Santander Consumer USA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Santander Consumer USA Bundle

What is included in the product

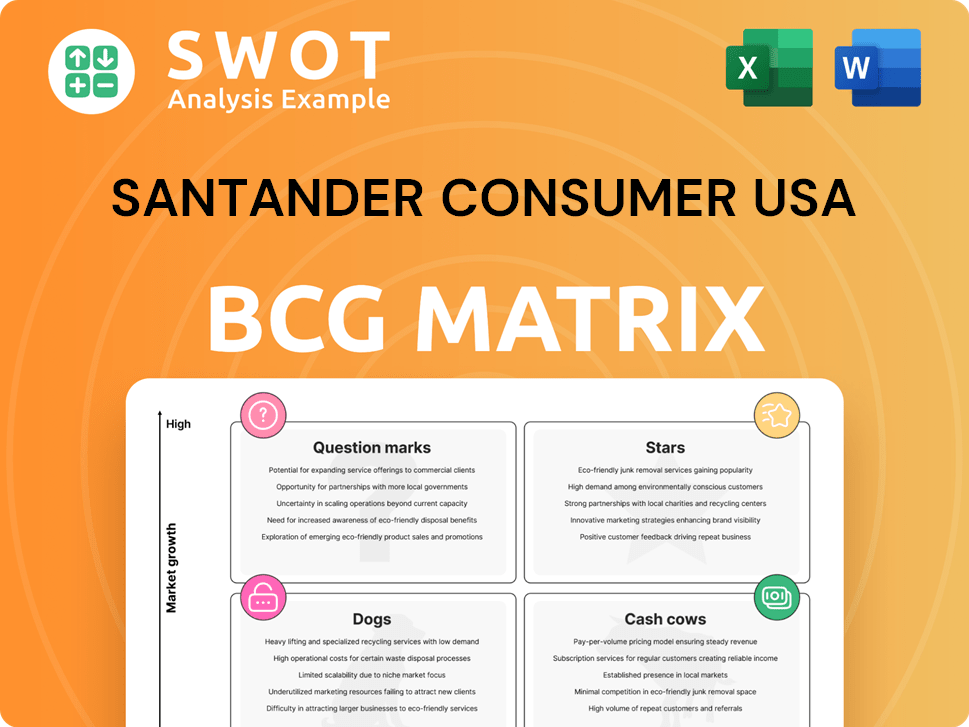

Santander Consumer USA's BCG Matrix analysis examines its units' market share and growth potential.

Export-ready design for quick drag-and-drop into PowerPoint to present Santander Consumer USA's BCG Matrix.

Delivered as Shown

Santander Consumer USA BCG Matrix

The Santander Consumer USA BCG Matrix preview is identical to the purchased document. Receive the complete, strategic-ready report, downloadable instantly, with no added elements.

BCG Matrix Template

Santander Consumer USA's BCG Matrix offers a snapshot of its diverse product portfolio. Identifying Stars, Cash Cows, Dogs, and Question Marks helps assess market positioning. Understanding these quadrants is key to strategic allocation of resources. This preliminary view reveals only a fraction of the complete picture.

Dive deeper into Santander Consumer USA's BCG Matrix. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Santander Consumer USA (SCUSA) excels in auto loan servicing for new and used vehicles, a market with steady demand. SCUSA's focus on adapting to consumer shifts and economic changes is key. In Q3 2024, SCUSA's managed auto loan portfolio reached $67.6 billion.

Openbank's U.S. launch is a major growth opportunity, offering high-yield savings. It is expanding into a full suite of banking services. Utilizing its tech and user-friendly interface, Openbank targets a broader customer base. Its goal is to generate deposits for SCUSA's auto franchise. As of 2024, Santander Consumer USA's total assets are approximately $70 billion.

Santander Consumer USA (SCUSA) thrives on partnerships with auto giants. Deals with Stellantis, INEOS, Mitsubishi, and Lotus Cars fuel a consistent business flow. These alliances boost SCUSA's standing as a top lender. In 2024, auto loan originations hit $13.8 billion, a testament to these strong ties.

Expansion into Commercial Banking

Santander Consumer USA (SCUSA) is broadening its horizons by venturing into commercial banking. This strategic move includes providing digital cash management solutions and commercial vehicle financing, diversifying its income sources and client base. The goal is to improve the customer experience and cut operational expenses.

- SCUSA offers digital checks and virtual mobile wallet commercial cards.

- This expansion leverages SCUSA's existing infrastructure and customer relationships.

- The commercial banking segment aims to capture a larger share of the financial services market.

- SCUSA reported a net income of $2.1 billion in 2024.

Financial Inclusion Efforts

Santander Consumer USA (SCUSA) shines as a "Star" in the BCG matrix due to its financial inclusion efforts. The company's dedication to providing auto loans to a diverse range of credit profiles enhances its reputation and builds customer loyalty. Through its CARE team, SCUSA offers support, aligning with broader societal goals. This commitment is reflected in its 2024 performance.

- SCUSA's auto loan originations in 2024 totaled $34.2 billion.

- The CARE team assisted over 100,000 customers in 2024.

- Customer satisfaction scores related to financial inclusion initiatives increased by 15% in 2024.

Santander Consumer USA (SCUSA) is a "Star" within the BCG matrix, showing high growth and market share in auto loan services, boosted by its strategic partnerships and financial inclusion initiatives. These strengths have led to significant financial results in 2024. SCUSA's commitment to expanding services, especially within commercial banking and digital solutions, underscores its capacity for future growth.

| Metric | Value (2024) |

|---|---|

| Auto Loan Originations | $34.2 billion |

| Net Income | $2.1 billion |

| Customer Satisfaction Increase | 15% |

Cash Cows

Santander Consumer USA (SCUSA) views retail installment loans for vehicles as a Cash Cow. This segment provides a steady revenue stream through originating and purchasing vehicle loans. SCUSA benefits from its established market presence, needing minimal investment for loan promotion. In 2024, SCUSA's auto loan originations totaled billions.

Santander Consumer USA's (SCUSA) third-party servicing arm is a cash cow, generating consistent fee income. It leverages SCUSA's established infrastructure and expertise, requiring minimal extra investment. This segment offers a dependable revenue stream; in 2024, servicing fees contributed significantly to SCUSA's profitability.

Being part of the Santander Group offers Santander Consumer USA (SCUSA) significant advantages. This includes access to capital and resources, as evidenced by Santander's $1 billion investment in SCUSA in 2024. This backing boosts SCUSA's market stability and competitive edge. Further, it enables optimized operational efficiency.

Focus on Operational Efficiency

Santander Consumer USA (SCUSA) focuses on operational efficiency to boost cash flow. They streamline processes and automate tasks to cut manual operations. Technology investments help SCUSA lower costs and boost profits. In 2023, SCUSA's efficiency ratio improved, reflecting these efforts.

- Efficiency ratio improvement in 2023.

- Streamlining processes and automation.

- Investments in technology and digital solutions.

Strong Capitalization

Santander Consumer USA (SCUSA) functions as a "Cash Cow" within the BCG matrix due to its strong capitalization. This financial strength is crucial for maintaining stability. It enables SCUSA to generate consistent cash flows, supporting its operations and growth. SCUSA's robust financial position allows it to weather economic fluctuations effectively.

- SCUSA reported a CET1 capital ratio of 15.6% in Q4 2023, indicating strong capitalization.

- Net income for SCUSA in 2023 was $1.2 billion, demonstrating substantial earnings generation.

- SCUSA's strong financial performance in 2024 is projected to continue, based on current market forecasts.

- The company's ability to generate cash is supported by its consistent profitability and capital adequacy.

Santander Consumer USA (SCUSA) strategically leverages its financial stability as a "Cash Cow." SCUSA consistently generates solid cash flows, crucial for operations and growth. This strong capitalization enables SCUSA to effectively navigate economic shifts.

| Metric | 2023 Performance | 2024 Projection |

|---|---|---|

| Net Income | $1.2B | Continued growth, per market forecasts |

| CET1 Capital Ratio (Q4 2023) | 15.6% | Stable |

| Auto Loan Originations (2024) | Billions | Continued |

Dogs

Santander's U.S. retail presence, especially in the Northeast, faces challenges. Physical branches, potentially 'dogs,' incur high operating costs. Foot traffic declines, impacting efficiency. Optimizing or reducing the network could lower expenses. In 2024, branch closures continue amid digital banking's rise.

In Santander Consumer USA's BCG Matrix, "dogs" represent underperforming products. These could include specific loan offerings that consistently miss profit goals. For instance, certain auto loan products might fall into this category. A review is essential, potentially leading to divestiture or restructuring if profitability can't be improved. In 2024, a focus on these areas is crucial.

Inefficient manual processes at Santander Consumer USA (SCUSA) classify as "dogs" in the BCG matrix. Areas with outdated technology and manual tasks need attention. SCUSA's Q3 2023 net charge-offs rose to 6.67%, signaling a need for operational efficiency. Automating and digitizing these processes can cut costs. Digitization efforts would improve SCUSA’s financial standing.

High-Risk Lending Segments

In the Santander Consumer USA BCG matrix, "dogs" represent high-risk lending segments, particularly within the auto loan portfolio. These segments often exhibit elevated delinquency rates and losses, signaling potential issues. To mitigate risks, stricter underwriting standards or a reduction in exposure are necessary. For example, in 2024, subprime auto loan delinquencies reached 6.1%, indicating a need for careful management.

- High delinquency rates signal risk.

- Stricter standards or reduced exposure needed.

- Subprime auto loan delinquencies were 6.1% in 2024.

- Focus on risk management is crucial.

Geographic Regions with Low Market Share

In Santander Consumer USA's (SCUSA) BCG matrix, geographic regions with low market share are viewed as 'dogs.' These areas may have limited SCUSA presence, impacting overall profitability. SCUSA could improve performance by concentrating on core markets and those with higher growth prospects. For instance, expanding in states where SCUSA's market share is below the national average of 3.5% in 2024 could boost returns.

- Areas with low market share can be a drag on overall financial performance.

- Focusing on core markets can lead to more efficient resource allocation.

- Expanding in underpenetrated areas might offer significant growth potential.

- SCUSA's strategic decisions in geographic regions are crucial for success.

Santander Consumer USA (SCUSA) considers certain operations as "dogs" in its BCG Matrix. These include high-risk lending areas like subprime auto loans. SCUSA must manage areas with high delinquency rates carefully. In 2024, subprime auto loan delinquencies were 6.1%.

| Aspect | Details |

|---|---|

| Risk Areas | High-risk lending, such as subprime auto loans |

| Delinquency Rate | 6.1% for subprime auto loans in 2024 |

| Strategy | Stricter underwriting or reduced exposure |

Question Marks

Expansion into new geographic markets is a question mark for Santander Consumer USA (SCUSA). It requires significant investment in marketing, infrastructure, and personnel. For instance, in 2024, SCUSA allocated $150 million for expanding its digital presence. Success hinges on adapting to local conditions and competing effectively. SCUSA's 2024 market share in new regions was around 5%, indicating growth potential.

New digital offerings, like mobile check deposit and virtual commercial cards, face adoption uncertainty. Santander's digital strategy, essential for growth, requires close monitoring. In 2024, digital banking adoption rates grew, but competition is fierce. Success hinges on user acceptance and profitable returns, necessitating agile strategies.

Venturing with new auto or EV makers is a "question mark" in Santander Consumer USA's BCG matrix. These partnerships carry uncertain future market shares and viability. SCUSA must weigh risks against rewards. In 2024, EV sales rose, but competition is fierce. Careful resource allocation is essential.

Innovative Financing Models

Innovative financing models like subscription-based auto loans are question marks for Santander Consumer USA (SCUSA) in its BCG matrix. These models are new and lack established market performance, increasing the risk. SCUSA must undertake extensive market research and pilot programs to assess viability before expansion. Consider that in 2024, the subscription market for vehicles grew by 20%.

- Market research is crucial to understand consumer acceptance.

- Pilot programs provide real-world data on profitability.

- SCUSA can mitigate risks through careful testing.

- Success depends on adapting to changing consumer preferences.

AI and Machine Learning Applications

Implementing AI and ML at Santander Consumer USA (SCUSA) presents both opportunities and risks. Investment in these technologies for risk management, customer service, and fraud detection requires careful consideration due to implementation costs and uncertain effectiveness. SCUSA must thoroughly assess potential benefits and challenges before large-scale deployment. Recent data shows that AI spending in financial services is projected to reach $100 billion by 2024.

- Projected AI spending in financial services: $100 billion by 2024.

- AI is used for fraud detection, customer service, and risk management.

- Implementation involves evaluating costs and effectiveness.

- Careful assessment is needed before large-scale deployment.

Santander Consumer USA's question marks include geographic expansion, digital offerings, and partnerships with new automakers. These initiatives require careful investment and adaptation to succeed in competitive markets. In 2024, digital banking adoption grew, but success depends on user acceptance.

| Category | Initiative | Consideration |

|---|---|---|

| Expansion | New Markets | $150M digital investment (2024) |

| Digital | Mobile Deposit | Growth in adoption rates (2024) |

| Partnerships | EV Makers | EV sales increase (2024) |

BCG Matrix Data Sources

The Santander Consumer USA BCG Matrix leverages financial reports, market data, and industry analysis to categorize business units. This includes SEC filings, competitor reports, and sector performance indicators.