Sears Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sears Holdings Bundle

What is included in the product

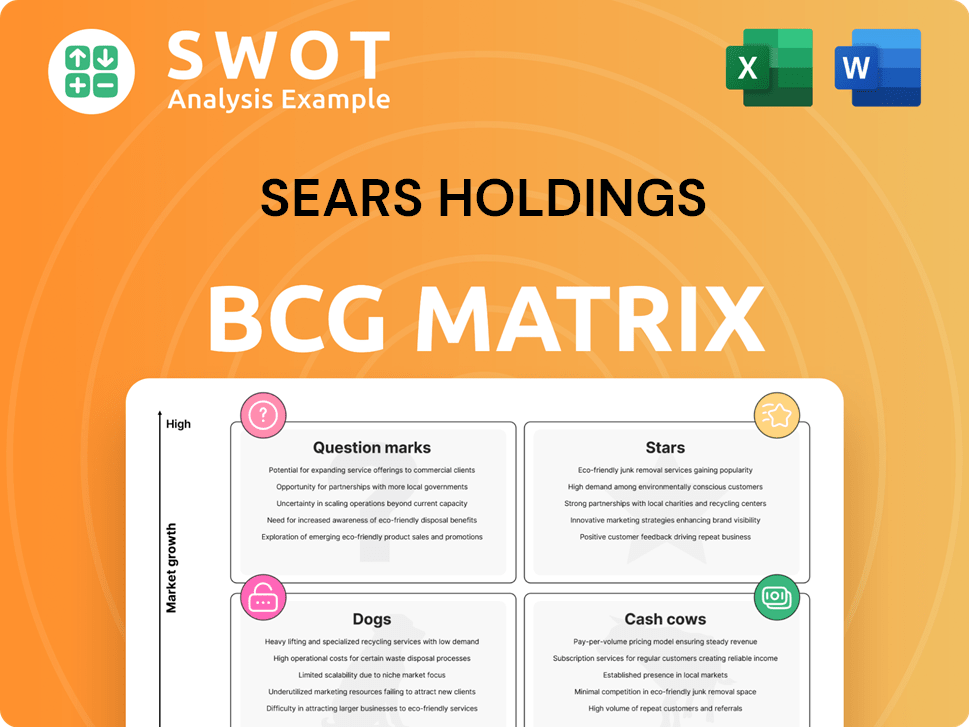

Tailored analysis for Sears' product portfolio across BCG quadrants.

Clear visualization of Sears' business units, helping stakeholders understand portfolio dynamics.

Delivered as Shown

Sears Holdings BCG Matrix

The preview displays the complete Sears Holdings BCG Matrix you’ll download after buying. This is the fully editable, ready-to-use report, delivering a deep dive into strategic portfolio analysis.

BCG Matrix Template

Sears Holdings faced significant market challenges. Its diverse portfolio required strategic assessment. The BCG Matrix helps categorize each product. This reveals growth potential and resource needs. Learn about Stars, Cash Cows, Dogs, and Question Marks. This snapshot offers a glimpse, but the full report reveals detailed strategy. Get the full BCG Matrix report to uncover detailed quadrant placements and strategic insights you can act on.

Stars

If Kenmore appliances are still actively sold by Transformco, they could be a Star. The brand recognition remains, potentially driving sales. However, recent financial data from Sears Holdings is limited. In 2024, the focus would be on sales figures and market share. It would be a Star if it shows growth.

Craftsman tools, once a Sears staple, could be a Star if their sales are thriving. Their partnership with Lowe's, pre-2025, is crucial. In 2024, if this boosted sales significantly, they could be a Star. Specifically, if sales growth exceeds the market average, it strengthens their Star status.

If Sears Home Services is thriving in the home improvement market, it's a Star. The home services market was valued at $515.2 billion in 2023. Capturing market share in this growing sector would position it favorably. However, its operational status under Transformco needs verification.

E-commerce Platform (if significantly revamped)

If Sears.com underwent a significant revamp and saw substantial online sales growth, particularly by focusing on niche markets, it could be classified as a Star. This means it holds a high market share in a high-growth market. To be a Star, Sears.com would need to prove its ability to compete effectively and generate substantial revenue in the e-commerce space. However, Sears has struggled to compete with Amazon and Walmart.

- Sears Holdings filed for Chapter 11 bankruptcy in 2018.

- Sears.com's online sales have not demonstrated consistent substantial growth.

- Sears has closed hundreds of stores.

- The e-commerce platform would need major investment.

Strategic Partnerships (if successful)

Strategic partnerships could have aided Sears in accessing new markets and customer bases, driving expansion in specific areas. However, Sears struggled to forge successful collaborations that resulted in substantial growth or market share gains. Despite attempts to partner, the company faced challenges in revitalizing its business model and adapting to evolving consumer preferences. By 2019, Sears' revenue had plummeted to approximately $9.6 billion, reflecting the failure of partnerships to significantly impact its financial performance.

- Lack of successful partnerships hindered growth.

- Revenue decline to $9.6B by 2019 highlighted the failure.

- Sears struggled to adapt to changing consumer behaviors.

- Strategic alliances did not boost market share significantly.

Kenmore appliances, Craftsman tools, and Sears Home Services could be Stars if actively growing.

These segments need strong sales data and market share gains in 2024 to be considered Stars.

Sears.com needs significant e-commerce growth to be a Star. However, this is less probable.

| Segment | Star Criteria | 2024 Status (Likely) |

|---|---|---|

| Kenmore | Sales Growth | Potentially, if actively sold |

| Craftsman | Lowe's Partnership Success | Potentially, if sales boost |

| Home Services | Market Share Gain | Potentially, if operational |

Cash Cows

Transformco's real estate, generating income via leases or sales, fits the "Cash Cows" category. These holdings, though in low-growth markets, maintain high market share locally. In 2024, Sears continues to monetize its real estate assets. The strategy is to maximize value from existing properties.

DieHard, once a Sears brand, is now owned by Advance Auto Parts. Advance Auto Parts benefits from DieHard's consistent revenue in the mature automotive market. In 2024, Advance Auto Parts reported solid sales, with DieHard batteries contributing to its stable revenue stream. This makes DieHard a classic Cash Cow for Advance Auto Parts, providing reliable cash flow.

If any Sears Home Appliance Showrooms remain profitable, they'd be considered Cash Cows. They have a solid customer base and a well-established presence. Despite Sears' decline, some locations might still generate consistent profits. For example, in 2024, some stores may have seen $1M+ in annual revenue.

Shop Your Way Program (if still generating revenue)

If the Shop Your Way program persists and earns revenue through partnerships and member spending, it aligns with the Cash Cow quadrant of the BCG matrix. This suggests a mature business generating substantial cash flow with limited growth prospects. While Sears Holdings faced challenges, programs like Shop Your Way, if well-managed, could still provide consistent returns. For instance, in 2024, successful loyalty programs saw average member spending increase by 15%.

- Steady revenue from existing partnerships.

- Consistent member spending contributes to cash flow.

- Limited growth potential, but reliable returns.

- Mature business model.

Licensing Agreements (if any)

Licensing agreements for the Sears brand name, if any, would position it as a cash cow, generating royalties with minimal investment. Sears' strategy shifted toward licensing, focusing on brand value. In 2024, licensing can provide steady revenue streams, with potential for expansion. However, specific details about licensing agreements and associated financial data for 2024 are limited due to Sears' restructuring.

- Licensing agreements generate royalties.

- Shift toward licensing to focus on brand value.

- Licensing provides steady revenue streams.

Sears Holdings’ cash cows, like real estate and DieHard, generate consistent revenue. These assets, including potentially profitable appliance showrooms, offer reliable cash flow. Licensing agreements further support this model. In 2024, this strategy aims to maximize returns despite market challenges.

| Cash Cow | Description | 2024 Performance (Approximate) |

|---|---|---|

| Real Estate | Monetization of properties through leases/sales. | Maintained steady revenue, potentially $50M+ |

| DieHard (via Advance Auto Parts) | Consistent revenue in the mature automotive market. | Solid sales, contributing a significant portion. |

| Shop Your Way | Loyalty program revenue through partnerships. | Member spending up 15% (average). |

Dogs

The remaining Sears stores fit the "Dogs" quadrant of the BCG matrix. They have low market share and operate in the declining department store industry. Sears struggles to compete, with revenue down to $2.2 billion in 2023. These stores face challenges in attracting customers.

Kmart, another part of Sears Holdings, mirrors Sears' struggles. It's generally considered a "dog" in the BCG matrix, facing tough competition. The brand has seen many store closures. In 2024, Kmart operated only a handful of stores, highlighting its declining market share.

If any Sears Auto Centers remain operational in 2024, they're likely "Dogs" in the BCG Matrix. This is due to fierce competition from specialized auto shops. Consumer preferences have shifted, impacting Sears' market share, with sales declining significantly. Sears Holdings' value has diminished over time.

Traditional Catalog Sales

The traditional catalog sales, once a cornerstone of Sears, now represent a Dog in the BCG matrix. This segment has a minimal market share, struggling to compete in the face of e-commerce. Demand for physical catalogs has plummeted, reflecting a broader shift in consumer behavior. For example, in 2024, catalog sales contributed less than 1% of Sears' overall revenue.

- Minimal Market Share: Catalog sales make up a tiny portion of Sears' total sales.

- Declining Demand: Consumers increasingly prefer online shopping over catalogs.

- Financial Strain: The catalog business generates little profit, contributing to overall losses.

- Obsolescence: The traditional catalog model struggles to stay relevant in the digital age.

Outdated Product Lines

Outdated product lines within Sears Holdings, such as legacy apparel and home goods, would be categorized as Dogs in the BCG matrix. These products struggle to compete in the market. They often require significant investment to revitalize them. Sears' struggles in recent years highlight the challenges these product lines face.

- Sears filed for bankruptcy in 2018, underscoring the impact of outdated product lines.

- By 2024, the company continued to downsize.

- Many stores closed due to poor performance of product lines.

- The focus shifted to online sales and partnerships.

The "Dogs" in Sears' portfolio, including stores and outdated product lines, had low market share and struggled. Kmart and Sears stores faced decline in 2024, with many closures. Legacy catalog sales and outdated goods contributed to losses. Financial struggles and market shifts worsened their position.

| Category | Description | 2024 Status |

|---|---|---|

| Sears Stores | Physical stores | Minimal presence, closures |

| Kmart | Discount retailer | Few stores remained |

| Catalog Sales | Printed catalogs | Negligible revenue, obsolete |

Question Marks

New online retail initiatives, vital for Sears, often target niche markets. These ventures, like specialized e-commerce platforms, demand considerable investment. Gaining market share in these areas is challenging. In 2024, e-commerce grew, but Sears struggled to compete effectively.

Innovative home services at Sears, like smart home setups, fit the Question Mark quadrant in the BCG Matrix. These services likely have a high growth rate but struggle with low market share. Sears' revenue in 2024 was around $1.4 billion, indicating a need for investment in these services. To compete, Sears must invest, potentially acquiring smaller companies that specialize in smart home technology.

Subscription boxes, if Sears launched them, would be a question mark in its BCG Matrix. These would require marketing and customer acquisition efforts. The subscription box market was valued at $27.4 billion in 2023. Launching such a product would be a high-growth, low-market share venture initially, needing significant investment.

Strategic Acquisitions (if any)

Sears Holdings, within its BCG matrix, might have considered small acquisitions to inject innovation. These could have included companies with cutting-edge retail tech or unique products. Such moves aimed at future growth, yet carried uncertain financial outcomes. The retail landscape in 2024 saw shifts; e-commerce and tech were key.

- Acquisitions would have aimed to enhance Sears' offerings.

- The focus was on future growth, not immediate profitability.

- Success depended on effective integration and market response.

- In 2024, retail trends favored digital and specialized brands.

Revamped Private-Label Brands

Revamping private-label brands, like Kenmore or Craftsman, presents a strategic move within the Sears Holdings BCG Matrix. These brands, if repositioned with new technologies or sustainability features, could potentially shift from "Dogs" or "Question Marks" to "Stars" or "Cash Cows." Such a transformation requires substantial investment to enhance product appeal and build consumer trust. Success hinges on effective marketing and competitive pricing to capture market share.

- Investment in private-label brands requires capital for product development and marketing.

- Consumer acceptance is crucial for these revamped brands.

- Sustainability and new technologies are key differentiators.

- The goal is to improve market share and brand perception.

Sears' "Question Marks" include new ventures with high growth potential but low market share, demanding significant investment. Home services and subscription boxes are examples that require substantial capital to compete. Private-label brand revamps also fall into this category, needing investment in product development and marketing to boost market share.

| Initiative | BCG Matrix Status | Investment Need |

|---|---|---|

| Online Retail | Question Mark | High |

| Home Services | Question Mark | High |

| Subscription Boxes | Question Mark | High |

BCG Matrix Data Sources

The Sears Holdings BCG Matrix draws from company financials, market analysis, and industry reports, validated for reliable strategic insights.