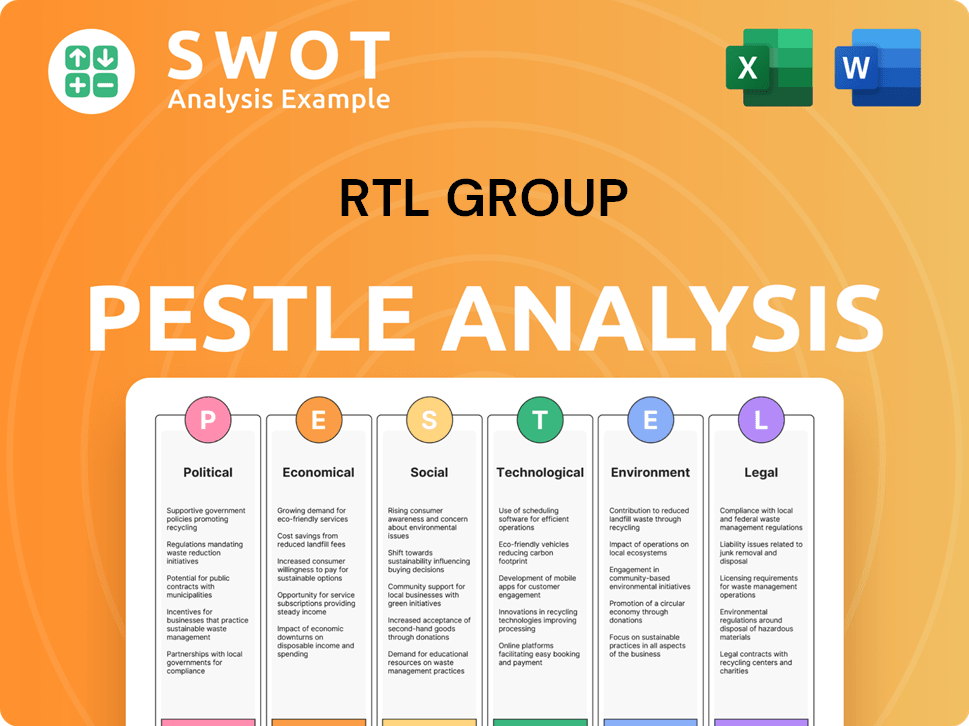

RTL Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RTL Group Bundle

What is included in the product

Analyzes external factors' impact on RTL Group: political, economic, social, tech, environmental, and legal.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Preview the Actual Deliverable

RTL Group PESTLE Analysis

This preview is the actual RTL Group PESTLE analysis. It includes Political, Economic, Social, Technological, Legal, and Environmental factors. All data is formatted and structured as presented here. This complete report is ready for immediate download after purchase. You will receive this document, without changes.

PESTLE Analysis Template

Understand the forces shaping RTL Group's future with our PESTLE Analysis. We unpack political, economic, and technological factors impacting the media giant. Spot market opportunities and mitigate risks with our expert insights. Get the full report instantly for detailed analysis and strategic advantage.

Political factors

Government media regulation significantly affects RTL Group. Broadcasting licenses, content rules, and ownership regulations are key. For example, in 2024, the EU updated its Audiovisual Media Services Directive, impacting content quotas. These changes influence RTL's market share and strategic moves. In 2024, RTL Group's revenue was around €7.3 billion.

Political stability is crucial for RTL Group's operations. Countries with stable governments foster predictable business environments. Political instability can disrupt advertising revenue. In 2024, the EU's media landscape faced regulatory changes impacting media groups. These factors influence investment and strategic decisions.

RTL Group faces public service broadcasting obligations in some European markets. These mandates, tied to licensing, dictate content types, news coverage, and accessibility. For instance, in 2024, obligations in Germany required specific news and children's programming. These obligations can influence programming budgets. In 2023, RTL Deutschland's revenue was €2.1 billion.

Government Funding and Support for Media

Government funding and support significantly influence the media landscape, potentially creating advantages or disadvantages for companies like RTL Group. Policies favoring specific media types or offering subsidies can distort competition and impact financial outcomes. For example, in 2024, the French government allocated €400 million to support the press. This support can affect RTL Group's ability to compete fairly. Regulatory decisions on content and media ownership further shape the competitive environment.

- Subsidies for certain media outlets.

- Content regulations and restrictions.

- Media ownership rules affecting competition.

International Relations and Trade Policies

International relations and trade policies are critical for RTL Group's content operations. Trade agreements directly affect content distribution and cross-border activities, potentially opening or closing markets. For example, the EU's Digital Services Act impacts how RTL distributes content within the bloc. Changes in international collaborations also shape opportunities for Fremantle, RTL's global content arm. In 2024, Fremantle's revenue reached €2.03 billion, reflecting the impact of international partnerships.

- EU's Digital Services Act impacts content distribution.

- Fremantle's 2024 revenue: €2.03 billion.

- Trade agreements affect market access.

- International collaborations create opportunities.

Political factors substantially affect RTL Group, influencing its strategic decisions and revenue streams. Government regulations, like the EU's Audiovisual Media Services Directive, shape content quotas and ownership. Political stability and international trade policies also play critical roles. In 2024, RTL Group's revenue reached approximately €7.3 billion.

| Factor | Impact | Example (2024) |

|---|---|---|

| Regulations | Content quotas, market access | EU Directive updates |

| Stability | Advertising revenue | Stable markets |

| Trade | Content distribution | Fremantle €2.03B revenue |

Economic factors

RTL Group's revenue heavily relies on advertising. In 2024, global ad spending reached $737 billion. Economic fluctuations and reduced business advertising can hurt RTL's performance, notably its TV ad income. Digital ad growth, however, offers some resilience. In 2025, digital ads are projected to rise further.

Consumer spending and confidence are key for media engagement. Reduced spending can hurt streaming subscriptions. In 2024, U.S. consumer spending grew, but concerns about inflation persist. Lower confidence may affect RTL+'s subscription growth, potentially impacting revenue for 2025.

Inflation poses a significant challenge, potentially inflating RTL Group's operational costs. Content production, tech investments, and salaries are all susceptible to rising prices. In 2024, the Eurozone's inflation rate fluctuated, impacting media firms. RTL Group must manage these costs to protect its profit margins. For example, content costs increased by 5% in 2023.

Exchange Rate Fluctuations

As a European media company, RTL Group faces exchange rate risks. Currency fluctuations affect the conversion of international revenues and costs, impacting its financial outcomes. For instance, a stronger euro could diminish the value of revenues from non-eurozone markets. The EUR/USD exchange rate has seen fluctuations, with the euro trading around $1.08 in early 2024. These shifts directly influence RTL Group's profitability and financial reporting.

- Exchange rate volatility impacts financial reporting.

- Euro strength can reduce the value of non-euro revenues.

- EUR/USD rate fluctuations directly affect profitability.

Overall Economic Growth in Operating Regions

Economic growth in RTL Group's European markets (Germany, France, Netherlands) directly impacts advertising revenue and consumer media spending. Robust economic conditions generally foster a positive business environment, boosting the company's performance. For instance, in 2024, Germany's GDP grew by 0.3%, influencing RTL's advertising income. The Netherlands saw a GDP increase of 0.1% in the same year, affecting its media consumption. These figures highlight the economic sensitivity of RTL's operations.

RTL Group's advertising revenue is sensitive to economic changes, with global ad spending hitting $737 billion in 2024. Consumer spending and confidence are vital for streaming subscriptions, while inflation influences operational costs and profit margins. Currency fluctuations, especially EUR/USD rates ($1.08 in early 2024), impact profitability.

| Factor | Impact | Data |

|---|---|---|

| Ad Spending | Influences revenue | $737B (2024 global) |

| Consumer Spending | Affects subscriptions | U.S. spending grew in 2024 |

| Inflation | Raises costs | Content costs +5% (2023) |

Sociological factors

Consumer media habits are transforming, favoring digital and on-demand content. RTL Group must adjust its content approach and distribution. In 2024, digital ad revenue rose, showing this shift. RTL Group invested in streaming to meet these needs.

Shifting demographics and audience fragmentation challenge traditional broadcasting. RTL Group must adapt to diverse audience segments across TV, radio, and streaming. For instance, in 2024, digital ad revenue grew by 10%, showing audience migration. Understanding these changes is key for RTL's strategic planning and content creation. This will ensure future relevance and profitability.

Social trends and cultural preferences are crucial for RTL Group. Fremantle must understand these to create popular content. In 2024, streaming surged with global subscriptions. For example, Netflix had over 260 million subscribers. This influences content demand.

Public Opinion and Trust in Media

Public perception and trust in media significantly affect RTL Group's audience engagement. Journalistic integrity and content credibility are crucial for maintaining audience trust. Recent data shows a decline in media trust across Europe. For example, a 2024 survey indicated a decrease in trust in news media. RTL Group's ability to uphold journalistic standards is vital for its financial performance and reputation.

- 2024 survey data reveals declining media trust in Europe.

- Maintaining journalistic integrity is key for audience retention.

- Trust directly impacts advertising revenue and viewership.

- RTL Group's reputation is tied to its content's credibility.

Workforce Diversity and Inclusion

Workforce diversity and inclusion are crucial for media companies like RTL Group. A strong commitment to diversity impacts the company's reputation and its ability to attract both talent and audiences. Inclusive content and diverse perspectives can lead to better audience engagement and market reach. RTL Group's initiatives in this area can be assessed through its public reports and diversity metrics. For example, in 2024, the media sector saw a 20% increase in diversity and inclusion initiatives.

- Diverse teams often lead to more creative and relevant content.

- Companies with strong D&I programs tend to have better employee retention rates.

- Audience preferences are increasingly influenced by diverse representation.

- RTL Group's performance can be benchmarked against industry standards.

Shifting social trends heavily influence media consumption patterns, requiring RTL Group to adapt content strategies. Digital adoption is soaring; ad revenue in 2024 saw an increase. Maintaining public trust is vital for RTL's brand and financial success. In 2024, audience trust dropped significantly, affecting advertising and viewership.

| Factor | Impact | 2024 Data |

|---|---|---|

| Audience Trust | Affects ad revenue & viewership | Trust in media declined across Europe, 2024 |

| Digital Shift | Content consumption and ad revenue | Digital ad revenue increased, showing shift |

| Diversity | Drives creative content | Media saw 20% rise in initiatives in 2024 |

Technological factors

The proliferation of streaming is reshaping media consumption, with RTL Group adapting rapidly. Investments in RTL+ and M6+ are key to maintaining market share. In 2024, streaming revenues for RTL Group increased, reflecting strategic digital shifts.

Developments in ad-tech are reshaping advertising across platforms. RTL Group's ad-tech investments, like Smartclip, are key. Smartclip's revenue in 2023 was approximately €200 million, a significant portion of RTL Group's digital revenue. These solutions optimize advertising revenue in both linear and digital media. RTL Group aims to increase digital revenue to around €1 billion by 2025.

AI can revolutionize RTL Group's operations. RTL Group is investing in AI for content creation and personalization. In 2024, AI-driven ad optimization increased ad revenue by 15%. Furthermore, AI enhances operational efficiency, reducing costs by 10%.

Evolution of Broadcasting Technology

RTL Group faces a dynamic technological landscape. While streaming services are expanding, traditional broadcasting technologies are still crucial. In 2024, linear TV advertising revenue was still significant, representing a large portion of RTL's income. RTL Group must balance investments in both linear and digital platforms. This includes infrastructure for broadcasting and content delivery.

- Linear TV advertising revenue in Europe was estimated at €10.5 billion in 2024.

- RTL Group's digital revenue increased by 9.3% in the first half of 2024.

- The global streaming market is projected to reach $170 billion by the end of 2025.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for RTL Group due to its extensive digital presence and user data collection. Strong security measures are crucial to safeguard systems and comply with data privacy regulations like GDPR. Recent data indicates a 30% rise in cyberattacks targeting media companies in 2024. RTL Group must invest in advanced cybersecurity.

- Cyberattacks on media companies increased by 30% in 2024.

- GDPR compliance is crucial for data privacy.

- RTL Group needs to invest in cybersecurity.

RTL Group's tech focus includes streaming, ad-tech, and AI, key for growth. Digital revenue grew 9.3% in the first half of 2024. The streaming market is projected to hit $170 billion by 2025.

| Technology Area | Key Investment | Impact in 2024 |

|---|---|---|

| Streaming | RTL+, M6+ | Revenue increase |

| Ad-tech | Smartclip | Ad revenue optimization (15%) |

| AI | Content/Personalization | Operational cost reduction (10%) |

Legal factors

Media ownership regulations are crucial for RTL Group. These rules impact mergers, acquisitions, and partnerships. European antitrust authorities oversee transactions to maintain fair market competition. In 2024, the EU continued to enforce strict media concentration rules, influencing RTL's strategic moves. The European Commission has blocked several media mergers in recent years to ensure diversity.

RTL Group must adhere to broadcasting licenses and content regulations across its operating countries. These include content standards, advertising rules, and political impartiality guidelines. Failure to comply can result in significant penalties, impacting operations. In 2024, RTL Group faced €1.2 million in fines for regulatory breaches.

RTL Group must comply with strict data privacy laws, such as GDPR, which govern how they handle user data. Failure to comply can lead to substantial fines, potentially reaching up to 4% of annual global turnover. In 2023, GDPR fines totaled €1.6 billion across various sectors. Maintaining user trust is paramount, and data protection is key to this.

Copyright and Intellectual Property Law

Copyright and intellectual property laws are crucial for RTL Group, safeguarding its content and brands. RTL Group actively manages its intellectual property rights to combat content piracy. In 2024, the global piracy market was estimated at $37.6 billion, emphasizing the need for strong IP protection. The company faces challenges related to unauthorized content use.

- RTL Group invests in legal resources to enforce its copyrights.

- Piracy significantly impacts revenue streams, necessitating continuous monitoring.

- The company navigates evolving digital rights management (DRM) technologies.

- RTL Group collaborates with industry partners to combat piracy.

Advertising Standards and Regulations

RTL Group faces stringent advertising regulations globally, impacting content and practices. Compliance is crucial, particularly regarding misleading claims and product-specific advertising. Regulatory bodies like the European Advertising Standards Alliance (EASA) set guidelines. In 2024, the advertising market in Europe was valued at approximately €92 billion, highlighting the sector's significance and the need for meticulous compliance.

- EU's Digital Services Act (DSA) and Digital Markets Act (DMA) impact online advertising, requiring transparency.

- Specific product categories (e.g., pharmaceuticals, alcohol) have strict advertising rules.

- Data privacy regulations (GDPR) influence how advertising data is collected and used.

- Failure to comply can result in significant fines and reputational damage.

Media ownership regulations and antitrust scrutiny are vital for RTL Group's mergers and acquisitions. Broadcasting licenses, content standards, and data privacy laws, such as GDPR, influence operations. Copyright and advertising regulations, along with intellectual property protection, significantly affect content distribution.

Advertising in Europe in 2024 was valued at approximately €92 billion, with strict guidelines. GDPR fines reached €1.6 billion in 2023, and the global piracy market was $37.6 billion. RTL faced €1.2 million in fines for regulatory breaches.

| Area | Impact | Data (2024) |

|---|---|---|

| Media Ownership | Mergers, Acquisitions | EU antitrust scrutiny |

| Content Regulation | Broadcasting Standards | €1.2M fines for breaches |

| Data Privacy | GDPR Compliance | GDPR fines in 2023 €1.6B |

Environmental factors

Sustainability and environmental reporting are becoming increasingly important for companies. Investors and stakeholders are demanding transparency regarding environmental impact. RTL Group must measure and disclose its environmental footprint, which includes energy use and emissions. For example, in 2024, the media sector saw a 15% rise in ESG-related investment.

Climate change poses indirect risks to RTL Group. Extreme weather could disrupt content production and distribution networks. For instance, severe storms might damage broadcasting infrastructure. In 2024, climate-related disasters caused billions in economic losses globally. These events can lead to operational delays and increased costs.

Broadcasting and data centers consume substantial energy. RTL Group's streaming services may strain energy resources. Energy efficiency and renewables are crucial. In 2024, data centers globally used ~2% of electricity. Transitioning reduces environmental impact.

Waste Management and Recycling

RTL Group faces environmental considerations in waste management, encompassing offices, production sets, and electronic equipment. Effective waste management and recycling programs are essential for lessening environmental impact. This includes handling e-waste from obsolete tech and reducing overall waste. In 2023, the EU generated 188.1 kg of municipal waste per capita.

- RTL Group must focus on reducing waste to align with EU targets.

- Explore partnerships with recycling companies.

- Implement paperless office initiatives.

- Ensure responsible disposal of electronic equipment.

Producing Environmentally Conscious Content

The demand for environmentally conscious content is rising, pushing media companies to integrate sustainability. RTL Group can leverage this by featuring environmental themes in its programming. This strategy can boost audience engagement and brand reputation. In 2024, 68% of consumers prefer sustainable brands, highlighting the importance of this shift.

- Adoption of sustainable production practices reduces carbon footprint.

- Eco-friendly content appeals to younger, environmentally aware demographics.

- Sustainability initiatives enhance brand image and attract investment.

RTL Group's environmental strategy must encompass waste reduction, particularly aligning with EU targets to decrease waste. Climate change poses indirect operational risks that the Group must take into account. Promoting eco-conscious content aligns with consumer preferences; 68% of consumers favouring sustainable brands in 2024.

| Aspect | Impact | Data Point (2024/2025) |

|---|---|---|

| Sustainability Reporting | Increasing demands | 15% rise in ESG-related investment (media sector, 2024) |

| Climate Risk | Operational disruptions | Billions in economic losses from climate disasters (global, 2024) |

| Energy Consumption | High usage | Data centers globally used ~2% of electricity (2024) |

| Waste Management | Regulatory and consumer focus | EU generated 188.1 kg municipal waste per capita (2023) |

PESTLE Analysis Data Sources

This RTL Group PESTLE relies on trusted databases, economic reports, policy updates, and market analyses.