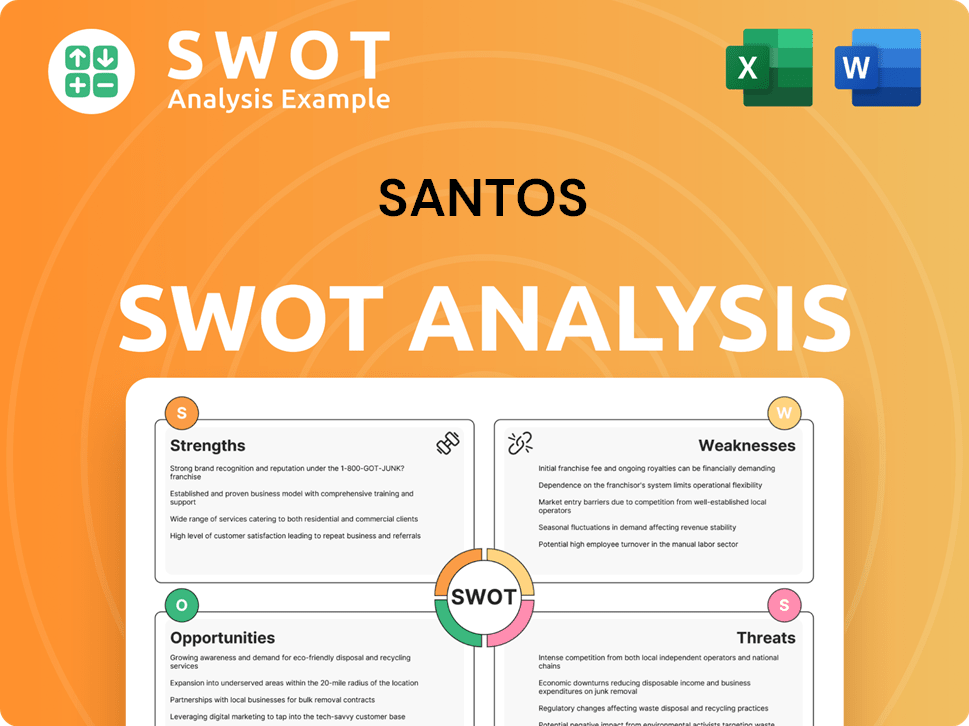

Santos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Santos Bundle

What is included in the product

Analyzes Santos’s competitive position through key internal and external factors.

Provides a simple, at-a-glance view of SWOT for focused planning.

Preview the Actual Deliverable

Santos SWOT Analysis

You're looking at a direct preview of the Santos SWOT analysis. What you see is what you get: the exact same comprehensive report.

SWOT Analysis Template

This Santos SWOT analysis offers a glimpse into the company's key areas: strengths, weaknesses, opportunities, and threats. The brief summary only scratches the surface of Santos’s strategic landscape and market positioning. You’ll gain more actionable insights to analyze financial performance and potential growth factors. Elevate your analysis and make smarter decisions.

Purchase the full SWOT analysis and get a dual-format package: a detailed Word report and a high-level Excel matrix. Built for clarity, speed, and strategic action.

Strengths

Santos boasts a strong, established presence in the Asia-Pacific, vital for hydrocarbon operations. They have extensive infrastructure supporting exploration, production, and distribution. This includes major LNG projects like PNG LNG and Gladstone LNG. This positions them to serve the growing Asian market. In 2024, Santos' production reached 100.2 million barrels of oil equivalent.

Santos' financial strength is evident in its 2024 results. It reported a substantial free cash flow, supporting strategic investments. Underlying profit was robust, allowing for shareholder returns. This financial stability maintains a strong balance sheet. Santos' credit rating reflects its solid performance.

Santos demonstrates strength through the advancement of critical projects. The Barossa project is slated for first gas in Q3 2025, while Pikka targets first oil by mid-2026. These developments are pivotal for boosting production volumes. This growth is projected to increase cash flow.

Commitment to Decarbonisation and CCS

Santos demonstrates a strong commitment to decarbonisation. They are actively investing in Carbon Capture and Storage (CCS) projects. The Moomba CCS project is already operational. Santos aims to build a commercial carbon storage business. This aligns with global trends.

- Moomba CCS has the capacity to store 1.7 million tonnes of CO2 annually.

- Santos plans to invest $5.5 billion in CCS projects.

- Santos has a target to achieve net-zero emissions by 2040.

Strong LNG Marketing and Contract Portfolio

Santos benefits from a robust LNG marketing arm, featuring long-term contracts with Asian customers. This strategic positioning, close to key markets, supports strong, stable revenues. The high-quality customer base and LNG's heating value further enhance pricing. In 2024, Santos' LNG sales volumes reached 2.8 million tonnes.

- Proximity to Asian Markets

- High Heating Value LNG

- Reputation for Reliability

- Contracted Position = Revenue Stability

Santos' strong Asia-Pacific presence is key. Extensive infrastructure supports production and distribution. This fuels growth, serving the Asian market effectively. Santos' LNG marketing secures stable revenues with strong contracts.

| Strength | Details | Data |

|---|---|---|

| Asia-Pacific Presence | Established operations and infrastructure. | PNG LNG and Gladstone LNG. |

| Financial Strength | Robust free cash flow & profitability | Underlying profit; strong balance sheet. |

| Strategic Projects | Barossa & Pikka projects enhancing volumes | Barossa (Q3 2025); Pikka (mid-2026). |

Weaknesses

Santos' over-reliance on fossil fuels, particularly oil and gas, is a key weakness. This dependence exposes the company to price fluctuations and growing pressure for cleaner energy. In 2024, oil and gas accounted for a significant 80% of Santos' revenue. The global shift towards decarbonization poses a long-term threat.

Santos' operations are largely concentrated in Australia and Southeast Asia, unlike more globally diversified competitors. This geographical focus exposes Santos to region-specific risks. For example, in 2024, about 70% of its revenue came from these areas. This concentration makes them vulnerable to local regulatory changes.

Santos' weaknesses include negative public perception tied to its oil and gas activities, impacting its reputation. The firm struggles with environmental concerns, facing opposition and legal battles. The Barossa project highlights these challenges, with legal setbacks. These issues can cause delays and raise expenses. In 2023, Santos' share price was affected by project setbacks and environmental concerns.

Exposure to Commodity Price Volatility

Santos faces risks from commodity price fluctuations, despite its LNG contracts. Spot market exposure means revenue and profitability are vulnerable to global oil and gas price swings. For instance, a 10% change in oil prices can significantly affect earnings. The company's financial results in 2024 showed sensitivity to these market dynamics.

- Spot market exposure impacts revenue.

- Oil and gas price swings can hurt profitability.

- 2024 financial results reflect market sensitivity.

Need for Continued Investment in Decarbonisation

Santos faces a weakness in its ongoing need for significant investment in decarbonisation efforts, including Carbon Capture and Storage (CCS). Achieving emissions reduction goals and establishing a viable CCS business demands substantial financial commitment. The effectiveness and affordability of these initiatives, especially CCS, depend on technological advancements and regulatory support. For example, the company allocated $200 million in 2023 for decarbonisation projects. The success of these projects will influence Santos's financial performance.

- Ongoing investments are crucial for emission targets.

- CCS success depends on technology and regulations.

- Decarbonisation projects require substantial funding.

- Financial performance is tied to these investments.

Santos grapples with an over-reliance on fossil fuels, heavily influencing its revenue and profitability. The company's geographical concentration heightens vulnerability to region-specific risks and regulatory changes, particularly in Australia and Southeast Asia. This geographical concentration accounts for nearly 70% of the company’s revenue.

Public perception challenges and project setbacks intensify the environmental issues. Additionally, commodity price fluctuations, including LNG contracts, make earnings volatile. Investing significantly in decarbonisation, and its success hinges on both technology and regulatory support and financial commitments.

| Weakness | Details | Impact |

|---|---|---|

| Fossil Fuel Dependency | 80% of 2024 revenue from oil and gas. | Vulnerability to price swings, pressure to decarbonize. |

| Geographical Concentration | 70% revenue from Australia/Southeast Asia. | Region-specific risks, regulatory exposure. |

| Environmental Concerns | Public opposition; legal challenges, Barossa project issues | Delays, reputational damage, cost increases. |

Opportunities

Santos is well-placed to benefit from the increasing demand for natural gas, especially LNG, in the Asia-Pacific region. This area is a significant market for the company. Santos's strategic location near these markets and its growing LNG production capacity, including Barossa, are key advantages. In 2024, Asia-Pacific LNG demand is expected to rise by 4.5%, presenting a strong opportunity.

The growing emphasis on lowering carbon emissions globally fuels the carbon capture and storage market's expansion. Santos is investing in CCS projects, like Moomba, which creates chances to offer carbon management services. This could lead to new revenue streams. The global CCS market is projected to reach $6.4 billion by 2027.

Santos boasts a diverse portfolio including Bedout, Narrabri, Beetaloo, PNG, and Alaska's North Slope. These assets offer potential for production growth and supply security. For example, Santos's 2024 production guidance is between 87 and 93 million barrels of oil equivalent. Exploration successes could significantly boost reserves. Investment in these areas could also drive long-term growth, with potential for substantial returns.

Leveraging Existing Infrastructure

Santos can capitalize on its existing infrastructure to streamline operations and cut costs. This advantage includes using existing LNG facilities, such as Darwin LNG, for new projects, boosting efficiency. For instance, in 2024, Santos's infrastructure supported a production of 89.8 million barrels of oil equivalent (mmboe). This strategic leverage enables cost-effective expansion.

- Darwin LNG processed approximately 4.8 million tonnes of LNG in 2024.

- Santos invested $1.1 billion in sustaining capital expenditure in 2024.

Technological Advancements and Digital Transformation

Embracing technological advancements and digital transformation presents significant opportunities for Santos. This includes enhancing operational efficiency and reducing costs through automation and data analytics. Santos has been investing in digital initiatives, with plans to increase spending by 15% in 2024. Further advancements in areas like remote monitoring and AI-driven predictive maintenance could lead to a 10% reduction in operational expenses.

- Digital transformation investments are projected to reach $200 million by 2025.

- AI-driven predictive maintenance could reduce downtime by 12%.

- Remote monitoring systems can improve safety compliance by 18%.

- Automation initiatives might cut labor costs by 8%.

Santos can gain from Asia-Pacific LNG demand, which is forecast to increase by 4.5% in 2024. Its focus on carbon capture and storage (CCS) aligns with the expanding market, projected at $6.4 billion by 2027. With a diversified portfolio and infrastructure leverage, Santos aims to increase efficiency. Digital transformation, with a planned 15% rise in spending in 2024, enhances operational and cost efficiency.

| Area of Opportunity | Strategic Initiative | 2024/2025 Impact |

|---|---|---|

| LNG Demand in Asia-Pacific | Expand LNG production and sales. | 4.5% growth in regional demand. Darwin LNG processed approx. 4.8 million tonnes of LNG. |

| Carbon Capture & Storage (CCS) | Invest in CCS projects (e.g., Moomba). | Market projected to reach $6.4B by 2027. |

| Production Growth | Develop diverse asset portfolio (Bedout, Narrabri, etc.). | Production guidance: 87-93 mmboe. $1.1 billion in sustaining capex in 2024. |

| Infrastructure Leverage | Utilize existing facilities (e.g., Darwin LNG). | 2024 production of 89.8 mmboe. |

| Digital Transformation | Invest in automation and data analytics. | Digital investment to increase 15% in 2024; Projected $200M by 2025. |

Threats

Santos faces threats from fluctuating commodity prices, primarily in oil and gas. Geopolitical events, supply/demand dynamics, and economic shifts drive price volatility. For instance, Brent crude averaged $82/bbl in 2023, impacting revenue. Adverse price swings can reduce Santos' profitability, potentially affecting its ability to invest in new projects.

Stricter environmental regulations pose a threat. These regulations, focused on reducing emissions, could increase Santos' operational costs. Limitations on new projects and potential carbon taxes are also risks. The EU's carbon border tax, starting in 2026, might affect Santos. In 2024, ESG-related risks saw increasing investor scrutiny.

Santos faces significant threats from opposition and legal challenges. Environmental groups and Indigenous groups have actively contested projects like Barossa, leading to project delays and cost overruns. For instance, the Barossa project has faced multiple legal hurdles. Such challenges can severely impact project timelines and profitability, as seen with recent setbacks.

Transition to Renewable Energy

The global push for renewable energy presents a significant threat to Santos. This transition could reduce the demand for fossil fuels, impacting Santos' revenue. The International Energy Agency projects renewables to account for over 80% of new power capacity through 2030. This shift might require Santos to adapt rapidly.

- Renewables' growth: Over 80% of new capacity by 2030.

- Impact on revenue: Reduced demand for fossil fuels.

- Need for adaptation: Rapid diversification is crucial.

Geopolitical Instability and Market Disruptions

Geopolitical instability poses significant threats to Santos, potentially disrupting energy markets and supply chains. These disruptions can lead to volatile demand and pricing for oil and gas. For instance, the Russia-Ukraine war in 2022 caused a 40% spike in European natural gas prices. Such external factors, largely beyond Santos' control, can severely impact its operations.

- Geopolitical tensions can disrupt energy markets.

- Supply chain impacts can create operational challenges.

- Demand and pricing can become uncertain.

Santos faces threats from volatile commodity prices, impacted by geopolitical events and demand shifts; Brent crude averaged $82/bbl in 2023. Stricter environmental regulations, including carbon taxes, are a concern. Opposition and legal challenges, such as those faced by the Barossa project, can delay and increase project costs.

| Threats | Impact | Data Point |

|---|---|---|

| Price Volatility | Reduced profitability | Brent crude $82/bbl (2023 avg) |

| Environmental Regulations | Increased costs & restrictions | EU carbon tax (2026 start) |

| Legal Challenges | Project delays & cost overruns | Barossa project hurdles |

SWOT Analysis Data Sources

This SWOT analysis relies on trusted financial statements, market analysis, expert opinions, and industry reports for precise insights.