Santos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Santos Bundle

What is included in the product

In-depth examination of each product/business unit across all BCG Matrix quadrants

Distraction-free view optimized for C-level presentation, helping them see the big picture.

Delivered as Shown

Santos BCG Matrix

The BCG Matrix you see is the complete document you receive after purchase. It's a ready-to-use, strategically designed report perfect for business analysis and planning.

BCG Matrix Template

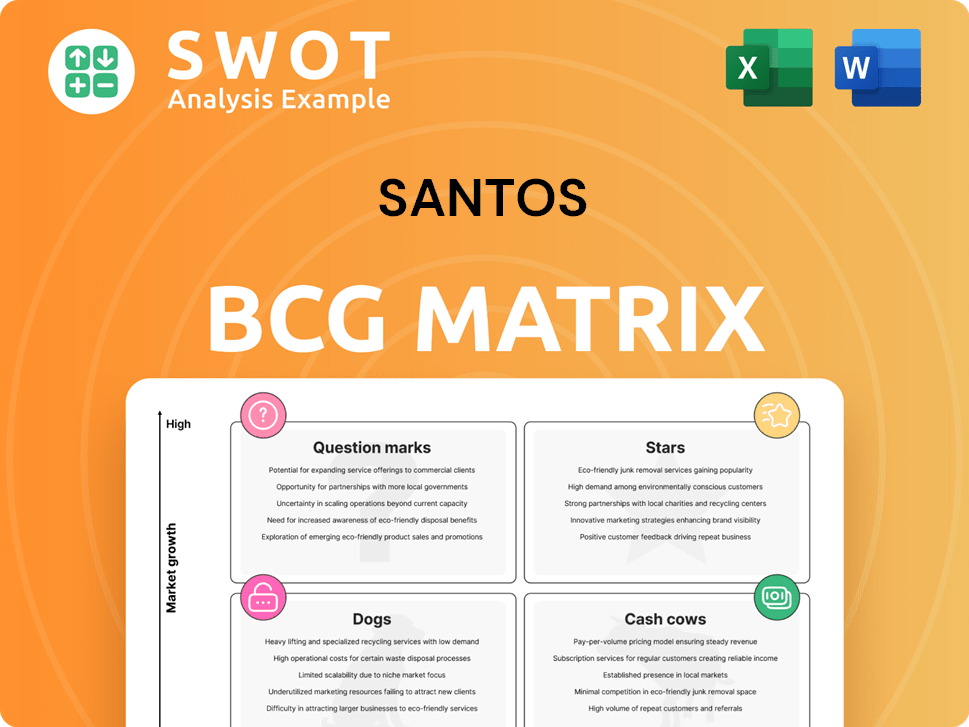

The Santos BCG Matrix offers a snapshot of the company's product portfolio, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks. This framework helps identify which products drive growth and which might need strategic adjustments. Understanding these classifications is crucial for making informed decisions about resource allocation and future investments. This analysis gives you a quick glance at market positions. Purchase the full BCG Matrix for a deep dive, strategic recommendations, and actionable insights.

Stars

The Barossa LNG project, 91% complete as of early 2025, is a "Star" for Santos. It's set for first gas in Q3 2025. This project boosts Santos' LNG capacity, targeting Asian demand. Successfully completed, it will solidify Santos's role in the Asia-Pacific LNG market by 2040. The project has a budget of $5.7 billion.

The Pikka Phase 1 oil project in Alaska is about 75% complete and is expected to start producing oil in mid-2026. This project is set to diversify Santos' production, moving beyond its usual natural gas focus. Promising well results suggest the project could generate strong future cash flow. Santos invested approximately $1.8 billion in the Pikka project in 2024.

The Moomba CCS Project, a key initiative for Santos, began operations in September 2024, capturing CO2. This project has notably cut Scope 1 and 2 emissions by 26% relative to the 2019-20 baseline. It strategically positions Santos to offer commercial carbon management services. The project's success supports growing CCS demand in Australia and Asia.

LNG Portfolio Expansion

Santos strategically expands its LNG portfolio, a key component of its growth strategy. This expansion is fueled by projects like Barossa, enhancing production capacity. Securing long-term LNG sales contracts with strong counterparties stabilizes revenue. Proximity to Asian markets offers a competitive edge in costs and emissions.

- Barossa project is expected to have a production capacity of approximately 3.3 million tonnes of LNG per annum.

- Santos has secured long-term LNG sales agreements with customers in Asia.

- The company's LNG is recognized for its high heating value, improving its market value.

- Santos's LNG sales contracts are with high-quality counterparties.

Disciplined Capital Allocation

Santos' disciplined capital allocation is a cornerstone of its strategy, underpinning strong financial performance. The company's low-cost operating model and adherence to budgets boost cash flow, supporting shareholder returns. This approach includes cost-cutting measures, ensuring a robust balance sheet and sustainable growth. This is exemplified by its 2024 financial results.

- Operating cash flow reached $3.5 billion in 2024.

- Final investment decision for the Dorado project in 2024.

- Santos' net debt was $3.1 billion as of December 31, 2024.

- Shareholder returns through dividends and buybacks in 2024.

Stars in the Santos portfolio, such as Barossa and Pikka, show high growth and market share potential. The Barossa project, 91% complete, targets the growing Asian LNG demand. Pikka Phase 1, about 75% complete, diversifies production.

| Project | Status | Focus |

|---|---|---|

| Barossa | 91% complete (early 2025) | LNG, Asian Markets |

| Pikka Phase 1 | 75% complete | Oil, Diversification |

| Moomba CCS | Operational (Sept 2024) | CCS, Emission Reduction |

Cash Cows

The Cooper Basin is a cash cow for Santos, thanks to its established infrastructure and low operational costs. Despite a gradual production decline, investments in infrastructure improve efficiency and profitability. This basin’s long-life natural gas assets offer Santos a stable operational base. In 2024, Santos reported steady production from the Cooper Basin, demonstrating its consistent cash-generating ability.

Gladstone LNG (GLNG) in Queensland, featuring two operational trains, is a pivotal cash cow for Santos, bolstering its LNG output and cash flow. GLNG benefits from diverse gas supplies, including Santos' assets and third-party providers. In 2024, GLNG's production is expected to be around 3.6 million tonnes. Long-term supply deals and efficiency maintain its cash-generating status.

Santos has a substantial stake in PNG LNG, run by ExxonMobil, a key LNG producer and revenue driver. The project's dependability and output are high, backed by robust Angore production, ensuring full plant capacity. In 2024, Santos's share of production was approximately 7.4 million metric tons of LNG. Increased equity lifting from PNG LNG is anticipated, enhancing its cash flow from this asset.

Western Australian Natural Gas Assets

Santos' Western Australian natural gas assets, gained via the Quadrant Energy acquisition, are a dependable source of production and cash flow. These assets boast low operational costs and substantial, long-term reserves. The company is actively developing and exploring in the region, including the Bedout Basin. This offers significant potential for future growth and value. In 2024, these assets contributed significantly to Santos' overall profitability.

- Stable cash flow from existing production.

- Low operational costs enhance profitability.

- Long-life reserves ensure sustained production.

- Exploration activities in Bedout Basin.

Existing LNG Infrastructure

Santos' existing LNG infrastructure, notably the Darwin LNG plant, is a key asset for processing and exporting natural gas. Backfilling these facilities with new gas sources, like the Barossa project, secures their ongoing profitability. The Darwin LNG plant's expansion plans, including potential Beetaloo gas exports, offer significant growth prospects. In 2024, Santos' LNG production contributed substantially to its overall revenue.

- Darwin LNG plant is a critical asset.

- Backfilling ensures profitability.

- Expansion plans offer growth.

- LNG production contributed to revenue in 2024.

Santos' cash cows, like Cooper Basin and GLNG, generate steady cash flow. These assets have low operational costs, boosting profitability. LNG infrastructure, such as Darwin LNG, is key for processing and exporting gas.

| Asset | 2024 Production (Approx.) | Key Benefit |

|---|---|---|

| Cooper Basin | Steady, consistent | Established infrastructure |

| GLNG | 3.6 MT (LNG) | Diverse gas supply |

| PNG LNG (Santos Share) | 7.4 MT (LNG) | High output |

Dogs

The Dorado oil field, a notable find, is experiencing uncertainty and delays, primarily due to Santos' resource allocation to other ventures. The project's timeline has been extended, potentially awaiting sanctioning beyond 2027. Considering the capital-intensive demands and regulatory uncertainties, Dorado aligns with a 'Dog' in the BCG matrix. This classification suggests high investment needs with uncertain short-term returns.

The Bayu-Undan field faces declining production, affecting Santos' revenue. In 2024, production dropped, impacting financial performance. CCS plans exist, but profitability is uncertain due to high decommissioning costs. This situation suggests a 'Dog' classification within the BCG Matrix.

The Narrabri Gas Project is mired in environmental and regulatory issues, causing delays and uncertainty. This project demands considerable investment for development, potentially delaying returns. With these hurdles and an unclear timeline, Narrabri fits the 'Dog' profile. Santos' 2024 report highlights these challenges, impacting its financial outlook.

Beetaloo Basin

The Beetaloo Basin, rich in gas, struggles with infrastructure and environmental pushback. Santos explores gas export, but the project’s financial future is unclear. High costs and regulatory challenges label it a 'Dog' in the BCG Matrix. This status reflects the project's current risks.

- Estimated gas resources: 2,200 petajoules (PJ).

- Development cost concerns due to remote location.

- Regulatory hurdles include environmental approvals.

- Commercial viability is uncertain.

Legacy Oil Assets

Legacy oil assets within Santos' portfolio, often viewed as "Dogs" in the BCG Matrix, face challenges like declining production and high operational costs. These assets, including those in the Cooper Basin, require substantial investment to sustain output, with limited prospects for significant expansion. This situation may lead to divestment or decommissioning decisions. In 2024, Santos' production from mature assets has been under pressure.

- Declining production rates and increasing operational expenses.

- Significant capital expenditures needed to maintain existing production levels.

- Limited potential for future growth or expansion of these assets.

- Divestment or decommissioning as the most viable strategic options.

Dogs in the BCG matrix represent underperforming assets requiring significant investment with uncertain returns. In 2024, Santos faced production declines and high operational costs in its 'Dog' assets. These assets include Dorado, Bayu-Undan, Narrabri, Beetaloo Basin, and legacy oil fields. These projects face regulatory and environmental issues.

| Project | Status | Key Issues |

|---|---|---|

| Dorado | Delayed | High investment needs, regulatory uncertainties, timeline extended beyond 2027. |

| Bayu-Undan | Declining | Production drop, high decommissioning costs, CCS profitability uncertain. |

| Narrabri | Delayed | Environmental, regulatory issues; high investment, unclear timeline. |

| Beetaloo Basin | Uncertain | Infrastructure, environmental challenges, uncertain financial future. |

| Legacy Oil | Declining | Production decline, high operational costs, limited expansion. |

Question Marks

The Papua LNG project is a pivotal growth venture for Santos, yet it is fraught with risks. The project demands substantial investment and navigates regulatory hurdles in Papua New Guinea. If the project succeeds, it could elevate Santos's status. However, failure could render it a 'Dog'. In 2024, the project's estimated cost is around $10 billion.

Pikka Phase 2 is a possible extension of Alaska's Pikka Phase 1. It demands more capital and battles market uncertainties, including oil prices and demand. The project's success depends on Santos securing funding. In 2024, oil prices fluctuated, impacting investment decisions. Santos's 2023 annual report shows $1.4B in free cash flow.

Santos' CCS expansion plans, targeting hubs in Darwin and Western Australia, are a high-growth venture. The CCS market is still nascent, with cost and scalability hurdles. Success hinges on government backing, tech advances, and carbon storage demand. In 2024, the global CCS capacity is expected to reach over 50 million tonnes of CO2 per year.

e-methane (Synthetic Methane) Production

Santos' e-methane production, using green hydrogen, is a question mark in its BCG Matrix. This is an innovative but uncertain venture. The technology is in its early stages, and economic viability is unproven. It supports decarbonization goals, but success hinges on breakthroughs and policies.

- Santos aims to produce 100,000 tonnes of green hydrogen annually.

- E-methane production costs are significantly higher than natural gas currently.

- Government support, like subsidies, is crucial for project viability.

- The market for e-methane is still developing.

Hydrogen Production and Export

Santos' hydrogen production and export plans are a question mark in the BCG matrix. This sector is still developing, and the financial gains are uncertain. The success depends on advancements in technology and the infrastructure. Global demand for hydrogen will be crucial.

- The global hydrogen market was valued at USD 130 billion in 2023.

- The market is projected to reach USD 280 billion by 2030.

- Australia aims to be a major hydrogen exporter.

- The cost of green hydrogen production is still high.

Santos' e-methane and hydrogen initiatives are "Question Marks" due to high uncertainty. These projects are in nascent markets, requiring technological breakthroughs. They face cost challenges and depend on government support for viability.

| Project | Market Status | Challenges |

|---|---|---|

| E-methane | Developing | High costs, unproven tech |

| Hydrogen | Growing | Infrastructure, cost of production |

| CCS Expansion | Growing | Scalability, policy support |

BCG Matrix Data Sources

This Santos BCG Matrix uses reliable data, sourcing from market analysis, financial statements, and industry reports.