw an increase in audience share, reaching 10.0% in the 14-59 age group. This strong performance boosts RTL Group's financial results.

Strategic Partnerships

RTL Group's strategic partnerships, like its renewed streaming deal with Deutsche Telekom, are vital. This collaboration includes RTL+ Premium within MagentaTV packages, offering over 55,000 hours of content. These alliances fortify RTL's foundation, fueling expansion and industry collaborations. In 2024, RTL Deutschland reported a 10% increase in streaming revenues.

- Deutsche Telekom partnership includes RTL+ Premium.

- Over 55,000 hours of programming are available.

- Partnerships strengthen RTL's core business.

- RTL Deutschland saw a 10% rise in streaming revenues in 2024.

M6+ Performance in France

The M6+ streaming service in France is a star, showing robust growth. In 2023, M6+ saw a 30% rise in monthly users and a 35% increase in streaming hours compared to 6play. This growth highlights its appeal and the effectiveness of its content strategy. The service features successful formats like "Les Traîtres Nouvelle Génération," "The Good Fight," and "The Marvelous Mrs. Maisel."

- Monthly users increased by 30% in 2023.

- Streaming hours rose by 35% in 2023.

- Popular formats include "Les Traîtres Nouvelle Génération."

- Successful content drives user engagement and growth.

RTL Group's Stars show significant growth and market leadership. RTL+ expanded, reaching over six million subscribers by late 2024. Fremantle, producing over 11,000 hours of content in 2024, targets €3 billion revenue by 2026. RTL Deutschland's increased audience share and M6+ streaming growth reinforce their Star status.

| Company | Key Metric (2024) | Growth/Target |

|---|---|---|

| RTL+ | 6M+ Subscribers | Projected 9M by 2026 |

| Fremantle | 11,000+ hrs Prod. | €3B Revenue by 2026 |

| RTL Deutschland | 10% Audience Share (RTL) | Increased streaming revenue |

Cash Cows

RTL Group's TV advertising revenue acts as a reliable cash cow. Although there was a minor dip in Q4 2024, the full-year revenue held steady at €2.35 billion. This segment continues to be a major revenue source for RTL Group. It consistently contributes a substantial portion to their annual earnings.

RTL Radio France is a cash cow for RTL Group, consistently generating substantial revenue. In 2024, its three radio stations had a 22.2% audience share within the 25-49 age group. This represents a 0.2 percentage point increase year-over-year. The stations' programming strategies effectively shape their brand and audience engagement.

Distribution revenue functions as a cash cow for RTL Group, offering a steady income stream. In 2024, distribution revenue rose by 6.9% to €354 million, primarily due to the performance of RTL Deutschland. This revenue source is a cornerstone of financial stability for the company.

Content Licensing

Content licensing is a significant cash cow for RTL Group. They license their content to various platforms globally, which brings in revenue. This strategy is boosted by partnerships like Asacha Media Group and Beach House Pictures, expanding content production and reach. In 2024, RTL Group saw a 5.3% increase in content licensing revenue.

- Revenue from content licensing grew by 5.3% in 2024.

- Partnerships with Asacha Media Group and Beach House Pictures are key.

- Content is distributed across numerous global platforms.

- This generates a consistent revenue stream for RTL Group.

Addressable TV Advertising

Addressable TV advertising is a cash cow for RTL Group. It expands ad inventory and draws in new advertisers, commanding premium prices over traditional linear TV. RTL Group leverages Smartclip to build an open ad-tech platform for European broadcasters and streaming services. This strategy capitalizes on the shift toward targeted advertising. In 2024, addressable TV ad spending in Europe reached $1.5 billion.

- Addressable TV offers premium pricing.

- Smartclip is key for RTL's ad-tech platform.

- European ad spending hit $1.5B in 2024.

- Attracts new advertisers.

RTL Group's cash cows, including TV advertising and content licensing, provide consistent revenue streams. TV advertising revenue in 2024 was €2.35 billion, indicating financial stability. Content licensing increased by 5.3% in 2024, which underlines the strength of its content portfolio.

| Cash Cow | 2024 Performance | Key Strategy |

|---|---|---|

| TV Advertising | €2.35B Revenue | Maintain Audience Share |

| Content Licensing | +5.3% Revenue Growth | Global Platform Partnerships |

| Distribution Revenue | +6.9% Increase | Leverage RTL Deutschland |

Dogs

Traditional print media, like those under RTL Group, face headwinds. RTL Deutschland's publishing division restructuring suggests difficulties. Print media's market share and growth are often low. In 2024, print ad revenue declined, reflecting these struggles.

Divested businesses like RTL Nederland fit the "dog" category in RTL Group's BCG matrix. RTL Group sold its TV and streaming services in Belgium, Croatia, and the Netherlands. These businesses likely had low market share and growth potential. In 2024, such divestitures help RTL Group focus on more promising ventures.

Smaller TV channels facing declining viewership are often categorized as dogs. These channels struggle with low ratings and find it hard to attract advertisers. For instance, Groupe M6's audience share dropped to 19.6% in 2024, down from 20.5% the prior year.

Non-Performing Radio Stations

In the RTL Group's portfolio, non-performing radio stations are considered dogs. These stations consistently underperform in listenership and advertising revenue. The rise of digital audio platforms further challenges their competitiveness, potentially leading to financial struggles. Turning around these assets often demands substantial investment with uncertain outcomes.

- Advertising revenue in radio decreased by 5.7% in 2024.

- Digital audio platforms have captured a significant share of the audio market.

- Many traditional radio stations face financial pressures.

- Significant investment might be needed to improve the performance.

Unsuccessful Joint Ventures

Unsuccessful joint ventures, like Salto, are classified as dogs in the BCG Matrix for RTL Group. Salto, a French streaming service, was closed in March 2023. These ventures often drain resources without providing adequate returns. The closure of Salto highlights the challenges in competitive markets.

- Salto's shutdown reflected strategic missteps in a crowded streaming market.

- RTL Group's focus shifted to core broadcasting as a result.

- Financial data indicates the venture was not profitable.

- The failure underscores the risks of joint ventures.

Dogs represent underperforming business units with low market share and growth. RTL Group divests such ventures to focus on profitable areas. Examples include struggling print media and underperforming TV channels. In 2024, these divestitures and closures aimed to streamline the portfolio.

| Category | Characteristics | RTL Group Examples (2024) |

|---|---|---|

| Print Media | Low growth, declining revenue | Restructuring of publishing divisions |

| Divested Businesses | Low market share, limited potential | Sale of TV services in several countries |

| Underperforming Channels | Declining viewership, difficulty attracting advertisers | Smaller TV channels with low ratings |

Question Marks

New show formats are classified as question marks in the BCG Matrix. Stefan Raab's new formats for RTL and RTL+ are prime examples. These formats target high growth but have uncertain market share. RTL Group's 2024 revenue increased by 6.7% to €7.3 billion, showing potential for growth. They must quickly establish market share to succeed.

Addressable TV is a question mark for RTL Group, posing both opportunities and challenges. It expands ad inventory and draws new advertisers, potentially commanding premium pricing. RTL Deutschland, with its ad-tech arm Smartclip, spearheads the Group's efforts. In 2024, addressable TV ad spending is forecasted to reach $2.5 billion in the US alone.

AI-aided content creation, like RTL+'s "Pumuckl's New Adventures," fits the question mark category. These ventures show high potential, leveraging AI to innovate content. However, the financial returns remain uncertain, making them risky investments. RTL Group's 2024 report may show the impact of these projects. These initiatives require careful monitoring and strategic investment decisions.

RTL Ventures Investments

RTL Ventures' investments are classified as question marks within the BCG Matrix. These ventures receive capital and media exposure from RTL Group to foster growth. Managing these investments requires careful strategic planning to capture market share. In 2024, RTL Group invested €150 million in its ventures.

- Question marks represent high-growth, low-market share investments.

- RTL Ventures provides funding and media support to startups.

- These investments need strategic management to gain market share.

- RTL Group invested €150 million in 2024.

New Streaming Technology (Bedrock Migration)

The migration of RTL+ in Germany to the Bedrock technology platform is a question mark in the BCG Matrix. This move aims to cut costs and boost innovation. It's a strategic bet with potential for significant gains. The migration is planned to be completed by early 2026.

- Cost Savings: The migration to Bedrock is expected to yield significant cost efficiencies, though specific figures are not available.

- Innovation Strength: The new platform is designed to increase RTL+'s ability to innovate.

- Timeline: The migration of RTL+ in Germany is scheduled for completion in early 2026.

Question marks in RTL Group's portfolio represent high-growth, uncertain market share investments. These include new show formats, addressable TV, and AI-aided content creation. Strategic investment is key to converting these ventures into stars. In 2024, RTL Group's revenue reached €7.3 billion, indicating growth potential.

| Category | Examples | Key Strategy |

|---|---|---|

| New Formats | Stefan Raab's shows | Quickly establish market share. |

| Addressable TV | Smartclip, Addressable TV ads | Expand ad inventory, premium pricing. |

| AI-aided Content | RTL+'s "Pumuckl" | Innovative content, careful monitoring. |

BCG Matrix Data Sources

RTL Group's BCG Matrix is informed by diverse data including financial filings, market reports, and industry analyses for insightful positioning.