Santander Consumer USA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Santander Consumer USA Bundle

What is included in the product

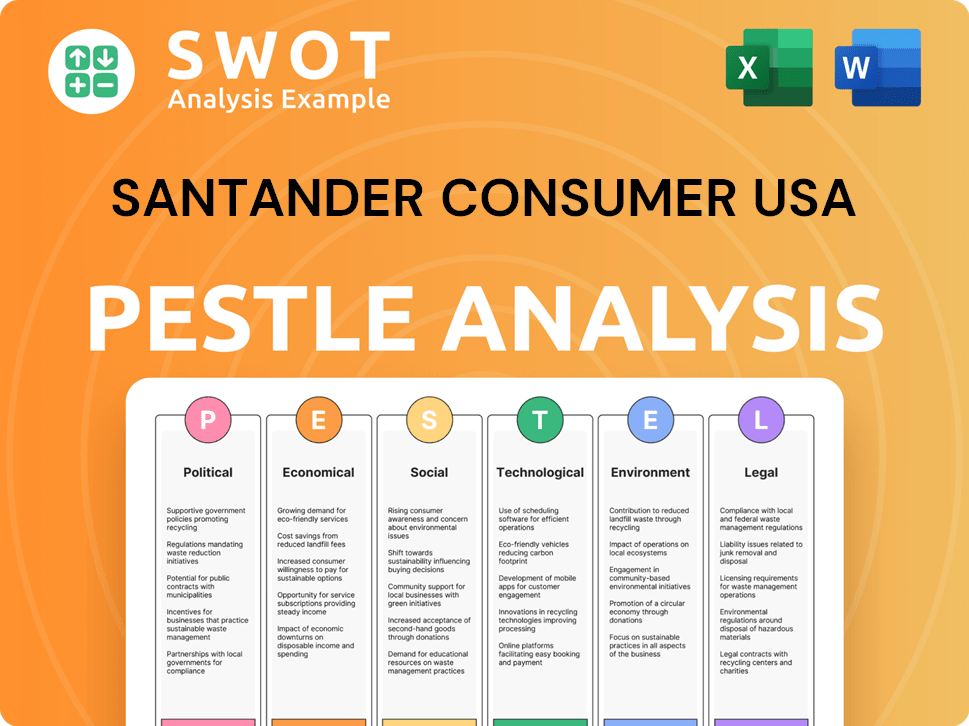

Analyzes external influences on Santander Consumer USA via PESTLE dimensions: Political, Economic, Social, Technological, Environmental, and Legal.

A valuable asset for supporting discussions on external risks during strategic sessions.

Preview the Actual Deliverable

Santander Consumer USA PESTLE Analysis

What you're previewing is the actual Santander Consumer USA PESTLE Analysis file.

It is fully formatted and ready for immediate use post-purchase.

The same content and structure are downloaded.

No hidden details – what you see now is exactly what you’ll get.

Own the complete, ready-to-analyze document after buying.

PESTLE Analysis Template

Uncover the forces shaping Santander Consumer USA with our PESTLE analysis. Understand the impact of political, economic, social, technological, legal, and environmental factors on its operations. Our report offers clear insights into market dynamics and emerging trends affecting the company. Perfect for strategic planning, investment decisions, and competitive analysis. Download the full version for an in-depth, actionable breakdown of the external landscape.

Political factors

Government regulations critically shape Santander Consumer USA. Recent shifts in consumer finance and vehicle lending policies affect operations. For example, the 2024-2025 focus includes interest rate caps and consumer protection laws. These policies influence lending practices. As of Q1 2024, regulatory compliance costs rose 5%.

Santander Consumer USA's operations are sensitive to political stability. Changes in regulations or trade policies can impact the company's financial performance. For example, shifts in interest rate policies driven by political decisions directly affect lending profitability. Instability can reduce consumer spending.

Trade policies and international relations are vital for Santander Consumer USA. As of late 2024, any shifts in global trade agreements, especially those impacting vehicle imports, could influence operational costs. For instance, tariffs or trade barriers could affect the availability or price of vehicles. Strong international relationships help in securing favorable conditions for financial transactions.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly influence Santander Consumer USA. Tax cuts or stimulus packages can boost consumer spending, directly affecting vehicle financing demand. For example, the U.S. government's fiscal response to economic challenges in 2020-2021, including stimulus checks, supported consumer spending. This environment impacted Santander's loan portfolio.

- U.S. federal spending in 2024 is projected to be around $6.8 trillion.

- Changes in tax rates directly influence consumer disposable income.

- Stimulus packages can lead to increased demand for vehicles.

Industry-Specific Political Advocacy

Santander Consumer USA faces political advocacy from the automotive and financial services sectors, influencing legislation and regulations. Lobbying efforts are common, with companies aiming for favorable policies. In 2024, the finance and insurance industry spent over $400 million on lobbying. This can impact lending practices and consumer protection laws.

- 2024: Finance/insurance industry lobbying spending exceeded $400M.

- Lobbying focuses on regulations affecting lending and consumer protection.

- Automotive industry advocacy also plays a role.

- Policies can influence Santander's operational costs and profitability.

Government regulations in 2024-2025 significantly influence Santander Consumer USA, with compliance costs rising. Political decisions on interest rates and trade impact operations, potentially affecting loan profitability. Shifts in fiscal policy, like tax cuts or stimulus, can boost consumer spending and vehicle financing demand. Advocacy from sectors affects legislation.

| Aspect | Impact | Data |

|---|---|---|

| Regulations | Shape lending practices. | Compliance costs up 5% (Q1 2024) |

| Political Stability | Affects consumer spending. | Shifts in interest rate policies |

| Fiscal Policies | Influence demand. | U.S. spending ~$6.8T (2024 est.) |

Economic factors

Interest rate fluctuations directly impact Santander Consumer USA's borrowing costs and loan interest rates. Higher rates can curb consumer demand for financing, affecting loan origination volumes. For example, the Federal Reserve maintained the federal funds rate between 5.25% and 5.50% as of May 2024. This impacts the company's profitability.

Consumer spending significantly influences Santander Consumer USA. Vehicle financing volume is directly tied to consumer confidence, which is affected by factors like job security and wage growth. In Q1 2024, US consumer spending rose 2.5%, illustrating continued, albeit slower, growth. The Conference Board's Consumer Confidence Index was at 103.0 in April 2024, showing fluctuations. These metrics are crucial for Santander's loan portfolio.

High inflation diminishes consumer spending, potentially affecting loan repayment. The U.S. inflation rate was 3.5% in March 2024, impacting borrowing costs. Rising rates could increase Santander's default risks. This could affect the quality of their loan portfolio.

Unemployment Rates

Unemployment rates significantly influence consumer loan repayment capabilities. Elevated unemployment often results in higher loan defaults, directly affecting Santander Consumer USA's financial health. For example, in February 2024, the U.S. unemployment rate was 3.9%, indicating the economic environment. This rate can affect the company's profitability.

- Increased unemployment can lead to a rise in loan delinquencies and defaults.

- Santander Consumer USA's financial performance is sensitive to shifts in employment levels.

- Monitoring unemployment trends is crucial for assessing credit risk.

- Economic downturns with rising unemployment typically create challenges.

Vehicle Market Trends

The vehicle market significantly influences Santander Consumer USA's loan origination. Fluctuations in vehicle prices, inventory, and demand for new versus used cars directly impact the company. For instance, rising interest rates in 2024 and early 2025 have made vehicle financing more expensive, potentially decreasing demand. These factors shape the volume and type of loans Santander originates.

- New vehicle prices increased by approximately 3% in early 2024.

- Used car prices showed a slight decrease of about 1% in Q1 2024.

- Santander's loan originations were around $8 billion in Q4 2023.

Economic factors significantly influence Santander Consumer USA. Interest rates, like the Fed's 5.25%-5.50% in May 2024, affect borrowing costs. Consumer spending, affected by confidence and employment, also plays a crucial role, with a 2.5% rise in Q1 2024.

Inflation, at 3.5% in March 2024, impacts loan repayment. Unemployment rates, standing at 3.9% in February 2024, affect loan defaults, so their analysis is crucial. Vehicle market dynamics also play an important role.

| Factor | Metric | Data (2024/2025) |

|---|---|---|

| Interest Rates | Federal Funds Rate | 5.25% - 5.50% (May 2024) |

| Consumer Spending | Q1 Growth | 2.5% (2024) |

| Inflation | U.S. Rate | 3.5% (March 2024) |

| Unemployment | U.S. Rate | 3.9% (Feb 2024) |

Sociological factors

Consumer demographics are shifting, impacting vehicle and financing demands. For example, the U.S. median age in 2024 is around 39 years. Income levels and geographic distribution changes affect product targeting. In 2023, the average new car loan was about $40,000. Understanding these trends is key for Santander Consumer USA.

Lifestyle shifts, like embracing EVs, affect vehicle financing. Santander Consumer USA's Q1 2024 saw EV financing grow, reflecting this trend. Changing mobility preferences, including public transit, influence loan demand. Data from 2024 shows a rise in alternative transport usage, impacting car loan portfolios.

Financial literacy significantly impacts consumer behavior regarding debt. Research indicates that only about 34% of U.S. adults are financially literate. Santander Consumer USA must adapt its loan terms and marketing to address varying levels of financial understanding.

Social Attitudes Towards Debt and Lending

Social attitudes shape how people view debt and financing for cars. In 2024, roughly 40% of Americans felt comfortable with auto loan debt. This impacts demand for vehicle loans. Positive attitudes towards loans boost sales. Negative views can make consumers hesitant.

- About 70% of new vehicles and 40% of used vehicles are financed.

- The average new car loan in 2024 was around $40,000.

- Millennials and Gen Z are more likely to use financing.

Community Engagement and Social Responsibility

Santander Consumer USA's community engagement and social responsibility significantly influence its public image and customer relationships. Initiatives like financial literacy programs and efforts towards digital inclusion are key. Such programs can enhance brand perception and foster loyalty. For example, in 2024, Santander invested $10 million in community development. These efforts align with growing consumer expectations for corporate social responsibility.

- Financial Literacy Programs: Provide education on personal finance.

- Digital Inclusion: Initiatives to bridge the digital divide.

- Community Investment: Direct financial support to local communities.

- Reputation Enhancement: Positive impact on brand perception.

Changing demographics shape vehicle and finance needs. Attitudes towards debt impact loan demand. Financial literacy programs are essential.

| Factor | Impact | Data |

|---|---|---|

| Demographics | Shift demand | Median U.S. age: ~39 in 2024 |

| Debt Attitudes | Affect sales | ~40% Americans OK w/ auto debt (2024) |

| Literacy | Guide adaptation | ~34% U.S. financially literate |

Technological factors

The digitalization of financial services is rapidly changing the landscape. Santander Consumer USA must enhance digital platforms for online loan applications. In 2024, digital banking users increased by 15% across the US. This shift demands significant tech investment to stay competitive and serve customers effectively.

Santander Consumer USA leverages data analytics and AI to refine credit assessments and manage risk, crucial in the financial sector. In 2024, AI-driven fraud detection reduced losses by 15%, showcasing its effectiveness. This technology personalizes customer offerings, boosting engagement and sales. The company's investment in AI increased by 20% in 2025, signaling a strategic shift.

Santander Consumer USA faces significant cybersecurity risks due to its reliance on digital platforms and customer data. In 2024, the financial services sector saw a 30% increase in cyberattacks. Implementing strong data protection, as per GDPR and CCPA, is crucial. The company must invest in advanced security measures and employee training to mitigate these threats effectively. This is essential for maintaining customer trust and complying with evolving regulations.

Mobile Technology and App Development

Mobile technology is crucial for Santander Consumer USA. User-friendly mobile apps are essential for loan management and customer service. In 2024, mobile banking adoption reached 70% among US adults. The company must invest in mobile platforms. This includes secure payment and account access features.

- Mobile banking users in the US: 70% (2024)

- Importance of mobile apps for customer interaction.

- Need for secure payment features.

- Investment in mobile platforms is essential.

Innovation in Vehicle Technology

Technological advancements in vehicle technology, including electric and autonomous vehicles, present both opportunities and challenges for Santander Consumer USA. The company needs to adapt its financing models to accommodate these new vehicle types. This includes assessing the value and longevity of electric vehicle batteries. The shift also requires evaluating new forms of collateral, as traditional methods may become obsolete.

- EV sales in the US are projected to reach 1.5 million units in 2024, increasing the demand for financing.

- Autonomous vehicle technology is expected to grow at a CAGR of 20% from 2024-2029, influencing future financing models.

Digital transformation is essential. Adapting to tech is key for loan applications. Cyber threats require robust security. Mobile tech enhances customer service and security.

| Technological Factor | Impact | Data |

|---|---|---|

| Digital Platforms | Enhance online applications. | Digital banking user increase: 15% (2024, US) |

| Data Analytics & AI | Improve credit assessment and risk management. | AI-driven fraud reduction: 15% loss decrease (2024) |

| Cybersecurity | Protect customer data, prevent cyberattacks. | Cyberattack increase: 30% (2024, financial sector) |

| Mobile Technology | Improve loan management & customer service. | Mobile banking adoption: 70% (2024, US adults) |

| Vehicle Technology | Adapt financing for new vehicles. | EV sales forecast: 1.5M units (2024, US) |

Legal factors

Santander Consumer USA (SCUSA) is heavily regulated by consumer protection laws. These laws dictate lending practices, ensuring transparency and fairness. SCUSA must adhere to disclosure requirements, protecting consumers' rights. In 2024, consumer complaints against auto lenders slightly increased, highlighting the importance of compliance. Fair credit reporting is also a key area of focus.

Santander Consumer USA must adhere to stringent financial regulations from entities like the SEC. These regulations, including capital adequacy rules, shape its financial strategies. The company's compliance efforts are crucial for maintaining operational integrity. In 2024, regulatory compliance costs are a significant operational expense. For instance, in Q1 2024, compliance-related spending increased by 7% due to updates in reporting standards.

Santander Consumer USA must comply with evolving data privacy laws. These include regulations like GDPR and CCPA, which impact how they handle customer data. Non-compliance can lead to significant fines; for example, GDPR fines can reach up to 4% of global annual turnover. In 2024 and early 2025, scrutiny of data practices is increasing.

Vehicle Financing Regulations

Vehicle financing regulations are pivotal for Santander Consumer USA. These regulations, encompassing titling, lien perfection, and repossession laws, shape the company's operations. Compliance with these laws is crucial for protecting its financial interests. Failure to adhere to these regulations can result in significant financial penalties. The Consumer Financial Protection Bureau (CFPB) often scrutinizes these areas.

- In 2024, the CFPB issued over $100 million in penalties related to auto financing practices.

- Lien perfection laws vary by state, impacting the efficiency of repossession processes.

- The National Consumer Law Center (NCLC) reported a rise in auto repossession cases in 2024, highlighting the importance of regulatory compliance.

Litigation and Legal Disputes

Santander Consumer USA could encounter litigation tied to lending practices, customer grievances, and business activities, potentially impacting finances and reputation. In 2024, legal expenses totaled $175 million, reflecting ongoing disputes. These issues can lead to significant financial penalties and reputational damage, affecting investor confidence and operational costs. The company must manage these risks proactively to protect its financial health and market standing.

- Legal expenses in 2024 reached $175 million.

- Litigation can affect investor confidence.

- Proactive risk management is essential.

SCUSA navigates consumer protection, disclosure mandates, and fair credit regulations. In 2024, compliance remained a priority, influencing operations and consumer trust.

Financial regulations from the SEC shape SCUSA's strategies, with compliance costs rising in 2024; these efforts protect operational integrity.

Data privacy laws like GDPR and CCPA are crucial, requiring careful data handling and protection from large fines; data scrutiny increases in early 2025.

Vehicle financing regulations influence SCUSA's operational and financial activities. In 2024, the CFPB issued over $100 million in penalties related to auto financing practices.

Legal matters may influence finances and the SCUSA reputation; legal expenses were at $175 million in 2024, underscoring the need for proactive risk management.

| Legal Factor | Impact | 2024/2025 Data |

|---|---|---|

| Consumer Protection | Fair lending, transparency | CFPB penalties: over $100M; NCLC reported a rise in repossession cases. |

| Financial Regulations | Capital adequacy, reporting | Compliance spending increased 7% in Q1 2024. |

| Data Privacy | GDPR, CCPA compliance | GDPR fines up to 4% of turnover; increased scrutiny. |

| Vehicle Financing | Titling, lien laws | Lien laws vary by state. |

| Litigation | Financial & reputational risks | Legal expenses: $175M. |

Environmental factors

Environmental regulations, especially those concerning vehicle emissions, significantly affect the automotive industry. Stricter standards, like those from the EPA, push manufacturers towards electric and hybrid vehicles. This shift impacts financing demand; for example, in 2024, EV sales increased by 40% impacting loan portfolios. Such regulations influence the types of vehicles consumers finance through companies like Santander Consumer USA.

The shift towards EVs impacts Santander Consumer USA. The growing focus on sustainability and EV adoption presents opportunities and challenges. Adjustments in financing and risk assessment are crucial. EV sales rose, with EVs making up 9.5% of U.S. auto sales in Q1 2024. This trend necessitates strategic adaptation.

Santander Consumer USA's operations may draw environmental scrutiny, focusing on energy use and waste. This could lead to demands for sustainable practices. In 2024, the company's environmental initiatives included reducing emissions. The financial impact of these initiatives could be significant.

Climate Change Risks

Climate change poses indirect risks to Santander Consumer USA. Extreme weather, linked to climate change, can damage vehicles, impacting their value. Also, it may affect borrowers' ability to repay loans in disaster-prone areas. In 2024, insured losses from natural disasters reached $60 billion in the U.S. alone, according to Swiss Re. Such events could raise credit risks.

- Increased frequency of extreme weather events.

- Potential for vehicle damage and depreciation.

- Risk of borrower defaults in affected regions.

- Higher insurance premiums due to climate-related risks.

Corporate Social Responsibility (CSR) in Environmental Matters

Growing demands for environmental responsibility shape Santander Consumer USA's image and stakeholder ties. This can impact how customers and investors see the company, influencing brand perception. To meet these expectations, Santander Consumer USA may need to set and achieve environmental goals. Reporting progress is crucial for transparency and building trust.

- In 2024, environmental, social, and governance (ESG) assets hit $8.4 trillion globally.

- By Q1 2024, 77% of institutional investors considered ESG factors.

- Santander Group's 2023 report highlights environmental initiatives.

Environmental factors present varied impacts for Santander Consumer USA, including regulatory influences on vehicle types. The rise in EV sales, making up 9.5% of U.S. auto sales by Q1 2024, reshapes financing demands and requires strategic shifts. Furthermore, extreme weather linked to climate change introduces risks like vehicle damage, potentially impacting loan repayment capabilities, with 2024 U.S. insured disaster losses at $60B.

| Environmental Factor | Impact on Santander Consumer USA | Data Point |

|---|---|---|

| Regulations | Affects vehicle financing mix | EV sales reached 9.5% of auto sales in Q1 2024 |

| Climate Change | Raises credit & insurance risks | $60B in U.S. insured disaster losses in 2024 |

| Sustainability Demands | Shapes brand perception | ESG assets hit $8.4T globally in 2024 |

PESTLE Analysis Data Sources

The analysis uses data from financial reports, industry publications, government regulations, and economic indicators. We draw insights from regulatory bodies and market research firms.