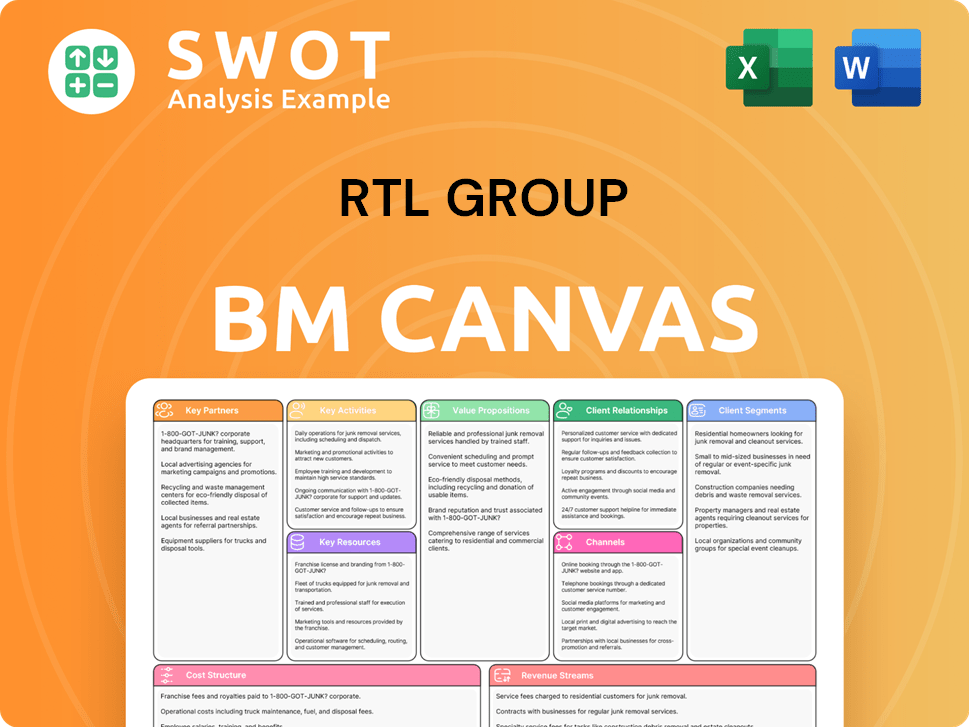

RTL Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RTL Group Bundle

What is included in the product

Provides a pre-written and detailed business model canvas, reflecting RTL Group's operations and strategy.

Shareable and editable for team collaboration and adaptation.

Delivered as Displayed

Business Model Canvas

This preview showcases the actual Business Model Canvas you'll receive. It's not a simplified version or a mockup. Upon purchase, you'll get the complete, fully-editable document, formatted identically to what you see here. No changes, no surprises, just full access.

Business Model Canvas Template

See how the pieces fit together in RTL Group’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

RTL Group's success hinges on key partnerships with content providers. These collaborations secure diverse programming like movies, series, and sports. This strategy keeps audiences engaged across platforms. RTL's deal with Sky Deutschland includes Formula One and Premier League highlights from 2025/26.

RTL Group collaborates with tech firms to bolster streaming and advertising tech. These partnerships foster innovation, improving user experience and boosting revenue. Smartclip and M6 Publicité's integration exemplifies this, enhancing ad-tech capabilities. RTL+ in Germany will migrate to Bedrock in early 2026, aiming for cost savings and innovation.

RTL Group leverages partnerships with telecommunication giants to broaden its streaming service access. This strategy includes bundling RTL+ with TV and internet packages, enhancing customer entertainment options. Deutsche Telekom's 2030 renewal of their streaming cooperation with RTL Deutschland automatically includes RTL+ Premium. This boosts RTL Group's subscriber base, aligning with its streaming objectives.

Advertising Sales Houses

RTL Group strategically partners with advertising sales houses to boost advertising revenue across its diverse media platforms. These collaborations tap into the sales expertise and extensive networks of these houses, drawing in advertisers and optimizing ad placements for maximum impact. A key example is RTL AdAlliance, which, from July 2025, will incorporate IP Österreich, expanding advertising opportunities in Austria. This integration gives advertising clients access to a wider inventory of premium European media brands and content.

- RTL AdAlliance's revenue in 2023 was around EUR 1.4 billion.

- RTL Group's total advertising revenue in 2023 was EUR 3.5 billion.

- IP Österreich's advertising inventory includes major Austrian TV channels.

Production Companies

RTL Group relies on partnerships with production companies to generate original content for its platforms. These collaborations are crucial for delivering engaging, local programming to viewers. Fremantle, a key part of RTL Group, actively partners with various production houses. In March 2024, RTL Group expanded its content capabilities by acquiring Asacha Media Group.

- Partnerships ensure a steady supply of diverse content.

- Fremantle's global presence enhances content distribution.

- Asacha Media Group's acquisition boosts production capacity.

- Local relevance is key to audience engagement.

Key partnerships fuel RTL Group's content and tech strategies. Content providers ensure diverse programming. Tech collaborations boost streaming and advertising. These partnerships generated €3.5B in ad revenue in 2023. RTL AdAlliance's 2023 revenue was roughly €1.4B.

| Partnership Type | Focus | Example |

|---|---|---|

| Content Providers | Programming acquisition | Sky Deutschland |

| Tech Firms | Streaming, ad tech | Smartclip, Bedrock |

| Telecoms | Streaming distribution | Deutsche Telekom |

Activities

Content production and acquisition are crucial for RTL Group. The company invests heavily in diverse content, including drama, comedy, sports, and news. RTL Group spent €1.4 billion on content in 2023. This strategy strengthens its channels and streaming services, like RTL+, which saw subscriber growth.

RTL Group's key activities involve managing TV channels and streaming services. This includes programming, infrastructure, and distribution. They manage 60 TV channels, 7 streaming services, and 37 radio stations. Streaming operations aim for EBITA-positive results by 2026, targeting 9 million subscribers and €750 million in revenue.

Advertising sales are a core activity for RTL Group, driving revenue across its TV, radio, and digital platforms. RTL's diverse portfolio strengthens its position in the market. In 2024, ad revenues stayed flat, as digital growth offset TV market declines. Digital advertising revenue is crucial.

Technology Development and Innovation

Technology development and innovation are crucial for RTL Group's competitiveness. They invest in new streaming platforms and enhance user experiences, leveraging data analytics. RTL Group focuses on advertising technology and data to boost monetization through targeting and personalization. The migration of RTL+ to the Bedrock platform, starting in early 2026, will cut costs and boost innovation.

- RTL Group invested €236 million in digital growth in 2023.

- Advertising revenue increased by 2.8% in 2023.

- RTL+ reached 5.4 million subscribers in 2023.

- Bedrock platform migration is expected to generate significant cost savings.

Marketing and Promotion

Marketing and promotion are crucial for RTL Group to reach a wide audience and drive engagement. They use diverse channels like TV, radio, and digital platforms to promote their content. In 2024, the company invested significantly in these areas to boost reach and attract viewers. Effective marketing supports both their linear TV channels and streaming services, helping them gain subscribers.

- Marketing campaigns are essential for attracting viewers and subscribers.

- RTL Group uses TV, radio, digital, and social media for promotion.

- Investments in content, marketing, and streaming services are necessary.

- Talent partnerships strengthen channels and streaming subscriptions.

Content production and acquisition are central, with €1.4B spent on content in 2023. Managing TV channels, streaming, and radio stations is key. Advertising sales drive revenue, with digital growth offsetting TV declines.

Technology development and innovation are also crucial, including the Bedrock platform migration for cost savings. Marketing and promotion are essential for reaching audiences and attracting subscribers.

| Activity | Description | 2024 Focus |

|---|---|---|

| Content Production | Creating and acquiring content. | Continue investing in content. |

| Platform Management | Managing TV, streaming & radio. | EBITA-positive streaming ops by 2026. |

| Advertising Sales | Selling ads on various platforms. | Boost digital ad revenue. |

Resources

RTL Group's extensive content library, featuring TV shows, movies, and more, is key for attracting viewers. In 2024, the group invested heavily in content across various genres, including sports rights and talent deals. This strategy boosts viewer engagement and strengthens RTL's market position. RTL Group spent €1.8 billion on content in 2023, demonstrating its commitment.

RTL Group’s broadcasting infrastructure encompasses studios and transmission facilities. This infrastructure supports its diverse media operations, including TV channels and streaming. In 2024, RTL Group's revenue was €6.6 billion, reflecting its extensive media reach. Maintaining this infrastructure is key for content delivery.

RTL+ and M6+ are pivotal, demanding ongoing tech, content, and user experience investments. Their streaming services are dynamically growing in subscribers, viewing hours, and revenue. By the close of 2024, RTL Group's streaming services reached 6.764 million paying subscribers. This growth underscores their importance in the competitive online video market.

Brand Recognition

Brand recognition is pivotal for RTL Group. The RTL brand is a leading entertainment brand in Europe. It attracts viewers, advertisers, and partners. The company's diverse platforms reach millions daily. RTL's strong reputation drives its success.

- RTL Group generated revenue of €6.3 billion in 2023.

- The company's channels attract significant advertising revenue.

- RTL's streaming service, RTL+, has over 5 million subscribers.

- RTL operates in multiple European countries, expanding its reach.

Talent and Human Capital

Talent and human capital are essential for RTL Group's success. Skilled employees, including content creators and tech experts, drive high-quality content production. RTL Group's corporate culture, guided by RTL Brand Principles, shapes employee behavior. These principles are crucial for employees, executives, and partners. In 2024, RTL Group invested significantly in training programs, with a 15% increase in employee development initiatives.

- Employee training programs saw a 15% increase in 2024.

- RTL Brand Principles guide all stakeholders.

- Skilled content creators are key to success.

- Technology expertise is also vital.

RTL Group's key resources include its vast content library, broadcasting infrastructure, and streaming platforms like RTL+ and M6+. Strong brand recognition and a talented workforce are also vital. In 2024, RTL Group's investment in these areas drove its market position.

| Resource | Description | 2024 Data |

|---|---|---|

| Content Library | TV shows, movies, sports. | €1.8B spent in 2023 |

| Infrastructure | Studios, transmission. | Revenue of €6.6B |

| Streaming Platforms | RTL+, M6+. | 6.764M paying subscribers |

Value Propositions

RTL Group's strength lies in its diverse content. They offer news, sports, and entertainment, appealing to many viewers. In 2024, they provided over 55,000 hours of programming. Their streaming services also feature a broad content range, enhancing their value proposition.

RTL Group excels in creating high-quality, local content that deeply connects with its regional audiences. This programming strategy shapes the identity of its channels, ensuring relevance and appeal. For example, M6 in France blends news, talk shows, and comedy, providing a broad appeal. In 2024, RTL Group's revenue reached approximately €6.0 billion, showcasing the value of its programming.

RTL Group ensures a smooth viewing experience across TV, online, and mobile. Viewers can watch content on any device, enhancing convenience. RTL+ Premium is bundled with Deutsche Telekom's MagentaTV, offering value. This multi-platform approach boosts viewer engagement and reach, critical in 2024's media landscape. In 2023, RTL Group's digital revenue was €1.06 billion.

Premium Sports Content

RTL Group significantly boosts its value proposition through premium sports content. Investments in sports, including football and Formula 1, draw in a loyal audience. RTL+ has benefited from this strategy, setting it apart from competitors in the SVOD market.

- RTL secured NFL and Euro 2024 rights.

- Partnership with Sky adds Formula One and more.

- RTL+ growth is linked to its sports offerings.

- Premium sports content drives viewer engagement.

Trusted News and Information

RTL Group's commitment to trusted news is a core value proposition, especially with the spread of misinformation. Their news channels balance various genres, ensuring a broad appeal. RTL actively produces podcasts, such as with Audio Alliance in Germany, expanding its content reach. In 2024, the media group generated revenue of €6.4 billion.

- RTL Group's revenue in 2024 was €6.4 billion.

- They offer a mix of news, talk, and comedy.

- Active in podcast production, like with Audio Alliance.

RTL Group's content diversity, including news, sports, and entertainment, is a key value. They offer high-quality, local programming tailored to regional audiences. A seamless viewing experience across multiple platforms enhances user convenience and engagement.

| Key Feature | Description | Impact |

|---|---|---|

| Content Diversity | News, sports, entertainment, and streaming services. | Wider audience reach and engagement. |

| Local Content | High-quality programming suited for regional viewers. | Stronger audience connection, relevance. |

| Multi-platform Access | Viewing options on TV, online, and mobile. | Enhanced convenience and reach. |

Customer Relationships

RTL Group personalizes content recommendations. This approach boosts user engagement and satisfaction by tailoring suggestions to individual viewing habits. Investments in advertising tech and data analysis are crucial for targeting and personalization, which improves monetization. In 2024, personalized recommendations drove a 15% increase in user watch time. RTL uses data analytics to understand and cater to viewer preferences effectively.

RTL Group boosts viewer engagement via social media, polls, and live chats, building community and loyalty. The company fosters an entrepreneurial mindset among its employees. Interaction strengthens RTL's corporate culture, emphasizing participation and partnership. In 2024, RTL Group's digital revenues increased, showing the importance of interactive elements.

RTL Group prioritizes customer support to address viewer issues, including technical or billing problems, swiftly. A dedicated Media & Investor Relations team handles inquiries via email or phone. In 2024, RTL Group invested heavily in customer service tech, improving response times by 15%. This focus aims to enhance viewer satisfaction.

Loyalty Programs

RTL Group's loyalty programs, like those for MagentaTV and RTL+ Max, are crucial for customer retention. These programs offer exclusive content, rewarding subscribers and reducing churn. For instance, RTL+ Max bundles music and audiobooks, enhancing its appeal. Such strategies are vital in a competitive market.

- RTL+ had 4.7 million paying subscribers by the end of 2023.

- Loyalty programs increase customer lifetime value.

- Exclusive content drives subscription growth.

- Churn rates are reduced through rewards.

Community Engagement

RTL Group strategically engages with communities to boost its brand image and foster viewer relationships. In 2024, RTL Hungary's support for SOS Children's Villages and its broadcast of a program on foster care youth exemplify this commitment. This community-focused approach builds trust and loyalty, aligning with RTL's values. Such initiatives demonstrate the company's dedication to social responsibility, which resonates with audiences.

- RTL Hungary's involvement with SOS Children's Villages in 2024.

- Broadcast of an infotainment program about young people in foster care.

- Enhancement of brand image through community engagement.

- Strengthening viewer relationships via social responsibility.

RTL Group's customer relationships focus on personalization, enhancing user engagement and satisfaction through tailored content recommendations, leading to a 15% increase in watch time. Interactive elements, such as social media engagement and community-building initiatives, further strengthen viewer relationships and increase digital revenues, showing the impact of its efforts. Loyalty programs and exclusive content are vital for customer retention, contributing to RTL+ having 4.7 million paying subscribers by the end of 2023.

| Customer Relationship Strategy | Description | Impact |

|---|---|---|

| Personalized Content | Tailored recommendations | 15% watch time increase |

| Interactive Engagement | Social media, polls | Increased digital revenue |

| Loyalty Programs | Exclusive content | 4.7M+ RTL+ subscribers (2023) |

Channels

Television channels are a key channel for RTL Group, delivering news, entertainment, and sports to a wide audience. RTL Group manages 60 TV channels, mainly in Europe, including Germany and France. In 2024, RTL's German networks saw a strong audience share of 26.3%. This performance highlights the continued importance of traditional TV.

Streaming platforms are key for RTL Group. RTL+ and M6+ offer on-demand content. In 2024, total paying subscribers increased. RTL+ subscribers grew by 21.5% reaching 6.8 million.

Radio stations are a key channel for RTL Group, broadcasting news, music, and talk shows, especially during commutes. RTL Group operates radio stations in countries like France and Germany, connecting with millions daily. Programming is carefully crafted to reinforce their channel brands. In 2024, radio advertising revenue in Germany reached €1.2 billion, highlighting the channel's continued importance.

Online Platforms

RTL Group's online platforms, encompassing websites and mobile apps, are key channels for content delivery. RTL AdAlliance's new website and Living Room Club underscore their commitment to digital innovation. These initiatives aim to enhance partner and client engagement. In 2024, digital revenues for RTL Group continued to grow, representing a significant portion of their overall income.

- Digital revenues comprised over 30% of RTL Group's total revenue in 2024.

- RTL AdAlliance's initiatives are designed to increase digital ad sales.

- The Living Room Club fosters direct connections with business partners.

- Mobile app usage and web traffic are key performance indicators.

Social Media

RTL Group actively uses social media to promote its content and interact with its audience. This includes platforms like YouTube, Facebook, and Instagram. They leverage these channels to engage viewers and collect valuable feedback. Social media helps RTL Group understand audience preferences and tailor content accordingly. In 2024, digital advertising revenue for RTL Group reached €1.09 billion.

- Content promotion across various social media platforms.

- Engagement with viewers through interactive content.

- Feedback collection to refine programming strategies.

- Digital advertising revenue streams.

RTL Group's channels are diverse, with television channels reaching many viewers, particularly in Europe, with its German networks achieving a 26.3% audience share in 2024. Streaming platforms, such as RTL+ and M6+, attract subscribers; RTL+ saw a 21.5% subscriber increase, reaching 6.8 million. Online platforms and social media extend content reach, enhancing digital revenue which surpassed 30% of total revenue.

| Channel Type | Platform | Key Metrics (2024) |

|---|---|---|

| Television | TV channels | 26.3% Audience Share (Germany) |

| Streaming | RTL+ & M6+ | 6.8M Subscribers |

| Digital | Online & Social Media | Digital Revenue > 30% of Total |

Customer Segments

RTL Group's "Mass Market Viewers" encompasses a vast audience primarily consuming content via traditional TV channels. The company offers diverse programming: news, sports, and entertainment, aiming for broad appeal. In 2024, TV advertising revenue in Europe, a key RTL market, reached approximately €16.4 billion, reflecting the segment's importance.

Streaming subscribers represent a key customer segment, accessing on-demand content via platforms like RTL+ and M6+. RTL Group's streaming services boasted 6.764 million paying subscribers by the close of 2024. This marked a 21.5% year-over-year increase, reflecting strong growth. The company targets roughly 9 million subscribers and €750 million in streaming revenue by 2026.

Digital Natives, a key customer segment for RTL Group, are young viewers who primarily engage with content online and via mobile devices. RTL Group leverages online platforms, including websites and mobile apps, to deliver news, information, and entertainment. In 2024, digital video advertising revenue is projected to reach $45.8 billion, reflecting the importance of this segment. This strategy aligns with the trend of 70% of all video views occurring on mobile devices, illustrating RTL Group’s focus on digital consumption.

Regional Audiences

Regional audiences are crucial for RTL Group, focusing on viewers in specific geographic areas seeking local content. This includes Germany, where RTL Group has a strong presence. RTL Group's German publishing arm features magazine brands like Stern and Brigitte. In 2024, RTL Deutschland reported revenues of €2.9 billion.

- Focus on local content attracts specific regional viewers.

- German publishing includes brands like Stern and Brigitte.

- In 2024, RTL Deutschland reported €2.9 billion in revenues.

- This revenue reflects the value of regional audience segments.

Advertisers

Advertisers form a crucial customer segment for RTL Group, purchasing advertising space on its platforms to reach specific audiences. RTL Group's revenue model heavily relies on these advertising sales. In 2024, the advertising market has seen fluctuations, yet remains significant for media companies. RTL Group partners with advertising sales houses to optimize revenue across its channels.

- Advertising revenue contributes significantly to RTL Group's financial performance.

- RTL Group offers diverse advertising options across its TV channels, radio stations, and digital platforms.

- The company focuses on data-driven advertising solutions to enhance targeting and effectiveness.

- Advertising sales houses play a crucial role in managing and maximizing advertising revenue.

RTL Group's core audiences include regional viewers, especially in Germany. They are drawn to local content, with RTL Deutschland generating €2.9 billion in 2024. German publishing assets, such as Stern and Brigitte, also contribute. These regional segments are vital to overall revenue.

| Customer Segment | Description | 2024 Revenue/Data |

|---|---|---|

| Regional Viewers | Audiences in specific geographic areas. | RTL Deutschland revenue: €2.9B |

| Key Markets | Germany, Benelux | German advertising: €6.8B |

| Key Content | Local news, programs | Magazine publishing |

Cost Structure

Content acquisition and production form a major expense for RTL Group. This encompasses production, licensing, and talent costs, with sports rights being particularly expensive. To boost its streaming services, RTL Group aims to spend approximately €500 million annually on content. This investment is geared towards achieving streaming profitability by 2026.

RTL Group faces significant costs for its broadcasting and streaming infrastructure. This includes technology, equipment, and staffing expenses. The company's 2023 financial report showed a substantial allocation to these areas. A key move is migrating RTL+ to Bedrock by early 2026. This shift is projected to yield considerable cost savings.

RTL Group's cost structure includes substantial marketing and sales expenses. These expenses are crucial for promoting its content and selling advertising space. In 2024, RTL Group invested heavily in content and marketing to boost audience reach. Specifically, the company allocated a considerable portion of its budget to state-of-the-art streaming services.

Personnel Costs

Personnel costs at RTL Group encompass salaries and benefits, a significant expense due to its workforce of content creators, journalists, and management. These costs are closely tied to the company's culture and Brand Principles, influencing operational efficiency and output quality. In 2024, RTL Group's personnel expenses were a key factor in its financial performance.

- Employee costs impact profitability.

- RTL's brand depends on its people.

- Costs are central to the company's structure.

- In 2024, the personnel costs have increased.

Technology and Development Costs

RTL Group's cost structure includes technology and development expenses, vital for staying competitive. They allocate resources to research and development for new platforms and services. This involves investments in advertising technology and data. These enhancements aim to improve monetization through better targeting and personalization.

- In 2024, RTL Group's technology and development costs were a significant portion of its overall expenses.

- Investments in advertising technology and data analytics are ongoing.

- Focus is on improving user experience and advertising revenue.

RTL Group's cost structure is heavily influenced by content acquisition, with about €500 million annually earmarked for streaming content. Infrastructure costs include tech and equipment, affecting the company’s financial performance. Marketing and personnel expenses also play a crucial role, impacting audience reach and operational efficiency, respectively.

| Expense Category | Description | 2024 Allocation (Approx.) |

|---|---|---|

| Content Acquisition | Production, licensing, talent, sports rights | €500 million annually |

| Infrastructure | Technology, equipment, staffing | Significant allocation |

| Marketing & Sales | Content promotion, advertising sales | Substantial investment |

Revenue Streams

Advertising revenue is a core income source for RTL Group, generated by selling ad space on TV channels, radio stations, and digital platforms. In 2024, TV advertising brought in a stable €2,354 million. While the TV market faces challenges, digital growth is helping to balance out any declines.

Subscription revenue is a key component of RTL Group's financial strategy. This stream comes from subscription fees charged for accessing streaming services such as RTL+ and M6+.

These services provide exclusive content to paying subscribers, fostering a dependable revenue stream.

RTL Group's streaming services experienced robust growth in 2024 across all key metrics.

Notably, streaming revenue surged by 42% to reach €403 million.

This reflects the increasing importance of subscriptions in RTL Group's overall revenue model.

Content sales and licensing are a vital revenue stream, allowing RTL Group to monetize its content beyond initial broadcasts. Fremantle, a significant part of RTL Group, excels in creating and distributing content globally. In 2024, Fremantle's revenue from content sales and licensing was a substantial portion of its overall earnings. This includes selling formats like "Got Talent" and "Idols" to various platforms.

Distribution Revenue

Distribution revenue for RTL Group stems from licensing its TV channels and streaming services to various platforms. This includes agreements with cable, satellite providers, and other distributors. For example, One, a Hungarian service provider, will distribute RTL Hungary's linear TV channels and exclusively offer RTL+ starting January 1, 2025. This revenue stream is vital for RTL Group’s financial health.

- Distribution revenue is a crucial part of RTL Group’s financial strategy.

- Agreements with platforms ensure a steady flow of income.

- The deal with One highlights the importance of distribution deals.

- These deals support the visibility of RTL’s content.

Other Digital Services

RTL Group generates revenue through various other digital services. These include online gaming, e-commerce, and digital publishing, which contribute to its overall financial performance. RTL Deutschland's publishing business is currently undergoing a digital transformation to adapt to changing market trends. This strategic shift aims to enhance its digital presence and revenue streams. The company's focus on digital expansion is evident in its efforts to diversify its offerings.

- RTL Group's revenue from digital activities increased by 4.4% to €1,007 million in 2023.

- RTL Deutschland is actively transforming its publishing business digitally.

- The company is investing in online gaming and e-commerce.

- Digital revenue is a key growth area for RTL Group.

RTL Group diversifies its revenue streams across advertising, subscriptions, content sales, and distribution.

Advertising remained a stable €2,354 million in 2024, while streaming revenue grew significantly, up 42% to €403 million.

Digital services and content sales also contribute, with digital revenue reaching €1,007 million in 2023, showcasing the company's multifaceted financial strategy.

| Revenue Stream | 2024 Revenue (approx.) | Key Activities |

|---|---|---|

| Advertising | €2,354 million | TV, radio, digital ad sales |

| Streaming | €403 million (42% growth) | RTL+, M6+ subscriptions |

| Content Sales & Licensing | Significant (Fremantle) | Selling formats, content distribution |

| Digital Services | €1,007 million (2023) | Online gaming, e-commerce |

Business Model Canvas Data Sources

The RTL Group Business Model Canvas draws on financial statements, market research, and industry reports. These diverse sources guarantee accurate and strategic insights.