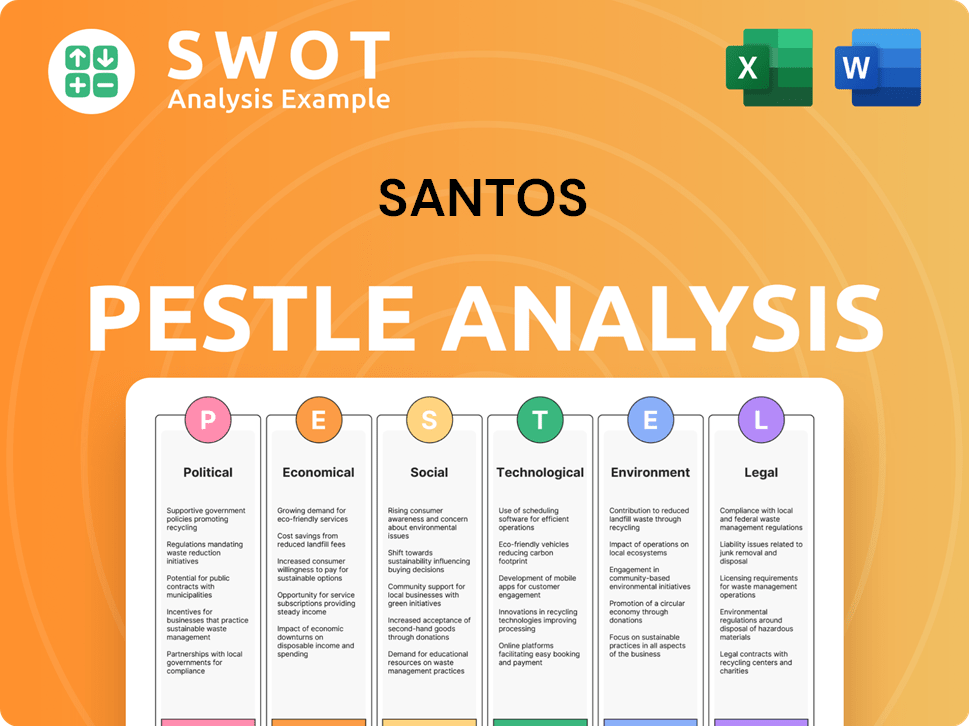

Santos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Santos Bundle

What is included in the product

Unpacks Santos' external influences across PESTLE categories for strategic decision-making.

Provides concise insights on Santos' external environment for planning sessions.

Preview the Actual Deliverable

Santos PESTLE Analysis

What you're previewing is the complete Santos PESTLE Analysis document. You'll get the identical, professionally crafted file upon purchase. It’s fully formatted and ready for immediate use. See the thorough examination of the market now! No hidden sections, just the final product.

PESTLE Analysis Template

Uncover Santos's future with our PESTLE analysis. Explore political impacts like changing energy policies. Analyze economic factors influencing profitability. Understand technological advancements shaping operations. Grasp environmental challenges & social shifts. Get the full report now!

Political factors

Government policies and regulations are crucial for Santos. Environmental approvals, emissions targets, and resource development rules in Australia and other regions directly affect the company. Policy shifts can alter project costs and timelines, impacting ventures like the Narrabri gas project. For example, Australia's emissions reduction targets for 2030 and beyond will influence Santos's investments. Santos's 2024 capital expenditure is projected to be $1.2-1.3 billion.

Santos's operations are significantly affected by political stability in areas like Papua New Guinea and Timor-Leste. Stable government relations are essential for asset management and project development. The Bayu-Undan CCS project, for instance, relies on agreements with the Timor-Leste government. Political risks can disrupt operations, potentially impacting the company's financial performance. Any instability could affect project timelines and investment returns. In 2024, Santos's projects faced delays due to political factors.

Global geopolitical instability and the push for energy security significantly shape oil and gas demand and prices, affecting Santos's financials. Santos benefits from its location near Asian markets, a key growth area. In 2024, Asia's energy consumption is projected to rise, offering Santos opportunities. For instance, in Q1 2024, Santos reported a free cash flow of $539 million.

Industry lobbying and political engagement

Santos actively lobbies governments and participates in industry forums to shape energy policies. Their political engagement aims to support business objectives like energy supply and low-carbon initiatives. In 2024, Santos spent over $1 million on lobbying efforts in Australia. The company's political donations face public and regulatory scrutiny.

- Lobbying spending exceeding $1 million in 2024.

- Focus on energy supply and low-carbon initiatives.

- Subject to public and regulatory scrutiny.

International climate agreements and national targets

International climate agreements and national emissions reduction targets significantly shape Santos' strategic direction. The Paris Agreement and similar accords pressure the company to reduce its carbon footprint. Santos aims to align its investments with these global climate goals. However, some critics contend the company's plans need to be more aggressive.

- Santos has set a target to achieve net-zero Scope 1 and 2 emissions by 2040.

- In 2024, Santos invested $200 million in carbon capture and storage (CCS) projects.

- The Australian government's emissions reduction targets also influence Santos' operations.

Government policies like emission targets influence Santos' operations and investments; for example, Australia’s 2030 targets. Political stability is vital, especially in regions like Papua New Guinea and Timor-Leste, impacting asset management and project timelines; Santos' lobbying reached over $1 million in 2024. Global climate accords, such as the Paris Agreement, drive Santos' strategic direction and require reducing its carbon footprint.

| Factor | Impact on Santos | Data/Example (2024-2025) |

|---|---|---|

| Regulations/Policies | Affect project costs, approvals. | $1.2-1.3B CapEx in 2024. |

| Political Stability | Essential for asset management. | Bayu-Undan CCS depends on agreements. |

| Geopolitics/Energy | Shapes demand, pricing | Q1 2024 FCF of $539M |

Economic factors

Santos' financial health is significantly influenced by global oil and gas price changes. The company's revenue and profitability directly correlate with market dynamics. In 2024, oil prices fluctuated, impacting earnings. For instance, Brent crude ranged from approximately $75 to $90 per barrel. Geopolitical events and economic conditions are key drivers of these price swings.

Santos faces significant capital expenditure demands for projects like Barossa and Pikka, essential for production growth. In 2024, Santos's capital expenditure was approximately $1.1 billion. Successfully financing these projects and controlling costs are crucial for boosting future production and delivering shareholder value. Any cost overruns or financing challenges can impact profitability and shareholder returns. Maintaining financial discipline is vital to navigate these investments effectively.

Santos prioritizes strong free cash flow to strengthen its balance sheet and reward shareholders. Major project completions should boost cash flow significantly. In 2024, Santos declared a final dividend of US 9.9 cents per share. This demonstrates their commitment to shareholder returns.

Global energy demand and market trends

Santos heavily relies on natural gas demand, especially in Asia. The global energy market's shift towards lower-carbon options impacts Santos. In 2024, Asian LNG demand is projected to rise by 4-5%. This presents both prospects and hurdles for Santos. The company must adapt to stay competitive.

- Asian LNG demand is rising by 4-5% in 2024.

- Santos is impacted by the move to lower-carbon energy.

Cost reduction initiatives

Santos is actively pursuing cost reduction initiatives to boost operational efficiency and maintain a competitive edge. These efforts are crucial for managing the volatility of commodity prices. The company aims to lower its unit production costs, as demonstrated by its recent financial reports. For example, in the first half of 2024, Santos reported a 10% reduction in operating costs. This strategy is designed to enhance profitability and resilience against market fluctuations.

- Operational cost reduction by 10% in the first half of 2024.

- Focus on unit production cost to maintain competitiveness.

- Strategic response to commodity price volatility.

Economic factors critically impact Santos, especially oil and gas prices which fluctuated in 2024. Capital expenditure on projects like Barossa, around $1.1B in 2024, affects financials. Natural gas demand growth in Asia, estimated at 4-5% in 2024, is pivotal.

| Factor | Impact | 2024 Data |

|---|---|---|

| Oil Prices | Revenue, profitability | Brent crude: $75-$90/barrel |

| Capital Expenditure | Production, shareholder value | Approx. $1.1 billion |

| Asian LNG Demand | Market opportunity | 4-5% growth |

Sociological factors

Santos heavily relies on its social license to operate, necessitating strong community ties. This involves constant engagement with local groups, including Indigenous communities. Project approvals and ongoing operations face risks from landholder and environmental group opposition. For instance, the Barossa gas project faced significant challenges, with delays and legal battles impacting its timeline. In 2024, Santos's community investment totaled $20 million, demonstrating its commitment to social responsibility.

Santos actively invests in communities where it operates, backing initiatives for social good. This includes educational programs and infrastructure projects. Community engagement is crucial for building trust and managing concerns. For example, in 2024, Santos spent $20 million on social investments. These efforts help maintain positive relations and secure operational licenses.

Santos significantly impacts employment and local economies. Its operations generate jobs and boost local economies through spending and investment. For instance, the Barossa Gas Project in Australia, as of early 2024, supported over 600 jobs during construction. These projects drive economic growth in regional areas.

Public perception and activism

Public perception significantly shapes Santos' trajectory, with the oil and gas sector under constant scrutiny. Activism around climate change and environmental concerns directly impacts Santos' reputation and operational strategies. For instance, in 2024, Santos experienced a 15% decrease in investor confidence due to environmental controversies. The company has faced criticism regarding its environmental record and climate strategy, leading to increased pressure for sustainable practices.

- 2024: Investor confidence in Santos dropped by 15% due to environmental concerns.

- Activism: Increased pressure on Santos for sustainable practices.

- Reputation: Public perception directly impacts Santos' standing.

Workforce transition and job creation

The energy transition significantly impacts the workforce, demanding a just transition strategy. Santos must address potential job displacement in existing fossil fuel operations while identifying opportunities in low-carbon sectors. This involves reskilling programs and exploring new ventures to retain and support its employees. For example, the International Energy Agency (IEA) projects that the clean energy sector could create over 14 million jobs by 2030.

- Just Transition: Focus on supporting workers in the transition from fossil fuels to low-carbon jobs.

- Reskilling Programs: Implement training initiatives to equip employees with skills relevant to new energy sectors.

- New Ventures: Explore opportunities in areas like renewable energy, carbon capture, and hydrogen.

- Job Creation: Capitalize on the growth of clean energy sectors to create new employment opportunities.

Santos must maintain strong community relations, especially with Indigenous groups, to secure project approvals. In 2024, Santos allocated $20 million for community investment, backing social programs and infrastructure projects. Public scrutiny around climate change significantly affects the company's reputation and investor confidence. The energy transition necessitates a just transition strategy to support its workforce.

| Aspect | Details | Impact |

|---|---|---|

| Community Engagement | $20M in 2024 social investment | Secures operational licenses and maintains trust. |

| Public Perception | 15% drop in investor confidence (2024). | Shapes operations and climate strategy. |

| Energy Transition | Focus on reskilling & new ventures. | Supports workforce & future opportunities. |

Technological factors

Santos is significantly investing in Carbon Capture and Storage (CCS) tech. The Moomba CCS project is a key example. It aims to store 1.7 million tonnes of CO2 annually. CCS success is vital for emission goals. The global CCS market is projected to reach $6.4 billion by 2024.

Technological advancements boost efficiency, cutting costs and boosting resource recovery. Targeted drilling and optimized operations significantly contribute to production volumes. In 2024, Santos invested $1.3 billion in technology. This includes enhanced data analytics, and automation, improving operational efficiency by 15%. These innovations are crucial for Santos' competitive edge.

Santos is actively involved in developing low-carbon fuels, aligning with global efforts to reduce emissions. They are investing in technologies like carbon capture and storage (CCS) and hydrogen production. In 2024, Santos allocated $200 million to CCS projects. The company aims to be a leading provider of cleaner energy solutions. This strategic shift reflects the growing demand for sustainable energy sources.

Digitalization and automation

Digitalization and automation are key technological factors for Santos. The company leverages smart technologies to boost operational efficiency and cut costs. Santos has been investing in digital solutions to streamline processes and improve decision-making. For example, Santos has automated several processes in its drilling operations.

- Santos invested $100 million in digital transformation in 2024.

- Automation reduced operational costs by 15% in specific areas.

- Smart sensors increased production efficiency by 10%.

Infrastructure repurposing

Santos can repurpose existing infrastructure for new technologies, like Carbon Capture and Storage (CCS). This approach offers cost savings and supports decarbonization goals. For example, retrofitting existing pipelines for CO2 transport is more economical than building new ones. The global CCS market is projected to reach $8.5 billion by 2025, showing growth potential.

- Repurposing reduces capital expenditure.

- CCS projects can attract government incentives.

- Infrastructure reuse accelerates project timelines.

- Decarbonization efforts improve the company's image.

Santos focuses on cutting-edge technologies such as CCS and automation, significantly investing in these areas to boost efficiency. Investment in technology totaled $1.3 billion in 2024, emphasizing digital solutions. Digital transformation accounted for $100 million in investments. The company's repurposing of existing infrastructure enhances both cost-effectiveness and sustainability. By 2025, the global CCS market is projected to reach $8.5 billion.

| Technology | Investment (2024) | Impact |

|---|---|---|

| CCS | $200 million | Supports emissions reduction |

| Digitalization | $100 million | Boosts operational efficiency |

| Automation | Various | Reduces operational costs (15% in some areas) |

Legal factors

Santos faces stringent environmental regulations and needs approvals for its projects. Compliance is crucial for operations. In 2024, environmental fines totaled $5 million. Delays in approvals can impact project timelines and costs. Recent regulations focus on emissions and sustainability.

Santos' operations in areas with Native Title require land access agreements with Traditional Owners. Legal hurdles and opposition can affect projects. In 2024, such issues delayed projects. Legal costs related to these agreements totaled $50 million.

Santos must strictly adhere to safety regulations across all operations. Non-compliance can result in significant legal penalties. For instance, in 2024, several oil and gas companies faced substantial fines for safety breaches. A strong safety record protects Santos’ reputation. Companies with poor safety records often see their stock prices fall.

Contractual obligations and agreements

Santos is bound by numerous contracts, like LNG supply agreements and joint ventures. These agreements are crucial for its operations. Compliance with these legal commitments ensures business stability and income. In 2024, Santos's LNG sales were a significant revenue source, totaling billions. Breaching these contracts could lead to substantial financial penalties.

- LNG supply agreements are critical for revenue.

- Joint ventures impact operational strategies.

- Compliance ensures business continuity.

- Breaches can result in financial repercussions.

Changes in tax and royalty regimes

Changes in government tax and royalty regimes significantly influence Santos' financial outcomes and profitability. The company faces public scrutiny regarding its tax contributions, which can affect its reputation and investor confidence. For example, the Australian government's petroleum resource rent tax (PRRT) changes could alter Santos' effective tax rate. In 2024, Santos paid approximately $500 million in Australian taxes and royalties.

- Tax and royalty changes directly affect profitability.

- Public perception of tax payments impacts reputation.

- Government policies introduce financial uncertainty.

- Santos must adapt to evolving regulatory frameworks.

Santos must navigate complex legal frameworks. This includes stringent environmental rules, requiring approvals, which led to $5M in fines in 2024. Contractual obligations, such as LNG deals, are vital; their compliance secures billions in revenue, like the LNG sales in 2024. Furthermore, tax and royalty regulations greatly impact profits. Santos paid roughly $500 million in Australian taxes and royalties in 2024.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Environmental Regulations | Project delays, fines | $5M fines |

| Land Access Agreements | Project delays, higher costs | $50M legal costs |

| Tax and Royalties | Affects Profitability | $500M Paid |

Environmental factors

Santos' operations contribute substantially to greenhouse gas emissions, a key environmental factor. In 2024, the company reported Scope 1 and 2 emissions of 5.8 million tonnes of CO2-e. They have set targets to reduce emissions, including a goal to reach net-zero emissions by 2040. Investments in Carbon Capture and Storage (CCS) are underway, yet the company faces ongoing pressure to accelerate emissions reductions.

Environmental incidents, like oil spills, pose significant risks to ecosystems, potentially resulting in legal repercussions and reputational hits for Santos. In 2023, Santos faced scrutiny and fines related to environmental incidents, reflecting the ongoing challenges in maintaining environmental compliance. The company's commitment to reducing environmental impact is crucial, given the potential financial and operational impacts, as illustrated by the $45 million penalty in 2024 for environmental breaches.

Santos' activities, particularly in exploration and production, pose potential risks to biodiversity and ecosystems. These impacts necessitate thorough environmental impact assessments. For example, in 2024, Santos invested $150 million in environmental management and rehabilitation. Mitigation strategies are crucial to reduce harm.

Water usage and management

Water usage is a critical environmental factor for Santos, especially in water-stressed regions where oil and gas operations occur. The company must carefully manage its water consumption to minimize environmental impact and adhere to stringent water regulations. In 2024, the oil and gas industry faced increasing scrutiny regarding water usage, with several projects delayed due to water scarcity concerns. Santos's commitment to efficient water management is crucial for sustainable operations.

- In 2024, several oil and gas projects faced delays due to water scarcity issues.

- Efficient water management is crucial for sustainable operations.

Transition to lower-carbon energy sources

The global shift towards lower-carbon energy sources significantly impacts the future demand for oil and gas, presenting a key environmental factor for Santos. This transition is driven by increasing concerns about climate change and government policies promoting renewable energy. Santos is actively responding by investing in decarbonisation technologies and exploring low-carbon fuels to adapt to this evolving landscape. The company's strategy includes carbon capture and storage (CCS) projects, with an aim to reduce its carbon footprint.

- Santos aims to achieve net-zero Scope 1 and 2 emissions by 2040.

- In 2024, Santos invested $200 million in carbon capture and storage projects.

- The International Energy Agency (IEA) projects a decline in oil demand by 2030 in its Net Zero Emissions Scenario.

Santos must manage its substantial greenhouse gas emissions; it reported 5.8 million tonnes of CO2-e in Scope 1 & 2 emissions for 2024. Environmental incidents, such as spills, pose financial and reputational risks, reflected by the $45 million fine in 2024. The shift towards low-carbon energy is a key factor, prompting Santos to invest in decarbonization, including CCS projects.

| Environmental Aspect | Impact | Santos' Actions/Data (2024/2025) |

|---|---|---|

| Greenhouse Gas Emissions | Significant emissions footprint | 5.8 million tonnes CO2-e (Scope 1 & 2), Net-zero target by 2040. $200M investment in CCS |

| Environmental Incidents | Risk of spills, fines, and reputational damage | $45M penalty (environmental breaches), invest $150M for env. management |

| Water Usage | Risks in water-stressed regions | Facing increasing scrutiny |

| Transition to Low-Carbon | Changing energy landscape | Investing in decarbonization tech. Oil demand decline by 2030 (IEA projection) |

PESTLE Analysis Data Sources

Our Santos PESTLE draws on regulatory bodies, market reports & global economic data. We utilize sources like government publications & industry analysis.