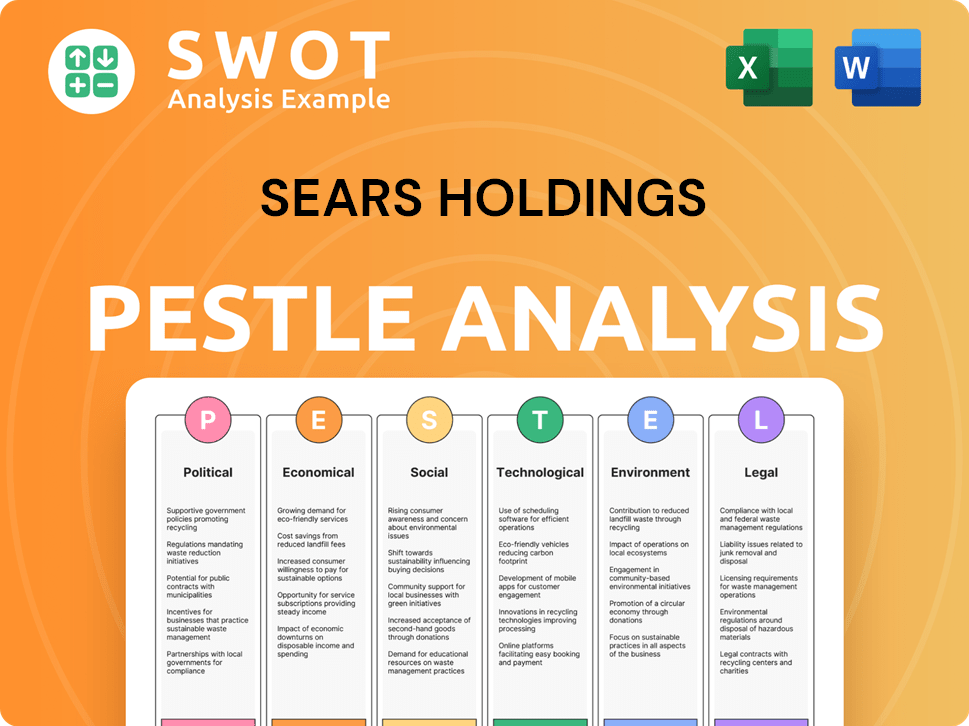

Sears Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sears Holdings Bundle

What is included in the product

Assesses the macro-environmental factors impacting Sears Holdings using Political, Economic, Social, Technological, Environmental, and Legal lenses.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Sears Holdings PESTLE Analysis

This PESTLE analysis of Sears Holdings is exactly as shown. You'll get the same fully formatted and professional insights after purchase.

PESTLE Analysis Template

Navigate Sears Holdings's challenges with our detailed PESTLE analysis. Explore crucial external factors, like shifting consumer habits and economic pressures, that impact the brand. Gain strategic insights to adapt to today's dynamic retail landscape.

Uncover the full scope of these trends and their influence on Sears Holdings. Understand legal and environmental considerations affecting the company's future performance.

This analysis is designed for immediate use and is great for market analysis. Get access to actionable data to help improve your market strategies and investments, today!

Political factors

Government regulations significantly influence retail operations, encompassing labor laws, trade policies, and safety standards. Changes in these areas can substantially impact operational costs and procedures for retailers like Sears. Political stability is also crucial; unstable regions can disrupt supply chains and consumer confidence. For example, the U.S. Department of Labor reported 1.2 million workplace injuries in 2024, affecting operational costs. Trade policies, such as tariffs, also affect retailers' sourcing costs.

Political stability is vital for Sears Holdings' operations, ensuring a predictable business environment. Geopolitical risks, such as trade wars or political instability in key sourcing regions, can disrupt supply chains. For instance, in 2024, increased tariffs impacted retail costs. Civil unrest or conflicts can decrease consumer spending, like the 5% drop in retail sales during a period of social unrest in 2024, affecting revenue.

Trade policies significantly impact Sears Holdings. Tariffs and import restrictions directly affect the cost of goods. For instance, in 2024, increased tariffs on Chinese imports raised costs. Fluctuations in these policies can severely impact pricing strategies and profitability. Sears, with its international sourcing, must closely monitor these changes to remain competitive.

Consumer Confidence and Political Events

Political events significantly shape consumer behavior. Elections, policy changes, and global conflicts can create uncertainty, influencing spending. For instance, the 2024 US presidential election could dramatically affect market sentiment. This uncertainty often leads to cautious consumer spending. Retail sales may fluctuate due to these shifts.

- Consumer confidence indicators often reflect political climates.

- Changes in trade policies can also affect consumer prices.

- Geopolitical instability can disrupt supply chains.

- Government regulations impact business operations and consumer choices.

Government Oversight of Mergers and Acquisitions

Large corporate transactions, including mergers and acquisitions, face government oversight to ensure regulatory compliance and public interest protection. The Kmart and Sears merger, for instance, underwent scrutiny. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) review deals. The goal is to prevent monopolies and protect consumers.

- In 2024, the DOJ and FTC have increased scrutiny of mergers, particularly in the tech and healthcare sectors.

- The agencies are focusing on potential impacts on competition and innovation.

- Recent merger challenges include those in the airline and pharmaceutical industries.

Political factors deeply impact Sears Holdings, influencing operations via regulations and trade policies, which affect costs. Political stability, crucial for supply chains, is vulnerable to geopolitical risks and consumer spending shifts. In 2024, tariff hikes significantly raised retail costs.

| Political Factor | Impact on Sears | 2024 Data/Examples |

|---|---|---|

| Government Regulations | Affects operational costs, compliance. | 1.2M workplace injuries reported by US DoL. |

| Trade Policies | Influences sourcing costs, pricing strategy. | Increased tariffs on imports affected costs. |

| Political Stability | Disrupts supply chains, impacts consumer confidence. | 5% drop in retail sales during unrest periods. |

Economic factors

Economic downturns can severely dent consumer spending, leading to decreased discretionary purchases. Sears struggled financially, especially during the 2008 recession. In 2023, the U.S. GDP growth was around 2.5%, and analysts predict slower growth in 2024. This could impact retail sales, potentially affecting companies like Sears.

The surge of discount retailers, like Walmart and Target, presented a formidable challenge to Sears. These competitors offered significantly lower prices and a broader product range. This intensified the pressure on Sears' pricing strategies and market share. For instance, in 2024, Walmart's revenue was approximately $648 billion, far exceeding Sears' diminished sales.

Retailers grapple with escalating costs. Operational expenses, like utilities and labor, are rising. Supply chain costs, encompassing transportation and raw materials, also strain budgets. Climate change impacts may further inflate expenses. These factors can diminish profit margins.

Consumer Spending Levels

Consumer spending is crucial for retail, including Sears. Inflation, employment, and wage growth directly impact consumer spending habits. In early 2024, inflation remained a concern, potentially curbing discretionary spending. The U.S. unemployment rate stood at 3.9% as of April 2024, influencing consumer confidence. Wage growth, though positive, hasn't always kept pace with inflation, affecting purchasing power.

- Inflation in early 2024: ~3%

- U.S. Unemployment Rate (April 2024): 3.9%

- Average hourly earnings growth (early 2024): ~4%

Debt Burden and Financial Mismanagement

High debt levels and financial mismanagement crippled Sears' ability to thrive. The company's inability to invest in modernization and adapt to shifting consumer preferences stemmed from this burden. Sears Holdings filed for bankruptcy in 2018, a clear indication of financial distress. The company's liabilities exceeded its assets, leading to its downfall.

- Sears' bankruptcy filing in 2018 highlighted its severe debt issues.

- Financial mismanagement prevented investments in crucial areas.

- High debt limited Sears' ability to compete effectively.

Economic indicators such as inflation, unemployment, and wage growth directly shape consumer behavior. As of early 2024, inflation hovered around 3%, the U.S. unemployment rate was 3.9%, and average hourly earnings grew by about 4%. These factors significantly impact retail sales. Sears' performance was critically tied to these conditions.

| Indicator | Early 2024 Value | Impact on Sears |

|---|---|---|

| Inflation | ~3% | Reduced consumer spending. |

| Unemployment Rate | 3.9% (April 2024) | Influenced consumer confidence. |

| Wage Growth | ~4% (early 2024) | Affected purchasing power, impacting retail sales. |

Sociological factors

Consumer preferences have drastically changed, favoring online shopping and immersive retail. Sears struggled to modernize, losing customers to e-commerce giants. In 2024, online retail sales hit $1.1 trillion, a 9.4% increase. Sears' outdated strategy failed to capture this shift, impacting sales.

The rise of e-commerce drastically reshaped retail. Online platforms gained popularity, driven by convenience and selection. In 2024, e-commerce sales are projected to reach $1.3 trillion in the U.S. alone. This shift pressured traditional retailers like Sears, which struggled to adapt. Consumers increasingly favored online shopping, impacting Sears' market share.

Modern consumers increasingly seek value, convenience, and integrated shopping experiences. Retailers must adapt to these demands to stay relevant. In 2024, 67% of shoppers preferred online purchases for convenience. Sears, facing these trends, needs to enhance its online presence. Failure to adapt could further erode its market share.

Brand Reputation and Customer Loyalty

Brand reputation and customer loyalty are crucial for any retailer's survival. Sears, once a retail giant, suffered significant damage to its brand image and customer loyalty. This decline was fueled by factors like store upkeep and customer service issues. The company's strategic missteps severely impacted its standing. Sears' sales plummeted from $42.5 billion in 2010 to $13.2 billion by 2016.

- Poor customer service led to customer dissatisfaction.

- Outdated stores diminished the shopping experience.

- Declining quality of merchandise eroded brand value.

- Lack of innovation made it lose market share.

Demographic Shifts

Demographic shifts significantly influence retail success. Urbanization and evolving consumer preferences, particularly across age groups, reshape target markets. Sears, once serving rural populations, struggled to adapt to urban customers. This failure contributed to its decline. For example, the US urban population grew from 64% in 1950 to nearly 83% in 2023, highlighting the shift Sears missed.

- Urban population growth continues, altering retail landscapes.

- Age-related preferences vary, impacting product demand.

- Sears' rural focus hindered adaptation to urban markets.

Societal shifts impacted Sears via changing consumer habits. These trends favored online shopping and experiences. Declining customer service and store quality further eroded brand image. Consumer behavior and demographics reshaped retail.

| Factor | Impact | 2024 Data/Trends |

|---|---|---|

| E-commerce Growth | Reduced in-store traffic, lower sales. | E-commerce sales: $1.3T (projected, US). |

| Brand Perception | Weakened customer loyalty and trust. | Customer service dissatisfaction persists. |

| Urbanization | Missed target market shift to city areas. | Urban population: ~83% (2023, US). |

Technological factors

Sears' failure to modernize its e-commerce platform severely impacted its ability to compete. In 2024, online retail sales in the U.S. reached approximately $1.1 trillion, yet Sears' digital presence remained weak. This technological deficiency hindered its ability to attract and retain customers in an increasingly digital marketplace. The lack of investment in online infrastructure led to decreased sales and contributed to its decline.

Technological advancements significantly shape retail. Inventory management, supply chain, and in-store experiences are all affected. Retailers must embrace tech to boost efficiency and customer satisfaction. For example, in 2024, e-commerce sales hit $1.1 trillion, highlighting tech's impact. Successful adaptation is vital for survival.

Data analytics helps retailers understand consumer behavior, enabling targeted marketing and personalized shopping. This enhances customer engagement and loyalty, crucial in today's market. In 2024, personalized marketing saw a 15% increase in conversion rates. Companies like Amazon use data to tailor experiences, driving sales. Efficient data use is vital for Sears' recovery.

Supply Chain Technology

Technological factors significantly impact Sears Holdings, particularly in supply chain management. AI and machine learning are vital for enhancing efficiency and adapting to disruptions. These technologies allow for better forecasting, inventory optimization, and faster response times. The global supply chain software market is projected to reach $20.7 billion by 2025, highlighting the importance of tech adoption.

- AI-driven demand forecasting can reduce inventory costs by 15-20%.

- Blockchain technology improves supply chain transparency.

- Automation streamlines logistics and reduces labor costs.

In-Store Technology

In-store technology significantly influences Sears' operational efficiency and customer experience. Cashierless checkouts and smart shelves streamline processes, potentially cutting labor costs. Retailers like Walmart are investing heavily in such technologies; in 2024, Walmart allocated approximately $14 billion for technology and supply chain improvements. However, Sears' adoption rate of these technologies remains uncertain, potentially affecting its competitiveness.

- Walmart's tech investment in 2024 was around $14 billion.

- Cashierless checkouts improve efficiency.

- Smart shelves offer inventory management.

Sears struggled with outdated technology. In 2024, e-commerce grew to $1.1T, bypassing Sears. They missed vital tech trends, like AI in supply chains. AI-driven demand cuts costs, a $20.7B global market by 2025, missed by Sears.

| Technology Area | Sears' Status | Industry Trend (2024-2025) |

|---|---|---|

| E-commerce | Weak online presence | $1.1T sales (2024) |

| Supply Chain | Outdated | AI, blockchain, $20.7B market |

| In-Store Tech | Limited | Walmart $14B tech spend (2024) |

Legal factors

Bankruptcy laws, like Chapter 11, offer a legal pathway for financially struggling companies. Sears' Chapter 11 filing involved intricate restructuring and asset liquidation. The process aims to reorganize debts or sell assets to repay creditors. Sears' bankruptcy highlighted the challenges of retail business adaptation, with sales plummeting to $1.4 billion in 2018. The case underscores how legal factors impact business survival.

Sears Holdings faced numerous lawsuits. These lawsuits involved product liability, employment disputes, and contract breaches. In 2018, Sears filed for bankruptcy, significantly impacting ongoing litigation. The bankruptcy proceedings further complicated these legal challenges, affecting creditors and stakeholders. Lawsuits can lead to significant financial burdens and reputational damage.

Sears Holdings faced legal obligations concerning labor laws, encompassing wages, work hours, and employee rights. The company implemented a Code of Vendor Conduct, mandating suppliers adhere to specific labor practices. In 2024, the U.S. Department of Labor reported a 3.9% unemployment rate, influencing wage negotiations. Furthermore, the National Labor Relations Board (NLRB) continues to enforce employee rights, affecting retail operations.

Supplier Contracts and Legal Disputes

Sears' reliance on supplier contracts was crucial, yet its financial troubles often led to disputes. These legal battles involved disagreements over payments and contract fulfillment. The firm's instability, particularly post-bankruptcy, severely strained supplier relationships. Legal actions with suppliers became frequent, impacting operations. The company faced numerous lawsuits related to breached contracts.

- In 2018, Sears filed for bankruptcy, which led to significant contract disputes.

- Post-bankruptcy, the legal landscape became even more complex, with ongoing litigation.

- Many suppliers experienced delayed payments or non-payment, increasing disputes.

Consumer Protection Laws

Sears Holdings must adhere to consumer protection laws, which are crucial for advertising, product safety, and fair business practices. Misleading advertisements can result in lawsuits, damaging the company's reputation and finances. In 2024, the Federal Trade Commission (FTC) reported over 2.6 million fraud reports, highlighting the importance of accurate marketing. These laws are vital for maintaining consumer trust and avoiding costly legal battles. Compliance is essential for Sears' survival in a competitive retail market.

- FTC received 2.6M fraud reports in 2024.

- Misleading ads can lead to legal action and financial penalties.

- Consumer trust is essential for brand survival.

- Product safety standards are critical for retailers.

Legal factors, crucial for Sears, involve bankruptcy proceedings impacting operations post-2018 filing. Numerous lawsuits, including those related to contracts, increased post-bankruptcy. Compliance with labor laws and supplier contracts shaped Sears’ operations, impacting stakeholder relations. Consumer protection laws also played a key role.

| Legal Area | Impact | Data/Statistics (2024/2025) |

|---|---|---|

| Bankruptcy | Restructuring & Liquidation | 2018 Sears bankruptcy impacted numerous contracts. |

| Lawsuits | Financial Burden, Reputation Damage | FTC reported 2.6M fraud reports in 2024. |

| Labor Laws | Wage & Employee Rights Compliance | U.S. unemployment rate 3.9% in 2024 influencing wage. |

| Consumer Protection | Consumer Trust and Penalties | FTC data & compliance with product safety. |

Environmental factors

Retail businesses like Sears must adhere to environmental regulations concerning waste, energy use, and material handling. Sears' Code of Vendor Conduct mandated supplier compliance with environmental laws. In 2024, the EPA reported a 2% increase in retail waste recycling rates. Non-compliance could result in substantial fines; for instance, in 2023, a large retailer was fined $1.5 million for improper waste disposal.

Sustainability is a growing concern for consumers and regulators, shaping business practices. Retailers like Sears face pressure to adopt eco-friendly operations and supply chains. In 2024, sustainable product sales rose, indicating consumer demand. Regulatory changes, like the SEC's climate disclosure rule, impact companies. Sears must adapt to these environmental shifts to remain competitive.

Waste management and recycling are crucial environmental factors for retailers like Sears, given their extensive operations and physical stores. Sears Holdings previously pushed its vendors to reduce waste and boost recycling efforts. In 2024, the retail sector saw a 15% rise in recycling programs, highlighting the importance of these initiatives. Retailers' waste reduction strategies directly impact environmental sustainability and operational costs.

Energy Consumption and Efficiency

Sears Holdings' retail stores and distribution centers' energy consumption is a key environmental factor. Energy efficiency efforts can significantly cut environmental impact and operational expenses. Implementing energy-saving measures, such as LED lighting and smart HVAC systems, is crucial. These initiatives not only benefit the environment but also enhance the company's financial performance.

- In 2023, the retail sector saw a 10% increase in energy efficiency investments.

- Smart building technologies can reduce energy consumption by up to 30%.

- Companies investing in green initiatives experience up to a 15% increase in customer loyalty.

Responsible Product Disposal Programs

Responsible product disposal programs are crucial for retailers like Sears to mitigate environmental impact. These programs ensure that old appliances and goods are disposed of properly, reducing pollution. Sears's partnership with the EPA's Responsible Appliance Disposal Program exemplifies this commitment. Such initiatives are increasingly vital, as environmental regulations tighten and consumer awareness grows.

- Sears's participation in the EPA's program helps manage waste responsibly.

- These programs are essential for meeting evolving environmental standards.

- Proper disposal reduces the risk of harmful substances entering the environment.

Sears, as a retailer, faces environmental regulations focusing on waste, energy, and material handling. Sustainability is a crucial factor, with eco-friendly practices influencing consumer choices and impacting business practices. Waste management, recycling, and energy efficiency directly affect both environmental impact and operational costs, representing significant areas of focus.

| Factor | Impact | Data |

|---|---|---|

| Waste Recycling | Compliance, Costs | Retail sector increased recycling programs by 15% in 2024. |

| Energy Efficiency | Cost savings, Compliance | Energy efficiency investments increased by 10% in 2023 within the retail sector. |

| Product Disposal | Compliance, brand | Companies with green programs increase customer loyalty by up to 15%. |

PESTLE Analysis Data Sources

Sears' PESTLE draws from financial statements, industry reports, government databases, and economic indicators to ensure comprehensive, data-driven analysis.