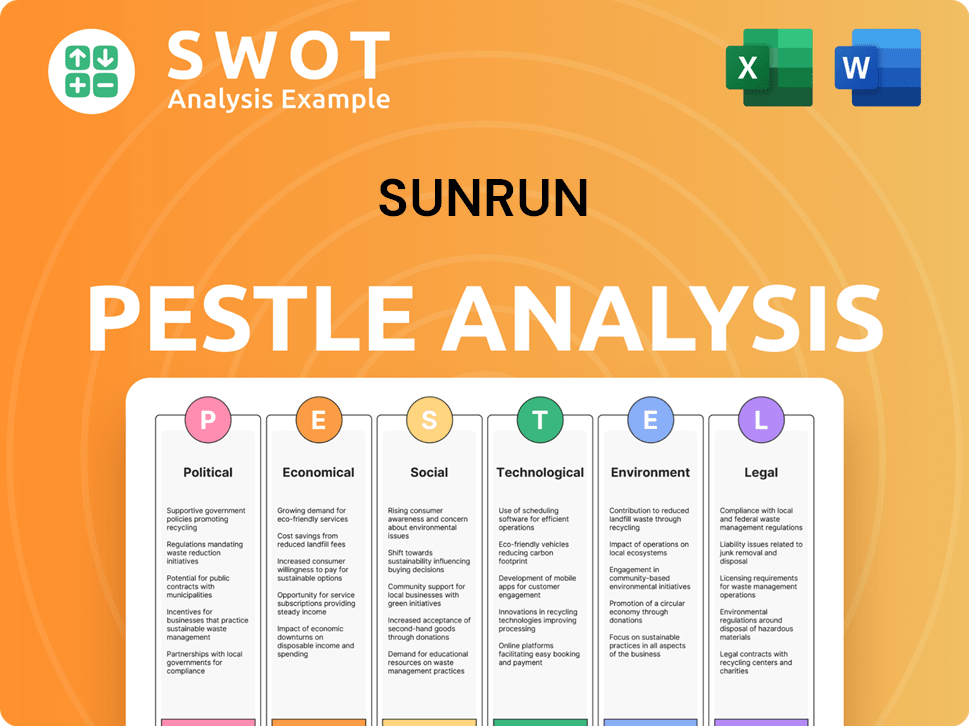

Sunrun PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sunrun Bundle

What is included in the product

This PESTLE analysis assesses external factors impacting Sunrun, covering political, economic, social, technological, environmental, and legal aspects.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Sunrun PESTLE Analysis

The content shown here is the Sunrun PESTLE Analysis you'll download. See the same, fully formatted document post-purchase.

PESTLE Analysis Template

Discover how external factors influence Sunrun's strategic landscape with our PESTLE Analysis. Explore political shifts and economic fluctuations shaping the solar industry. Analyze social trends, technological advancements, legal frameworks, and environmental considerations. Gain invaluable insights into Sunrun’s competitive position and future prospects. Buy the full version and unlock comprehensive, actionable intelligence.

Political factors

Government incentives, like the federal Investment Tax Credit (ITC), play a crucial role in solar energy adoption. Sunrun's business model heavily relies on these policies, with the weighted average ITC expected to be about 44% in 2025. Any changes to these incentives could directly impact Sunrun's pricing and profit margins. For example, the ITC provides a tax credit for 30% of the cost of solar, impacting affordability.

State-level renewable energy goals and mandates significantly boost the market for companies like Sunrun. These policies, promoting clean tech, drive demand for solar and storage solutions. For instance, in 2024, California aims for 100% clean energy by 2045, boosting solar adoption. Such targets create a stable, expanding market for Sunrun's offerings.

Local and federal regulations significantly influence Sunrun's operations. Permitting and interconnection policies vary widely by state, affecting installation costs and timelines. For example, the Inflation Reduction Act of 2022 offers substantial tax credits, boosting solar adoption. The U.S. solar market grew 52% in 2023, showing the impact of federal support. These regulatory shifts can create both opportunities and challenges for Sunrun.

Political Stability and Support for Renewables

Political factors significantly shape Sunrun's operational environment. Government policies and regulations, such as tax credits and renewable energy mandates, directly affect the company's profitability and expansion. The Biden administration's Inflation Reduction Act of 2022, for example, includes substantial tax credits for solar energy, boosting demand. However, shifts in political power can introduce uncertainty, impacting long-term investment decisions.

- The Inflation Reduction Act of 2022 provides a 30% tax credit for residential solar installations.

- State-level policies, such as net metering regulations, vary widely and influence the economics of solar adoption.

- Political stability is crucial for investor confidence and project financing.

Trade Policies and Tariffs

Trade policies significantly impact Sunrun. Tariffs on imported solar panels and components directly affect their costs and supply chain efficiency. For instance, the U.S. imposed tariffs on imported solar panels in 2018, which increased costs. These policy shifts introduce uncertainty, potentially impacting project timelines and profitability. The competitiveness of solar installations can be directly influenced by these factors.

- In 2024, the U.S. continued to evaluate and adjust tariffs on solar products, impacting companies like Sunrun.

- Changes in trade agreements with countries like China can rapidly alter the cost structure for solar installations.

- Sunrun must strategically manage its supply chain to mitigate risks associated with tariff fluctuations.

Political factors deeply affect Sunrun's profitability, driven by government incentives like the federal ITC, offering about 44% weighted average credit in 2025. State-level renewable energy targets, exemplified by California’s 2045 clean energy goal, boost solar demand. Regulations and trade policies, including tariffs and the Inflation Reduction Act, influence costs and supply chains.

| Political Factor | Impact on Sunrun | Recent Data/Examples |

|---|---|---|

| Federal Incentives | Affects pricing, margins | ITC: 30% tax credit on solar installations from the Inflation Reduction Act of 2022. |

| State Mandates | Drives demand | California’s goal of 100% clean energy by 2045. |

| Regulations & Trade | Influences costs & supply | US solar market grew 52% in 2023 due to federal support, trade policies changed in 2024 |

Economic factors

Rising interest rates can make solar loans less attractive, potentially reducing customer demand for Sunrun's services. Higher rates increase the cost of capital for Sunrun, impacting its profitability. In 2024, the Federal Reserve maintained its benchmark interest rate, but future fluctuations could affect Sunrun's financing costs. Sunrun's reliance on financing makes it sensitive to these economic shifts.

Macroeconomic trends significantly impact Sunrun. Economic downturns or high inflation can curb consumer spending on solar installations. Consumer confidence directly influences homeowners' solar investment decisions. In 2024, inflation concerns and fluctuating interest rates may affect Sunrun's growth. The U.S. solar market is projected to grow, but economic headwinds remain.

Sunrun faces fluctuating costs for vital materials. Polysilicon and battery prices directly affect their expenses. For instance, battery costs rose in 2023, impacting profitability. Effective cost management is vital for their competitiveness. This is important for maintaining healthy profit margins.

Access to Capital and Financing

Sunrun's model hinges on securing capital to fund solar installations, primarily through tax equity and debt. Access to affordable financing directly impacts Sunrun's ability to deploy solar systems and expand its customer base. Higher interest rates or reduced availability of tax equity can significantly increase costs and slow growth.

- In Q1 2024, Sunrun secured $1.1 billion in financing.

- Sunrun's debt-to-equity ratio was approximately 2.5 as of Q1 2024.

- The weighted average interest rate on Sunrun's debt was around 6.5% in early 2024.

Electricity Prices

Rising retail electricity prices significantly boost the appeal of solar energy for homeowners, directly benefiting Sunrun. As of early 2024, the U.S. average retail electricity price was around 17 cents per kilowatt-hour, a figure that has steadily increased. This trend makes Sunrun's solar offerings more financially competitive. Higher prices from traditional utilities often lead to increased adoption of solar solutions, fueling Sunrun's growth and market share.

- U.S. average retail electricity price was approximately 17 cents/kWh (early 2024).

- Sunrun's services become more attractive as traditional electricity costs rise.

- Increased adoption of solar solutions is expected.

Economic factors significantly influence Sunrun's performance. Interest rate fluctuations impact solar loan attractiveness and Sunrun's financing costs. Inflation and economic downturns can curb consumer spending. As of Q1 2024, Sunrun secured $1.1B in financing, yet high rates remain a concern.

| Factor | Impact on Sunrun | 2024 Data/Projections |

|---|---|---|

| Interest Rates | Affects loan attractiveness & financing costs | Benchmark rate held in early 2024, ~6.5% debt rate |

| Inflation/Recession | Impacts consumer spending on solar | Growth projected; headwind concerns |

| Electricity Prices | Boosts appeal of solar energy | U.S. avg. 17 cents/kWh (early 2024) |

Sociological factors

Consumer awareness of climate change and the benefits of clean energy has increased. This boosts demand for residential solar. In 2024, solar installations grew, with residential solar capacity reaching 8.3 GW. Sunrun is well-positioned to capitalize on this trend. Consumer preference for energy independence further fuels this growth.

Sunrun's customer base hinges on homeowners, so demographics are key. Homeownership rates vary; in 2024, around 65% of U.S. households owned their homes. Income levels are crucial, with higher earners often more likely to adopt solar. Age also plays a role, as older homeowners might have different priorities.

Sunrun's community engagement and public perception are crucial. Positive relationships and trust are key for market expansion and customer loyalty. Addressing concerns about sales practices and customer service is vital. Sunrun's Q1 2024 customer satisfaction score was 82%, reflecting ongoing efforts to improve. Focusing on ethical practices and community benefits strengthens their brand.

Lifestyle Changes and Electrification

Lifestyle shifts, such as the rise of electric vehicles (EVs) and home electrification, are pivotal for Sunrun. The integration of solar and storage with home energy solutions becomes increasingly relevant. Home electrification is growing, with a 20% increase in heat pump installations in 2024. Sunrun can capitalize on this trend.

- EV sales are expected to reach 40% of all new car sales by 2025.

- Home battery storage installations rose by 60% in 2024.

- Sunrun's customer base grew by 25% in the last year.

Disaster Resilience and Energy Security

Societal anxieties regarding grid reliability and severe weather events are escalating, fueling demand for battery storage for backup power and energy security. Sunrun's services directly address this need, attracting homeowners seeking enhanced resilience. In 2024, approximately 70% of U.S. households experienced power outages, driving interest in backup solutions. Sunrun's focus aligns with these growing concerns.

- 70% of U.S. households experienced power outages in 2024.

- Extreme weather events are increasing, impacting grid reliability.

- Demand for backup power solutions is rising.

Rising climate awareness boosts solar adoption. Grid unreliability drives battery demand. Sunrun gains from lifestyle shifts towards EVs and home electrification.

| Sociological Factor | Impact on Sunrun | Data (2024/2025) |

|---|---|---|

| Consumer Awareness | Increases demand | Solar capacity: 8.3 GW in 2024. |

| Energy Independence | Fuels growth | Home battery storage grew 60% in 2024. |

| Lifestyle Shifts | Creates opportunities | EV sales expected at 40% by 2025. |

Technological factors

Technological advancements continuously boost solar panel efficiency, translating to more energy from less space. This is crucial as efficiency gains reduce installation costs and improve the return on investment for consumers. For instance, the average efficiency of commercially available solar panels has increased from around 15% in 2010 to over 20% in 2024, with some panels exceeding 24%. This trend makes solar power more competitive.

Technological advancements are key for Sunrun. Battery technology is rapidly improving, boosting energy density, lowering costs, and enhancing performance. This is essential for Sunrun's goal of combining storage with solar systems, providing complete energy solutions. In Q1 2024, the average installed cost of residential solar-plus-storage systems was about $4.30/watt, showing a decreasing trend.

Sunrun integrates advanced energy management software and AI to refine energy use and boost system performance. The firm's focus on virtual power plants highlights its tech-driven approach. In 2024, the global energy management software market reached $15.2 billion, with AI's influence growing rapidly. Sunrun's investments in these areas aim to enhance customer value and grid stability.

Virtual Power Plant Technology

Virtual Power Plant (VPP) tech enables residential solar and storage systems to offer grid services, a key technological factor for Sunrun. Sunrun's involvement in VPP programs is growing, creating new revenue streams. The company is leveraging its substantial customer base to aggregate distributed energy resources effectively. This strategic move highlights Sunrun's innovative approach to energy management and grid integration.

- Sunrun's VPP capacity grew to 500 MW in 2024.

- VPP revenue increased by 40% in the same year.

- The company aims to expand VPP capacity to 1 GW by 2025.

Integration of Solar, Storage, and EV Charging

Technological advancements are making it easier to integrate solar panels, battery storage, and EV charging. This integration allows companies like Sunrun to offer complete home energy management. The growth in this area is significant; in 2024, the U.S. residential battery storage market saw a 60% increase in deployments. This trend is expected to continue, with forecasts projecting substantial growth in the coming years.

- Residential solar-plus-storage systems grew by 25% in 2024.

- EV charger installations increased by 40% in areas with solar.

- Sunrun's customer base for integrated systems expanded by 35%.

Technological innovations drive Sunrun's growth via more efficient solar panels and battery storage. Battery tech advancements improve energy density and reduce costs. AI-driven energy management enhances system performance, supporting virtual power plants and grid services.

| Tech Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Solar Panel Efficiency | Avg. panel efficiency >20% | Efficiency gains continue, >24% |

| Residential Battery Storage | Deployments up 60% | Continued growth |

| Sunrun VPP Capacity | 500 MW | Target 1 GW |

Legal factors

The federal Solar Investment Tax Credit (ITC) is pivotal for Sunrun's finances. The ITC offers a 30% tax credit for solar systems installed through 2032. Any adjustments to the ITC's rules or rates directly affect the cost-effectiveness of solar projects. For example, the ITC helped the solar industry grow significantly, with over 3.6 million homes now using solar power.

Net metering policies, crucial for solar adoption, differ across states, influencing the financial appeal of solar energy. These policies dictate how customers are compensated for surplus energy fed back into the grid. As of late 2024, states like California and Nevada have revised net metering rules, potentially altering customer savings. The impact of these policy changes can significantly affect the return on investment for solar installations.

Interconnection standards and regulations are crucial for Sunrun's operations, influencing installation timelines and expenses. Complex processes can delay projects, increasing costs, while streamlined ones can boost efficiency. In 2024, navigating these regulations is vital for Sunrun's growth, with varying state-by-state requirements. For instance, in California, interconnection applications increased 20% in Q1 2024.

Consumer Protection Laws and Regulations

Sunrun faces consumer protection laws concerning sales, contracts, and disclosures. Deceptive sales allegations can cause legal issues and reputational damage. In 2024, the Federal Trade Commission (FTC) and state attorneys general continued scrutinizing solar companies' sales practices. The Consumer Financial Protection Bureau (CFPB) has also been involved.

- FTC actions against solar companies have increased by 15% in 2024.

- Sunrun's customer complaints rose by 8% due to contract disputes in Q3 2024.

- Legal settlements related to deceptive marketing cost solar companies an average of $2 million in 2024.

Building Codes and Permitting Requirements

Sunrun must comply with diverse local building codes and permitting rules across different regions, impacting project timelines and complexity. This compliance is crucial for legal operation. These regulations cover aspects like electrical wiring, structural integrity, and fire safety. The permitting process can vary from a few weeks to several months. Delays can increase costs and affect customer satisfaction.

- Permitting costs can range from $100 to $1,000+ per installation, depending on the location and complexity.

- Project delays due to permitting can range from 2 to 6 months.

- Sunrun's legal and compliance costs were approximately $100 million in 2024.

Legal factors significantly influence Sunrun's operations, encompassing the Solar Investment Tax Credit, which provides substantial financial benefits, with a 30% credit available until 2032, impacting project cost-effectiveness. Net metering policies, varying by state, affect customer savings and solar adoption rates, necessitating compliance with consumer protection laws enforced by entities such as the FTC. Furthermore, adherence to local building codes and permitting regulations directly influences project timelines and costs.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| ITC | 30% tax credit, influencing project costs | Over 3.6M homes use solar, incentivized by ITC. |

| Net Metering | Influences savings and solar adoption | California and Nevada revised rules. |

| Consumer Protection | Sales practices and contract disclosures | FTC actions up 15%; complaints up 8%. |

| Building Codes | Impact project timelines | Permitting costs range $100-$1,000+; delays 2-6 months. |

Environmental factors

Climate change fuels extreme weather, increasing the demand for resilient home energy. Sunrun's solar-plus-storage solutions offer enhanced energy security. In 2024, the U.S. saw over $100 billion in damages from weather disasters. Installation schedules and system performance are increasingly vulnerable.

The increasing emphasis on curbing greenhouse gas emissions fuels demand for clean energy. Sunrun's solar services directly aid these goals. In 2024, the U.S. solar market grew, with residential solar capacity expanding. This growth reflects a commitment to reducing carbon footprints. The company's focus aligns with environmental targets.

Sunrun must maintain an ethical and sustainable supply chain for solar panel components. Scrutiny exists regarding polysilicon sourcing, a key material. As of 2024, the solar industry faces increasing pressure to trace and verify the origin of all components to combat forced labor concerns. The company's ESG reports will reflect its efforts in this area.

Waste Management and Recycling of Solar Panels and Batteries

As solar and battery systems age, waste management and recycling are vital. The industry is working on recycling infrastructure. This includes materials from solar panels and batteries. Recycling reduces environmental impact.

- By 2024, the global solar panel recycling market was valued at roughly $250 million.

- The market is projected to reach about $4 billion by 2033.

- Recycling can recover valuable materials like silver and silicon.

Environmental Permitting for Installations

Sunrun faces environmental permitting demands, needing permits for solar installations. Residential projects have fewer stringent rules than large-scale ones. Compliance is essential to avoid penalties and ensure project legality. These permits cover environmental protection, waste disposal, and site-specific requirements. In 2024, permit costs ranged from $50 to $500 per installation, depending on location and complexity.

- Permit costs vary by location and complexity.

- Compliance is crucial to avoid penalties.

- Permits cover environmental protection and waste disposal.

- Residential projects have less stringent requirements.

Environmental factors significantly shape Sunrun's business, influencing demand, operations, and sustainability efforts. Extreme weather, exacerbated by climate change, increases the need for resilient energy solutions, boosting solar-plus-storage demand, with the U.S. facing over $100 billion in weather disaster damages in 2024. Additionally, environmental regulations and consumer preferences drive the adoption of clean energy. Sunrun must navigate supply chain sustainability, ethical sourcing, and waste management, with the global solar panel recycling market valued at roughly $250 million in 2024, projected to reach about $4 billion by 2033.

| Environmental Factor | Impact on Sunrun | Data (2024-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increases demand for resilient energy solutions (solar-plus-storage) | U.S. weather disaster damages >$100B (2024), Increased project vulnerability |

| Greenhouse Gas Emissions Regulations | Boosts demand for clean energy (solar) | Residential solar capacity expanded in 2024, aligns with environmental targets |

| Sustainable Supply Chain & Recycling | Impacts sourcing, waste disposal, and public perception | Solar panel recycling market ~$250M (2024), growing to ~$4B (2033) |

| Environmental Permitting | Affects project costs and operational compliance | Permit costs: $50-$500/installation (2024), varies by location |

PESTLE Analysis Data Sources

The Sunrun PESTLE relies on industry reports, government data, financial publications, and market analyses. We leverage economic indicators, policy updates, and technology forecasts.