Sunrun Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sunrun Bundle

What is included in the product

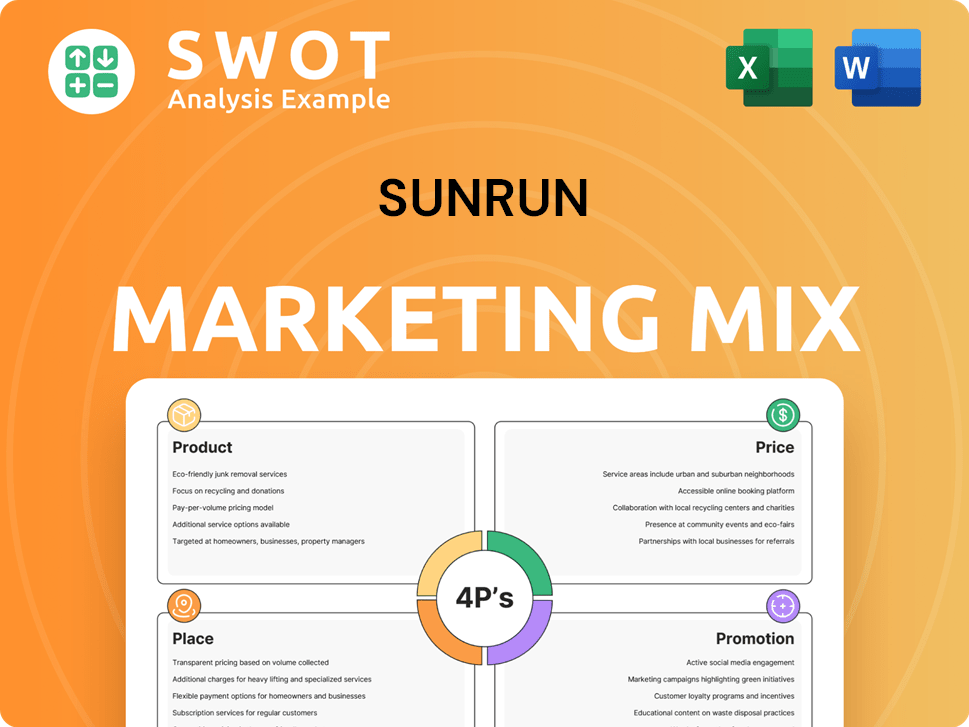

Provides a thorough analysis of Sunrun's 4Ps: Product, Price, Place, and Promotion.

Helps non-marketing teams instantly understand Sunrun's solar strategy through a clean and focused 4P's breakdown.

What You Preview Is What You Download

Sunrun 4P's Marketing Mix Analysis

This is the very Marketing Mix analysis you will get—no hidden content. It's the same Sunrun-focused document ready to download. Examine every detail of the real version. Purchase with total confidence, knowing the value you see is the value you get.

4P's Marketing Mix Analysis Template

Sunrun dominates the solar market, but how? Their product strategy, from panels to battery storage, is a key factor. Pricing strategies reflect different financing options & market positioning. Strategic partnerships and a strong online presence optimize Place. Targeted ads and community events highlight Promotion. Get the full picture, analyze their entire marketing mix for insights, and elevate your own strategy—unlock the full, editable report now!

Product

Sunrun's residential solar systems are a cornerstone of its marketing strategy. They design, install, finance, and maintain solar panels for homeowners, customizing systems for individual energy needs. This core offering lets customers generate their own clean power. In Q1 2024, Sunrun installed 145 MW of solar, showcasing continued demand.

Sunrun's product strategy includes battery storage solutions, like Tesla Powerwall and Enphase batteries. These batteries store excess solar energy, boosting energy independence. In 2024, the residential battery storage market grew significantly. Sales of residential storage systems increased by 50% year-over-year. This offers backup power during outages, appealing to many homeowners.

Sunrun's energy management services optimize energy use for solar and storage system owners. They monitor system performance and manage energy flow, enhancing system efficiency. In Q1 2024, Sunrun's customer base grew, indicating strong demand for these services. This helps customers save money and improve grid stability. Sunrun's services are key to its value proposition.

Virtual Power Plant Participation

Sunrun's virtual power plant (VPP) participation is a key component of its marketing mix, focusing on product strategy. The company aggregates stored energy from customers' batteries to support the grid. This VPP approach provides grid stability and offers homeowners incentives. Sunrun's VPP programs are expanding, with over 80,000 systems participating by late 2024.

- Increased Grid Stability: VPPs help balance energy supply and demand.

- Customer Incentives: Homeowners earn by sharing excess energy.

- Technological Integration: Sunrun uses advanced software for VPP management.

- Strategic Expansion: Plans for continued growth in VPP capabilities.

Electric Vehicle Charging and Integration

Sunrun's marketing mix includes electric vehicle (EV) charging and integration, offering EV charger installations and bidirectional energy flow. This allows EVs like the Ford F-150 Lightning to power homes. In 2024, the U.S. EV charger market was valued at $1.8 billion, projected to reach $9.3 billion by 2030. Sunrun's integration enhances home energy resilience and reduces reliance on the grid.

- 2024 U.S. EV charger market: $1.8 billion.

- Projected 2030 market value: $9.3 billion.

- Bidirectional charging benefits: Home backup power.

- Sunrun's focus: Home energy solutions.

Sunrun's product offerings encompass residential solar systems, battery storage, and energy management services. These integrated solutions boost energy independence for homeowners. Battery storage sales saw a 50% YoY increase in 2024.

Sunrun's virtual power plants (VPPs) provide grid stability and homeowner incentives; over 80,000 systems participated by late 2024. EV charging and bidirectional energy flow further enhance energy resilience.

| Product | Key Features | 2024 Data |

|---|---|---|

| Solar Systems | Custom design, install, finance, and maintain. | 145 MW installed in Q1 2024. |

| Battery Storage | Tesla Powerwall, Enphase batteries; backup power. | 50% YoY sales growth. |

| Energy Services | Optimized energy use; system monitoring. | Customer base expanded in Q1 2024. |

| Virtual Power Plant | Aggregate stored energy; grid support. | 80,000+ systems by late 2024. |

| EV Charging | Charger installs; bidirectional energy. | U.S. market at $1.8B in 2024, $9.3B projected by 2030. |

Place

Sunrun heavily relies on direct-to-consumer sales, controlling the entire customer journey. This approach includes lead generation, sales consultations, and installation. In Q1 2024, Sunrun's customer additions were 23,000. This model allows for direct customer relationships and service. Direct sales are a key component of their marketing mix.

Sunrun leverages third-party dealers to boost sales and installations. This strategy allows Sunrun to access diverse markets and scale operations. Dealers often offer Sunrun's financing options, making solar more accessible. In Q1 2024, Sunrun's dealer channel contributed significantly to customer additions, indicating its effectiveness.

Sunrun's online platform, www.sunrun.com, is a pivotal direct sales channel, handling a substantial portion of customer interactions. This digital presence is crucial for lead generation, with approximately 60% of leads originating online in 2024. Customer engagement metrics, such as website traffic and time spent on site, have increased by 15% year-over-year, showcasing the platform's effectiveness.

Retail Partnerships

Sunrun's retail partnerships, notably with Lowe's, are key to its marketing strategy. These partnerships enable Sunrun to showcase its solar and storage solutions in physical stores, boosting visibility. This strategy provides direct customer interaction and sales opportunities. As of Q1 2024, Sunrun's partnership with Lowe's has facilitated significant customer acquisition.

- Expanded Reach: Retail partnerships increase Sunrun's customer base.

- Increased Sales: Physical presence drives direct sales.

- Brand Awareness: Retail locations improve brand visibility.

- Customer Engagement: In-store interactions educate consumers.

New Homebuilder Partnerships

Sunrun's collaboration with homebuilders, such as Toll Brothers, integrates solar and storage solutions directly into new constructions. This strategic move simplifies solar adoption for new homeowners, enhancing market access. By 2024, the residential solar market is experiencing significant growth; Sunrun's approach aligns with this trend. The partnership model streamlines sales and installation processes, boosting efficiency.

- Toll Brothers reported delivering 2,663 homes in Q1 2024, highlighting the scale of potential solar installations.

- Sunrun’s Q1 2024 shareholder letter mentions continued expansion in partnerships with homebuilders.

- The U.S. residential solar market grew 29% year-over-year in Q1 2024, according to SEIA.

Sunrun's "Place" strategy involves diverse channels like direct sales and partnerships to enhance market reach. Partnerships with retailers such as Lowe's are crucial, with physical locations facilitating customer acquisition and boosting brand awareness. Collaboration with homebuilders streamlines solar adoption, capitalizing on the residential solar market's growth. These strategies aim to optimize customer access.

| Channel | Strategy | Q1 2024 Metrics |

|---|---|---|

| Direct-to-Consumer | Lead generation, sales, installation | 23,000 customer additions |

| Dealers | Third-party sales and installation | Significant contribution to customer additions |

| Online Platform | Website sales and customer interaction | 60% of leads online, 15% YoY website traffic increase |

| Retail Partnerships (Lowe's) | In-store solar solution display | Customer acquisition through in-store interactions |

| Homebuilder Partnerships (Toll Brothers) | Solar integrated into new homes | 2,663 homes delivered by Toll Brothers in Q1 2024 |

Promotion

Sunrun's 2024 strategy includes digital marketing through Google and Facebook Ads. They aim to connect with homeowners seeking solar options. The company's digital ad spend in 2023 was approximately $150 million. Digital campaigns generate a significant portion of Sunrun's leads. This approach boosts brand visibility and customer acquisition.

Sunrun boosts customer acquisition via referral programs. These programs reward existing customers for successful referrals. In 2023, referral programs significantly contributed to customer growth. Sunrun's referral initiatives offer incentives like bill credits. This strategy leverages word-of-mouth marketing effectively.

Sunrun's educational marketing strategy focuses on informing consumers about solar energy benefits. They use their website, blog, and social media. As of late 2024, Sunrun's online content saw a 20% increase in engagement. This helps build trust and brand awareness. This approach supports informed decision-making about clean energy options.

al Offers and Incentives

Sunrun actively uses promotions and incentives to boost customer acquisition. They provide discounts on initial solar system payments and bundle deals that include both solar panels and energy storage solutions. These strategies aim to lower the upfront cost and make solar energy more appealing. In Q1 2024, Sunrun reported a 20% increase in customer additions, partly due to these promotional efforts.

- Discounts on initial payments.

- Bundled offers for solar and storage systems.

- Q1 2024: 20% increase in customer additions.

Brand Building and Awareness

Sunrun strategically builds its brand around reliability, quality, and excellent customer service, setting itself apart in the solar industry. This approach has led to significant brand recognition, crucial in a market where trust is paramount. Their brand-building efforts include extensive marketing campaigns, partnerships, and a focus on customer satisfaction. In 2024, Sunrun's marketing spend was approximately $200 million, reflecting its commitment to brand visibility.

- Achieved significant brand recognition.

- Marketing spend in 2024 was approximately $200 million.

- Focus on customer satisfaction.

Sunrun uses promotions such as payment discounts and bundled deals. These strategies helped boost customer acquisitions. In Q1 2024, customer additions grew by 20% because of these initiatives.

| Promotion Type | Description | Impact (Q1 2024) |

|---|---|---|

| Payment Discounts | Reduced upfront costs. | Increased customer acquisition. |

| Bundle Deals | Packages with solar and storage. | Improved market appeal. |

| Customer Additions | Referral programs & Incentives | 20% growth attributed to promotion efforts |

Price

Sunrun's pricing strategy heavily relies on solar lease agreements. Customers pay a fixed monthly rate for using Sunrun's solar systems, typically over 20-25 years. This model offers predictability, with 60% of new customers choosing leases in 2024. In Q1 2024, the average monthly payment for a Sunrun lease was around $100-$150, depending on system size and location. This approach contrasts with outright purchases.

Sunrun utilizes Power Purchase Agreements (PPAs) as a key element of its marketing strategy. Customers pay a fixed rate per kWh for solar energy, while Sunrun handles system ownership and maintenance. This model simplifies the transition to solar, reducing upfront costs. In 2024, PPAs were a significant driver of Sunrun's customer acquisition, with approximately 20% of new customers opting for this financing option.

Sunrun offers solar loans, enabling customers to own their systems. This can unlock tax benefits and boost home value. According to a 2024 report, solar loan adoption is up 15% year-over-year. Loan options often feature fixed interest rates. The average loan term is 20-25 years, as of late 2024.

Cash Purchase

Sunrun's cash purchase option allows customers to buy solar systems directly. This maximizes financial returns by eliminating financing costs. Customers are then eligible for all available incentives, like the federal solar tax credit. This approach offers the best long-term value.

- In 2024, the federal tax credit is 30% of the system cost.

- Cash purchases avoid interest payments, increasing savings.

- Sunrun offers competitive pricing for cash deals.

Incentives and Tax Credits

Sunrun's pricing strategy is heavily influenced by federal, state, and local solar incentives and tax credits. These incentives substantially decrease the upfront or overall cost of solar systems for customers. The specifics of these benefits depend on how the customer finances their system, such as through a purchase or a lease. These incentives are designed to stimulate the adoption of solar energy.

- Federal Investment Tax Credit (ITC): The ITC allows homeowners to deduct 30% of the cost of installing solar from their federal taxes.

- State and Local Incentives: These include rebates, tax credits, and other programs that further reduce costs.

- Financing Impact: The benefits vary based on whether the customer buys or leases a system.

Sunrun employs a multi-faceted pricing approach. Solar leases and PPAs provide predictable monthly payments, with leases being favored by 60% of customers in 2024. Loans enable ownership, and cash purchases maximize returns. The 30% federal tax credit significantly impacts system costs.

| Pricing Model | Description | Key Benefit |

|---|---|---|

| Solar Lease | Fixed monthly payments over 20-25 years. | Predictable costs |

| PPA | Pay per kWh used. | Reduced upfront cost |

| Solar Loan | Ownership through financing | Tax benefits and increased home value |

4P's Marketing Mix Analysis Data Sources

We analyze SEC filings, earnings calls, investor presentations, company websites, and market research for the Sunrun 4Ps.