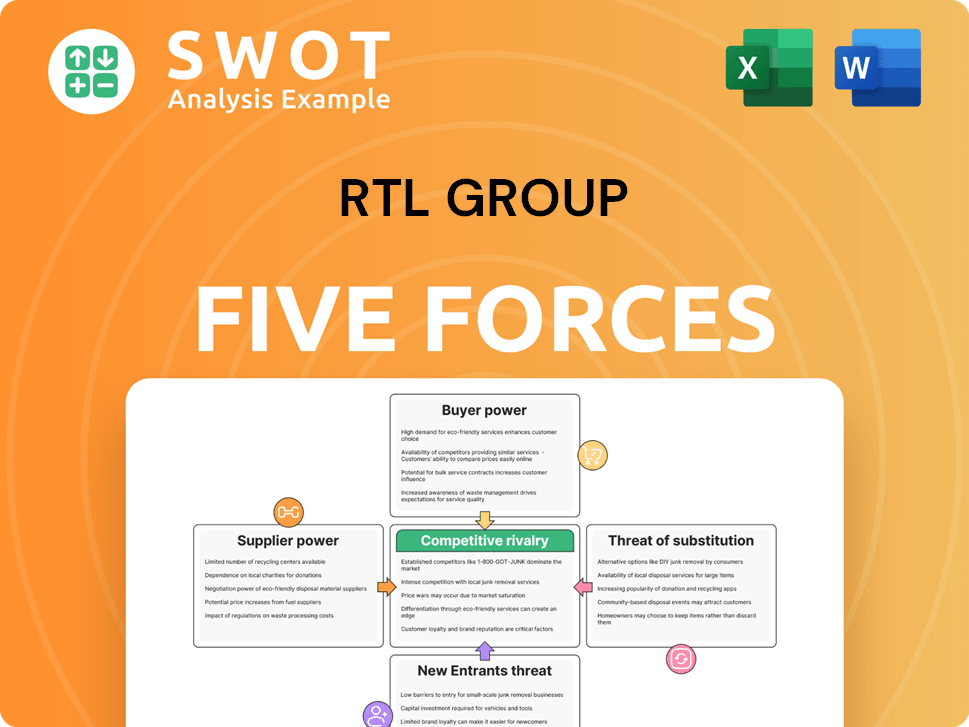

RTL Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

RTL Group Bundle

What is included in the product

Tailored exclusively for RTL Group, analyzing its position within its competitive landscape.

Duplicate tabs for various scenarios, giving you the flexibility to analyze different market conditions.

What You See Is What You Get

RTL Group Porter's Five Forces Analysis

This preview showcases the complete RTL Group Porter's Five Forces analysis. The document here is identical to the one you will download immediately after purchase. You'll receive a fully formatted, professional analysis ready for your use. There are no differences—what you see is exactly what you get. No hidden content.

Porter's Five Forces Analysis Template

RTL Group faces intense competition from established media giants and digital platforms. Buyer power is moderate, with viewers having numerous content options. Suppliers, primarily content creators, hold significant influence. The threat of new entrants is high due to low barriers. Substitutes like streaming services pose a notable challenge.

Unlock key insights into RTL Group’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Content creators, including production companies and independent producers, have some bargaining power, especially with hit shows. RTL Group depends on them for its TV and streaming platforms. The creators' power depends on demand and alternatives. In 2024, content spending is projected to increase significantly, with major players investing billions.

Technology providers for streaming and advertising tools hold moderate bargaining power over RTL Group. They supply crucial tech for content delivery and monetization. In 2024, RTL invested significantly in its tech, reducing reliance on external vendors. The market sees competition among tech providers, lessening their leverage.

Talent agencies significantly influence RTL Group, especially with high-profile personalities. Securing top talent is vital for content success and audience engagement. The power of these agencies is notable, as demonstrated by rising talent fees in 2024. RTL Group's established presence and long-term contracts help mitigate this influence to some extent. In 2024, talent costs represented a substantial portion of overall production expenses.

Rights Holders

Rights holders, like those for sports and movies, wield significant bargaining power. Their exclusive content is crucial for attracting audiences and driving subscription revenue. RTL Group faces stiff competition from other media giants to secure these valuable rights. This impacts their negotiation position and content acquisition costs. For example, in 2024, the cost of major sports broadcasting rights has increased by an average of 10-15% globally.

- Exclusive content drives viewer engagement.

- Competition increases acquisition costs.

- Rights holders have strong negotiation leverage.

- RTL Group must balance costs with content value.

Transmission and Distribution Networks

RTL Group, while owning some infrastructure, depends on external transmission and distribution networks. These suppliers' power is constrained by alternatives and RTL's investment capabilities. For instance, in 2024, the company allocated a significant portion of its capital expenditure towards infrastructure. This strategic investment enhances its bargaining position.

- Dependency on external networks, balanced by internal infrastructure.

- Investment in infrastructure, such as 2024's capital expenditure allocation.

- Availability of alternative networks.

- Impact on bargaining power.

RTL Group's supplier power varies based on the service. Talent agencies and rights holders hold strong positions, dictating terms and costs, notably in 2024. Tech providers' leverage is moderate due to competition, whereas content creators gain power with successful shows.

| Supplier Type | Bargaining Power | 2024 Impact |

|---|---|---|

| Rights Holders | High | Rights costs up 10-15% |

| Talent Agencies | Significant | Rising talent fees |

| Tech Providers | Moderate | RTL tech investment |

| Content Creators | Variable | Content spending rise |

Customers Bargaining Power

Viewers wield substantial bargaining power, fueled by diverse entertainment choices. They can effortlessly swap between channels, streaming platforms, or social media. In 2024, global streaming subscriptions surged, with Netflix boasting over 260 million subscribers. RTL Group must provide captivating content and user-friendly experiences to keep viewers engaged. The average daily time spent watching video content in 2024 was around 3 hours.

Advertisers wield substantial bargaining power, deciding where to spend their budgets. RTL Group, in 2024, faced stiff competition for ad revenue. Its success hinges on audience reach and targeting. RTL's 2024 ad revenue was €6.3 billion; it must offer compelling value.

Streaming subscribers wield significant power, thanks to the ease of switching between services. RTL Group faces pressure to offer compelling value, like exclusive content and competitive pricing, to retain viewers. Subscriber growth is a crucial metric for RTL's streaming success; in 2024, the streaming market saw subscriber churn rates hover around 5-7%.

Radio Listeners

Radio listeners wield considerable bargaining power due to the wide array of stations available. RTL Group, as of Q3 2023, reported digital audio revenue growth, highlighting the importance of adapting to listener preferences. To maintain listenership, RTL Group must consistently deliver compelling content and popular formats. Local content and well-known personalities are key in attracting and retaining audiences in competitive markets.

- Listener loyalty is crucial for advertising revenue.

- Digital platforms offer alternative listening options.

- Content quality and relevance drive listenership.

- Local market strategies are essential.

Content Distributors

Content distributors, such as cable companies and streaming aggregators, wield considerable bargaining power. RTL Group relies on these distributors to reach a wide audience. However, RTL's direct-to-consumer streaming services offer an alternative. This reduces dependence on third-party distributors, as seen with RTL's 2024 strategy.

- RTL Group's revenue in 2023 was approximately €6.5 billion.

- Direct-to-consumer platforms are becoming increasingly important for content distribution.

- The shift towards streaming impacts the bargaining dynamics.

- RTL's strategic investments aim to strengthen its direct distribution channels.

Viewers, armed with choices, influence RTL Group. Streaming's growth, with Netflix topping 260M subscribers in 2024, heightens this. RTL Group must offer engaging content; the average 2024 video watch time was ~3 hours daily.

| Factor | Impact | 2024 Data |

|---|---|---|

| Viewer Choice | High Bargaining Power | Streaming subs surge |

| Content Quality | Crucial | ~3hrs/day video watch |

| Platform Access | Ease of Switching | Netflix: 260M+ subs |

Rivalry Among Competitors

Traditional broadcasters, such as ProSiebenSat.1 Media SE, pose significant competitive rivalry for RTL Group, vying for viewers and ad revenue. These rivals boast strong brands and established distribution networks. RTL Deutschland increased its TV advertising market share in 2024. The audience lead grew to 7.0 percentage points over ProSiebenSat1, highlighting intense competition.

Global streaming services like Netflix, Amazon, and Disney+ fiercely compete, boasting massive content and subscribers. These giants invest heavily, increasing the pressure on RTL Group. RTL Group counters with local content and strategic partnerships. Data shows Netflix had 260.8 million subscribers in Q1 2024, highlighting the scale of competition [3]. RTL Group's success proves that local players can compete with global giants.

RTL Group faces competition from media giants like Vivendi and MFE-MediaForEurope. These rivals operate in TV, radio, and content, boasting international reach. For example, Vivendi's revenue in 2023 was approximately €9.7 billion. RTL Group needs strategic alliances to compete effectively [5].

Online Platforms

Online platforms, like YouTube and social media, intensify competition for audiences and ad revenue. These platforms offer user-generated content and targeted advertising, pressuring traditional media. RTL Group needs to evolve its content strategy to engage younger demographics effectively. The surge in video content via apps and streaming services impacts pricing. RTL Group's digital ad revenue in 2023 was €2.4 billion.

- YouTube's ad revenue in 2023 was $31.5 billion.

- TikTok's ad revenue in 2023 exceeded $11 billion.

- Netflix's 2023 revenue reached $33.7 billion, increasing competition.

- RTL Group's digital revenue grew by 6.5% in 2023.

Consolidation Trends

The media landscape is consolidating, intensifying competition. RTL Group faces pressure to merge for scale and efficiency. Strategic partnerships are crucial for RTL's competitive standing. In 2024, RTL sold its TV businesses in Belgium, Croatia, and the Netherlands to regional players, aiming for consolidation. This strategic move helps RTL focus on core strengths.

- Consolidation increases competition.

- RTL must pursue mergers and partnerships.

- RTL sold businesses in key markets.

- Focus is on core strengths.

Competitive rivalry for RTL Group is fierce, involving traditional broadcasters and global streaming services. Online platforms like YouTube and social media also intensify the battle for audiences and advertising revenue. RTL Group must adapt its strategy, considering partnerships and consolidation to stay competitive.

| Rivalry Type | Key Competitors | Impact |

|---|---|---|

| Traditional TV | ProSiebenSat.1, others | Audience/ad revenue battle |

| Streaming Services | Netflix, Amazon, Disney+ | Content & subscriber competition |

| Online Platforms | YouTube, TikTok | Digital ad revenue pressures |

SSubstitutes Threaten

The streaming landscape presents a significant threat to RTL Group due to numerous substitutes. Services like Netflix, Disney+, and Amazon Prime Video compete for viewers' attention. RTL+ needs to stand out with unique content, competitive pricing, and a user-friendly experience to combat this. In 2024, Netflix's global subscriber base reached approximately 260 million, highlighting the scale of competition.

Traditional TV continues to be a threat, particularly for live content. RTL Group must carefully manage streaming investments alongside its established TV operations. Strong linear TV channels are vital for advertising and reaching audiences. In 2024, linear TV ad revenue was still significant, even as streaming grew. RTL Group's strategy must reflect this balance.

Social media platforms like YouTube, TikTok, and Instagram pose a threat as substitutes, especially for younger audiences seeking short-form video content. These platforms attract viewers, potentially diverting them from RTL Group's offerings. RTL Group must use social media to stay competitive, promoting its content, and engaging viewers. In 2024, TikTok's average user spent nearly an hour daily on the platform.

Gaming and Other Entertainment

Gaming, podcasts, and digital entertainment are major substitutes. They vie for consumer time and spending, pressuring RTL Group. Competition is fierce; RTL must deliver high-quality content. In 2024, the global gaming market is estimated at $282.7 billion. This intense competition impacts RTL's profitability.

- Gaming revenues are projected to reach $300 billion by the end of 2024.

- Podcast ad revenue is expected to hit $2.5 billion in 2024.

- Streaming services compete aggressively for viewers.

- RTL Group must innovate to maintain market share.

Piracy

Piracy poses a considerable threat to RTL Group, particularly through illegal downloading and streaming of content across various markets. This can undermine revenue streams and erode the value of their intellectual property. RTL Group must actively collaborate with industry partners to combat piracy effectively.

- In 2024, global losses from digital piracy were estimated to be around $31.8 billion.

- The Motion Picture Association (MPA) reported that piracy rates remain high in regions with weaker enforcement.

- RTL Group invests in technologies to identify and remove pirated content.

RTL Group faces stiff competition from various substitutes. Streaming services like Netflix and Disney+ are major rivals, with Netflix boasting approximately 260 million subscribers globally in 2024. Platforms such as YouTube and TikTok also attract viewers, particularly younger audiences. Gaming and digital entertainment pose significant threats to RTL Group's revenue streams.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Streaming Services | Direct Competition | Netflix: ~260M Subscribers |

| Social Media | Audience Diversion | TikTok: ~1 hour daily user time |

| Gaming | Entertainment Spending | Global Gaming Market: $282.7B (est.) |

Entrants Threaten

The threat of new entrants in the streaming market is high. With the rise of platforms like Netflix and Disney+, the barrier to entry is comparatively low. This intensifies competition for subscribers and content rights. RTL Group needs to innovate and invest in its streaming services, such as RTL+, to remain competitive. In 2024, streaming services generated over $100 billion in revenue globally.

Tech giants like Apple and Google could easily enter the media market, posing a real threat to RTL Group. These companies have vast financial resources and well-established technology platforms. In 2024, Apple reported over $380 billion in revenue, demonstrating its financial power. RTL Group needs to use its existing content and partnerships to stay competitive.

Niche content providers, focusing on specific genres, pose a threat to RTL Group by attracting dedicated audiences. RTL Group needs to offer diverse content to compete effectively. In 2024, the streaming market saw significant growth in niche platforms. This requires RTL Group to continuously adapt and innovate to meet audience demands.

Foreign Media Companies

Foreign media companies pose a threat by potentially entering RTL Group's markets, intensifying competition. These entrants could introduce innovative content and business models, reshaping the landscape. RTL Group faces the challenge of reinforcing its local presence and adapting swiftly to evolving market conditions. In 2024, international streaming services increased their market share in Europe. This requires strategic agility.

- Increased competition from global players like Netflix and Amazon.

- Introduction of new content formats and distribution methods.

- Need for RTL Group to invest in local content and digital platforms.

- Adaptation to changing consumer viewing habits.

Regulatory Barriers

Regulatory barriers significantly influence the media landscape, potentially hindering new entrants. Licensing and content quotas, for example, can restrict market access. RTL Group must stay vigilant regarding these regulations and their impact. The company should advocate for policies that foster fair competition. The evolving nature of these rules necessitates continuous monitoring and adaptation.

- Licensing requirements can limit the number of new broadcasters.

- Content quotas may favor established players with existing libraries.

- RTL Group needs to lobby for equitable regulatory frameworks.

- Staying informed about regulatory changes is crucial for strategic planning.

The threat of new entrants is a significant challenge for RTL Group, fueled by low barriers to entry in the streaming sector and potential disruption from tech giants like Apple and Google. Niche content providers and foreign media companies further intensify competition, requiring RTL Group to offer diverse content and adapt to evolving market conditions. Regulatory hurdles like licensing can also impact new entrants.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Tech Giants | Vast financial resources | Apple's revenue: $380B+ |

| Niche Providers | Attract dedicated audiences | Significant growth in niche platforms |

| Foreign Media | Intensified competition | Int. streaming services market share in Europe increased |

Porter's Five Forces Analysis Data Sources

The analysis utilizes RTL Group's annual reports, industry analysis from consulting firms, and market share data. This provides a comprehensive view of competition.