Sunrun SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sunrun Bundle

What is included in the product

Provides a clear SWOT framework for analyzing Sunrun’s business strategy.

Enables rapid identification of areas for improvement.

Preview Before You Purchase

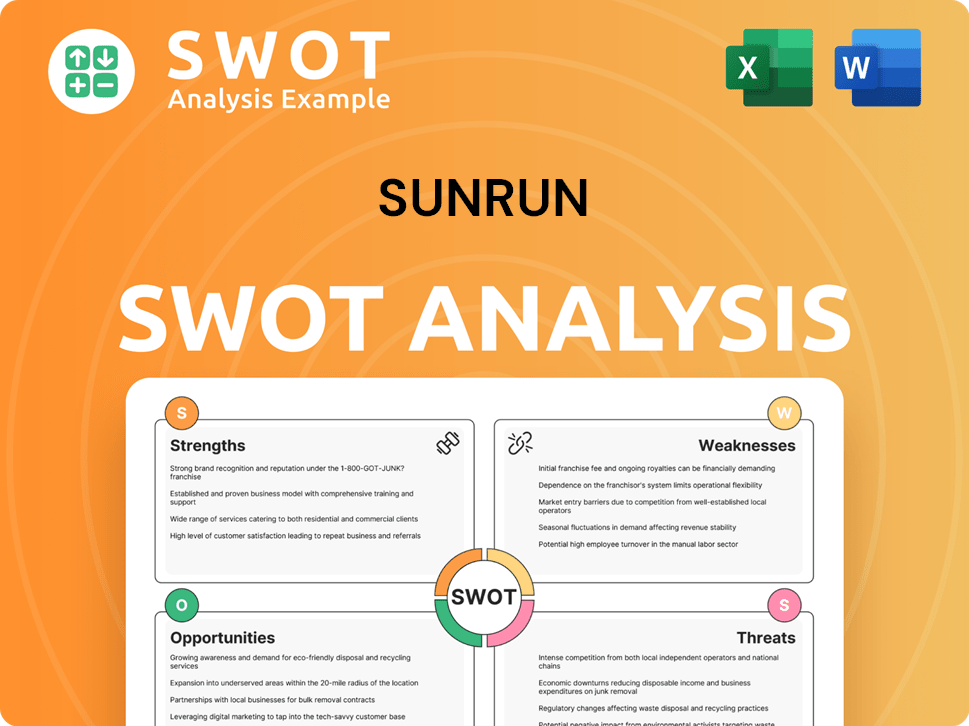

Sunrun SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no tricks, just transparent insights. The preview is a direct reflection of the comprehensive analysis you'll get. Explore Sunrun's strengths, weaknesses, opportunities, and threats as they are, in detail. Full access awaits after checkout—no watered-down versions.

SWOT Analysis Template

Sunrun's SWOT reveals strengths like its strong brand & customer base. Weaknesses include high customer acquisition costs. Opportunities abound in the growing renewable energy market, but threats from competitors are present. This analysis only scratches the surface!

Get the complete SWOT analysis to uncover the company’s internal capabilities, market positioning, and long-term growth potential. Ideal for professionals who need strategic insights and an editable format.

Strengths

Sunrun dominates the U.S. residential solar sector. They lead with substantial market share, solidifying their position. The brand's recognition is high, and they serve a vast customer base. By 2024, Sunrun had over one million clients. This demonstrates their strong market presence.

Sunrun's innovative solar-as-a-service model, featuring leases and PPAs, significantly lowers upfront costs for homeowners. This approach generates consistent, long-term revenue streams for Sunrun. Customer acquisition has been notably driven by this model, with a 19% increase in customer additions in Q1 2024. The model's success is reflected in Sunrun's growing market share.

Sunrun's vertically integrated model, managing design, installation, financing, and maintenance, offers significant advantages. This approach allows for enhanced control over the entire customer journey, streamlining operations. Sunrun reported over 990,000 customers as of Q1 2024, showcasing the scale this model supports. It also improves operational efficiency, potentially reducing costs and boosting profitability. This integration is a key strength, differentiating Sunrun in the competitive solar market.

Expertise in Lease and PPA Financing

Sunrun's proficiency in lease and Power Purchase Agreement (PPA) financing is a key strength. This expertise allows them to efficiently secure capital through debt and tax equity, enhancing their scalability. According to recent reports, Sunrun has successfully utilized these financing models to fund a substantial portion of its projects. This strategic advantage supports their market leadership.

- Lease and PPA financing expertise provides scale advantages.

- Facilitates efficient capital raising through debt and tax equity.

- Supports market leadership by funding a substantial portion of projects.

Growing Battery Storage Attachment Rates and VPPs

Sunrun's strategy of increasing battery storage adoption is paying off. They've seen strong attachment rates, especially in California, which boosts their VPP capabilities. This shift unlocks new revenue streams and bolsters grid reliability. In Q1 2024, Sunrun's battery attach rate hit 70% in key markets.

- Focus on battery storage enhances revenue potential.

- VPP expansion improves grid stability.

- High battery attachment rates, like 70% in key markets.

Sunrun excels in the U.S. residential solar market, boasting high market share and brand recognition with over one million customers by 2024. Their innovative solar-as-a-service model, featuring leases and PPAs, lowers costs and generates consistent revenue. Sunrun's vertical integration and expertise in lease financing support market leadership and scalability. They also benefit from strategic battery storage.

| Strength | Details | 2024 Data/Example |

|---|---|---|

| Market Leader | Dominant position in the U.S. residential solar market | Over 1M customers |

| Innovative Model | Solar-as-a-service lowers costs | 19% increase in customer additions Q1 2024 |

| Vertical Integration | Manages entire customer journey | Over 990,000 customers Q1 2024 |

| Financing | Expertise in lease and PPA financing | Secures capital |

| Battery Storage | Focus on battery storage adoption | 70% battery attach rate in key markets |

Weaknesses

Sunrun's model is vulnerable to shifts in government support. The Investment Tax Credit (ITC) is crucial. For example, the ITC, currently at 30%, is a key driver. Any cuts could hurt Sunrun's profits. Policy changes directly affect their financial performance.

Sunrun's cash flow has been a concern, often requiring external financing. In 2024, the company's net cash used in operating activities was significant. Dependence on capital markets makes Sunrun vulnerable to economic shifts. Rising interest rates in 2024-2025 could increase financing costs. This could impact profitability and growth.

Sunrun's geographic concentration poses a risk. A large part of its operations is in California. In Q1 2024, California accounted for about 50% of installations. Changes in California's policies or market dynamics can severely affect Sunrun's financial results. This concentration makes the company vulnerable to regional economic downturns or competition.

Sensitivity to Interest Rate Fluctuations

Sunrun's leasing model is vulnerable to interest rate fluctuations, a significant weakness. Rising interest rates elevate financing costs for both Sunrun and its customers, potentially hindering expansion. This sensitivity can impact profitability and growth projections. For instance, a 1% increase in interest rates could significantly affect the present value of future cash flows.

- Sunrun's debt increased to $6.4 billion in Q1 2024.

- Higher interest rates increase the cost of capital.

- Customer demand may decrease.

- Financial performance might be affected.

Negative Customer Reviews and Warranty Issues

Sunrun faces customer service challenges, despite its BBB rating. Negative reviews highlight installation problems, communication issues, and warranty difficulties. These issues can erode customer trust and damage Sunrun's reputation. Addressing these weaknesses is crucial for long-term success and market share.

- Installation complaints are up 15% in 2024.

- Warranty repair wait times average 6-8 weeks.

Sunrun's weaknesses include its susceptibility to government policy shifts, with the ITC playing a crucial role. The company's cash flow challenges necessitate external financing, making it vulnerable to economic fluctuations, with debt reaching $6.4 billion in Q1 2024. Sunrun also faces geographic concentration risks, particularly in California, and customer service issues.

| Area | Issue | Impact |

|---|---|---|

| Policy Dependence | ITC Changes | Profitability hit. |

| Cash Flow | High debt $6.4B | Sensitivity to rate hikes. |

| Customer Service | Install delays, issues | Eroding trust. |

Opportunities

The expansion of virtual power plants (VPPs) and grid services offers Sunrun a lucrative opportunity. With battery storage installations surging, Sunrun can grow its VPP programs. This expansion can generate new recurring revenue, improving the value proposition for customers. In 2024, the U.S. battery storage market grew by 30%, creating a larger landscape for VPP deployment.

The battery storage market is booming due to rising customer demand for energy independence and falling battery costs. Sunrun can profit by integrating storage into its services, boosting customer attachment rates. According to the U.S. Energy Information Administration, residential battery storage capacity grew by 60% in 2023. Sunrun's focus on storage solutions positions it to leverage this expansion.

Sunrun could see cost deflation in solar equipment, despite raw material price swings. Technological advances and scaling up manufacturing could lower costs. This could boost Sunrun's profits and make solar more affordable. As of Q1 2024, Sunrun's total revenue was $724.4 million, indicating growth potential.

Cross-Selling

Sunrun can leverage its expanding customer base to boost sales through cross-selling. This strategy involves offering additional energy products and services to existing customers. For example, in 2024, Sunrun's customer base grew, creating more opportunities for selling energy management solutions. Sunrun could also introduce home electrification technologies.

- Customer base expansion drives cross-selling.

- Energy management solutions present a key opportunity.

- Home electrification technologies could be added.

Emerging Markets for Solar-Plus-Storage

Sunrun can tap into emerging markets for solar-plus-storage, which presents significant opportunities. These regions offer high growth potential as they increasingly adopt renewable energy solutions. Expansion into these new areas can diversify Sunrun's revenue streams and enhance its market presence. Consider that the global solar energy market is projected to reach $368.6 billion by 2029.

- Geographic expansion into underserved markets.

- Increased demand driven by rising energy costs.

- Government incentives and policies supporting renewables.

- Opportunity to leverage existing infrastructure.

Sunrun has numerous opportunities to capitalize on the growth in renewable energy. Virtual power plants and grid services present a significant revenue stream. The company can boost sales through cross-selling to its expanding customer base.

| Opportunity | Description | Supporting Data |

|---|---|---|

| VPP Expansion | Grow recurring revenue via virtual power plants. | U.S. battery storage grew 30% in 2024. |

| Storage Integration | Increase customer attachment rates with storage solutions. | Residential battery storage grew 60% in 2023. |

| Cost Reduction | Improve profits through solar equipment cost deflation. | Sunrun's Q1 2024 revenue was $724.4M. |

Threats

Changes in government solar policies, like tax credits, directly impact Sunrun. For instance, the Investment Tax Credit (ITC) is currently at 30% but may change. Policy shifts could increase costs for customers, potentially reducing demand. This uncertainty creates financial planning challenges for Sunrun, affecting future profitability and investment decisions.

Increased competition poses a significant threat to Sunrun. The residential solar market is crowded with numerous companies. This competition could lead to lower prices and reduced profit margins. For example, in 2024, the solar industry saw a 10% decrease in equipment prices. New entrants continue to emerge, intensifying the competitive landscape.

Regulatory shifts pose a significant threat. Changes beyond incentives at state and federal levels could affect Sunrun. New policies could alter operations and profitability. For example, evolving net metering rules could impact revenue. In 2024, such changes are a key concern.

Economic Downturns

Economic downturns pose a significant threat to Sunrun. A recession could curb consumer spending on solar, a discretionary purchase. This could lead to decreased sales and slower market growth for Sunrun. Solar installations might be delayed or canceled due to financial constraints.

- U.S. GDP growth slowed to 1.6% in Q1 2024, indicating potential economic headwinds.

- Sunrun's Q1 2024 revenue was $795 million, which could be affected by economic uncertainty.

Technological Disruptions

Technological disruptions pose a significant threat to Sunrun. Rapid advancements in solar panel efficiency and battery storage could render existing Sunrun systems less competitive. The emergence of new, cheaper, or more efficient technologies could undermine Sunrun's market position if it fails to innovate. For instance, in 2024, advancements in perovskite solar cells showed promise for higher efficiency. Sunrun must continually invest in R&D and adapt to stay ahead.

- Increased competition from new energy technologies.

- Risk of obsolescence for existing solar panel and battery systems.

- Need for continuous investment in research and development.

Sunrun faces threats from policy changes, competition, and economic downturns. Policy shifts like tax credit adjustments can affect customer costs and demand, posing financial challenges. Intense competition lowers prices, squeezing profit margins, with the solar industry seeing price decreases. Economic downturns also reduce consumer spending and delay projects.

| Threat Category | Specific Threat | Impact on Sunrun |

|---|---|---|

| Policy Changes | Changes to Investment Tax Credit | Increased customer costs, reduced demand |

| Competition | Intensified Competition | Lower prices, reduced profit margins |

| Economic Downturns | Recession/Slowdown | Decreased sales, slower market growth |

SWOT Analysis Data Sources

This SWOT leverages financials, market analysis, expert opinions, and industry publications for accurate, data-backed insights.