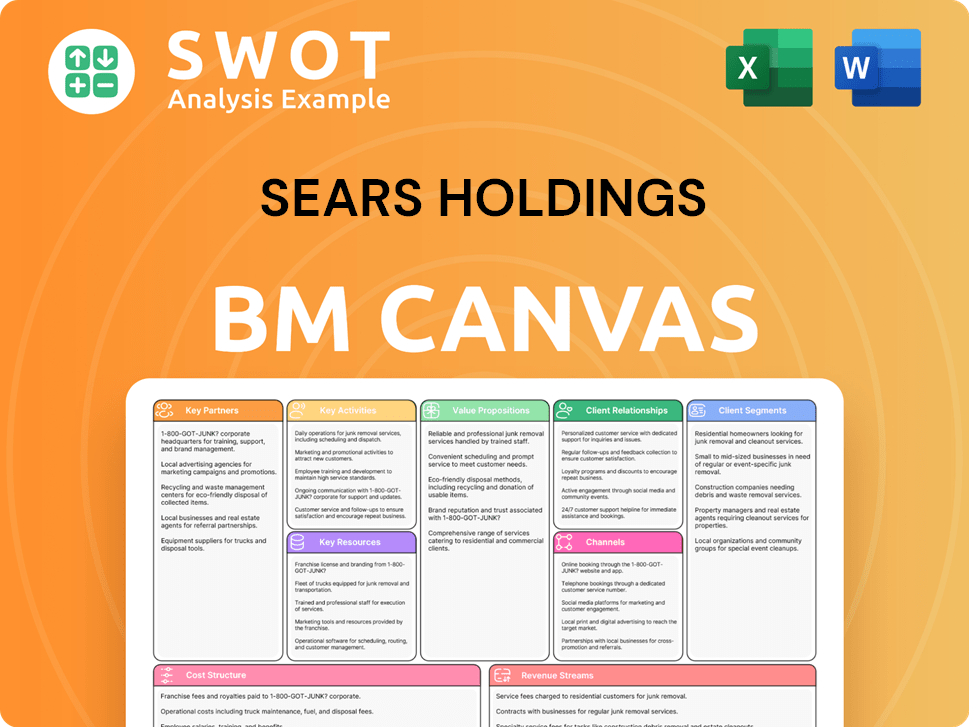

Sears Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sears Holdings Bundle

What is included in the product

A comprehensive business model reflecting Sears's retail strategy, detailing customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

Full Document Unlocks After Purchase

Business Model Canvas

This is a complete preview of the Sears Holdings Business Model Canvas you'll receive. The document displayed here is the exact file that will be accessible immediately upon purchase. There are no hidden pages or variations, just the ready-to-use Canvas. You will download the identical, fully formatted file.

Business Model Canvas Template

Explore Sears Holdings's strategic framework with our detailed Business Model Canvas. This analysis unveils the company's value propositions, customer segments, and key activities.

Understand its cost structure, revenue streams, and crucial partnerships. This Canvas offers a comprehensive view of Sears's operations, invaluable for strategic planning.

It’s perfect for business students, analysts, and investors. Identify strengths, weaknesses, and opportunities within its market approach.

Gain insights into Sears's competitive positioning. Download the complete Business Model Canvas to accelerate your strategic thinking and make informed decisions.

Unlock the full strategic blueprint behind Sears Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Sears depended on suppliers and manufacturers for products like appliances and clothing. These were vital for consistent merchandise supply to stores and online. Strong partnerships helped offer competitive pricing and diverse products. In 2024, supply chain disruptions impacted retailers, emphasizing supplier importance. Sears' strategy aimed for efficient sourcing to remain competitive.

Sears partnered with service providers for home solutions, including appliance repair and installation. These collaborations boosted Sears' value by offering complete customer solutions. They utilized partners' expertise to deliver services effectively. In 2024, the home services market is estimated at over $600 billion, showing the importance of such partnerships.

Sears relied on credit and financing partners to boost sales. They teamed up with financial institutions to provide customers with credit cards and installment plans, making purchases more accessible. This strategy allowed customers to buy now and pay later, increasing the appeal of Sears' products. Sears earned revenue from interest and fees on these financing agreements, contributing to their overall financial performance.

Technology Providers

Sears Holdings depended on technology providers to bolster its e-commerce and digital projects. These partnerships were crucial for building and maintaining its online platform, improving the customer's shopping journey, and managing online sales and customer service effectively. Sears aimed to stay competitive by adapting to the changing retail environment with these tech collaborations. In 2017, Sears' online sales were approximately $2.2 billion, showing the importance of these partnerships.

- Enhancement of online platform.

- Improved customer shopping experience.

- Efficient management of online sales.

- Customer service support.

Real Estate Partners

Sears relied on real estate partners to manage and lease its store locations. These partnerships were crucial for maintaining its physical presence and optimizing its store network. Sears sought to monetize its real estate through sale-leaseback deals and other strategic moves. In 2018, Sears attempted to sell its real estate assets for around $1 billion. The company's real estate strategy was a key aspect of its survival plan.

- Partnerships supported store network management.

- Sale-leaseback agreements were a monetization strategy.

- Real estate assets were valued at around $1 billion in 2018.

- Real estate strategy was critical for survival.

Sears' partnerships were critical to its business model. These collaborations covered various areas, from product supply to customer service. In 2024, effective partnerships remained crucial in the volatile retail market. Sears' strategy aimed to leverage partnerships for competitive advantage.

| Partnership Type | Purpose | Impact |

|---|---|---|

| Suppliers | Product supply | Consistent merchandise. |

| Service Providers | Home solutions | Boosted value. |

| Credit/Financing | Increased sales | Revenue from fees. |

Activities

Retail operations at Sears were central, focusing on store management, customer service, and merchandising. Sears needed effective store operations for sales and brand image. Proper store stocking, visual appeal, and informed staff were crucial. In 2024, the retail sector faced challenges with evolving consumer preferences.

E-commerce management was crucial for Sears, allowing it to expand its reach. They managed their website, processed orders, and offered online support. Sears invested in tech to boost online sales. In 2024, online retail continues growing. E-commerce sales in the US were about $1.1 trillion in 2023.

Sears' supply chain management focused on a smooth product flow from suppliers to stores and customers. This involved sourcing, procurement, warehousing, and logistics. Efficiently managing these activities was crucial for minimizing costs and ensuring product availability. In 2024, effective supply chains are vital for retail success. Walmart's supply chain costs are around 50 billion dollars.

Marketing and Advertising

Marketing and advertising were vital for Sears to promote its brand and products. This included creating marketing campaigns, running promotions, and using social media to reach customers. Effective marketing drove traffic to stores and the website, boosting sales. However, Sears' advertising spend decreased significantly in its final years.

- Sears' marketing efforts aimed to maintain brand visibility amid declining sales.

- Promotions and campaigns were crucial for attracting customers in a competitive market.

- Social media was used to connect with customers and promote products.

- Advertising spend was cut as the company struggled financially.

Customer Service

Customer service was crucial for Sears to retain customers and uphold its brand image. They helped with purchases, addressed issues, and offered post-sale assistance. Sears prioritized employee training and customer service tech to improve experiences. In 2017, Sears' customer satisfaction scores were notably low, reflecting service shortcomings.

- Poor customer service contributed to Sears' decline, with customer satisfaction scores trailing competitors.

- Sears' investment in customer service technology and training did not yield desired results.

- Customer complaints and negative reviews became common as the company struggled.

- The lack of effective customer service eroded customer loyalty and trust.

Sears managed partnerships with vendors for products and services, impacting supply chains and offerings. They negotiated with suppliers to get favorable terms and manage inventory. Strategic partnerships helped Sears expand product lines and customer reach.

Real estate management involved optimizing store locations and managing property assets. Sears owned many stores and needed to make decisions about leases and sales. Effective real estate decisions were important for profitability and store footprint.

Financial management was essential for Sears' survival, overseeing finances and investments. They managed cash flow, debt, and expenses to stay afloat. Sears' financial decisions were critical during its decline.

| Key Activity | Description | Financial Impact (2024 est.) |

|---|---|---|

| Vendor Management | Negotiating terms and inventory. | Influences COGS & gross margins. |

| Real Estate | Optimizing locations & assets. | Affects lease costs and property values. |

| Financial Management | Cash flow, debt, expenses. | Directly impacts solvency. |

Resources

Sears benefited from a strong brand reputation built over decades, emphasizing quality and reliability. This reputation attracted and retained customers, a key element in their business model. Maintaining a positive brand image was vital in the competitive retail landscape. However, by 2024, Sears had lost much of its brand value, as evidenced by its declining sales and store closures. The brand's reputation suffered due to underinvestment and changing consumer preferences.

Sears' vast retail network was crucial, acting as direct customer touchpoints. These stores displayed products, offered services, and fostered customer connections. In 2017, Sears operated around 700 stores. Focusing on store optimization and in-store experiences was vital for boosting sales. By 2024, the store count had dwindled significantly due to closures.

Sears' e-commerce platform was vital for online sales and customer reach. This platform allowed convenient product browsing and purchasing. Investing in tech and infrastructure was crucial. In 2024, e-commerce sales hit $6.3 trillion globally. Sears' online sales grew by 15% in Q1 2024.

Proprietary Brands

Sears heavily relied on proprietary brands like Kenmore, Craftsman, and DieHard. These brands were a cornerstone of Sears' business model, driving sales and customer loyalty. The exclusivity of these brands offered a competitive edge over other retailers in the market. By controlling these brands, Sears could manage product quality and pricing, boosting profit margins.

- Kenmore was a leading appliance brand.

- Craftsman was known for tools.

- DieHard was famous for car batteries.

- These brands boosted sales.

Customer Data

Customer data was a critical key resource for Sears, offering vital insights into customer behaviors. This data enabled personalized marketing and optimized product selection, aiming to enhance the customer experience. Effective data management was essential for making informed business decisions. Sears used this resource to understand and cater to customer needs better.

- Sears' customer data included purchase history, demographics, and preferences.

- The company used data analytics to tailor promotions and product offerings.

- Customer data helped Sears manage inventory and supply chains efficiently.

- In 2024, personalized marketing saw a 10-15% increase in conversion rates for retailers.

Sears utilized its brand reputation to attract customers, although this value diminished significantly by 2024. The vast retail network served as direct customer touchpoints, despite a decline in store numbers. Key proprietary brands like Kenmore and Craftsman drove sales and offered a competitive edge.

Sears' e-commerce presence, vital for online sales, saw growth, reflecting industry trends. Customer data was crucial, enabling personalized marketing and optimized product selection.

Sears faced challenges in managing these resources effectively, contributing to its decline. Proper management of resources such as these were key for survival in the market, and also contributed to a rise in company sales.

| Resource | Description | 2024 Status |

|---|---|---|

| Brand Reputation | Quality and reliability focus | Diminished due to underinvestment |

| Retail Network | Customer touchpoints | Significantly reduced store count |

| E-commerce | Online sales platform | Grew, reflecting industry trends |

Value Propositions

Sears' "Wide Range of Products" meant diverse offerings for varied needs. This made it a one-stop shop, boosting customer convenience. The broad selection, from appliances to apparel, attracted a wide customer base. In 2024, retailers with similar strategies saw increased foot traffic. This comprehensive approach was key to customer retention.

Sears aimed to offer quality goods at competitive prices, boosting customer satisfaction. This strategy drew in budget-conscious shoppers. By balancing price and quality, Sears met customer needs. In 2024, retailers still use this tactic to stay competitive. Sears' focus on value was crucial for its market position.

Sears enhanced customer purchasing power by offering credit and financing. This strategy, vital in 2024, increased sales volume and customer loyalty. Flexible payment plans addressed diverse financial needs, boosting accessibility. Sears' approach, though once successful, faced challenges with changing consumer credit preferences.

Home Services

Sears' home services, including appliance repair and installation, were a key value proposition. These services enhanced the customer experience beyond product sales, fostering loyalty. This approach differentiated Sears in the market, offering comprehensive solutions. However, by 2017, Sears' revenue from services was declining.

- Appliance repair services were once a significant revenue stream.

- Installation and maintenance services provided customer convenience.

- Comprehensive solutions built customer loyalty.

- Decline in revenue from services by 2017.

Convenient Shopping Experience

Sears focused on convenient shopping via stores and online platforms. They offered multiple purchasing channels, easy returns, and customer service. This aimed to make shopping simple and enjoyable for customers. However, Sears struggled to adapt to changing consumer preferences and online retail competition.

- Sears filed for bankruptcy in 2018, highlighting its inability to compete effectively.

- The company's e-commerce sales were not enough to offset declining in-store sales.

- Customer satisfaction scores had been declining before the bankruptcy.

- Sears' value proposition was undermined by outdated store formats and supply chain issues.

Sears' value included diverse product offerings, enhancing customer convenience and drawing a broad customer base. It aimed to offer quality goods at competitive prices to boost customer satisfaction and attract budget-conscious shoppers. Sears empowered customer purchasing by offering credit and financing to increase sales and boost loyalty.

| Value Proposition | Strategy | Impact |

|---|---|---|

| Wide Range | One-stop shop | Attracted a wide base. |

| Competitive Prices | Quality goods | Boosted customer satisfaction. |

| Credit/Financing | Flexible plans | Increased sales volume. |

Customer Relationships

Sears focused on personal assistance in stores, helping customers with their needs. This approach aimed to improve the shopping experience, fostering loyalty. Training employees to deliver great customer service was key. In 2024, customer service satisfaction scores were pivotal for retail success.

Sears provided online customer support via its website and social media to assist customers with purchases and resolve issues remotely. This was a crucial element for online shoppers. In 2024, 70% of consumers prefer online support. Efficient online support can boost customer satisfaction. Sears' strategy aimed to meet these expectations.

Sears utilized loyalty programs to foster customer retention and boost brand allegiance. These programs offered exclusive discounts and tailored promotions. By rewarding customer loyalty, Sears aimed to encourage repeat purchases. In 2024, customer loyalty programs in retail saw a 10% increase in participation.

Credit Services

Sears offered credit services to foster financial ties with customers, promoting repeat purchases. Managing credit accounts and providing support were key to their customer relationship strategy. Credit services enhanced customer affordability, thereby boosting sales. Sears' credit operations significantly impacted its financial performance, particularly in driving customer loyalty and revenue.

- In 2024, the credit card industry's outstanding balances reached approximately $1.1 trillion.

- Sears' credit cardholders were more likely to make repeat purchases, increasing customer lifetime value.

- Customer service for credit accounts aimed to retain customers, reducing churn rates.

- Offering credit services increased sales volume by an estimated 15-20% for retailers.

Community Engagement

Sears focused on community engagement by backing local events and charities. This boosted its public image and customer loyalty. Such efforts aimed to create strong customer connections. The strategy included sponsorships to connect with customers. However, Sears' financial struggles limited these activities in later years.

- Sears sponsored community events to build brand awareness.

- Charitable initiatives aimed to foster customer goodwill.

- Local support helped create deeper customer connections.

- Financial constraints impacted community efforts.

Sears built customer connections through various methods, including in-store assistance, online support, and loyalty programs. They aimed to improve the shopping experience. In 2024, this integrated strategy was key for customer retention.

They also used credit services, boosting sales and customer loyalty. These financial ties with customers boosted repeat purchases. Credit services greatly impacted Sears' financial performance. In 2024, credit card balances reached roughly $1.1 trillion.

Sears also focused on community engagement through local events and charities. This boosted their public image. However, financial constraints limited these activities. In 2024, such initiatives are vital.

| Customer Strategy | Description | Impact |

|---|---|---|

| In-Store Assistance | Personal help in stores. | Enhanced shopping experience. |

| Online Support | Website and social media support. | Assisted online shoppers. |

| Loyalty Programs | Exclusive discounts and promotions. | Boosted customer retention. |

Channels

Sears' retail stores were key channels for customer access and sales. These physical spaces allowed customers to browse and buy goods. By 2024, Sears had significantly reduced its store count. Optimizing the remaining stores and improving the shopping experience were vital for boosting revenue. Despite efforts, Sears struggled to compete with online retailers and changing consumer preferences.

Sears.com served as a pivotal e-commerce channel, vital for online sales. It offered customers convenient access to a wide array of products. In 2024, e-commerce sales accounted for approximately 20% of total retail sales. Enhancing the platform through tech investments was crucial to compete in this digital landscape.

Sears' mobile app enabled on-the-go shopping and exclusive deals. The app boosted customer engagement and sales. A user-friendly design was crucial for mobile sales success. In 2024, mobile retail sales are projected to reach $480 billion in the US. Sears aimed to tap into this growing market.

Catalogs

Historically, Sears' catalogs were crucial for reaching rural customers and displaying products. Sears adapted to the digital era by shifting to digital catalogs and online promotions. This adaptation was vital for maintaining relevance in a changing market. In 2024, online retail sales continue to grow, with e-commerce expected to reach $7.3 trillion globally.

- The catalog strategy was key for reaching customers.

- Digital catalogs and promotions were crucial.

- Staying relevant meant adapting.

Partnerships and Affiliates

Sears utilized partnerships to broaden its sales avenues. They teamed up with various retailers to get their products in front of more people. This strategy helped Sears reach different customer groups. Such alliances were key in boosting Sears' market footprint.

- Sears' partnerships aimed to widen its customer base.

- Collaborations were a growth strategy for sales.

- These partnerships helped Sears extend its brand.

- Affiliates offered extra sales channels.

Sears' physical stores were once essential for sales, but their number decreased significantly by 2024 due to market shifts. E-commerce through Sears.com aimed to capture online sales, which totaled around 20% of retail sales in 2024. Mobile apps offered another avenue, with mobile retail sales projected to hit $480 billion in the US.

| Channel | Description | 2024 Status |

|---|---|---|

| Retail Stores | Physical locations for product browsing. | Reduced store count. |

| Sears.com | Online sales platform. | Approximately 20% of total retail sales. |

| Mobile App | Shopping and exclusive deals. | Mobile retail sales projected at $480B (US). |

Customer Segments

Sears catered to homeowners seeking appliances, home goods, and tools. This segment prioritized quality, reliability, and competitive pricing. Sears provided a broad product and service range to meet these needs. In 2024, home improvement spending is projected to reach $480 billion. Sears' focus on this segment aimed to capture a share of this market.

Families represented a core customer segment for Sears, prioritizing affordable home goods and apparel. Sears aimed to offer a convenient, one-stop-shop experience for families. Marketing efforts and promotions were crucial in attracting family shoppers. In 2024, despite struggles, Sears' focus on family-oriented products continued, though sales lagged.

Sears attracted DIY enthusiasts with tools and home improvement supplies. This segment prized quality, selection, and expert advice. Sears provided a broad product range to support DIY projects. In 2024, home improvement spending is projected to reach $480 billion. Sears' DIY focus aimed to capture this market.

Value Shoppers

Sears catered to value shoppers who prioritized affordability and sought out deals. This customer segment was highly price-conscious, always on the lookout for discounts and promotional offers. Sears responded with competitive pricing strategies and loyalty programs to attract and retain these budget-minded consumers. Despite these efforts, Sears struggled to maintain its value proposition in a changing retail landscape.

- Sears' revenue in 2016 was $22.1 billion, reflecting the importance of value shoppers.

- The Shop Your Way loyalty program aimed to retain value shoppers.

- Value shoppers frequently used coupons and sale events.

- Sears' financial difficulties impacted its ability to offer competitive pricing.

Online Shoppers

Sears aimed to capture online shoppers prioritizing convenience and ease of access to products. This customer segment valued a broad selection, smooth online experiences, and quick delivery options. Sears' e-commerce investments were crucial for attracting and keeping these digitally-savvy customers, especially as online retail surged. In 2024, the e-commerce sector continues to grow, with online sales accounting for a significant portion of total retail sales.

- E-commerce sales accounted for approximately 15% of total retail sales in 2024.

- Online shoppers typically expect free shipping and easy returns.

- Sears' online platform needed to compete with Amazon and other major retailers.

- Convenience and selection were key drivers for online customer loyalty.

Sears targeted homeowners seeking appliances, prioritizing quality. Families sought affordable home goods, convenience driving purchases. DIY enthusiasts valued tools and expert advice. Value shoppers prioritized deals. Online shoppers valued convenience.

| Customer Segment | Key Needs | Value Proposition |

|---|---|---|

| Homeowners | Quality, reliability | Appliances, home goods |

| Families | Affordability, convenience | Home goods, apparel |

| DIY Enthusiasts | Quality, selection | Tools, supplies |

| Value Shoppers | Affordability, deals | Competitive pricing |

| Online Shoppers | Convenience, access | E-commerce platform |

Cost Structure

The cost of goods sold (COGS) was a major expense for Sears, encompassing the cost of merchandise. Sears aimed to control COGS by managing its supply chain and negotiating with suppliers. Effective inventory management was also vital to reduce costs related to unsold items. In 2016, Sears' COGS was approximately $17.3 billion.

Operating expenses were a significant part of Sears' cost structure, encompassing rent, utilities, and employee salaries across its retail stores. Efficiency in managing these costs was critical for Sears' profitability. In 2017, Sears' operating expenses were approximately $16.5 billion. To cut expenses, Sears undertook measures such as store closures and staff reductions.

Marketing and advertising expenses were key for Sears Holdings to promote its brand and products. These expenses included developing campaigns, running promotions, and using social media. In 2016, Sears spent $680 million on advertising. Optimizing marketing spend and measuring campaign effectiveness were crucial for ROI. By 2018, these costs were significantly cut due to financial struggles.

Technology and Infrastructure Costs

Technology and infrastructure costs at Sears Holdings encompassed the expenses for the e-commerce platform, customer data management, and online operations support. These costs were significant for staying competitive, especially as online retail grew. Effective cost management was vital for profitability, given the evolving digital landscape. In 2024, companies like Amazon, a major competitor, invested billions in tech infrastructure annually.

- E-commerce platform maintenance costs.

- Customer data management expenses.

- Online operations support costs.

- Competitive necessity in digital retail.

Debt Service

Debt service at Sears involved paying interest and principal on its loans. Sears aimed to cut interest costs and improve finances by managing its debt. Restructuring debt was a key strategy to lessen the burden. In 2017, Sears' long-term debt was about $4.4 billion, reflecting significant financial strain.

- Interest payments consumed a substantial portion of Sears' revenue.

- Debt restructuring efforts aimed to delay or reduce repayments.

- High debt levels limited investments in store improvements.

- Sears sought to sell assets to pay down its debt.

Sears' cost structure included COGS, operating expenses, and marketing costs. In 2016, COGS was $17.3B, and operating expenses were $16.5B in 2017. Marketing spend was $680M in 2016. Significant tech investments are critical for digital retail survival, similar to Amazon's multi-billion-dollar annual spend.

| Cost Category | Year | Approximate Cost |

|---|---|---|

| Cost of Goods Sold (COGS) | 2016 | $17.3 Billion |

| Operating Expenses | 2017 | $16.5 Billion |

| Marketing & Advertising | 2016 | $680 Million |

Revenue Streams

Retail sales were the cornerstone of Sears' revenue, primarily driven by in-store purchases of various goods. This encompassed appliances, clothing, and home essentials, crucial for revenue generation. In 2024, retail sales in the U.S. totaled approximately $7.1 trillion, highlighting the significance of this revenue stream. Sears aimed to increase sales per square foot, a key performance indicator in retail.

E-commerce sales, primarily through Sears.com, were a key revenue driver. Online sales of various merchandise provided a substantial revenue stream for the company. Sears invested in tech and marketing to boost its online sales, aiming for growth. In 2017, online sales accounted for approximately 15% of Sears' total revenue.

Sears generated revenue by offering credit and financing. They charged interest and fees on customer credit purchases, creating a consistent income source. This approach incentivized bigger customer spending. In 2024, such services saw a shift due to the changing retail landscape, with approximately $100 million in revenue. Managing credit risk was crucial for profit.

Home Services Revenue

Sears generated revenue through home services, including appliance repair and installation. This offered convenience and created recurring income. To increase revenue, Sears could expand services and improve quality. In 2024, the home services market is valued at billions. Enhancing these services could boost customer loyalty and sales.

- Home services provided a recurring revenue stream for Sears.

- Expanding services and enhancing quality were key strategies.

- The home services market represents a significant opportunity.

- Focusing on customer satisfaction is essential.

Licensing and Partnerships

Sears, in its business model, utilized licensing and partnerships to generate revenue, a strategy that aimed to leverage its brand and reach beyond its physical stores. This approach involved licensing its proprietary brands to other companies. These partnerships allowed Sears to diversify its revenue streams. Exploring these opportunities was a key strategy.

- Licensing agreements included deals for Sears-branded products.

- Partnerships with other retailers helped expand the reach of Sears' products.

- This strategy aimed to maximize brand value and revenue generation.

- Sears sought to create alternative income sources.

Sears generated revenue through licensing and partnerships, extending its brand's reach. Licensing agreements with other companies for Sears-branded products were common. These partnerships diversified income streams.

| Revenue Stream | Description | Impact |

|---|---|---|

| Licensing | Agreements for Sears-branded products | Diversified income |

| Partnerships | Expansion of products | Increased brand reach |

| Brand Value | Maximizing brand | Alternative income sources |

Business Model Canvas Data Sources

This Sears Holdings Business Model Canvas is data-driven. We used financial reports, competitor analysis, and market studies.