Uber Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Uber Bundle

What is included in the product

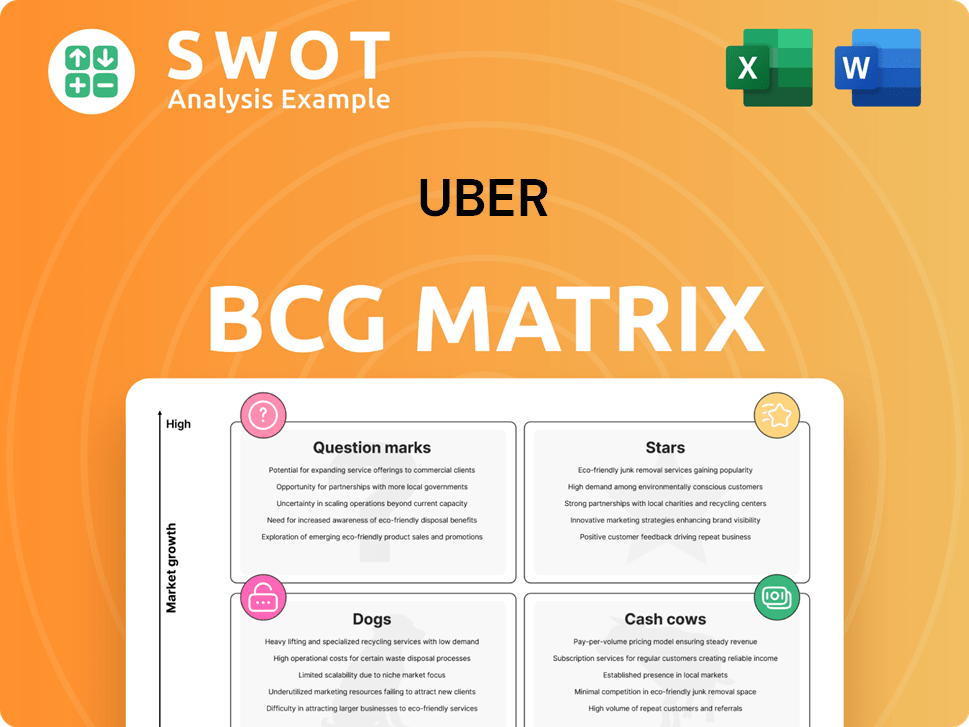

Uber's BCG Matrix reveals strategic investment, holding, or divestment recommendations across its portfolio.

Quickly visualize Uber's business units with a one-page BCG matrix, removing complexity.

Preview = Final Product

Uber BCG Matrix

This preview showcases the identical Uber BCG Matrix you'll receive. Upon purchase, you gain immediate access to this strategic analysis tool—ready for your insights.

BCG Matrix Template

Uber's complex portfolio, from ride-hailing to food delivery, demands strategic clarity. A preliminary look suggests diverse product placements within the BCG Matrix. This reveals potential Stars, Cash Cows, and Question Marks. Understanding these positions is key for Uber's future. The full BCG Matrix unveils detailed quadrant breakdowns, strategic recommendations, and actionable insights—purchase now for a competitive advantage.

Stars

Uber's ride-hailing in major cities is a star. It boasts a substantial market share and ongoing growth. Uber utilizes its strong brand and large network. Efficiency and customer experience are key to maintaining its lead. In 2024, Uber's revenue from ride-hailing reached $20 billion.

Uber Eats demonstrates robust growth, fueled by the rising demand for food delivery. It holds a significant market share in the delivery sector through expanding into new markets and restaurant partnerships. Grocery delivery integration boosts consumer appeal. In 2024, Uber Eats reported a 25% increase in gross bookings.

Uber One, a star in Uber's portfolio, has shown impressive growth. In 2024, Uber reported a 14% increase in monthly active platform consumers. This membership boosts user frequency and retention. Offering perks like discounts and priority service, Uber One keeps customers engaged. This expansion highlights Uber's successful value-added services.

Autonomous Vehicle Initiatives

Uber's autonomous vehicle initiatives are a star in its BCG Matrix, representing high growth potential. Strategic partnerships and testing in key cities like Phoenix and Pittsburgh are underway. This focus is fueled by the expectation of reduced costs and increased efficiency. Autonomous vehicles could significantly impact Uber's profitability.

- Waymo partnership: Uber has partnered with Waymo for autonomous vehicle development.

- Testing locations: Uber has been testing autonomous vehicles in select cities.

- Cost reduction: Autonomous vehicles are expected to lower operational expenses.

- Efficiency gains: Self-driving technology aims to improve service efficiency.

Advertising Platform

Uber's advertising platform is a rising star, fueled by targeted ads within its apps. It's becoming a significant revenue source, leveraging a massive user base. Uber's data analytics enhance ad value, attracting more advertisers. This focus on ad tech will likely boost growth.

- In Q1 2024, Uber's advertising revenue reached $279 million.

- Uber's monthly active platform consumers were 150 million in Q1 2024.

- Uber's ad platform offers targeted ads, enhancing user engagement.

- Uber plans to expand its ad offerings and improve ad tech.

Uber's initiatives in autonomous vehicles are performing well, aligning with high-growth opportunities. Strategic alliances and deployments in cities like Phoenix and Pittsburgh underscore its focus. The aim is to lower costs and enhance operational efficiency using self-driving tech, promising major profitability benefits.

| Key Metric | Data | Year |

|---|---|---|

| Partnership with Waymo | Ongoing development | 2024 |

| Testing Locations | Phoenix, Pittsburgh | 2024 |

| Expected Cost Reduction | Significant | Future |

Cash Cows

Uber's ride-sharing services, especially in established markets, are cash cows. They consistently generate substantial revenue and high-profit margins. This is due to their extensive user base and strong brand recognition, requiring minimal additional investment. In 2024, Uber's ride-sharing segment continued to be a primary revenue driver, with approximately $30 billion in gross bookings.

UberX is a cash cow for Uber. It offers affordable rides and has a large market share. In Q3 2023, Uber's revenue reached $9.29 billion, with ride-sharing contributing significantly. It's a consistent revenue source due to steady demand.

Uber's airport transportation is a cash cow. Demand for airport rides is consistently high, ensuring a steady revenue flow. Uber's platform integrates airport services smoothly, attracting travelers. In 2024, airport rides contributed significantly to Uber's overall profits. This segment offers stability and profitability for the company.

Uber Black

Uber Black, a premium service, is a cash cow for Uber, targeting customers who prioritize luxury and are willing to pay more. This segment enjoys higher profit margins compared to standard rides. Uber Black's focus on quality ensures sustained demand from those seeking superior experiences. In 2024, Uber's revenue reached $37.3 billion.

- Premium service with higher profit margins.

- Focus on luxury and quality.

- Sustained demand from a specific customer segment.

- Uber's 2024 revenue was $37.3 billion.

Uber Connect

Uber Connect is Uber's package delivery service, utilizing its driver network. It addresses the rising need for quick deliveries, offering a handy solution for businesses and individuals. The integration within the Uber platform ensures easy booking and tracking. Uber's delivery revenue grew by 23% year-over-year in Q3 2023.

- Uber Connect provides same-day delivery.

- It uses Uber's existing driver network.

- The service is integrated with the Uber platform.

- Delivery revenue saw a 23% YoY increase in Q3 2023.

Cash cows for Uber include ride-sharing services, generating substantial revenue with high-profit margins. These segments require minimal investment due to a strong user base and brand recognition. Airport transportation and premium services like Uber Black also contribute significantly to Uber's revenue, ensuring stability and profitability. Uber's 2024 revenue reached $37.3 billion.

| Segment | Description | Revenue Driver |

|---|---|---|

| Ride-Sharing | Established markets with high margins. | Extensive user base, strong brand. |

| Airport Transport | High demand, seamless integration. | Steady revenue, traveler needs. |

| Uber Black | Premium service, luxury focus. | Higher profit margins, quality. |

Dogs

Uber Freight, classified as a "Dog" in the BCG Matrix, has struggled with profitability. In Q3 2023, Uber Freight's revenue was $1.3 billion, yet it still reported a loss. The freight market's competitiveness and operational challenges hinder its success. Strategic restructuring or divestiture might be needed, given its financial struggles.

Uber's micro-mobility efforts, like Jump bikes, haven't thrived. They've struggled with high upkeep and regulations. Competition has also been fierce. For example, in 2024, the micro-mobility market showed mixed results. Uber might rethink or exit this area.

Uber's presence in some international markets faces hurdles, including regulatory issues and fierce competition. These areas, requiring substantial investment, have uncertain growth potential. For example, Uber Eats exited the South Korean market in 2024. Strategic reassessment, possibly including market exits, is crucial for these regions.

Discontinued Ventures

Uber's "Dogs" include discontinued ventures. These are services that didn't gain enough traction. They represent investments that didn't pay off. Strategic decisions are key in these cases. Uber has shuttered various projects.

- Uber Eats in certain markets.

- Self-driving car program (sold to Aurora).

- Uber Freight's international expansion.

Uber Health

Uber Health might be categorized as a 'Dog' in the BCG matrix. It currently has a limited market share and slower growth compared to other Uber services. This service, providing transportation for healthcare, struggles to scale and compete. Focused investment or partnerships could boost its performance. For example, in 2024, the healthcare transportation market was valued at approximately $7.8 billion.

- Market Share: Uber Health has a smaller market share than established players.

- Growth Rate: The growth rate for Uber Health is slower than for other Uber services.

- Competition: Faces competition from specialized healthcare transportation providers.

- Investment: May need more investment or strategic partnerships.

Several Uber ventures are classified as "Dogs" in the BCG Matrix, indicating low market share and slow growth. These include Uber Freight, facing profitability challenges, and certain international market operations. Strategic moves like restructuring or divestiture are often considered for "Dogs." In 2024, these segments showed minimal revenue growth.

| Category | Examples | Challenges |

|---|---|---|

| Uber "Dogs" | Uber Freight, some international markets, discontinued ventures | Low market share, slow growth, profitability issues |

| Financial Data (Q3 2023) | Uber Freight revenue: $1.3B, still with losses | Stiff competition, regulatory hurdles |

| Strategic Actions | Restructuring, divestiture, market exits | Limited returns, uncertain future |

Question Marks

Uber's AV partnerships, like Waymo, face deployment uncertainties. Regulatory hurdles, tech issues, and capital needs are key. Success could reshape Uber, but failure risks losses. In 2024, AV tech's market size was ~$16.8B; Uber's stake is evolving.

Expanding into new geographic markets is a key strategy for Uber. These markets could offer high growth, but require investments in infrastructure, marketing, and regulations. In 2024, Uber's expansion efforts focused on regions like Latin America and Southeast Asia. Careful market analysis and partnerships are vital.

Uber for Teens, a service targeting younger riders, is a question mark in the BCG Matrix. It has a low market share, reflecting its nascent stage. The service's success hinges on attracting teen users while prioritizing safety. Focused marketing and enhanced safety measures are key to boosting its market share in 2024. In 2023, Uber's revenue was $37.3 billion.

Grocery Delivery Expansion

Uber's grocery delivery expansion is a question mark in its BCG Matrix. Grocery delivery faces tough competition, including from Instacart and Walmart. Growth in online grocery sales is evident; in 2024, online grocery sales in the US reached approximately $95 billion. Uber must differentiate itself and forge strong retail partnerships to succeed.

- Market share for online grocery delivery is competitive.

- Uber needs to invest in logistics and technology.

- Partnerships with established grocers are crucial.

- Online grocery sales in the US were $95B in 2024.

Electric Vehicle Integration

Uber's move towards electric vehicle (EV) integration places it firmly in the Question Mark quadrant of the BCG Matrix. This strategy is forward-looking, aiming for cost savings and environmental responsibility, but faces significant challenges. High initial EV costs, the need for extensive charging infrastructure, and varying driver acceptance levels mean a substantial investment and careful execution are needed. Success hinges on navigating these complexities to build a viable EV ecosystem.

- Uber has committed to becoming a fully electric platform in North America by 2030.

- In 2024, EVs represent a small but growing portion of Uber's fleet.

- The cost of EVs and charging infrastructure pose significant financial hurdles.

- Driver adoption and the availability of charging stations are critical factors.

Uber's EV integration is a Question Mark; it requires significant investments. High EV costs and charging needs are key hurdles. Success depends on effective execution, targeting a 2030 North American EV transition.

| Aspect | Challenge | 2024 Data |

|---|---|---|

| EV Fleet Share | Low initial EV adoption | ~1-3% of Uber fleet |

| Charging Infrastructure | Limited availability | ~60,000 public charging stations in the US |

| EV Cost | High upfront costs | Average EV price: ~$50,000 |

BCG Matrix Data Sources

Uber's BCG Matrix uses financial statements, industry reports, market research, and competitor data.