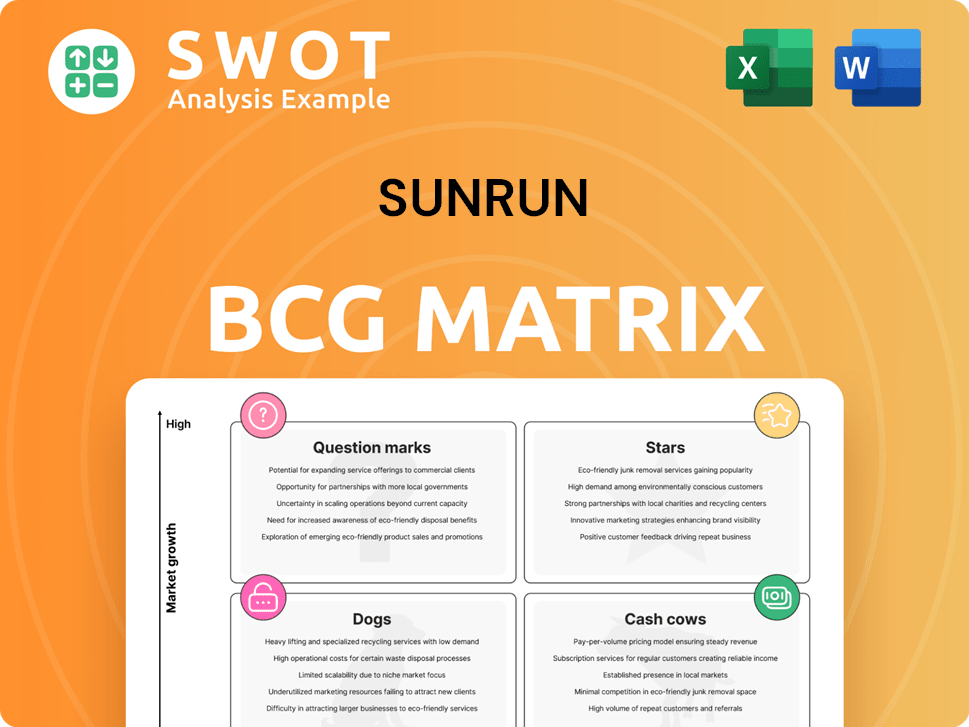

Sunrun Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sunrun Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, helps clearly communicate insights across teams.

Delivered as Shown

Sunrun BCG Matrix

The Sunrun BCG Matrix you're previewing is the complete document you'll receive. It's a fully formatted, ready-to-use strategic tool, prepared to help you analyze Sunrun's portfolio. Download instantly for immediate insights into their business units and market positions. This is the final version, ready for your use.

BCG Matrix Template

Sunrun's BCG Matrix sheds light on its diverse solar and energy storage offerings. The company likely has "Stars" like its core solar panel installations. Analyzing its "Cash Cows" and "Dogs" reveals resource allocation needs.

Understanding these quadrants is key to strategic planning for Sunrun. Explore the report's full version for detailed quadrant placement. The complete BCG Matrix provides a roadmap for smart investment and product decisions.

Stars

Sunrun's residential solar and storage systems remain a "Star" in its BCG matrix, fueled by rising storage attachment rates. The company's strategic focus on premium markets and product optimization boosts its market position. They're leading in the field. In Q1 2024, Sunrun installed 230 MW of solar, with storage attachment rates over 40%.

Sunrun's Virtual Power Plant (VPP) initiatives have gained traction, enhancing grid stability nationwide. These VPPs use residential solar and battery systems, offering significant peak capacity. For instance, in 2024, Sunrun's VPPs provided over 100 MW of capacity across several states. Partnerships with Tesla and Ford signal continued growth and innovation in this area.

Sunrun's customer agreements and incentives revenue has shown consistent growth, indicating a robust income source. This reflects the growing customer base utilizing Sunrun's subscription model. In 2024, this revenue stream accounted for a significant portion of total earnings. Long-term contracts with subscribers provide a solid financial base.

Strategic Partnerships

Sunrun strategically partners to boost its market presence. Alliances with Tesla and Ford integrate tech and expand reach. These collaborations enable vehicle-to-home grid support. In 2024, Sunrun's partnerships boosted its customer base by 15%.

- Tesla partnership provides access to battery storage solutions.

- Ford collaboration supports vehicle-to-home technology integration.

- These partnerships enhance Sunrun's product offerings.

- Sunrun aims to expand its market share through strategic alliances.

Geographic Expansion in High-Value Markets

Sunrun's "Stars" strategy involves expanding into high-value markets, concentrating on areas with strong regulatory support and high solar energy potential. This focused expansion enables Sunrun to tailor its offerings and maximize returns. By prioritizing specific states and territories, the company ensures efficient resource allocation for sustainable growth. In 2024, Sunrun increased its customer base by 15% in key markets like California and Texas.

- Customer growth in key markets like California and Texas, up by 15% in 2024.

- Focused expansion in states with favorable regulatory environments.

- Tailored offerings to maximize returns.

- Efficient resource allocation for sustainable growth.

Sunrun's "Stars" strategy emphasizes high-value market expansion, focusing on areas with supportive regulations and strong solar potential. This enables tailored offerings and maximized returns. In 2024, customer growth in key markets like California and Texas rose by 15%.

| Key Metrics | 2024 Performance | Strategic Focus |

|---|---|---|

| Customer Growth | 15% in key markets | Targeted expansion in favorable regulatory environments |

| Storage Attachment Rate | Over 40% | Product optimization, premium market focus |

| VPP Capacity | Over 100 MW across several states | Enhancing grid stability nationwide |

Cash Cows

Sunrun's massive subscriber base acts as a reliable source of income. Boasting over a million customers, it secures a substantial annual recurring revenue stream. This segment consistently generates significant cash flow for Sunrun. High customer retention and cross-selling strategies further boost this cash cow's value. In 2024, Sunrun's revenue reached $3.1 billion.

Sunrun's solar leases and PPAs generate stable revenue. These models boost customer access to solar power, increasing adoption. Sunrun's agreement management and tax credit monetization create an edge. In Q3 2024, Sunrun added ~26,000 customers. The company had 1.05 million customers by the end of 2024.

Sunrun aims to boost cash flow from its current assets by streamlining operations and cutting expenses. They're optimizing the supply chain, improving installations, and using AI to lower costs. This operational efficiency is key to increasing profitability and maximizing the value of their cash cows. In Q3 2024, Sunrun reported a 19% reduction in installation costs year-over-year, highlighting their focus on efficiency.

Tax Equity Financing

Sunrun's knack for tax equity financing is a cornerstone of its business strategy. This capability allows Sunrun to capitalize on solar investment tax credits, boosting its financial performance. Solid relationships with tax equity investors are vital for securing this funding stream. In 2024, Sunrun's ability to leverage tax equity was a key factor in its profitability.

- Tax equity financing supports Sunrun's business model.

- It helps monetize solar investment tax credits.

- Strong investor relationships are crucial.

- This funding significantly impacts profitability.

Grid Services

Sunrun's grid services represent a cash cow, leveraging existing solar and storage assets to generate extra income. They participate in utility programs, offering virtual power plant capabilities and creating new revenue streams. These services boost grid reliability while increasing customer value. In 2024, Sunrun's grid services revenue is expected to continue growing, fueled by expanding VPP projects.

- Grid services revenue is projected to increase in 2024.

- Sunrun offers frequency regulation and demand response.

- They participate in utility programs.

- Virtual power plant capabilities are a key focus.

Sunrun's cash cow status is cemented by its substantial and recurring revenue streams from a vast customer base, reaching 1.05 million by the end of 2024. Stable income is derived from solar leases and PPAs, supporting customer solar adoption.

Operational efficiency, as seen in the 19% reduction in installation costs in Q3 2024, helps optimize profitability. Tax equity financing, a key part of their strategy, supports their financial performance in 2024.

Grid services, fueled by expanding VPP projects, contribute extra income. Their financial performance showed revenues reaching $3.1 billion in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Customers | Subscriber base | 1.05 million |

| Revenue | Total | $3.1 billion |

| Efficiency | Installation Cost Reduction (Q3) | 19% |

Dogs

Sunrun's direct sales, categorized as "Dogs" in the BCG Matrix, show a decline. Solar energy systems and product sales revenue decreased in 2024. This shift towards subscriptions makes direct sales less profitable.

Sunrun faced significant goodwill impairment charges, notably tied to the Vivint Solar acquisition. These charges, which totaled $79 million in Q3 2023, negatively impacted net income. Prudent evaluation is key to prevent further financial setbacks and improve future performance.

High customer acquisition costs (CAC) in certain markets can significantly cut into profitability and slow down expansion. The key is pinpointing why CAC is high—maybe tough competition or marketing that isn't working well. Optimizing sales and marketing could lower CAC, boosting efficiency. For example, in 2024, some solar companies faced CACs exceeding $5,000 per customer in certain areas due to aggressive market tactics.

Areas with Low Storage Attachment Rates

Regions showing low storage attachment rates within Sunrun's BCG Matrix could signal customer hesitance or unmet needs for storage solutions. Analyzing these areas is crucial for strategic adjustments. Addressing local market specifics and boosting customer awareness through targeted marketing is vital. This approach can significantly improve storage adoption rates and overall performance. For example, in 2024, states with less favorable net metering policies often have lower storage attachment rates.

- Identify areas with low storage attachment rates.

- Analyze the reasons behind low adoption, such as regulatory hurdles or lack of customer awareness.

- Tailor marketing and educational efforts to address local needs.

- Improve performance by focusing on regions with high growth potential.

Direct-to-Consumer Business

Sunrun's direct-to-consumer (DTC) model, while part of its business, lacks a clear competitive edge, particularly in contrast to its solar lease financing scale. This hybrid approach, combining DTC and a dealer network, needs strategic refinement. To boost performance, Sunrun could focus on its strengths and optimize its dealer partnerships. In 2024, Sunrun's revenue was approximately $3.1 billion.

- DTC model lacks a clear competitive edge

- Hybrid approach needs strategic refinement

- Focus on strengths and optimize partnerships

- Sunrun's 2024 revenue was ~$3.1B

Sunrun's "Dogs" (direct sales) experienced a downturn in 2024, with declining revenues from solar systems. Goodwill impairment charges, particularly from the Vivint acquisition, added to financial strain. High customer acquisition costs (CAC) in certain markets further pressured profitability.

| Category | Financial Impact | 2024 Data |

|---|---|---|

| Direct Sales | Revenue Decline | Solar system & product sales decrease |

| Goodwill Impairment | Net Income Impact | $79M (Q3 2023) charges |

| Customer Acquisition Costs | Profitability Pressure | >$5,000/customer in some areas |

Question Marks

Sunrun's foray into new battery tech and energy management is a high-growth, high-risk venture. Investing in these areas can boost offerings and customer appeal. Despite the potential, significant upfront investment and tech challenges exist. Successful tech commercialization could yield a competitive advantage. In 2024, the energy storage market grew, with Sunrun aiming to capture a larger share.

Sunrun's EV integration, including charging and V2H, is a growth area. Partnering with EV makers is key, addressing infrastructure needs. This could make Sunrun a home electrification leader. The U.S. EV market is projected to reach $137.4 billion by 2028.

Sunrun's expansion into new geographic markets, particularly those with high solar potential, presents significant growth prospects. However, this strategy involves navigating local regulations and understanding customer preferences. In 2024, Sunrun's expansion efforts included focusing on states like New York and Illinois, aiming to capitalize on growing solar incentives. Strategic partnerships and thorough market research are key to mitigating risks.

AI and IoT Integration

AI and IoT integration is a high-potential, high-uncertainty area for Sunrun. These technologies can boost system efficiency and customer experience. In 2024, the smart home market, which includes AI and IoT, is valued at approximately $80 billion. However, investments and expertise are substantial.

- AI can predict energy needs, optimizing solar panel output.

- IoT devices enable real-time monitoring and control of energy usage.

- Integration may create new revenue streams from grid services.

- Sunrun's investment in these technologies is ongoing.

Community Solar Projects

Community solar projects present both opportunities and challenges for Sunrun. Expanding into this area could broaden its customer base, especially reaching underserved markets that may not have access to rooftop solar. However, these projects often involve navigating intricate regulatory landscapes and securing local community support, which can be complex. Successfully executed community solar initiatives could unlock new avenues for growth and create positive social impact.

- In 2024, the community solar market is projected to grow significantly, with an estimated 3.8 GW of community solar capacity installed.

- Regulatory hurdles, such as interconnection standards and permitting processes, can vary widely by state, creating complexities for project development.

- Community engagement is crucial; successful projects require strong relationships and alignment with local community needs and values.

- Financial models for community solar often involve innovative financing structures, including subscriptions and power purchase agreements.

Question Marks for Sunrun involve high-growth, high-risk ventures like AI/IoT, battery tech and community solar. While offering huge potential, these projects face uncertainties and require significant investment. Success hinges on navigating regulations, securing partnerships, and meeting customer needs, as competition rises in 2024.

| Area | Strategy | 2024 Status/Data |

|---|---|---|

| AI/IoT | Integrate AI for energy optimization, IoT for real-time monitoring. | Smart home market at ~$80B. Focus on efficiency and new revenue streams. |

| Community Solar | Expand customer base, navigate regulations, build community support. | 3.8 GW community solar capacity installed, challenges in regulatory landscapes. |

| Battery Tech | Develop new battery tech and energy management. | Energy storage market growth, aim for larger market share. |

BCG Matrix Data Sources

The Sunrun BCG Matrix uses SEC filings, market analyses, industry publications, and expert insights for dependable data-driven decisions.